Case Study: Pfizer (PFE) stock according to high performing analysts

Key Points

Performance

Pfizer shares rose by 1.89% this week; however, on a year-to-date basis, PFE shares are still down by 21.24%. This compares poorly to the S&P 500, which is up by 3.15% on a year-to-date basis thus far.

Event & Impact

Pfizer continues to struggle to find growth in the post-COVID-19 era. This company saw massive sales and earnings growth throughout 2021 and 2022 due to its COVID-19 vaccine success, but now the company must generate growth elsewhere.

Noteworthy News:

In an attempt to generate growth, Pfizer announced a $43 billion acquisition this week. The company is attempting to buy Seagen, which is a powerhouse in the oncology industry. Also, Pfizer recently received approval for its RSV vaccine, which has the potential to generate an estimated $10 billion in annual sales.

Nobias Insights

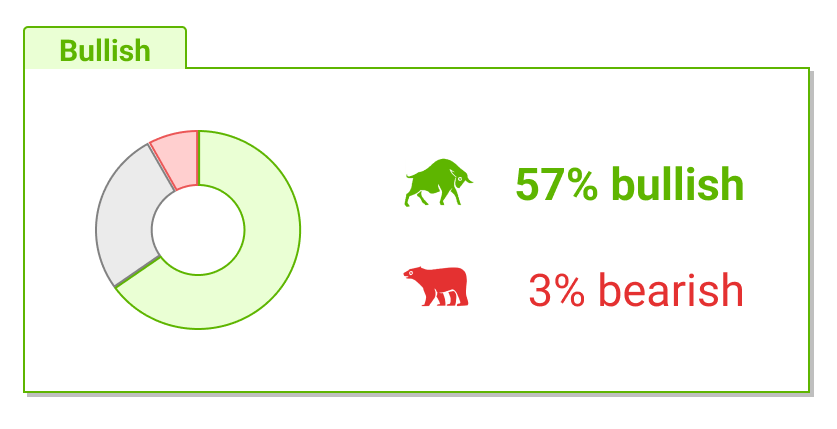

57% of recent articles published by credible authors focused on Pfizer shares offer a “Bullish” bias. Only two out of six credible Wall Street analysts covering PFE believe shares are likely to rise in value. However, the average price target applied to Pfizer by credible analysts is $49.84, implying upside potential of approximately 23.4% relative to the stock’s current share price of $40.37.

Bullish Take Spencer Kimball, a Nobias 4-star rated author, said, “The Food and Drug Administration’s independent advisors on Tuesday recommended what would be the world’s first RSV vaccine, a shot from Pfizer for adults ages 60 and older, despite safety concerns after two trial participants developed a rare neurological disorder.”

Bearish Take Ned Pagliarulo, a Nobias 4-star rated author, said, “Pfizer is under pressure to make up for declining revenue from its COVID vaccine and antiviral treatment, sales of which are forecast to drop significantly this year and stay lower in the future.”

PFE Mar 2023

The healthcare sector continues to be one of the worst performing areas of the market throughout 2023. The S&P 500 average is up by 3.15% on a year-to-date basis; however, the Health Care sector is down by 6.56%. One of the worst performing large-cap biopharmaceutical stocks on the year is Pfizer, which is down by more than 21% on a year-to-date basis. During the trailing 12-month period, PFE shares are down by 23.72%.

This weakness comes on the heels of its massive COVID-19 success. During 2021 and 2022, Pfizer saw its earnings per share rise by 99% and 49%, respectively, due to the COVID-19 vaccine that it helped to develop with Moderna.

However, in 2023, PFE’s bottom-line is expected to fall by nearly 50% and the credible analysts that Nobias tracks are questioning where the company’s future growth will come from?

Bullish Nobias Credible Analysts Opinions:

With regard to pivoting away from COVID-19 sales and looking for growth from other drugs, Spencer Kimball, a Nobias 4-star rated author, published an article at CNBC this week that highlighted Pfizer’s break through in the RSV vaccine market.

