Case Study: What Credible analysts are saying on Broadcom (AVGO) stock

Key Points

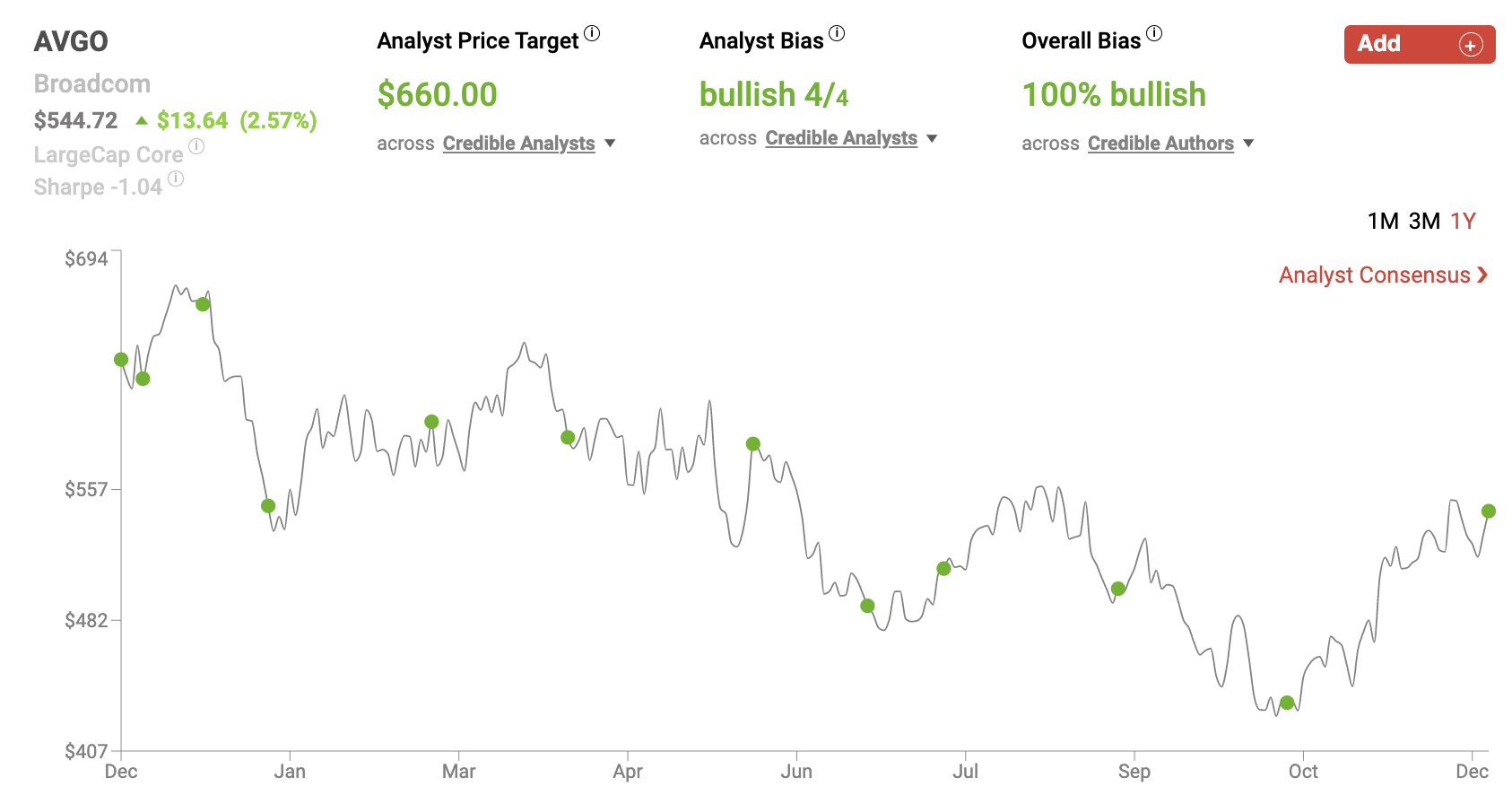

Broadcom (AVGO) shares rose by 1.22% this week. They popped 2.57% on Friday, during a post-Q4 earnings rally. On a year-to-date basis, AVGO is now down by 17.88%. This compares favorably to the S&P 500, which is down by 17.97% during 2022 thus far.

Broadcom continues to outperform many of its peers in the semiconductor industry, using its unique combination of hardware and software to weather today’s tough macro economic environment.

