Case Study: Oracle (ORCL) stock according to high performing analysts

Although Oracle missed top-line estimates during Q3, the company’s sales still increased by 18% on a year-over-year basis. The company’s management team highlighted its ongoing cloud growth and market share expansion. Oracle also announced that it was increasing its dividend by 25% alongside its third quarter numbers.

Nobias Insights: 65% of recent articles published by credible authors focused on Oracle shares offer a “bullish” bias. 1 out of the 2 credible Wall Street analysts who cover ORCL believe shares are likely to rise in value. The average price target being applied to Oracle by these credible analysts is $101.00, which implies upside potential of approximately 20.1% relative to the stock’s current share price of $84.07.

Bullish Take: Vladimir Dimitrov, a Nobias 4-star rated author, said, “Given Oracle's high margin growth and strong competitive advantages, I'm still optimistic on the long-term attractiveness of the stock. With a forward non-GAAP P/E ratio of only 18x and sell-side analysts still have a lot of catching-up to do, Oracle remains as one of my highest conviction ideas.”

Bearish Take: Andrew Kessel, a Nobias 5-star rated author, said, “The cloud computing company posted revenue of $12.4 billion in the quarter ended February 28, up 18% year-over-year, just short of the Street's expectations of $12.43 billion.”

Key Points

Performance

Oracle shares fell by 6.71% this week, pushing their year-to-date gains down to just 0.42%. This compares poorly to the S&P 500 which is up by 0.98% on a year-to-date basis thus far, and the Nasdaq Composite Index, which is up by 7.24% on the year.

Event & Impact

Oracle posted fiscal 2023 third quarter results this week, beating Wall Street estimates on the bottom line while missing expectations on the top-line. During Q3, ORCL’s revenue totaled $12.40 billion, missing Wall Street’s consensus estimate by $20 million. Oracle’s Q3 non-GAAP earnings-per-share came in at $1.22, beating Wall Street’s consensus estimate by $0.02/share.

Noteworthy News:

Although Oracle missed top-line estimates during Q3, the company’s sales still increased by 18% on a year-over-year basis. The company’s management team highlighted its ongoing cloud growth and market share expansion. Oracle also announced that it was increasing its dividend by 25% alongside its third quarter numbers.

Nobias Insights

65% of recent articles published by credible authors focused on Oracle shares offer a “bullish” bias. One out of the two credible Wall Street analysts who cover ORCL believes shares are likely to rise in value. The average price target being applied to Oracle by credible analysts is $101.00, implying upside potential of approximately 20.1% relative to the stock’s current share price of $84.07.

Bullish Take Vladimir Dimitrov, a Nobias 4-star rated author, said, “Given Oracle's high margin growth and strong competitive advantages, I'm still optimistic on the long-term attractiveness of the stock. With a forward non-GAAP P/E ratio of only 18x and sell-side analysts still have a lot of catching-up to do, Oracle remains as one of my highest conviction ideas.”

Bearish Take Andrew Kessel, a Nobias 5-star rated author, said, “The cloud computing company posted revenue of $12.4 billion in the quarter ended February 28, up 18% year-over-year, just short of the Street's expectations of $12.43 billion.”

ORCL Mar 2023

Oracle (ORCL) posted its fiscal 2023 third quarter earnings this week, missing Wall Street’s estimates on the top-line, but beating expectations on the bottom-line. Although Oracle missed revenue estimates, the stock still produced 18% year-over-year growth, showing strong demand for its products and services. Yet, even with this growth in mind, Oracle shares fell by 6.71% on the week, pushing its year-to-date gains down to just 0.42%.

Bearish Nobias Credible Analysts Opinions:

A Seeking Alpha report put a spotlight on an opinion expressed by Barclay's analyst Raimo Lenschow who said that Oracle had "an in-between quarter" that "did not represent a catalyst" for future growth. Lenschow bumped his price target for Oracle up from $81 to $85 and said, "We believe many investors will remain skeptical. If Oracle is correct, then we would have a multi-year story here, and waiting for actual numbers is a viable strategy for investors."

Andrew Kessel, a Nobias 5-star rated author, published a post-earnings update on Oracle this week at Proactive Investors. Looking at the company’s Q3 results, Kessel said, “The cloud computing company posted revenue of $12.4 billion in the quarter ended February 28, up 18% year-over-year, just short of the Street's expectations of $12.43 billion. Non-Gaap earnings were $1.22 per share, up from $1.13 a year ago and ahead of expectations of $1.20.”

“However,” Kessel continued, “net income fell to $1.9 billion from $2.3 billion a year earlier.” “The biggest driver of revenue growth was cloud services. Fiscal third quarter cloud revenue was $4.1 billion, up 45% year-over-year,” he said.

And, he pointed out that Oracle’s CEO, Safra Catz, put a spotlight on this as well during the company’s earnings report, stating, “Our strong quarterly earnings growth was driven by 48% constant currency growth for the total revenue of our two cloud businesses, infrastructure and applications.”

Brody Ford, a Nobias 4-star rated author, also wrote a post-earnings report on Oracle this week. His report was published at Yahoo Finance and once again, he focused on the strength of the company’s cloud operations.

Ford said, “While Oracle’s cloud infrastructure business — renting computing power and storage — has been a relative laggard in the market, analysts have been optimistic the services are gaining customers and helping accelerate growth. The software giant has employed aggressive marketing and favorable pricing in an attempt to win clients from larger competitors Microsoft Corp. and Amazon.com Inc., which have seen cloud division growth slowdowns in recent quarters.”

“More than two-thirds of Oracle’s cloud revenue is generated by business applications such as Fusion software for managing corporate finances and NetSuite’s enterprise planning tools, which are targeted at small- and mid-size companies. Fusion sales increased 25% in the quarter, compared with 23% growth in the previous period. NetSuite revenue jumped 23%, compared with 25% in the fiscal second quarter,” he continued.

Ford also touched upon the performance of Cerner, the healthcare oriented data company that Oracle purchased for $28 billion last year. He wrote, “Oracle’s digital health records provider Cerner generated sales of $1.5 billion in the period, and Chairman Larry Ellison said the company anticipates even stronger growth for the unit.”

Ford also highlighted analyst commentary on Oracle’s Q3 results, stating, “Large cloud deals, including one announced with Uber Technologies Inc., increased investor excitement ahead of earnings, wrote JP Morgan’s Mark Murphy.” He also said that Bloomberg Intelligence’s Anurag Rana said, “We continue to believe the company is navigating the slowdown better than most large rivals.”

Looking ahead, Ford mentioned that the company provided guidance for the current quarter. He said that Catz projected top-line growth of 16% during the quarter. Ford continued, “The outlook is in line with estimates. Profit, excluding some items, will be $1.56 a share to $1.60 a share, she added. Analysts, on average, projected $1.45 a share.”

Lastly, regarding shareholder returns, he said, “Oracle increased its dividend 25% to 40 cents a share.”

According to Seeking Alpha, ORCL raised its dividend from $0.32/share to $0.40/share and this payment will be made on April 24th, 2032 to shareholders of record on April 11th, 2023. Currently, Oracle yields 1.90%.

Bullish Nobias Credible Analysts Opinions:

Vladimir Dimitrov, a Nobias 4-star rated author, doubled down on his bullish sentiment towards Oracle shares, writing an article this week which highlighted the stock as one of his highest conviction ideas in the market.

Dimitrov noted that he likes Oracle’s operational “playbook” with regard to focusing on internal growth and high margin sales. He said, “One of the main pillars of Oracle's strategy has been to retain its high profitability, which allows the company to finance internally most of its growth projects.”

“This way,” Dimitrov wrote, “Oracle's management does not need to increase prices and slash fixed cost at a time when many of its peers would be forced by the market to do so. Thus, the company is in a much better position to consistently gain market share.”

“While some competitors are looking for ways to slash costs, Oracle is now doubling down on its strategy to grow organically by pursuing higher return on capital projects,” Dimitrov said. “During the latest quarter, ORCL has reported capital expenditure at nearly 20% of sales, which highlights the level of growth in demand that the company is experiencing,” he continued.

