NIO with Nobias technology: Is This Luxury EV Maker A Buy After Falling 43% From Its Highs?

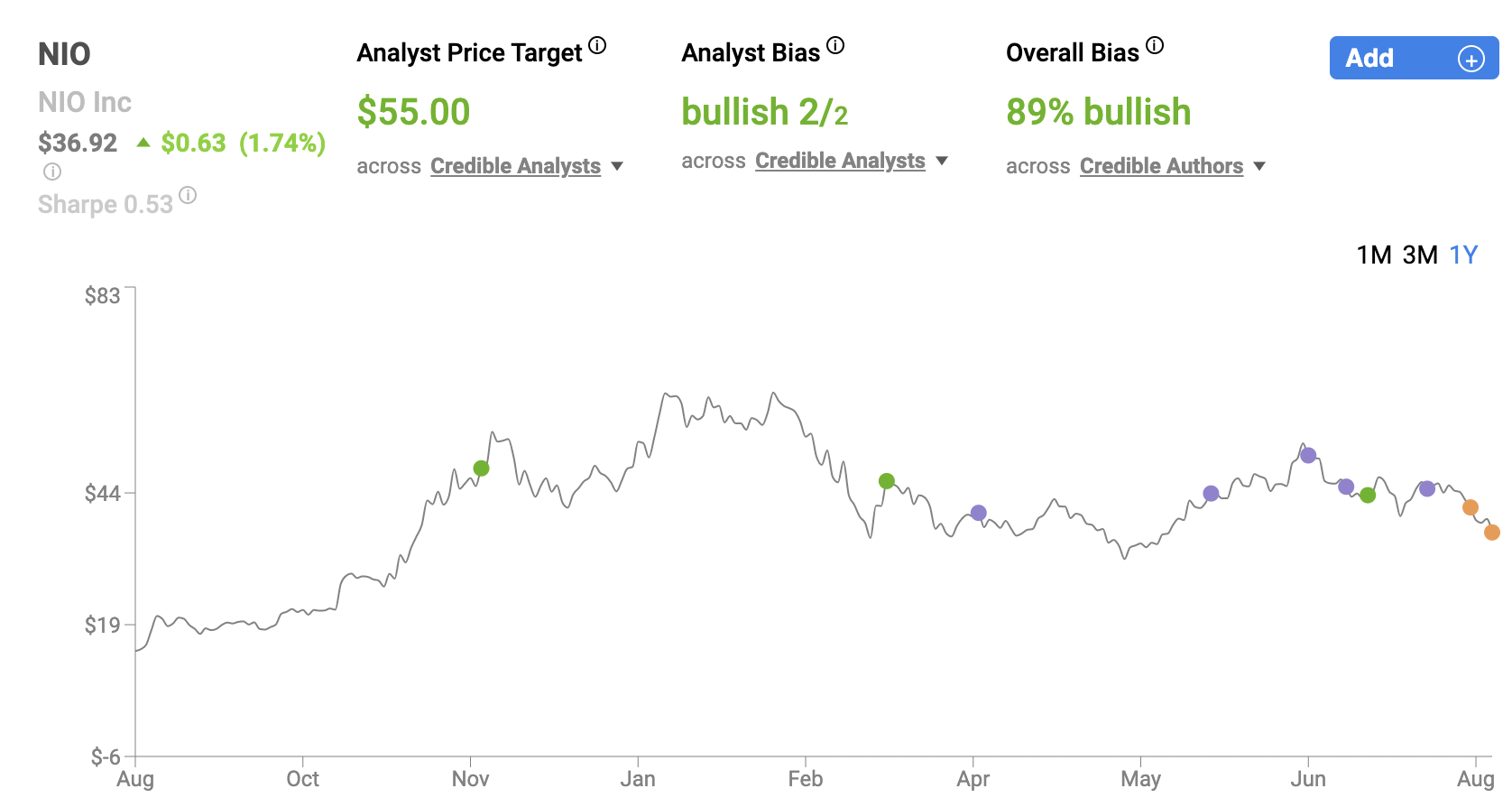

Chinese technology stocks continue to be the talk of the town, as far as the Nobias credible author community goes. So many of these companies have turned into battleground stocks with investors offering strong opinions on either side of the bull/bear argument. And that’s no different for Nio (NIO), the Chinese electric vehicle (EV) maker, who reported earnings last week. NIO shares are down more than 43% from their 52-week high. And therefore, we wanted to see what the Nobias community had to say about the stock after its recent sell-off.

Chinese technology stocks continue to be the talk of the town, as far as the Nobias credible author community goes. So many of these companies have turned into battleground stocks with investors offering strong opinions on either side of the bull/bear argument. And that’s no different for Nio (NIO), the Chinese electric vehicle (EV) maker, who reported earnings last week. NIO shares are down more than 43% from their 52-week high. And therefore, we wanted to see what the Nobias community had to say about the stock after its recent sell-off.

On August 12th, NIO posted its second quarter results and beat analyst expectations on both the top and bottom lines. IAM News, a Nobias 4-star rated analyst, covered the earnings results in a recent article Benzinga, highlighting the print saying, “The start-up lost approximately $0.07 per share which translates to 0.42 yuan. This is less than both the expected loss of 0.68 yuan as well as the 1.15 yuan for the same period last year. Revenue surged 127.2% YoY as it amounted to $1.31 billion or 8.45 billion yuan, which topped the 8.32 billion yuan that Refinitiv analysts expected.”

The analyst notes that Nio remains an innovator in the battery space, which is paramount to success in the EV market. And, while there is a lot of competition in the EV space, Nio is attempting to set itself apart with a new battery swapping system. IAM news said, “Nio's battery swapping service makes it different from everyone else. It differentiates itself from competitors by offering special service stations to its users where they can swap their depleted battery for a fully charged one.”

During Nio’s Q2 conference call with investors, the company’s Founder and CEO, William Li highlighted his company’s unique battery swap system, saying, “Up until now, we have deployed 361 swap stations in 103 cities and completed over 3 million battery swaps for the users. In July, we announced NIO Power's battery-swap station deployment plan by 2025. We plan to increase the total number of battery-swap stations to over 700 by the end of 2021 and to over 4,000 globally by the end of 2025.”

The analyst highlights ongoing supply chain issues, specifically regarding the lack of semiconductor supply available to vehicle manufacturers which would delay its global product rollout. IAM News says that Nio had plans to expand into “EV haven Norway” in September, but right now, those plans remain up in the air.

However, even with macro uncertainty in place, NIO offered Q3 guidance. IAM News wrote, “As for the third quarter, revenues are expected in the range between 8.91 billion yuan and 9.63 billion yuan, which would translate to a rise between 96.9% to 112.8% compared to last year's quarter as it hopes to deliver between 23,000 and 25,000 vehicles.”

Li also touched upon that forward guidance, saying, “According to the data published by China Passenger Car Association, in the first half of 2021, the penetration rate of battery electric vehicles has reached 8.4% in China. NIO's penetration in the Tier 1 and the Tier 2 cities in China has been growing at a much faster pace. In Shanghai, the first half of this year has witnessed our penetration in the premium SUV segment, reaching 13.7% among all ICE and the electric vehicles. Our monthly order intake keeps it growing, but the delivery volume will be determined by the overall capacity of the supply chain. We expect the total delivery in the third quarter to be between 23,000 and 25,000 vehicles.”

