BRK with Nobias Technology: Case Study on Berkshire Hathaway

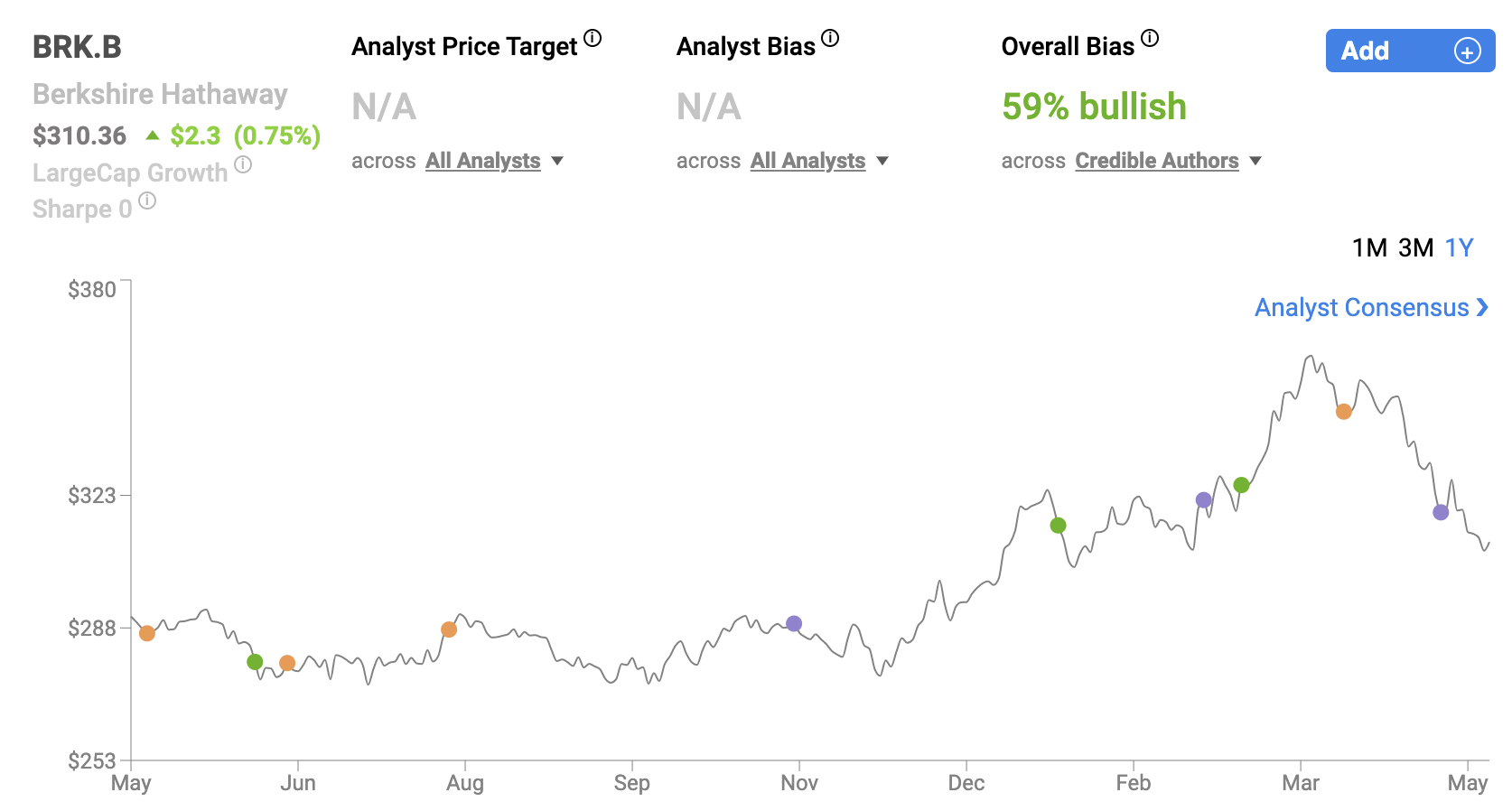

Berkshire Hathaway (BRK.A)(BRK.B) hit an all-time high in late March. At the time, Berkshire shares were outperforming the broader market by a wide margin. Through March 31st, the S&P 500 was down approximately 5.5% on the year. Berkshire, on the other hand, was up roughly 17.3%.

BRK.B posted first quarter earnings on April 30th and since then, the stock has trended downward. During the last month, Berkshire shares are down 10.18%. This has pushed the stock’s year-to-date performance down to 3.18%. These 3%+ gains still represent significant alpha relative to the S&P 500’s year-to-date losses of 16.11%; however, down 14.2% from all-time highs, several credible authors tracked by the Nobias algorithm have published bullish reports, highlighting their belief that BRK.A/BRK.B is a potential bargain here in the $300 area.

Shortly before Berkshire’s recent earnings report, Growth at a Good Price, a Nobias 5-star rated author, wrote an article titled, “Berkshire Hathaway: All-Time High And Still A Buy”. Even though BRK shares have slipped since this article was published, the 5-star rated author clearly laid out their thesis for why BRK was likely to continue to outperform during today’s volatile market environment.

