NVAX with Nobias technology: After A Poor Performance During 2021, Can Novavax Rebound This Year?

Throughout the COVID-19 pandemic period the vaccine producers have been in the spotlight. Shares of Pfizer (PFE), BioNTech (BNTX), Moderna (MRNA), and Johnson and Johnson (JNJ) have all had a regular place in the healthcare spotlight because of their vaccines. Pfizer and BioNTech have been the biggest winners here, with their shares up 51.51% and 47.47%, respectively, during the trailing twelve months. Moderna and Johnson and Johnson haven’t fared so well, trailing their peers, the healthcare sector, and the broader market, with trailing twelve month gains of just -0.05% and 1.55%, respectively. However, there is another company working hard on COVID-19 vaccines (which is usually outside of the spotlight). And, its shares have performed the worst, by far, compared to the stocks mentioned during the last year or so. After posting returns of approximately 3000% during 2020, Novavax (NVAX) shares have fallen 38.12% during the past year. With this major underperformance in mind, we wanted to take a look at what the credible authors and analysts that the Nobias algorithm tracks have had to say about the stock. Could this relative underperformance be creating a buying opportunity?

In general, Vaccine stocks have suffered in recent weeks, because there is a growing concern surrounding the long-term viability of the vaccines against the ever mutating COVID-19 virus. George Budwell, a Nobias 4-star rated analyst recently published an article highlighting his favorite 2 COVID-19 growth stocks for 2022. To begin the piece, he highlighted the uncertainty surrounding the potential longevity (and eventual end) of the COVID-19 pandemic, saying: “In brief, immunologists and epidemiologists alike have started to float the idea that the highly infectious omicron variant might ramp up natural immunity to the virus around the globe, sparking the end to the pandemic phase of the outbreak and marking the beginning of the endemic phase. The endemic phase is expected to be characterized by seasonal outbreaks in COVID-19, much like the flu.”