When concluding their piece, IAM News notes that this remains a relatively small competitor in the global EV market. They say that Nio has lagged behind their peers in recent months when it comes to deliveries, which is worrisome in a world where first mover advantage and quickly capturing market share could make or break a company in this highly competitive industry. However, IAM News concludes, “Once EV adoption truly picks up, NIO has positioned itself well for the premium segment of the EV era with its innovative battery subscription business, its cutting-edge vehicles, and strong execution.”

The issue with so many of these tech stocks operating in cutting edge industries is valuation. Investors are forced to pay high premiums for the innovation that companies like Nio offer and oftentimes, it can be difficult to identify fair value because of the speculative nature of the premiums that investors have proven willing to pay.

In a July article, Mark R Hake, a Nobias 4-star rated analyst, published his value oriented analysis, pointing towards upside in NIo shares. Thinking about possible earnings-per-share of $0.27 in 2023, Hake wrote, “That would put NIO stock on a forward price-to-earnings (P/E) multiple of over 186 times earnings. Assuming EPS doubles over the next 2 years, the P/E would fall to a more normal 47 times. So, in effect, Nio stock does not seem to be out of touch with reality here.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

Hake continued, highlighting the company’s price-to-sales multiple and comparing it to a major rival, saying, “Moreover, if we compare the price-to-sales (P/S) multiple to Tesla (TSLA), Nio definitely seems too cheap.” He noted that TSLA shares trade with a P/S multiple of nearly 10x and said: “If we apply those multiples to Nio the estimate is $87.2 billion (i.e., 9.87 x $8.83 billion). That is about the same as July 2’s market value of $87.17 billion. In addition, using the 2023 forecast of $12.85 billion in sales, using the Tesla multiple of 7.95 times, the market value will be $102.16 billion. This is 17.3% higher than July 2’s price.

As a result, the implication is that Nio stock should be at $59.12 per share (i.e., 1.173 x $50.40). This is also close to what 22 Wall Street analysts say Nio stock is worth. Seeking Alpha’s survey of analysts shows that their average target price is $60.42 per share or 20% over the July 2nd price.” At the time, Nio was trading for approximately $50/share, and today, shares trade for $36.92, so NIO has fallen some 24% since Hake performed his due diligence, pointing towards even more upside potential.

Looking at the credible authors that we track with the Nobias algorithm, the average price target that these individuals place on NIO shares is $55.00 (so fairly close to the $60.42/share consensus that Hake mentioned). Compared to today’s $36.92 share price, the Nobias community’s consensus represents upside potential of 33%. With that in mind, it should come as no surprise that the vast majority of credible authors that we track remain bullish on shares, despite the stock’s recent pullback.

Disclosure: Nicholas Ward has no position in any stocks mentioned in this article. Nicholas Ward wrote this article for Nobias at their request with a view of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

Airbnb with Nobias technology: Can This Travel Stock Overcome Pandemic Headwinds?

Management seemed very excited about the future and Wall Street analysts have hopped on board that bullish train. Since the company’s Q2 report, we’ve seen three Wall Street analysts who’re rated 4 or 5 stars by the Nobias algorithm update their price targets on ANBN shares, all of which are much higher than the stock’s current price. Stephen Ju of Credit Suisse, who is rated 5 stars by our algorithm, updated his price target to $167. Ronald Josey, of JMP Securities, who is rated 4 stars by our algorithm, updated his price target to $180. Bernie McTernan of Needham, who is rated 4 stars by our algorithm, updated his price target to $200.

Back in June, before the rise of the Delta variant in the United States, Brian Withers, a Nobias 5-star rated analyst, recently discussed AirBnB in a Motley Fool podcast in which he and his colleagues highlighted the strong demand that the reopening of the economy has created for the travel/leisure company.

Regarding demand, Withers said, "Airbnb will have a great current quarter. Everyplace I want to travel is booked full on Airbnb, revenge travel is unreal this year. Outdoorsy, Airbnb for RVs will be a great buy for them. RVs on Outdoorsy are also fully booked everywhere." He highlighted the fact that he’s had to change recent trip plans for his family because of a lack of available lodging across numerous rental platforms.

Brian Stoffel, a Nobias 3-star rated analyst, who was also on the call, mentioned that, “Anecdotal evidence can get you in trouble as an investor.” That’s true. Investors should focus on the macro data when it comes to due diligence because that is what paints the most accurate picture.

Trevor Jennewine, a Nobias rated 4-star analyst who also writes for the Motley Fool highlighted the macro data in the travel/leisure space back in June as well, comparing Airbnb’s operational results to those of its largest peers in the hotel industry, which showed ABNB’s relative strength as far as revenue resiliency goes.

Jennewine looked at the 2019 full-year revenue produced by Airbnb, Hyatt, and Hilton, and compared that full-year figure to the trailing twelve month results starting at Q1, 2021. He notes that Airbnb’s comparative sales had fallen by 23%. Hilton’s sales were down 65% on a relative basis. And Hyatt was the worst performer, seeing its relative top-line performance down by 70%.

Jennewine concluded that, “Airbnb's resilience gives the company a tremendous advantage, but that competitive edge is compounded by the flexibility afforded to travelers. Guests can book stays in big cities, rural towns, and everywhere in between. Not only that, but Airbnb lists unique lodgings like adobes, castles, yurts, and treehouses. Put another way, Airbnb is the gatekeeper to a multitude of unique experiences. That should be a powerful growth driver as the travel industry rebounds.”

The Motley Fool contributors on the podcast agreed. They discussed their belief that the pandemic has changed consumers’ spending habits and highlighted why this likely bodes well for Airbnb. Along those lines, Withers said, “I actually think this is one of those things like Etsy has picked up a ton of customers throughout the coronavirus as people have gone on and tried it. I think Airbnb will be the same thing, is people will start to see the benefits of staying in somebody else's place.” He continued, saying, “I think it gives you more space, it gives you more options. It certainly as a family, we traveled with our family and our dog, it allows us to take our dog with us. It's just a great thing all around. I think that hotels will continue to be for business travelers, but this will be for reunions and people, families traveling and whatnot, will really gravitate toward the Airbnb way to travel.”

And, while this is obviously a speculative statement at this point in time, it does paint a bullish outlook for the stock, assuming that we don’t see another strong wave of COVID which puts people back into stay-at-home mode. In June, the re-opening trade was in full effect and it appeared like travel regulations, mask mandates, and social distancing may soon be a thing of the past. However, a lot has changed during the last month or so and now, with hospitals throughout various areas of the country filling back up, creating a shortage of beds in ICU units, it appears as though those who went all in on the re-opening trade got a bit ahead of themselves.

Airbnb reported its second quarter earnings on August 12th, 2021 and at first glance, it appears that the company lived up to Withers’ high expectations. Airbnb beat analyst consensus estimates on both the top and bottom lines. The company’s GAAP EPS came in at -$0.11/share, which was $0.32/share above the consensus target of -$0.43. ABNB’s sales totaled $1.34 billion during the quarter, which represented growth of 300% on a year-over-year basis.

