Case Study: Lululemon (LULU) stock according to high performing analysts

Several other athletic apparel/footwear stocks, including Nike and Footlocker, struggled during the first quarter, largely due to inventory issues and ongoing macroeconomic uncertainty. However, when LULU posted its first quarter results, the stock exceeded expectations, posting strong results and offering full-year guidance that called for 15% sales growth.

Nobias Insights: 85% of recent articles published by credible authors focused on LULU shares offer a “bullish” bias. Four out of the five credible Wall Street analysts who cover Lululemon believe that shares are likely to rise in value. The average price target applied to LULU by these credible analysts is $430.00, implying an upside potential of 19.3% relative to the stock’s current share price of $360.40

Bullish Take: Harrison Miller, a Nobias 4-star rated author, said, “For the year, Lululemon anticipates earnings rise to range from $11.74 to $11.94 per share compared to $10.07 last year. The company sees a 17% revenue increase to $9.44 billion to $9.15 billion. The guidance surpasses FactSet earnings forecasts of $11.60 per share on $9.37 billion in sales.”

Bearish Take: Phil Wahba, a Nobias 4-star rated author, stated, “Since the acquisition, Lululemon has taken write-downs almost equal to Mirror’s price tag, meaning Mirror is now nearly worthless in accounting terms.”

Key Points

Performance

LULU shares rose by 0.28% this week, pushing their year-to-date gains up to 11.45%. This compares poorly to the S&P 500 which is up by 12.41% on a year-to-date basis.

Event & Impact

Lululemon posted its first quarter results last week, beating analyst consensus estimates on both the top and bottom lines. During Q1, LULU’s revenue totaled $2.0 billion, beating Wall Street’s consensus estimate by $80 million. Lululemon’s Q1 non-GAAP earnings per share came in at $2.28, which was $0.29/share above consensus estimates.

Noteworthy News:

Several other athletic apparel/footwear stocks, including Nike and Footlocker, struggled during the first quarter, largely due to inventory issues and ongoing macroeconomic uncertainty. However, when LULU posted its first quarter results, the stock exceeded expectations, posting strong results and offering full-year guidance that called for 15% sales growth.

Nobias Insights

85% of recent articles published by credible authors focused on LULU shares offer a “bullish” bias. Four out of the five credible Wall Street analysts who cover Lululemon believe that shares are likely to rise in value. The average price target applied to LULU by these credible analysts is $430.00, implying an upside potential of 19.3% relative to the stock’s current share price of $360.40

Bullish Take Harrison Miller, a Nobias 4-star rated author, said, “For the year, Lululemon anticipates earnings rise to range from $11.74 to $11.94 per share compared to $10.07 last year. The company sees a 17% revenue increase to $9.44 billion to $9.15 billion. The guidance surpasses FactSet earnings forecasts of $11.60 per share on $9.37 billion in sales.”

Bearish Take Phil Wahba, a Nobias 4-star rated author, stated, “Since the acquisition, Lululemon has taken write-downs almost equal to Mirror’s price tag, meaning Mirror is now nearly worthless in accounting terms.”

LULU Jun 2023

Last week, Lululemon (LULU) reported its first quarter earnings, beating Wall Street’s estimates on both the top and bottom lines. These positive surprises helped to turn the tide for LULU shares and buck the negative trend that has played out in the appeal space throughout 2023 thus far.

Other athletic apparel/footwear companies such as Nike (NKE) and Footlocker (FL) struggled during their Q1 reports due to operational struggles in the world’s largest markets, the U.S. and China, ongoing inventory issues, and concerns about margin compression associated with promotions to offload product backlogs, there was major concern for LULU coming into its first quarter results.

Bullish Nobias Credible Opinions:

But, as Harrison Miller, a Nobias 4-star rated author, pointed out in the report that he published at Investors.com last week, Lululemon’s growth is here to stay. Miller wrote, “Athleisure apparel giant Lululemon Athletica (LULU) reported strong first-quarter results and full-year guidance late Thursday in what's been a mixed bag for retailers this earnings season.”

However, he noted, “Lululemon earnings didn't have to break a sweat to beat analyst forecasts. Earnings vaulted 54% to $2.28 per share while revenue leapt 24% to $2 billion.” Regarding the expectations that Wall Street had for LULU coming into the quarter, Miller wrote, “Analysts expected Lululemon adjusted earnings to bolt 32.4% to $1.96 per share while sales sprinted 19.3% to $1.924 billion.”

Looking at operating data, Miller said, “Comparable sales rose 13%, slowing from the 28% growth last year and 27% growth in the fourth quarter, respectively. FactSet guided same-store sales to rise 15.4%.” “Direct-to-consumer net revenue represented 42% of total sales, slightly lower than 45% from Q1 2022,” he continued.

Miller noted that for the upcoming quarter, LULU management guided towards 15% revenue growth and EPS to arrive in a range of $2.47 to $2.52 (in-line with consensus estimates of $2.49/share). “For the year,” he added, “Lululemon anticipates earnings rise to range from $11.74 to $11.94 per share compared to $10.07 last year. The company sees a 17% revenue increase to $9.44 billion to $9.15 billion. The guidance surpasses FactSet earnings forecasts of $11.60 per share on $9.37 billion in sales.”

Shoshy Ciment, a Nobias 4-star rated author, also reported on LULU’s results in an article that she published at Yahoo Finance titled, “What Lululemon’s Strong Results Say About Its Growing Standing in Retail”. Ciment said, “The athleisure brand, which typically caters to higher income consumers, has consistently managed to weather macro-economic headwinds plaguing the retail industry at large.”

Regarding the company’s ability to navigate ongoing supply chain issues, uncertain markets, and inventory build ups in the environment where other retailers struggled, she said, “Lululemon managed to maintain a full-price selling model as other retailers implement large-scale promotions.” “According to Morgan Stanley analysts led by Alex Straton,” she wrote, “Lululemon’s “unique pricing power” is a result of its strong core assortment, price integrity and premium margins.”

Ciment ended her piece stating, “Given the positive results this quarter, analysts have largely remained bullish on Lululemon’ growth trajectory through the remainder of the year, as it introduces new products and expands to new markets.”

Bearish Nobias Credible Opinions:

Phil Wahba, a Nobias 4-star rated author, published an article this week at Yahoo Finance that highlighted the plan that Lululemon CEO, Calvin McDonald, put into place to generate such strong results.

Wahba began his piece by highlighting LULU’s $500 million acquisition of Mirror in 2020 - the company’s first attempt to diversify away from clothing and into the exercise space to compete with companies like Peloton (PTON).

However, he notes, “Since the acquisition, Lululemon has taken write-downs almost equal to Mirror’s price tag, meaning Mirror is now nearly worthless in accounting terms.” In response to that saga, Wahba says that McDonald has pivoted to growth ideas within the apparel space. “He [McDonald] told investors in 2022 that he plans to hit $12.5 billion in revenue by 2026 as Lululemon becomes an ever more formidable rival to Nike and leaves competitors like Under Armour in its dust,” Wahba wrote.

“Lululemon’s branding as a hip retailer targeting a wealthy clientele has been vital to its growth, hence why the company is credited with the invention of “athleisure,” at the intersection of good fit and high-quality fabrics,” he said.

However, Wahba added, McDonald wanted to diversify the company’s product lines. “It’s slowly expanded into menswear and, more recently, golfing and hiking clothes,” he wrote. “After all,” he continued, “one cannot reach $12.5 billion in annual sales on women’s yoga pants alone.” McDonald’s plan is obviously working; Wahba points out that LULU is clearly outperforming its peers.

“Lululemon’s performance contrasts with the sharp decline in sales in the past year at rival brands like Gap Inc.’s Athleta and despite the arrival of up-and-comers in the higher-end activewear space like Vuori, Rhone, and Alo Yoga,” he said.

“Another big prong in McDonald’s plan is making Lululemon a global player,” Wahba added. “Canada, its home market, and the U.S. together generate 86% of its revenue,” he wrote. “But Lululemon sees tremendous opportunities abroad, notably in the U.K. and China.” “Last quarter, international sales rose 60%,” Wahba said.

