FB, TWTR and SNAP with Nobias Technology: Case Study on two Social Media companies

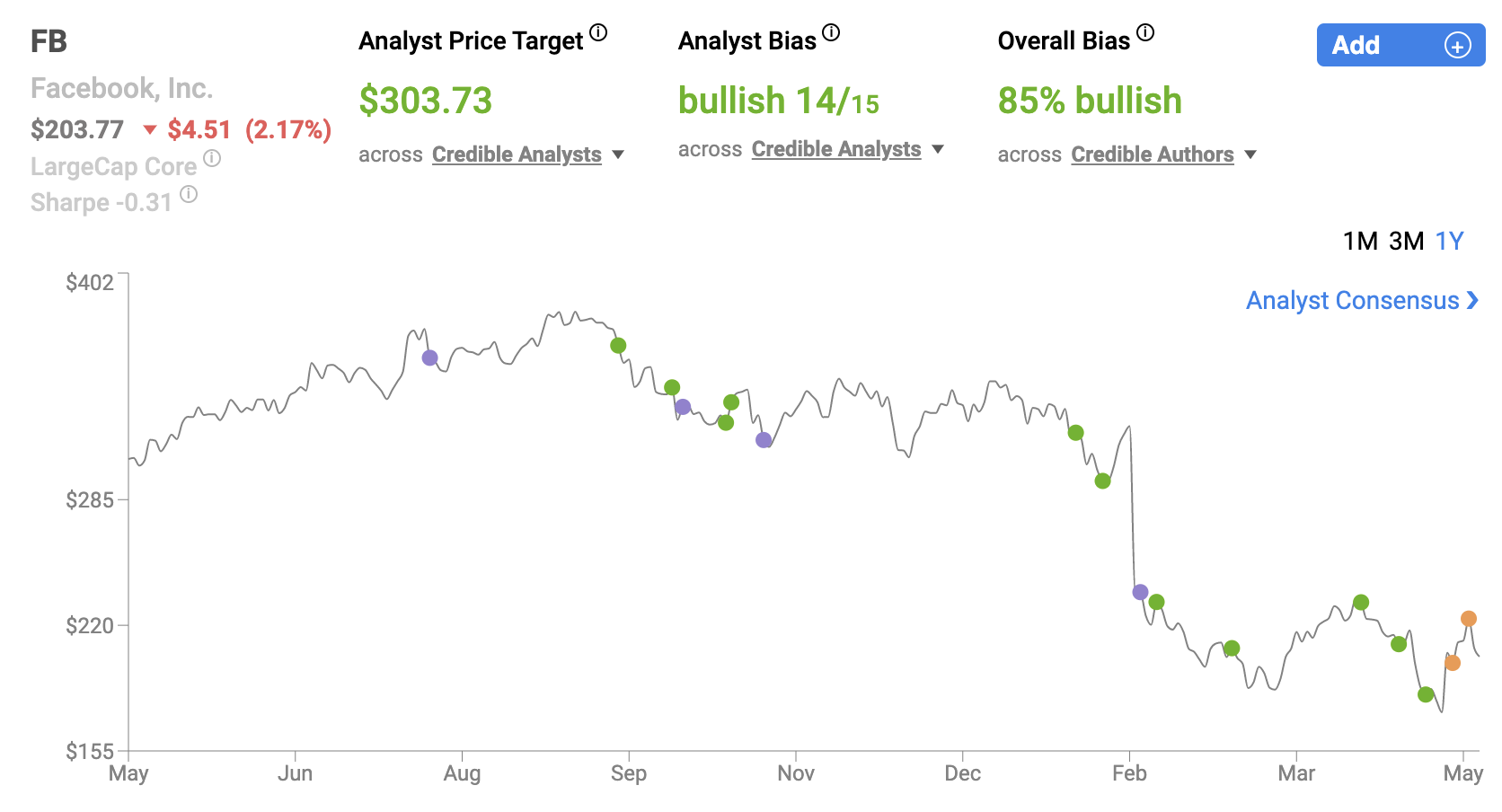

Last week, we provided an update on Meta Platorm’s (FB) recent sell-off, its Q1 results, the ensuing rally, and the bias that we’re seeing amongst the credible authors and analysts that the Nobias algorithm tracks. In the report, we stated, “86% of the recent reports that we’ve seen published by credible authors came with a “Bullish” bias attached.”

We also noted that: “In response to these earnings, FB shares rallied 17.59% on Thursday. The stock ended the trading session at $205.73. And yet, even with this 17.59% rally in mind, that $205.73 closing price is still significantly lower than the average price target being applied to shares by the credible Wall Street analysts that the Nobias algorithm tracks. That average price target currently sits at $318.40, which implies upside potential of 54.77% from the stock’s current share price.”

