NIO with Nobias technology: Is This Luxury EV Maker A Buy After Falling 43% From Its Highs?

Chinese technology stocks continue to be the talk of the town, as far as the Nobias credible author community goes. So many of these companies have turned into battleground stocks with investors offering strong opinions on either side of the bull/bear argument. And that’s no different for Nio (NIO), the Chinese electric vehicle (EV) maker, who reported earnings last week. NIO shares are down more than 43% from their 52-week high. And therefore, we wanted to see what the Nobias community had to say about the stock after its recent sell-off.

On August 12th, NIO posted its second quarter results and beat analyst expectations on both the top and bottom lines. IAM News, a Nobias 4-star rated analyst, covered the earnings results in a recent article Benzinga, highlighting the print saying, “The start-up lost approximately $0.07 per share which translates to 0.42 yuan. This is less than both the expected loss of 0.68 yuan as well as the 1.15 yuan for the same period last year. Revenue surged 127.2% YoY as it amounted to $1.31 billion or 8.45 billion yuan, which topped the 8.32 billion yuan that Refinitiv analysts expected.”

The analyst notes that Nio remains an innovator in the battery space, which is paramount to success in the EV market. And, while there is a lot of competition in the EV space, Nio is attempting to set itself apart with a new battery swapping system. IAM news said, “Nio's battery swapping service makes it different from everyone else. It differentiates itself from competitors by offering special service stations to its users where they can swap their depleted battery for a fully charged one.”

During Nio’s Q2 conference call with investors, the company’s Founder and CEO, William Li highlighted his company’s unique battery swap system, saying, “Up until now, we have deployed 361 swap stations in 103 cities and completed over 3 million battery swaps for the users. In July, we announced NIO Power's battery-swap station deployment plan by 2025. We plan to increase the total number of battery-swap stations to over 700 by the end of 2021 and to over 4,000 globally by the end of 2025.”

The analyst highlights ongoing supply chain issues, specifically regarding the lack of semiconductor supply available to vehicle manufacturers which would delay its global product rollout. IAM News says that Nio had plans to expand into “EV haven Norway” in September, but right now, those plans remain up in the air.

However, even with macro uncertainty in place, NIO offered Q3 guidance. IAM News wrote, “As for the third quarter, revenues are expected in the range between 8.91 billion yuan and 9.63 billion yuan, which would translate to a rise between 96.9% to 112.8% compared to last year's quarter as it hopes to deliver between 23,000 and 25,000 vehicles.”

Li also touched upon that forward guidance, saying, “According to the data published by China Passenger Car Association, in the first half of 2021, the penetration rate of battery electric vehicles has reached 8.4% in China. NIO's penetration in the Tier 1 and the Tier 2 cities in China has been growing at a much faster pace. In Shanghai, the first half of this year has witnessed our penetration in the premium SUV segment, reaching 13.7% among all ICE and the electric vehicles. Our monthly order intake keeps it growing, but the delivery volume will be determined by the overall capacity of the supply chain. We expect the total delivery in the third quarter to be between 23,000 and 25,000 vehicles.”

When concluding their piece, IAM News notes that this remains a relatively small competitor in the global EV market. They say that Nio has lagged behind their peers in recent months when it comes to deliveries, which is worrisome in a world where first mover advantage and quickly capturing market share could make or break a company in this highly competitive industry. However, IAM News concludes, “Once EV adoption truly picks up, NIO has positioned itself well for the premium segment of the EV era with its innovative battery subscription business, its cutting-edge vehicles, and strong execution.”

The issue with so many of these tech stocks operating in cutting edge industries is valuation. Investors are forced to pay high premiums for the innovation that companies like Nio offer and oftentimes, it can be difficult to identify fair value because of the speculative nature of the premiums that investors have proven willing to pay.

In a July article, Mark R Hake, a Nobias 4-star rated analyst, published his value oriented analysis, pointing towards upside in NIo shares. Thinking about possible earnings-per-share of $0.27 in 2023, Hake wrote, “That would put NIO stock on a forward price-to-earnings (P/E) multiple of over 186 times earnings. Assuming EPS doubles over the next 2 years, the P/E would fall to a more normal 47 times. So, in effect, Nio stock does not seem to be out of touch with reality here.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

Hake continued, highlighting the company’s price-to-sales multiple and comparing it to a major rival, saying, “Moreover, if we compare the price-to-sales (P/S) multiple to Tesla (TSLA), Nio definitely seems too cheap.” He noted that TSLA shares trade with a P/S multiple of nearly 10x and said: “If we apply those multiples to Nio the estimate is $87.2 billion (i.e., 9.87 x $8.83 billion). That is about the same as July 2’s market value of $87.17 billion. In addition, using the 2023 forecast of $12.85 billion in sales, using the Tesla multiple of 7.95 times, the market value will be $102.16 billion. This is 17.3% higher than July 2’s price.

