Case Study: Microsoft (MSFT) stock according to high performing analysts

Key Points

Performance

Microsoft shares rose by 8.24% this week, pushing their year-to-date gains up to 28.25%. This compares favorably to both the S&P 500 and the Nasdaq Composite Index, which are up by 9.03% and 17.71%, respectively, on a year-to-date basis.

Event & Impact

Microsoft posted its fiscal 2023 third quarter results this week, beating consensus estimates on both the top and bottom lines. During Q3, MSFT’s revenue totaled $52.86 billion, beating Wall Street’s consensus estimate by $1.85 billion. Microsoft’s Q3 non-GAAP earnings per share came in at $2.45, which was $0.22/share above consensus estimates.

Noteworthy News:

Coming into Q3 the market feared a major cloud slowdown from MSFT due to slowing enterprise spending; however, the company posted 16% year-over-year cloud growth, assuaging these fears.

Nobias Insights

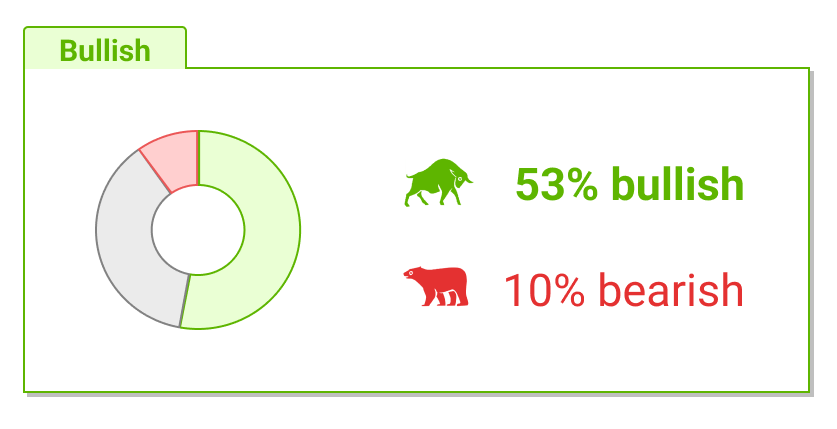

53% of recent articles published by credible authors focused on MSFT shares offer a “bullish” bias. One of the two credible Wall Street analysts covering MSFT believes that shares are likely to rise in value. The average price target being applied to Microsoft by these credible analysts is $248.50, implying a downside of approximately 19.1% relative to the stock’s current share price of $307.26.

Bullish Take Dividend Sensei, a Nobias 4-star rated author, said, “Cloud computing is expected to grow 21% annually through 2028 to $222 billion.”

Bearish Take Joe Toppe, a Nobias 4-star rated author, stated, “British regulators blocked Microsoft’s $69 billion purchase of video game maker Activision Blizzard on Wednesday, saying it would hurt competition in the cloud gaming market.”

MSFT Apr 2023

Microsoft posted its fiscal 2023 third quarter results this week, beating Wall Street’s consensus estimates on both the top and bottom lines. These results inspired shares to rally; Microsoft closed the week up by 8.24%. This rally pushed Microsoft’s year-to-date gains up to 28.25%.

During the trailing twelve month period, MSFT shares are now up by 6.09% and the company’s market capitalization currently sits at $2.27 trillion.

Bullish Nobias Credible Analysts Opinions:

Harsh Chauhan, a Nobias 4-star rated author, covered Microsoft’s Q3 results this week at the Motley Fool. Regarding Microsoft’s illustrious history, Chauhan said, “A $1,000 investment made in Microsoft five years ago is now worth almost $3,300, assuming the dividends were reinvested.”

“That translates into an average annual return of nearly 27%.” Investors can expect such solid returns from Microsoft in the future as well, thanks to the fast-growing markets the company is involved in such as cloud computing and generative artificial intelligence (AI),” he continued.

Looking at Microsoft’s third quarter results, Chauhan said, “Its revenue was up 7% year over year to $52.9 billion in the third quarter of fiscal 2023 (for the three months ended March 31). “Microsoft's non-GAAP (generally accepted accounting principles) earnings increased 10% year over year to $2.45 per share,” he added.

Chauhan also wrote, “Robust growth in the company's productivity and cloud businesses was enough to offset the 9% year-over-year revenue drop in the personal computing business, which produced a quarter of the company's top line last quarter.”

Chauhan maintains a bullish outlook on MSFT shares, in large part, because of its ongoing cloud growth. He said, “Microsoft's 23% share of the cloud infrastructure services market puts it in position to make the most of this huge growth opportunity and help sustain the healthy pace at which its cloud business is growing.” He quoted a research report, stating, “Gartner estimates that $597 billion will be spent on public cloud services globally this year, up nearly 22% from last year's levels. The market research firm expects the impressive growth to continue in 2024 with another 21% increase in worldwide public cloud spending to $724.5 billion.”

