Case Study on Apple (AAPL) with Nobias technology

Apple (AAPL) reported its third quarter earnings last week after the market’s closing bell, posting revenue that was in-line with Wall Street’s consensus and earnings-per-share which beat analyst estimates. This bottom-line beat allowed investors to breathe a sigh of relief. Apple shares rallied more than 3% during the trading session of Friday in response to the Q3 data.

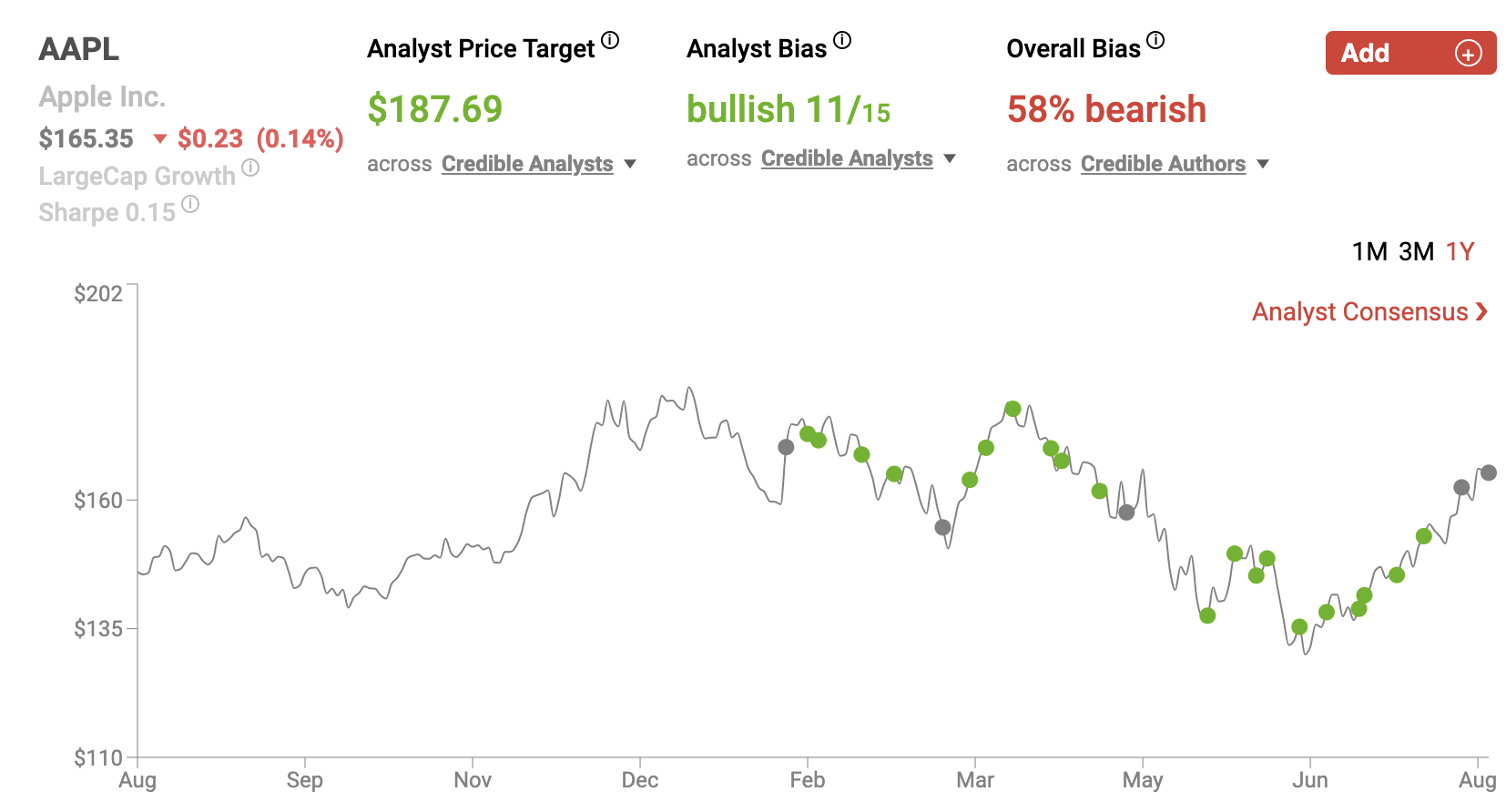

After making recent lows in the $130/share range in mid-June, Apple has rallied roughly 25% to its current share price of $162.51. Yet, even after this bullish move in recent weeks, the company continues to trade at a discount to its 52-week highs of $182.94. The credible analysts that Nobias tracks believe that the company’s positive momentum is likely to continue, with an average price target that implies a move back to those prior all-time highs.

