Case Study: PayPal (PYPL) stock according to high performing analysts

Key Points

Performance

PayPal (PYPL) shares fell by 18.28% this week, pushing their year-to-date gains down to -17.28%. This compares poorly to the S&P 500 and the Nasdaq Composite Index, which are up by 7.84% and 18.27% on the year, respectively,

Event & Impact

PayPal posted its first quarter results this week, beating Wall Street’s expectations on both the top and bottom lines. During Q1, PYPL’s revenue totaled $7.04 billion, beating Wall Street’s consensus estimate by $50 million. PayPal’s Q1 non-GAAP earnings-per-share came in at $1.17, which was $0.07/share above consensus.

Noteworthy News:

PayPal beat Wall Street’s expectations on the top and bottom lines and provided full-year earnings-per-share growth guidance of approximately 20%. However, the company pointed towards narrowing margins and it appears that Wall Street does not like this trend.

Nobias Insights

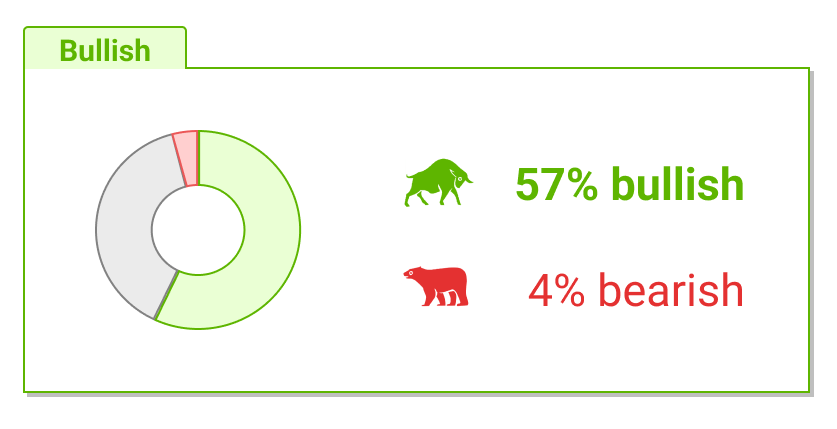

57% of recent articles published by credible authors focused on PYPL shares offer a “bullish” bias. Both of the credible Wall Street analysts who recently covered PYPL believe that shares are likely to rise in value. The average price target applied to PayPal by these credible analysts is $110.00, which implies an upside potential of approximately 78.3% relative to the stock’s current share price of $61.69.

Bullish Take Reinhardt Krause, a Nobias 5-star rated author, said, “For the quarter ended March 31, PayPal earnings rose 33% from a year earlier to $1.17 per share. The digital payments company said revenue climbed 9% to $7.04 billion, topping estimates by about 1%.”

Bearish Take Andrew Kessell, a Nobias 5-star rated author, stated, “It’s possible there are concerns about Paypal’s succession plan. In February, the company confirmed that CEO Dan Schulman will step down later this year.”

PYPL May 2023

PayPal (PYPL) reported its first quarter earnings this week, creating a lot of volatility around its shares. According to PayPal’s report, the company beat Wall Street’s estimates and updated investors when it came to full-year growth guidance.

The company’s management team is still calling for strong double digit growth on the year; however, even with that beat & raise quarter in mind, shares fell double digits in the aftermath of its report. On the week, PYPL dropped by 18.28%. This pushed its year-to-date performance into negative territory.

During 2023 thus far, PayPal shares are now down by 17.28%, which compares poorly to the broader markets. The S&P 500 and the tech-heavy Nasdaq are up by 7.84% and 18.27% on the year, respectively, showing the stark underperformance that Paypal has generated throughout the first 5 months of the year.

And yet, looking at the opinions expressed by credible authors and analysts alike, it appears that this dip represents a buying opportunity. Currently, the average price target being applied to PYPL shares by credible Wall Street analysts represents double digit upside potential.

Bullish Nobias Credible Analysts’ Opinions:

Reinhardt Krause, a Nobias 5-star rated author, wrote an article that he published at Investors.com that broke down Paypal’s post-earnings volatility. Krause said, “PayPal stock plunged 12.7% to close at 65.91 on the stock market today.” He mentioned that the company reported earnings which had earnings, revenue, and total payment volumes that beat Wall Street’s expectations; and yet, the stock still fell.

