UNH with Nobias Technology: Case Study on United Healthcare

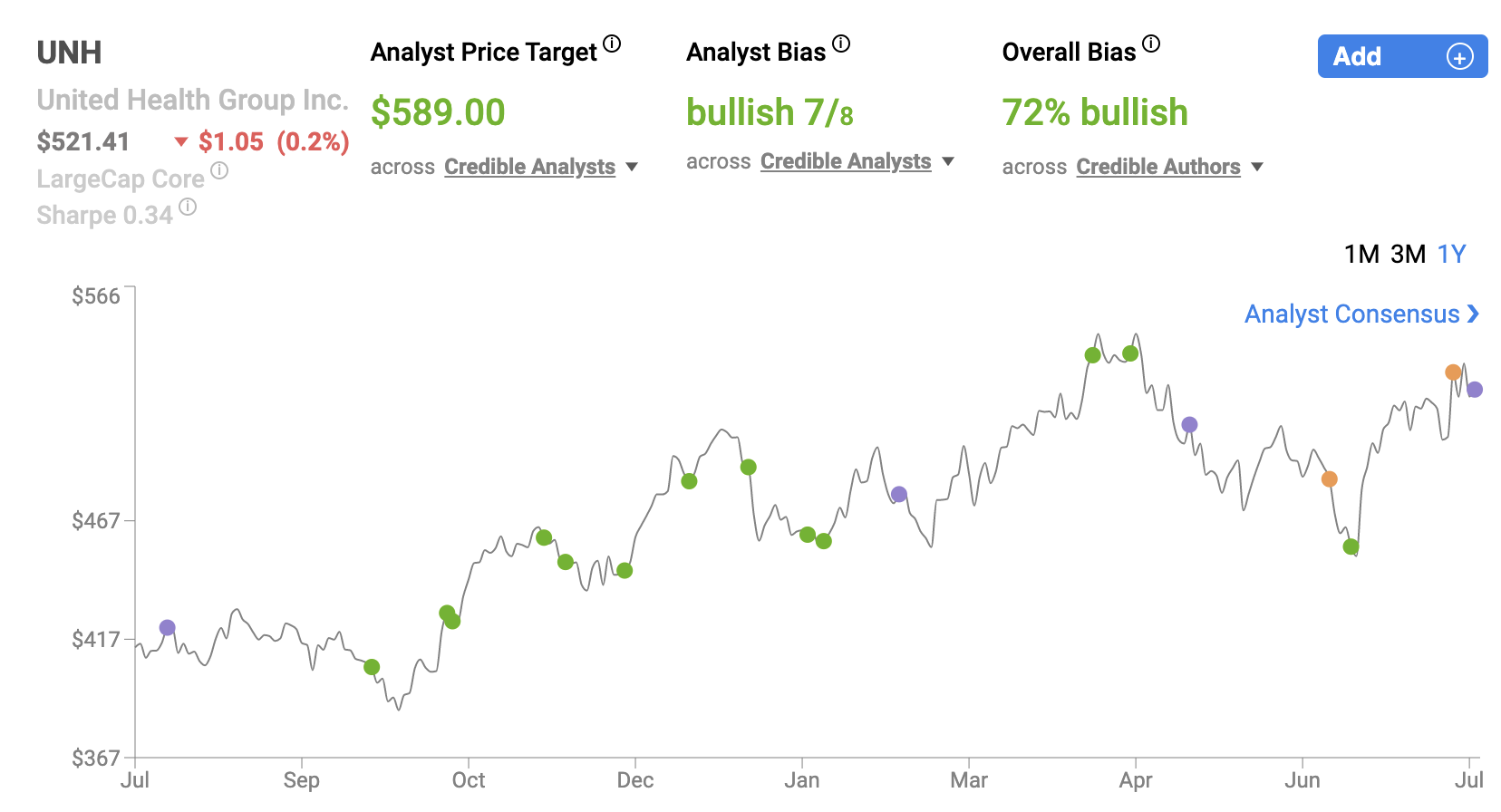

United Healthcare reported earnings on Friday of last week. It was the first major insurance company to do so. The company continued its trend of beating Wall Street estimates and rallied into the end of the week. UNH shares were up by 3.02% on the week, pushing its year-to-date gains up to 5.47%. This means that UNH is a major out-performer on a year-to-date basis (the S&P 500 is down by 19.46% during 2022 thus far). And yet, even with this relative year-to-date outperformance in mind, credible analysts are still bullish on UNH moving forward, projecting double digit upside potential.

Jonathan Block, a Nobias 4-star rated author, recently highlighted the importance of Unitedhealth earnings in a Seeking Alpha report, writing, “UnitedHealth's results are closely looked at by investors as they are seen as a bellwether for the rest of the industry. The company is the largest health insurer based on membership.”

Block’s report stated, “UnitedHealth has a history of beating analyst estimates going back at least to Q2 2017.” Block said, “As COVID-19 continues to have less of a daily impact, one statistic in earnings releases to pay attention to is change in the medical loss ratio ("MLR").” He continued, “During the height of the pandemic, many doctor visits and procedures were put off, allowing the MLR to fall for many insurers. This helped the bottom line.”

