XOM with Nobias technology: Is Exxon A Buy With Oil At Record Highs?

Prior to the Russian Invasion of Ukraine, Nobias 4-star rated author, Billy Duberstein, published a report on The Motley Fool, in which he highlighted his outlook for energy sector stocks. Duberstein wrote: “Oil stocks were the best-performing segment of the market in 2021 -- especially the upstream producers. While some may think this was a short-term blip based on the rollout of vaccines, economic reopening, and supply constraints, prices could stay this high for a while.

The sector has been underinvesting in exploration and production for years, and while electric vehicles and clean energy alternatives are growing at a fast pace, they are still a small portion of the overall auto and energy markets.

With the U.S. economy looking strong and chastened energy producers now focusing more on shareholder returns than growth, we could see oil prices stay this high for some time, or even move higher on any type of geopolitical shock. Given that many oil producers currently trade at low multiples based on today's earnings, I wouldn't be surprised to see energy stocks outperform again this year.” And, being that we have seen a major “geopolitical shock” since Duberstein’s article was originally published, it appears likely that Exxon’s (XOM) short-term prospects have improved.

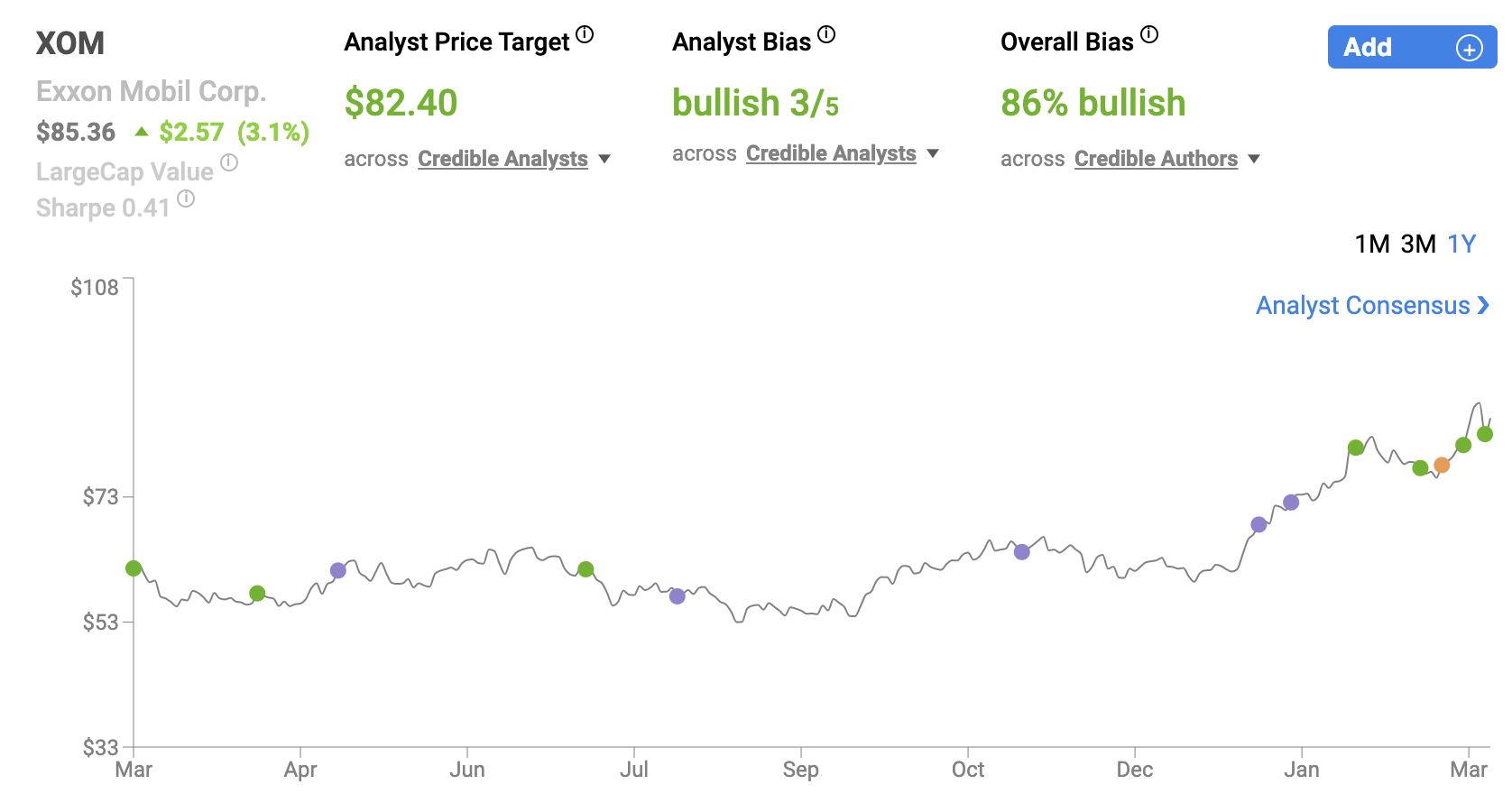

XOM March 2022

Since Russian forces invaded Ukraine on February 24th, 2022, The United States Oil ETF (USO) has increased in value by 29.4%. The price of WTI Crude has increased from approximately $92/barrel to $125.60/barrel since 2/24/2022 (approximately 36.5%). And, according to this CNBC report, U.S. gas prices (at the pump) hit record highs today as prices soared above the $4.00/gallon mark.

Exxon Mobil shares have benefitted from this rally as well. XOM shares are up 42.38% on a year-to-date basis. And yet, looking at the authors and analysts tracked by the Nobias algorithm, there is still a strong bullish lean associated with the stock (86% of articles published by credible sources recently have expressed “Bullish” sentiment).

