FB, TWTR and SNAP with Nobias Technology: Case Study on two Social Media companies

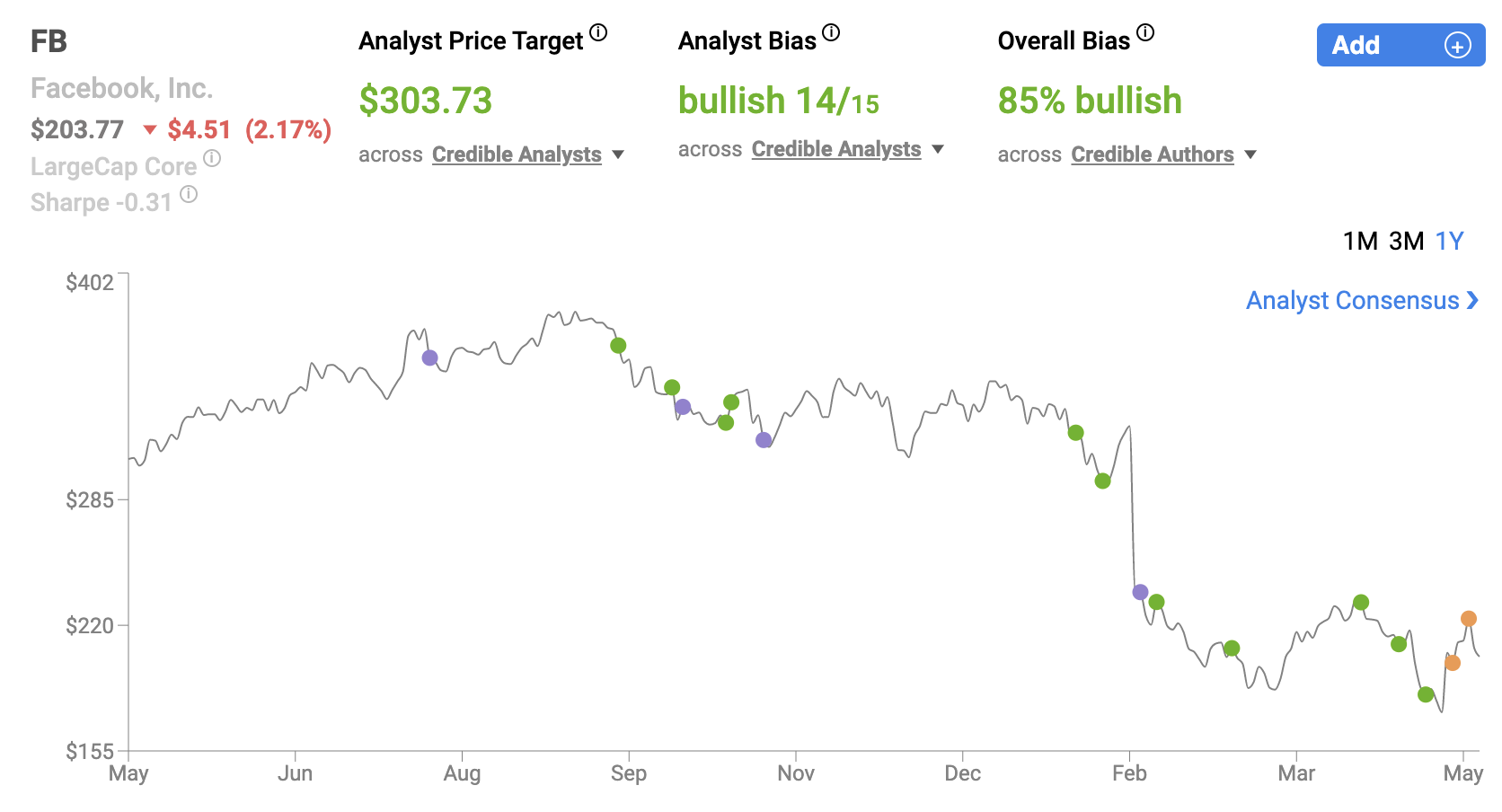

Last week, we provided an update on Meta Platorm’s (FB) recent sell-off, its Q1 results, the ensuing rally, and the bias that we’re seeing amongst the credible authors and analysts that the Nobias algorithm tracks. In the report, we stated, “86% of the recent reports that we’ve seen published by credible authors came with a “Bullish” bias attached.”