So why did the stock fall double digits? “What hurt PayPal stock is that Wall Street seemed unimpressed with the size of the company's raised 2023 outlook,” he answered.

Looking at the company’s Q1 earnings data, he said, “For the quarter ended March 31, PayPal earnings rose 33% from a year earlier to $1.17 per share. The digital payments company said revenue climbed 9% to $7.04 billion, topping estimates by about 1%.”

“Analysts expected PayPal earnings of $1.10 a share on revenue of $6.98 billion. A year earlier, PayPal earned 88 cents a share on sales of $6.48 billion,” he continued, proving the top- and bottom-line beats. “Total payment volume processed from merchant customers climbed 10% to $354.5 billion. Analysts had projected total payment volume of $344.8 billion,” Krause added, highlighting the use of Paypal’s network during Q1. Then, he said, “The company predicted adjusted earnings growth of about 20% to $4.95 a share, including the first-quarter beat. Its earlier view called for 19% growth to about $4.87.”

At first glance, this 20% growth outlook was impressive as well. However, Krause wrote, “In a note to clients, Jefferies analyst Trevor Williams said the size of PayPal's guidance came in mixed.”

Bearish Nobias Credible Analysts Opinions:

Andrew Kessell, a Nobias 5-star rated author, also covered PayPal’s earnings report in an article this week; like Krause, he highlighted the company’s strong Q1 growth numbers and full-year outlook, before adding, “It’s possible there are concerns about Paypal’s succession plan. In February, the company confirmed that CEO Dan Schulman would step down later this year.”

Dave Kovaleski, a Nobias 4-star rated author, covered PayPal’s Q1 report in an article at the Motley Fool titled, “Why PayPal Stock Dropped 14.4% This Week”. He too, seemed perplexed by the negative post-earnings stock volatility, writing, “PayPal sank following the release of Q1 earnings results on Monday, but at first glance, it's not clear why.”

“However,” Kovaleski said, “several analysts lowered their price targets for PayPal, primarily due to projections of lower operating margin expansion than previously anticipated.” “Specifically,” he continued, “non-GAAP operating margin is anticipated to increase by 100 basis points this year, as opposed to the previous expectation of 125 basis points.”

Digging into this, Kovaleski wrote: “The company said the reduced guidance reflects its unbranded processing volume contributing more to growth. The unbranded processing business is its merchant processing arm, which operates through platforms like PayPal Braintree and PayPal Complete Payments. While growing, it is a lower-margin segment than its payment business.” However, after looking over the company’s results, Kovaleski still came away from the quarter with a bullish bias.

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

“Overall,” he concluded, “PayPal plans to reduce this margin drag by expanding unbranded products and cross-selling services, so it seems like a minor concern. PayPal remains a good bargain right now with a forward price-to-earnings ratio of just 13.”

Overall bias of Nobias Credible Analysts and Bloggers:

However, we saw a different conclusion drawn from a credible Wall Street analyst, Moshe Katri, this week. Katri, who works for Wedbush, is a Nobias 4-star rated analyst. According to the Fly on the Wall, “Wedbush analyst Moshe Katri lowered the firm's price target on PayPal to $85 from $100 and keeps an Outperform rating on the shares. The firm notes that PayPal reported better-than-expected Q1/2023 results, with most operating and volume metrics exceeding expectations, including e-commerce growth inflecting from the prior quarter's trough levels. Maintaining its conservative tone, citing global macro challenges, the company's guidance suggested moderating revenue growth in Q2/2023, Wedbush adds.”

Although Katri lowered Wedbush’s price target, that $85.00/share level is still approximately 38% higher than PayPal’s current share price of $61.69. Overall, the average price target of the credible analysts who cover PYPL shares is $110.00. This represents upside potential of approximately 78.3%.

The credible author community leans bullish on shares as well. 57% of recent articles published on PYPL shares by credible authors tracked by the Nobias algorithm have expressed a “Bullish” bias.

Disclosure: Nicholas Ward is long PYPL. Nicholas Ward wrote this article for Nobias at their request with the intention of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.