The current rally has continued. Today, FB shares trade for $223.41. And, the changing sentiment surrounding this stock has inspired us to take a look at a couple of Meta’s largest competitors, Snap Inc. (SNAP) and Twitter (TWTR) to see what the credible authors and analysts that we track think about these two companies as well.

Nobias covered Twitter recently as well, highlighting the then rumor, and eventual news, regarding Elon Musk’s attempt to take the company private. In those reports, we highlighted the relatively negative sentiment surrounding TWTR shares. While the vast majority of credible authors have expressed bullish opinions on FB recently, the same cannot be said of TWTR. Right now, 87% of recent articles that we’ve tracked recently have expressed “Bullish” bias towards FB stock. TWTR, on the other hand, has seen 60% of recent reports express a bearish bias.

FB May 2022

Furthermore, the current consensus price target for Meta shares amongst the credible analysts that we track is $298.88. This implies upside potential of approximately 33.8% relative to the stock’s current price. Right now, the average price target being applied to TWTR shares is $49.90, well below Musk’s proposed takeover price of $54.20, and essentially in-line with the stock’s current share price of $49.06 (the average price target being applied to TWTR represents upside potential of just 1.7%).

In a recent article published by Nobias 4-star rated author, Vlad Savov, some of the potential roadblocks to Musk’s grand plans for Twitter were brought to light. Savov touches upon Musk’s vision to use Twitter to facilitate free speech; however, he believes that the company may struggle in its biggest growth markets.

Savov wrote, “Asia, home to more than half the world’s population, is Twitter’s biggest growth opportunity and arguably a far thornier challenge. If the Tesla Inc. and SpaceX billionaire makes good on promises to scrap censorship, he’ll encounter a plethora of perplexing regulations, wielded by sometimes authoritarian governments, pushed to the limits by a horde of first-time internet users.”

Regarding the Chinese market specifically, Savov wrote, “Twitter is officially banned in China, but the country will still demand a lot of Musk’s attention. Amazon.com Inc. founder Jeff Bezos alluded to the potential conflicts in a tweet shortly after Musk’s deal, asking “Did the Chinese government just gain a bit of leverage over the town square?” He continued, “The company in 2020 instituted labels for government officials and “state-affiliated media” for publications like Xinhua and Global Times, and readers are reminded of this government-backing any time they like or retweet stories.”

Savov said, “Chinese media have called the practice “intimidation” and already begun to lobby the billionaire to roll it back.” With regard to Musk’s take on free speech, Savov mentioned a Tweet that the billionaire published which stated, “By ‘free speech’, I simply mean that which matches the law. I am against censorship that goes far beyond the law.”

Regarding this Chinese saga, Savov concluded, “Could Beijing also offer up access to its 1.4 billion people? Perhaps under the right terms. They would certainly not include free speech.” Savov brings up similar concerns related to the Indian and other southeast Asian markets, implying that conflicts of interest and regulation could pose problems for the company moving forward.

Brett Molina, a Nobias 4-star rated author, expressed a more bullish outlook on Twitter in a recent report that he published at Yahoo Finance, touching upon initiatives that Musk might take to increase the value and profitability of the Twitter platform.

Molia wrote, “Musk said he could cut executive and board pay to cut costs and find opportunities to monetize tweets, according to a Reuters report.” He continued, “Other changes to the service might include easing content moderation, which Musk has criticized, cutting back on ads, and introducing an edit button.”

Molina said, “One of the big benefits for taking Twitter private is Musk can make changes more quickly without worrying about pleasing shareholders.” And, he quoted Wedbush Securities analyst Dan Ives, who recently said, “We think a subscription service will be key to a potential turnaround for Twitter. We view this as one of the first business model changes to the platform."

Since our last update, Twitter posted its Q1 earnings results. The company missed on the top-line, reporting revenue of $1.2 billion (which was $30 million below consensus estimates). But, this $1.2 billion sales figure did represent 15.4% year-over-year growth. TWTR’s non-GAAP EPS came in at $0.90/share, beating estimates by $0.87/share. During the quarter, Twitter’s advertising revenue increased by 23%, totaling $1.11 billion.

The company noted that, “Costs and expenses totaled $1.33 billion, an increase of 35% year-over-year. This resulted in an operating loss of $128 million and -11% operating margin, compared to an operating income of $52 million or 5% operating margin in the same period of the previous year.”

