MSFT with Nobias technology: Down Nearly 10% From All-Time Highs, Is Microsoft A Buy?

Microsoft is currently the world’s second largest company (in terms of market capitalization). This $2.25 trillion company is in many investors’ portfolios because its diverse operations, strong balance sheet, and reliable cash flows allow investment managers who hail from many different schools of thought to own MSFT shares.

MSFT is one of only 2 companies in the world with a AAA-rated balance sheet (the other is Johnson and Johnson). For reference, this means that MSFT’s credit is considered to be of higher quality than the United State’s government’s (the U.S. government’s credit rating is AA+ after a 2011 downgrade). With that in mind, investors who focus on high quality defensive assets tend to own MSFT.

Microsoft is also a leader in several of the strong secular growth markets in the technology space (such as the cloud, data storage, artificial intelligence, digital security, and gaming). This means that growth oriented managers have been known to flock towards MSFT as well. And lastly, Microsoft is known to return billions upon billions of dollars to its shareholders every year, in the form of a reliably growing dividend (Microsoft has increased its dividend for 20 consecutive years and sports a 10-year dividend growth rate of 13%). This means that even income oriented investors are often attracted to this high growth tech stock.

Needless to say, the company’s $2 trillion+ market cap hasn’t happened by accident. MSFT has been one of the top stocks in the market for years now (during the last 5 years, Microsoft shares are up 368.62%, which is well above the 93.02% gains that the S&P 500 has posted during the same period). And yet, recently, we’ve seen shares sell off alongside the broader markets during recent weeks.