He states that Nike is expected to generate roughly $50 billion in revenue this year. So, Lululemon still has a long way to go to become the top brand in the athletic apparel space. But, he said that analysts believe that LULU has what it takes to continue to take market share over the long term.

Sell-side Analysts Opinions

Regarding Wall Street’s opinion of Lululemon, two 4-star Nobias ratings have updated their outlooks on LULU shares since the company’s recent Q1 report.

Paul Lejuez, a Nobias 4-star rated analyst from Citi, recently raised his price target on LULU shares. According to The Fly on the Wall, “Citi raised the firm's price target on Lululemon to $450 from $440 and keeps a Buy rating on the shares. The company's Q1 sales and earnings were better than expected on every line item and much better than investors feared, the analyst tells investors in a research note. In a "choppy macro environment" in the U.S., Lululemon grew sales 17% in the region, underscoring the strength of the brand in its most well-developed market, says the firm. Citi believes Lululemon is one of the most compelling growth stories in retail.”

John Kernan, a Nobias 4-star rated analyst from SG Cowen, also recently raised his LULU price target. According to The Fly on the Wall, “TD Cowen raised the firm's price target on Lululemon to $531 from $525 and keeps an Outperform rating on the shares.

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

The firm said stores continue to be a key catalyst in customer retention and acquisition, and they also serve as "focal points for community gatherings, product launches and connectivity/loyalty that are key to the retailer's community-based customer engagement model".”

Overall bias of Nobias analysts and Bloggers:

Overall, 4 out of the 5 credible analysts who cover LULU believe that shares are likely to increase in value. The average price target being applied to Lululemon shares by these analysts is $430.00.

Currently, LULU trades for $360.40. Therefore, that average credible analyst price target implies upside potential of approximately 19.3%.

The credible authors that the Nobias algorithm tracks share this positive sentiment. 85% of recent articles focused on LULU shares have expressed a “bullish” bias.

Disclosure: Nicholas Ward has no LULU position. Nicholas Ward wrote this article for Nobias at their request with the intention of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

Case Study: Apple (APPL) stock according to high performing analysts

Apple highlighted its first major product launch in years, with its augmented reality/virtual reality headset, the Vision Pro. This piece of hardware is slated to cost roughly $3,500 and, according to analysts, offers consumers access to cutting edge AR/VR capabilities. Analysts also believe that the AR/VR market is likely to grow at a rapid pace throughout the remainder of this decade, inspiring the bullish sentiment surrounding AAPL shares.

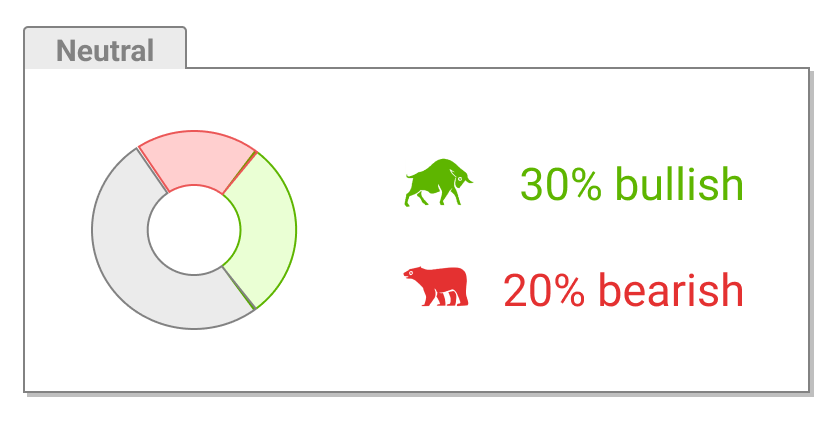

Nobias Insights: 49% of recent articles published by credible authors on AAPL shares offer a “neutral” bias after its nearly 45% year-to-date rally. Four out of the five credible Wall Street analysts covering Apple are “bullish”; however, the average price target being applied to AAPL by these credible analysts is $173.60, which implies downside potential of 4.1% relative to the stock’s share price of $180.96.

Bullish Take: Nobias 4-star rated author, Dani Cook, said, “The VR market is expected to hit a value of $227 billion by 2029, expanding at a compound annual growth rate of 45%, according to Fortune Business Insights.”

Bearish Take: The Value Portfolio, a Nobias 5-star rated author,stated, “For the upcoming quarter, the company expects a continued negative impact from forex along with massive weakness in the Mac and iPad division.”

Key Points

Performance

AAPL shares fell by 1.3% this week, pushing their year-to-date gains down to 44.69%. This compares favorably to the S&P 500 which is up by 12.41% on a year-to-date basis.

Event & Impact

Apple’s Worldwide Developers Conference (WWDC) occurred this week, causing Apple shares to rally to all-time highs of $184.95 on Monday.

Noteworthy News:

Apple highlighted its first major product launch in years, with its augmented reality/virtual reality headset, the Vision Pro. This piece of hardware is slated to cost roughly $3,500 and, according to analysts, offers consumers access to cutting edge AR/VR capabilities. Analysts also believe that the AR/VR market is likely to grow at a rapid pace throughout the remainder of this decade, inspiring the bullish sentiment surrounding AAPL shares.

Nobias Insights

49% of recent articles published by credible authors on AAPL shares offer a “neutral” bias after its nearly 45% year-to-date rally. Four out of the five credible Wall Street analysts covering Apple are “bullish”; however, the average price target being applied to AAPL by these credible analysts is $173.60, which implies downside potential of 4.1% relative to the stock’s share price of $180.96.

Bullish Take Nobias 4-star rated author, Dani Cook, said, “The VR market is expected to hit a value of $227 billion by 2029, expanding at a compound annual growth rate of 45%, according to Fortune Business Insights.”

Bearish Take The Value Portfolio, a Nobias 5-star rated author, stated, “For the upcoming quarter, the company expects a continued negative impact from forex along with massive weakness in the Mac and iPad division.”

AAPL Jun 2023

Apple (AAPL) shares hit new all-time highs this week after bullish commentary that came out of its WWDC 2023 event. The WWDC event is Apple’s Worldwide Developers Conference where the company typically highlights new hardware and/or software products or capabilities that it’s focused on launching each year.

The 2023 event was centered around Apple’s first major product launch in years. The company pulled back the curtains and shed light on its augmented/virtual reality headset, entering into the fierce competition for market share in this fast growing industry. Apple’s hardware, called the Vision Pro headset, is priced at roughly $3,500 and excited investors because of its long-term sales volume potential.

AAPL hit all-time highs of $184.95 on Monday before trending lower throughout the remainder of the week. During the last 5 days, AAPL shares are down by 1.30%; however, on a year-to-date basis, Apple is beating the broader market by a wide margin, up by 44.69%.

Bullish Nobias Credible Opinions:

This week, Nobias 4-star rated author, Dani Cook, highlighted Apple as a top buy in her article titled, “2 Virtual Reality Stocks to Invest in”. Looking at Apple’s AR/VR hardware specs, Cook wrote, “The Vision Pro has taken a massive step forward in VR, with features never before seen in competing headsets. “The device is a full-fledged computer in a headset casing, granting it all the productivity and entertainment capabilities of a MacBook,” she continued.

“Meanwhile,” Cook said , “it has removed the need for controllers required in headsets from Sony and Meta by utilizing eye tracking and hand gestures.” Overall, she’s bullish on this area of the market, stating, “The VR market is expected to hit a value of $227 billion by 2029, expanding at a compound annual growth rate of 45%, according to Fortune Business Insights.”

And therefore, she believes that Apple’s entrance into the space bodes well for its shares in the long-term. “Apple's dominance in consumer tech and brand loyalty strengthen its outlook in VR and make its stock an attractive buy as the industry blossoms,” she concludes.

Luke Lango, Nobias 4-star rated author, also published a report this week that put a spotlight on his bullish growth outlook for the AR/VR space. Writing about Apple’s Vision Pro launch, he said, “In fact, Apple isn’t even calling it a VR headset. It’s calling it a “spatial computer” to differentiate the product from the rest of the VR world.”