UNH Jul 2022

However, Block stated, “There are already signs MLRs are rising. In its Q1 results, the MLR was 82%, up from 80.9% in the year-ago period.” Yet, despite these rising MLR figures, Block noted that UNH management increased its full-year guidance after a bullish Q1 report (where the company beat Wall Street’s estimates on both the top and bottom lines).

Back in mid-April, the company stated, “Based upon the first quarter performance and enterprise-wide growth outlook, the Company increased its full year net earnings outlook to $20.30 to $20.80 per share and adjusted net earnings to $21.20 to $21.70 per share.” Coming into UNH’s second quarter report, Block noted, “For Q2 2022, analysts are expecting GAAP EPS of $4.99 and revenue of $79.68B.”

Damian J. Troise, a Nobias 4-star rated author, collaborated on a macro write-up published at MarketBeat on Friday, which highlighted consumer sentiment data, alongside several prominent earnings reports (including UnitedHealthcare’s), which sent the market higher into the weekend.

Troise wrote, “Stocks are broadly higher in afternoon trading on Wall Street Friday following an encouraging report on consumer sentiment and inflation expectations.” His report stated, “Wall Street has been worried that the Fed could go too far in raising rates and actually bring on a recession. Investors have been closely watching economic reports for clues as to how the central bank might react and the latest upbeat consumer sentiment report raises the chance of the Fed softening its current policy.”

Troise said, “A July survey from the University of Michigan showed that inflation expectations have held steady or improved, along with general consumer sentiment. It was a welcome update following several government reports this week that showed consumer prices remained extremely hot in June, along with wholesale prices for businesses.”

Thinking about market impact, Troise wrote, “The report also bodes well for investors looking for signs that the Federal Reserve might eventually ease off its aggressive policy to fight inflation.” And looking at the ticker specific action on Friday, he said, “Technology stocks, banks and healthcare companies made some of the biggest gains.”

With specific regard to UNH, Troise stated, “UnitedHealth Group rose 5% after raising its profit forecast for the year following a strong earnings report.” When UnitedHealthcare reported Q2 earnings on July 15th, 2022, the company once again beat Wall Street’s consensus expectations on the top and bottom lines.

UNH produced quarterly revenue of $80.3 billion during Q2, beating the consensus estimate by $620 million, and representing 12.6% year-over-year growth. UnitedHealthcare’s non-GAAP earnings-per-share came in at $5.57/share, beating estimates by $0.37/share. The company stated that “Earnings from Operations were $7.1 Billion, Growth of 19% Year-Over-Year”. UNH’s “Cash Flows from Operations were $6.9 Billion, 1.3x Net Income”.

Andrew Witty, chief executive officer of UnitedHealth Group, said, “Customers are responding as we build on our five growth pillars, enabling us to move into the second half of 2022 with strong momentum serving ever more people more deeply.”

The company highlighted the overall scope of its business, stating: “Total people served by UnitedHealthcare has grown by over 600,000 in 2022, including 280,000 in the second quarter. Growth was led by UnitedHealthcare’s community-based and senior offerings. The number of people served with domestic commercial benefit offerings has grown by over 250,000 over the past year, including 80,000 in the second quarter.”

UnitedHealthcare touched upon its medical care ratio, stating: “The second quarter 2022 medical care ratio was 81.5% compared to 82.8% last year, due to COVID effects and business mix. Favorable medical reserve development of $890 million compared to $500 million in the year ago second quarter. Days claims payable were 50.6, compared to 49.1 in the first quarter of 2022 and the second quarter of 2021.”

And, once again, UNH raised full-year bottom-line guidance, stating: “Based upon the first half performance and growth expectations, the company increased its full year net earnings outlook to $20.45 to $20.95 per share and adjusted net earnings to $21.40 to $21.90 per share. Growth in the second quarter was balanced across the company’s businesses, driven especially by continued strong expansion in people served at UnitedHealthcare and in value-based arrangements at Optum Health.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

After UNH’s Q2 results were posted, John Reese, a Nobias 5-star rated author, published an article at Nasdaq.com which put a spotlight on UNH as a company which was recently upgraded via “Validea's Patient Investor model based on the published strategy of Warren Buffett.”

Reese stated, “This strategy seeks out firms with long-term, predictable profitability and low debt that trade at reasonable valuations.” Regarding UNH and the Validea Patient Investor model, Reese said, “The rating according to our strategy based on Warren Buffett changed from 86% to 93% based on the firm’s underlying fundamentals and the stock’s valuation.”

To put this into perspective, he continued, “A score of 80% or above typically indicates that the strategy has some interest in the stock and a score above 90% typically indicates strong interest.” Looking at the data collected by the Nobias algorithm, it appears that the consensus amongst the credible authors and Wall Street analysts that we track agree with the Validea outlook.

95% of recent articles on UNH published by credible authors (only those with Nobias 4 and 5-star ratings) have expressed a “Bullish” bias on the stock. Right now, the average price target being applied to UNH shares by the credible Wall Street analysts that we track (once again, only those with 4 and 5-star Nobias ratings) is $588.63. Today, UNH shares trade for $529.75. Therefore, that average price target implies upside potential of 11.1%.

Disclosure: As of 7/17/2022, Nicholas Ward had no position in UNH. Nicholas Ward wrote this article for Nobias at their request with a view of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.