Case Study: Alibaba (BABA) stock according to high performing analysts

Key Points

Performance

Alibaba shares rose by 16.94% this week, pushing their year-to-date gains up to 11.09%. This compares favorably to the S&P 500 which is up by 7.46% on a year-to-date basis thus far.

Event & Impact

WAlibaba announced that it was splitting its business up into 6 operating segments this week. Analysts believe that this move will enhance the growth potential of each individual segment, unlocking value for shareholders moving forward.

Noteworthy News:

BABA’s famous founder, Jack Ma, was sighted in mainland China for the first time in a year this week as well. Ma left China amidst regulatory crackdowns on private tech companies and his return is being viewed as a bullish signal for private business in the near-term.

Nobias Insights

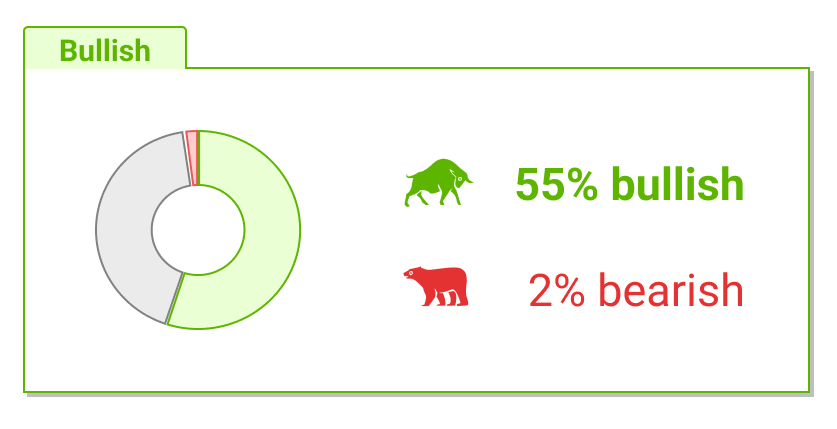

55% of recent articles published by credible authors focused on BABA shares offer a “bullish” bias. The credible Wall Street analyst who covers Alibaba believes shares are likely to fall in value. The average price target being applied to BABA by this credible analyst is $155.00, which implies upside potential of approximately 51.7% relative to the stock’s current share price of $102.18.

Bullish Take Huileng Tan, a Nobias 4-star rated author, said, “Alibaba's massive restructuring plan announced Tuesday is boosting hopes that China's crackdown on the tech sector is finally ending — and this sent shares of the e-commerce giant surging,”

Bearish Take Josh Horwitz, a Nobias 4-star rated analyst, said, “The restructuring is among the biggest corporate moves by a major Chinese tech company in recent years, as the industry cowered under tighter regulatory oversight, causing deals to dry up and dampening risk appetite among businesses.”

BABA Apr 2023

After becoming one of the largest companies in the world, Alibaba shares have struggled in recent years, in light of tough regulation on the Chinese tech sector by its government. During late 2020, BABA hit all-time highs in the $320/share area. Today, they trade for a fraction of that price, at $102.18. But, despite the stock’s long-term downtrend, BABA experienced a strong rally this week.

Shares rose by 16.94% during the last 5 trading sessions, pushing BABA’s year-to-date performance into positive territory. BABA is now up by 11.09% during 2023 thus far, meaning that the shares have outperformed the S&P 500, which is up by 7.46% on the year.

This week’s rally was inspired by news that Alibaba plans to restructure its business, splitting into 6 separate entities, potentially unlocking value for shareholders moving forward.

Bullish Nobias Credible Analysts Opinions:

Huileng Tan, a Nobias 4-star rated author, published an article at Business Insider this week which highlighted BABA’s recent rally and shed a light on the possible inspiration for the company’s split. “Alibaba's massive restructuring plan announced Tuesday is boosting hopes that China's crackdown on the tech sector is finally ending — and this sent shares of the e-commerce giant surging,” Tan said. She continued, “The Hong Kong Stock Exchange-listed shares rose as much as 16% on Tuesday, closing 12% higher at 94.55 Hong Kong dollars, or about $12.”