“You can enjoy both AR and VR experiences. You can control everything with your hands and gestures. And the headset boasts a better-than-4K screen resolution for each eye,” he said. Lango was quick to note, “None of that was possible before the Vision Pro.” He doesn’t believe that this will be a mass market product right away.

“At $3,499, the Vision Pro won’t become ubiquitous,” Lango wrote. “But,” he said, “it will generate significant interest in and engagement with extended reality content.” “And as wealthy folks shell out for this new tech, the average consumer will be watching from the sidelines. And that will drum up pent-up demand for a headset,” he explains. Over the next few years, Lango believes that, “The number of people using VR every day will grow by hundreds of percent, and the amount of content in VR environments will grow just as much.”

Bearish Nobias Credible Opinions:

The Value Portfolio, a Nobias 5-star rated author, recently published a bearish article in response to Apple’s recent product announcement and the stock’s ongoing rally. “Apple is a great company,” he said. “But it's a great company at too high a price.”

Regarding Apple’s new hardware launch, The Value Portfolio wrote: “Apple Inc. has announced its Vision Pro, the company's first new product category since the Apple Watch. The category has done incredibly well as a new wearables category for the company. However, we'd argue that was due to the health benefits. As we'll see throughout this article, we don't expect the Vision Pro to outperform, but even if it does, it won't justify Apple's valuation.”

Looking at the company’s fundamental results and forward guidance, The Value Portfolio noted, “For the 6-month period [trailing], the company's net sales dropped almost 5%.”During this same period of time, they said, “the company's net income has dropped roughly 4%.”

“That continued weakness at a 30+ P/E is a tough position for the company to be inside,” The Value Portfolio adds. Furthermore, looking at expectations for the coming quarters, The Value Portfolio stated, “There are warnings for a continued decline in revenue.”

Also, The Value Portfolio added, “for the upcoming quarter, the company expects a continued negative impact from forex along with massive weakness in the Mac and iPad division.”“The company thinks that the weakness won't necessarily continue,” The Value Portfolio said, “but at its valuation, it needs more than stagnation, it needs growth.” “As a result, we recommend against investing in the company at the present time,” the author concluded.

Although The Value Portfolio might not like Apple’s prospects in the near-term, AJ Fabino, a Nobias 4-star rated author, published an article at Benzinga this week stating the former Apple co-founder Steve Jobs’ biographer, Walter Isaacson, believes that Jobs would have “loved” the Vision Pro device.

“He would love it," Isaacson said in a CNBC interview earlier this week,” Fabino wrote. "I think he always wanted to go into new fields ever since he decided to make the iPod in the early 2000s, which was an unusual thing for, you know, a computer company to do, and likewise with the iPhone,” Isaacson continued.

Fabino noted that Jobs had an interest in the “advancement of human-computer interfaces” and used Siri as an example of Jobs’ affinity for this space. Isaacson agrees. “When he [Jobs] saw Siri, that was a great leap in human-computer interface, and this is one of the next big leaps in that,” he said.

Sell-side Analysts Opinions

Only one of the five credible Wall Street analysts who cover AAPL shares provided an update on their opinion on Apple stock after the company’s recent product launch. Nobias 5-star rated analyst, Toni Sacconaghi’s response to Apple’s Worldwide Developers Conference was neutral. In a note to clients this week, she maintained his $175.00 price target.

According to The Fly on the Wall, “Bernstein analyst Toni Sacconaghi notes that Apple executives delivered their keynote presentation at the company's annual Worldwide Developer Conference, or WWDC, which included the introduction of the company's much anticipated AR/VR device, the Vision Pro.

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

The Vision Pro provided a glimpse into the future, the firm says, pointing out that Apple has a strong track record of creating new markets. Nonetheless, Bernstein continues to struggle with the consumer value proposition beyond traditional VR applications. The firm also highlights that the device is shipping later and is more expensive than anticipated, and will likely be immaterial to Apple's financials for at least a couple of years. Bernstein has a Market Perform rating on the shares with a price target of $175.”

Overall bias of Nobias Credible Analysts and Bloggers:

Overall, the average price target being applied to Apple shares by these 5 credible Wall Street analysts is $173.60. Apple currently trades for $180.96 after rallying to all-time highs this week. Therefore, the average Nobias credible analyst price target implies downside potential of approximately 4.1%. The credible authors that Nobias tracks share this fairly neutral outlook after Apple’s recent rally, with 49% of articles signaling that shares will increase in value.

Disclosure: Nicholas Ward is long AAPL. Nicholas Ward wrote this article for Nobias at their request with the intention of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

Case Study: Palantir (PLTR) stock according to high performing analysts

This week, PLTR signed a $463 million contract with the U.S. Special Operations Command centered around AI. This continues the trend of PLTR winning large-scale AI-driven contracts, which is bolstering the stock’s year-to-date rally.

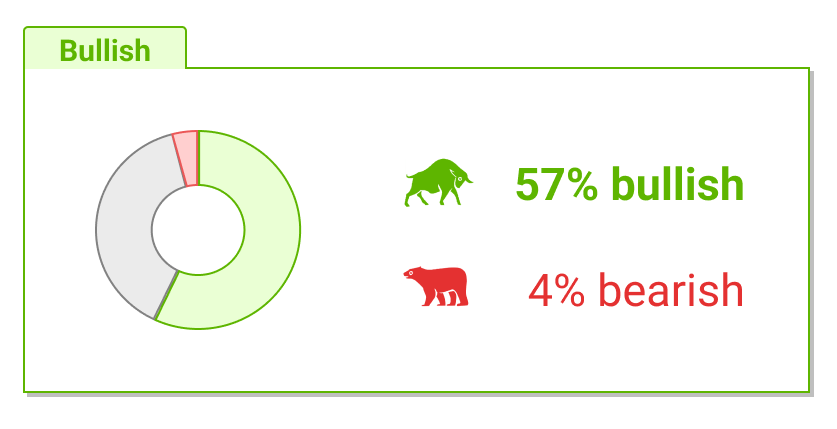

Nobias Insights: 57% of recent articles published by credible authors focused on PLTR shares offer a “bullish” bias. The one credible Wall Street analyst who covers Palantir believes that shares are likely to fall in value. The price target being applied to PLTR by this credible analyst is $7.00, which implies a downside potential of approximately 53% relative to the stock’s current share price of $15.02.

Bullish Take: 5-star rated author, The Value Portfolio, said, “At a 2% FCF yield with a double-digit growth rate, Palantir Technologies Inc. has the ability to continue growing. It has no debt and a strong net cash position which means profits can be rapidly directed to shareholders. Putting all of this together, Palantir is a valuable long-term investment that can drive substantial returns.”

Bearish Take: Michel Cohen, a Nobias 4-star rated author, stated, “The Bear Cave alleges that Palantir inflates its financial metrics through certain practices, like investing in companies and then requiring those companies to buy Palantir products. It reportedly invested about $400 million across 20 SPAC mergers, with those companies then purchasing at least $700 million in Palantir software.”

Key Points

Performance

Palantir (PLTR) shares rose by 1.90% this week, pushing their year-to-date gains up to 135.05%. This compares favorably to both the S&P 500 and the Nasdaq Composite, which are up by 12.41% and 27.65%, respectively, on a year-to-date basis.

Event & Impact

Bullish sentiment continues to push stocks with artificial intelligence tailwinds higher. Palantir is benefitting from this trend due to its strength with enterprise software and long-standing relationships with various segments of the U.S. government.

Noteworthy News:

This week, PLTR signed a $463 million contract with the U.S. Special Operations Command centered around AI. This continues the trend of PLTR winning large-scale AI-driven contracts, which is bolstering the stock’s year-to-date rally.

Nobias Insights

57% of recent articles published by credible authors focused on PLTR shares offer a “bullish” bias. The one credible Wall Street analyst who covers Palantir believes that shares are likely to fall in value. The price target being applied to PLTR by this credible analyst is $7.00, which implies a downside potential of approximately 53% relative to the stock’s current share price of $15.02.

