DISH with Nobias technology: DISH Network Shares Have Fallen 15% In A Month. Is This Dip Worth Buying?

There has been an interesting tug of war going on in recent years in the media and entertainment space between the content producers and the distribution platforms. Demand for content is higher than ever as society becomes more efficient and humans have more free time on their hands. This secular theme has led to a handful of big winners in the media/entertainment space which have produced strong total returns for shareholders in recent years and continue to trade with elevated valuation premiums.

However, the “cord cutting” phenomenon that we’ve witnessed play out over the last 5 years or so has really damaged the sentiment surrounding the legacy distribution platforms and many of these stocks trade with bargain barrel valuations attached to them because many investors believe that streaming is the way of the future and things like cable and satellite television are going to go the way of the dodo.

DISH Network (DISH) is one such legacy player. DISH shares are down roughly 34.2% over the last 5 years (drastically underperforming the broader market). For comparison’s sake, the S&P 500 is up 115.9% over this same period of time. DISH reported its Q3 earnings on November 4th, posting sales results which were in-line with analyst estimates. DISH’s top-line result was $4.45 billion, which was down 1.8% on a year-over-year basis.

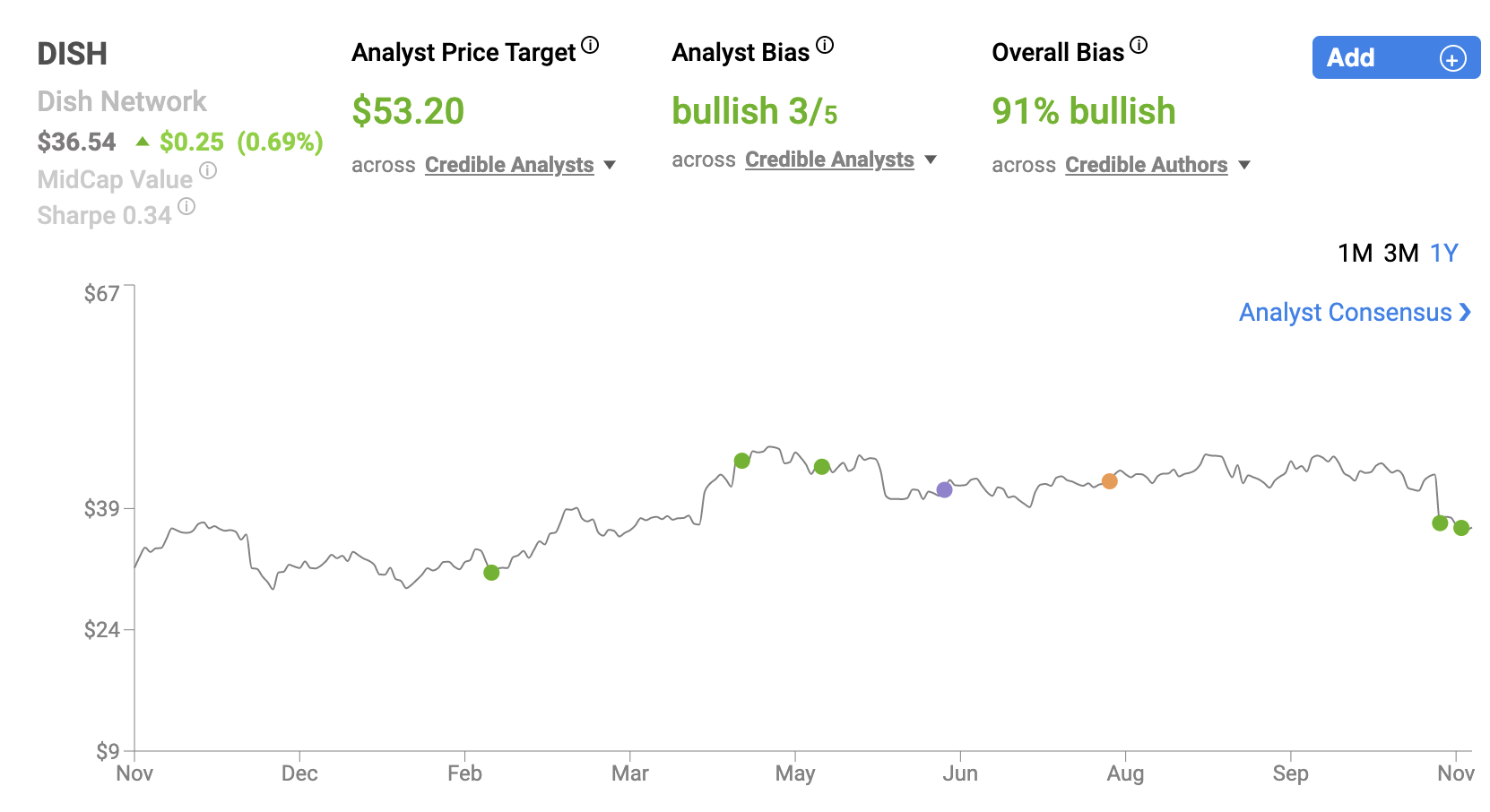

DISH Nov 2021

DISH missed analyst expectations on the bottom-line, posting GAAP earnings-per-share of $0.88, which was $0.03 below Wall Street’s consensus estimate. DISH shares are down approximately 15.2% since reporting Q3 results. And therefore, we wanted to take a look at what the Nobias community of credible authors have been saying about shares recently to see whether or not this company has the potential to turn itself around, making this a double digit dip that investors should take advantage of.

Billy Duberstein, a Nobias 4-star rated analyst, touched upon the secular headwinds that DISH currently faces in a recent article at The Motley Fool. Early on in Duberstein’s report, he said, “The provider of DISH satellite cable TV, the SLING skinny bundle, and Boost Mobile prepaid wireless plans is up against some tough societal changes, and it lost subscribers in each of its businesses.”

He continued, highlighting the subscriber loss data from DISH’s Q3 report, writing, “DISH endured the loss of 13,000 pay TV subscribers, compared with an addition of 116,000 last year. As many know, the cable pay TV bundle is facing long-term declines, though DISH's large presence in rural parts of the nation without access to fast broadband should allow it to retain these pay TV customers for longer than the overall industry. So to see declines was disappointing, even as many are now moving over to streaming. DISH Network saw a 6% decline in satellite subscribers, while the skinny OTT Sling bundle grew subscribers by 4% -- not enough to offset legacy declines. Increased content costs also lowered margins.”

Duberstein also mentioned that DISH’s wireless segment lost 121,000 subscribers during Q3, which was especially disappointing for investors, because as he puts it, “that segment is supposed to be a potential growth business for the company.”

