Case Study: JPMorgan (JPM) stock according to high performing analysts

Key Points

Performance

JPMorgan shares rose by 9.35% this week, pushing their year-to-date gains up to 2.67%. Despite this week’s strong gains, JPM has underperformed the S&P 500, which is up 8.20% on a year-to-date basis thus far.

Event & Impact

JPM posted its first quarter results this week, beating Wall Street estimates on both the top and bottom lines. During Q1, JPM’s revenue totaled $38.3 billion, beating Wall Street’s consensus estimate by $2.53 billion. JPMorgan’s Q1 GAAP earnings-per-share came in at $4.10, beating Wall Street’s consensus estimate by $0.69/share.

Noteworthy News:

JPMorgan appears to have performed well throughout the banking crisis period. The company’s CEO, Jamie Dimon, recently said that the crisis isn’t over and will have long-term ramifications for banks; however, the company continues to show financial strength as its deposits and net interest income continue to climb.

Nobias Insights

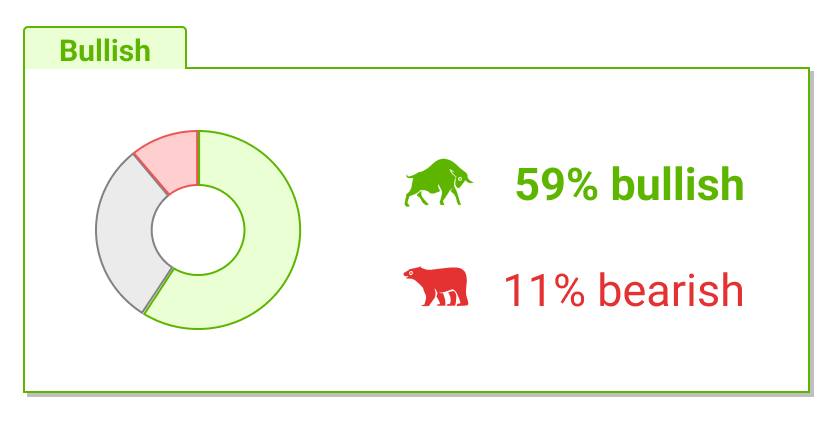

59% of recent articles published by credible authors focused on JPM shares offer a “bullish” bias. Four out of the six credible Wall Street analysts who cover JPM believe that shares are likely to rise in value. The average price target applied to JPMorgan is $148.00, which implies upside potential of approximately 6.7% relative to the stock’s current share price of $138.73.

Bullish Take Harrison Miller, a Nobias 4-star rated author, said, “Deposits were slightly higher at the end of the quarter compared to the end of 2022, up 2% to $2.37 trillion, as depositors poured into the well-capitalized giant,

Bearish Take Rob Starks Jr., a Nobias 4-star rated author, stated, “Although JPMorgan Chase is by far the largest bank in the U.S., even it wasn't immune from the fallout that resulted from last month's collapses of Silicon Valley Bank and Signature Bank, the second- and third-largest bank failures in U.S. history, respectively.”

JPM Apr 2023

Every earnings season is kicked off with the big banks reporting their results. This week we saw a slew of big-bank earnings, including the largest: JPMorgan. This earnings cycle is especially intriguing for investors because it's the first since the banking crisis that played out in recent months.

Bearish Nobias Credible Analysts Opinions:

Jon Hopkins, a Nobias 4-star rated author, recently penned an article which put a spotlight on JPMorgan CEO, Jamie Dimon’s thoughts about the banking crisis. Regarding the crisis, Hopkins wrote, “The recent banking issues in the US began with the collapse of Silicon Valley Bank (SVB), which was closed by regulators on March 10 as depositors pulled tens of billions of dollars from the bank. The smaller Signature Bank was closed two days later. And in Europe, Swiss regulators brokered a purchase of Credit Suisse by UBS.”

“JPMorgan and other large banks stepped in to make $30 billion of deposits at First Republic, another regional lender that investors feared could become the next SVB,” he added. Looking for possible contagion, Hopkins noted, “The stress on the regional banks has led investors and analysts to suggest that the “too big to fail” institutions would be a beneficiary of the crisis, but Dimon said JPMorgan wants to strengthen the smaller banks for the benefit of the whole financial system.”

Hopkins quoted Dimon, who recently published a letter to shareholders, that said, "Any crisis that damages Americans' trust in their banks damages all banks - a fact that was known even before this crisis. While it is true that this bank crisis 'benefited' larger banks due to the inflow of deposits they received from smaller institutions, the notion that this meltdown was good for them in any way is absurd.”

“As I write this letter, the current crisis is not yet over, and even when it is behind us, there will be repercussions from it for years to come,” Dimon said. This rhetoric established a somber mood in the market surrounding JPM shares. Dimon made these comments in early April and at the time, the stock was down approximately 5.5% on a year-to-date basis. Yet, Rob Starks Jr., a Nobias 4-star rated author, recently highlighted JPMorgan’s performance during the recent banking crisis in a Motley Fool article and called the stock a compelling long-term opportunity after its recent weakness.