Bullish Take 5-star rated author, The Value Portfolio, said, “At a 2% FCF yield with a double-digit growth rate, Palantir Technologies Inc. has the ability to continue growing. It has no debt and a strong net cash position which means profits can be rapidly directed to shareholders. Putting all of this together, Palantir is a valuable long-term investment that can drive substantial returns.”

Bearish Take Michel Cohen, a Nobias 4-star rated author, stated, “The Bear Cave alleges that Palantir inflates its financial metrics through certain practices, like investing in companies and then requiring those companies to buy Palantir products. It reportedly invested about $400 million across 20 SPAC mergers, with those companies then purchasing at least $700 million in Palantir software.”

PLTR Jun 2023

Artificial Intelligence has been one of the major driving forces of the broad market rally - and especially the tech-heavy Nasdaq’s outperformance—that we’ve seen throughout 2023 thus far. This year, the S&P 500 is up by 12.41% and the Nasdaq has risen by 27.65%.

Still, investors are looking for the next big secular growth trend to latch onto and the fervor behind artificial intelligence has ramped up recently, largely on the back of Nvidia's stellar Q1 earnings report. Nvidia shares are up by 170.3% on a year-to-date basis and bullish sentiment has increased for other names in the semiconductor and software industries that deal with artificial intelligence.

Another stock that has been a beneficiary of this bullish trend is Palantir Technologies (PLTR) which is up by 68.4% during the last month alone. Palantir’s recent rally has pushed its year-to-date gains into the triple digits as well. PLTR shares are up by 135.05% during 2023 thus far.

Yet, when looking at the reports by the credible authors and analysts that the Nobias algorithm tracks who cover PLTR shares, there is a major divergence in sentiment surrounding this stock. 57% of recent articles published by credible authors on PLTR stock have expressed a “Bullish” bias; however, the lone credible Wall Street analyst that Nobias tracks who has offered an opinion on PLTR shares believes that they’re likely to experience a significant sell-off.

Bullish Nobias Credible Opinions:

The most recent bullish report that a credible Nobias author has published on PLTR was by Nobias 5-star rated author, The Value Portfolio. In their June 7th article on Seeking Alpha, The Value Portfolio highlighted the company’s AI-driven growth.

The Value Portfolio said, “Palantir is one of the strongest companies in the AI space, especially when looking at directly selling AI to customers.” They put a spotlight on a $463 million contraction with the U.S. Special Forces for AI that was announced this week.

Looking at Q1 data, The Value Portfolio wrote, “The company signed 64 deals during the last quarter, and it's shown an increased ability to get large scale deals.” “The company has closed almost $400 million in new contracts, a 60% improvement YoY, foretelling strong potential revenue growth for the company versus prior growth rates,” they continued.

“Palantir's scale is also evident through deal sizes, with 22 deals at least $5 million and 8 at least $10 million,” The Value Portfolio said. And, they noted, that Palantir has a history of receiving larger and larger orders from legacy clients, resulting in “exciting” growth potential from its expanding client portfolio.

The Value Portfolio mentioned that at first glance, PLTR shares look expensive after their recent rally. Regarding PLTR’s valuation, they wrote, “the company has $750 million in annualized cash flow, which is a FCF yield of 2.5%. That's an atrocious long-term valuation and shows that the company has growth ahead to justify its current valuation.” But, due to Palatir’s rapid growth rate, The Value Portfolio believes that the company can grow into its present valuation - and more - concluding their report by saying:

“At a 2% FCF yield with a double-digit growth rate, Palantir Technologies Inc. has the ability to continue growing. It has no debt and a strong net cash position which means profits can be rapidly directed to shareholders. Putting all of this together, Palantir is a valuable long-term investment that can drive substantial returns.”

Bearish Nobias Credible Opinions:

Cavenagh Research, a Nobias 5-star rated author, who has been bullish on PLTR shares in the past, recently turned bearish, however. In an article published at Seeking Alpha on May 26, 2023, Cavenagh Research highlighted the reason for their sentiment shift.

“Overall,” they said, “I continue to like Palantir's value proposition in the fast-growing data analytics market. However, the risk/ reward for an investment is now considerably less attractive at about $13/ share than at $7/share, where the stock was trading only a few months ago.”

Cavenagh Research noted that PLTR beat Wall Street estimates on both the top and bottom lines during its Q1 report; however, they said, there were underlying concerns. Looking at PLTR’s Q1 top-line results, Cavenagh Research wrote, “During the period from January to end of March, the company generated group revenues of approximately $525.2 million, up about 18% YoY, and topping consensus estimate by approximately 4%, according to data collected by Refinitiv.”

Looking at profit-related metrics, they said, “GAAP operating income came in at $121.5 million, far exceeding even the upper end of optimistic estimates, and marking the second quarter in a row of GAAP profitability.” Despite these beats, Cavenagh Research laid out their bearish thesis on shares with 5 primary bullet points:

First, Palantir's dollar-based net retention rates fell about 400 basis points, to 111%, as compared to 115% one quarter prior.

Second, despite the revenue support brought about by SPACs related accounting, Palantir's commercial contribution margin declined 800 basis points.

Third, average revenue per employee fell $547 tsd of revenue per employee, down 9% YoY, as total headcount grew to 3,850, up 26% YoY.

Fourth, and expanding on employee-related metrics, I would like to point out that PLTR's share-based compensation expenses remain >20% of revenue!

Fifth, Palantir's growth appears to be slowing: Referencing, Palantir's 2Q revenue guidance of revenues in the range of $528-532M, I point out that QoQ growth slowed to 1%, while YoY growth slowed to 12% YoY, the lowest level since Palantir's IPO.

The author did note that Artificial Intelligence could be the growth catalyst that improves Palantir’s operations. “Recently, Palantir's management has emphasized the introduction of their Artificial Intelligence Platform (AIP), which enables customers to safely utilize large language models (LLMs),” they wrote.

“According to CEO [Alex] Karp,” Cavenagh Research said, “the demand for AIP has been unprecedented, as AI adoption captures the interest of a very wide range of customers, including the interest from over 100 Fortune 1000 companies.”

“Due to Palantir's significant experience in handling sensitive data and technology, the company is well-positioned to be a leading player in the emerging field of AI,” they added. However, the author concluded, “it is way too early to assign any 'equity value' to Palantir's AI capability and strategy, in my opinion.” And therefore, Cavenagh Research said, “Reflecting on rich valuation, paired with slowing growth in the core business, I downgrade Palantir to Underperform/ Sell.”

Michel Cohen, a Nobias 4-star rated author, recently highlighted another bearish report published by Edwin Dorsey, the author of The Bear Cave, which focused on PLTR’s recent rally and the future prospects of its shares.

Cohen wrote, “The Bear Cave views Palantir as an "AI imposter" and an "overhyped data consultant."’ Cohen said that Dorsey believes that Palantir “Management has fueled this enthusiasm, frequently mentioning "AI" during company calls. It was mentioned 68 times on their Q1 2023 conference call, up from 17 mentions in Q4 2022 and only six mentions in Q1 2022.”

Furthermore, Cohen wrote, “The Bear Cave alleges that Palantir inflates its financial metrics through certain practices, like investing in companies and then requiring those companies to buy Palantir products. It reportedly invested about $400 million across 20 SPAC mergers, with those companies then purchasing at least $700 million in Palantir software.” However, he states that Karp remains very bullish on his company’s prospects.

Cohen said, “Karp, meanwhile, spoke to Bloomberg on Thursday after hosting the company's AIPCon customer conference. His response to critics of the company and its software was "to ask the Russians."’

Sell-side Analysts Opinions

The most recent update provided on PLTR shares by Louie DiPalma, of William Blair & Company International, who is the only credible analyst that Nobias tracks who covers PLTR shares, was bearish as well.

According to the Fly on the Wall, “Last Tuesday, Space Systems Command, Los Angeles Air Force Base, announced that it awarded Palantir a three-month bridge extension, instead of a long-term renewal, on its Space Force data software services contract, which is Palantir's third-largest contract, William Blair analyst Louie DiPalma the analyst tells investors in a research note. And late Friday, Space Systems Command announced that it selected 17 other vendors along with Palantir for a five-year, $900M data analytics contract that builds upon the sole-sourced Palantir program, adds the analyst.

