Case Study: Lowe's (LOW) stock according to high performing analysts

Key Points

Performance

Lowe’s shares rose by 2.84% this week, pushing their year-to-date gains down to just 0.35%. This compares poorly to the S&P 500 which is up by 5.79% on a year-to-date basis thus far.

Event & Impact

Lowe’s posted fourth quarter results this week, beating Wall Street estimates on the bottom line while missing expectations on the top-line. During Q4, LOW’s revenue totaled $22.40 billion, missing Wall Street’s consensus estimate by $310 million. Lowe’s Q4 non-GAAP earnings-per-share came in at $2.28, beating Wall Street’s consensus estimate by $0.07/share.

Noteworthy News:

After a strong post-pandemic rally (since during 2020, 2021 and 2022, Lowe’s earnings-per-share increased by 55%, 35%, and 15%, respectively) Lowe’s highlighted poor 2023 growth guidance, causing its shares to sell-off this week. Yet, even so, credible authors and analysts have pointed to Lowe’s historically cheap valuation as a source of bullish sentiment moving forward.

Nobias Insights

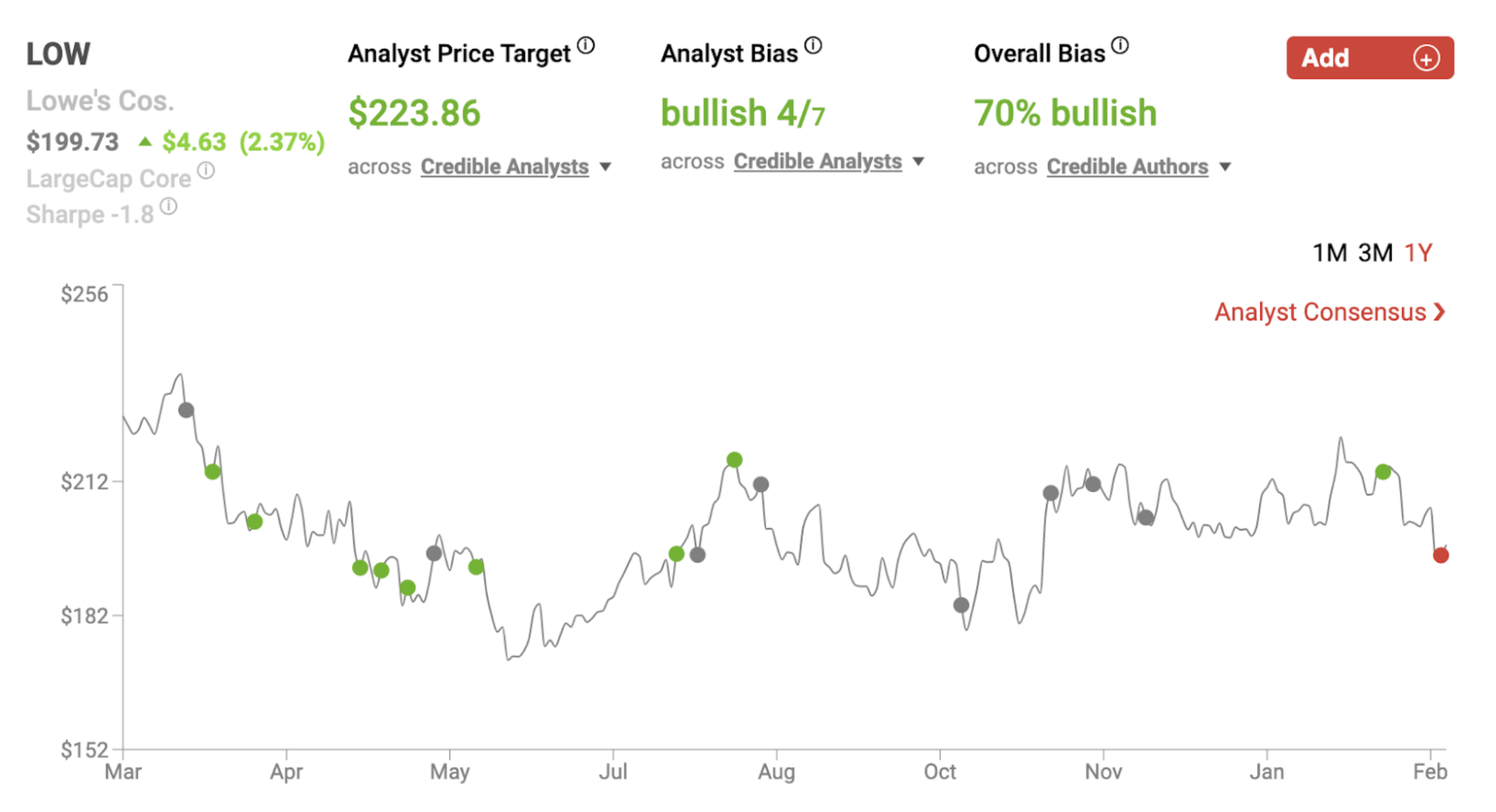

70% of recent articles published by credible authors focused on Lowe’s shares offer a “Bullish” bias. 4 out of the 7 credible Wall Street analysts who cover LOW believe shares are likely to rise in value. The average price target being applied to Lowe’s by these credible analysts is $223.86, which implies upside potential of approximately 12.2% relative to the stock’s current share price of $199.73.

Bullish Take Jonathan Wheeler, a Nobias 4-star rated author, said, “The company is trading right around 15X earnings, and for right around a 2% dividend yield. Combine that with a normal earnings growth rate of nearly 15% over the long-term, and I think LOW is a very attractive stock currently, even considering the macro short-term risks.”

Bearish Take Shawn Johnson, a Nobias 4-star rated author, said, “The two largest home improvement retailers, Home Depot (HD) and Lowe’s (LOW), warned of market weakness in recent earnings reports, indicating that the year ahead is likely to be difficult as inflation weighs on consumers.”

LOW Mar 2023

Home Improvement giant, Lowe's (LOW), reported Q4 earnings this week, causing its stock to drop by 2.84%. These weekly declines pushed Lowe’s year-to-date gains down to just 0.35%. Therefore, Lowe’s is underperforming the S&P 500, which is up by 5.79% during 2023 thus far, by a wide margin.

