Case Study: Adobe (ADBE) stock according to high performing analysts

Key Points

Performance

Adobe shares rose by 9.75% this week, pushing their year-to-date gains down to 6.30. This compares favorably to the S&P 500 which is up by 2.92% on a year-to-date basis thus far.

Event & Impact

Adobe posted fiscal 2023 first quarter results this week, beating Wall Street estimates on both the top and bottom lines. During Q1, ADBE’s revenue totaled $4.66 billion, beating Wall Street’s consensus estimate by $40million. Adobe’s Q1 non-GAAP earnings-per-share came in at $3.80, beating Wall Street’s consensus estimate by $0.12/share.

Noteworthy News:

Not only did Adobe beat Q1 consensus estimates, but the company posted bullish guidance for its current quarter and raised its full-year 2023 guidance above Wall Street’s consensus.

Nobias Insights

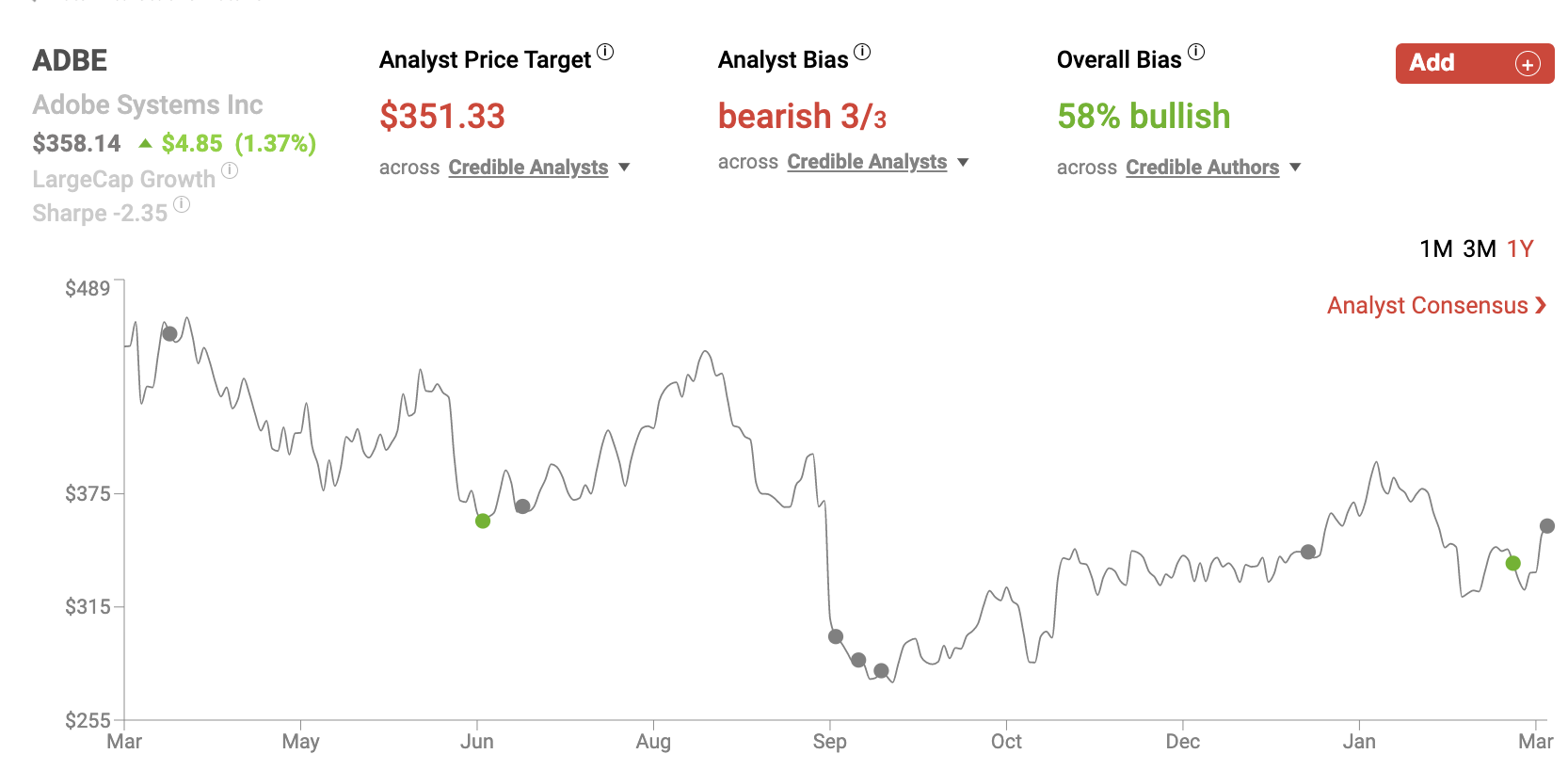

58% of recent articles published by credible authors focused on Adobe shares offer a “bullish” bias. However, after the stock’s nearly 10% rally this week, all three credible Wall Street analysts covering ADBE believe shares are likely to fall in value. The average price target applied to Adobe is $352.00, implying a downside of approximately 1.7% relative to the stock’s current share price of $358.14.

Bullish Take Patrick Seitz, a Nobias 4-star rated author, said, “For its fiscal 2023, Adobe projected adjusted earnings per share of $15.30 to $15.60. The midpoint of $15.45 topped Wall Street's goal of $15.29. Adobe's previous earnings outlook called for $15.15 to $15.45 a share.””

Bearish Take Vladimir Dimitrov, a Nobias 4-star rated author, said, “Adobe was late in its efforts to develop cloud-based collaboration platforms and had to play catch-up in many of its verticals.

ADBE Mar 2023

Software-as-a-service (SaaS) companies have struggled over the past 12-18 months due to fears ignited by higher interest rates revolving around a slowing economy and less corporate capital expenditures being allocated towards enterprise software solutions. Adobe (ADBE) is one of the companies that have struggled, down by 19.40% during the trailing 12-month period.