The firm says there is risk that Palantir's growth for the program will be limited as the Space Force "splits the pie among the numerous vendors." Over the long term, there is the potential for the same type of migration off of the Palantir platform that took place with the Raven program and is taking place for the FDA's CDER program, contends Blair. The firm sees risk that Palantir's "premium 8.5-times sales multiple will compress as competition pressures revenue growth and profitability." It keeps an Underperform rating on the shares and sees downside to $4 and $5 in a "bear case scenario."

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

This report was published in late March of 2023. Since then, PLTR shares have continued to rally.

Overall bias of Nobias Credible Analysts and Bloggers:

When looking at the reports by the credible authors and analysts that the Nobias algorithm tracks who cover PLTR shares, there is a major divergence in sentiment surrounding this stock. 57% of recent articles published by credible authors on PLTR stock have expressed a “Bullish” bias; however, the lone credible Wall Street analyst that Nobias tracks who has offered an opinion on PLTR shares believes that they’re likely to experience a significant sell-off.

On March 31st, 2023, PLTR was trading for $8.45/share. Today, shares are trading at $15.02/share. The price target being applied to PLTR by DiPalma is $7.00, which represents downside potential of approximately 53%.

Yet, as bulls have stated, Artificial Intelligence remains a long-term growth tailwind for Palantir, meaning that the bulls and the bears are likely to be grappling over this speculative growth stock for years to come.

Disclosure: Nicholas Ward is long PLTR. Nicholas Ward wrote this article for Nobias at their request with the intention of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

Case Study: Broadcom (AVGO) stock according to high performing analysts

Broadcom shares had experienced a massive run-up in earnings due to the recent success of its peers, who also design and manufacture artificial intelligence related semiconductors. AVGO shares gave back roughly 5% of their recent gains this week; however, during the last month, they've still been up by 30.75%. The company is expected to continue to grow at a high single digit rate moving forward. It pays a 2.27% dividend yield. And, AVGO continues to be generous with its buyback program, repurchasing $3.4 billion worth of shares during Q2.

Nobias Insights: 75% of recent articles published by credible authors focused on AVGO shares offer a “Bullish” bias. Four out of the five credible Wall Street analysts who cover Broadcom believe that shares are likely to rise in value and updated their price targets on shares this week after seeing the company’s Q2 results. The average price target from the post-earnings updates that we saw this week was $905.00. Therefore, looking at the most up-to-date credible analyst opinions, it appears that AVGO shares offer upside potential of approximately 11.5% relative to the current $812.00 share price.

Bullish Take: AJ Fabino, a Nobias 4-star rated author, said, “Broadcom issued earnings of $10.32 per share, ahead of a $10.08 estimate, on revenues of $8.73 billion, which beat the $8.71 billion estimates, according to Benzinga Pro.”

Bearish Take: Ahmed Farhath, a Nobias 4-star rated author, stated, “Over the last 3 months, EPS estimates have seen 18 upward revisions and 3 downward. Revenue estimates have seen 12 upward revisions and 8 downward.”

Key Points

Performance

Broadcom shares fell by 5.56% this week, pushing their year-to-date gains down to 46.71%. This compares favorably to both the S&P 500 and the Nasdaq Composite Index, which are up by 11.98% and 27.47%, respectively, on a year-to-date basis.

Event & Impact

Broadcom posted its second quarter results this week, beating analyst consensus estimates on both the top and bottom lines. During Q2, AVGO’s revenue totaled $8.73 billion, beating Wall Street’s consensus estimate by $20 million. Broadcom's Q2 non-GAAP earnings-per-share came in at $10.32, which was $0.18/share above consensus estimates.

Noteworthy News:

Broadcom shares had experienced a massive run-up in earnings due to the recent success of its peers, who also design and manufacture artificial intelligence related semiconductors. AVGO shares gave back roughly 5% of their recent gains this week; however, during the last month, they've still been up by 30.75%. The company is expected to continue to grow at a high single digit rate moving forward. It pays a 2.27% dividend yield. And, AVGO continues to be generous with its buyback program, repurchasing $3.4 billion worth of shares during Q2.

Nobias Insights

75% of recent articles published by credible authors focused on AVGO shares offer a “Bullish” bias. Four out of the five credible Wall Street analysts who cover Broadcom believe that shares are likely to rise in value and updated their price targets on shares this week after seeing the company’s Q2 results. The average price target from the post-earnings updates that we saw this week was $905.00. Therefore, looking at the most up-to-date credible analyst opinions, it appears that AVGO shares offer upside potential of approximately 11.5% relative to the current $812.00 share price.

Bullish Take AJ Fabino, a Nobias 4-star rated author, said, “Broadcom issued earnings of $10.32 per share, ahead of a $10.08 estimate, on revenues of $8.73 billion, which beat the $8.71 billion estimates, according to Benzinga Pro.”

Bearish Take Ahmed Farhath, a Nobias 4-star rated author, stated, “Over the last 3 months, EPS estimates have seen 18 upward revisions and 3 downward. Revenue estimates have seen 12 upward revisions and 8 downward.”

AVGO Jun 2023

After Nvidia’s (NVDA) and Marvell Technology’s (MRVL) beat-and-raise earnings reports last week that caused their shares to soar on the back of artificial intelligence-related growth, all eyes were on Broadcom (AVGO) this week.

AVGO reported its second quarter earnings results on Wednesday, and once again, beat analyst expectations on both the top and bottom lines. However, unlike its peers, AVGO shares didn’t experience double digit post-earnings rallies. It appears that much of AVGO’s results were priced into the stock, (which had experienced a 30%+ rally during the month coming into its second quarter report).

However, after examining its results, four of the five credible analysts that Nobias tracks who cover AVGO shares increased their price targets and despite its 46.71% year-to-date rally, it appears that Broadcom shares continue to offer double digit upside potential.

Bullish Nobias Credible Opinions:

Andrew Kessel, a Nobias 5-star rated author, touched upon one of Broadcom’s recent bullish catalysts in an article that he published at Proactive Investors this week. Prior to the blowout quarters from Nvidia and Marvell last week, AVGO shares were already headed higher because of news that broke between it and its largest customer, Apple (AAPL), which provided investors with peace of mind knowing that the iPhone maker wasn’t going to cut Broadcom out of its supply chain in the coming years.

“Earlier this week,” Kessel wrote, “Broadcom received a repeat ‘Buy’ rating from UBS analysts after the company announced two multi-year agreements with Apple to supply radio frequency and wireless components and modules.”

“The analysts wrote that the agreement also appeared to quash speculation from earlier this year that Apple would displace Broadcom components from its devices beginning in 2025, although they noted that Apple continues to push more technology in-house to reduce reliance on external vendors,” he added.

So, while it’s true that Apple continues to invest heavily in its own semiconductor assets in an attempt to move more and more of its supply chain under its own control, investors were pleased to hear that this isn’t a threat that Broadcom needs to worry about in the coming quarters.

This sigh of relief turned into an outright bullish fervor surrounding AVGO shares after two of its rivals in semiconductor industry, NVDA and MRVL beat analyst expectations by wide margins, causing their shares to rise by more than 25% and 40%, respectively, last week.

AVGO shares were dragged up by the NVDA and MRVL rallies. During the last month, Broadcom has seen its share price appreciate by 30.75%. This is an unprecedented move by this relatively mature semiconductor. AVGO is a large-cap stock with a market cap of $338.5 billion. However, unlike Nvidia and Marvell, which trade with forward price-to-earnings multiples of 51.6x and 39.3x, respectively, Broadcom is a relative value option for investors in the semiconductor segment, with a forward P/E ratio of just 19.5x. And therefore, coming into its most recent quarter, Broadcom had a lower bar to clear, as far as the growth expectations required to support its valuation multiples went.

