DE with Nobias technology: Deere and Co. (DE) Shares Have Doubled Since 2019. Is There Still Room To Run?

Deere and Co. (DE) shares have been on an interesting ride over the last year or so. Deere recently reported its fiscal Q4 2021 results, wrapping up a year in which the company posted earnings-per-share growth of 119%. This triple digit growth figures comes on the heels of a -13% growth year during the worst of the COVID-19 pandemic during the company’s fiscal 2020 period.

The $18.99/share of earnings that DE reported for the full fiscal year in 2021 is well above the $9.94/share earnings figure that DE reported during pre-COVID times in 2019. And, with that in mind, the stock has been a major winner over the last couple of years. DE shares were trading for approximately $173 at the end of 2019. Today, they’re trading for $349.24, meaning that shares have essentially doubled during the last 2 years.

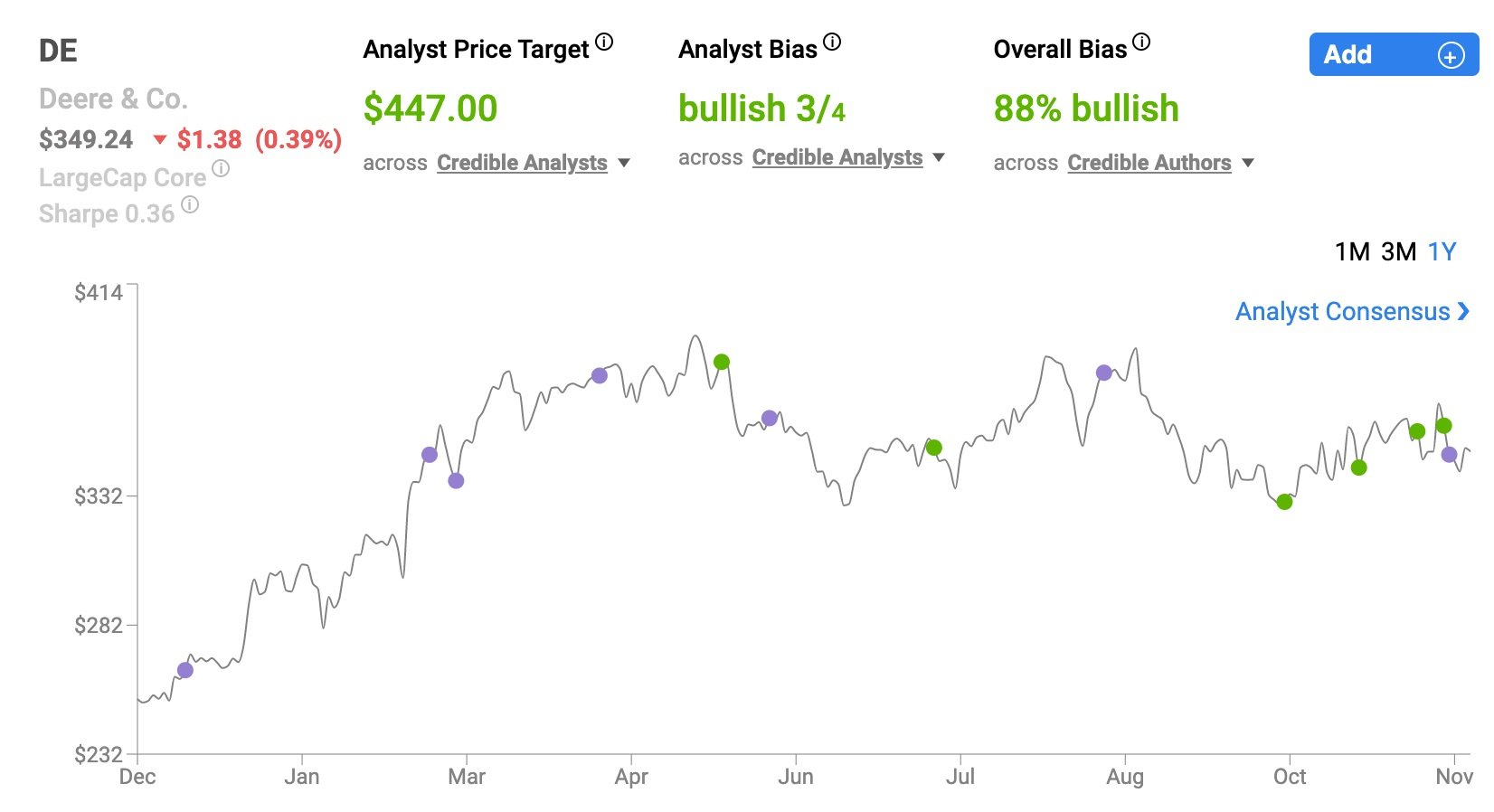

DE shares are up 29.80% on a year-to-date basis, meaning that they’ve outperformed the broader market thus far in 2021 (the S&P 500 is up approximately 21.3% thus far this year). However, Deere share have dipped in recent months and today they’re trading down approximately 12.75% from their 52-week high of $400.34. With this recent weakness in mind, we wanted to take a look at what the credible authors (Nobias rated 4 or 5 stars) have had to say about the stock recently. Is DE a buy during this dip? Let’s see what the analysts tracked by our algorithm have to say.