Mike Peterson, a Nobias 5-star rated author, published an article at Apple Insider breaking down the company’s third quarter results. Peterson said, “Apple has reported that it made a record-breaking $83 billion in the third quarter of 2022, coming slightly ahead of Wall Street expectations for the economically impacted fiscal period.” He continued, “Its Q3 2022 results mark a slight 2% year-over-year increase from the $81.4 billion in revenue reported in 2021.”

AAPL Aug 2022

During the quarter, Apple produced GAAP earnings-per-share of $1.20 during Q3. This figure was slightly lower than the $1.30/share that Apple produced during Q3 one year ago; however, it did beat analyst consensus estimates on the bottom-line.

Peterson wrote, “Analysts were expecting Apple to report revenue around $82 billion and earnings-per-share of $1.16 in the June quarter.” Peterson broke down Apple’s operating segments, showing that iPhones and Apple’s Services segment served as the primary growth vehicles for the company during the third quarter. He wrote, “The company's iPhone revenue reached $40.6 billion, up slightly from $39.6 billion in the year-ago quarter. iPad revenue is down to $7.22 billion, a decrease from $7.37 billion in Q3 2021.” He continued, “Mac revenue went down to $7.38 billion, down from the year-ago revenue of $8.2 billion. Wearables, Home, and Accessories decreased slightly to $8.08 billion, down from $8.8 billion.”

And lastly, Peterson said, “Services, which has long been a growth driver for Apple, brought in $19.6 billion in the June quarter, an increase from the $17.4 billion it raked in during Q3 2021.” Touching upon the macro environment that Apple was operating in during the third quarter, Peterson stated, “Apple's Q3 2022 also saw the brunt of effects from Covid-related disruptions in China and supply chain issues. Although it did not provide formal guidance, Apple warned of a $4 billion to $8 billion revenue hit from those problems.”

Yaёl Bizouati-Kennedy, a Nobias 4-star rated author, published a post-earnings report at Yahoo Finance, where she highlighted the bullish Wall Street response to Apple’s quarter. Regarding the company’s top-line print, Bizouati-Kennedy wrote, “The revenue figures were “better than expected despite supply constraints, strong foreign exchange headwinds, and the impact of our business in Russia,” Tim Cook said in an earnings call, according to a transcript.” She also quoted Apple’s CFO, Luca Maestri, who spoke on the Q3 conference call as well.

Maestri said, “Our June quarter results continued to demonstrate our ability to manage our business effectively despite the challenging operating environment. We set a June quarter revenue record and our installed base of active devices reached an all-time high in every geographic segment and product category. During the quarter, we generated nearly $23 billion in operating cash flow, returned over $28 billion to our shareholders, and continued to invest in our long-term growth plans.”

This bullish tone by management was accepted by Daniel Ives of Wedbush Securities, who is a Nobias 5-star rated Wall Street analyst. Bizouati-Kennedy highlighted commentary provided by Ives in a recent analyst note. She said, “Wedbush Securities analyst Dan Ives views revenue of $14.6 billion from “the all-important China region” — down just 1% year-over-year despite the nation’s pandemic shutdowns — as a “‘Top Gun’ Maverick-like feat for Cook and company, and speaks to the overall demand story seen with Apple.”’

Bizouati-Kennedy noted that Ives reiterated his outperform rating on Apple, with a $200/share price target. According to Bizouati-Kennedy, Ives concluded his research note stating, “Looking ahead, we believe the key to Apple’s success over the next 6-12 months will be the company’s ability to capitalize on the iPhone upgrade cycle while staying on track for the fall of 2022. With China issues and supply chain as a ‘peak issue’ in the rear view mirror for now, Cook and company laser focus their sights on the iPhone 14 production/demand cycle for the September launch of this next key iPhone model. We estimate roughly 225 million Apple customers have not upgraded their iPhones in 3.5 years, creating a strong pent-up demand story with iPhone 14 despite the darkening global macro backdrop.”

Luc Olinga, a Nobias 4-star rated author, offered a more bearish take on the quarter in a post-earnings article that he published at The Street, titled, “Apple May Have a Big Problem with the Mac and iPad”. Olinga highlighted the strong iPhone numbers that Apple generated during Q3, but said, “there is a vagueness surrounding two other flagship products: the Mac and the iPad.” He wrote, “Mac sales were down 10.4% year-over-year at $7.38 billion and below analysts' expectations of $8.45 billion.”