However, during 2023, sentiment has shifted when it comes to the technology sector, the SaaS industry, and Adobe, in particular. The tech-heavy Nasdaq is up by 11.97% during 2023 thus far. The iShares Expanded Tech-Software Sector ETF (IGV) is up by 11.60% on a year-to-date basis.

Adobe shares are up by 6.3%, which lags its industry, but still outperforms the broader market (the S&P 500 is up by 2.92% on the year). ADBE shares experienced a significant rally this week, rising 9.75%, after the company reported a beat and raise quarter.

Bullish Nobias Credible Analysts Opinions:

Patrick Seitz, a Nobias 4-star rated author, covered Adobe’s first quarter earnings results in an article that he published at Investors.com this week. Seitz wrote, “Adobe stock rose Thursday after the digital media and marketing software firm beat Wall Street's targets for its fiscal first quarter and guided higher for the full year.” He said, “The San Jose, Calif.-based company late Wednesday said it earned an adjusted $3.80 a share on sales of $4.66 billion in the quarter ended March 3.”

Seitz highlighted the company’s top and bottom-line beats, stating, “Analysts polled by FactSet had expected Adobe to earn $3.68 a share on sales of $4.62 billion.” Looking at fundamental growth, Seitz said, “On a year-over-year basis, Adobe earnings rose 13% while sales climbed 9%.”

Regarding forward guidance, Seitz stated, “For the current quarter, Adobe predicted adjusted earnings of $3.78 a share on sales of $4.77 billion. That's based on the midpoint of its guidance. Analysts had expected earnings of $3.76 a share on sales of $4.75 billion in the fiscal second quarter.” “Also,” he added, “for its fiscal 2023, Adobe projected adjusted earnings per share of $15.30 to $15.60. The midpoint of $15.45 topped Wall Street's goal of $15.29. Adobe's previous earnings outlook called for $15.15 to $15.45 a share.”

AJ Fabino, a Nobias 5-star rated author, also covered Adobe’s earnings results in an article this week. Looking at Adobe’s operational success, Fabino wrote, “Its growth can be attributed to a 10% increase in digital media and a 14% surge in digital experience units. The digital media segment saw an 8% rise in creative cloud, with a 16% boost in the document cloud sub-segment.” He also highlighted Wall Street’s response to earnings, putting a spotlight on recent post-earnings analyst reports.

