Credible Wall Street analysts and bloggers on Apple (APPL) stock

Key Points

Apple shares rallied 7.53% on Friday after reporting a top and bottom-line beat during their fiscal Q4 report. This pushed their year-to-date results up to -14.4%, better than the S&P 500’s -18.7% results and the Nasdaq’s -29.9% year-to-date losses.

Apple’s sticky ecosystem allowed it to generate reliable profits while other technology firms struggled.

Apple posted record Q4 sales results, sparking a near-term rally.

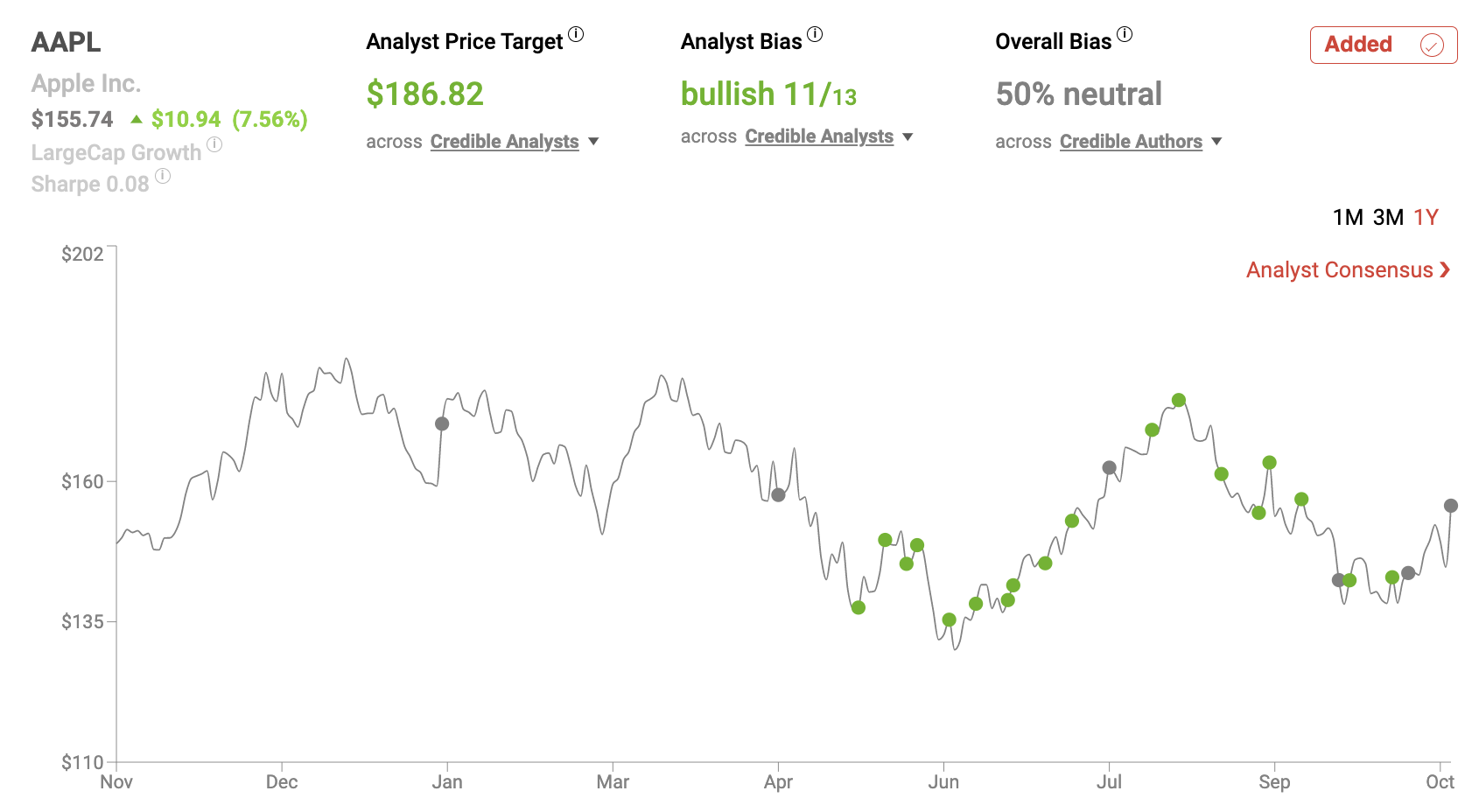

50% of recent articles published by credible authors were “Bullish”. 11 out of 13 credible Wall Street analysts believe shares are headed higher. The average price target being applied to Apple shares by credible analysts is $$186.82 which implies upside potential of approximately 20%.

Performance

Event & Impact

Noteworthy News:

Nobias insights

Apple (AAPL) reported fiscal 2022 fourth quarter results this week, beating Wall Street’s consensus estimates on both the top and bottom lines. Year-to-date, Apple shares have outperformed the S&P 500, the Nasdaq, and its big-tech peers and this trend continued after the company reported its most recent quarterly results. Apple rallied by 7.53% on Friday, pushing their 2022 losses up to just 14.4% (relatively better than the S&P 500’s -18.7% losses and the Nasdaq’s -29.9% losses). And moving forward, the credible Wall Street analysts that the Nobias algorithm tracks see upside potential of approximately 20% ahead.

AAPL Oct 2022

Bullish Nobias credible authors:

Patrick Seitz, a Nobias 4-star rated author, published a post-earnings report on Apple at Investors.com, highlighting the company’s operating results and several analyst updates on the stock. Seitz wrote, “The Cupertino, Calif.-based company late Thursday said it earned $1.29 a share on sales of $90.1 billion in its fiscal fourth quarter ended Sept. 24.” He continued, “On a year-over-year basis, Apple earnings rose 4% while sales climbed 8%.”