With these ongoing investments in mind, Dimitrov believes that Oracle can continue to take market share from larger peers in the cloud space. He concluded this report, “Given Oracle's high margin growth and strong competitive advantages, I'm still optimistic on the long-term attractiveness of the stock. With a forward non-GAAP P/E ratio of only 18x and sell-side analysts still have a lot of catching-up to do, Oracle remains as one of my highest conviction ideas.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

And it’s not just authors who are bullish on ORCL shares. After the company’s Q2 report back in December of 2022, Bank of America analyst, Brad Stills, who carries a Nobias 4-star rating, raised his price target on ORCL shares from $90 to $95, due to the stock’s double digit revenue growth projections.

Stills hasn’t updated his outlook following the Q3 report yet; however, overall, the average price target being placed on ORCL shares by the credible analysts that the Nobias algorithm follows is $101.00/share.

Overall bias of Nobias Credible Analysts and Bloggers:

Today, Oracle trades at $84.07. Therefore, the average analyst price target implies upside potential of approximately 20.1%. Overall, the credible author community is bullish on ORCL shares as well. 65% of recent articles that focused on the stock expressed a “bullish” bias.

Disclosure: Nicholas Ward has no ORCL position. Nicholas Ward wrote this article for Nobias at their request with the intention of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

Case Study: Altria (MO) stock according to high performing analysts

Altria announced this week that it is acquiring eVapor company, NJOY, for $2.75 billion, in the company’s latest attempt to move away from a cigarette-centric business model.

Nobias Insights: 66% of recent articles published by credible authors focused on Altria shares offer a “bullish” bias. The credible Wall Street analyst who covers MO believes shares are likely to rise in value. The average price target being applied to Altria by these credible analysts is $59.00, which implies upside potential of approximately 26.6% relative to the stock’s current share price of $46.61.

Bullish Take: Dividend Sensei, a Nobias 4-star rated author, said, “Altria Group, Inc. is one of the most celebrated dividend kings in history. Not just for its incredible 53-year dividend growth streak, but also because it's the single best-performing stock in history.”

Bearish Take: Tradevestor, a Nobias 4-star rated author, said, “I hope Altria Group, Inc. is proceeding with more caution as well this time after e-"vapor"-ating $13 Billion last time around.”

Key Points

Performance

Altria's shares fell by 0.65% this week, pushing their year-to-date gains down to 2.39%. This compares favorably to the S&P 500 which is up by 0.98% on a year-to-date basis thus far.

Event & Impact

In 2018, Altria made two major investments, accounting for nearly $15 billion, into reduced risk products in an attempt to diversify its revenue stream away from combustible tobacco products (cigarettes). Those investments didn’t work, resulting in billions of write downs. And yet, Altria’s cigarette volumes continue to fall, forcing the company into more M&A activity this week.

Noteworthy News:

Altria announced this week that it is acquiring eVapor company, NJOY, for $2.75 billion, in the company’s latest attempt to move away from a cigarette-centric business model.

Nobias Insights

66% of recent articles published by credible authors focused on Altria shares offer a “bullish” bias. The one credible Wall Street analyst who covers MO believes shares are likely to rise in value. The average price target being applied to Altria by these credible analysts is $59.00, which implies upside potential of approximately 26.6% relative to the stock’s current share price of $46.61.

Bullish Take Dividend Sensei, a Nobias 4-star rated author, said, “Altria Group, Inc. is one of the most celebrated dividend kings in history. Not just for its incredible 53-year dividend growth streak, but also because it's the single best-performing stock in history.”

Bearish Take Tradevestor, a Nobias 4-star rated author, said, “I hope Altria Group, Inc. is proceeding with more caution as well this time after e-"vapor"-ating $13 Billion last time around.”

MO Mar 2023

For decades, Altria (MO) has been providing not only a high dividend yield, but also, market beating total returns to its shareholders. And yet, during the last 5 years, the stock has majorly underperformed the major averages.

Altria is the leading U.S. tobacco company and a societal shift away from combustible tobacco has hurt the stock’s sales volumes in a significant way. But, as we saw this week, the company is still aggressively trying to reduce its dependency on cigarette sales and move into markets that provide a more sustainable future in terms of sales and earnings growth.

Bullish Nobias Credible Analysts Opinions:

Dividend Sensei, a Nobias 4-star rated author, recently published an article on Altria which highlighted its near-term headwinds and the company’s long-term plans to overcome them. Dividend Sensei began their article by stating, “Altria Group, Inc. (NYSE:MO) is one of the most celebrated dividend kings in history. Not just for its incredible 53-year dividend growth streak, but also because it's the single best-performing stock in history.” They continued, noting that, “$1 invested 90 years ago into $173,000 today, adjusted for inflation.” And yet, despite being the top performing long-term stock in the market, Altria faces major headwinds in 2023.

Regarding Altria’s cigarette sales volumes, Dividend Sensei said, “MO's volume declines in Q4 were surprisingly bad, at 12%. The company was able to mostly offset this with 9% price increases for the quarter and 9.5% for the entire year, higher than the 8% inflation rate of 2022.” The author continued, “Do you know what U.S. cigarette sales will likely be in 2061? Zero. So how can MO survive for four decades if its current core business is extinct? Because the RRP-based smoke-free future will succeed.”

Dividend Sensei highlighted Altria’s post-cigarette future plans, writing, “MO has a joint venture with Japan Tobacco to market its Horizon heat sticks through its retail network in the U.S. as soon as the FDA approves them.” They also wrote, “It's on! Oral nicotine pouches are growing at 70% though granted from a small base. Still, it's achieved a 6% market share of the oral tobacco market, and its market share in this fast-growing part of the industry is slowly but steadily rising.”

RRP stands for “reduced risk products” and its clear that the company is focused on investing in non-combustible tobacco products to diversify its revenue stream. Dividend Sensei said that there are risks associated with such a major operational change; however, they concluded, “For now, I can confidently say that all the best data points to one clear thing. Altria remains an 8% yielding rich retirement dream aristocrat that continues to deliver where it counts.”

Lee Jackson, a Nobias 4-star rated author, also recently covered Altria at 24/7 Wall Street, putting a spotlight on the stock’s recent weakness and its relatively attractive valuation. Jackson wrote, “This maker of tobacco products offers value investors a great entry point now as it has been hit as cigarette sales have slowed.” He continued, “Altria Group Inc. is the parent company of Philip Morris USA (cigarettes), UST (smokeless), John Middleton (cigars), Ste. Michelle Wine Estates and Philip Morris Capital. PMUSA enjoys a 51% share of the U.S. cigarette market, led by its top cigarette brand Marlboro.”

“Altria also owns over 10% of Anheuser-Busch InBev, the world’s largest brewer, which some feel is worth more than $10 billion and may be a segment of the company that could be sold,” Jackson added. Lastly, he touched upon the stock’s $1 billion “shareholder-friendly” buyback plan that was recently announced and said that, “Investors receive a 7.93% dividend” as well.

Jackson concluded his piece stating, “Stifel has a $50 target price on Altria stock. The consensus target is $49.65, and the shares ended Wednesday trading at $47.14.”

Although Altria’s long-term performance has proven to be top notch, over the last 5 years this company has underperformed the market in a major way. Altria shares are down by 29.52% during the trailing 5-year period, whereas the S&P 500 has risen by 39.64% during this same time period. One of the major reasons that Altria has underperformed recently its its failed JUUL acquisition saga.

On Dec. 20th, 2018, Altria acquired a 35% stake in JUUL, a leading vaping company at the time, for $12.8 billion. Furthermore, the company invested $1.8 billion into Cronos, a marijuana company, in late 2020 as well. These moves were meant to diversify its revenue away from combustible tobacco; however, in hindsight, neither move panned out, resulting in billions of dollars in write downs.

In their article, Dividend Sensei wrote, “while Juul and Cronos were a mistake, which management has admitted, the balance sheet damage has since been fixed.” With that stronger balance sheet in mind, Altria announced a new acquisition this week, with the company, once again, trying to buy its way into the e-vapor market.