Granted, Q2 of 2020 was the worst quarter than travel and leisure stocks have seen in decades, due to the onslaught of the COVID-19 pandemic throughout the spring and summer of 2020. But, even though the strong beat was expected, what appears to have surprised many analyst is the fact that Airbnb’s adjusted EBITDA came in at $217 million, which was not only well above the negative $397 million EBITDA figure that the company produced in Q2 of 2020, but it was above the negative $43 million bottom-line figure that Airbnb produced during Q2 on 2019 (prior to the COVID-19 pandemic).

During the company’s second quarter shareholder letter, Airbnb management offered bullish commentary saying, “Our Q2 results reflect the success of our efforts to prepare for the travel rebound, as well as our continued operating discipline. Q2 Nights and Experiences Booked nearly matched pre-COVID levels; GBV and revenue exceeded pre-COVID levels; net loss improved; Adjusted EBITDA was positive and demonstrated significant margin expansion; and active listings reached their highest level yet. In fact, in the last few weeks, we had our biggest night ever in the U.S. and our biggest night globally since the pandemic began, with more than 4 million guests staying at an Airbnb listing.”

Furthermore, in the “Outlook” section of the letter, Airbnb management highlighted future growth prospects saying, “In the near term, we believe revenue and Adjusted EBITDA provide clearer indications of quarterly performance. While the COVID-19 pandemic creates ongoing uncertainty for our future results, we expect Q3 2021 revenue to be our strongest quarterly revenue on record and to deliver the highest Adjusted EBITDA dollars and margin ever.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

Management seemed very excited about the future and Wall Street analysts have hopped on board that bullish train. Since the company’s Q2 report, we’ve seen three Wall Street analysts who’re rated 4 or 5 stars by the Nobias algorithm update their price targets on ANBN shares, all of which are much higher than the stock’s current price. Stephen Ju of Credit Suisse, who is rated 5 stars by our algorithm, updated his price target to $167. Ronald Josey, of JMP Securities, who is rated 4 stars by our algorithm, updated his price target to $180. Bernie McTernan of Needham, who is rated 4 stars by our algorithm, updated his price target to $200.

Today, ABNB trades for $143.69. Overall, the average recent update was $171.75, which implies upside potential of 16.3%. Right now, looking at the overall community of credible authors tracked by the Nobias algorithm, we see that the average analyst price target is very similar, at $172.67.

Even though COVID-19 fears remain in place, 85% of the credible authors that we track express a “Bullish” opinion on shares. And therefore, it appears that Airbnb remains an attractive option for investors who’re looking to increase exposure to the travel and leisure (or more specifically, the lodging) area of the market.

Disclosure: Nicholas Ward has no position in any stocks mentioned in this article. Nicholas Ward wrote this article for Nobias at their request with a view of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

Baidu with Nobias technology: Down 55%, Is It Time To Buy “The Google of China”?

We recently covered Alibaba (BABA) in a quarterly update article and it appears that it isn’t the only Chinese tech giant that is being discussed frequently by analysts. Another company that popped up on our radar recently, with regard to an increase in analyst chatter, is Baidu (BIDU). Much like Alibaba, Baidu shares have suffered in a major way throughout 2021 due to increasing regulatory pressure being put onto the biggest players in the Chinese technology space by the Chinese Communist Party.

Not only have growth prospects been hurt by regulation that we’ve seen in recent month, but investors/analysts alike have rising concerns about the variable interest entity structure, which is what allows foreign investors to gain access to chinese companies in the stock markets, being ripped apart, therefore, creating a lot of international bag holders for Chinese equities.

We recently covered Alibaba (BABA) in a quarterly update article and it appears that it isn’t the only Chinese tech giant that is being discussed frequently by analysts. Another company that popped up on our radar recently, with regard to an increase in analyst chatter, is Baidu (BIDU). Much like Alibaba, Baidu shares have suffered in a major way throughout 2021 due to increasing regulatory pressure being put onto the biggest players in the Chinese technology space by the Chinese Communist Party.

Not only have growth prospects been hurt by regulation that we’ve seen in recent month, but investors/analysts alike have rising concerns about the variable interest entity structure, which is what allows foreign investors to gain access to chinese companies in the stock markets, being ripped apart, therefore, creating a lot of international bag holders for Chinese equities.

It’s true that fear surrounding the dismantling of the VIE ownership structure by Chinese leadership is speculative. However, the threat alone changes the risk/reward calculus related to stocks like BABA and BIDU. Yet, anyone familiar with the stock market knows that sentiment tends to move share prices too far, whether we’re talking about bullish rallies or bearish sell-offs. And, with that in mind, we wanted to take a look at what the credible authors who’ve published work on BIDU have had to say recently, now that the BIDU shares have sold off by 55%, relative to their prior 52-week highs set in mid-February. Due to this weakness, it appears that institutional investors have become more and more interested in the rebound potential of BIDU shares.

Debasis Saha, a Nobias 4-star rated analyst, recently published a report which highlighted the increased demand for BIDU shares within the hedge fund community. Saha said, “Prominent investors were betting on the stock. The number of long hedge fund bets rose by 38 recently. Baidu, Inc. was in 89 hedge funds' portfolios at the end of March. The all time high for this statistic was previously 72. This means the bullish number of hedge fund positions in this stock currently sits at its all time high.” This is an interesting trend because it’s often thought that big institutional money is what drives markets. However, it’s clear that not everyone in the institutional space is bullish on BIDU.

Richard Saintvilus, a Nobias 4-star rated analyst, published a Q2 preview piece earlier this week which pointed out that famed growth investor, Cathie Wood of Ark Investments, sold out of her large BIDU stake recently. Saintvilus said, “China’s regulatory crackdown has sparked fears among U.S. investors that foreign investors will flee Chinese stocks. Cathie Wood's ARK funds recently sold off Baidu shares, among other China holdings, for the same reasons.”

However, Saintvilus also touched upon the stock’s recent pullback, saying that a contrarian stance may be a reasonable one to take at the moment. He wrote, “This pullback, however, might be a good opportunity for investors who have been on the sidelines.” Saintvilus says that Bidu, which is often referred to as the “Google of China” offers compelling growth, even outside of its search engine assets, which include “a stand-alone artificial intelligence (AI) semiconductor capabilities, as well as streaming and autonomous vehicles.”

Regarding Baidu’s future growth potential, Saintvilus also points out that “with consecutive quarters of strong earnings that has yielded tons of cash flow, Baidu is ready to put its cash to work, promising to boost its investments by some 30% annually over the next several years.” Coming into the Q2 results, Saintvilus said, “Currently trading at around $163, Baidu still has a consensus Street price target of $308 which implies close to 90% upside.”

This highlights the high potential of a contrarian bet being placed at today’s relatively low share price levels. However, the bullish hedge fund outlook and the high consensus price target being placed on shares coming into the second quarter by Wall Street wasn’t enough to inspire a bounce back.

BIDU reported its second quarter earnings recently (on August 12th), beating analyst estimates on both the top and bottom lines. However, as Zheping Huang, a Nobias 4-star rated analyst, recently pointed out in a Yahoo Finance article, the company’s forward looking guidance disappointed investors, sparking the most recent leg of the stock’s sell-off.

BIDU shares have fallen roughly 7% since their August 12th report and Huang highlighted the fundamentals driving the move saying, “Baidu Inc. delivered a conservative outlook for the current quarter as a resurgent pandemic outbreak in China overshadowed the internet search giant’s push into newer arenas like cloud and smart devices.Revenue for the three months ended June climbed 20% from a year earlier to 31.35 billion yuan ($4.8 billion), compared with the 30.9 billion yuan of estimates. The company predicted sales of 30.6 billion yuan to 33.5 billion yuan for the September quarter, versus the 33.1 billion yuan seen by analysts, saying that the recent increase in Covid-19 cases across large parts of China left business visibility “limited.”’

