Case Study: World Wrestling Entertainment (WWE) stock according to high performing analysts

Key Points

Performance

World Wrestling Entertainment shares rose by 19.32% this week, pushing their year-to-date price gains up to 46.37%. This compares favorably to the S&P 500 which is up by 7.34% on a year-to-date basis thus far.

Event & Impact

World Wrestling Entertainment and UFC partent Endeavor agreed to a $21.4 billion merger this week, creating a potential powerhouse in the combat sports industry.

Noteworthy News:

Historically, WWE has been one of the biggest winners in the media/entertainment industry posting nearly 1000% gains during the last decade. However, several of its major shows are facing media rights negotiations in 2024 and therefore, its management team was looking to sell, in an attempt to broaden its scope, and potentially enhance its value before entering into those negotiations with major media distributors.

Nobias Insights

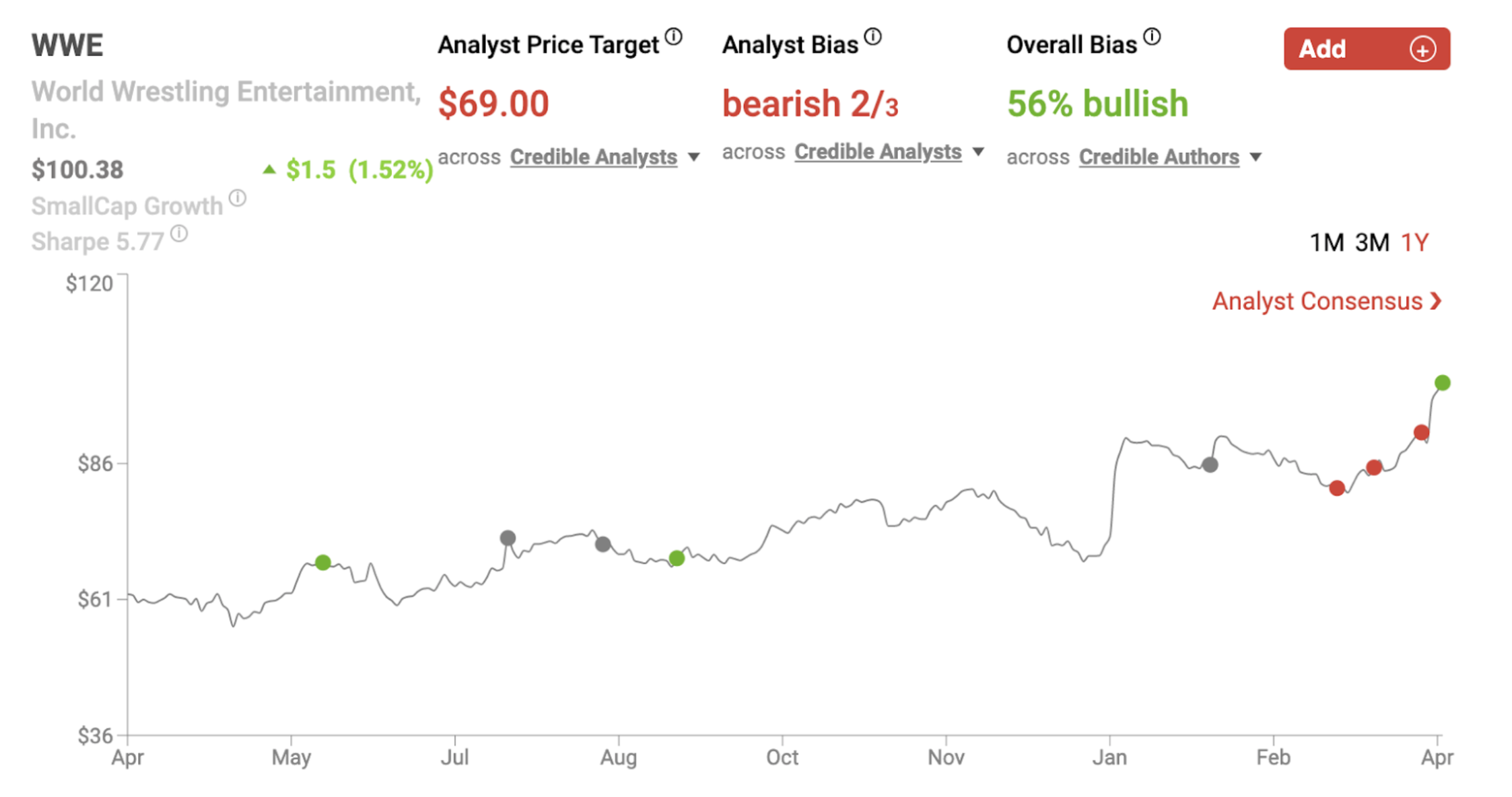

56% of recent articles published by credible authors focused on WWE shares offer a “bullish” bias. One of the three credible Wall Street analysts who cover World Wrestling Entertainment believes shares are likely to fall in value. The average price target applied to WWE shares by credible analysts is $69.00, implying a downside potential of 31% relative to the stock’s current share price $100.38.

Bullish Take Andrew Kessel, a Nobias 5-star rated author, “The company claims there are synergies in the range of $50 million to $100 million, primarily through back-office consolidation.”

Bearish Take Margaret Moran, a Nobias 4-star rated author, stated, “We will have to wait and see what changes the combined company plans to make before it is safe to speculate on how said changes could drive growth.”

WWE Apr 2023

A major merger occurred in the media/entertainment industry this week. On Monday, April 3rd, 2023, a press release announced that World Wrestling Entertainment (WWE) and Endeavor Group, which owns the UFC mixed martial arts promotional company, were coming together as one.