Bearish Nobias Credible Analysts Opinions:

Tradevestor, a Nobias 4-star rated author, covered this M&A activity in their recent article at Seeking Alpha. The author wrote, “Altria Group, Inc. investors are having a déjà vu moment this morning. The company has announced its $2.75 Billion acquisition of NJOY Holdings, as reported by Seeking Alpha. This is not a surprise given recent news items including the Juul exit (thank heavens for that, although it means little at this point financially) and swirling rumors about an NJOY deal.” They highlighted their outlook on the deal, stating, “After listening to Altria's business update webcast, I am presenting a few reasons why I am cautiously optimistic that this time is different with Altria's attempt to buy growth.”

Listing the differences between Altria’s JUUL and NJOY acquisitions, Tradevestor said, “The most obvious difference is the price tag. With Juul, Altria shelled out $13 Billion. While $2.5 Billion is still a hefty amount, it represents only 3% of Altria's current market cap.” They continued, “With Juul, Altria had a 35% majority stake but was not the outright owner. This time, Altria has outright acquired NJOY, giving it both strategic and operational control it likely never had with Juul. As the CEO mentioned, Altria can leverage its existing resources to benefit the consumers (and the business of course).”

And, regarding regulatory approval of products, Tradevestor wrote, “NJOY's ACE is the only pod-based e-vapor product with FDA marketing authorization, with the E-cigarette and Vape Market expected to have a CAGR of 30% between 2023 and 2030.”

”NJOY currently holds 6 of the 23 e-vapor marketing authorization from the FDA, according to the business update,” they added. Furthermore, Tradevestor said, “It also appears like NJOY is being responsible in marketing and securing its products as it is not in the top products used by under-age smokers.”

In conclusion, the author stated, “Whenever someone says Altria Group, Inc. is a bad investment due to declining volume, I make a case for the company by showing its history, operating discipline, pricing power, undervaluation, and the general power of compounding.”

“I am still fully invested in Altria and plan to do so based on what I've read so far about NJOY and what I heard on this business update. However, I am proceeding with caution and not adding to my position here,” they said.

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

Highlighting the ongoing risk with Altria shares, Tradevestor ended their report by stating, “I hope Altria Group, Inc. is proceeding with more caution as well this time after e-"vapor"-ating $13 billion last time around.”

Overall bias of Nobias Credible Analysts and Bloggers:

Despite the ongoing uncertainty surrounding Altria with regard to cigarette volumes and its ability to grow its RRP product portfolio, 66% of recent articles published by credible authors have included a “Bullish” bias towards shares. Also, the only credible Wall Street analysts that Nobias tracks who has provided an opinion on Altria is bullish.

Currently, the average price target being applied to MO shares by the credible Wall Street analyst community is $59.00. Today, MO trades for $46.61. Therefore, that credible analyst price target implies upside potential of approximately 26.6%. And, once you factor in the stock’s roughly 8% dividend yield, near-term total return potential rises up to the 35% area.

Disclosure: Nicholas Ward is long MO.. Nicholas Ward wrote this article for Nobias at their request with the intention of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

Case Study: Broadcom (AVGO) stock according to high performing analysts

Broadcom continues to execute on its growth plans, resulting in strong fundamentals. These fundamentals have trickled down to shareholders’ pockets, with AVGO becoming a favorite stock amongst dividend investors. Yet, there is M&A risk at play here, with Broadcom’s proposed ~$60 billion acquisition of VMWare still up in the air.

Nobias Insights: 90% of recent articles published by credible authors focused on Broadcom shares offer a “Bullish” bias. 3 out of the 4 credible Wall Street analysts who cover AVGO believe shares are likely to rise in value. The average price target being applied to AVGO by these credible analysts is $626.25, which implies downside potential of approximately 1.0% relative to the stock’s current share price of $632.76.

Bullish Take: Nobias 4-star rated author, Jonathan Wheeler, said, “I've long admired Broadcom from afar, but haven't opened a position. I think that's going to change here in the near future. The more I dig into the company, the more I like it.”

Bearish Take: Vladimir Dimitrov, a Nobias 4-star rated author, said, However, organic growth is slowing down, and Broadcom Inc.'s more aggressive movement into infrastructure software also holds a number of risks. These risks were not as pronounced in the company's prior deals. Thus, investors should not rely so heavily on Broadcom Inc.'s prior success. Although I see Broadcom Inc. as one of the best-positioned semiconductors stocks, I have a hard time turning bullish on the stock.

Key Points

Performance

Broadcom shares rose by 8.15% this week, pushing their year-to-date gains up to 14.32%. This compares favorably to the S&P 500 which is up by 5.79% on a year-to-date basis thus far and the Nasdaq Composite Index, which is up by 12.54% during 2023 thus far.

Event & Impact

Broadcom posted 2023 Q1 quarter results this week, beating Wall Street estimates on the top and bottom lines. During Q1, AVGO’s revenue totaled $8.92 billion, beating Wall Street’s consensus estimate by $20 million. Broadcom’s Q1 non-GAAP earnings-per-share came in at $10.33, beating Wall Street’s consensus estimate by $0.17/share.

Noteworthy News:

Broadcom continues to execute on its growth plans, resulting in strong fundamentals. These fundamentals have trickled down to shareholders’ pockets, with AVGO becoming a favorite stock amongst dividend investors. Yet, there is M&A risk at play here, with Broadcom’s proposed ~$60 billion acquisition of VMWare still up in the air.

Nobias Insights

90% of recent articles published by credible authors focused on Broadcom shares offer a “bullish” bias. 3 out of the 4 credible Wall Street analysts believe AVGO shares are likely to rise in value. The average price target being applied by these credible analysts is $626.25, which implies downside potential of approximately 1.0% relative to the stock’s current share price of $632.76.

Bullish Take Nobias 4-star rated author, Jonathan Wheeler, said, “I've long admired Broadcom from afar, but haven't opened a position. I think that's going to change here in the near future. The more I dig into the company, the more I like it.”

Bearish Take Vladimir Dimitrov, a Nobias 4-star rated author, said, However, organic growth is slowing down, and Broadcom Inc.'s more aggressive movement into infrastructure software also holds a number of risks. These risks were not as pronounced in the company's prior deals. Thus, investors should not rely so heavily on Broadcom Inc.'s prior success. Although I see Broadcom Inc. as one of the best-positioned semiconductors stocks, I have a hard time turning bullish on the stock.

AVGO Mar 2023

Broadcom (AVGO) reported its fiscal 2023 Q1 results this week, beating Wall Street’s expectations on both the top and bottom lines, causing shares to rally by 8.15% during the past 5 trading sessions. This strong weekly performance has pushed AVGO’s year-to-date gains up to 14.32%, which beats both the S&P 500 and the Nasdaq Composite Index’s year to date returns.

Those two indexes have posted gains of 5.79% and 12.54%, respectively, during 2023 thus far. After Broadcom’s weekly rally, the stock is essentially trading in-line with the credible analyst average price target. Yet, 90% of articles published by credible authors remain bullish on AVGO shares.

Bullish Nobias Credible Analysts Opinions:

Nobias 4-star rated author, Jonathan Wheeler, covered Broadcom in a recent report, highlighting his bullish stance on the company. He wrote, “I've long admired Broadcom from afar, but haven't opened a position. I think that's going to change here in the near future. The more I dig into the company, the more I like it.”

Wheeler said, “The company is a $250B market cap behemoth today, and is an amalgamation of multiple business lines purchased over time. The Broadcom you bought 15 years ago isn't the same company today, by a long shot.”

Looking at its operations, Wheeler noted, “The company derives the majority of its revenues (~70%) currently from semiconductors, with a significant portion of that derived from Apple (AAPL) (~20%) in its wireless line.” But, he likes this industry, stating, “Smartphones have only grown more complex, and Broadcom's chips are more necessary than ever in 5G phones, although competition among the chipmakers is fierce.”