During Lowe’s Q4 report the company beat Wall Street consensus on the bottom-line, with sales coming up short of consensus estimates. Yet, the credible authors and analysts that the Nobias algorithm tracks remain largely bullish on shares. The current average price target being applied to LOW stock implies double digit upside potential from current share price levels.

Bullish Nobias Credible Analysts Opinions:

Prior to Lowe’s Q4 report, Jonathan Wheeler, a Nobias 4-star rated author, published a bullish report on Lowe’s, noting that it has closed the historical performance gap between rival Home Depot in the home improvement retail industry.

Wheeler said, “The debate has been well hashed out among investment analysts as to whether to own Home Depot (HD) or LOW over the years. LOW was a perpetual laggard, while HD has had best-in-class metrics. However, LOW has actually outperformed over a shorter time horizon.”

During the last 5 years, LOW shares are up 129.3% while HD shares are up just 64.3%. He noted, “The gap between HD and LOW was stark. In the past two years, the company's initiatives have made up substantial ground, which shows a huge improvement in shareholder value creation and overall profitability.”

Wheeler shows that since 2019, Lowe’s return on invested capital (ROIC) is 33.3% whereas Home Dept’s figure comes in at just 12.56%. Looking at where Lowe’s management is investing its money, he said, “Management has invested significant capex in modernizing the company's tech, right-sizing employee output to improve productivity, and improving the supply chain.” And, he says, these investments are paying off. Wheeler noted that they have led to steady margins in the 13% area and free cash flows which have increased throughout the pandemic period.

Lastly, Wheeler touches upon valuation. He wrote, “The company is trading right around 15X earnings, and for right around a 2% dividend yield. Combine that with a normal earnings growth rate of nearly 15% over the long-term, and I think LOW is a very attractive stock currently, even considering the macro short-term risks.”

Wheeler continued, “Based on analyst projections for earnings growth and a return to the company's long-term average valuation, and investors could be looking at 18-19% annualized total returns from a purchase today.” He concluded his article, stating, “Metrics are all pointed in the right direction, the company is closing the gap with HD, and I see a bright future ahead. I'm calling LOW a buy here, and I'll be adding to my long-term position.”

