Case Study: Nike (NKE) stock according to high performing analysts

Key Points

Performance

Nike shares have risen by 7.00% during the last week, pushing their year-to-date gains up to 5.78%.. This compares favorably to the S&P 500 which is up by 4.34% on a year-to-date basis thus far.

Event & Impact

Nike posted fiscal 2023 third quarter results this week, beating Wall Street estimates on both the top and bottom lines. During Q3, NKE’s revenue totaled $12.39 billion, beating Wall Street’s consensus estimate by $910 million. Nike’s Q3 GAAP earnings-per-share came in at $0.79, beating Wall Street’s consensus estimate by $0.25/share.

Noteworthy News:

Nike posted strong regional sales, with direct-to-consumer and wholesale initiatives working. The company continued to work through its post-pandemic inventories during the quarter, which weighted on margins. But, management is bullish moving forward, raising full-year sales guidance during the Q3 report.

Nobias Insights

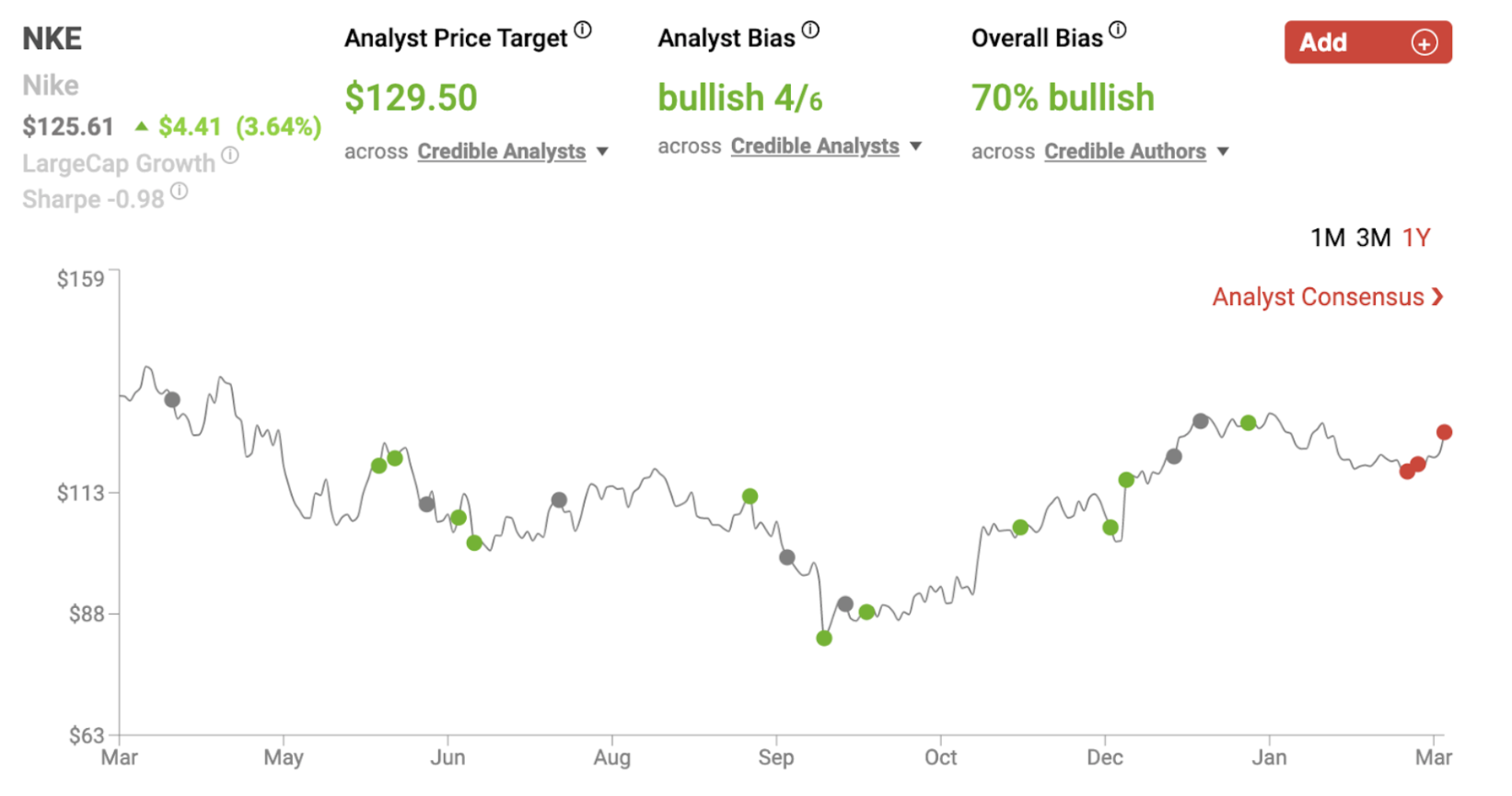

70% of recent articles published by credible authors focused on Nike shares offer a “Bullish” bias. 4 out of the 6 credible Wall Street analysts who cover NKE believe shares are likely to rise in value. The average price target being applied to Nike by these credible analysts is $129.50, which implies upside potential of approximately 3.1% relative to the stock’s current share price of $125.61.

Bullish Take Shoshy Ciment, a Nobias 4-star rated author, said, “The athletic giant reported Q3 revenues of $12.4 billion, up 14% from the same time last year and ahead of expectations from analysts surveyed by Yahoo.”