Furthermore, Wheeler notes, “As companies move to the cloud and further digitize, Broadcom's networking expertise should keep their chips in demand in both cloud and on-premises servers.” Then, he points out that Broadcom has a growing software applications business as well.

Wheeler said, “Infrastructure software represents around 30% of the business, and is growing relatively slowly, coming in at 4% on the most recent quarter. However, operating at a 72% margin, it's significant for the company's bottom line, and provides a solid base of cash flows.” He notes that these high margins attract shareholders and said that the company is working on an acquisition that would drastically increase the size of this area of Broadcom’s business.

Wheeler wrote, “The company is looking to dole out ~$60B this year for VMware (VMW), the data center virtualization company. This would bring software revenues up from around 30% to around 50% of revenues.” Looking at AVGO’s balance sheet, Wheeler said, “The company has $39.5B in total debt, and generated $16.31B in free cash flow this past year. What's impressive here is the company is turning 50% of revenues into free cash flow, which grew 25% yoy in the most recent quarter.”

Wheeler also put a spotlight on the company’s shareholder returns, stating, “Broadcom has hiked the dividend every year since 2011, and most recently authorized a 12% increase. On top of that, the company repurchased $8.5B in shares this past year and still has $13B remaining on the current authorization.”

“Since going public, Broadcom has compounded earnings growth at ~30% per year,” he said.. Wheeler continued, “Broadcom has compounded its free cash flow 29% per year since going public.” “However,” he points out, “it's still trading for ~15X earnings and a 3% dividend yield. These types of numbers are almost kind of shocking, and what I'd expect to find in a no-growth type business, not one that just grew revenues 21% last year.”

Looking at forward return expectations, Wheeler stated, “Based on FCF multiples and analyst estimates, an investment today could yield around 12% annualized. That's at current multiples, not the average multiple, which would be substantially more.” Wheeler wrote this report on February 24th, 2023 and concluded it, “Broadcom is a strong buy here.”

Heavy Moat Investments, a Nobias 5-star rated author, also recently published a bullish report on AVGO. This author analyzed the stock from a dividend income lens, highlighting the stock’s popularity amongst dividend growth investors.

Regarding this strategy, they said, “Dividend Growth Investing (often abbreviated as DGI) has been a very popular strategy among investors in recent years due to its potential to generate stable and growing income streams over the long term.”

Heavy Moat Investments continued, “The true power of DGI is shown once dividends are reinvested into the company, creating a snowball effect by compounding the quarterly dividends received over the years.” Then, they highlighted AVGO’s dividend growth history, showing why it’s a great fit for this strategy.

Looking at Broadcom’s historical dividend payments, Heavy Moat Investments said, “From $0.67 in 2013 to $16.9 in the trailing twelve months, an astounding 25-fold increase translates to a median growth rate of 40%. This track record is unmatched and grew the company to one of the largest semiconductor stocks on the planet at an enterprise value of $272 billion.”

Even with such strong historical dividend growth in mind, Heavy Moat Investments believes that AVGO’s dividend remains safe and is likely to continue to grow moving forward. They wrote, “The dividend is also safe at a 41% Free cash flow payout ratio over the last year.”

“According to Seeking Alpha, analysts expect Broadcom to grow its earnings around mid to high single digits and I believe that is a very reasonable assumption. The large earnings power, a low payout ratio, and modest growth going forward should allow AVGO to continue raising its dividend alongside earnings in the high single digits to low teens,” Heavy Moat Investments said. They concluded their piece stating, “As a solid dividend growth stock with ample opportunity to raise its dividend, I'd consider Broadcom a light buy.”

Bearish Nobias Credible Analysts Opinions:

Vladimir Dimitrov, a Nobias 4-star rated author, covered AVGO’s Q1 results in an article published this week at Seeking Alpha, coming away with a more tepid outlook on AVGO shares than Wheeler and Heavy Moat Investments. He began by stating, “Even though performance across business segments was mixed and gross margins noted a decline, Broadcom stock's earnings per share exceeded expectations, both on a GAAP and Non-GAAP basis.”

Looking at Broadcom’s top-line results, he said, “Consolidated net revenue improved 16% year-on-year, entirely driven by Semiconductor Solutions, which increased by 21%. Infrastructure Software, however, fell by 1%, largely driven by softness in Brocade - a business acquired only a couple of years ago in 2017.”

“In a nutshell,” he continued, “it appears that until the pending VMware (VMW) transaction is complete, AVGO's topline growth is expected to be largely driven by its Semiconductor Solutions division and would likely slow down through the rest of 2023.”

“A forward revenue growth of 10% is still impressive but is well below the historical average for Broadcom,” noted Dimitrov. “In terms of gross profitability,” he said, “Broadcom is currently among the highest gross margin semiconductor companies. At the same time, the business is among the least capital-intensive within the broader peer group.”

“In the case of Broadcom,” he continued, “the company has achieved this largely through its recent acquisitions and a stronger focus on software. Although I personally, favor the more capital-intensive peers within the semiconductors space, Broadcom's management has done a very good job historically at both selecting its targets and integrating them within its long-term strategy.”

Ultimately, Dimitrov concluded, “Broadcom Inc.'s Q1 2023 results were yet another testament that the acquisition-led strategy is working. By focusing on low capital intensity and high gross margin areas that were also highly complementary with Broadcom's legacy business, the company was able to sustain both high topline growth and industry-leading margins. All that resulted in outstanding shareholder returns, high dividend increases, and a premium valuation.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

But, even with this good news in mind, he couldn’t ignore the risks associated with Broadcom’s acquisition driven strategy. He said, “However, organic growth is slowing down, and Broadcom Inc.'s more aggressive movement into infrastructure software also holds a number of risks. These risks were not as pronounced in the company's prior deals. Thus, investors should not rely so heavily on Broadcom Inc.'s prior success. Although I see Broadcom Inc. as one of the best-positioned semiconductors stocks, I have a hard time turning bullish on the stock.”

Overall bias of Nobias Credible Analysts and Bloggers:

Overall, 90% of recent articles published by the credible authors that the Nobias algorithm tracks have expressed a “Bullish” bias towards Broadcom. 3 out of the 4 credible Wall Street analysts that the Nobias algorithm tracks who have expressed an opinion on AVGO shares believe that they’re likely to increase in value.

Yet, the lone bear here is dragging down the average analyst price target. After its rally this week, AVGO trades for $632.76. Currently, the average price target being applied to AVGO shares by the credible analysts that Nobias tracks is $626.25, implying slight downside potential of approximately 1%.

Disclosure: Nicholas Ward is long AVGO.. Nicholas Ward wrote this article for Nobias at their request with the intention of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

