Credible Wall Street analysts and bloggers on British Petroleum (BP) stock

Key Points

British Petroleum (BP) shares rose more than this week. BP shares are now up by 23.98% on the year, meaning that they’ve drastically outperformed the broader market this year (the S&P 500 is down by 20.89% during 2022 thus far).

BP posted earnings that included $8.6 billion in profits, allowing the company to increase its dividend and announce significant buyback plans moving forward

In response to rising profits and shareholder returns from the oil/gas space, politicians are discussing “windfall” taxes which could hurt profitability in the industry in the coming quarters.

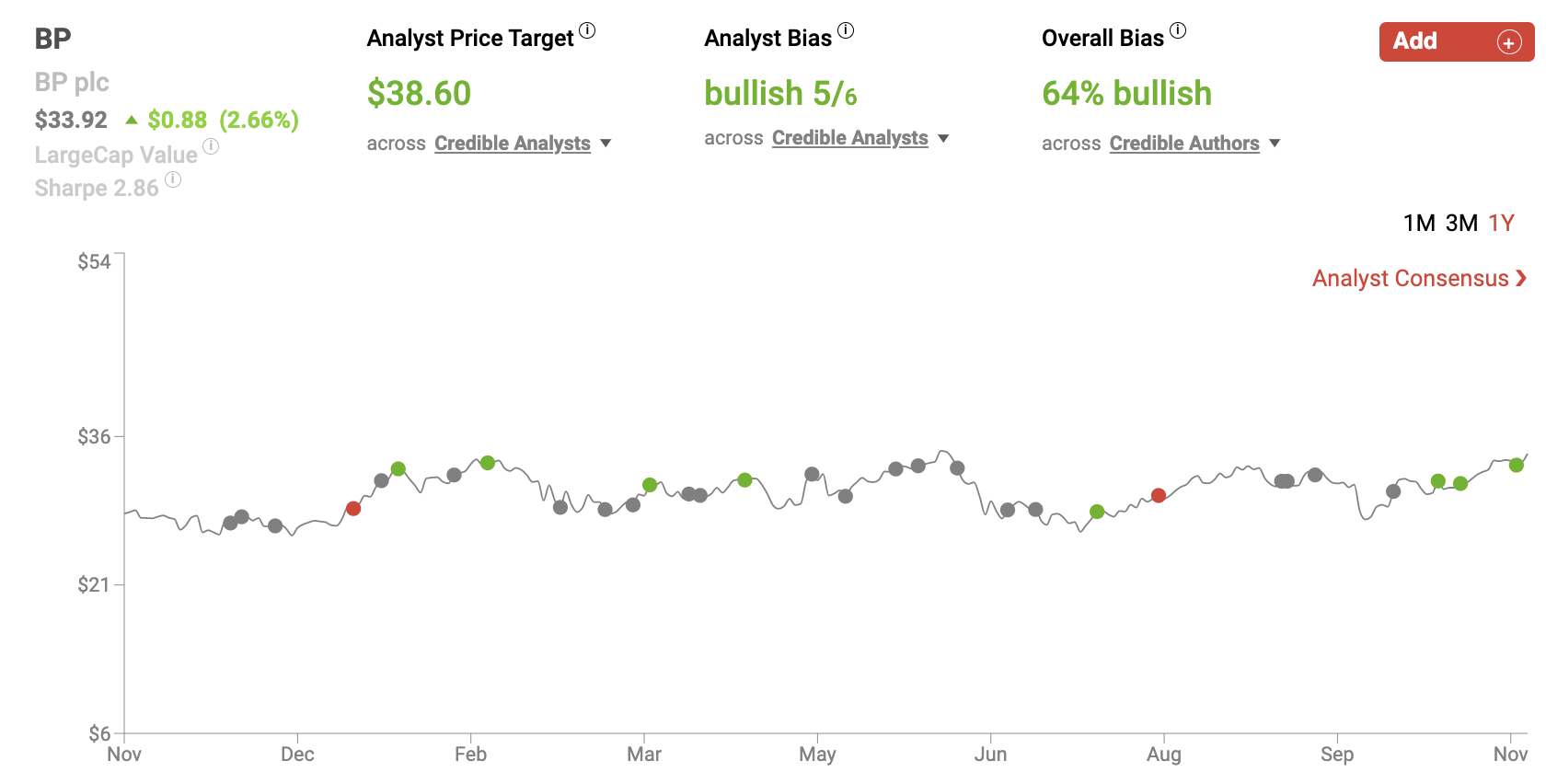

64% of recent articles published by credible authors were “Bullish”. 5 out of 6 credible Wall Street analysts believe shares are headed higher. The average price target being applied to BP shares by credible analysts is $38.60 which implies upside potential of approximately 13.8% relative to BP’s current share price of $33.92.

Performance

Event & Impact

Noteworthy News:

Nobias insights

The S&P 500 is down by 20.89% on a year-to-date basis. Throughout 2022, there is only one sector that has posted positive results: energy. The supply/demand imbalance created by removing Russian energy exports from the global markets alongside recent OPEC production cuts has caused the price of oil to soar. This has resulted in robust profits for oil/gas companies, one of which reported earnings this week.

British Petroleum (BP) posted Q3 results, missing Wall Street’s estimates on the top-line, but beating the Street’s consensus on the bottom-line. Because of these results, BP shares rose by 3.18% this week. This positive weekly performance pushed BP’s year-to-date gains up to 23.93%. And yet, even after this nearly 45% relative outperformance (compared to the S&P 500) the credible authors and analysts that the Nobias algorithm tracks remain largely bullish on BP’s prospects moving forward.

