BBBY with Nobias technology: Is Bed Bath & Beyond A Buy After Activist Investor Interest?

Bed Bath & Beyond has been a very volatile stock in recent weeks, rising by more than 60% before quickly retracing its steps, falling roughly 25% from its recent highs. On March 1st, Nobias 5-star rated author, Sarita Garza, covered BBBY in an article at The Markets Daily, highlighting the company’s business summary and recent earnings results.

Garzo wrote, “Bed Bath & Beyond, Inc engages in the operation of retail stores and retails domestics merchandise and home furnishings. Its products include domestic merchandise and home furnishings such as bed linens and related items, bath items, kitchen textiles kitchen and tabletop items, fine tabletop, basic house wares, general home furnishings, and consumables.” Garzo continued, “Bed Bath & Beyond (NASDAQ:BBBY) last posted its quarterly earnings results on Thursday, January 6th. The retailer reported ($0.25) earnings per share (EPS) for the quarter, missing the Thomson Reuters’ consensus estimate of $0.02 by ($0.27). The firm had revenue of $1.88 billion for the quarter, compared to analyst estimates of $1.95 billion. Bed Bath & Beyond had a negative net margin of 4.64% and a positive return on equity of 3.22%.”

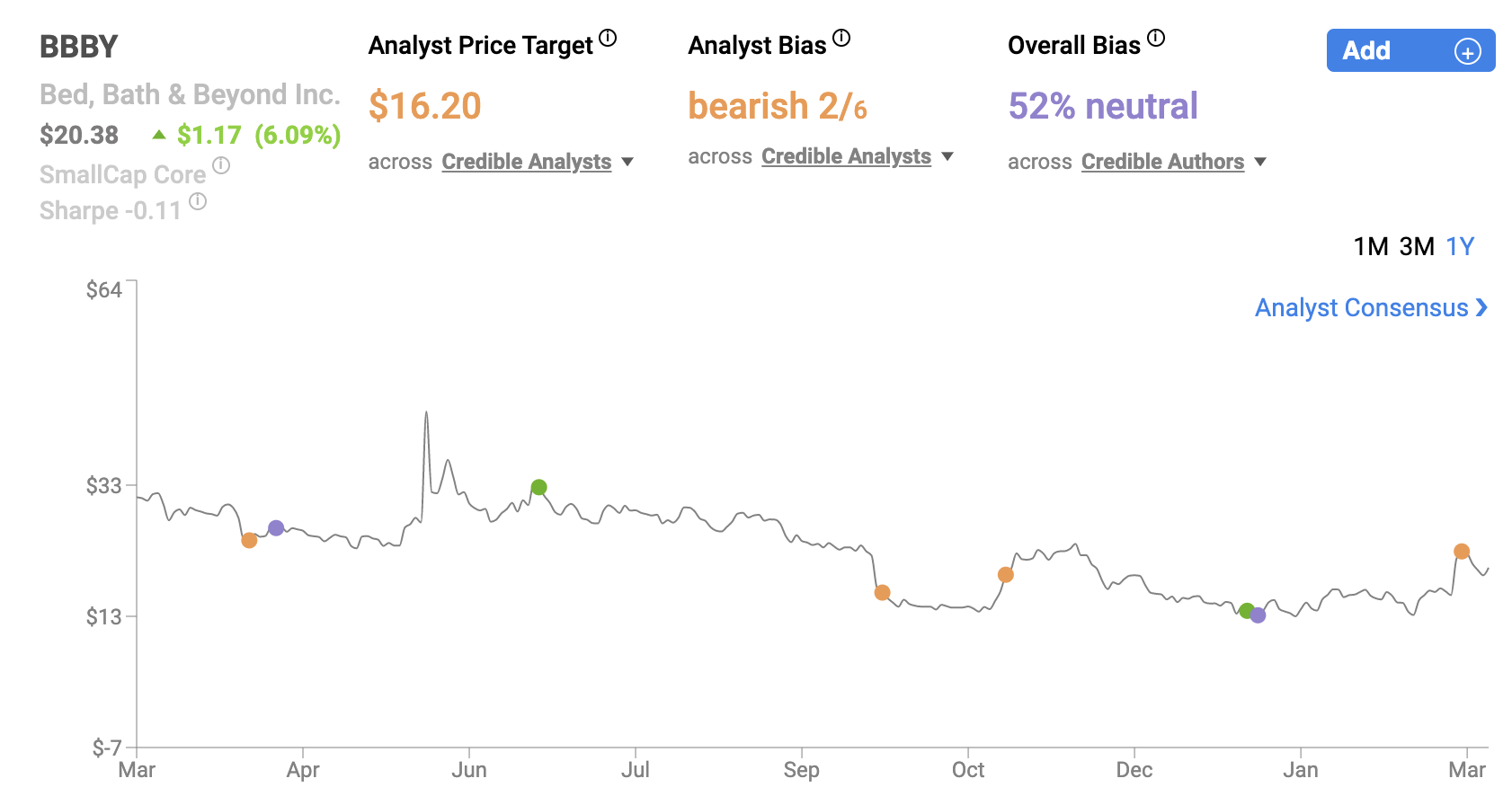

BBBY shares sold off after this fiscal Q3 results, extending a period of share price weakness which has lasted for years. However, after these recent struggles, there has been a slew of insider buying activity of BBBY, as well as more recently, an activist investing firm going long the company’s shares. It appears that this insider/institutional demand has inspired the stock’s recent rally and we wanted to provide coverage of this activity to Nobias subscribers.