Kimball wrote, “The Food and Drug Administration’s independent advisors on Tuesday recommended what would be the world’s first RSV vaccine, a shot from Pfizer for adults ages 60 and older, despite safety concerns after two trial participants developed a rare neurological disorder.” He continued, “A majority of the FDA committee members backed the vaccine, but they wrestled with separate votes on whether the safety and efficacy data are adequate to support an approval by the agency. The FDA is expected to make its decision in May.”

Taking a look at the safety concerns surrounding the vaccine, Kimball said, “The vote followed concerns at the FDA and among advisory committee members about two cases of Guillain-Barre syndrome in about 20,000 vaccine recipients.” Regarding Guillain-Barre, Kimball wrote, “Symptoms can range from brief weakness to paralysis. Most patients, even those with severe cases, recover.”

Looking at Pfizer’s RSV vaccine data, Kimball said, “The shot was about 86% protective against lower respiratory tract illness with three or more symptoms, and 66.7% effective against the same condition with two or more symptoms, according to an FDA review of Pfizer’s data.”

“Pfizer estimates that if 50% of people ages 60 and older receive the shot, the vaccine could prevent more than 5,000 deaths, 68,000 hospitalizations, 51,000 emergency department visits and more than 422,000 outpatient visits,” he concluded.

Ian Lyall, a Nobias 4-star rated author, also covered the breaking RSV vaccine news in a report that he published at Proactive Investors this week, noting that, “The panel voted 7-4 in favour of the new drug, citing data from the company's study which showed the shot was effective and safe in preventing lower respiratory tract disease caused by RSV in people aged 60 years and older.”

Lyall mentioned that other drug makers such as GSK PLC, Johnson & Johnson, Moderna, and Merck are also racing for final approval. Looking at the financial implications of this potential approval, Lyall said, “The RSV vaccine market is estimated to be worth US$5bn to US$10bn.”

In even bigger news regarding Pfizer’s drug pipeline and future growth plans, on Monday, March 13th, 2023, news broke that Pfizer had agreed to acquire Seagen (SGEN) in a $43 billion M&A (mergers and acquisitions) deal. Plans surrounding this deal were discussed in a press release that Pfizer published titled, “Pfizer Invests $43 Billion to Battle Cancer”

Bearish Nobias Credible Analysts Opinions:

Ned Pagliarulo, a Nobias 4-star rated author, covered this M&A move in an article published at BioPharma Dive this week. Pagliarulo said, “Pfizer is under pressure to make up for declining revenue from its COVID vaccine and antiviral treatment, sales of which are forecast to drop significantly this year and stay lower in the future.” To do so, he said, “Pfizer has agreed to buy Seattle-based Seagen for $43 billion in a blockbuster deal that would unite the pharmaceutical giant with a biotechnology company that pioneered a new type of tumor-killing medicine.”

Pagliarulo noted that, “Seagen specializes in a type of cancer therapy known as an antibody-drug conjugate, and has steadily improved on the technology since its founding in 1997.” Looking at the size and scale of this deal, Pagliarulo wrote, “The acquisition is the largest Pfizer has attempted since its 2009 purchase of Wyeth, and is the most sizable in the drug industry by value since AbbVie’s $63 billion buyout of Allergan in 2019.”

“Pfizer’s acquisition offer of $229 per share values Seagen at a 33% premium to the stock’s closing price Friday,” he said, touching upon the M&A premium that Pfizer management decided to pay. “Pfizer described the deal, for which it will take out $31 billion in new debt, as an opportunity to replicate its COVID-19 success in cancer, an area it has increasingly prioritized,” Pagliarulo added.

Pagliarulo noted that this deal has the potential to double Pfizer’s early stage drug pipeline while still resulting in increased profitability in the near-term. “Pfizer expects the deal will boost its revenue immediately and be neutral to slightly accretive to earnings per share by the third or fourth full year after the deal’s completion,” he wrote. “Together,” Pagliarulo said, ‘Seagen’s four medicines are expected to earn an estimated $2.2 billion this year, a figure Pfizer anticipates will increase to greater than $10 billion annually by 2030.”