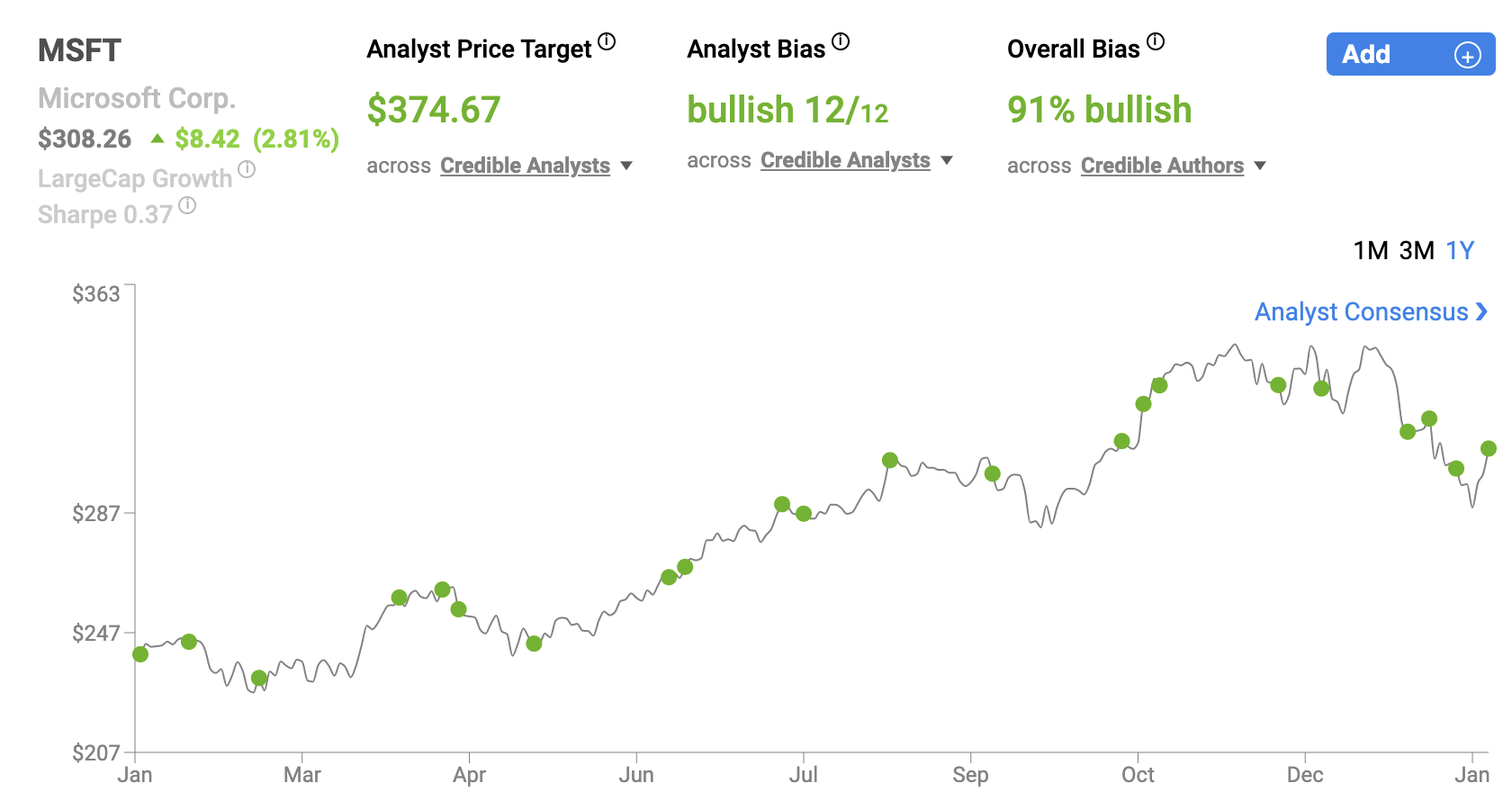

MSFT Jan 2022

Microsoft shares are down 9.67% during the last month on the heels of Microsoft’s recent Q2 earnings report and breaking news that the company was attempting to make it largest M&A deal ever (by acquiring gaming company, Activision Blizzard (ATVI) in an all-cash deal valued at approximately $68.7 billion). Therefore, we wanted to take a look at what the credible authors and analysts that we track with the Nobias algorithm have to say about this company and its stock to see whether or not this roughly 10% dip is something that investors should consider buying.

When Microsoft reported its Q2 fiscal 2022 earnings on January 25th, the company beat Wall Street’s estimates on both the top and bottom lines. Microsoft posted quarterly revenues of $51.7 billion, which were up 20% on a year-over-year basis. On the bottom-line, MSFT beat estimates as well, posting diluted earnings-per-share of $2.48, which represented 22% year-over-year growth.

During the company’s earnings report, Microsoft’s CEO, Satya Nadella, said: “Digital technology is the most malleable resource at the world’s disposal to overcome constraints and reimagine everyday work and life. As tech as a percentage of global GDP continues to increase, we are innovating and investing across diverse and growing markets, with a common underlying technology stack and an operating model that reinforces a common strategy, culture, and sense of purpose.”

During Q2, MSFT saw double digit sales growth across all of its major operating segments. The company’s Productivity and Business Processes segment posted revenue of $15.9 billion which represented 19% y/y growth. The company’s Intelligent Cloud segment revenue came in at $18.3 billion, up 26% y/y. And, Microsoft’s Personal Computing segment posted sales of approximately $17.5 billion, up 15% y/y.

The company ended the quarter with more than $125 billion in cash and cash equivalents on its balance sheet, compared to just $48.2 billion of long-term debt. And, Microsoft noted that it returned $10.9 billion to shareholders during the quarter in the form of dividends and buybacks, which was 9% more than it did during the second quarter a year before.

So, from an operational standpoint, the results were seemingly all positive. And, Nobias 4-star rated author, Anthony Di Pizio noted that these strong results make Microsoft one of his favorite defensive stocks to “buy in tough times”. He said, “In a difficult market, owning diversified companies can help to protect against excessive downside. Microsoft operates a portfolio of globally recognized businesses that perform well in different environments, so when one is struggling due to external factors like economic uncertainty, others often pick up the slack.”

Di Pizio appeared to be bullish on Microsoft’s recent Activision Blizzard acquisition, saying, “Microsoft's gaming business is especially interesting because the company recently acquired developer Activision Blizzard, which is best known for its Call of Duty series.

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

On the business diversity front, this acquisition adds yet another arrow to Microsoft's quiver.” “But,” he says, “the company's largest segment by revenue is actually cloud services, driven by its Azure platform.” And, Di Pizio appears to be bullish here as well, noting, “Microsoft Azure offers over 200 products and 40 solutions, including a platform to build advanced technologies like artificial intelligence and machine learning. Azure is used by 95% of the Fortune 500 companies.” He mentioned that during Microsoft’s fiscal year in 2022, the company is expected to post sales of $196 billion and earnings-per-share of $9.22. He continued, saying that these two figures represent compounded annualized growth rates of 17% and 26%, respectively, since the start of fiscal 2020.

In other words, Microsoft’s business has managed to continue to grow at a strong double digit clip throughout the COVID-19 recession period, which factors into his favorable outlook on shares during times of high market volatility. And, overall, it appears that Di Pizio is not alone in this bullish stance.

This week the Nobias algorithm spotted Joseph Bonner of the investment firm Argus, who is rated as a Nobias 5-star analyst, establishing a $371/share price target on MSFT shares. With this new price target taken into account, the average price target being applied to Microsoft from the credible analysts that we track (only those with Nobias 4 and 5-star ratings) now comes in at $363.57.

Today, MSFT shares trade for $308.26, which means that this average price target represents an upside potential of approximately 17.9%. 92% of the credible authors that we track express bullish opinions on MSFT shares as well. All in all, looking at the outlooks and opinions analyzed by the Nobias algorithm, it does appear as though Microsoft’s recent pullback represents an intriguing opportunity to accumulate shares.

Disclosure: Nicholas Ward is long MSFT. Nicholas Ward wrote this article for Nobias at their request with a view of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.