The author said, “ In the last 12 months, Berkshire has grown its earnings to record levels, bought back shares, and added a brand new insurer to its portfolio. It’s been a great run, and the market has rewarded Berkshire with record highs.” They continued, “Many stocks are down this year, as are the S&P 500 and NASDAQ-100. Is it reasonable to expect Berkshire to keep outperforming when so many of its mega-cap peers are undergoing difficulties? I would argue that, yes, it is reasonable to expect that.”

Regarding the company’s defensive stance, Growth at a Good Price stated: “It is well known that Berkshire Hathaway invests in companies that have economic moats. These include:

Companies in industries with high barriers to entry (banks, utilities).

Companies whose customers face high switching costs.

Companies with strong brand identities like Apple (AAPL).”

BRK.B May 2022

They stated, “The Berkshire Hathaway Energy companies are mostly utilities, which are protected by high barriers to entry.” And, regarding the advantages of defensive moats, the author said, “Moats increase the likelihood of solid earnings results because, among other things, they give companies pricing power–the ability to raise prices without reducing demand. When a company faces little competition, it can raise prices easily, because its customers have no alternative suppliers.”

Coming into the Q1 report, the author said, “Berkshire Hathaway’s financials are, as you’d probably expect, fantastic.” They pointed out: “For the full fiscal year, Berkshire reported:

Revenue: $276.09 billion in revenue, up 12.46%.

Operating income: $114.8 billion, up 64.75%.

Net income: $89.79 billion, up 111%.

Free cash flow: $61.69 billion, up 47.9%.

Common equity: $514.9 billion.”

Even near all-time highs, the author touched upon Berkshire’s relatively cheap valuation. They said, “When you look at Berkshire’s overall package of growth, profitability, and balance sheet strength, you’d think that the stock would trade at a premium. After all, it’s without a doubt a high-quality asset. But when we look at some of Berkshire’s key valuation multiples, we can see that it isn’t overpriced at all.”

Then, Growth at a Good Price stated: “At today’s prices, BRK.B trades at just:

8.9 times GAAP earnings.

2.89 times sales.

1.54 times book value.

19 times operating cash flow.”

Since then, BRK’s share price has dropped by nearly 15%. During Q1, Berkshire’s operational earnings were relatively flat, coming in at $7.04B vs. $7.29B in Q4 2021 and $7.02B in Q1 2021. But, even without outsized growth, it appears that Growth at a Good Price’s thesis remains intact. They concluded their article stating, “Near all-time highs, it’s still cheap relative to its overwhelmingly solid fundamentals. And in today’s market, quality counts.”

One thing that analysts continue to point out, when it comes to a bullish Berkshire thesis, is that Warren Buffett himself, who is one of the world’s richest individuals and widely considered to be one of the greatest all-time investors, has been using a share repurchase program to buy back Berkshire shares.

Daniel Foelber, a Nobias 4-star rated author, recently published an article at The Motley Fool, which highlighted Buffett’s illustrious career. Foelber said, “Buffett is one of the greatest investors of all time. The compound annual growth rate of Berkshire Hathaway between 1965 and 2021 is a staggering 20.1% -- which is one of the best long-term track records out there.” He points out that Buffett has achieved this success by making “bold” bets on high conviction ideas.

Foelber wrote, “Today, Berkshire Hathaway owns $358.7 billion in public securities. Of that amount, 66% is concentrated in Apple, Bank of America, and American Express. Seventy-six percent is in the top five holdings. And 87% is in the top 10 holdings.”

Regarding this portfolio concentration, Foelber said, “On the surface, having 45% of a portfolio in Apple stock may look extremely risky.” “But,” he continued, “Buffett is known for his shrewd research, high conviction, and preference to go with only his best ideas.” With this in mind, seeing Buffett consistently buy back Berkshire shares is often seen as a bullish signal for BRK.A/BRK.B stock.

Buybacks only happen when Buffett, his partner, Charlie Munger, and the other leaders at Berkshire believe that their shares are cheap. And, when Warren Buffett - the consummate value investor - believes that Berkshire shares are cheap, the market tends to hop on board that trend.

During Q4 2021, Berkshire bought back $6.9 billion worth of Berkshire shares. And, during the more recently announced Q1 2022 report, the company highlighted $3.2 billion worth of buybacks.

The Q1 buyback number was lower on a sequential basis; however, as Timothy Bowens, a Nobias 4-star rated author recently pointed out, the company used its war chest of cash during Q1 to take advantage of the market’s macro dip.

Bowens wrote, “The company had $143.9 billion in cash and US Treasury bills as of December 31. on March 31, 2021, and reduced to $102.7 billion by March 31, 2022.” He continued, “While the conglomerate was looking to start the year slowly in terms of investment activity, in three weeks from February 21 it spent more than $40 billion”.