Olinga continued, “The resurrection of the iPad observed at the time of the covid-19 pandemic seems to be fading. The iPad's revenue fell 2% to $7.22 billion but came in above analysts' expectations ($6.93 billion), which were very low as there is consensus that Apple may give tablets less priority if the chip shortage continues.”

Olinga noted the macro headwinds that Peterson highlighted leading to the $4b-$8b headwind in the coming quarter. He also said, “The dollar has risen more than 13% so far this year and reached a two-decade peak against its global peers earlier this month.”

The strong dollar hurts the profitability of Apple devices sold in emerging markets. And, at a higher level, Olinga stated, “Besides these explanations, the Mac and the iPad also suffer from a demand problem on the part of consumers, who have begun to limit their spending in preparation for difficult times.” He wrote, “Semiconductor makers and computer vendors have warned that demand for PCs and smartphones is slowing across the world. The Mac and the iPad do not seem to be spared by this trend.” And, this is a problem in Olinga’s eyes, because he wants to see the company continue to diversify its revenue stream. He stated, “The consumer tech giant from Cupertino, California continues to rely on the iPhone, its flagship product, but until when?”

Luke Lango, a Nobias 4-star rated author, offered a counter argument to Olinga’s thesis in a recently published report titled, “It’s Time to Prepare for the Next Big Apple Product Launch”. Lango acknowledged Apple’s heavy reliance on the iPhone, stating, “Today, there are more than a billion iPhones across the globe. In the just-ended quarter, Apple sold more than $40 billion worth of them. And it’s now the most valuable company in the world, with a $2.6 trillion market capitalization.” He continued, “Talk about a revolutionary product. Since the iPhone was first announced, AAPL has risen more than 4,000%, turning every $10,000 investment into more than $400,000!” But, as he notes, “The smartphone market is saturated.”

Regarding annual iPhone sales, Lango said, “The number of iPhones sold per year by Apple soared from 11.6 million in 2008 to 231.2 million in 2015. Since then, annual unit sales have plateaued between 200- and 240 million units per year.”

Lango transitioned to his next big idea for the company, writing, “Now, what if I told you that Apple was about to do it all over again? What if it were set to release a brand-new product over the next 12 months?” Lango believes that moving into the car space is going to be the next major bullish catalyst for AAPL stock. He said, “In 2008, just a year after the launch of the iPhone, Steve Jobs speculated that the company’s next big breakthrough product would be an Apple car. Nearly 15 years later, that vision is becoming a reality.”

Lango wrote, “Rumors first broke about an Apple car back in 2015. Then in 2017, the company made a dramatic pivot. It decided to ditch making a car in favor of just developing self-driving technology. In another equally dramatic pivot in 2019, Apple switched back to its plans of making a full-scale EV. And just last year, Digitimes reported that Apple will mass produce its long-awaited and highly anticipated Apple car in 2024.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

Looking at Apple’s iPhone success, Lango sees similarities to the electronic vehicle market. He wrote, “In 2007, smartphone penetration rates in the U.S. were about 10%. Last year, global EV penetration rates were about 10%.” He believes that the ~10% market adoption rate is the sweet spot for Apple’s entry into this major global market, stating, “That’s exactly where we are today with EVs. Naturally, Apple is planning to soon launch its own EV.”

Lango does note that the law of large numbers is likely to limit Apple’s upside moving forward. He said, “With a $2 trillion market cap, Apple stock’s days of scoring investors 10X-plus returns is behind it.” However, he concluded, “if the Apple car is a hit, it’ll be able to grow that business by leaps and bounds for the next 10-plus years!”

The community of credible authors that Nobias tracks (only those with 4 and 5-star Nobias ratings) don’t share Lango’s enthusiasm for AAPL shares. 61% of recent articles published on Apple by credible authors have expressed a “Bearish” sentiment.

However, the credible Wall Street analysts that we track (once again, only those with 4 and 5-star Nobias ratings) are much more bullish on the stock. 11 of the 14 credible analysts that have a buy/sell/hold rating on Apple expect to see its share price move higher. Right now, the average price target being applied to AAPL shares by these credible analysts is $184.91. Apple closed Friday’s post-earnings trading session up 3.28% to $165.35. Therefore, that $187.69 average credible analyst price target represents upside potential of approximately 13%.

Disclosure: Nicholas Ward is long AAPL. Nicholas Ward wrote this article for Nobias at their request with a view of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.