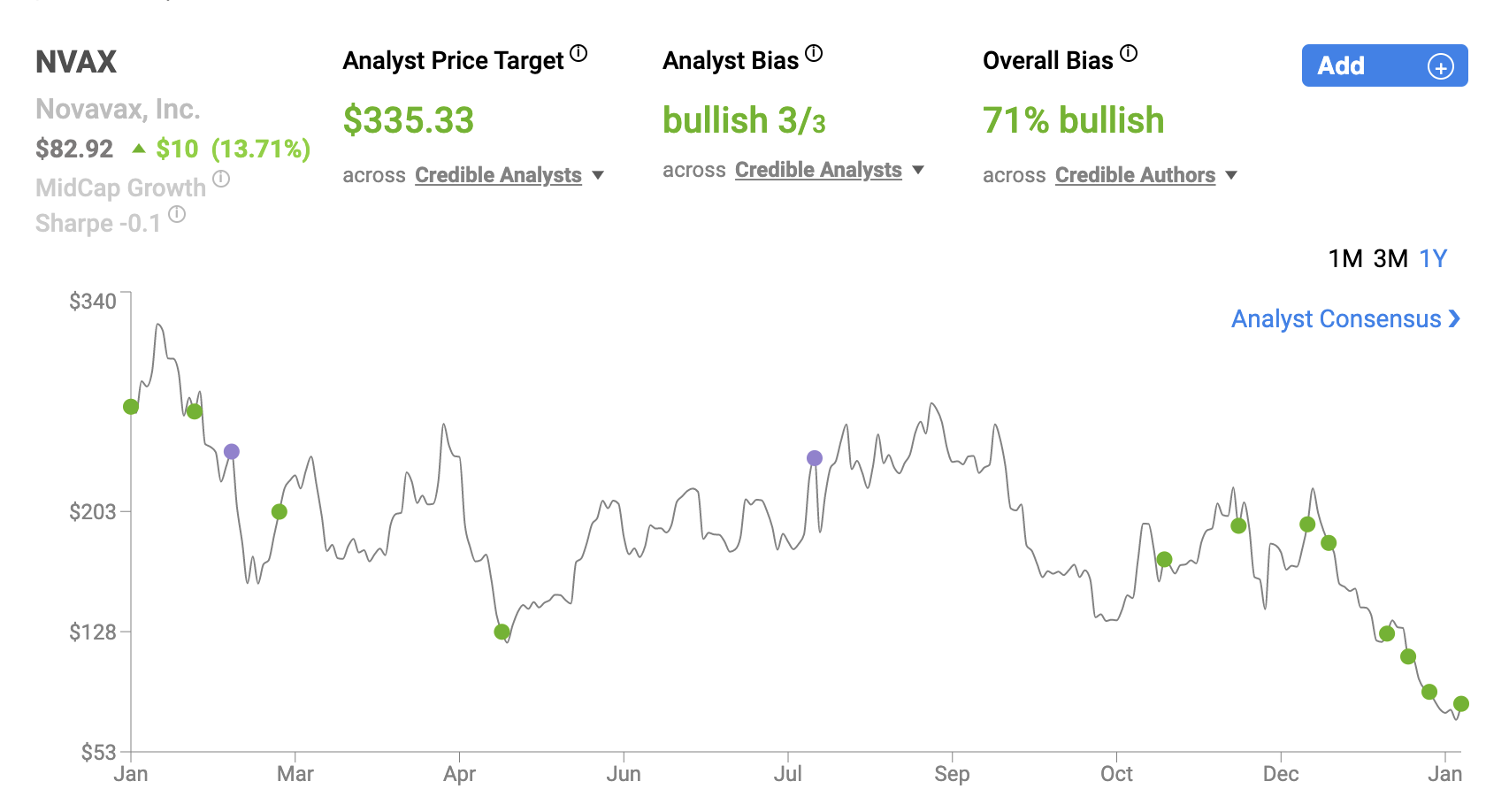

NVAX Jan 2022

So, what does this mean for the vaccine makers? Budwell wrote, “the endemic phase won't result in a complete drop-off in demand for COVID-19 products. If anything, this next stage of the outbreak ought to result in sustained, albeit lower, demand for these life-saving products in the years ahead.”

Budwell named Novavax as one of his top 2 COVID-19 picks, but he was quick to highlight the concerns surrounding the stock which have led to its relative underperformance. He said, “Investors appear to [sic] concerned that Novavax's novel coronavirus vaccine will enter the U.S. market too late to compete effectively against the mRNA juggernauts from Pfizer and Moderna.”

Budwell favors Novavax, in part, because of the ongoing vaccine hesitancy that we continue to see in the U.S. (and in other markets as well). He wrote, “The fact is that there is still a large contingent of Americans who would prefer a more traditional protein-based vaccine like the one from Novavax, compared with a novel mRNA vaccine.” And overall, he believes that NVAX shares are simply too cheap.

Budwell concluded his article writing, “The biotech's stock is now trading at less than 3 times Wall Street's most pessimistic 2022 sales forecast. What's more, the company could have another blockbuster product on the market at some point in the near future with its flu vaccine NanoFlu. And if Novavax's shares fail to rebound soon, this novel vaccine maker might simply get bought out by one of the many big pharmas that missed the boat on the COVID-19 vaccine opportunity.”

Budwell isn’t the only credible author that we track who believes that NVAX shares are cheap. Nobias 5-star rated Taylor Carmichael recently published an article at The Motley Fool which also highlighted a bull case for NVAX shares. Regarding valuation, Carmichael said, “One, the stock is downright cheap right now. Novavax sports a forward price-to-earnings (P/E) ratio of 3.39, while Moderna is three times as expensive at a P/E of 10.63. I expect these ratios to come into alignment once Novavax starts shipping 2 billion doses of the COVID vaccine this year.” He continued, citing manufacturing delays, not drug quality, as the reason for NVAX’s recent underperformance.

Carmichael wrote, “Novavax's vaccine candidate had outstanding results in phase 3 trials. Some observers have called it best-in-class. But the stock's been hammered while Novavax has tried to scale up manufacturing while assuring regulators that the vaccine doses from the plants are just as pure as the ones used in clinical trials.” He expects these delays to end in the near-term, saying, “Now, authorities around the world are signing off on its vaccine candidate. Novavax expects to file with the Food and Drug Administration this week. As the biotech ships more and more vaccine doses out into the world, the stock will resume its epic run upward.”

Faisal Humayun, a Nobias 5-star rated author, is also bullish on NVAX’s manufacturing capabilities moving forward, highlighting the company’s long-term plans in this regard in a recent article. Humayun said, “From a manufacturing perspective, the company already has a capacity of 150 million doses per month. Novavax also has licensing agreements in India, South Korea and Japan. This boosts their overall manufacturing capability.”