Broadcom posted Q4 earnings this week, beating Wall Street’s expectations on the top and bottom lines. AVGO posted Q4 sales of $8.93 billion, which was $30 million above estimates, representing 20.5% year-over-year growth. AVGO’s Q4 non-GAAP earnings-per-share totaled $10.45, beating consensus by $0.17/share, representing 33.8% growth relative to the $7.81/share non-GAAP EPS that AVGO generated during Q4 of 2021.

100% of recent articles published by credible authors focused on AVGO shares offer a “Bullish” bias. 4 out of the 4 credible credible Wall Street analysts who cover Broadcom believe shares are likely to rise in value. The average price target being applied to Broadcom by these credible analysts is $660.00, which implies upside potential of approximately 21.2% relative to AVGO’s current share price of $544.72

Geoff Considine, a Nobias 5-star rated author, said: “The longer-term outlook is favorable, however, with a consensus estimate of 16.9% per year in EPS growth over the next 3 to 5 years.”

Financially Free Investor, a Nobias 4-star rated author said, “AVGO definitely has more risk than the blue-chip MSFT but also offers much higher dividend yield and growth prospects. The risk comes from its aggressive acquisition strategy, which has worked well in the past. Its most recent acquisition (pending) of VMWare for $60 Billion will add quite a bit of additional debt but would diversify more heavily in the software business.”

Performance

Event & Impact

Noteworthy News:

Nobias insights

Bullish Take:

Bearish Take:

Broadcom (AVGO) posted Q4 earnings this week, beating Wall Street’s estimates on both the top and bottom lines. This news allowed the stock’s recent rally to continue. AVGO shares are now up by 14.65% during the last month. However, even with this near-term rally in mind, AVGO shares are down by 17.88% on a year-to-date basis. This means that they’ve slightly outperformed the S&P 500, which is down by 17.97% throughout 2022 thus far.

AVGO Dec 2022

However, the credible analysts that Nobias tracks who have expressed an opinion on AVGO shares believe that their run is just beginning, calling for upside potential north of 20% from the stock’s current share price of $544.72.

Bullish Nobias credible authors:

Financially Free Investor, a Nobias 4-star rated author, recently published a report titled “5 Relatively Safe And Cheap Dividend Stocks To Invest In - December 2022” which included Broadcom as one of the stocks on their list.

The author highlighted the process which they used to arrive at their highest rated dividend stocks for December of 2022, stating, “The S&P 500 currently yields roughly 1.60%. Since our goal is to find companies for a dividend income portfolio, we should logically look for companies that pay yields that are at least similar to or better than the S&P 500.”They continued, “We will limit our choices to companies that have a market cap of at least $10 billion and a daily trading volume of more than 100,000 shares.”

Also, Financially Free Investor said, “We also will check that dividend growth over the last five years is positive, but there can be some exceptions.”The author went on to mention that they were tracking data related to the following metrics: Current yield, Dividend growth history, Past five-year and 10-year dividend growth, Payout ratio, EPS growth, Chowder number, Debt/equity ratio, Debt/asset ratio, S&P's credit rating, PEG ratio, Distance from 52-week high, and lastly, Sales or Revenue growth.

And, with all of those data metrics in mind, they arrived at their final lists, which included Broadcom in the section labeled: “High Yield, Moderately Safe”. When breaking down Broadcom shares, Financially Free Investor wrote: AVGO (Broadcom): We have included AVGO as the technology company here in place of MSFT (in the A-List). AVGO definitely has more risk than the blue-chip MSFT but also offers much higher dividend yield and growth prospects. The risk comes from its aggressive acquisition strategy, which has worked well in the past. Its most recent acquisition (pending) of VMWare for $60 Billion will add quite a bit of additional debt but would diversify more heavily in the software business.”

Earlier this week, Geoff Considine, a Nobias 5-star rated author published an article on Broadcom, breaking down his outlook for shares coming into the stock’s recent fourth quarter fiscal 2022 results. Considine began his piece stating, “Broadcom, which will report Q4 FY 2022 results after market hours on December 8th, has been one of the few bright spots in the semiconductor industry over the past year.” He also mentioned that, “AVGO is the largest holding in SOXX [the iShares Semiconductor ETF]”

The SOXX has performed poorly over the trailing twelve months, down by 29.88%, which makes Broadcom’s relative outperformance all the more impressive. Considine highlighted the regulatory risks that Financially Free Investor brought up, writing, “Broadcom is in the midst of acquiring VMware (VMW) for $61 Billion and the deal is expected to close sometime in the next 12 months. The remaining hurdles are mainly regulatory.” However, he continued, “My own analysis suggests that the deal is likely to be completed.”