Tan put a spotlight on a Bank of America report on the news, stating, ‘"Baba's breakup may be an important experiment," Bank of America analysts wrote in a Tuesday note seen by Insider, referring to Alibaba's stock symbol on the New York Stock Exchange.”

As China has "always required its biggest sectors and firms to 'contribute to the society,'" Alibaba's split could address various concerns including anti-trust and policy risks, the bank suggested,” she added.

Bearish Nobias Credible Analysts Opinions:

Josh Horwitz, a Nobias 4-star rated analyst, published an article at Reuters this week, which not only focused on Alibaba’s restructuring, but the return of Jack Ma to mainland China, which he says is a bullish signal for Chinese business.

Regarding the company’s decision to restructure, Horwitz wrote, “Alibaba said the biggest restructuring in its 24-year history would see it split into six units - Cloud Intelligence Group, Taobao Tmall Commerce Group, Local Services Group, Cainiao Smart Logistics Group, Global Digital Commerce Group and Digital Media and Entertainment Group.”

“The restructuring is among the biggest corporate moves by a major Chinese tech company in recent years, as the industry cowered under tighter regulatory oversight, causing deals to dry up and dampening risk appetite among businesses,” he said.

Horwitz then highlighted the recent regulatory headwinds that private business has faced in China in recent years, writing, “Lately, authorities have been softening their tone towards the private sector as leaders try to shore up an economy battered by three years of strict COVID-19 curbs.” However, he noted, “Alibaba's shares had received a boost on Monday after founder Ma returned to China as his overseas stay was viewed by the industry as a reflection of the sober mood of its private businesses.”

“The revamp comes a day after Alibaba founder Jack Ma returned home from a year-long stay abroad, a move that dovetailed with Beijing's effort to spur growth in the private sector after two years of crackdown,” Horwitz added.

This isn’t a coincidence. Horwitz said, “China's new premier, Li Qiang, had recognised Ma's return to the mainland could help boost business confidence among entrepreneurs and since late last year had begun asking him to come back, five sources with knowledge of the matter told Reuters.”

Shanthi Rexaline, a Nobias 4-star rated author, published an article at Benzinga this week which put a spotlight on a bullish analyst report that related to Alibaba’s restructuring plans. Rexaline wrote, “Alibaba’s reorganization will help unlock value, said Thomas Hayes, founder of Hedge Funds Tips.” “This is a huge move for shareholders, enabling 'sum of the parts' valuation to be realized on a much faster timeline,” he added.

Piotr Kasprzyk, a Nobias 4-star rated author, highlighted what each of Alibaba’s operating segments does in an article published at Seeking Alpha this week. Regarding the company’s Cloud segment, he said, “Alibaba is considered the biggest infrastructure-as-a-service provider in the Asia Pacific and the third largest in the world by revenue. In addition, the company is the biggest provider of public cloud services in China. Alibaba Cloud offers various cloud services, including servers, computing, storage, network, security, database, and IoT services.”

Kasprzyk broke down the company’s small business segment, stating, “Alibaba's Taobao Tmall Business Group, currently known as China Commerce retail businesses primarily include Taobao and Tmall, which together constitute the world's largest digital retail business in terms of GMV as of March 31, 2022. Additionally, Taobao Deals offers consumers value-for-money products, Taocaicai provides next-day pick-up services for groceries and fresh goods at neighborhood pick-up points, and the company's direct sales businesses offer upgraded consumer experiences with integrated online and offline capabilities, including Tmall Supermarket, Freshippo, and Sun Art.”