Humayun also said that Novavax is working on several combo vaccines, including one that will protect patients from both COVID-19 and the flu. Humayun continued, “From a long-term perspective, Novavax is building a strong pipeline of vaccines. Clinical trials are ongoing for Covid-19, seasonal influenza and combination vaccines. The company has also initiated trials for a combination of NanoFlu and respiratory syncytial virus (RSV) vaccine.”

Carmichael is also bullish on the future of the company’s vaccine portfolio, in large part, because he thinks that the safety profile of the NVAX vaccine may allow it to quickly gain market share once it’s approved. Carmichael said, “The first-round mRNA vaccines are highly safe (definitely safer than staying unvaccinated). Nonetheless, there's a tiny risk that an mRNA booster in young people might cause heart inflammation, specifically myocarditis and pericarditis. The Novavax vaccine doesn't seem to have this risk and might win market share on this basis alone.”

Lastly, he also believes that “Novavax has a commanding lead over Moderna in flu vaccines” and therefore, the longer-term prospect of a combo COVID-19/flu vaccine would be a big winner for this company in the event that the pandemic turns endemic and the world requires annual boosters.

Adria Cimino, another Nobias 5-star rated author, recently published an article on NVAX where she too highlighted the importance of vaccine approval and rollout for this company’s near-term prospects. Cimino noted that the “European Commission authorized the vaccine in late December” and therefore, “Novavax said doses will start arriving in Europe this month.” She continued, saying, “Novavax has signed an advance purchase agreement with the European Union for the delivery of as many as 200 million doses through next year.”

Cimino mentioned that the pricing of these doses is unknown; however, if the NVAX vaccines contracts land in the ~$20 area (which is the price point where Cimino says that its rivals often sell their vaccines) then this EU delivery could represent sales of approximately $4 billion. She noted, “That's huge for a biotech company's very first commercialized product.”

And, that’s just in the EU. The U.S. is another major market for NVAX and like Carmichael said, bullish investors believe that NVAX will receive emergency use authorization in the U.S. in the near future. Cimino wrote, “Early in the vaccine race, the U.S. awarded Novavax $1.6 billion in funding for its program. As part of the deal, the company would produce 100 million doses for the U.S. So, if authorized, Novavax's vaccine will get its chance to enter the U.S. market”

With bullish sales/earnings prospects in mind, Cimino wondered whether or not it was possible for NVAX shares to reach some of the highest price targets that are currently being applied to shares on Wall Street, which generally hover in the $300/share area.

Today, NVAX trades for $82.92, which means a $300 target represents upside potential of roughly 260%. In an attempt to justify that massive rally, Cimino said, “let's do some math.” She continued, saying, “The current earnings per share estimate for Novavax this year is $25.71. If the stock were to rise to $300, it still would be reasonably priced in relation to that level of earnings. Novavax would have a price-to-earnings ratio of about 11. By comparison, Moderna today is trading at about 14 times trailing-12-month earnings.” With that in mind, she concluded that a major rally from here is certainly possible.

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

Cimino wrote, “As always, biotech stocks that depend heavily on one product remain high-risk. Any disappointment could crush the shares. But if Novavax successfully manages this next chapter in its vaccine story, it's possible this biotech stock could reach analysts' highest forecasts.” NVAX’s 52-week high is $331.68 - a level that the shares reached back in February of 2021. And looking at the credible Wall Street analysts that the Nobias algorithm tracks, it appears that they believe the stock can return to these prior highs.

Right now, the average price target being applied to NVAX shares by the credible analysts that we track is $335.33. This represents upside potential of approximately 300%. However, it is important to note that the credible authors that we track are slightly less bullish.

70% of the reports published by credible authors that we follow are bullish; however, the other 30% of opinions which lean bearish continue to remain focused on the lack of U.S. approval and ongoing market share concerns.

It’s clear that NVAX has upside potential, but without U.S. approval of its COVID-19 or the combo vaccines that it’s working on in its pipeline, the stock’s growth story remains speculative. But, all equities are risk assets and overall, the majority of both the authors and analysts that we track appear to believe that the risk/reward scenario applied to NVAX shares after its recent sell-off is an attractive one.

Disclosure: Of the stocks mentioned in this article, Nicholas Ward is long JNJ and PFE. Nicholas Ward wrote this article for Nobias at their request with a view of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.