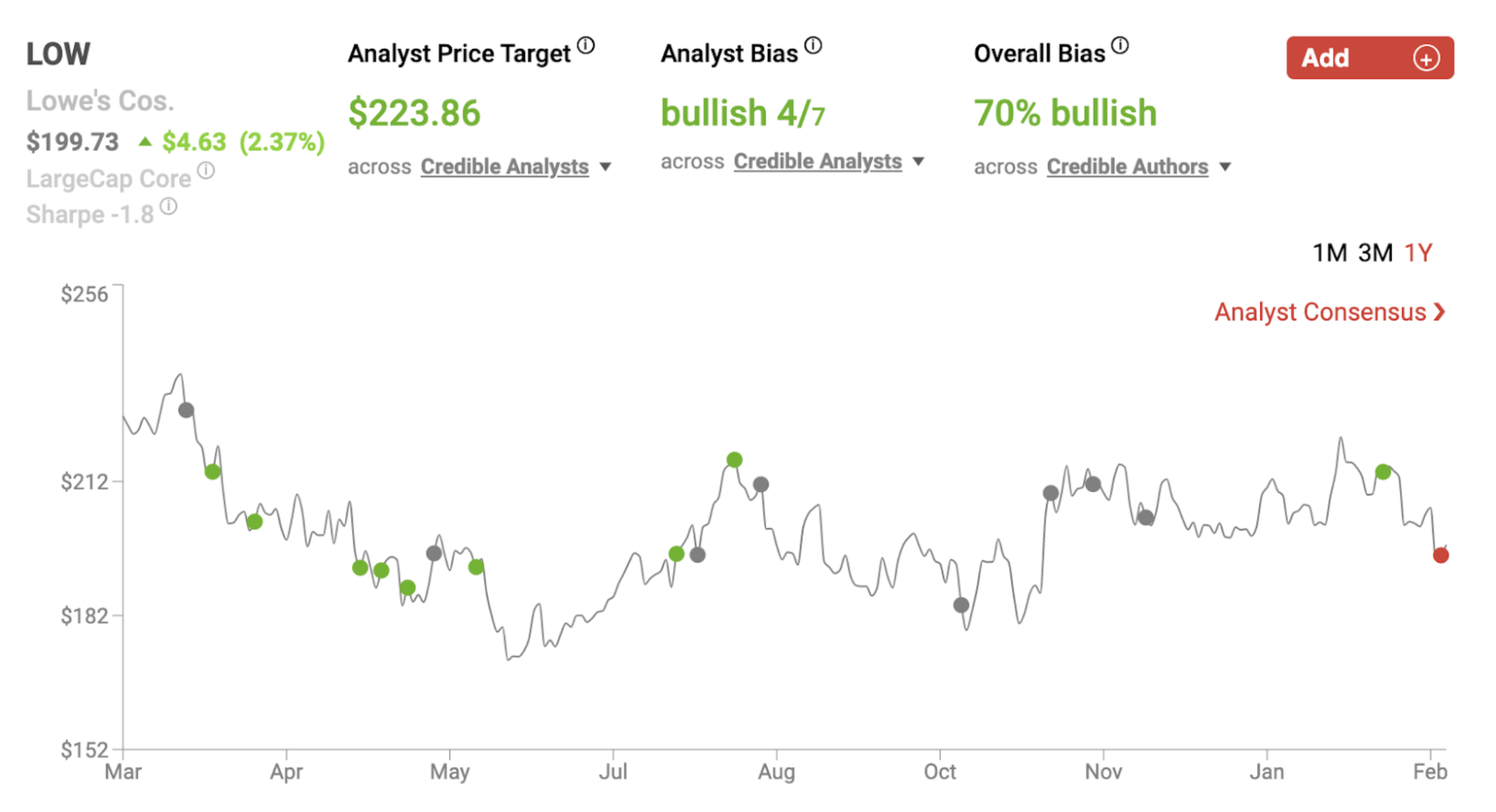

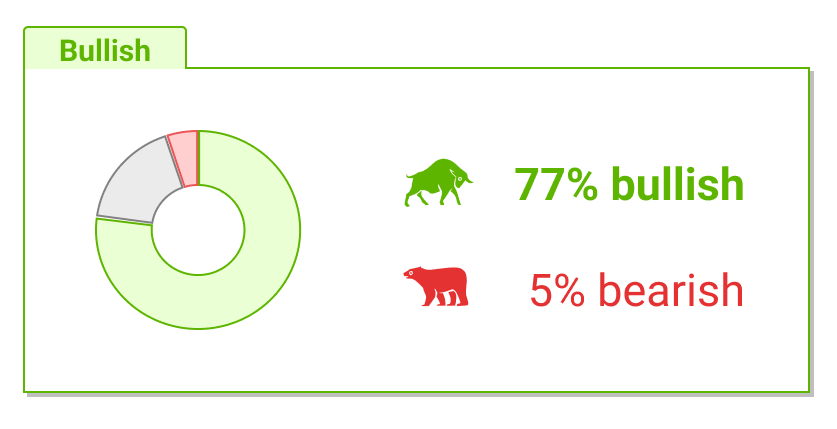

Case Study: Lowe's (LOW) stock according to high performing analysts

After a strong post-pandemic rally (since during 2020, 2021 and 2022, Lowe’s earnings-per-share increased by 55%, 35%, and 15%, respectively) Lowe’s highlighted poor 2023 growth guidance, causing its shares to sell-off this week. Yet, even so, credible authors and analysts have pointed to Lowe’s historically cheap valuation as a source of bullish sentiment moving forward.

Nobias Insights: 70% of recent articles published by credible authors focused on Lowe’s shares offer a “Bullish” bias. 4 out of the 7 credible Wall Street analysts who cover LOW believe shares are likely to rise in value. The average price target being applied to Lowe’s by these credible analysts is $223.86, which implies upside potential of approximately 12.2% relative to the stock’s current share price of $199.73.

Bullish Take: Jonathan Wheeler, a Nobias 4-star rated author, said, “The company is trading right around 15X earnings, and for right around a 2% dividend yield. Combine that with a normal earnings growth rate of nearly 15% over the long-term, and I think LOW is a very attractive stock currently, even considering the macro short-term risks.”

Bearish Take: Shawn Johnson, a Nobias 4-star rated author, said, “The two largest home improvement retailers, Home Depot (HD) and Lowe’s (LOW), warned of market weakness in recent earnings reports, indicating that the year ahead is likely to be difficult as inflation weighs on consumers.”

Key Points

Performance

Lowe’s shares rose by 2.84% this week, pushing their year-to-date gains down to just 0.35%. This compares poorly to the S&P 500 which is up by 5.79% on a year-to-date basis thus far.

Event & Impact

Lowe’s posted fourth quarter results this week, beating Wall Street estimates on the bottom line while missing expectations on the top-line. During Q4, LOW’s revenue totaled $22.40 billion, missing Wall Street’s consensus estimate by $310 million. Lowe’s Q4 non-GAAP earnings-per-share came in at $2.28, beating Wall Street’s consensus estimate by $0.07/share.

Noteworthy News:

After a strong post-pandemic rally (since during 2020, 2021 and 2022, Lowe’s earnings-per-share increased by 55%, 35%, and 15%, respectively) Lowe’s highlighted poor 2023 growth guidance, causing its shares to sell-off this week. Yet, even so, credible authors and analysts have pointed to Lowe’s historically cheap valuation as a source of bullish sentiment moving forward.

Nobias Insights

70% of recent articles published by credible authors focused on Lowe’s shares offer a “Bullish” bias. 4 out of the 7 credible Wall Street analysts who cover LOW believe shares are likely to rise in value. The average price target being applied to Lowe’s by these credible analysts is $223.86, which implies upside potential of approximately 12.2% relative to the stock’s current share price of $199.73.

Bullish Take Jonathan Wheeler, a Nobias 4-star rated author, said, “The company is trading right around 15X earnings, and for right around a 2% dividend yield. Combine that with a normal earnings growth rate of nearly 15% over the long-term, and I think LOW is a very attractive stock currently, even considering the macro short-term risks.”

Bearish Take Shawn Johnson, a Nobias 4-star rated author, said, “The two largest home improvement retailers, Home Depot (HD) and Lowe’s (LOW), warned of market weakness in recent earnings reports, indicating that the year ahead is likely to be difficult as inflation weighs on consumers.”

LOW Mar 2023

Home Improvement giant, Lowe's (LOW), reported Q4 earnings this week, causing its stock to drop by 2.84%. These weekly declines pushed Lowe’s year-to-date gains down to just 0.35%. Therefore, Lowe’s is underperforming the S&P 500, which is up by 5.79% during 2023 thus far, by a wide margin.

During Lowe’s Q4 report the company beat Wall Street consensus on the bottom-line, with sales coming up short of consensus estimates. Yet, the credible authors and analysts that the Nobias algorithm tracks remain largely bullish on shares. The current average price target being applied to LOW stock implies double digit upside potential from current share price levels.

Bullish Nobias Credible Analysts Opinions:

Prior to Lowe’s Q4 report, Jonathan Wheeler, a Nobias 4-star rated author, published a bullish report on Lowe’s, noting that it has closed the historical performance gap between rival Home Depot in the home improvement retail industry.

Wheeler said, “The debate has been well hashed out among investment analysts as to whether to own Home Depot (HD) or LOW over the years. LOW was a perpetual laggard, while HD has had best-in-class metrics. However, LOW has actually outperformed over a shorter time horizon.”

