Case Study on Lowe's (LOW) with Nobias technology

Lowe’s (LOW) reported its second quarter earnings this week, posting mixed results. However, despite a top-line miss, LOW shares were still higher by 2.5% on the week. Lowes fought through the inflationary environment that retailers are currently operating in, growing its earnings by nearly 10%. Since Lowe’s posted Q2 results, several credible Wall Street analysts have raised their price targets for LOW shares. Right now, the average credible analyst price target for LOW implies double digit upside potential.

Derek Lewis, a Nobias 5-star rated author, published an earnings preview article at Zacks this week. Lewis began his piece by highlighting the recent strength shown by LOW shares. He said, “The Zacks Building Products – Retail Industry has been hot over the last month, gaining a rock-solid 11.8% and just marginally underperforming the S&P 500’s gain of 12.2%.”

This article was published on 8/15/2022; during the week of 8/15-8/21, LOW shares rose another 2.5%. This means that during the last 30 days, LOW shares are now up by 13.71%. Lewis notes that mean reversion is likely a factor at play here.

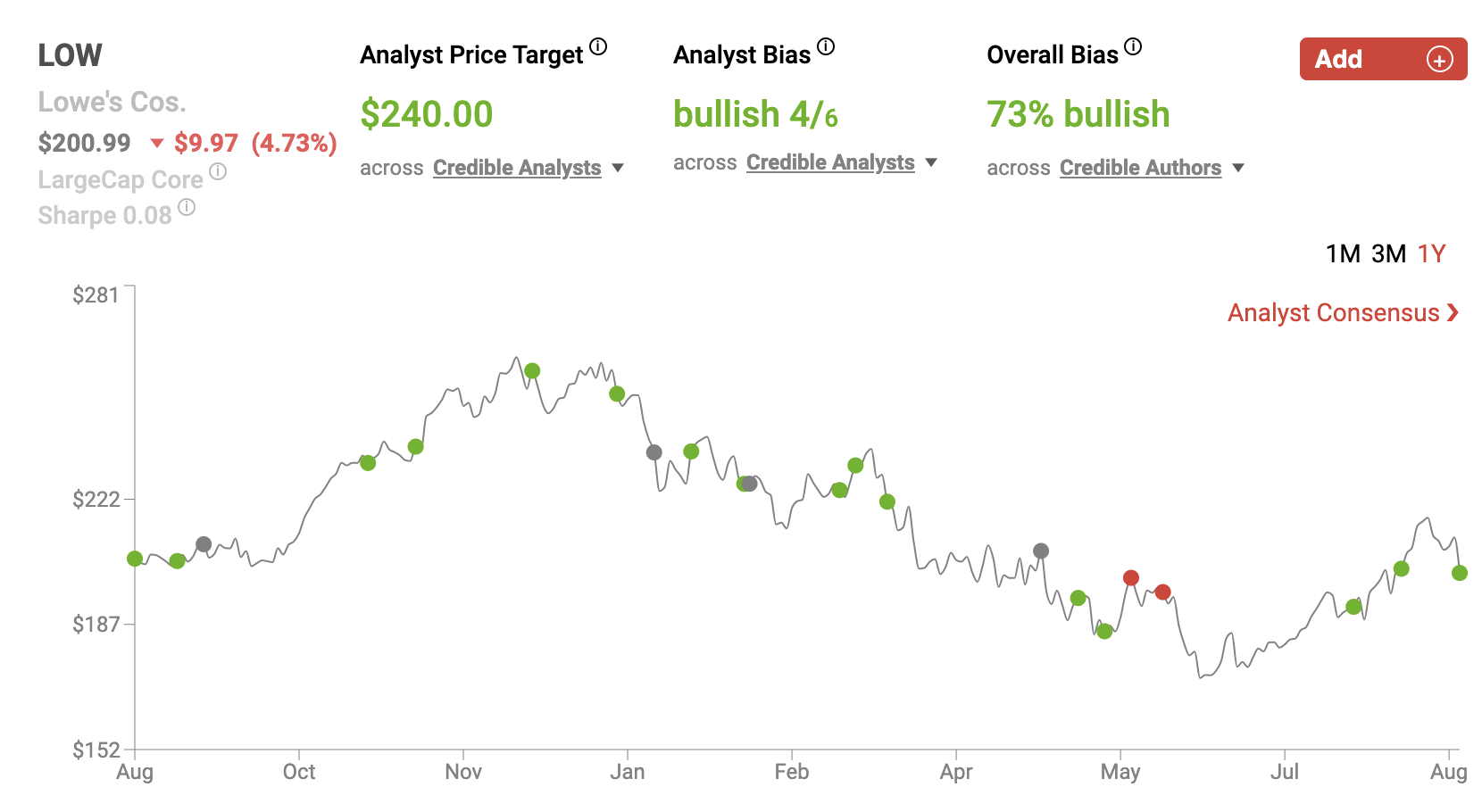

LOW Aug 2022

During the summer, the sentiment surrounding LOW shares pushed its valuation down well below its long-term historical averages as higher interest rates, higher mortgage rates, and a slowdown in the housing market caused investors to move away from the home improvement names. Lewis said, “Lowe’s shares carry solid valuation levels; the company’s 15.4X forward earnings multiple is well beneath its five-year median of 18.3X and represents an enticing 8% discount relative to its Zacks Industry.”