Harrison Miller, a Nobias 4-star rated author, highlighted Lowe’s Q4 operating results in an article that he published at Investors.com this week. Regarding LOW’s bottom-line, MIller said, “Lowe's earnings accelerated for the third quarter in a row, jumping 28% to $2.28 per share as revenue climbed 5.2% to $22.445 billion.”

Looking at the company’s top-line results, Miller said, “Lowe's comparable sales fell 1.5% for the fourth quarter while U.S. comparable sales dipped 0.7%. FactSet projected flat growth year-over-year.” Overall, Lowe’s Q4 revenue came in at $22.4 billion.

Miller touched upon these mixed results, relative to the analyst consensus, stating, “The FactSet consensus projected a 24% earnings increase to $2.21 per share on 6.4% revenue growth to $22.7 billion.” “For full-year 2022,” he said, “Lowe's earnings were $13.76 per share on $97 billion in sales.” And finally, touching upon full-year guidance, Miller said, “For fiscal 2023, Lowe's forecasts earnings to range from $13.60 to $14 per share on $88 billion to $90 billion in total sales.”

Sticking to the capital allocation theme that Wheeler highlighted in his piece, during Lowe’s Q4 earnings report, the company highlighted its shareholder returns, stating: “During the quarter, the company repurchased approximately 10 million shares for $2.0 billion, and it repurchased 71 million shares for $14.1 billion for the year. Total share repurchases in 2022 were $1.1 billion higher than anticipated, reflecting better-than-expected operating performance and the company's commitment to return excess capital to shareholders.

The company also paid $643 million in dividends in the fourth quarter and $2.4 billion in dividends for the year. In total, the company returned $16.5 billion to shareholders through share repurchases and dividends in 2022.”

Bearish Nobias Credible Analysts Opinions:

Shawn Johnson, a Nobias 4-star rated author, published a post-earnings report this week, highlighting the macro environment that Lowe’s is operating in. He wrote, “The two largest home improvement retailers, Home Depot (HD) and Lowe’s (LOW), warned of market weakness in recent earnings reports, indicating that the year ahead is likely to be difficult as inflation weighs on consumers.”

Johnson quoted Lowe’s Chief Financial Office, Brandon Sink, who touched upon the macro environment during Lowe’s Q4 earnings conference call, saying, “In 2023, residential investment will be under some pressure, given elevated levels of inflation, higher interest rates and a more cautious consumer. We are forecasting a slight decline in the home improvement market.”

Johnson wrote, “For 2023, Lowe’s sales are projected to be between $88-$90 billion, while same-store-sales are projected to be flat or down 2% for the year. Executives view the pullback in DIY demand as fleeting, and other industry experts see a “historic boom” for home remodeling.” He also noted that, “Shares of both Home Depot and Lowe’s are down more than 10% in the past month.” But, he says, there is potential good news on the horizon.

“Ellison [Lowe’s CEO} noted that the average equity for homes in the US is approximately $330,000, and expectations of an aging housing stock could point to continued demand for home upgrades,” Johnson said. Furthermore, he stated, “The housing meltdown has led to a lumber crisis, with lumber futures down 70% within the past year. And homebuilders are taking notice.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

Johnson wrote, “Pulte Group (PHM) [a $12.5 billion home builder company] announced in its latest earnings call that the company is increasing its pace of construction amid rising lumber stocks and more affordable pricing”

Despite the poor growth projections for 2023 by Lowe’s management team during its Q4 report, the majority of credible authors and analysts that the Nobias algorithm tracks remain bullish on LOW shares.

Overall bias of Nobias Credible Analysts and Bloggers:

70% of recent articles published on the stock by credible authors have expressed a “Bullish” opinion. 4 out of the 7 credible Wall Street analysts that the Nobias algorithm follows who have expressed an opinion on LOW shares believe that they’re likely to increase in value.

Presently, Lowe’s is trading for $199.73/share. The average credible analyst price target for LOW shares is currently $223.86, which implies upside potential of approximately 12.1%.

Disclosure: Of the stocks discussed in this article, Nicholas Ward is long LOW and HD. Nicholas Ward wrote this article for Nobias at their request with the intention of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.