During the last 5 years, LOW shares are up 129.3% while HD shares are up just 64.3%. He noted, “The gap between HD and LOW was stark. In the past two years, the company's initiatives have made up substantial ground, which shows a huge improvement in shareholder value creation and overall profitability.”

Wheeler shows that since 2019, Lowe’s return on invested capital (ROIC) is 33.3% whereas Home Dept’s figure comes in at just 12.56%. Looking at where Lowe’s management is investing its money, he said, “Management has invested significant capex in modernizing the company's tech, right-sizing employee output to improve productivity, and improving the supply chain.” And, he says, these investments are paying off. Wheeler noted that they have led to steady margins in the 13% area and free cash flows which have increased throughout the pandemic period.

Lastly, Wheeler touches upon valuation. He wrote, “The company is trading right around 15X earnings, and for right around a 2% dividend yield. Combine that with a normal earnings growth rate of nearly 15% over the long-term, and I think LOW is a very attractive stock currently, even considering the macro short-term risks.”

Wheeler continued, “Based on analyst projections for earnings growth and a return to the company's long-term average valuation, and investors could be looking at 18-19% annualized total returns from a purchase today.” He concluded his article, stating, “Metrics are all pointed in the right direction, the company is closing the gap with HD, and I see a bright future ahead. I'm calling LOW a buy here, and I'll be adding to my long-term position.”

Harrison Miller, a Nobias 4-star rated author, highlighted Lowe’s Q4 operating results in an article that he published at Investors.com this week. Regarding LOW’s bottom-line, MIller said, “Lowe's earnings accelerated for the third quarter in a row, jumping 28% to $2.28 per share as revenue climbed 5.2% to $22.445 billion.”

Looking at the company’s top-line results, Miller said, “Lowe's comparable sales fell 1.5% for the fourth quarter while U.S. comparable sales dipped 0.7%. FactSet projected flat growth year-over-year.” Overall, Lowe’s Q4 revenue came in at $22.4 billion.

Miller touched upon these mixed results, relative to the analyst consensus, stating, “The FactSet consensus projected a 24% earnings increase to $2.21 per share on 6.4% revenue growth to $22.7 billion.” “For full-year 2022,” he said, “Lowe's earnings were $13.76 per share on $97 billion in sales.” And finally, touching upon full-year guidance, Miller said, “For fiscal 2023, Lowe's forecasts earnings to range from $13.60 to $14 per share on $88 billion to $90 billion in total sales.”

Sticking to the capital allocation theme that Wheeler highlighted in his piece, during Lowe’s Q4 earnings report, the company highlighted its shareholder returns, stating: “During the quarter, the company repurchased approximately 10 million shares for $2.0 billion, and it repurchased 71 million shares for $14.1 billion for the year. Total share repurchases in 2022 were $1.1 billion higher than anticipated, reflecting better-than-expected operating performance and the company's commitment to return excess capital to shareholders.

The company also paid $643 million in dividends in the fourth quarter and $2.4 billion in dividends for the year. In total, the company returned $16.5 billion to shareholders through share repurchases and dividends in 2022.”

Bearish Nobias Credible Analysts Opinions:

Shawn Johnson, a Nobias 4-star rated author, published a post-earnings report this week, highlighting the macro environment that Lowe’s is operating in. He wrote, “The two largest home improvement retailers, Home Depot (HD) and Lowe’s (LOW), warned of market weakness in recent earnings reports, indicating that the year ahead is likely to be difficult as inflation weighs on consumers.”

Johnson quoted Lowe’s Chief Financial Office, Brandon Sink, who touched upon the macro environment during Lowe’s Q4 earnings conference call, saying, “In 2023, residential investment will be under some pressure, given elevated levels of inflation, higher interest rates and a more cautious consumer. We are forecasting a slight decline in the home improvement market.”

Johnson wrote, “For 2023, Lowe’s sales are projected to be between $88-$90 billion, while same-store-sales are projected to be flat or down 2% for the year. Executives view the pullback in DIY demand as fleeting, and other industry experts see a “historic boom” for home remodeling.” He also noted that, “Shares of both Home Depot and Lowe’s are down more than 10% in the past month.” But, he says, there is potential good news on the horizon.

“Ellison [Lowe’s CEO} noted that the average equity for homes in the US is approximately $330,000, and expectations of an aging housing stock could point to continued demand for home upgrades,” Johnson said. Furthermore, he stated, “The housing meltdown has led to a lumber crisis, with lumber futures down 70% within the past year. And homebuilders are taking notice.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

Johnson wrote, “Pulte Group (PHM) [a $12.5 billion home builder company] announced in its latest earnings call that the company is increasing its pace of construction amid rising lumber stocks and more affordable pricing”

Despite the poor growth projections for 2023 by Lowe’s management team during its Q4 report, the majority of credible authors and analysts that the Nobias algorithm tracks remain bullish on LOW shares.

Overall bias of Nobias Credible Analysts and Bloggers:

70% of recent articles published on the stock by credible authors have expressed a “Bullish” opinion. 4 out of the 7 credible Wall Street analysts that the Nobias algorithm follows who have expressed an opinion on LOW shares believe that they’re likely to increase in value.

Presently, Lowe’s is trading for $199.73/share. The average credible analyst price target for LOW shares is currently $223.86, which implies upside potential of approximately 12.1%.

Disclosure: Of the stocks discussed in this article, Nicholas Ward is long LOW and HD. Nicholas Ward wrote this article for Nobias at their request with the intention of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

Case Study: Target (TGT) stock according to high performing analysts

Although Target’s sales were on the rise during Q4, its margins continue to suffer, coming in well below pre-pandemic levels. However, the company’s management team highlighted a $5 billion capex program with a goal to resolve these margin related issues.

Nobias Insights: 52% of recent articles published by credible authors focused on Target shares offer a “Neutral” bias. After the stock’s 9.4% year-to-date rally, only 38% credible Wall Street analysts who cover TGT believe shares are likely to rise in value. The average price target being applied to TGT by these credible analysts is $179.57, which implies upside potential of approximately 8.2% relative to the stock’s current share price of $166.00.

Bullish Take: Mark Soloman, a Nobias 4-star rated author, said, “Earlier this month, Target said it would invest $100 million through 2026 to add more than half a dozen additional sortation facilities to its U.S. network. Its goal is to reach 15 sort centers within the next four years, up from the current level of nine.”

Bearish Take: Mariane Wilson, a Nobias 4-star rated author, said, “For fiscal 2023, Target expects that comparable sales will range from a low single-digit decline to a low single-digit increase. The retailer expects full-year earnings per share of between $7.75 and $8.75, below Wall Street’s expectations of $9.23 per share.”

Key Points

Performance

Target shares rose by 1.84% this week, pushing their year-to-date gains up to 9.40%. This compares favorably to the S&P 500 which is up by 5.79% on a year-to-date basis thus far.

Event & Impact

Target posted fourth quarter results this week, beating Wall Street estimates on the top and bottom lines. During Q4, TGT’s revenue totaled $31.40 billion, beating Wall Street’s consensus estimate by $670 million. Target’s Q4 non-GAAP earnings-per-share came in at $1.89, beating Wall Street’s consensus estimate by $0.49/share.

Noteworthy News:

Although Target’s sales were on the rise during Q4, its margins continue to suffer, coming in well below pre-pandemic levels. However, the company’s management team highlighted a $5 billion capex program with a goal to resolve these margin related issues.

Nobias Insights

52% of recent articles published by credible authors on Target shares offer a “neutral” bias. After the stock’s 9.4% year-to-date rally, only 38% credible Wall Street analysts believe TGT shares are likely to rise in value. The average price target being applied by these credible analysts is $179.57, which implies upside potential of approximately 8.2% relative to the stock’s current share price of $166.00.

Bullish Take Mark Soloman, a Nobias 4-star rated author, said, “Earlier this month, Target said it would invest $100 million through 2026 to add more than half a dozen additional sortation facilities to its U.S. network. Its goal is to reach 15 sort centers within the next four years, up from the current level of nine.”

