Case Study: What Credible analysts are saying on Johnson & Johnson (JNJ) stock

Key Points

Performance

Johnson & Johnson shares fell by 0.46% this week. However, they’re up by 2.98% on a year-to-date basis. This compares favorably to the S&P 500, which is down 19.4% in 2022 thus far.

Event & Impact

Although JNJ outperformed the broader market in 2023, it underperformed many of its large cap, pure-play biopharmaceutical peers. According to credible authors/analysts, this relative underperformance in 2022 is setting the stage for a positive year in 2023.

Noteworthy News:

Johnson & Johnson is a dividend king, with 60 consecutive years of annual dividend increases, and the company plans to spin off its Consumer Health segment in 2023, creating a growth catalyst for shares.

Nobias Insights

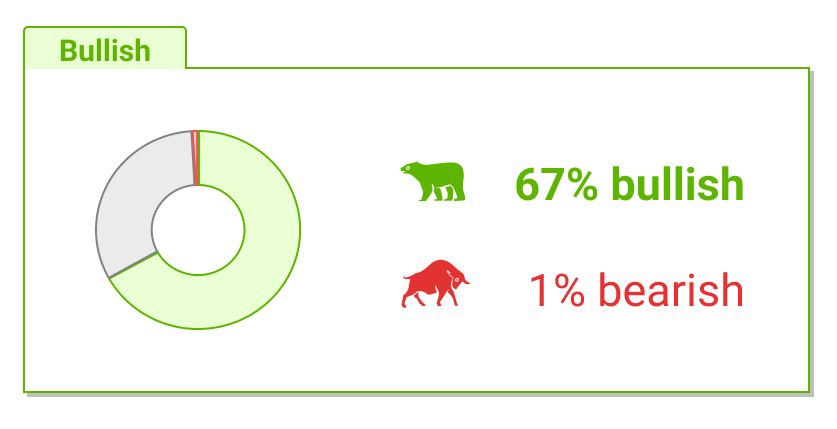

67% of recent articles published by credible authors focused on JNJ shares offer a “bullish” bias. 4 out of the 5 credible Wall Street analysts who cover Johnson & Johnson believe shares are likely to rise in value. The average price target being applied to JNJ by credible analysts is $192.40, which implies upside potential of approximately 8.7% relative to JNJ’s current share price of $177.56.

Bullish Take Mark Roussin, a Nobias 4-star rated author, said: “JNJ is a dividend king with strong portfolio of products and a rare AAA credit rating, making an investment in JNJ about as reliable as they come.”

Bearish Take Jonathan Block, a Nobias 4-star rated author, said, “Johnson & Johnson (NYSE:JNJ) has had a modest year and is up just 3%.”

JNJ Dec 2022

The health care sector was a big winner during 2022; outperforming the broader market, which fell by roughly 20% on the year, by a wide margin. The S&P 500 was down by 19.4% on the year. And yet, the healthcare sector posted losses of just 3.55%. What’s more, many of the world’s largest bio-pharmaceutical companies provided strong gains for investors during what was otherwise, a very negative year.

Bearish Nobias Credible Analysts Opinions:

Jonathan Block, a Nobias 4-star rated author, published a report at Seeking Alpha this week highlighting the relative outperformance of these large cap bio-pharma companies. He wrote, “Merck (MRK) shareholders have much to celebrate as the company is the best performing large US pharma of 2022 with a return of ~44% this year.”

Block said, “With a year-to-date return of 34%, Eli Lilly (LLY) had the second-best return of the year.” His litany continued, “AbbVie (ABBV) was the third-best performer of the group with an ~19% return.” He noted that Bristol Myers Squibb (BMY) posted a roughly 15% return for investors during 2022. And he wrapped up his list, noting that, “Johnson & Johnson (NYSE:JNJ) has had a modest year and is up just 3%.”