Looking ahead to the company’s Q4 report, Considine said, “The consensus expectation for Q4 EPS is $10.3 per share, as compared to $7.81 for the same quarter of last year. It is worth noting, however, that the outlook is for considerably slower earnings growth in the next year or two”.

But, looking further out into the future, Considine was even more bullish, stating, “The longer-term outlook is favorable, however, with a consensus estimate of 16.9% per year in EPS growth over the next 3 to 5 years.” He then moved onto the company’s dividend metrics, writing, “AVGO has a forward dividend yield of 3.03% and trailing 3-, 5-, and 10-year dividend growth rates of 15.7%, 32.1%, and 40.2% per year, respectively.”

Considine also noted that coming into the Q4 report, Broadcom had a dividend payout ratio of 46.9%. Regarding his rating on AVGO shares, Considine wrote, I raised my rating on AVGO from a neutral / hold to a bullish / buy on August 15, 2022 and reiterated the buy rating on September 13th, following the Q3 earnings report.” He continued, “AVGO’s earnings growth has been impressive, both in consistency and magnitude. The valuation looked reasonable, with a forward P/E of 15.1, well below the average P/E for the stock since mid-2019.”

Lastly, he highlighted the consensus view on shares, stating, “The Wall Street consensus rating was a buy and the consensus 12-month price target corresponded to an expected total return of about 25% for the next year.” Considine concluded his report by saying, “Broadcom has performed admirably so far in 2022 and the consensus expectation is that the company will be able to maintain its quarterly earnings at the high level achieved in Q3.” “Overall,” he said, “things look good approaching the Q4 earnings report. I am maintaining my buy rating on AVGO.”

Broadcom reported its Q4 results on 12/8/2022, beating Wall Street consensus estimates on both the top and bottom lines. AVGO posted Q4 sales of $8.93 billion, which was $30 million above estimates, representing 20.5% year-over-year growth. AVGO’s Q4 non-GAAP earnings-per-share totaled $10.45, beating consensus by $0.17/share, representing 33.8% growth relative to the $7.81/share non-GAAP EPS that AVGO generated during Q4 of 2021.

During Broadcom’s Q4 earnings report, its CEO, Hock Tan, was quoted saying: "Broadcom's fiscal year 2022 revenue grew 21% year-over-year to a record $33.2 billion, as a result of strong demand from hyperscale, service providers, and enterprise. This growth was driven by our strong partnerships with customers and accelerated adoption of our next generation technologies. As we look into fiscal 2023, our increased R&D investments during the preceding years position us to extend our leadership in next generation products within the end markets we address."

Furthermore, the company’s CFO, Kirsten Spears, was quoted saying: “In fiscal 2022 we achieved record adjusted EBITDA margin of 63%, generating $16.3 billion in free cash flow or 49% of revenue, demonstrating our stable and focused business model. Consistent with our commitment to return cash to shareholders, we will resume our authorized share repurchase programs for the remaining $13 billion, and we are increasing our quarterly common stock dividend by 12 percent to $4.60 per share for fiscal year 2023. The target fiscal 2023 annual common stock dividend of $18.40 per share is a record, and the twelfth consecutive increase in annual dividends since we initiated dividends in fiscal 2011."

Broadcom’s quarterly release also highlighted the strength its balance sheet, saying, “The Company's cash and cash equivalents at the end of the fiscal quarter were $12,416 million, compared to $9,977 million at the end of the prior quarter.”

Disclosure: Nicholas Ward is long AVGO.

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

The company also provided forward guidance for the upcoming quarter, stating: Based on current business trends and conditions, the outlook for the first quarter of fiscal year 2023, ending January 29, 2023, is expected to be as follows:

First quarter revenue guidance of approximately $8.9 billion; and

First quarter Adjusted EBITDA guidance of approximately 63 percent of projected revenue.”

Overall bias of Nobias Credible Analysts and Bloggers:

Broadcom shares rallied 2.57% during the trading session on Friday because of this earnings report. AVGO shares closed the week trading for $544.72. Over the last month, AVGO shares are now up by 14.65%. However, both the credible author and analyst communities that the Nobias algorithm tracks believe that this rally is just getting started. 100% of recent articles published by the credible author community of AVGO stock has expressed a “Bullish” sentiment.

Furthermore, 4 out of 4 credible Wall Street analysts that Nobias tracks who have expressed an opinion on AVGO shares believe that they’re headed higher. Right now the consensus price target amongst these credible analysts for AVGO shares is $660.00. Therefore, relative to the stock’s current share price, this consensus credible price target implies upside potential of approximately 21.2%.

Disclosure: Nicholas Ward has no DG position. Nicholas Ward wrote this article for Nobias at their request with the intention of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.