AJ Fabino, a Nobias 4-star rated author, covered AVGO’s quarterly results in an article published at Business Insider this week. Fabino wrote, “Broadcom Inc, a global leader in semiconductor and infrastructure software solutions, issued second-quarter earnings which beat Street expectations.” He continued, “Broadcom issued earnings of $10.32 per share, ahead of a $10.08 estimate, on revenues of $8.73 billion, which beat the $8.71 billion estimates, according to Benzinga Pro.”

“The company repurchased 5.6 million shares during the quarter and announced a quarterly dividend of $4.60 per share,” he added. Lastly, Fabino noted, “Broadcom said it anticipates its third-quarter revenue to be about $8.85 billion, edging past estimates of $8.72 billion.”

Bearish Nobias Credible Opinions:

Ahmed Farhath, a Nobias 4-star rated author, covered the market’s expectations for Broadcom’s second quarter results in a recent article published at Seeking Alpha. Farhath touched upon the stock’s history of beating Wall Street’s expectations, stating, “Over the last 2 years, AVGO has beaten EPS estimates 100% of the time and has beaten revenue estimates 100% of the time.”

Looking at last quarter’s results, he added, “The company on March 2 reported Q1 Non-GAAP EPS of $10.33, beating estimates by 17 cents. Revenue of $8.92 billion was up 15.7% from last year and ahead of consensus by $20 million.”

Coming into this quarter, analysts have become increasingly more bullish on shares. Farhath wrote, “Over the last 3 months, EPS estimates have seen 18 upward revisions and 3 downward. Revenue estimates have seen 12 upward revisions and 8 downward.” Looking at Q2 estimates, he said, “The consensus EPS estimate is $10.14 and the consensus revenue estimate is $8.71 billion.”

These figures would represent top and bottom-line growth of approximately 7.5% and 12.0%, relative to last year’s second quarter results of $8.1 billion in sales with $9.07 in non-GAAP EPS.

Sell-side Analysts Opinions

Shares were relatively flat on these Q3 results. AVGO has hovered in the $800 area since reporting them, meaning that this company didn’t experience the same post-earnings rally as NVDA and MRVL. However, that may be due to the stock’s 30%+ run-up into earnings. And, looking at Wall Street’s response to its Q2 report, it appears that AVGO continues to have upside potential ahead of it.

After its Q2 numbers hit, several credible Wall Street analysts that Nobias tracks increased their price target on AVGO shares. According to the Fly on the Wall, “Deutsche Bank raised the firm's price target on Broadcom to $870 from $675 and keeps a Buy rating on the shares post the fiscal Q2 results.” The Deutsche Bank analyst who covers AVGO is Ross Seymore who carries a 5-star Nobias rating.

Christopher Rolland of Susquehanna , a Nobias 4-star rated analyst, also raised his price target. According to the Fly on the Wall, “Susquehanna raised the firm's price target on Broadcom to $910 from $785 and keeps a Positive rating on the shares. The firm said we remain encouraged by Broadcom's optimism around their new long-term deal in wireless and cellular and as they reiterated their mixed signal content.”

Truist analyst William Stein, a Nobias 4-star rated analyst, also came away from the quarterly results with a bullish bias. According to the Fly on the Wall, “Truist analyst William Stein raised the firm's price target on Broadcom to $890 from $700 and keeps a Buy rating on the shares. The company posted a "modest" Q2 earnings beat, though the management also offered more details in AI, including the 70% growth in the business, the analyst tells investors in a research note. In addition to AI, Broadcom continues to do well in many other respects - it's keeping lead times elevated at 50 weeks, its inventory is under solid control, its customer and channel inventory appear lean, and its buybacks are strong, Truist added.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

Lastly, Bank of America analyst Vivek Arya, a Nobias 4-star rated analyst, also raised his price target significantly. According to the Fly on the Wall, “BofA analyst Vivek Arya raised the firm's price target on Broadcom to $950 from $800 and keeps a Buy rating on the shares after the company issued a "slight" fiscal Q2 beat and gave a Q3 revenue outlook above consensus. The firm's new target reflects a higher multiple as AI accelerates company growth potential. In a bull case scenario where Broadcom can grow AI exposure to about 25% of sales, and hold growth rates of non-AI assets at previously mentioned levels, the firm sees incremental $2B and $3 upside to its sales and EPS estimates, respectively, the analyst added.”

Overall bias of Nobias Credible Analysts and Bloggers:

Overall, 80% of credible analysts who cover AVGO shares believe that the company is likely to increase in value. 75% of recent reports published by the credible author community that the Nobias algorithm tracks have also expressed a “Bullish” bias towards shares.

Currently, Broadcom trades for $812.00. The average price target from the post-earnings updates that we saw this week was $905.00. Therefore, looking at the most up-to-date credible analyst opinions, it appears that AVGO shares offer upside potential of approximately 11.5%.

Disclosure: Nicholas Ward is long AVGO. Nicholas Ward wrote this article for Nobias at their request with the intention of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

Case Study: 3M Company (MMM) stock according to high performing analysts

Legal headwinds surrounding these “forever chemicals” has cast a major shadow over 3M shares for years. Analysts have speculated that the overall cost of this issue could rise above the $100 billion level across the world. This results in major uncertainty for 3M shareholders moving forward, so settlements, even when costly, can provide a bullish catalyst for investors looking to begin to quantify the potential risk.

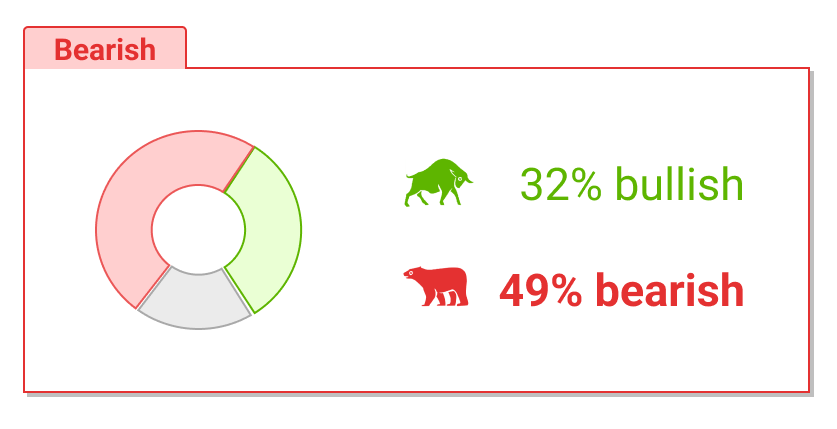

Nobias Insights: 50% of recent articles published by credible authors focused on MMM shares offer a “neutral” bias. Two of the four credible Wall Street analysts who cover 3M believe that shares are likely to rise in value. The average price target applied to MMM by these credible analysts is $129.00, which implies upside potential of approximately 25.8% relative to the stock’s current share price of $102.53..

Bullish Take: Nobias 4-star rated author, Bretty Ashcroft Green, said, “3M's stock jumped more than 10% on Friday morning after Bloomberg News reported the company agreed to a tentative settlement of at least $10 billion with a variety of U.S. cities and towns to resolve water pollution claims tied to "forever chemicals.”

Bearish Take: Samuel Smith of Sure Dividend, a Nobias 4-star rated author, stated, “3M is facing a number of uncertainties, including litigation headwinds, and global supply chain disruptions and logistics challenges.”

Key Points

Performance

MMM shares rose by 6.38% this week after rallying by 8.75% on Friday. This rally pushed MMM’s year-to-date losses up to -16.28%. This compares poorly to the S&P 500 which is up by 11.98% on a year-to-date basis.

Event & Impact

On Friday news broke that 3M Company had accepted a tentative agreement with certain U.S. towns and cities regarding its PFAS chemical pollution. The settlement is reported to be at least $10 billion and still requires approval by 3M’s Board of Directors.

Noteworthy News:

Legal headwinds surrounding these “forever chemicals” has cast a major shadow over 3M shares for years. Analysts have speculated that the overall cost of this issue could rise above the $100 billion level across the world. This results in major uncertainty for 3M shareholders moving forward, so settlements, even when costly, can provide a bullish catalyst for investors looking to begin to quantify the potential risk.