Bearish Take Mariane Wilson, a Nobias 4-star rated author, said, “For fiscal 2023, Target expects that comparable sales will range from a low single-digit decline to a low single-digit increase. The retailer expects full-year earnings per share of between $7.75 and $8.75, below Wall Street’s expectations of $9.23 per share.”

TGT Mar 2023

Target (TGT) reported its fiscal 2022 Q4 results this week, beating Wall Street’s expectations on both the top and bottom lines. These results culminate a terrible year for the company - fundamentally speaking - where its earnings-per-share fell by approximately 56%.

Yet, management provided forward looking guidance which calls for a return pre-pandemic profitability in the not too distant future and it appears that Wall Street agrees, with TGT shares up by 9.4% on the year thus far throughout 2023.

Although the stock has already outperformed the S&P 500 by a wide margin on a year-to-date basis (during this period of time, the S&P as risen by 5.79%), credible analysts still see high single digit upside potential. What’s more, Target pays a 2.6% dividend yield, pointing towards a strong total return year for shareholders, overall, if the analyst consensus is correct.

Bullish Nobias Credible Analysts Opinions:

Harrison Miller, a Nobias 4-star rated author, covered Target’s Q4 earnings results in an article published this week at Investors.com. Miller highlights the company’s bottom-line results, stating, “Target's adjusted earnings dropped 40% to $1.89 per share while revenue climbed 1.3% to $31.48 billion for the quarter. That managed to top the FactSet consensus of a 56% earnings drop to $1.40 per share on a slight dip in revenue to $30.675 billion.”

Miller moved onto the top-line results, writing, “Total comparable sales inched up 0.7% for the period. Same store sales rose 1.9%, offset by a 3.6% decline in digital sales. FactSet projected same store sales to fall 1.6% during the period.”

Looking at Target’s updated forward guidance, Miller said, “For Q1 2023, Target forecasts comparable sales to range from a low-single digit decline to a single-digit increase. Adjusted earnings and GAAP earnings are both expected to range from $1.50 to $1.90 per share on a 4% to 5% increase in operating income.”

Mark Soloman, a Nobias 4-star rated author, also touched upon Target’s Q4 results in an article this week. Like Miller, Solomon highlighted the company’s operational results. But, he also went into depth about the company’s growth plans moving forward, putting a spotlight on management’s stated plans regarding capital expenditures on its supply chain facilities.

Solomon said, “The Minneapolis-based retailer also announced plans to spend up to $5 billion this year across a variety of disciplines, including an expansion of its supply chain facilities.” He continued, “Earlier this month, Target said it would invest $100 million through 2026 to add more than half a dozen additional sortation facilities to its U.S. network. Its goal is to reach 15 sort centers within the next four years, up from the current level of nine.”

“These facilities, erected next to or near Target locations, would take distribution pressure off the stores and allow employees to focus more time on serving customers,” Solomon wrote. Furthermore, he said, “Starting in the spring, Target will expand an offering known as Drive Up Returns that allows customers to return new, unopened items from their car at no charge. Drive Up Returns will be available on purchases made through Target.com accounts, the retailer said.” “The objective, according to Target, is to build in more efficiencies to the returns process and reduce the costs and inconvenience of handling mail-in returns,” noted Soloman.

Bearish Nobias Credible Analysts Opinions:

Mariane Wilson, a Nobias 4-star rated author, covered Target’s Q4 results and management investment plans in an article at Chain Store Age this week; however, instead of distribution and supply chain, Wilson focused her analysis on Target’s margin issues and management’s plans to fix them. She began by saying, “Target Corp. beat fourth-quarter expectations amid a “very challenging environment” and said it plans to expand its owned-brands as consumers spending shifted away from discretionary items.”

Later, Wilson wrote, “For fiscal 2023, Target expects that comparable sales will range from a low single-digit decline to a low single-digit increase. The retailer expects full-year earnings per share of between $7.75 and $8.75, below Wall Street’s expectations of $9.23 per share.”

These disappointing full-year EPS expectations are due to poor margins, yet it appears that the company is on its way towards resolving those issues. “In a presentation at the company's annual Financial Community Meeting in New York,” Wilson wrote, “Target said it plans to open about 20 stores in a variety of sizes in 2023, with many of the locations including new design elements that reflect the local community, sustainable features and experiences that highlight new brands, assortment and services.”

“In addition,” Wilson continued, “ Target is making investments in about 175 of its existing stores, ranging from full remodels to the addition of Ultra Beauty or Apple shop-in-shop experiences, or expanded capacity for same-day fulfillment service” “In other 2023 initiatives,” she added, “Target plans to launch or expand more than 10 owned brands. In an appeal to an increasingly value-conscious shopper, the retailer said will offer more items starting at $3, $5, $10 and $15. It also plans to emphasize more markdown campaigns and add new features to its Target Circle loyalty program.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

And in conclusion, she said, “During the next three years, Target said it expects its operating income margin rate will reach, and begin to move beyond, its pre-pandemic rate of 6 percent, and believes it could reach an operating income margin rate of 6 percent as early as fiscal 2024, depending on the speed of recovery for the economy and consumer demand.”

Overall bias of Nobias Credible Analysts and Bloggers:

Overall, it appears as though the credible author and credible analyst communities haven’t been sold on this turnaround plan. 52% of recent articles about Target published by the credible authors that Nobias tracks have expressed a “Neutral” sentiment towards TGT shares.

Furthermore, only 38% of the credible Wall Street analysts that the Nobias algorithm follows who have expressed an opinion on TGT shares believe that they’re likely to rise in value. Currently, TGT is trading for $166.00/share. The average price target that the credible analyst community is placing on TGT is $179.57.

Therefore, although the credible bears outnumber the credible bulls on Wall Street, it appears that the bulls have higher conviction in their theses because even with 5 out of the 8 opinions that we’re compiling coming in bearish, the average price target associated with TGT shares implies upside potential of approximately 8.2%.

Disclosure: Nicholas Ward has no TGT position. Nicholas Ward wrote this article for Nobias at their request with the intention of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

Case Study: Home Depot (HD) stock according to high performing analysts

Home Depot’s trailing earnings were essentially in-line with expectations and the company announced a 10% dividend increase during its Q4 report; however, management forward guidance, which called for negative mid-single digit EPS growth during 2023, spooked investors, causing a -2.0% sell-off on the week.

Nobias Insights: 58% of recent articles published by credible authors focused on Home Depot shares offer a “Bullish” bias. Yet, just 2 out of the 4 credible credible Wall Street analysts who cover HD believe shares are likely to rise in value. The average price target being applied to Home Depot by these credible analysts is $323.00, which implies upside potential of approximately 8.9% relative to the stock’s current share price of $296.66.

Bullish Take: Mark Roussin, a Nobias 4-star rated author, said, “HD also happens to be one of my favorite dividend growth stocks as they have proven to generate tons of free cash flow which has led to a fast growing dividend.”

Bearish Take: Marianne Wilson, a Nobias 4-star rated author, said, “For fiscal 2023, Home Depot expects sales to be flat versus fiscal 2022 and earnings per share to fall in the “mid-single digits” percentage range.”

Key Points

Performance

Home Depot shares fell by 2.01% this week, pushing their year-to-date losses down to -6.09%. This compares poorly to the S&P 500 which is up by 3.82% thus far during 2023.

Event & Impact

Home Depot posted fourth quarter results this week, beating Wall Street estimates on the bottom-line, but missing estimates on the top-line. During Q4, HD’s revenue totaled $35.83 billion, missing Wall Street’s consensus estimate by $170 million. Home Depot’s Q4 GAAP earnings-per-share came in at $3.30, beating Wall Street’s consensus estimate by $0.02/share.

Noteworthy News:

Home Depot’s trailing earnings were essentially in-line with expectations and the company announced a 10% dividend increase during its Q4 report; however, management forward guidance, which called for negative mid-single digit EPS growth during 2023, spooked investors, causing a -2.0% sell-off on the week.