Bearish Take Ananya Mariam Rajesh, a Nobias 4-star rated author, said, “Nike's shares fell 2% in extended trading on Tuesday after the company said it expects 2023 gross margin to decline about 250 basis points, at the low end of its previous forecast range.”

NKE Mar 2023

Nike (NKE) reported its fiscal 2023 third quarter results on Tuesday, beating Wall Street estimates on both the top and bottom lines. Also, Nike management raised full-year sales guidance, resulting in a beat and raise quarter. Yet, Nike’s share price is falling in the after hours on Tuesday evening, seemingly due to margin headwinds.

Looking at the sentiment being expressed towards NKE shares by both the credible authors and the credible Wall Street analysts that the Nobias algorithm follows, this post-earnings dip appears to represent a buying opportunity. Both groups of credible individuals are collectively bullish on Nike shares moving forward.

Bullish Nobias Credible Analysts Opinions:

Shoshy Ciment, a Nobias 4-star rated author, published a review of Nike’s third quarter results at newsbreak.com. She said , “The athletic giant reported Q3 revenues of $12.4 billion, up 14% from the same time last year and ahead of expectations from analysts surveyed by Yahoo.”

Ciment continued, “Net income was $1.2 billion, down 11% compared to the prior year.” She also noted, “Diluted earnings per share were $0.79, down 9% over the same time last year, but also ahead of analysts’ expectations for the quarter.” She mentioned the company’s wholesale segment as a particular bright spot during the quarter, with sales rising by 18% on a year-over-year basis, and she showed that this strength could continue as Nike continues to invest in wholesale partnerships alongside its direct-to-consumer ambitions.

“And just yesterday,” Ciment added, “Foot Locker said it has reignited a strong partnership with Nike , which previously indicated a move to limit the amount of product it would sell to the retailer. Nike will remain the standout brand in the retailer’s portfolio and will make up between 55% and 60% of Foot Locker’s total sales mix by 2026.”

SGB Media, a Nobias 4-star rated author, touched upon Nike’s operating segment results in the post-earnings report that they published on Tuesday afternoon. The author wrote, “Nike Brand revenues were $11.8 billion, up 14 percent on a reported basis and up 19 percent on a currency-neutral basis, with double-digit growth in North America, the EMEA and APLA. Greater China grew 1 percent on a currency-neutral basis “despite a challenging December following the shift in the country’s COVID-19 policies.”’

They continued, “Converse revenues were $612 million, up 8 percent on a reported basis and up 12 percent on a currency-neutral basis, led by double-digit growth across all channels in North America, partially offset by declines in Asia.” “Nike Direct sales were $5.3 billion, up 17 percent on a reported basis and up 22 percent on a currency-neutral basis,” they wrote.

SGB Media also noted, “Nike Brand Digital sales increased 20 percent on a reported basis or 24 percent on a currency-neutral basis.” Lastly, they said, “Wholesale revenues grew 12 percent on a reported basis and 18 percent on a currency-neutral basis.”

Bearish Nobias Credible Analysts Opinions:

Despite Nike’s strong sales growth, shares dipped in the after hours trading season as the market digested the firm’s results and Ananya Mariam Rajesh, a Nobias 4-star rated author, explained why in the article that she published at Reuters on Tuesday.

Rajesh wrote, “Nike's shares fell 2% in extended trading on Tuesday after the company said it expects 2023 gross margin to decline about 250 basis points, at the low end of its previous forecast range.” She continued, “The company's margins remain pressured by a strong U.S. dollar, higher freight costs and Nike's efforts to offer steeper discounts in an attempt to get rid of excess inventory, Chief Financial Officer Matthew Friend said.” Yet, she went on to note that the company raised its full-year top-line growth estimate, implying that larger than expected sales, even with lower margins, could bolster Nike’s full-year bottom-line. “Nike now expects reported revenue for the full year to increase in the high-single-digit range, compared with its previous forecast of growth in the mid single digits,” Rajesh said.

The credible analysts that the Nobias algorithm tracks have been bullish on Nike shares throughout 2023. Kate Fitzsimons, who is a Nobias 5-star rated analyst, recently raised her firm’s price target on shares. According to The Fly on the Wall, “Wells Fargo analyst Kate Fitzsimons raised the firm's price target on Nike to $146 from $135. The firm keeps an Overweight rating on the shares following its global sports apparel & footwear market share analysis given market dominance especially across footwear, and top-line and margin visibility looking to 2024.”

Two 4-star rated analysts also recently raised their price targets on Nike shares. According to The Fly on the Wall, “HSBC analyst Erwan Rambourg raised the firm's price target on Nike to $125 from $100 and keeps a Hold rating on the shares. The analyst remains cautious on sporting goods names but sees "light at the end of the tunnel.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

Also, “Cowen analyst John Kernan raised the firm's price target on Nike to $141 from $131 and keeps an Outperform rating on the shares. The analyst raised his estimates and price target post the holiday period as promotions likely drove incremental top-line upside in N. America.”

Overall bias of Nobias Credible Analysts and Bloggers:

Overall, 4 out of the 6 credible analyst the Nobias tracks who have expressed opinions on NKE shares believe that they’re likely to increase in value. Currently the average price target being applied to Nike by these analysts is $129.50.

Compared to NKE’s closing price on Tuesday, March 21st, 2023, of $125.61, that represents upside potential of approximately 3.1%. Furthermore, 70% of recent articles written on Nike by the credible authors that the Nobias algorithm follows have expressed a “bullish” bias.

Disclosure: Nicholas Ward is long NKE. Nicholas Ward wrote this article for Nobias at their request with the intention of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.