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

In a separate Bloomberg article that Huang penned, he included the full quote, writing: “The Covid-19 situation in China is evolving and business visibility is limited,” Baidu said in a statement Thursday, adding that the preliminary view is subject to change. The stock market hates uncertainty, above all else, and anytime you have a management team offering guidance like this (however truthful and frank it may be) investors are likely to sell shares. And yet, even with this uncertain guidance in mind, when we look at the credible authors tracked by the Nobias algorithm, the vast majority of them remain bullish on BIDU shares.

Right now, 91% of credible authors maintain a bullish opinion. And, the average price target amongst these credible sources sits at $325.00/share, which is even higher than the overall Wall Street consensus. Today, BIDU trades for $159.63. Compared to the $325 average price target that we’re seeing, this implies upside potential of roughly 103.6%. Obviously that is a fantastic near-term return potential. It’s worth noting that analysts have been wrong about the direction of BIDU shares for most of 2021; however, it's undeniable that the risk/reward here is intriguing. Because of that, it appears that BIDU is a stock that investors with high degrees of intestinal fortitude (especially those who do not fear continued Chinese crackdowns on its tech sector) may want to consider. These shares certainly aren’t for the faint of heart, but it’s rare that we see such a large discrepancy between current share prices and the average price target of the credible analyst community tracked by our algorithm.

Disclosure: Nicholas Ward has no BIDU position; however, he is long several of Cathie Wood’s Ark Invest ETFs, including ARKK, ARKW, ARKG, ARKX, ARKQ, and ARKF. . Nicholas Ward wrote this article for Nobias at their request with a view of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

Alibaba with Nobias technology: Is The Regulatory Risk Worth The Reward?

In mid-April, we published an article, highlighting Alibaba (BABA). At the time, BABA shares were trading for approximately $238/share. Back then, Alibaba shares had fallen more than 25% since their 52-week highs and we highlighted the bull/bear arguments that credible authors were making for and against the stock, in the face of ongoing Chinese regulatory fears. Today, we see BABA shares trading for $191.66, which means that they’ve fallen another 19.4% and now trade with a 40% discount relative to their current 52-week high of $319.32.

In mid-April, we published an article, highlighting Alibaba (BABA). At the time, BABA shares were trading for approximately $238/share. Back then, Alibaba shares had fallen more than 25% since their 52-week highs and we highlighted the bull/bear arguments that credible authors were making for and against the stock, in the face of ongoing Chinese regulatory fears. Today, we see BABA shares trading for $191.66, which means that they’ve fallen another 19.4% and now trade with a 40% discount relative to their current 52-week high of $319.32.

The regulatory fears still represent the overwhelming headwinds for this stock. However, from a fundamental standpoint, Alibaba’s growth story remains intact. This is what makes BABA so intriguing. Relative to its big-tech counterparts in the United States, BABA shares look relatively cheap on a trailing and forward looking basis. However, investors continue to fear potential backlash that the company might face from the Chinese Communist Party as well as the threat of de-listing and/or the destruction of the variable interest entity (VIE) structure which allows for international investors to gain exposure to various Chinese equities.

Therefore, in this piece, we wanted to take another look at BABA shares to see what the 4 and 5-star analysts that we track at Nobias have recently said about the company in an attempt to see whether or not these are shares that investors should consider buying into weakness.

Billy Duberstein, a Nobias 5-star rated analyst, recently published an article on The Motley Fool titled, “Why Alibaba Stock Fell 13.9% in July”. In his piece, Duberstein began by highlighting the Ant Financial IPO which was canceled by Chinese regulators last year as well as the $2.8 billion fine that the Chinese government forced Alibaba to pay because of anticompetitive practices. However, he continued, highlighting the more recent weakness saying, “Last month, however, marked a whole new ball game for Chinese technology stocks broadly, especially those listed on U.S. exchanges. Thus, Alibaba's stock got cut down further with the rest of the sector.”

Regarding the more broad issues that big-tech names in China have been having with regulators, Duberstein wrote, “In the early part of the month, regulators banned DiDi Chuxing from app stores, citing violations of data collection and usage policies. However, many interpreted the move as retaliation against Didi for going through with its U.S. IPO, even after authorities apparently didn't want the company to do so.” Then, he continued, saying, “Regulators then decimated the online education sector, saying online education companies would be prevented from making a profit on after-school tutoring services.”

Duberstein also mentioned a crackdown on the food delivery industry in China with regard to maintaining minimum wages and mentioned that while Alibaba is not the industry leader in that space, the company “also competes in delivery through its Ele.me and Freshippo platforms.” All in all, he notes, BABA was not directly in the cross hairs of any of the recent Chinese government regulations. However, he notes, “Since Alibaba is a large component of many Chinese technology ETFs and index funds, it was hit along with the rest, despite most of July's crackdowns being directed at other companies.”

Duberstein summed up his piece, highlighting the company’s valuation, strong balance sheet, and continued leadership position in a handful of attractive industries with perceived secular tailwinds. However, he clearly stated that ongoing regulation is a “wildcard” for the company and therefore, this may not be the right stock for risk averse investors. He writes, “At a valuation of just around 20 times next year's earnings estimates, Alibaba's stock seems quite cheap, especially since it also has a healthy net cash position of around $50 billion and equity interests in many other companies. However, the Communist Party's crackdown on tech companies remains a big wild card. Still, for those willing to bet the regulatory onslaught will end at some point, Alibaba's leading positions in e-commerce and cloud computing could present an attractive long-term opportunity.”

Since our last article, BABA posted its second quarter earnings results. The outcome was mixed, with the company beating analyst consensus estimates on the bottom-line, but missing top-list expectations. Zheping Huang, a Nobias 4-star rated analyst, covered the company’s earnings report in an article on Yahoo Finance. Regarding the company’s fundamental performance, Huang said, “Revenue for the three months ended June climbed to 205.7 billion yuan ($31.8 billion), compared with the 209.4 billion yuan average of analyst estimates. Net income was 45.1 billion yuan, rebounding from a loss in the previous quarter following the record antitrust penalty. The company announced Tuesday it was boosting its share buyback program by 50% to $15 billion.”

Nobias 5-star rated analyst, Sam Quirke touched upon the strong quarterly results and the even more appealing valuation that the company appears to offer in his recent article saying, “The current downtrend has also pulled down Alibaba’s price-to-earnings ratio which is now at an appetizing 23. This is well below the mid-50s where it spent much of 2017, 2018, and 2019 and further boosts the risk/reward set up currently in play.”

Quirke continued, saying, “Any relaxation in government scrutiny or geopolitical tension would also go a long way to easing the downward pressure, but rest assured; this is a fast-growing e-commerce company that’s on track to service more than a billion unique customers annually in the coming years. It’s already trading at a significant discount and any further weakness should be viewed as a buying opportunity.” He wrote this piece on August 4th and the stock closed that trading session at $200.71. And, as Shanthi Rexaline, a Nobias 4-star rated analyst, pointed out in her recent piece, Duberstein and Quirke aren’t the only individuals who believe that BABA looks cheap after its recent sell-off.