Alex Philippidis, a Nobias 4-star rated author, wrote an article this week highlighting one of the primary reasons why he believes Pfizer made this deal: upcoming patent cliffs. In the pharmaceutical industry, limited duration patent protections mean that companies must continually re-invest themselves as generic competition eventually eats away at drug sales and profits. And, as Philippidis points out, Pfizer is about to face a major patent cliff issue with its oncology portfolio.

Taking a look at Seagen’s portfolio of drugs, Philippidis wrote, “Seagen currently markets four drugs that generated a combined $1.707 billion in net product sales last year, up 23% from $1.386 billion in 2021. Three are ADCs—Adcetris, indicated for some forms of large cell lymphoma as well as Hodgkin’s lymphoma; the urothelial cancer drug Padcev® (enfortumab vedotin‐ejfv); and the cervical cancer treatment Tivdak® (tisotumab vedotin-tftv). Seagen’s fourth drug, Tukysa® (tucatinib) is a tyrosine kinase inhibitor indicated for some forms of breast and colorectal cancer.” He continued, “Adcetris finished 2022 with near-blockbuster net product sales of $839 million (up 19% from $706 million in 2021); followed by Pacdev, $451 million (up 33% from $340 million); Tukysa, 353 million (up 6% from $334 million); and Tivdak, $63 million (up more than 10-fold from $6 million).”

And, as Pagliarulo also mentioned, there are high expectations for these drug sales to grow over the next decade. “By 2030, Berens has estimated, Seagen’s four marketed drugs will rack up a combined $8 billion-plus in revenues: Adcetris will more than double in sales to $2.2 billion, Pacdev will balloon nearly 10-fold to $4.1 billion, Tukysa to $1.6 billion, and Tivdak to $560 million,” Philippidis wrote.

This is important because Pfizer has significant near-term patent cliffs which will negative impact its current slate of oncology drugs. “By 2027,” Philippidis said, “Pfizer can also expect to lose the alliance revenue it collects from having co-developed prostate cancer drug Xtandi® (enzalutamide) with Astellas Pharma (an estimated $1.4 billion in 2024). And in 2028, Pfizer will lose patent protection for breast cancer treatment Ibrance® (palbociclib), projected to generate $5 billion in 2024. Those three drugs account for a combined $7.5 billion or 60% of the $12.5 billion in oncology revenue that Pfizer is projected to make in 2024.”

Solving this issue is of utmost importance for the company which is already seeing sales headwinds in its COVID-19 vaccine division. After Pfizer’s recent Q4 earnings report, we saw several credible Wall Street analyst rescue their price targets on PFE shares.

According to The Fly on the Wall, “Barclays analyst Carter Gould lowered the firm's price target on Pfizer to $44 from $49 and keeps an Equal Weight rating on the shares post the Q4 results. The analyst reduced COVID-19 2023 sales expectations and says the greater risk is still to the downside with the end of the public health emergency on the horizon. The firm sees a difficult setup to underwrite rising demand versus current levels. “ Gould is a Nobias 5-star rated analyst.

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

The Fly on the Wall also noted that,“Wells Fargo analyst Mohit Bansal downgraded Pfizer to Equal Weight from Overweight with a price target of $50, down from $54. Bansal thinks an earnings down-revision cycle is coming in the near-term and sees margin pressure on the core business due to increased investments in new launches. While he thinks the company could have an attractive long-term profile, the analyst thinks a "COVID reset" may be needed before the stock could work again.” Bansal is a Nobias 4-star rated analyst. It appears that Pfizer’s $43 billion Seagen deal is a part of that “reset” .

Overall bias of Nobias Credible Analysts and Bloggers:

And, despite the negative commentary provided by credible analysts after Pfizer’s most recent quarter, the stock’s -21.24% year-to-date performance has pushed shares well below the average price target that these same credible individuals have applied to shares. Currently, PFE shares trade for $40.37 which implies 23.4% upside potential relative to the average credible analyst price target of $49.83%.

Furthermore, 57% of recent articles published on PFE shares by the credible authors are Nobias tracks have expressed a “Bullish” bias towards shares, signaling a buy-the-dip mentally into the stock’s double digit sell-off.

Disclosure: Nicholas Ward has no PFE position. Nicholas Ward wrote this article for Nobias at their request with the intention of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.