CRWD with Nobias technology: CrowdStrike: Is It Time To Buy This Cyber Security Stock After A Q4 Earnings Beat?

We’ve seen numerous headlines related to cyber crimes in recent years. Just last week, news broke that hackers stole company data from Samsung related to its Galaxy devices. The Verge broke down this story in an article, highlighting the fact that the hacking out, named Lapsus$ claimed responsibility. The Verge report noted that Lapsus$ also recently hacked chip maker Nvidia as well.

Prior to the Russian invasion of Ukraine, The Hill highlighted recent warnings from U.S. government agencies that Russian cyber attacks could target U.S. infrastructure and/or private institutions in response to the aid that the United States has provided to Ukraine and the impending sanctions that were likely to go into place.

The Hill’s report read, “The Cybersecurity and Infrastructure Security Agency (CISA) has issued a "Shields Up" alert for American organizations saying that U.S. systems could face Russian cyberattacks amid warnings from Biden administration officials that a Russian invasion of Ukraine could be imminent.”

Recent 5G/internet of things innovation has led Wall Street analysts to speculate about the “5th Industrial Revolution”. A recent study published by the National Center for Biotechnology Information titled, “Is COVID-19 pushing us to the Fifth Industrial Revolution (Society 5.0)?” stated, “The fifth industrial revolution is dawning upon the world in unforeseeable ways as we increasingly rely on Industry 4.0 technologies including Artificial Intelligence (AI), Big Data (BD), the Internet of Things (IoT), digital platforms, augmented and virtual reality, and 3D printing.”

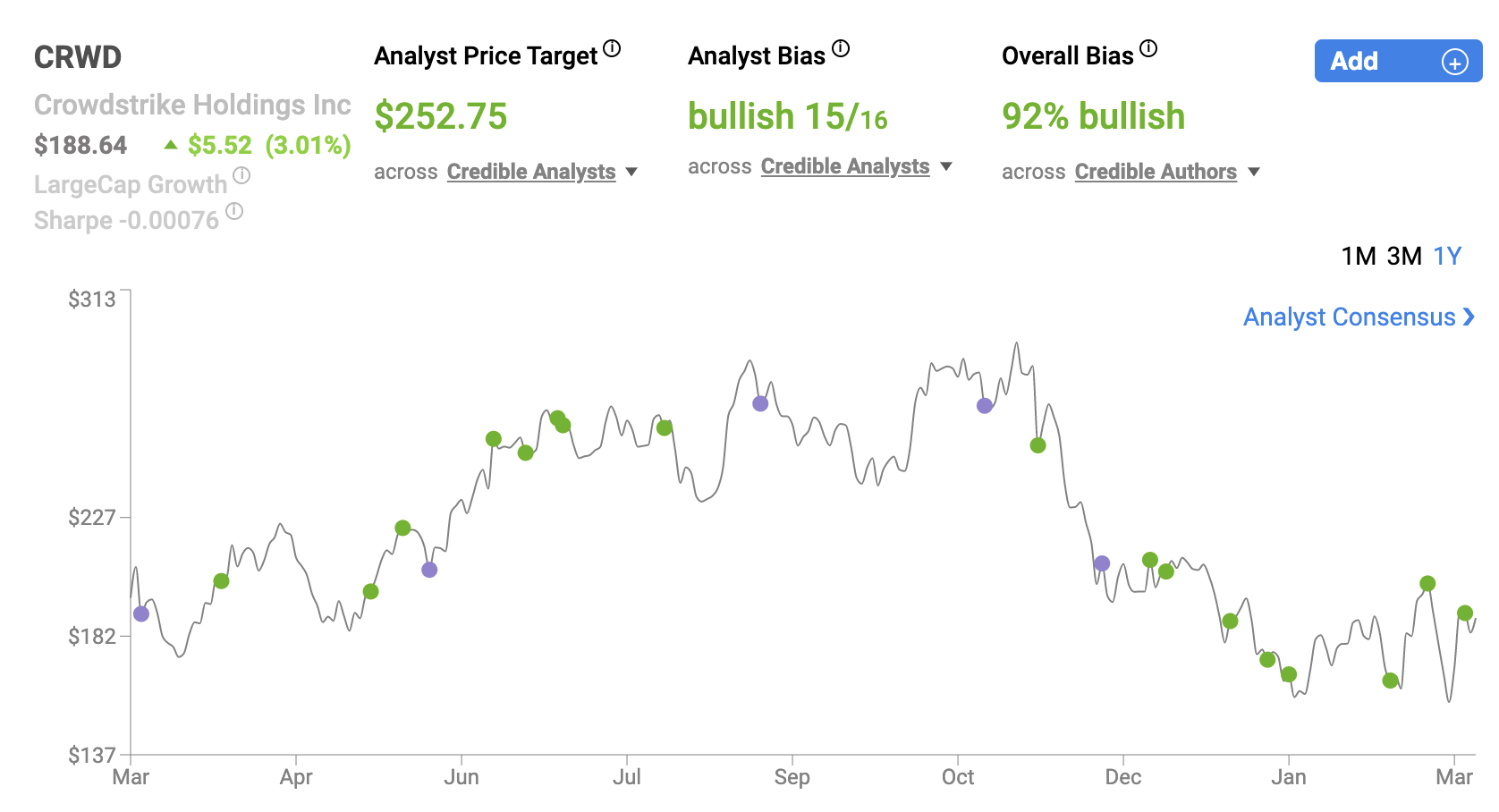

CRWD March 2022

The fact of the matter is, everyday the world forges further and further into the digital age. And, this has created a secular tailwind in the cybersecurity industry. However, in recent weeks, even with threats of state based cyber attacks on the rise, cybersecurity stocks have hold off.