On August 4th, Rexaline penned an article highlighting 3 analyst upgrades which came after Alibaba reported Q2 numbers. In her piece she wrote: “Needham analyst Vincent Yu maintained a Buy rating and $330 price target for Alibaba shares. Raymond James analyst Aaron Kessler reiterated a Strong Buy rating and $300 price target. KeyBanc Capital Markets analyst Hans Chung maintained an Overweight rating and lowered the price target from $270 to $250.”

Rexaline points out that the Needham analyst was bullish on Alibaba’s improving margins, which came in “better than expected despite investments.” She also touched upon the Needham analysts’ view that increased regulation could be a good thing for BABA, due to the fact that it could end up hurting the company’s competition. She quoted Vincent Yu who said, "We believe Alibaba is navigating the current regulatory environment well and is poised to grow in several business areas such as ride-hailing and food delivery, in which increased regulations can benefit the overall industry as some competition will be eliminated."

Regarding the Raymond James upgrade, Rexaline wrote, “Alibaba increased its share repurchase program from to $10 billion to $15 billion, the largest share repurchase program in its history, the analyst said.” Raymond James appears to be bullish on the buyback because they believe shares to be cheap; Rexaline highlighted this saying, “Alibaba's valuation, at 10 times the estimated market place EPS estimate for 2022, is attractive, the firm added.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

Hans Chung was the most bearish analyst that Rexaline highlighted. He appears to have major concerns about ongoing regulation and the uncertainty that this creates. Rexaline wrote, “Uncertainty around regulation on industrywide data privacy and security issues is also an overhang, Chung said.” She also noted that Chung has worries about near-term guidance recently provided by the company, writing, “On the other hand, the analyst said revenue guidance for fiscal year 2022 appears unachievable.” However, even with these headwinds in mind, low valuation appears to outweigh growth concerns because Chung’s price target of $250 still represents upside potential of roughly 30% from here.

Due to the ongoing volatility that BABA shares experience in the market today, this stock certainly isn’t for the faint of heart. However, it’s rare that investors have the chance to buy into such a well established company posting 30%+ growth that are trading with market multiples. Looking at the credible authors that Nobias tracks, it appears that the broader community shares the bullish sentiment expressed by these 3 Wall Street analysts.

At this point in time, the regulatory headwinds that BABA faces are well known; however, 91% of the credible authors that our algorithm tracks have a bullish opinion of Alibaba shares. In short, it appears that the Nobias community of credible analysts believe that the risk is worth the reward when it comes to BABA shares.

Disclosure: Nicholas Ward has no BABA position. Nicholas Ward wrote this article for Nobias at their request with a view of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

Teladoc with Nobias technology: Down 51% From Its Highs, Is It Finally Time To Buy?

During 2020, Tele-medicine took the world by storm. The pandemic forced the digital medicine trend onto consumers, ushering in years of growth expectations in just months. And from a stock market standpoint, Teladoc (TDOC) was the major beneficiary of this trend, seeing its shares rise from roughly $80 at the beginning of 2020 to recent highs of $308. However, throughout 2021, we have seen TDOC experience significant weakness. Today, TDOC shares are trading for just $149.26, down more than 51% from their prior highs. Teladoc recently posted Q2 earnings and with that in mind, we wanted to take a look at the company’s results and see what the credible authors tracked by the Nobias algorithm had to say about the stock’s prospects moving forward.

During 2020, Tele-medicine took the world by storm. The pandemic forced the digital medicine trend onto consumers, ushering in years of growth expectations in just months. And from a stock market standpoint, Teladoc (TDOC) was the major beneficiary of this trend, seeing its shares rise from roughly $80 at the beginning of 2020 to recent highs of $308. However, throughout 2021, we have seen TDOC experience significant weakness. Today, TDOC shares are trading for just $149.26, down more than 51% from their prior highs. Teladoc recently posted Q2 earnings and with that in mind, we wanted to take a look at the company’s results and see what the credible authors tracked by the Nobias algorithm had to say about the stock’s prospects moving forward.

In an article titled, “Is It Too Late to Buy Teladoc Stock?” that Nobias 5-star rated analyst, Zhiyuan Sun penned in late July, the author touched upon TDOC’s recent weakness, noting that it has been one of the worst performers in the healthcare sector during 2021, saying, “Investors are becoming increasingly skeptical of the company's ability to operate a digital consultation platform outside of pandemic conditions -- and they are not wrong to be dubious.” It’s clear that this 5-star rated analyst is not a fan of TDOC stock, due primarily for valuation reasons.

Sun highlighted the company’s continued success on the top-line; however, as he notes, TDOC is struggling to generate a profit. He wrote, “During Q1, Teladoc's total revenue increased by 183% year over year to $453.7 million as it facilitated 4.28 million sessions, up 109% from year-ago levels. It did not take many steps to improve its profitability, however, and its net loss widened to $199.6 million from Q1 2020's loss of $29.6 million.”

TDOC issued full-year guidance at the end of its Q1 report, putting a spotlight on its plans to generate approximately $2 billion via roughly 13 million digital visits. However, Sun believed that the company is going to have a hard time meeting those goals saying, “Unfortunately, Teladoc's peak performance is arguably behind it -- and the company may have significant problems meeting its guidance. Telehealth use has already fallen by 37% from its pandemic highs.”

Sun concluded his bearish piece saying, “In addition, its strategy of growing membership and visit count at a loss isn't helping its profitability situation. The stock looks extremely expensive at 11.8 times revenue. Investors who still want Teladoc in their portfolios would be well advised to wait for its valuation to come down even further before buying this healthcare stock on the dip.” Since he wrote his article, TDOC shares have been fairly flat, so the dip he’s looking for hasn’t yet occurred. But, Q2 earnings were posted on July 27th. In the immediate aftermath of those results, TDOC shares sold off some 10%. However, they quickly rebounded and another Nobias 5-star rated analyst, Keith Speights, who covers healthcare stocks at The Motley Fool, believed that the comeback was warranted.

In a recent article, Speights wrote, “With such a steep sell-off, you might think that Teladoc has big problems. However, the healthcare stock rebounded later in the morning on Wednesday as investors more fully digested Teladoc's news. My view is that this comeback is warranted. I believe that there was a lot of good news in the virtual care leader's second-quarter conference call that shouldn't be overlooked.”

Speights touched upon the company’s bottom-line woes saying, ‘Investors seemed to initially focus mainly on Teladoc's Q2 net loss of $133.8 million, or $0.86 per share. That result was a lot worse than the consensus analysts' estimate of a net loss of $0.56 per share. However, I think that Teladoc's bottom line isn't nearly as bad as it might seem.” He went on to explain that “Most of it stemmed from acquisition-related expenses related to Teladoc's purchases of Livongo Health and InTouch Health. Both are investments that I fully expect will pay off nicely for Teladoc over the long run”.. And, as Speights points out, “The rest of Teladoc's net loss was due to the company paying down debt. As with the acquisition-related expenses, my view is that the debt reduction is a story of short-term pain but long-term gain.”