In today’s volatile environment, the market rewarded Apple for its reliable growth with a 7.5% rally. However, Seitz also pointed out that Apple’s Chief Financial Officer, Luca Maestri, highlighted ongoing foreign exchange headwinds and weakness in the personal computer industry which will likely hurt Mac sales during the quarterly report.

Seitz quoted Maestri who said, "Overall, we believe total company year-over-year revenue performance will decelerate during the December quarter as compared to the September quarter.” But, Seitz also highlights bullish commentary provided by Apple’s CEO during the earnings call as well. He wrote, “On the earnings call, Chief Executive Tim Cook noted that Apple is supply-constrained on several new products. He said the company hasn't been able to make enough iPhone 14 Pro models and Apple Watch Ultra wearables to meet demand.”

Furthermore, Seitz also highlighted a bull/bear tug-of-war going on between a couple of credible Wall Street analysts. Seitz noted that Wedbush Securities analyst Daniel Ives, who is a Nobias 5-star rated analyst, called Apple "a tech standout in a dark economic and FX storm."

Seitz continued, “In a report, Ives reiterated his outperform rating on Apple stock but trimmed his 12-month price target to 200 from 220.” Yet, not everyone was as bullish as Ives. Seitz said, “At least six Wall Street analysts cut their price targets on Apple stock after the company's fiscal Q4 report.” He put a spotlight on one of these resorts stating, “Barclays analyst Tim Long was more cautious on the holiday quarter. He is now modeling 3% sales growth for Apple in the December quarter. Long rates Apple stock as equal weight, or neutral, with a price target of 156.”

Irfan Ahmad, a Nobias 5-star rated author, also wrote about Apple’s fiscal Q4 results this week at Digital Information World. Ahmad said, “Apple’s report for this quarter provided an outlook of $90 billion of revenue generated while profits hit the $20 billion mark.”

Looking at operating segments, Ahmad wrote, “Both iPhone and Mac sales were up. The former had a 9.8% increase while the latter was up by a staggering 25%.” He continued, “iPad sales however showed a decline and were reported to be down by 13%.”