BP Nov 2022

Bullish Nobias credible authors:

Sam Meredith, a Nobias 4-star rated author, published a report at NBC Philadelphia which highlighted British Petroleum’s recent earnings report this week. Meredith wrote, “The British energy major posted underlying replacement cost profit, used as a proxy for net profit, of $8.2 billion for the three months through to the end of September.” That compared with $8.5 billion in the previous quarter and marked a significant increase from a year earlier, when net profit came in at $3.3 billion.” The author points out that “Analysts polled by Refinitiv had expected a third-quarter net profit of $6 billion.”

Alex Kimani, a Nobias 4-star rated author, also published a report which focused on BP’s recent earnings last week at oilprice.com. Kimani provided more detail on BP’s recent results, stating, “BP has high energy volatility to thank for the impressive earnings, which helped boost the earnings contribution from the oil giant’s big trading unit. Indeed, adjusted Q3 profit for the gas and low carbon energy unit totaled $6.24B, more than double the $3B profit the business made in Q2.”

Meredith touched upon shareholder returns, stating, “BP announced another $2.5 billion in share repurchases and said net debt had been reduced to $22 billion, down from $22.8 billion in the second quarter.” Kimani quoted an analyst report from Jeffreys which provided an even more aggressive outlook for the company’s buyback plan. He wrote, ‘“We believe BP will be able to set buyback at US$11bn over the next four quarters, setting BP's shareholder remuneration yield at the highest level in the sector (12%),” Jeffries analysts have said.”

Kimani says that these share buybacks are coming because capital expenditures across the oil space have been “mostly flat” in recent years. He wrote, “Data from the U.S. Energy Information Administration (EIA) shows that Big Oil companies have mostly downshifted both capital spending and production for the second-quarter. An EIA review of 53 public U.S. gas and oil companies, responsible for about 34% of domestic production, showed a 5% decline in capital expenditures in the second-quarter vs. Q1 this year.”

With regard to low capex and higher prices, Meredith wrote, “The world's largest oil and gas majors have reported bumper earnings in recent months, benefiting from surging commodity prices following Russia's invasion of Ukraine.” Meredith continued, “Combined with BP, oil majors Shell, TotalEnergies, Exxon and Chevron have posted third-quarter profits totaling nearly $50 billion.”

While these rising profits are great for the companies and their shareholders, the large buybacks and growing dividends that oil/gas companies have announced in recent months are creating problems for them in the political spectrum. The United Kingdom has already announced a “windfall tax” on energy profits.

An article published by the British Broadcasting Corporation this week broke down how the British tax works: “Rishi Sunak introduced the tax when he was chancellor, describing it as a 25% Energy Profits Levy. It applies to profits made from extracting UK oil and gas, but not from other activities such as refining oil and selling petrol and diesel on forecourts.

The tax also allows the firms to apply for tax savings worth 91p of every £1 invested in fossil fuel extraction in the UK. When the BBC asked the government how much the tax break would cost it received no reply.” The BBC article said, “The Treasury says it expects the tax to raise £5bn in its first year, but that may be optimistic if Shell is not contributing until 2023.”

Meredith points out that a similar tax proposal could arise in the United States as well, writing, “U.S. President Joe Biden on Monday called on oil majors to stop "war profiteering" and threatened to pursue higher taxes if industry giants did not work to cut gas prices.” This would put further pressure on oil/gas company profits and potentially slow shareholder returns.

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

Michael Hewson, a Nobias 5-star rated author, published a report this week which provided more details on the UK’s Energy Profits Levy and its impact on BP. Hewson said, “The “energy profits levy” as it is known, has been set at 25% until 2025 and puts BP and Shell effective UK tax rate at 65%.” He continued, “BP has already set aside an $800m adjustment in this quarter’s numbers in respect of the latest UK windfall tax, pushing the tax take from the North Sea to $2.5bn for this year. BP is also continuing to pay over $1.2bn a year in respect of the Gulf of Mexico oil spill.”

In Meredith’s piece, he highlighted recent commentary provided by BP’s CEO, Bernard Looney, who spoke at the ADIPEC conference in the United Arab Emirates on Monday. With regard to the political pressure and BP’s current operating environment, Looney said, "Our job is to pay our taxes; our job is to invest.” We just announced a $4 billion acquisition in the United States just last week in renewable natural gas so that's what our job is to do. We will continue to do that and do the very best that we can.”

Overall bias of Nobias Credible Analysts and Bloggers:

Despite rising political pressure against the oil and gas industry, the majority of the credible authors appear to be focused on rising profits as 64% of recent articles published on BP shares have expressed a “Bullish” bias. 5 out of the 6 credible analysts that the Nobias algorithm tracks who have expressed an opinion on BP shares are bullish as well. With the company’s recent Q3 earnings results factored into recent analyst reports, the average price target that is currently being applied to BP shares by credible analysts is $38.60. Today, BP shares trade for $33.92. Therefore, even after BP’s year-to-date price gains of nearly 24%, the average credible analyst price target implies upside potential of approximately 13.80%.

Disclosure: Nicholas Ward has no position in any company discussed in this article. Nicholas Ward wrote this article for Nobias at their request with the intention of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.