As a result, the implication is that Nio stock should be at $59.12 per share (i.e., 1.173 x $50.40). This is also close to what 22 Wall Street analysts say Nio stock is worth. Seeking Alpha’s survey of analysts shows that their average target price is $60.42 per share or 20% over the July 2nd price.” At the time, Nio was trading for approximately $50/share, and today, shares trade for $36.92, so NIO has fallen some 24% since Hake performed his due diligence, pointing towards even more upside potential.

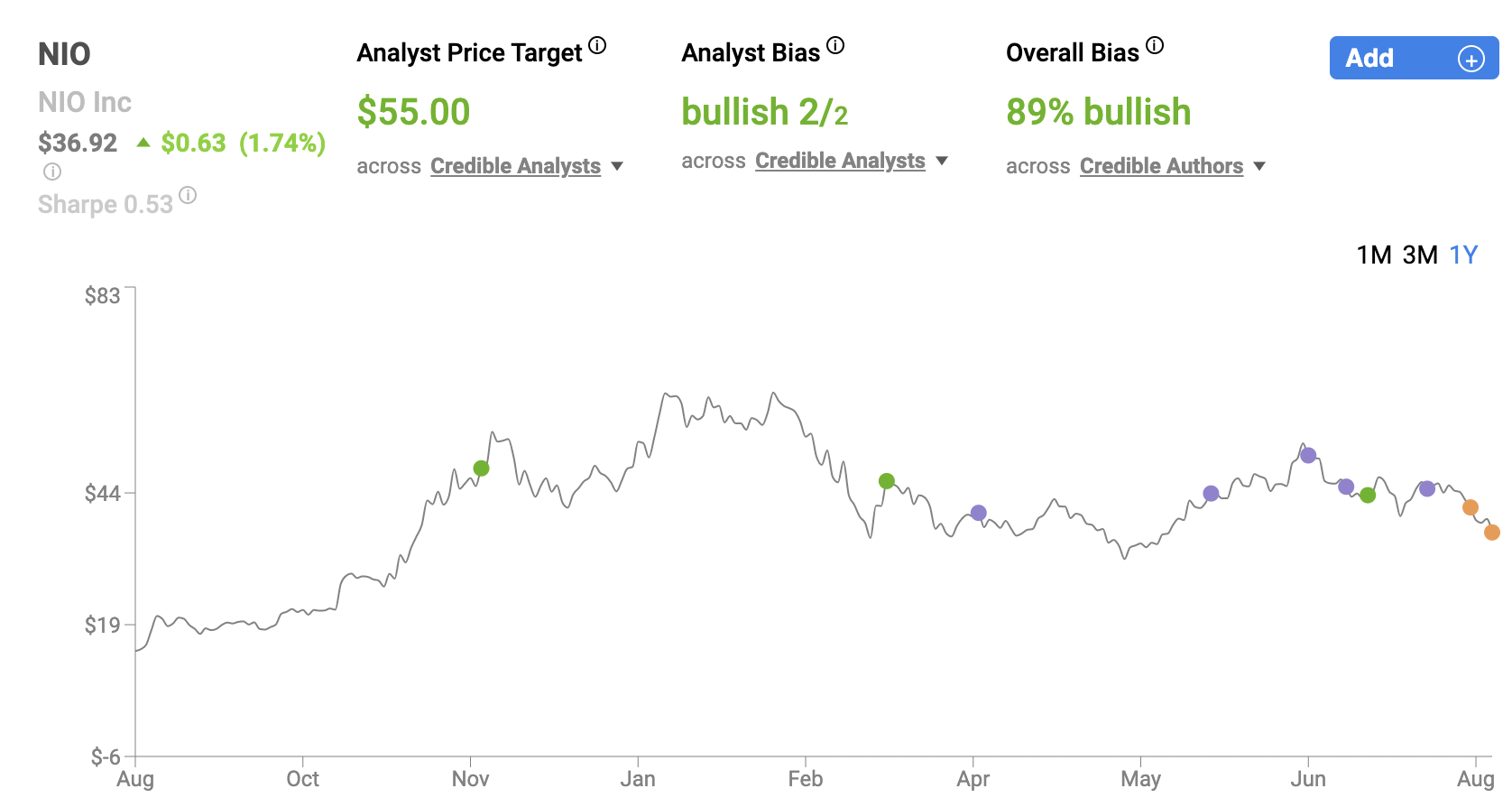

Looking at the credible authors that we track with the Nobias algorithm, the average price target that these individuals place on NIO shares is $55.00 (so fairly close to the $60.42/share consensus that Hake mentioned). Compared to today’s $36.92 share price, the Nobias community’s consensus represents upside potential of 33%. With that in mind, it should come as no surprise that the vast majority of credible authors that we track remain bullish on shares, despite the stock’s recent pullback.

Disclosure: Nicholas Ward has no position in any stocks mentioned in this article. Nicholas Ward wrote this article for Nobias at their request with a view of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.