CONSUMER DISCRETIONARY SECTOR IN INDIA (Overview)

Overview

In India, the consumer discretionary sector includes companies involved in the production and distribution of non-essential goods and services. It encompasses a wide range of industries that cater to consumer preferences and discretionary spending.

These industries are driven by consumer preferences, discretionary income levels, lifestyle trends, and economic conditions. The sector is also influenced by factors such as changing demographics, urbanization, a rising middle-class population, increasing consumer spending, and the growth of e-commerce.

It's important to note that the consumer discretionary sector in India, like in any country, can have variations and nuances based on the specific market dynamics and regulations within the country. Consumer Discretionary mainly consists of large-cap companies, comprising 369 of the 543 stocks in the sector. There are 103 midcaps and 72 smallcaps.

Key subsectors within the consumer discretionary sector in India include:

Automobiles: Manufacturers and distributors of cars, motorcycles, commercial vehicles, and related components.

Consumer Durables: Companies involved in the production and sale of appliances, electronics, home furnishings, and other durable goods.

Retail: Various retail formats, including department stores, specialty stores, supermarkets, e-commerce platforms, and other retail chains.

Media and Entertainment: Companies involved in broadcasting, films, television, digital media, advertising, and entertainment services.

Hospitality and Leisure: Hotels, restaurants, travel services, amusement parks, and other leisure-related businesses.

Textiles: Producers/ Manufacturing units of various kinds of fabrics, such as cotton mills.

Real Estate: Companies dealing in commercial, industrial, residential, or other kinds of properties.

Historical Performance

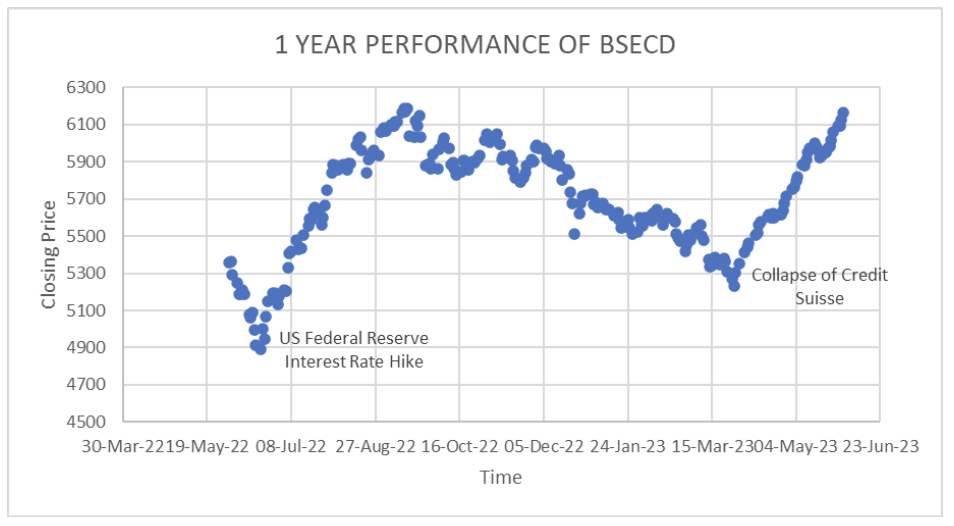

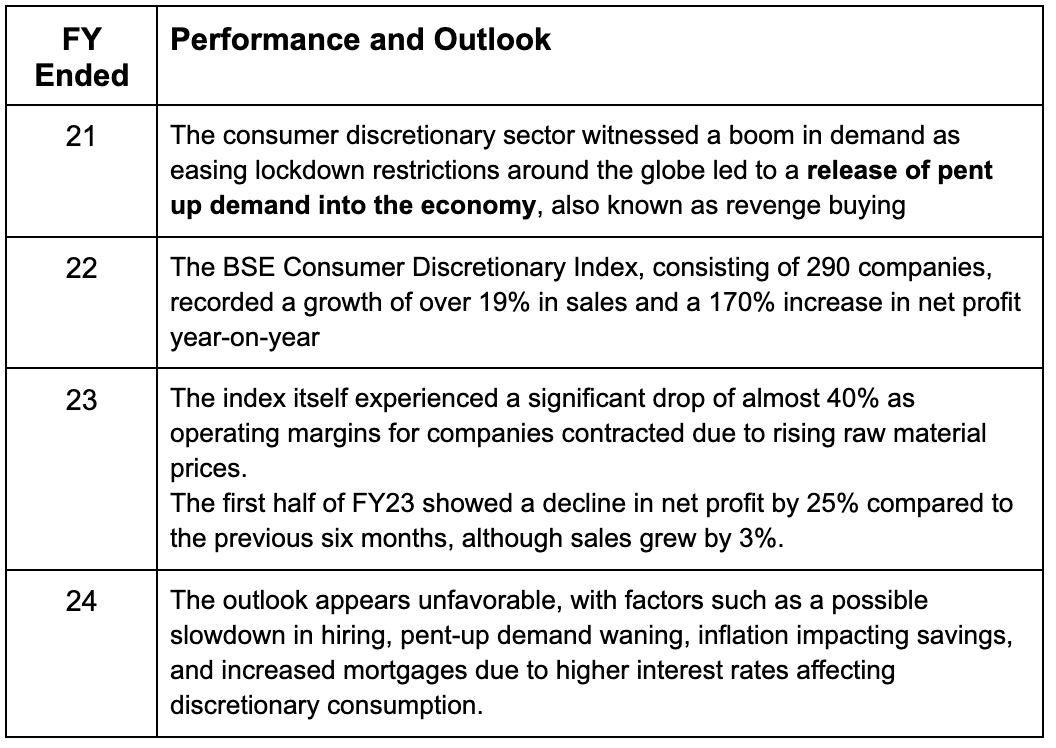

The BSECD is a composite index representing all stocks belonging to the consumer discretionary sector listed on the BSE. Over the past 10 years, the index has exhibited an overall trend of growth except for sharp declines occurring during events such as the COVID-19 pandemic and the collapse of banks.

While analyzing data pertaining to the period from March 2022 to June 2022, it can be observed that interest rate hikes across the globe led to a downward spike in stock prices. The banking turmoil of March 2023 adversely affected the stock market as a whole and, with it, the consumer discretionary sector..

The consumer discretionary sector has produced a return of 230% in terms of percentage change in price over the last 10 years, lower than its peers in industrials and Information Technology. Overall, it ranks third in terms of 10 year percent returns.