BBBY March 2022

In late January, Bed Bath & Beyond shares bounced on an SEC report highlighting an insider purchase by the company’s COO, John Hartman, bought $100,005.00 worth of shares at $15.00, upping his ownership to 700,166 shares of the company’s stock. However, this rally was relatively short-lived and in recent weeks, we saw BBBY sink down towards its 52-week low in the $12 range.

A recent report by Seeking Alpha news editor, Jessica Kuruthukulangara, shows that Hartman wasn’t the only insider buying into this recent weakness. Her report shows other recent insider purchases by members of BBBY’s management team and members of its Board of Directors.

Kuruthukulangara wrote:

CFO Gustavo Arnal bought 15K shares at $13.78-13.81/share, after which he now holds 333.2K shares.

Chief stores officer Gregg Melnick bought 7.2K shares at $13.79-13.84/share, following which he now owns 104K shares.

Chief merchandising officer Joseph Hartsig bought 5K shares at $13.78/share, after which he now holds 221.5K shares.

Chief customer officer Rafeh Masood bought 7K shares at $14/share, following which he now owns 153K shares.

Joshua Schechter, a BBBY director, bought 6K shares at $13.85-13.87/share, after which he now holds 35K shares.

The confidence expressed by BBBY’s management team wasn’t enough to meaningfully bolster its shares price. However, last week, news broke that RC Ventures LLC, an investment firm managed by Ryan Cohen, who co-founded Chewy (CHWY) and is currently the Chairman of Gamestop (GME), took a 9.8% stake in BBBY and this news sent the stock soaring.

Cohen, a popular figure in the retail industry because of his success at Chewy, sent a letter to BBBY’s Board of Directors, highlighting the rationale of his firm’s large investment. Cohen’s letter to BBBY’s Board of Directors stated: “We have carefully assessed Bed Bath’s assets, balance sheet, corporate governance, executive compensation, existing strategy and potential alternatives. While we like Bed Bath’s brand and capital allocation policy, we have concerns about leadership’s compensation relative to performance and its strategy for reigniting meaningful growth.”

Cohen noted that Bed Bath & Beyond, “is struggling to reverse sustained market share losses, stem years-long share price declines and navigate supply chain volatility.” Also, he noted, “the Company’s named executive officers were collectively awarded nearly $36 million in compensation last fiscal year – a seemingly outsized sum for a retailer with a nearly $1.6 billion market capitalization.”

Cohen’s letter pointed out BBBY’s recent performance issues. He noted that BBBY shares have a 1-year total return of -43.55%, a 3-year total return of 10.67%, a 5-year total return of -54.01%, a 10-year total return of -69.32%, and a 20.57% total return during the current tenure of CEO Mark Tritton.

In comparison’, Cohen points out that the S&P 500’s returns during these same periods of time all outpace BBBY’s by a wide margin. His letter stated that the S&P 500’s 1-year, 3-year, 5-year, 10-year, and CEO-matching returns were 16.47%, 63.10%, 98.81%, 284.91%, and 46.11%, respectively.

Cohen challenged BBBY’s current leadership, saying, “Almost two-and-a-half years into Mr. Tritton’s tenure, Bed Bath has underperformed the S&P Retail Select Industry Index by more than 58% on an absolute basis and is looking at an approximately 29% decline in full-year sales from pre-pandemic levels.” Cohen then moved onto a series of suggestions for the company’s Board to consider, which, in his opinion, has the potential to unlock significant value for shareholders. His letter stated, “We believe Bed Bath needs to narrow its focus to fortify operations and maintain the right inventory mix to meet demand, while simultaneously exploring strategic alternatives that include separating buybuy Baby, Inc. (“BABY”) and a full sale of the Company.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

Cohen also brought up the potential to unlock shareholder value by selling the company outright to a private equity buyer, saying: “The final path we want to raise for consideration is a full sale of Bed Bath, in its current form, to one of the many well-capitalized financial sponsors with track records in the retail and consumer sectors and the ability to pay a meaningful premium.” He concluded his letter saying, “Hopefully leadership acts with urgency to implement the aforementioned suggestions. Given that I am the Chairman of GameStop and overseeing a systematic transformation, I am not in a position to join Bed Bath’s Board and personally drive the initiatives outlined in this letter. This does not mean, however, that RC Ventures will not seek to hold the Board and management accountable if necessary.” And, on this news, BBBY stock soared, with its share price rising from approximately $16.00/share to more than $26.00/share, or a single day rally of roughly 62.50%.

Since then, the exuberance surrounding BBBY shares has worn off and today, they trade for $19.99/share (meaning that they’ve lost roughly 27% of their value during the last 5 trading sessions). Yet, this $19.99/share price is still roughly 25% higher than BBBY traded for prior to Cohen’s letter, so it appears that the market has reacted positively, overall, to this activist investor news.

However, when looking at the credible authors and analysts that the Nobias algorithm tracks (only those with 4 and 5-star ratings) we see a more bearish outlook. Only 51% of the recent articles published on Bed Bath & Beyond by the credible authors that we track have expressed a “Bullish” opinion on BBBY shares. And, when looking at the price targets currently being applied to BBBY by the credible Wall Street analysts that we follow, we see that the average price target for this company is currently $16.20. This is essentially in-line with the level that BBBY traded at prior to Cohen’s letter. And, relative to the current $19.99 share price, it implies downside potential of nearly 19%.

Disclosure: Nicholas Ward has no position in any stocks mentioned in this article. Nicholas Ward wrote this article for Nobias at their request with a view of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.