So, while JNJ shares outperformed the major average to the tune of 23%, they still underperformed many of their direct peers. However, it appears that this relative underperformance during 2022 is setting the stage for a strong 2023 for Johnson and Johson as the majority of both credible authors and analysts who cover the stock express a “Bullish” bias towards shares.

Bullish Nobias Credible Analysts Opinions:

Mark Roussin, a Nobias 4-star rated author, recently published a bullish article focused on Johnson and Johnson titled, “Johnson & Johnson: Time To Buy Before The Split”. He is referring to an upcoming spin-off that the company has announced: in late 2023, Johnson and Johnson plans to split off its Consumer Products segment into a separate company, meaning that the remaining Johnson and Johnson will be more heavily focused on the faster growing pharmaceutical side of the business.

Roussin wrote, “As it stands now, Johnson & Johnson operates within three segments:

Consumer Health

Pharmaceutical

Medical Devices (MedTech)”

He continued, “To give you an idea on the size of each segment, here is a look at the revenues for each segment through the first nine months of 2022:

Consumer Health = $11.2B

Pharmaceutical = $39.4B

MedTech = $20.7B”

Looking at the Consumer Health segment specifically, Roussin said, “The consumer health segment has been a staple for the business, as it includes items such as: Band-Aid, Listerine, Aveeno, Neutrogena, and Tylenol among other products. These are essential products that are required regardless of the economic backdrop.” He called this side of the business “stable”, but noted that it shouldn’t offer the same sort of growth and dividend growth that the Pharma/MedTech segments are likely to produce moving forward.

With regard to Johson and Johson’s dividend, Roussin said, “Right now there are 48 Dividend Kings in the US, and one of those happens to be Johnson & Johnson. This is a prestigious list for dividend stocks and in order to be on this list, you must pay a growing dividend for 50+ CONSECUTIVE years.” He went on to say that JNJ’s annual dividend growth streak currently sits at 60 consecutive years.

Lastly, he noted, “The new JNJ will now be a faster growing business, and I can see it playing out very similar to that of AbbVie (ABBV) when they spun-off from Abbott Labs (ABT) about a decade ago, and that would be very intriguing.” Since spinning off from Abbot, AbbVie, which is the more pharma-focused business of the two, has posted price gains of 389%. Roussin concluded, “JNJ is a dividend king with strong portfolio of products and a rare AAA credit rating, making an investment in JNJ about as reliable as they come.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

Insider Monkey, a Nobias 4-star rated author, recently published an article titled, “Top 5 Stocks to Buy in 10 Different Sectors”. Insider Monkey tracks hedge fund activity and to see which stocks are popular amongst the major Wall Street funds. They included Johnson and Johnson in their healthcare picks, stating: “Johnson & Johnson (NYSE:JNJ) is a leader in pharmaceuticals, medtech, and consumer health that ranks as a top pick in the healthcare sector. In Q3 2022, the company’s worldwide revenue rose 8.2% year over year when excluding acquisitions and divestitures on an operational basis to $23.8 billion with its consumer health sales increasing 4.7% year over year operationally to $3.8 billion. Johnson & Johnson (NYSE:JNJ)’s worldwide pharmaceutical sales rose 9% year over year operationally to $13.2 billion and its MedTech sales rose 8.1% year over year operationally to $6.8 billion. 85 hedge funds in our database owned shares of Johnson & Johnson (NYSE:JNJ) at the end of Q3.”

Overall bias of Nobias Credible Analysts and Bloggers:

Overall, 67% of recent articles published by credible authors tracked by the Nobias algorithm expressed a “bullish” bias towards JNJ shares. 4 out of the 5 credible Wall Street analysts that Nobias tracks who have also offered an opinion on Johnson & Johnson believe that the company’s shares are likely to increase in value. Currently, JNJ trades for $177.56, and the average price target being applied to shares by the credible analysts community is $192.40. That $192.40 target implies upside potential of approximately 8.4%.

Disclosure: Nicholas Ward is long JNJ. Nicholas Ward wrote this article for Nobias at their request with the intention of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.