Nobias Insights

50% of recent articles published by credible authors focused on MMM shares offer a “neutral” bias. Two of the four credible Wall Street analysts who cover 3M believe that shares are likely to rise in value. The average price target applied to MMM by these credible analysts is $129.00, which implies upside potential of approximately 25.8% relative to the stock’s current share price of $102.53.

Bullish Take Nobias 4-star rated author, Bretty Ashcroft Green, said, “3M's stock jumped more than 10% on Friday morning after Bloomberg News reported the company agreed to a tentative settlement of at least $10 billion with a variety of U.S. cities and towns to resolve water pollution claims tied to "forever chemicals.”

Bearish Take Samuel Smith of Sure Dividend, a Nobias 4-star rated author, stated, “3M is facing a number of uncertainties, including litigation headwinds, and global supply chain disruptions and logistics challenges.”

MMM Jun 2023

3M Company (MMM) rallied by 8.75% on Friday due to positive headlines regarding its potential “forever chemicals” legal liability. The potential for significant legal and cleanup costs associated with the PFAS chemicals that MMM has manufactured over the years has made this stock a recent underperformer.

Even after Friday’s rally, during the trailing twelve month period MMM shares are down by 30.8%. On a year-to-date basis, 3M Company is still down by 16.28%. Yet, this weakness has pushed MMM’s valuation down well below its historical averages and collectively, the credible Wall Street analysts that Nobias tracks believe that 3M offers strong double digit upside potential.

Bearish Nobias Credible Analysts’ Opinions:

In early May, Samuel Smith of Sure Dividend, a Nobias 4-star rated author, provided readers with an annual update on 3M Company shares. Smith began his report by stating, “3M has one of the best track records in the entire market when it comes to dividend longevity. It has paid dividends for more than 100 years, and it has raised its dividend for over 60 years in a row.”

This company is more than a Dividend Aristocrat (companies with 25+ years of consecutive annual dividend increases); MMM is a Dividend King, which are companies with annual dividend increase streaks of 50+ years. Smith wrote, “There are only 48 Dividend Kings, including 3M.”

Looking at 3M’s operations, Smith wrote, “Today, 3M is a large diversified global manufacturer. It manufactures ~60,000 products, which are sold in ~200 countries around the world.”“To raise dividends for more than 60 years requires multiple durable competitive advantages,” he said. “For 3M, technology and intellectual property are its biggest competitive advantages.

“3M has more than 40 technology platforms and a team of scientists dedicated to fueling innovation. Innovation has provided 3M with over 100,000 patents obtained throughout its history, which helps fend off competitive threats,” Smith added.

Smith notes that the company has achieved this by maintaining a well diversified business structure. “3M is comprised of four divisions,” he said.

Regarding those 4 segments, Smith wrote:

The Safety & Industrial division produces tapes, abrasives, adhesives and supply chain management software, as well as personal protective gear and security products.

The Health Care segment supplies medical and surgical products, as well as drug delivery systems.

Transportation & Electronics division produces fibers and circuits with a goal of using renewable energy sources while reducing costs.

The Consumer division sells office supplies, home improvement products, protective materials and stationery supplies.

Looking at the stock’s recent performance, Smith said, “3M has struggled to generate growth over the past few years. Still, 3M maintains a promising long-term outlook.” He continued, “We believe the company is capable of growing adjusted earnings-per-share by 5% per year over the next five years.”

Moving onto MMM’s valuation, Smith wrote, “Based on expected adjusted earnings-per-share of ~$8.75 for 2023, 3M stock has a price-to-earnings ratio of 13.1.”“This is lower than its average valuation,” he added. Smith continued, “Our estimate of fair value is a price-to-earnings ratio of 17, which is a little below its 10-year historical average, but we believe it is warranted due to slowing growth and rising interest rates.” He also touched upon some of the negative catalysts that have inspired this relative undervaluation, writing, “3M is facing a number of uncertainties, including litigation headwinds, and global supply chain disruptions and logistics challenges.”

Bullish Nobias Credible Analysts Opinions:

These litigation concerns were the topic of an article published on Friday by Nobias 4-star rated author, Bretty Ashcroft Green titled, “3M: Positive Lawsuit Developments For This Cheap Dividend King”.

Green quoted a Seeking Alpha headline which read: “3M's stock jumped more than 10% on Friday morning after Bloomberg News reported the company agreed to a tentative settlement of at least $10 billion with a variety of U.S. cities and towns to resolve water pollution claims tied to "forever chemicals.” “Let's take a look at how cheap MMM stock might be after deducting some litigation cost assumptions combined with the exit of 3M's PFAS business come 2025,” he continued.

Green wrote, “I'm going to make a maybe not-so-conservative assumption here and assume that there are $30 Billion in litigation costs to carry forward.” He also noted that things could be worse. “I'm baking in $30 Billion to my equation, some were floating numbers above $100 Billion just for the PFAS portion alone. You never know where this will wind up,” Green said. He compared 3M’s legal issues to the talcum powder headwinds that healthcare company Johnson and Johsnon (JNJ) faces and put a spotlight on a recent $8.9 billion settlement that JNJ agreed to pay. “The proposed settlement would be paid out over 25 years through a subsidiary, which filed for bankruptcy to enable the $8.9 billion trust, Johnson & Johnson said in a court filing,” he wrote.

“Basically,” Green continued, “a trust is set up for the payout to occur over 25 years. I would assume something similar here. With that in mind, $30 Billion over 25 years would be a litigation cost of $1.2 Billion a year.” He noted that during the trailing twelve months, 3M Company generated $5.45 billion of net income. Therefore, he says that the company could cover this theoretical liability easily, with upwards of $4.1 billion of retained owner earnings left over.

Green says that owner earnings are one of the primary metrics that famed value investor, Warren Buffett, used when evaluating businesses, and with that in mind, he wrote: “Buffett discounted stabilized businesses such as these at the 10-year treasury rate. I baked in a high- and a low-end market cap based on the long and short ends of the risk-free yield curves. Blending the two gives a fair market cap of $98 billion. There are 551.672 million shares outstanding as of June 2, 2023. This gets us to a fair value of $177.64 a share based on these assumptions.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

Green said that he personally owns 3M shares, writing, “I, like most, have been waiting to hear any revelations in the 3M court case. $10 billion sounds like a lot, with more to come, but at least we're getting some rational judgments.” With this news in hand, Green concluded his piece by stating that he plans to begin “buying” MMM shares again.

Overall bias of Nobias Credible Analysts and Bloggers:

Looking at credible analyst opinions on MMM shares, two out of the four credible individuals that Nobias tracks have expressed bearish outlooks for 3M shares. The credible author community is equally torn; 50% of recent reports published by these credible authors have expressed a “neutral” bias.

The most recent update that we’ve seen from a credible Wall Street analyst comes from Citi’s Andrew Kaplowitz, who is a Nobias 5-star rated analyst. According to the Fly on the Wall, “Citi analyst Andrew Kaplowitz raised the firm's price target on 3M to $126 from $117 and keeps a neutral rating on the shares. The analyst says megatrends and "still emerging fiscal tailwinds" should help moderate the potential downside for industrials in a slowing macro-economic environment. In addition, improving price versus cost trends and gradually improving supply chains should remain supportive of improving profitability for much of the group, Kaplowitz tells investors in a 2023 outlook research note.”

Overall, the average price target applied to 3M Company by credible analysts tracked by the Nobias algorithm is $129.00. After 3M’s rally on Friday, shares are trading for $102.53, meaning that the $129.00 average price target implies upside potential of approximately 25.8%.

Disclosure: Nicholas Ward has no MMM position. Nicholas Ward wrote this article for Nobias at their request with the intention of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

Case Study: Verizon (VZ) stock according to high performing analysts

Despite the Amazon headwinds, Verizon shares appear to be historically cheap at current levels, trading with a single digit price-to-earnings ratio that represents a roughly 50% discount to their historical averages. Furthermore, Verizon shares provide investors with a 7.31% dividend yield after their recent sell-off.