Instead of focusing on earnings-per-share, Speights says that there are other, more important metrics that investors should be tracking when it comes to Teladoc’s performance. He wrote, “Perhaps the most important metric to watch is Teladoc's revenue per member per month (PMPM). In Q2, the company reported $2.47 in revenue PMPM. That's an increase of 142% over the prior-year period. It also reflected a 10.3% quarter-over-quarter jump.” When concluding his bullish piece, Speights said, “If I had to single out just one thing from Teladoc's Q2 update as a reason for buying the stock, it would be that the company's future appears to be brighter than ever.” He touched upon several statements that TDOC’s CEO, Jason Gorevic, made during the company’s quarterly report.

Gorevic mentioned that Teladoc’s new agreement with HCSC, which Speights points out is “the fifth-biggest health insurer in the U.S”, was “a landmark deal” for the company. Speights said, “The company expects the HCSC contract will drive growth beginning in early 2022 that will extend over a three-year period at least.” Gorevic also said that his company’s "late-stage pipeline at this point is 20% greater than it was last year."

In Speights view, this bodes well for growth, and ultimately, TDOC’s fundamentals eventually justifying today’s speculative valuation. In terms of Sun’s call that TDOC would have a hard time meeting its full-year guidance figures, during the Q2 report, TDOC management reaffirmed full-year revenue guidance, calling for:

Total revenue to be in the range of $2,000 million to $2,025 million.

EBITDA to be in the range of $(120) million to $(100) million.

Adjusted EBITDA to be in the range of $255 million to $275 million, including an estimated $20 million in lower expenses primarily related to Livongo devices as a result of the merger.

Net loss per share, based on 157.4 million weighted average shares outstanding, to be between $(3.60) and $(3.35).

Total U.S. paid membership to be in the range of 52 million to 54 million members and visit fee only access to be available to approximately 22 million individuals.

Total visits to be between 13.5 million and 14.0 million.

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

In short, while the company is still struggling to generate profits, its client relationships continue to grow and while it’s unclear whether or not we have seen peak digital healthcare visits as society reopens and the world emerges from the COVID-19 pandemic, TDOC felt confident enough to maintain guidance for 2021 (at least).

While these two 5-star rated analysts provided compelling bull/bear arguments, overall, we see that the vast majority of the credible analysts that we track with the Nobias algorithm remain bullish on TDOC shares. Right now, 78% of credible authors have a “Bullish” opinion on the stock, with an average price target of $189.67, which implies upside potential of approximately 27%. Since the company’s Q2 earnings report, we’ve seen five different 5-star rated analysts update their price targets on TDOC shares.

Ryan MacDonald of Needham came in at $205/share. Stephanie Davis of SVB Leerink came in at $218. Donald Hooker of Keybanc updated his price target to $180. Michael Wiederhorn of Oppenheimer had the highest price target of the blue chip analysts that we track, at $220. And George Hill of Deutsche Bank was the only 5-star rated analyst who came in at “Neutral” as opposed to “Buy” with a $153 target. All in all, the average post-Q2 price target came in at $195.20, implying upside potential of nearly 31%.

Disclosure: Nicholas Ward has no position in any stock mentioned in this article. Nicholas Ward wrote this article for Nobias at their request with a view of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

Chevron with Nobias technology: Does This Oil Stock Have More Room To Run After Its 20.5% Year-to-Date Performance?

In 2020, when the COVID-19 pandemic began, forcing governments across the world to enact travel restrictions and other social distancing regulations, demand in the energy markets fell off of a cliff. We saw the price of a barrel of oil plummet and the “big oil” companies all saw their operational performances, and therefore, their share prices, suffer. In 2020, the energy sector was the worst performing area of the S&P 500, down more than 33%. However, when the “reopening” rally occurred during the first quarter of 2021, the energy space was a major beneficiary. Throughout much of 2021, we’ve seen Investors migrate out of the “stay-at-home” stocks, which were largely centered in the tech sector, due to the acceleration of trends related to the digital workplace, and into the more economically sensitive, cyclical stocks, because of the thesis surrounding a rapidly reflating global economy.

In 2020, when the COVID-19 pandemic began, forcing governments across the world to enact travel restrictions and other social distancing regulations, demand in the energy markets fell off of a cliff. We saw the price of a barrel of oil plummet and the “big oil” companies all saw their operational performances, and therefore, their share prices, suffer. In 2020, the energy sector was the worst performing area of the S&P 500, down more than 33%. However, when the “reopening” rally occurred during the first quarter of 2021, the energy space was a major beneficiary.

Throughout much of 2021, we’ve seen Investors migrate out of the “stay-at-home” stocks, which were largely centered in the tech sector, due to the acceleration of trends related to the digital workplace, and into the more economically sensitive, cyclical stocks, because of the thesis surrounding a rapidly reflating global economy.

This change of sentiment sent energy from worst to first, in terms of year-to-date performance. It wasn’t long ago that the energy sector was up more than 45% of a year-to-date basis. However, with the rise of the Delta variant, the migration from secular growth into cyclical value has experienced a speed bump, and over the last month, the energy space has become the S&P 500’s worst performing sector, down more than 7.2%.

Energy is still the best performing sector on a year-to-date basis, up 30.3% after the recent sell-off. However, with the threat of another strong COVID-19 wave on the horizon, investors are questioning whether or not we’ll see demand for oil remain elevated.

This has caused weakness in shares on oil/gas related stocks, even though their recent earnings reports beat analyst expectations. It appears that investors are at a crossroads when it comes to “big oil” and with that in mind, we wanted to take a look at Chevron (CVX), which just beat Wall Street’s expectations on both the top and bottom lines.

Martin Baccardax, a Nobias 4-star rated analyst who writes for TheStreet covered CVX’s recent earnings report in an article highlighting the company’s surprisingly good results and renewed buyback plan. He began by highlighting CVX’s bottom-line beat, saying, “Chevron said adjusted earnings for the three months ending in June came in at $1.60 per share, up from a $1.59 per share loss over the the same period last year and four cents ahead of the Street consensus forecast.”

Baccardax then moved to the top-line numbers, saying, “Group revenues, the company said, surged 178% higher from last year to $37.6 billion, again topping analysts' estimates of a $34.7 billion tally.” Baccardax highlighted an earnings related quote from Chevron’s CEO, Mike Wirth which read, “Second quarter earnings were strong, reflecting improved market conditions, combined with transformation benefits and merger synergies. Our free cash flow was the highest in two years due to solid operational and financial performance and lower capital spending.”

Baccardax also highlighted the fact that Wirth said that the company will resume share repurchases in Q3, “at an expected rate of $2 billion to 3 billion per year.” This is bullish for shareholders because it shows that management is confident enough in its cash flows to provide cash to shareholders while still managing its balance sheet and capex requirements.

With regard to shareholder returns and the strength of CVX’s dividend in particular, Rekha Khandelwal, a Nobias 5-star rated analyst who writes for The Motley Fool, recently published an article highlighting CVX’s recent dividend increase. She said, “With a 4% dividend increase for the first quarter, 2021 is Chevron's 34th consecutive year of dividend growth. Not many energy companies can boast of that long of a dividend growth streak. BP and Royal Dutch Shell both slashed their respective payouts last year due to an extremely tough market for oil and gas. Since 2005, Chevron's dividend has grown at a compound annual growth rate of more than 7%.”