In a separate recent article, Bowens touched upon these recent investments in more detail, highlighting Berkshire’s focus on the energy sector. He wrote, “According to Berkshire’s latest 13F filing, the company purchased 118.3 million shares of OXY in multiple transactions from March 12 to 16, bringing its stake in OXY to 136.4 million shares, or ~14.6% of its outstanding shares. Berkshire also owns warrants from OXY that provide the right to purchase an additional 83.9 million shares of common stock at about $59.62 each, plus an additional 100,000 shares of OXY preferred stock.” He also said, “Earlier, Berkshire revealed that it bought around 9.4 million shares of oil titan Chevron in the fourth quarter, increasing its stake to 38 million shares currently worth $6.2 billion.”

The Energy sector is the #1 performing area of the market during 2022 thus far, up 44.83% on a year-to-date basis. The Energy sector is the only sector with positive year-to-date performance in today’s market environment; the second highest performing S&P 500 sector on a YTD basis is Consumer Staples, which have posted losses of 0.32% during 2022.

Historically, Bowens writes, Buffett has been more likely to go against the grain as opposed to chasing the market’s momentum. However, that trend has changed recently. Bowens wrote, “For decades, Berkshire Hathaway Chairman and CEO Warren Buffett maintained a fairly conservative approach to investing, favoring retail and banking stocks, while giving ample leeway to more volatile sectors such as technology and energy.”

He continued, “Lately, though, Buffett seems to be veering away from his famous ethos of buying stocks with a decent margin of safety. After all, he has been doubling down on his energy investments while cutting his holdings in technology and banking even though oil and gas stocks have had high valuations for several years while technology stocks are decidedly cheaper.”

However, Bowens likes this move. He highlighted the global supply constraints being put on the global energy markets, largely related to the sanctions that many countries are putting on Russian oil exports, as well as the secular nature of the ongoing ESG (environmental, social, and governmental) movement, and said that he believes this will create a positive environment for energy names for the foreseeable future.

Bowens wrote, “And, make no mistake about it: Oil markets are likely to remain undersupplied for years to come, whether the Ukraine crisis is quickly resolved or not, thanks in large part to years of underinvestment amid the ESG boom.”

Bowens concluded his piece saying, “Given this backdrop, it’s no surprise that Warren Buffett abandoned his well-known investment mantra of being afraid when others are greedy and greedy when they’re afraid and heeding Sir Winston Churchill’s warning to never let a good crisis go to waste.”

He also pointed out: “One final note: Oil stocks remain undervalued, and the S&P energy sector is still far behind its 2014 levels since the last time oil broke above $100 a barrel.”

Carl Surran, a Nobias 4-star rated author, recently published a report at Seeking Alpha which highlighted a recent major renewable energy project that Berkshire has embarked upon too, showing the diverse nature of the firm’s energy and utility assets.

Surran said, “Warren Buffett's Berkshire Hathaway (BRK.A, BRK.B) unveils plans for a $3.9B renewable energy project in Iowa, including wind and solar generation, in a project that could rank as one of the biggest in the renewable industry.” He continued, “In a filing with the Iowa Utilities Board, Berkshire's MidAmerican Energy says its proposed Wind PRIME prject [sic] would add more than 2K MW of wind generation and 50 MW of solar generation to Iowa, bolstering the state's already significant wind market.”

The energy space isn’t the only area of Berkshire’s business that has performed well lately. Joanna Marsh, a Nobias 4-star rated author, recently penned an article at Freightwaves.com, which highlighted the profit gains of Berkshire’s railway assets.

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

Marsh wrote, “BNSF’s first-quarter 2022 net profit rose 10% despite a 3% decline in volumes, the company reported Monday.” She continued, “First-quarter 2022 net income was $1.37 billion, compared with $1.25 billion in the first quarter of 2021. BNSF is a privately held company whose parent is Berkshire Hathaway (NYSE: BRK.B).”

Regarding sales, Marsh wrote, “Total revenues grew 10% to nearly $5.97 billion amid a 14% gain in average revenue per unit, which in turn was supported by higher fuel surcharge revenue.” She highlighted the segment performance of Berkshire’s BNSF Railway, saying that its Consumer Product revenues rose 10% to $2.08 billion, its Agricultural Products revenues rose by 4% to $1.36 billion, its Industrial revenues rose to $13 billion, and its Coal volumes rose by 30% to $889 million.

Finally, she said, “Operating income rose 8% to $2 billion, while operating ratio (OR) was 64.6%, compared with 63.7% a year ago. Investors sometimes use OR to gauge the financial health of a company, with a lower OR implying improved health.”

Overall, 59% of recent articles published by credible authors focused on Berkshire Hathaway have included a “Bullish” bias, showing that the majority of individuals that we track agrees with Growth at a Good Price’s thesis: even after year-to-date outperformance, Berkshire shares remain attractive.

Disclosure: Nicholas Ward has no BRK.A or BRK.B position. Nicholas Ward wrote this article for Nobias at their request with a view of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.