Regarding this negative sentiment, Lewis notes that it was spreading throughout the analyst community in recent weeks as well. He wrote, “Analysts have been overwhelmingly bearish for the quarter to be reported, with five downwards estimate revisions coming in over the last 60 days. Still, the Zacks Consensus EPS Estimate of $4.63 pencils in a notable 9% year-over-year uptick in earnings.”

But, he notes, this company has a history of outperforming analyst estimates. Lewis stated, “LOW has been the definition of consistency within its bottom-line results, chaining together an impressive 13 consecutive EPS beats. Just in its latest print, the company posted a solid 8.3% bottom-line beat.” He continued, “Top-line results have also been remarkable; Lowe’s has posted eight revenue beats over its last ten quarters.”

When Lowes posted earnings on 8/17/2022 its results were mixed. LOW continued its trend of beating Wall Street estimates on the bottom-line, posting non-GAAP EPS of $4.67/share, beating consensus estimates by $0.07/share. This $4.67/share EPS result represented 9.9% year-over-year growth. Lowes missed analyst estimates on the top-line, however.

The company’s Q2 sales came in at $27.48 billion, representing -0.3% year-over-year growth, and missing estimates by $680 million. During the company’s second quarter report, LOW’s CEO, Marvin Ellison, stated: “I am pleased that our team drove operating margin improvement and effectively managed inventory despite lower-than-expected sales – a clear reflection of our relentless focus on operating discipline and productivity. Our results in the first half were disproportionately impacted by our 75% DIY customer mix, which was partially offset by our double-digit Pro growth for the ninth consecutive quarter. Despite continued macro uncertainty, we remain confident in the long-term strength of the home improvement market and our ability to take share. To help our hourly front-line associates during this period of high inflation, we are awarding an incremental bonus of $55 million. I’d like to thank our associates for their continued hard work and dedication.”

Lowes noted that its same-store sales fell by 0.3% during the quarter. But, in the U.S., LOW’s same-store numbers were slightly better, rising by 0.2%. Management noted that “DIY sales were impacted by the shortened spring and lower demand in certain discretionary categories, which was partially offset by a 13% increase in Pro customer sales.”

During the company’s Q2 earnings conference call, Ellison mentioned some of the tough year-over-year comparisons that his company is facing, especially when it comes to the DIY customer. He said, “Also, while we plan for a modest sector pullback this year as we lap outsized DIY consumer demand, we now believe that certain categories like patios and grills are disproportionately impacted by the unprecedented demand from 2020 and 2021. This unprecedented demand was likely fueled by the combination of three rounds of government stimulus, an increase in consumer savings rate and a temporary shift away from spending on services towards spending on goods, including home improvement products.”

Elison also put a spotlight on his company’s continued eCommerce growth, stating, “On Lowes. com, sales grew 7% this quarter, representing a sales penetration of nearly 10%. We're continuing to invest in omnichannel capabilities because we believe there is still tremendous runway for further growth ahead.”

LOW highlighted its shareholder returns during the quarter, stating, “With a disciplined focus on its best-in-class capital allocation program, the company continues to create sustainable value for its shareholders. During the quarter, the company repurchased approximately 21.6 million shares for $4.0 billion, and it paid $524 million in dividends.”

During its Q2 earnings press release, Lowe’s provided investors with an update on full-year guidance, stating: Full Year 2022 Outlook -- a 53-week Year (comparisons to full year 2021 -- a 52-week year)

Total sales of $97 billion to $99 billion, including the 53rd week

53rd week expected to increase total sales by approximately $1.0 billion to $1.5 billion

Comparable sales expected to range from a decline of -1% to an increase of 1%

Gross margin rate up slightly compared to prior year

Depreciation and amortization of approximately $1.75 billion

Operating income as a percentage of sales (operating margin) of 12.8% to 13.0%

Interest expense of $1.1 to $1.2 billion (previously $1.0 to $1.1 billion)

Effective income tax rate of approximately 25%

Diluted earnings per share of $13.10 to $13.60

Total share repurchases of approximately $12 billion

ROIC of over 36%

Capital expenditures of approximately $2 billion

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

After the market had a chance to digest Lowe’s Q2 results, shares ended the week trading for $211.36. This is 24.2% above the stock’s recent lows of $170.12; however, despite this recent rally, LOW shares are still down by 17.28% on a year-to-date basis.

However, the credible authors and analysts that the Nobias algorithm tracks believe that the stock’s recent positive trend will continue. Since LOW posted Q2 results, several analysts have come out with bullish calls on the company.

Michael Baker, a Nobias 5-star rated analyst from Davidson, raised his price target for Lowe’s from $225 to $247. Seth Basham, a Nobias 5-star rated analyst from Wedbush, raised his price target from $200 to $225. And, Scot Cirrarelli, a Nobias 4-star rated analyst from Truist, raised his price target from $237 to $263. 76% of recent articles published by credible authors (only those with 4 and 5-star Nobias ratings) have included a “Bullish” bias. Right now 5 out of the 7 credible analysts (once again, only those with Nobias 4 and 5-star ratings) believe that LOW shares are likely to head higher. Amongst these credible analysts, the current average analyst price target for LOW shares is $240. Relative to the stock’s $200 price tag, this implies upside potential of 20%.

Disclosure: Nicholas Ward is long LOW. Nicholas Ward wrote this article for Nobias at their request with a view of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.