DE Dec 2021

One of the primary reasons that DE has sold off recently was the labor agreement issues that the company was having with its union workers which went on strike in mid-October. The company has recently resolved the labor issues, coming to an agreement with union leaders, and Vidhi Choudhary, a Nobias 4-star rated analyst, recently covered this dispute in an article at The Street.

Choudhary said that after the company posted such strong quarterly results back in August, the union began to feel as if its workers weren’t being compensated as generously as their recent productivity deserves. He wrote, “Union members have been urging their negotiators to broaden the scope of the bargaining to include work rules, scheduling and other compensation.”

And, after early negotiations between the company and the union, Choudhary noted, “Union members rejected the first proposal October 10, saying the raises and other improvements to benefits offered then were inadequate when Deere’s farm and construction equipment sales are rising and other employers are boosting pay significantly to attract workers.” This dispute caused investors to fear a production slowdown and falling margins as wage inflation related to the negotiations was factored into future estimates.

Tyler Jett, a Nobias 4-star rated author, published an article at Yahoo Finance recently, highlighting the final deal that both sides agreed to in mid-November, ultimately ending the 5-week strike period. After weeks of negotiations, Jett wrote that the two sides agreed to a deal which not only increased worker compensation, but also retirement benefits. He wrote, “Under the contract approved Wednesday, workers on the lowest end of the pay grade, like those in foundry support, will see an hourly wage increase to $22.13 from $20.12. The skilled trades positions at the top of the pay grade, like electricians, will see hourly boosts to $33.05 from $30.04.”

And yet, even with this wage inflation in mind, Deere’s management remained confident about the company’s future moving forward into 2022, maintaining strong guidance. Fiscal 2021 was a record year for Deere in terms of net income. DE generated $5.96 billion in net income this year, which was more than double the $2.8 billion in net income that it generated during 2020 and well above its all-time net income record, produced in 2013, of $3.5 billion.

The Associated Press published an article at last month highlighting management’s forward estimates, saying, “Next year, Deere predicts its profits will grow even higher to between $6.5 billion and $7 billion as demand for its iconic green tractors remains high and infrastructure spending helps boost demand for its construction equipment.” The article highlighted ongoing supply chain risks, saying, “The company said demand will likely exceed what Deere can produce next year again because of the ongoing supply chain problems.” However, overall, the consensus Wall Street estimate for Deere’s fiscal 2022 earnings-per-share currently sits at $22.32/share, which is 18% above the company’s record 2021 figure.

And, with regard to these strong profit oriented metrics, Passive Income Pursuit, a Nobias 5-star rated analyst, posted an article on Deere earlier in the year, highlighting the company’s strong shareholder returns. Passive Income Pursuit wrote, “On August 25th the Board of Directors at Deere & Company (DE) approved an increase in the quarterly dividend payment. The dividend was increased from $0.90 to $1.05 which is an excellent 16.7% increase. Shares currently yield 1.12% based on the new annualized payout.” But, as they point out, this wasn’t the only dividend increase that Deere provided in 2021.

Deere did not increase its dividend in 2020, because of the uncertainties related to the COVID-19 pandemic. The company didn't cut its dividend like so many stocks did during the COVID-19 recession; however, its frozen dividend was concerning to many income oriented investors. But, as Passive Income Pursuit points out, the company has more than made up for this in the minds of those who pay close attention to dividend growth. They wrote, “While this raise is exciting enough, what's truly special is that back in March Deere had already announced an increase. The previous raise was a hefty 18.4% and with this second raise announced the November payout will be 38.2% higher than last year!”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

With regard to DE’s long-term dividend growth history, Passive income Pursuit wrote, “Dating back to 1992 there's been 29 years with year over year dividend growth ranging from 0.0% to 300.0% with an average of 19.6% and a median 9.5%.” These strong dividend growth results in mind, combined with the nearly 20% forward earnings-per-share estimates in place for 2022, appear to be driving the bullish sentiment surrounding Deere shares within the Nobias community.

Right now, 88% of the credible authors that our algorithm tracks are expressing “Bullish” opinions on the stock. And, looking at the 4 and 5-star rated Wall Street analysts that we track, the average price target for DE shares is currently $447.00. Relative to Deere’s current share price of $349.24, this represents upside potential of approximately 28%.

Today, DE shares trade for approximately 18x earnings. This $447.00 price target is in-line with a 20x multiple being applied to the current consensus average of $22.32 for 2022 earnings-per-share. Therefore, it appears that the blue chip analysts that Nobias tracks expect to see multiple expansion over the next 12 months or so, signaling that this dip may be an attractive opportunity for longer term investors to take advantage of.

Disclosure: Nicholas Ward is long DE. Nicholas Ward wrote this article for Nobias at their request with a view of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.