However, even while being generous to shareholders, Khandelwal notes that the company has invested enough into growth and exploration projects to maintain its output levels. She wrote, “Chevron's five year reserve-replacement ratio is 99%, which shows that it can largely sustain its production at current levels without exhausting its proved reserves.” Khandelwal continued, saying, “The company expects $14 billion of capital and exploratory expenditure in 2021. Between 2022 to 2025, it expects to spend an average of $14 billion to $16 billion in capital and exploratory projects. That should help it maintain its reserve-replacement ratio close to 100%.”

Lastly Khandelwal highlighted the company’s alternative energy investments, touching upon its partnership with Toyota Motors in hydrogen technology development, before saying, “Moreover, Chevron continues to invest in low-carbon technologies through venture investments in geothermal, wind, and other clean energy projects. That hedges the company's dependence on oil and gas in the very long-term, should their use decline quicker than expected. At the same time, this approach allows it to continue generating cash from its established oil and gas business.”

All in all, Khandelwal believes that the combination of “an established track record of dividend growth, capital discipline with a focus on growth, a strong balance sheet, and openness to emerging low-carbon technologies'' paints a bullish picture for CVX shares. This is why she named Chevron her top energy pick in the month of June. And, Khandelwal isn’t the only analyst who is highly rated by the Nobias algorithm that likes this company as a defensive dividend oriented play.

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

in a recent Motley Fool article titled, “Before The Market Crash Comes, Buy and Hold These 3 Dividend Stocks” where various contributors picked their favorite defensive investments to hold throughout periods of market volatility, Daniel Foelber, a Nobias 5-star rated analyst, chose Chevron as his pick, saying, “Chevron is one of the rare energy Dividend Aristocrats. Despite booms and busts in the oil and gas market, it has been able to boost its annual payout for over 30 consecutive years. This consistency is due in part to the strength of its balance sheet, which continues to be arguably the best of the oil majors.”

Foelber mentioned CVX’s cyclical nature, noting, “For better or worse, Chevron stock tends to march to the beat of oil and gas prices rather than if the market is rising or falling.” However, he concluded his bullish pick by saying, “Given this operational advantage, a track record for strong financials, and consistent dividend raises, Chevron is an oil stock worth buying before a market crash.” Overall, 90% of the credible authors that the Nobias algorithm tracks have a “Bullish” outlook on CVX shares.

In the last month alone, we’ve seen 10 reports published on the stock by 4 and 5-star rated analysts. 9 of these reports came with “Buy” ratings and the remainder came with a “Neutral” outlook. Right now, the average price target amongst these highly rated individuals for Chevron is $124.40, which implies 22.2% upside potential relative to the stock’s current share price of $101.81.

Disclosure: Nicholas Ward has no position in any stock mentioned in this article. Nicholas Ward wrote this article for Nobias at their request with a view of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

Broadcom Inc: Upside Ahead, Even Without the SAS Acquisition

Sometimes, stocks are in the news for what turns out not to be any news at all. This recently happened to Broadcom (AVGO), when the Wall Street Journal reported that Broadcom was in talks to acquire SAS Institute, which is the largest privately held software services provider. In a recent article, Anusuya Lahiri, a Nobias 4-star rated analyst who writes for Bezinga, broke down the WSJ story, saying that AVGO appeared to be attempting to “double down on enterprise software”. Lahiri noted that “A deal, which would value SAS in the range of $15 billion- $20 billion, could be finalized in the coming weeks.” And, she stated that as of May 2, 2021, Broadcom held $9.5 billion of cash and cash equivalents, which meant that the company could easily make such a deal.

Often stocks are in the news for what turns out not to be any news at all. This recently happened to Broadcom (AVGO), when the Wall Street Journal reported that Broadcom was in talks to acquire SAS Institute, which is the largest privately held software services provider. In a recent article, Anusuya Lahiri, a Nobias 4-star rated analyst who writes for Bezinga, broke down the WSJ story, saying that AVGO appeared to be attempting to “double down on enterprise software”.

Lahiri noted that “A deal, which would value SAS in the range of $15 billion- $20 billion, could be finalized in the coming weeks.” And, she stated that as of May 2, 2021, Broadcom held $9.5 billion of cash and cash equivalents, which meant that the company could easily make such a deal.

AVGO shares jumped some 4% on this news when it broke in mid-July. The market obviously liked the idea of this chip maker continuing to diversify its revenue stream into the software-as-a-service (SaaS) industry because SaaS sales tend to result in higher margins, more predictable cash flows (oftentimes, SaaS sales are recurring and subscription based), and ultimately, higher multiples on earnings which results in higher share prices. However, after the WSJ report was published, it didn’t take long for SAS Institute's management team to squash the rumors. The very next day, another WSJ article was published saying that the deal was off.

Cara Lombardo authored that piece and she wrote, “Talks for Broadcom Inc. to buy SAS Institute Inc. have ended after the founders of the closely held software company changed their minds about a sale, people familiar with the matter said.” AVGO shares gave back their short-term gains in the days after this second report was published; however, over the course of the month of July, AVGO has continued to rise, apparently on its own accord. And, with that in mind, we wanted to take a look at what the credible authors that the Nobias algorithm tracks had to say about the stock’s prospects, even without the SAS acquisition in mind.

Nobias 5-star rated analyst, Nicholas Rossolillo recently published an article on Nasdaq.com titled, “3 Reasons Broadcom Is A Dirt Cheap Tech Dividend Stock”. The title here speaks for itself with regard to his bullish lean; however, he made it clear that in his opinion, the company can stand on its two feet just fine, even without increased exposure to software sales.

Rossolillo highlighted the strength of Broadcom’s semi-conductor business, saying, “During the fiscal 2021 second quarter (the three months ended May 2, 2021), total revenue increased 15% year over year to $6.61 billion. Driving this increase was a 20% rise in semiconductor sales, which make up about three-fourths of Broadcom's business.” He noted that AVGO’s chip segment has struggled a bit in recent years due to pressures put onto the company by the U.S./China trade war and then the COVID-19 pandemic, which created supply chain bottlenecks in the semiconductor industry.

However, he was quick to point out a demand turnaround, saying, “But now chips Broadcom specializes in are in high demand, especially for mobile phones (including for 5G mobility), data centers, business networking equipment, and automotive tech.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

Rossolillo also highlighted the fact that AVGO has been busy in recent years in the merger and acquisition markets, acquiring other software oriented names such as CA Technologies, Symantec, and Brocade Communications. He said, “because of these acquisitions in the last few years, Broadcom's overall gross profit margin was 61% in fiscal Q2, compared to 56% a year ago and just 54% at the end of fiscal 2018.”

And, moving forward, Rossolillo remains bullish, noting that “Steady software growth paired with rallying chip sales means Broadcom's bottom-line will likely grow at an even faster rate for the remainder of this year.” And lastly, he touched upon the company’s strong cash flows, saying, “Broadcom reported a 28% increase in net income in Q2 to $2.98 billion and free cash flow of $3.44 billion. That equates to an incredible free cash flow profit margin of 52%.”

These cash flows have allowed AVGO to generously return cash to shareholders via a growing dividend. AVGO currently yields 2.97%, which is more than twice as high as the S&P 500’s 1.27% dividend yield. Right now, AVGO shares trade for 17.6x 2021 earnings-per-share expectations, which means that this company has a sub-market multiple. It appears that analysts believe this is a good deal, considering the stock is expected to grow its bottom-line at a 24% clip this year.