During the trailing 30 days, the ETFMG Prime Cyber Security ETF (HACK) is down 3.98%. CrowdStrike (CWRD) is a popular stock in the cybersecurity space, with a market cap of $43.7 billion. CRWD shares are down 0.94% during the last month. CRWD is down 7.09% on a year-to-date basis. And, shares of this cybersecurity firm are down 38.3% from their 52-week high.

On February 15th, 2022, Michael Walen, a Nobias 5-star rated author, published a report on CRWD at The Markets Daily. Walen described CrowdStrike’s business model, saying: “CrowdStrike Holdings, Inc is a holding company, engaged in the provision of cloud-delivered solutions for next-generation endpoint protection that offers cloud modules on its Falcon platform through a SaaS subscription-based model. It operates through Domestic and International geographical segments.”

Regarding CRWD’s financials, Walen wrote: “CRWD stock has a market cap of $41.42 billion, a price-to-earnings ratio of -192.13, a PEG ratio of 17.72 and a beta of 1.44. The company’s 50-day moving average price is $188.90 and its 200-day moving average price is $233.70. The company has a current ratio of 1.90, a quick ratio of 1.90 and a debt-to-equity ratio of 0.77.” Also in mid-February, Graham Grieder, a Nobias 5-star rated author, posted an article on CrowdStrike, saying that its shares were at “Do or Die Territory” in terms of a share price turnaround.

Grieder began his piece saying, “The company IPO'd in 2019 and has performed very well since. At the peak, the stock was up almost 400% from the IPO price. Even today, it remains ~175% from the initial offering. Clearly, it has come under attack along with the rest of the growth/tech market, but is the story good enough to turn around?”

Regarding the company’s growth, Grieder was very bullish highlighting the company’s 67% ARR growth in recent years. However, when looking at a speculatively valued growth stock like CRWD, all that matters is what numbers the company produces moving forward.

Regarding future growth expectations, Grieder said, “So what did they expect to achieve in Q4? They were looking for $406.5-$412.3 million in revenue (53-56% growth). For the full year, this would take them to around $1.4 billion which is ~64% year-over-year. That's pretty good if you ask me.”

CRWD’s strong growth is the primary reason why Grieder believes an investor would be interested in buying CRWD shares. However, even with these strong expectations in mind, he questioned, “Will it be good enough for the market? That's the question.”

Bringing up the question, “Why sell?” Grieder highlighted the valuation concerns surrounding CRWD. He said, “The biggest risk is that all of the future growth is already priced in, and now we are starting to see the growth decelerate. Now, this is natural. There's no way the company is going to grow revenue at 60%+ year-over-year for the entirety of their lifespan.” He also touched upon a bearish macro environment, saying, “With inflation and yields rising, growth gets impacted even harder as future dollars become worthless and less what seems like every day. For the turnaround to happen, I think we need to see hard evidence that the current high inflation is in fact transitionary, and not here forever.”

Wrapping up his report, Grieder wrote, “As you can see, we are at a bit of a pivot point. A lot of it does depend on the macro market and where the economic winds shift with regards to growth stocks. But, the earnings report in early March will paint a clear short-term picture.”

Today, CRWD trades for $184.87. Part of the stock’s recent uptick in share price was based on CRWD’s recent Q4 report. CRWD reported Q4 earnings on March 9th, 2022 and beat analyst estimates on both the top and bottom lines.

The company’s revenue totaled $431 million, up 62.7% on a year-over-year basis. The company’s non-GAAP earnings-per-share came in at $0.31/share, beating analyst consensus estimates by $0.11/share. CrowdStrike provided investors with full-year fiscal 2023 guidance during their fourth quarter report. The company is calling for 2023 full-year revenues to arrive in a range of $2.133 billion-$2.163 billion, which represents approximately 47% y/y growth compared to fiscal 2022’s $1.45 billion revenue figure. The company is calling for non-GAAP income per share to arrive in a $1.03-$1.13 range, representing roughly 61.2% growth relative to 2022’s full-year non-GAAP income per share of $0.67.

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

During the Q4 report George Kurtz, CrowdStrike’s co-founder and chief executive officer, said: "CrowdStrike once again delivered an exceptional fourth quarter and capped off a record year, achieving new milestones across both the top and bottom line.

Net new ARR of $217 million in the quarter was a new all-time high, driven by expansion of our leadership in the core endpoint market as well as a record quarter for cloud, identity protection and Humio. As our record results, growing scale and module adoption rates demonstrate, customers are increasingly leveraging the breadth and depth of the Falcon platform as they look to transform their security stack.” And, he isn’t the only one expressing bullish sentiment surrounding this company’s fundamentals and growth potential.

Looking at the community of credible authors that the Nobias algorithm tracks, we see that 92% of recent articles have expressed “Bullish” opinions on CRWD shares. Right now, the average price target being applied to CRWD by the credible Wall Street analysts that we track is $252.75. This represents upside potential of 36.7%. Since the company’s Q4 report on 3/9/2022, we’ve seen 7 credible Wall Street analysts (only those with 4 and 5-star Nobias ratings) update their price targets for CRWD shares. The average of these recently updated price targets is $261.43. This represents upside potential of approximately 41.4% relative to the stock’s current share price of $184.87.

Disclosure: Nicholas Ward has no position in CRWD. Nicholas Ward wrote this article for Nobias at their request with a view of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.