Furthermore, Twitter said, “Stock-based compensation (SBC) expense grew 60% year-over-year to $177 million and was approximately 15% of total revenue.” However, while costs were on the rise, so were users. Twitter stated, “Average monetizable daily active usage (mDAU)[2] was 229.0 million for Q1, up 15.9% compared to Q1 of the prior year.” The company noted that average U.S. mDAU’s were up 6.4% and average international mDAU’s were up 18.1%.

TWTR shares are relatively flat since posting these results. They’re down 0.39% during the last week. Therefore, it appears that the merger arbitrage game is limiting potential upside here. However, another social media platform also recently posted Q1 results and according to the credible authors and analysts that Nobias tracks, it has relatively attractive upside.

Albert Lin, a Nobias 4-star rated author, recently published an article at Seeking Alpha breaking down Snap’s earnings, which he called a “Mixed Bag”. Lin touched upon the results, saying, “Snap reported 1Q22 total revenue of $1.06 billion (+37.8% Y/Y) and non-GAAP EPS of -$0.02 which both came short of Street expectations of $1.07 billion and $0.01. Adj. EBITDA for the quarter was $64 million (vs. $22 million Street and guidance of breakeven), representing an adj. EBITDA margin of 6%.”

SNAP’s revenue totaled $1.06 billion during the quarter, up 38% y/y. Lin continued, “For 2Q22, the social media company guided revenue growth of 20-25% YoY (vs. +27% YoY Street) and adj. EBITDA of $0-50mm, short of Street estimates of $144 million.” SNAP said, “Daily Active Users increased 18% year-over-year to 332 million”. Lin touched upon this, saying, “this compares less favorably to the company's multi-quarter record of 20%+ growth.” Like TWTR, the majority of SNAP’s growth is coming from international markets.

Lin wrote, “Digging deeper into the user base, we can see growth stalling in North America where DAUs increased just 5% YoY in Q1 and 1% QoQ over the last 3 quarters.” He continued, “DAU growth in Rest of World appears to be picking up the slack in North America and Europe by contributing 10 million incremental users in Q1.”

But, Lin points out that this relative growth scenario isn’t ideal. He wrote, “However, RoW ARPU remains significantly below North America at just $0.95 vs. $7.77 in the quarter. In my view, the structurally lower revenue per user outside of Snap's core North American market poses a challenge to incremental revenue acceleration as the US market eventually slows.”

Ultimately, regarding SNAP (and the entire social media industry as a whole), Lin concluded, “Considering the company is yet to turn a profit, I believe investors are unlikely to stick with the stock through thick and thin under a hawkish Fed. That said, I would generally stay on the sidelines and recommend investors to do the same for all social media stocks including Twitter (TWTR), Pinterest (PINS) and Meta (FB).”

Irfan Ahmad, a Nobias 5-star rated author, recently published a much more bullish perspective, highlighting SNAP’s strong user growth and its leadership in the augmented reality market, saying that its Q1 results were “promising to say the least.”

Ahmad noted the higher ARPU that SNAP generates in international markets, but stated, “Keeping that point aside, Snap is still flourishing as the more users it has, the more the ads are viewed. Furthermore, this attracts more members to join in with promising aspects.” He continued, “Speaking of usage trends, Snap is doing quite well on that front, especially in regards to AR tools. Today, nearly 250 million users engage via AR elements on a routine basis. Similarly, more than 250,000 creators have used the Lens Studio to design 2.5 million Lenses, keeping creativity at an all-time high.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

Ahmad continued, “This growing interest in AR Tools is another indication of how Snap could further benefit by venturing into the realm of creativity while keeping in mind the latest trends.” He stated, “It’s no surprise that both tech giants Apple and Meta are far ahead of the race because they’ve got more resources on hand. But despite this, Snap proves that it’s far better than them when it comes to staying on top of trends.”

And, he concluded, “Remember, most AR trends of today have stemmed all thanks to Snapchat and if it continues to work its magic with more AR tools, it could very well remain a leader in the market.” Overall, the consensus amongst the credible authors that Nobias tracks leans bullish when it comes to Snap Inc. 75% of recent articles published by such authors have expressed a “Bullish” bias.

The average price target currently being applied to SNAP shares by the credible Wall Street analysts that we track also implies bullish sentiment. SNAP’s current share price is $30.16. The average analyst price target that we track is currently $50.32. This implies upside potential of approximately 66.8%. Therefore, according to the credible analysts that we track, when comparing Meta, Twitter, and Snap, there is a clear winner: SNAP, with upside of nearly 67%.

Disclosure: Of the stocks discussed in this article, Nicholas Ward is long FB. Nicholas Ward wrote this article for Nobias at their request with a view of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.