Valuentum, a Nobias 4-star rated author, published a report on Exxon in early January titled, “Exxon Mobil Is A Valuentum Style Stock With A Hefty Dividend Yield” highlighting the stock’s attractive valuation. At a high level, Valuentum described the company’s operations, saying, “Exxon Mobil is involved in the exploration and production of crude oil/natural gas, and the manufacture of petroleum products as well as the transportation and sale of crude oil, natural gas and petroleum products. It also makes commodity petrochemicals.”

Regarding XOM’s valuation, the author wrote, “We think Exxon Mobil is worth $92 per share with a fair value range of $62-$122 per share.” Valuentum continued, “Our valuation model reflects a compound annual revenue growth rate of 15.5% during the next five years, a pace that is higher than the company's 3-year historical compound annual growth rate. Our valuation model reflects a 5-year projected average operating margin of 10.2%, which is above Exxon Mobil's trailing 3-year average. Beyond year 5, we assume free cash flow will grow at an annual rate of ~1% for the next 15 years and 3% in perpetuity. For Exxon Mobil, we use a 9% weighted average cost of capital to discount future free cash flows.”

Looking forward, Valuentum remained bullish on the company’s prospects, highlighting management’s commitment towards profitability. They wrote, “Exxon Mobil noted in its early December update that its capital expenditures would come in around ~$20-$25 billion from 2022-2027. Its investments are focused on operations in the Permian Basin, Guyana, Brazil, its’ liquefied natural gas ('LNG') business, and its petrochemical businesses.” For comparison’s sake, Valuentum wrote, “From 2010-2014, Exxon Mobil's annual capital expenditures averaged ~$33 billion (I, II).”

FInally, the author noted that the company hopes to use excess cash flows to buy back shares (which should further augment its bottom-line). They wrote, “During its third-quarter 2021 earnings update, Exxon Mobil announced that starting in 2022, it would begin repurchasing sizable amounts of its stock (buybacks were subdued during the 2018-2020 period). Its new stock buyback program will see the energy giant repurchase up to $10.0 billion of its shares over the 12-24 months starting in 2022.” In conclusion, Valuentum said that by reducing debt load (and therefore, interest expenses), improving its cost structure, and reducing its capex, “Exxon Mobil's initiatives are forecasted to double its earnings by 2027 from 2019 levels.”