Moving onto its Local Services segment, Kasprzyk said, “The company utilizes online and mobile technology to improve consumer services in two distinct scenarios: "To-Home" and "To-Destination". The "To-Home" businesses, such as Ele.me and Taoxianda, allow consumers to access merchant services from home, including food and beverage delivery, groceries, and pharmaceutical products. The "To-Destination" businesses, including Amap, Fliggy, and Koubei, provide consumers with convenient access to quality services at their destinations, such as navigation, travel services, and local services.”

Looking at BABA’s Glocal Business Media Group, Kasprzyk wrote, “Alibaba's future Global Digital Business Group operates both retail and wholesale businesses to connect buyers and sellers across the globe. The International Commerce Retail businesses include Lazada, AliExpress, Trendyol, and Daraz. Lazada is a fast-growing e-commerce platform in Southeast Asia that provides access to a wide range of products. It also operates a reliable logistics network for its consumers and merchants. AliExpress enables global consumers to purchase directly from manufacturers and distributors around the world. Trendyol is a leading e-commerce platform in Turkey that offers a broad selection of products and services, including instant delivery services for food and groceries, leveraging its product sourcing capabilities and supply chain advantages in Turkey. Daraz is a leading e-commerce platform across South Asia, with key markets in Pakistan and Bangladesh. Besides that, the International Commerce Wholesale business operates Alibaba.com, China's largest integrated international online wholesale marketplace, connecting buyers and sellers across more than 190 countries in the fiscal year 2022.”

He then highlighted the company’s Smart Logistics segment, stating, “Cainiao provides one-stop-shop logistics services and supply chain management solutions to merchants and consumers using its self-developed logistics capacities and capabilities. It also digitizes the entire logistics process using data insights and technology to enhance consumer experience and efficiency.”

Regarding BABA’s Digital Media and Entertainment Group, he wrote, “Youku and Quark are key platforms for digital media and entertainment content distribution, while Alibaba Pictures offers an integrated platform for content production, promotion, and distribution. Our other platforms, including newsfeed and literature platforms, allow users to discover and consume content and interact with each other. We also develop, operate, and distribute mobile games through Lingxi Games.”

Finally, regarding the Ant Group, Kasprzyk said, “Ant Group is a financial technology company 1/3 of which is owned by Alibaba. The company operates Alipay, a mobile and online payment platform with over a billion users in China. In addition to payments, Ant Group also offers a range of financial services, including wealth management, micro-lending, insurance, and credit scoring.”

Lastly, he highlighted the potential for this deal to unlock significant value for shareholders, stating, “The final value of Alibaba Group calculated as a sum of individual parts equals $382.97 billion which translates to $143.5 a share. This number shows that the company is severely undervalued which aligns with valuations presented in previous articles.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

Today Alibaba shares trade for $102.18. Kasprzyk’s $143.50 value estimate represents similar upside potential to the price target that is currently being applied to BABA by the credible Wall Street analyst that the Nobias algorithm tracks.

Overall bias of Nobias Credible Analysts and Bloggers:

According to the Fly on the Wall, last year, “BofA analyst Eddie Leung lowered the firm's price target on Alibaba to $155 from $162 and kept a Buy rating on the shares ahead of the company's Q2 results on August 4. The analyst estimates revenue declining 3% year-over-year to RMB 199.5B, mainly to reflect the China lockdown impact on multiple businesses. The delisting news in the U.S. remains a source of stock volatility, Leung tells investors in a research note. The conversion of Alibaba's secondary listing in Hong Kong to a primary listing will mitigate liquidity risk, but related news could remain a source of stock volatility as some American depository receipt investors may not be able to own non-U.S. stocks, says the analyst. ” Leung’s $155 price target implies upside potential of approximately 51.7%.

The credible author community that the Nobias algorithm tracks is also bullish on BABA shares. 55% of recent articles published by these individuals on Alibaba note that BABA shares are likely to rise in value.

Disclosure: Nicholas Ward has no BABA position. Nicholas Ward wrote this article for Nobias at their request with the intention of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.