Nobias Insights

58% of recent articles published by credible authors on Home Depot shares offer a “bullish” bias. Yet, only two out of the four credible Wall Street analysts who cover HD believe prices are likely to rise in value. The average price target applied to Home Depot is $323.00, which implies upside potential of approximately 8.9% relative to the stock’s current share price of $296.66.

Bullish Take Mark Roussin, a Nobias 4-star rated author, said, “HD also happens to be one of my favorite dividend growth stocks as they have proven to generate tons of free cash flow which has led to a fast growing dividend.”

Bearish Take Marianne Wilson, a Nobias 4-star rated author, said, “For fiscal 2023, Home Depot expects sales to be flat versus fiscal 2022 and earnings per share to fall in the “mid-single digits” percentage range.”

O Feb 2023

Home Depot reported Q4 earnings this week, missing Wall Street’s estimates on the top-line, but beating consensus estimates on the bottom-line. The company also announced disappointing full-year guidance for 2023, calling for negative earnings-per-share growth over the coming 12 month period.

Home Depot is one of the largest physical retailers in the world with a $302 billion market cap, so it is often viewed as a bellwether, in terms of consumer health. During its Q4 earnings report, Home Depot announced its annual dividend increase for 2023, stating, “The Company today announced that its board of directors approved a 10 percent increase in its quarterly dividend to $2.09 per share, which equates to an annual dividend of $8.36 per share.”

However, this wasn’t enough to stop the stock from falling by 2.01% during the week. This negative weekly performance pushed Home Depot’s year-to-date losses down to -6.09%. This means that the stock has underperformed the S&P 500 by a wide margin thus far during 2023. Comparatively, the S&P 500 has posted gains of 3.82% on a year-to-date basis.

Bearish Nobias Credible Analysts Opinions:

Marianne Wilson, a Nobias 4-star rated author, covered Home Depot’s Q4 results in an article that she published at Chain Store Age this week. Looking at HD’s quarterly results, Wilson wrote, “Home Depot reported net earnings of $3.36 billion, or $3.30 per share, for the quarter ended Jan. 29, compared with net earnings of $3.35 billion, or $3.21 per share, in the year-ago period. Analysts had expected earnings of $3.28 per share.”

Moving onto the bottom-line, she said, “Sales inched up 0.3% to $35.83 billion, missing estimates of $35.97 billion. Home Depot attributed the miss to a decrease in lumber prices, which are significantly down from a year ago.”

Wilson continued, “The average ticket rose 5.8%, to $90.05, with the increase largely fueled by inflation. Total customer transactions dropped 6%.” “For the full year,” she said, “Home Depot has sales of $6.2 billion, up 4.1% from the year-ago period. Comparable sales increased 3.1% and comparable sales in the U.S. increased 2.9%.”

Looking at the full-year bottom-line results, Wilson said, “Net earnings for fiscal 2022 were $17.1 billion, or $16.69 per share, compared with net earnings of $16.4 billion, or $15.53 per share in fiscal 2021.” And finally, looking at management’s forward guidance, Wilson stated, “For fiscal 2023, Home Depot expects sales to be flat versus fiscal 2022 and earnings per share to fall in the “mid-single digits” percentage range.”

This negative bottom-line guidance for fiscal 2023 played a heavy role in the stock’s sell-off this week, but Wilson explained one of the reasons why HD expects to struggle to produce earnings growth this year. She said, “The Home Depot is boosting its employees' pay amid a still tight labor market for retailers.” The home improvement giant announced the increased compensation in its fourth-quarter earnings release in which it provided a flat outlook for the coming year,” she continued.

Providing details on HD's compensation plans, Wilson said, “Beginning in the first quarter of fiscal 2023, Home Depot will invest an additional approximately $1 billion in annualized compensation for frontline, hourly associates. (At the end of the fourth quarter, the company had a total of approximately 475,000 associates.)”

She mentioned that management called its employee base “a key differentiator and competitive advantage for the company” and therefore, by investing in higher wages and benefits for its staff, Home Depot management believes that it is setting itself up for long-term success.

Bullish Nobias Credible Analysts Opinions:

Geoff Considine, a Nobias 5-star rated author, also penned an article this week which put a spotlight on HD’s negative guidance and the stock’s recent sell-off. Regarding 2023 headwinds, Considine wrote, “Higher labor costs are, of course, is a negative. The volatility in lumber prices in the past several years makes it harder to forecast sales and earnings. In the Q4 earnings call, management noted the negative impacts of declining lumber prices on sales. Higher interest rates have mixed impacts.”

“Another challenge for investors in assessing HD is that it will be hard for 2023 results to look favorable against the backdrop of very robust earnings growth over the past three years, a period during which diluted EPS increased by 60%,” he continued.

But, despite near-term headwinds, Considine believes that the stock’s recent weakness has created an attractive buying opportunity. He said, “A full-blown recession would be bad news for HD, as people rein in discretionary spending, but interest rates comparable to current levels may serve to encourage people to improve their current homes rather than moving.”

Furthermore, he wrote, “The Wall Street consensus outlook continues to be a buy, with a consensus 12-month price target that maps to an expected 12-month total return of 14.4% over the next year.” Considine concluded, “The market-implied outlooks to mid-2023 and into the start of 2024 are both modestly bullish. While the valuation is somewhat high today, even after the sell-off following the Q4 earnings call, I'm maintaining a buy rating on HD.”

Taking an even more bullish stance, Mark Roussin, a Nobias 4-star rated author, published an article titled, “3 Foundational Dividend Stocks To Build A Portfolio Around” this week, in which he highlighted Home Depot as a potential core position for investor portfolios.

Roussin said, “The third stock I consider a MUST OWN stock is Home Depot (HD), the leading home improvement retailer with a market cap of $327 billion [the other two companies that Roussin listed in this article were Microsoft (MSFT) and Johnson and Johnson (JNJ)].” He continued, “HD also happens to be one of my favorite dividend growth stocks as they have proven to generate tons of free cash flow which has led to a fast growing dividend.”

Regarding Home Depot’s dividend growth prowess, Roussin wrote, “Over the past 5 years, the company has increased their dividend at an average of 16.4% per year. The current dividend is $7.60 per share, which equates to a dividend yield of 2.4% [since this article was published HD’s share price has fallen, resulting in a dividend yield of 2.82%]. The company has increased the dividend for 13 consecutive years and counting.”

Taking a look at the company’s all-weather business model, Roussin stated, “Home Depot is unique in the fact that they do well when the real estate sector performs well, but on the flip side they can also perform well even without the real estate sector. Reason being is that when the real estate sector, particularly the home building sector, is doing well, new home buyers have numerous items to add to their new home. When the market is poor and interest rates are high, you will see more homeowners stay in place, but maybe do the home improvement projects they had been contemplating.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

And finally, regarding the stock’s valuation, Roussin said, “HD shares are trading at a forward earnings multiple of 19x, which suggests flat to 1% adjusted EPS growth in 2023. This compares favorably to the company's five year average of 21.5x and the company's 10-year average earnings multiple of 22.0x, suggesting shares of HD are undervalued.”

Overall bias of Nobias Credible Analysts and Bloggers:

The credible author community that the Nobias algorithm follows agrees with this bullish sentiment. 58% of recent articles published by credible authors have expressed a “Bullish” bias. Yet, the credible Wall Street analyst community is less enthusiastic.

Only 50% of credible analysts that the Nobias algorithm follows who have expressed an opinion on HD shares believe that they’re likely to increase in value. The average price target being applied to Home Depot by these individuals is $323.00, which implies upside potential of approximately 8.9% relative to HD’s current share price of $296.66.

Adding the stock’s 2.82% dividend yield into the equation means that we arrive at double digit total return prospects moving forward; however, it’s clear that authors and analysts alike acknowledge a slew of macro headwinds that could serve as road bumps for the stock’s growth trajectory.

Disclosure: Nicholas Ward is long HD. Nicholas Ward wrote this article for Nobias at their request with the intention of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

Case Study: Realty Income (O) stock according to high performing analysts