Keith Speights, a Nobias 4-star rated author, also recently published a bullish report on the stock, titled, “3 Great Dividend Stocks to Buy That Are Trouncing the Market Right Now” which highlighted XOM’s appeal to income oriented investors. Speights wrote, “ExxonMobil has long been a favorite for income-seeking investors. With a dividend yield of 4.7%, it still is. The stock is even a Dividend Aristocrat with 39 consecutive years of dividend increases.” But, he said that an investment in XOM isn’t just about the dividend. In his opinion, the company offers strong growth prospects as well.

Speights wrote, “For one thing, the company's business appears to be the strongest it's been in years with ExxonMobil generating strong cash flows.” He continued, “ExxonMobil also recently discovered two new oil reservoirs off the coast of Guyana. The company thinks these sites will add to its previous estimate of 10 billion oil-equivalent barrels from its off-shore rigs in the area.”

More recently, on March 2, 2022, Graham Grieder, a Nobias 5-star rated author, published a report titled, “Exxon Mobil Is Still A Buy At $110 Oil” expressing his bullish opinion on XOM shares, even after the huge alpha that shares have posted throughout 2022.

Grieder wrote, “It's hard to believe, but we saw oil close at over $100 a barrel, and it hasn't slowed down since. This is welcome news for Exxon Mobil (XOM) shareholders. Unfortunately, it is coming on the back of war in Ukraine. How much higher can oil go? Will we see $150 once again? Either way, Exxon is going to be a cash machine. You can bet shareholders will be rewarded handsomely if we see this continue for some time. It's not too late to get in.”

Grieder breaks down Exxon’s cash flow potential, stating, “In 2021, the breakeven price worked out to $41. This means they covered their CapEx and dividends at $41 per barrel. Keep in mind it's currently trading around $110. So, what does that mean? Well, for every $1 increase in the price of oil, Exxon sees ~$475 million cash in earnings.”

Grieder believes that one of the biggest benefits of higher oil prices for XOM is the company’s ability to repair its balance sheet. He wrote, “It means that Exxon is printing cash, and that means shareholders are going to get rewarded handsomely. With cash, comes flexibility. Exxon is going to make paying down debt further a priority. In 2021, we saw $20 billion fall off the balance sheet, and that trend likely continues in 2022. As of right now, analysts are expecting to see the net debt land around $34 billion by year's end.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

Grieder notes that is the case, XOM’s leverage ratio could fall to below 0.50x (well below the 5.0x levels that the company posted in 2020). He continues, “That is an incredible turn of events and it's all thanks to the price of oil. It's very likely that if we continue to see elevated oil prices throughout 2022 and 2023 that that number gets even closer to 0.”

Like Valuentum, Grieder mentioned XOM’s buyback as a bullish tailwind for shares. With oil selling for $100+/barrel, Grieder wrote, “As of now, the buyback program for 2022 is only at $10 billion. If we see $100+ oil last for weeks, or better yet months, there is no doubt in my mind that will get increased as well.”

Concluding his article, Grieder mentioned that oil markets are likely to stay “very volatile” in the short-term. However, he said, “Anything over $70 [regarding oil prices] is extremely bullish for Exxon.” Although, he did provide a bit of caution to overly optimistic investors after Exxon’s recent share price rally, saying, “It is not too early to get to in Exxon, or oil in general. But please, set stops. Do not get burnt on the turnaround. It will without a doubt eventually come, and it will come quickly.”

When looking at the average price target being applied to Exxon shares by the credible (4 and 5-star rated) Wall Street analysts that the Nobias algorithm tracks, it appears that this cautious optimism is warranted. Right now, the average price target applied to XOM shares by credible analysts is $82.40. Today, XOM shares trade for $85.36, meaning that this price target implies downside potential of approximately 5%.

Disclosure: Nicholas Ward has no position in any stocks mentioned in this article. Nicholas Ward wrote this article for Nobias at their request with a view of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.