These are two leaders in the combat sports industry and both management teams highlighted their belief in significant synergies moving forward. WWE, in particular, has been a big winner for its shareholders, historically.

During the last 5 and 10-year periods, WWE shares have produced price returns of 171.08% and 999.34%, respectively. Both of these figures beat the S&P 500, which was up by 57.09% and 158.36% during the same periods, by a wide margin. Yet, WWE had media rights expirations coming up on the horizon, inspiring its management team to sell.

Bearish Nobias Credible Analysts Opinions:

Harrison Miller, a Nobias 4-star rated author broke down the deal in a report that he published at Investors.com this week. Miller wrote, “Ultimate Fighter Championship parent Endeavor Group announced it will buy a 51% majority stake in WWE early Monday.” He continued, “The deal creates a "live sports and entertainment powerhouse" valued at $21.4 billion, Endeavor said in its announcement.”

Looking at the structure of the deal, Miller said, “WWE shareholders will roll all existing equity into a new entity that will serve as the parent of UFC and WWE. The new company will be named at a later date and intends to list on the New York Stock Exchange under the ticker "TKO" after the deal is finalized. UFC and WWE will each contribute cash to the new company so it holds approximately $150 million.” He also highlighted the fact that there are a lot of big names in the entertainment industry involved in this deal from a leadership perspective.

Here’s how the post-merger leadership ladder will look like, according to Miller, “Endeavor CEO Ariel Emanuel will continue in his role and lead the new company. WWE Executive Chairman Vince McMahon will serve as executive chairman of the board, which will consist of six Endeavor appointees and five WWE nominees. Mark Shapiro will serve as president and COO of Endeavor and the new company. And Dana White and Nick Khan will continue in their roles as CEO of UFC and WWE, respectively.”

Margaret Moran, a Nobias 4-star rated author, also covered the deal in an article at Guru Focus this week. She wrote, “World Wrestling Entertainment Inc. (WWE, Financial) has been seeking a buyer for months as executive chairman and majority shareholder Vince McMahon looks to get the best deal before the company’s media rights for "Raw" and "Smackdown" expire in October 2024.” She notes that McMahon was enthusiastic about the deal; however, investors were not.

“Even though the deal values WWE at a significant premium to its share price as of the time of the announcement, shares took a hit of 4% on Monday, while Endeavor dove over 6%,” she said. It’s important to note; however, that throughout the rest of the week, WWE shares did rally as the market became more bullish on this deal’s prospects.

However, Moran’s article was published on Monday, before this rally began and one issue, she points out, is the valuations involved. Moran said, “The merger will create a sports and entertainment powerhouse from WWE and UFC that should be able to take advantage of key synergies to up the number of fights and expand original content, but the media rights for "Raw" and "Smackdown" will need to be renegotiated amid an unfavorable macroeconomic environment, and the valuation ratios for both companies are arguably overheated already.”

Looking at WWE’s fundamentals growth, she stated, “Over the past three years, it has grown its revenue per share at an annual rate of 11.2% and its earnings per share at an annual rate of 39.1%.”And moving onto valuation metrics for WWE, Moran said, “This solid growth has spurred a price-earnings ratio of 38.17, which is a little on the high side but still lower than the company’s historical median of 51.24. According to the GuruFocus reverse discounted cash flow model, the company will need to continue growing its earnings per share by 21.52% for the next decade to be worth its current valuation, meaning it would need to book even faster growth to justify the $9.3 billion valuation the merger deal puts on it.”

Regarding Endeavor’s fundamental metrics, she said, “Endeavor’s current price-earnings ratio is on the high side at 45.04. However, its forward price-earnings ratio is just 15.48, based on 2023 earnings estimates from Morningstar. If the company can meet expectations, it may be fairly valued based on the merger’s estimates.”

“In a statement on Monday, McMahon highlighted some of company’s expected growth synergies going forward, including maximizing the value of combined media rights, enhancing sponsorship monetization, developing new forms of content and looking for further value-added acquisitions,” Moran wrote. But, she concluded her piece with a cautious, wait-and-see, tone regarding McMahon’s growth plans, writing, “We will have to wait and see what changes the combined company plans to make before it is safe to speculate on how said changes could drive growth.”

Bullish Nobias Credible Analysts Opinions:

Andrew Kessel, a Nobias 5-star rated author, touched upon the possible synergies of the deal in an article that he published at ProactiveInvestors this week. Kessel said, “The company claims there are synergies in the range of $50 million to $100 million, primarily through back-office consolidation. And, he notes, this is why the two parties agreed to a merger which involved such a high premium for WWE’s business.

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

Kessel noted, “The merger between WWE and UFC-owner Endeavor values the companies at a combined total of more than $21 billion. Notably, it values WWE at $9.3 billion, a more than 33% premium over the company’s market cap on Friday.”

Overall bias of Nobias Credible Analysts and Bloggers:

Currently three of the credible Wall Street analysts that the Nobias algorithm tracks offer opinions on WWE shares. None of these individuals have published updated reports this week regarding the merger; however, coming into the week, 2 out of the 3 credible individuals were bearish on WWE shares. The average price target being applied to WWE by these credible Wall Street analysts is $69.00/share. That represents downside potential of approximately 31% relative to the stock’s current share price of $100.38.

However, the credible author community is more bullish on WWE’s prospects moving forward, with 56% of recent articles published on shares expressing a “Bullish” bias.

Disclosure: Nicholas Ward has no position in either WWE or EDR. Nicholas Ward wrote this article for Nobias at their request with the intention of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.