He wrote, “Although JPMorgan Chase is by far the largest bank in the U.S., even it wasn't immune from the fallout that resulted from last month's collapses of Silicon Valley Bank and Signature Bank, the second- and third-largest bank failures in U.S. history, respectively.” Starks Jr. continued, “The company began March trading at $142.10 but ended it down 9% to $129.30.”

With that sell-off in mind, he asks, is the bank too big to fail? Starks Jr. highlighted the U.S. government’s regulation which is meant to prohibit large financial institutions from failing. He said, “The U.S. government enacted the Dodd-Frank Act in 2010 to prevent banks from taking the same type of ill-considered risks that led to the Great Recession and required taxpayer-funded bailouts. Under the original Dodd-Frank rules, financial institutions holding $50 billion or more in assets were deemed "systemically important."’

“Unfortunately,” he added, “the Trump administration rolled back parts of Dodd-Frank, and boosted the SIFI demarcation line from $50 billion to $250 billion.”Starks Jr. noted that, “Signature Bank had assets of $110.4 billion on the books when it failed, while SVB Financial had total assets of $211.8 billion when it failed”. “In comparison,” he stated, “JPMorgan holds $3.66 trillion in assets -- well above the new SIFI threshold.”

With this in mind, he says that a bank like JPMorgan is under heightened regulatory scrutiny and therefore, less likely to face catastrophic issues. With regulation in mind, he notes that JPMorgan was forced to stop stock buybacks in late 2022 because of financial safety ratios that needed improvement.

“The good news, however, is that it only took a short period for the bank to ramp up its capital reserves to its target Common Equity Tier 1 capital (CET1) of 13% (a level above the Federal Reserve's requirement of 12%),” he added. With all of this in mind, Starks Jr. concluded, “As the fifth-largest bank in the world by total assets, it is literally too big to fail, even though no one in the federal government wants to admit that fact.”

“If JPMorgan came close to collapsing, Washington would likely bail it out rather than risk the damage to the global financial system that would result from its collapse,” he continued. “As a result,” Starks Jr. said, “while its stock price might fall off a cliff during an existential crisis, JPMorgan shareholders would be unlikely to take a total loss, unlike SVB and Signature's shareholders.” Overall, he said, “If you are a buy-and-hold value investor looking for a solid bank stock that offers an attractive dividend, now would be an excellent time to buy this safe-haven stock.”

Bullish Nobias Credible Analysts Opinions:

This week, JPM shares rose by 9.35%, largely due to Friday’s 7.55% rally in response to the company’s Q1 earnings report. Harrison Miller, a Nobias 4-star rated author, covered JPMorgan’s first quarter results in an article that he published this week at Investors.com. In his introduction, Miller stated, “Banks are expected to report strong net interest income and solid lending.” “But,” he asked, “what will they forecast for these key metrics going forward, in the wake of recent turmoil?”

As it turns out, JPMorgan had bullish things to say about its operations. Regarding the company’s earnings results, Miller said, “JPMorgan earnings bolted 55% to $4.10 per share on a 25% leap in revenue to a quarterly record $38.35 billion.”

These numbers soundly beat Wall Street’s expectations for the quarter. Miller wrote, “For Friday's report, analysts expected earnings to jump 29% to $3.41 per share on 17.7% revenue growth to $36.13 billion.”Not only did JPMorgan post strong top and bottom-line growth, but the company showed that it remains strong, from a financial perspective, in the aftermath of the recent regional bank crisis.

Deposits were slightly higher at the end of the quarter compared to the end of 2022, up 2% to $2.37 trillion, as depositors poured into the well-capitalized giant,” Miller said. Higher deposits combined with rising interest rates helped the bank to generate such strong profits.

According to Miller, JPMorgan’s “Net interest income spiked 49% to $20.9 billion, and it raised its net interest income forecast to $81 billion for the full year.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

Nobias hasn’t seen any of the credible Wall Street analysts that it tracks update their opinions on JPM shares since its Q1 report was published on Friday morning; however, coming into the report 4 out of the 6 credible analysts who follow the stock believed that shares were likely to rise in value.

Overall bias of Nobias Credible Analysts and Bloggers:

The most recent credible analyst upgrade was posted on March 13, 2023 by Mike Mayo, a Nobias 5-star rated analyst from Wells Fargo, who upgraded the stock from “Equal Weight” to “Overweight”, raising his price target from $148.00 to $155.00.

Currently, the average price target being applied to JPM shares is $148.00. After the stock’s 9%+ rally this week, JPM shares trade for $138.73. Therefore, the credible analyst community believes that there is more room for shares to run; their $148.00 price target implies upside potential of approximately 6.7%. The credible author community is also bullish on JPM shares; 59% of recent articles published by credible authors have expressed a “Bullish” bias towards JPMorgan.

Disclosure: Nicholas Ward has no JPM position. Nicholas Ward wrote this article for Nobias at their request with the intention of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.