Ninety percent of the credible authors that we track with the Nobias algorithm have a “Bullish” rating on AVGO shares. Right now, the average credible analyst price target on AVGO is $526.63, which implies upside potential of approximately 8.5% when compared to the stock’s current share of of $485.40.

Disclosure: Nicholas Ward is long AVGO. Nicholas Ward wrote this article for Nobias at their request with a view of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

HCA: Up More Than 50% Year-to-Date, Does HCA Have More Upside Ahead?

The S&P 500 is having a great year thus far, up 17.29%. This is well above the major index’s long-term average and this strong double digit performance is something that the vast majority of investors are going to be incredibly pleased with. However, the 17.29% year-to-date performance pales in comparison to the 50.92% year-to-date performance that HCA Healthcare Inc. (HCA) has generated and with this in mind, we wanted to take a look at this hospital operator to see whether or not HCA shares have more room to run after the fantastic results that they’ve posted through the first 7 months of the year.

The S&P 500 is having a great year thus far, up 17.29%. This is well above the major index’s long-term average and this strong double digit performance is something that the vast majority of investors are going to be incredibly pleased with. However, the 17.29% year-to-date performance pales in comparison to the 50.92% year-to-date performance that HCA Healthcare Inc. (HCA) has generated and with this in mind, we wanted to take a look at this hospital operator to see whether or not HCA shares have more room to run after the fantastic results that they’ve posted through the first 7 months of the year.

HCA likely isn’t a stock that many investors have heard of. It certainly doesn’t carry the brand value of some of the big bio-tech/big-pharma stocks. However, this company is a major player in its field. Brenden Rearick, a Nobias 4-star rated analyst, highlighted the company’s size in a recent article, saying, “HCA is the largest health system in the U.S. by net patient revenue at over $44 billion; that’s nearly 50% greater than CommonSpirit Health, the second-largest system in the country.” He continued, noting that “HCA, which is based out of Nashville and operates across 2,000 facilities in both the U.S. and U.K.”.

Keith Speights, a Nobias 5-star rated analyst who publishes work at The Motley Fool, recently penned an article titled “3 Surprising Stocks That Have Crushed the Market so Far This Year” where he highlighted HCA’s 2021 gains. He began his HCA section by asking the all important question, “Why is the hospital chain having such a banner year?” Then, he quickly answered, “Chalk it up to a COVID-19 recovery.”

One might assume that hospitals would have thrived during a pandemic, but that wasn’t the case. Evan Niu, a Nobias 5-star rated analyst recently published an article at Millennial Money where he explained the weakness that hospital operators like HCA experienced last year saying, “One of the peculiar consequences of the COVID-19 pandemic was that many hospitals and other healthcare facilities took financial hits when the crisis started, as many patients avoided the facilities out of fear of exposing themselves to the deadly virus. People delayed many non-essential elective procedures—a major profit center for hospitals—out of an abundance of caution.”

Speights touched upon this as well saying, “Hospitals were hit hard last year during the worst of the pandemic. The biggest problem was that many more lucrative non-urgent surgeries had to be delayed. Those surgeries are no longer being pushed back, benefiting HCA.”

Niu highlighted HCA’s recent earnings result (which caused the stock to pop nearly 14%), saying, “Revenue in the second quarter came in at $14.4 billion, ahead of the consensus estimate of $13.6 billion. Same facility admissions jumped by 17.5%, while same-facility equivalent admissions were up 26.8%. The business is rebounding across the board as pandemic-related restrictions, which had previously been impacting demand and procedure volumes, have eased in recent months.”

Niu noted that HCA posted year-over-year growth in admissions, equivalent admissions, patient days, equivalent patient days, and outpatient surgery visits during Q2. He continued, saying, “That all resulted in net income of $1.45 billion, or $4.36 per share, easily beating the $3.16 per share in profit Wall Street was expecting. Adjusted EBITDA in the second quarter was $3.22 billion, including $822 million in government stimulus income.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

Speights highlighted this growth in his article as well, mentioning that HCA management “expects demand will remain strong throughout the rest of 2021” which bodes well for the company’s bottom-line growth in a bounce-back year. Niu touched upon the company’s updated full-year guidance from the Q2 report, saying, “Thanks to the momentum HCA is seeing, the company boosted its full-year guidance. Revenue in 2021 is now forecast in the range of $57 billion to $58 billion, up from its prior outlook of $54 billion to $55.5 billion. This is the second consecutive quarter that HCA has increased its outlook after raising it in April. Adjusted EBITDA for 2021 should be $12.1 billion to $12.5 billion, which should result in earnings per share of $16.30 to $17.10. HCA Healthcare expects to spend approximately $3.7 billion in capital expenditures this year.”

With this increased guidance in mind, we’ve seen a handful of blue chip (4 and 5-star rated) analysts raise their price targets on HCA shares. Nobias 5-star rated Michael Wiederhorn of Oppenheimer placed a $275 price target on HCA. Nobias 4-star rated Ann Hynes of Mizuho followed suit with a $275 price target. Nobias 4-star rated Ralph Giacobbe of Citigroup updated his price target from $215 to $268. And, Nobias 4-star rated A.J. Rice of Credit Suisse came out with a $267 price target.

Overall, we see a recent average price target of $271.25 amongst the blue chip analyst group. This represents upside potential of approximately 9.2% when compared to HCA’s current share price of $248.20. Further, 81% of the credible authors that the Nobias algorithm tracks are “Bullish” on HCA shares. Right now, the average price target amongst the overall credible author community that we track is $272.50, representing upside potential of roughly 9.8%.

Disclosure: Nicholas Ward has no position in HCA. Nicholas Ward wrote this article for Nobias at their request with a view of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

IBM with Nobias technology: Is The Turnaround Finally Here?

International Business Machines (IBM) has been a perplexing stock for investors to follow over the last decade or so. “Big Blue” as the company is called, was a leader - potentially even the top dog - in the tech sector prior to the digital age. However, unlike many of its “old tech” peers, IBM has not been able to transition into the new growth sectors (cloud, digital security, artificial intelligence, software-as-a-service, etc) effectively.

It wasn’t long ago that IBM had gone more than 20 quarters in a row posting negative y/y growth. The company’s fall from grace was a long and arduous process, with its shareholders experiencing massive underperformance relative to its peers, the tech sector, and the broader markets at large.

International Business Machines (IBM) has been a perplexing stock for investors to follow over the last decade or so. “Big Blue” as the company is called, was a leader - potentially even the top dog - in the tech sector prior to the digital age. However, unlike many of its “old tech” peers, IBM has not been able to transition into the new growth sectors (cloud, digital security, artificial intelligence, software-as-a-service, etc) effectively.

It wasn’t long ago that IBM had gone more than 20 quarters in a row posting negative y/y growth. The company’s fall from grace was a long and arduous process, with its shareholders experiencing massive underperformance relative to its peers, the tech sector, and the broader markets at large.

IBM’s underperformance throughout the last decade has caused its valuation to crater to near single-digit price-to-earnings ratio levels. And now that IBM has generated positive top-line growth for two quarters in a row, investors are starting to ask themselves, “Has this format stalwart finally turned the corner?”

Cheap stocks are difficult to find in the tech sector and if IBM can sustain a positive growth rate moving forward, its shares could be a last bastion of hope for value investors. So, with all of this in mind, we wanted to take a look at what the credible analysts that the Nobias algorithm tracks have had to say about the stock during the past week in response to its positive Q2 earnings results.