“Meanwhile,” Amhad said, “wearables and accessories also showed a 10% increase while services were noted to have gone up by 5%.” Like Seitz, Ahmad focused on Tim Cook’s optimism during Apple’s Q4 conference call.

Regarding Cook’s comments, Ahmad said, “A lot of praise was given to Apple’s strong ecosystem and its strive to protect customers at all costs as this in turn led to record sales and the installation of new devices.” Ahmad concluded, “He [referring to Cook] was happy with the results and hoped to see the company succeed further in the next quarter as records continue to be broken and revenue continues to skyrocket when compared to previous years.”

Growth at a Good Price, a Nobias 4-star rated author, published an Apple post-earnings roundup article at Seeking Alpha this week. The author highlighted Apple’s fundamental data, stating, “In the most recent quarter, Apple delivered:

$90 billion in revenue, up 8%.

$38 billion in gross profit, up 8.2%.

$24.8 billion in operating income, up 4.7%.

$20.72 billion in net income, up 0.82%.

$1.29 in EPS, up 3.2%.

$122 billion in full year cash from operations, up 17%.”

The author continued, “In addition, the profitability was healthy. Based on the metrics above, we get a 42% gross margin, a 27.5% EBIT margin, and a 23% net margin. A big win on all of these metrics.”

Growth at a Good Price mentioned that Apple shares were struggling coming into the Q4 report. They wrote, “Apple's stock stumbled in the weeks heading into the release. Expectations were low, peer companies missed earnings estimates, and a rumor circulated saying that Apple cut iPhone 14 Plus production.”

However, they quickly provided their bullish counterpoint, writing, “I was personally optimistic heading into earnings, as I knew that the iPhone 14 rumor was overblown (the 14 Plus is just one of four iPhone 14 models). Still, the magnitude of the earnings beat impressed me.”

Growth at a Good Price says that while other big-tech stocks were struggling in recent months, Apple’s sticky consumer ecosystem allowed it to outperform.

Regarding this ecosystem they said, “Apple's customer loyalty is legendary. Apple itself touted this factor as one of the reasons for its Q4 beat. Additionally, the firm 'Access' calculated Apple's brand loyalty (defined as customers who repeatedly buy similar products) at 87%. That figure is higher than average, so Apple's claims of having high customer loyalty are backed by third party studies.”

Furthermore, the author points out, “Apple was rated the world's most valuable brand in 2022 by the Visual Capitalist.” Growth at a Good Price wrote, “Apple puts a lot of emphasis on building an interconnected ecosystem of devices that integrate well with each other.” They continued, “This incentivizes buying one Apple product after another, which leads to repeat sales.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

After the stock’s 7%+ rally on Friday, the author turned towards the stock’s valuation. They said, “If the treasury yield were to rise to 6%, Apple would need to grow much faster than 5% per year in order to be worth buying.” “It isn't conservative,” Growth at a Good Price noted, “to just assume that a huge company will grow faster than 5% per year forever”. Therefore, they concluded, “Apple stock looks like a great value in 2022.”

“Certainly,” the author continued, “it's a comparatively good value by the standards of big tech.” They did provide a note of caution though, stating, “I would not personally be buying at prices higher than $171.” But, being that Apple shares closed the trading session on Friday at $155.74, Growth at a Good Price still sees upside ahead.

Overall bias of Nobias Credible Analysts and Bloggers:

So does the community of credible Wall Street analysts that the Nobias algorithm tracks. 11 out of the 13 credible analysts that Nobias tracks believe that Apple shares are likely to increase in value moving forward. Right now the average price target being applied to AAPL shares by these individuals is $186.82. Therefore, the collective outlook of the credible analysts community sees upside potential of approximately 20%.

Disclosure: Nicholas Ward is long AAPL. Nicholas Ward wrote this article for Nobias at their request with the intention of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.