Fabino stated:

BMO Capital's Keith Bachman maintains a Market Perform rating and raised the price target from $390 to $395.

Wolfe Research's Alex Zukin reiterated an Outperform rating, raising the price target from $400 to $440.

UBS analyst Karl Keirstead maintains a Neutral rating, increasing the price target from $350 to $400.

None of these analysts is considered credible by the Nobias algorithm (they are not 4 or 5-star rated analysts); however, Sami Badri, who carries a Nobias 4-star rating, also came out with a post-earnings update this week, raising their firm's price target on ABDE shares.

According to The Fly on the Wall, “Credit Suisse analyst Sami Badri raised the firm's price target on Adobe to $350 from $325 and keeps a Neutral rating on the shares following the solid beat and raise quarter. Despite the solid print, the firm remains on the sidelines until it becomes clear the strong momentum will continue under macroeconomic uncertainties, the analyst tells investors in a research note.”

After their beat and raise quarter, ADBE shares rallied by 9.75% this week. And, with that in mind, even though Badri raised their price target on shares, Adobe is now trading above their new $350 target, implying that the stock is no longer trading with an attractive valuation.

Bearish Nobias Credible Analysts Opinions:

Vladimir Dimitrov, a Nobias 4-star rated author, agrees that Adobe is trading near fair value at today’s levels, yet despite this, he is still cautious on shares. In a recent article, Dimitrov highlighted Adobe’s strong business model and its industry leading margins. “The business' unique positioning that caters to many small content creators, freelancers and small to medium businesses also results in the highest gross margins within the broader peer group of large cap software and cloud players,” he said.

Dimitrov continued, “Only Microsoft (MSFT), Alphabet (GOOG) and Oracle (ORCL) come anywhere close to Adobe when it comes to net income margins.” But, he said, “As we dig deeper into Adobe's strategy and capital allocation, some major problems begin to surface.”

“It is no secret to anyone that Adobe has been on an acquisition spree over the past decade or so,” wrote Dimitrov. He stated, “Adobe has been following this strategy to support its sales growth by adding a number of platforms to its portfolio - from video collaboration to marketing, commerce and project management.” However, he said that this points to the fact “that Adobe was late in its efforts to develop cloud-based collaboration platforms and had to play catch-up in many of its verticals.”

Looking at Adobe’s most recent M&A activity, Dimitrov is worried. “The most recent deal for Figma, however, is orders of magnitude larger than Adobe's previous deals,” he said. He mentioned that the size of this deal “significantly increases integration risk” for Adobe and also points towards the idea that the firm overpaid for its target.

Dimitrov highlighted Adobe’s capital allocation strategy regarding stock buybacks and share based compensation as the cause for his concern. He states that Adobe spends nearly all of its free cash flows to buy back shares. “In and of itself, this is concerning to me,” Dimitrov wrote, “but we should also consider that this massive amount spent on share repurchases - more than $23bn since 2012, did little good to existing shareholders.” He noted that Adobe’s outstanding share count only fell by 8% over the last decade and signaled that the cash spent on these buybacks could have been more productively used elsewhere.

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

Dimitrov concluded his report by stating, “On the surface, Adobe appears as a very attractive long-term opportunity - a highly profitable and sticky business model that also appears to be trading near fair value.” But, he continued, “I am still having a hard time rating ADBE as a buy”.

Overall bias of Nobias Credible Analysts and Bloggers:

In terms of the credible authors that the Nobia algorithm tracks, Dimitrov is in the minority with his cautious stance. 58% of recent articles published on ADBE shares by credible authors have expressed a “Bullish” bias. Yet, when it comes to the credible Wall Street analysts that the Nobias algorithm follows who have expressed an opinion on Adobe, all price targets are bearish.

Currently, all three credible analysts have price targets that signal a falling share price and their average price target is $352.00. Today, ADBE shares closed at $358.14 and therefore, that credible analyst average price target implies downside potential of approximately 1.7%.

Disclosure: Nicholas Ward is long ADBE. Nicholas Ward wrote this article for Nobias at their request with the intention of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.