Looking at another growth catalyst for Microsoft moving forward, Chauhan said, “With the generative AI market set to clock 34% annual growth through 2030, per Grand View Research, Microsoft is setting itself up to make the most out of this nascent technology. As such, it won't be surprising to see this potential AI winner continue soaring.”

Dividend Sensei, a Nobias 4-star rated author, also highlighted MSFT’s Q3 results in a report this week, once again focusing on the company’s enormous cloud growth potential. Dividend Sensei said, “Azure revenue is expected to grow 33% this year and keep growing at solid [sic] 24% to 29% rate through 2028.” He continued, “Cloud computing is expected to grow 21% annually through 2028 to $222 billion. For context, MSFT is expected to generate $210 billion in revenue for the entire company this year.”

Then, the author went on to put a spotlight on Microsoft’s cash flows and its shareholder return prospects. Dividend Sensei wrote, “Free cash flow is expected to be a record $90 billion this year and grow to $140 million by 2028.” And they expect Microsoft to use these profits to reward investors. “Buybacks are expected to be $24 billion this year and grow to $34 billion by 2028,” Dividend Sensei said. “MSFT is paying $20 billion per year dividend [sic] dividends, and that's expected to grow to $35 billion by 2028,” they continued. “Despite $350 billion in buybacks and dividends,” the author concluded, “MSFT's net cash position is expected to grow to $217 billion (including deferred subscription revenue) by 2028.”

Bearish Nobias Credible Analysts Opinions:

Although Microsoft posted the top and bottom-line beat on Tuesday, not all of the headlines associated with the company with week were bullish. On Wednesday, Joe Toppe, a Nobias 4-star rated author, highlighted bad news that Microsoft received regarding its record breaking acquisition of Activision Blizzard in an article that he published at Yahoo Finance.

Toppe wrote, “British regulators blocked Microsoft’s $69 billion purchase of video game maker Activision Blizzard on Wednesday, saying it would hurt competition in the cloud gaming market.” “Both Microsoft and Activision will appeal the decision, despite facing opposition to the all-cash deal from contemporaries like Sony and regulators in the U.S. and Europe concerned the consolidation would give Microsoft control of popular game franchises like Call of Duty, World of Warcraft and Candy Crush,” he continued.

However, Toppe noted that both parties are still trying to get this deal completed, writing, “Microsoft President Brad Smith said in a tweet Wednesday that the company remains fully committed to the acquisition and would appeal the decision.”

Dina Bass, a Nobias 4-star rated author, also touched upon the UK regulator headlines in an article that she published at BNN Bloomberg this week. Bass wrote, “Microsoft Corp. executives sought to reassure workers in the Xbox gaming unit that there’s a way forward for the approval of the company’s planned $69 billion purchase of Activision Blizzard Inc., while emphasizing that its success in gaming isn’t solely dependent on the deal.”

Bass noted that Microsoft Gaming Chief Phil Spencer “told staffers that Microsoft President Brad Smith was up at 2 a.m. Seattle time Wednesday drafting a response to the UK Competition and Markets Authority. ”Chief Financial Officer Amy Hood, who oversees acquisitions, held a senior leadership meeting the same day,” she continued.

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

According to her sources, Bass wrote, “The Xbox chief said the acquisition was intended to speed up Microsoft’s gaming plans, but doesn’t represent the entirety of the company’s gaming strategy, which would move ahead even without Activision”.

Overall bias of Nobias Credible Analysts and Bloggers:

Overall, 53% of recent articles written by credible Wall Street analysts have expressed a “bullish” bias towards MSFT shares. 50% of the credible Wall Street analysts that are tracked by the Nobias algorithm who have expressed an opinion on Microsoft believe that shares are headed higher.

Since Microsoft’s earnings report this week, Nobias 5-star analyst, John DiFucci of Guggenheim, raised his price target on MSFT shares.

According to the Fly of the Wall, “Guggenheim raised the firm's price target on Microsoft to $232 from $212 and keeps a Sell rating on the shares, noting that the company exceeded fiscal Q3 estimates set by guidance "on all pertinent line items" other than free cash flow, for which it had not given guidance. Microsoft management did a good job of managing expectations for the quarter, but while Office 365 is doing well and should continue to as tailwinds compound over time, "Azure and Windows are struggling," the analyst argues. The firm does not expect Microsoft to continue the free cash flow or revenue growth it's enjoyed for years, the analyst added.”

Currently, the average price target being applied to Microsoft by Nobias credible analysts is $248.50. After its 8.24% rally this week, Microsoft is trading for $307.26. Therefore, that average price target implies downside potential of approximately 19.1%.

Disclosure: Nicholas Ward is long MSFT. Nicholas Ward wrote this article for Nobias at their request with the intention of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.