Nobias Insights: 57% of recent articles published by credible authors focused on VZ shares offer a “bullish” bias. Both of the two credible Wall Street analysts who cover Verizon believe that shares are likely to rise in value. The average price target being applied to VZ by these credible analysts is $47.50, which implies an upside potential of approximately 37.4% relative to the stock’s current share price of $34.58.

Bullish Take: A recent analyst note from Nobias 5-star rated analyst, Simon Flattery, stated, “Morgan Stanley analyst Simon Flannery upgraded Verizon Communications to Overweight from Equal Weight with a price target of $44, up from $41, which offers over 20% total returns. Following the stock's significant underperformance in 2022, Verizon trades at a "historically attractive valuation on an absolute and relative basis," Flannery tells investors in a research note.”

Bearish Take: Reinhardt Krause, a Nobias 5-star rated author, stated, “Telecom stocks tumbled Friday on renewed reports that e-commerce giant Amazon.com plans to resell mobile phone services in the U.S. through its Prime loyalty program.”

Key Points

Performance

VZ shares fell by 0.85% this week, pushing their year-to-date losses down to -13.81%. This compares poorly to the S&P 500, which is up by 11.98% on a year-to-date basis.

Event & Impact

This week, rumors began to swirl that Amazon is interested in potentially disrupting the consumer wireless business by providing cellular services to Amazon Prime members. Oftentimes, when Amazon enters a new industry, it quickly becomes the 800-pound gorilla that its peers have to contend with. This caused a sell-off in the telecommunications space on Friday.

Noteworthy News:

Despite the Amazon headwinds, Verizon shares appear to be historically cheap at current levels, trading with a single digit price-to-earnings ratio that represents a roughly 50% discount to their historical averages. Furthermore, Verizon shares provide investors with a 7.31% dividend yield after their recent sell-off.

Nobias Insights

57% of recent articles published by credible authors focused on VZ shares offer a “bullish” bias. Both of the two credible Wall Street analysts who cover Verizon believe that shares are likely to rise in value. The average price target being applied to VZ by these credible analysts is $47.50, which implies an upside potential of approximately 37.4% relative to the stock’s current share price of $34.58.

Bullish Take A recent analyst note from Nobias 5-star rated analyst, Simon Flattery, stated, “Morgan Stanley analyst Simon Flannery upgraded Verizon Communications to Overweight from Equal Weight with a price target of $44, up from $41, which offers over 20% total returns. Following the stock's significant underperformance in 2022, Verizon trades at a "historically attractive valuation on an absolute and relative basis," Flannery tells investors in a research note.”

Bearish Take Reinhardt Krause, a Nobias 5-star rated author, stated, “Telecom stocks tumbled Friday on renewed reports that e-commerce giant Amazon.com plans to resell mobile phone services in the U.S. through its Prime loyalty program.”

VZ May 2023

On Friday the U.S. stock market rallied in a major way in response to the debt ceiling bill being passed by the Senate, signaling that an unprecedented debt default was no longer a threat to the U.S. economy.

The S&P 500 rose by 1.45% on Friday. The Dow Jones Industrial Average was up by 2.12%. And the tech-heavy Nasdaq was up by 1.07%. In other words, this was a broad based rally; however, two notable exceptions were the major U.S. wireless companies, AT&T (T) and Verizon (VZ).

During Friday’s trading session AT&T shares fell by 3.80% and Verizon dipped by 3.19%.This was in response to headlines that popped up regarding news that Amazon (AMZN) could be a competitive threat to the U.S. wireless companies in the future.

Bearish Nobias Credible Analysts’ Opinions:

Reinhardt Krause, a Nobias 5-star rated author, covered this news in a report published at Investors.com on Friday. Krause wrote, “Telecom stocks tumbled Friday on renewed reports that e-commerce giant Amazon.com plans to resell mobile phone services in the U.S. through its Prime loyalty program.”

“Dish Network surged and Amazon stock ended the day higher,” he added. “Reports that Amazon could partner with satellite TV broadcaster Dish surfaced a week ago,” Krause said. “Those reports said Dish would sell its prepaid Boost Mobile wireless plans through Amazon. Dish is a newcomer to the wireless phone market.”

However, right now, sources tell Krause that these headlines are more rumor than fact. “In an email to Investor's Business Daily,” he wrote, “an Amazon spokesperson said: "We are always exploring adding even more benefits for Prime members, but don't have plans to add wireless at this time."’

“Meanwhile,” Krause said, “Verizon spokesperson Rich Young in an email said nothing is going on.” He went on to quote Young, who said: "Verizon is not in negotiations with Amazon regarding the resale of the nation's best and most reliable wireless network. Our company is always open to new and potential opportunities, but we have nothing to report at this time."

Krause also noted that AT&T denied any immediate plans. Lastly, Krause highlighted an analyst note that UBS’s John Hodulik provided to clients this week.

According to Krause, Hodulik stated, "We believe such a distribution agreement could help DISH drive subscribers but it is unlikely to drive a meaningful shift in industry competition absent attractive handset promotions. We believe a bigger risk for the industry would be Amazon selling its own branded wireless service."

Bullish Nobias Credible Analysts Opinions:

Yet, in spite of these headlines, the majority of credible authors and analysts that the Nobias algorithm tracks continue to express bullish sentiment towards VZ shares. Gen Alpha, a Nobias 5-star rated author, recently published a bullish article on VZ shares titled, “Verizon: Seriously Undervalued, I'm Adding More”.

The author acknowledged Verizon’s recent underperformance, stating, “The market is undoubtedly concerned about what the future holds for Verizon, given that it lost 263K net consumer wireless postpaid phone customers during the first quarter.”

However, Gen Alpha sees growth coming from other areas of Verizon’s business. “Looking ahead,” they wrote, “fixed wireless continues to present a compelling opportunity for VZ, as it seeks to take a bigger share of the broadband pie.”

Gen Alpha continued, “This is reflected by the incumbent broadband provider Comcast seeing just 5,000 net broadband customer additions during Q1, while Verizon saw 437K total net adds in the same quarter, the highest net adds in over 10 years.” But, they said, this isn’t a story about sub-par losses, but instead, rising profits and attractive valuation.

“While the aforementioned decline in postpaid wireless customers is worth monitoring, it’s important to note that overall profitability is a more important metric,” Gen Alpha wrote. Regarding those bottom-line results, Gen Alpha stated, “Verizon’s results on the profitability front were better, as it grew wireless service revenue by 3% YoY to $11.9 billion during Q1 and grew adjusted EBITDA by $1.5 billion over the prior year period to $8.3 billion.” And, they continued, this bottom-line success is trickling down to shareholders in the form on a high dividend yield.

“Importantly for income investors, VZ now sports one of its highest yields in its history, as shown below,” wrote Gen Alpha. “The 7.2% dividend yield is well-covered by a 52% payout ratio and comes with 18 years of consecutive growth,” they continued. Furthermore, regarding the strength of VZ’s dividend, Gen Alpha said: “This yield is convenient because of the Rule of 72, which is a great way of calculating when your money will double. Based on this calculation, investors could double their capital every 10 years (72 divided by 7.2), even if Verizon doesn’t grow its dividend over the long-term, which I don’t believe will be the case.”

Looking at dividend safety, the author points out that Verizon maintains an investment grade rated balance sheet, stating, “Meanwhile, VZ maintains a BBB+ credit rating, and its net unsecured debt to adjusted EBITDA ratio stands at a reasonable 2.7x, down 0.1x from the prior year period.”

“Lastly,” the author says, “VZ appears to be in deep value territory at the current price of $36.05 with a forward PE of just 7.7, sitting far below its normal PE of 14.3.”

Gen Alpha concluded their article highlighting their “Buy” rating on VZ shares, stating, “I'm taking the opportunity to increase my income by adding at current levels, and income investors may be well-served to take a hard look at VZ at its current deeply discounted price.”

Dividend Sensei, a Nobias 4-star rated author, also recently put a spotlight on Verizon’s sell-off and the stock’s intriguing valuation in an article published at Seeking Alpha. They wrote, “Private equity is paying 11X for companies right now, meaning Verizon is dirt cheap by even private equity standards.”