Duberstein notes that DISH still has 5G aspirations and being that the total addressable market in that industry is so high, analysts continue to view this as a potential way for the company to make up for the negative growth that its legacy revenue streams are experiencing. Yet, he concludes his piece highlighting the stock’s uncertainty, saying, “DISH's stock is quite cheap after the sell-off, at just 8.7 times trailing earnings. However, its core business is facing stagnation or decline, and its new 5G venture is highly uncertain. As such, it remains a risky stock, albeit with potential upside should the 5G effort pay off.”

However, as Wayne Rhodes, a Nobias 5-star rated analyst, recently pointed out in his DISH Q3 report, there are quite a few analysts who remain bullish on DISH, largely due to its low valuation and increased profit-related outlooks.

Rhodes said, “ Stock analysts at Truist Securiti raised their FY2021 earnings per share estimates for DISH Network in a report released on Thursday, November 4th.” He continued, “Truist Securiti analyst G. Miller now forecasts that the company will earn $3.79 per share for the year, up from their previous estimate of $3.43.”

Rhodes also pointed out that, “Deutsche Bank Aktiengesellschaft boosted their price objective on shares of DISH Network from $68.00 to $77.00 and gave the company a “buy” rating in a report on Thursday, August 12th.” He highlighted a bit price target upgrade from Moffett Nathanson as well citing that firm’s recent upgrade “of DISH Network from a “sell” rating to a “neutral” rating and boosted their price objective for the company from $15.00 to $40.00 in a report on Monday, July 26th.”

More recently, he highlighted a Raymond James report on DISH which resulted in that firm cutting its price target from $56.00 to $52.00; however, as Rhodes notes, the Raymond James analyst “set a “strong-buy” rating on the stock in a research note on Friday.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

Today, DISH shares trade for $36.54, which means that the Raymond James price target represents upside potential of approximately 42.3%. “Finally,” Rhodes reported, “Pivotal Research boosted their price target on shares of DISH Network from $60.00 to $65.00 and gave the stock a “buy” rating in a research note on Friday, September 17th.”

All in all, when it comes to recent analyst reports, Rhodes says that “One investment analyst has rated the stock with a sell rating, six have assigned a hold rating, four have issued a buy rating and two have issued a strong buy rating to the company.” The bullish lean of the analysts that Rhodes cites is in-line with the strong bullish sentiment that the Nobias algorithm tracks when looking at reports published by credible authors. In that regard, DISH has a 91% “Bullish” sentiment score.

And when looking at the valuations that the blue chip (4 and 5-star rated) Wall Street analysts that the Nobias algorithm tracks have applied to DISH shares, we see that the average price target for this company is $53.20. Relative to DISH’s current share price of $36.54, this $53.20 figure represents upside potential of 45.6%.

Disclosure: Nicholas Ward has no DISH position. Nicholas Ward wrote this article for Nobias at their request with a view of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.