Last week, we provided an update on Meta Platorm’s (FB) recent sell-off, its Q1 results, the ensuing rally, and the bias that we’re seeing amongst the credible authors and analysts that the Nobias algorithm tracks. In the report, we stated, “86% of the recent reports that we’ve seen published by credible authors came with a “Bullish” bias attached.”

We also noted that: “In response to these earnings, FB shares rallied 17.59% on Thursday. The stock ended the trading session at $205.73. And yet, even with this 17.59% rally in mind, that $205.73 closing price is still significantly lower than the average price target being applied to shares by the credible Wall Street analysts that the Nobias algorithm tracks. That average price target currently sits at $318.40, which implies upside potential of 54.77% from the stock’s current share price.”

The current rally has continued. Today, FB shares trade for $223.41. And, the changing sentiment surrounding this stock has inspired us to take a look at a couple of Meta’s largest competitors, Snap Inc. (SNAP) and Twitter (TWTR) to see what the credible authors and analysts that we track think about these two companies as well.

Nobias covered Twitter recently as well, highlighting the then rumor, and eventual news, regarding Elon Musk’s attempt to take the company private. In those reports, we highlighted the relatively negative sentiment surrounding TWTR shares. While the vast majority of credible authors have expressed bullish opinions on FB recently, the same cannot be said of TWTR. Right now, 87% of recent articles that we’ve tracked recently have expressed “Bullish” bias towards FB stock. TWTR, on the other hand, has seen 60% of recent reports express a bearish bias.

FB May 2022

Furthermore, the current consensus price target for Meta shares amongst the credible analysts that we track is $298.88. This implies upside potential of approximately 33.8% relative to the stock’s current price. Right now, the average price target being applied to TWTR shares is $49.90, well below Musk’s proposed takeover price of $54.20, and essentially in-line with the stock’s current share price of $49.06 (the average price target being applied to TWTR represents upside potential of just 1.7%).

In a recent article published by Nobias 4-star rated author, Vlad Savov, some of the potential roadblocks to Musk’s grand plans for Twitter were brought to light. Savov touches upon Musk’s vision to use Twitter to facilitate free speech; however, he believes that the company may struggle in its biggest growth markets.

Savov wrote, “Asia, home to more than half the world’s population, is Twitter’s biggest growth opportunity and arguably a far thornier challenge. If the Tesla Inc. and SpaceX billionaire makes good on promises to scrap censorship, he’ll encounter a plethora of perplexing regulations, wielded by sometimes authoritarian governments, pushed to the limits by a horde of first-time internet users.”

Regarding the Chinese market specifically, Savov wrote, “Twitter is officially banned in China, but the country will still demand a lot of Musk’s attention. Amazon.com Inc. founder Jeff Bezos alluded to the potential conflicts in a tweet shortly after Musk’s deal, asking “Did the Chinese government just gain a bit of leverage over the town square?” He continued, “The company in 2020 instituted labels for government officials and “state-affiliated media” for publications like Xinhua and Global Times, and readers are reminded of this government-backing any time they like or retweet stories.”

Savov said, “Chinese media have called the practice “intimidation” and already begun to lobby the billionaire to roll it back.” With regard to Musk’s take on free speech, Savov mentioned a Tweet that the billionaire published which stated, “By ‘free speech’, I simply mean that which matches the law. I am against censorship that goes far beyond the law.”

Regarding this Chinese saga, Savov concluded, “Could Beijing also offer up access to its 1.4 billion people? Perhaps under the right terms. They would certainly not include free speech.” Savov brings up similar concerns related to the Indian and other southeast Asian markets, implying that conflicts of interest and regulation could pose problems for the company moving forward.

Brett Molina, a Nobias 4-star rated author, expressed a more bullish outlook on Twitter in a recent report that he published at Yahoo Finance, touching upon initiatives that Musk might take to increase the value and profitability of the Twitter platform.

Molia wrote, “Musk said he could cut executive and board pay to cut costs and find opportunities to monetize tweets, according to a Reuters report.” He continued, “Other changes to the service might include easing content moderation, which Musk has criticized, cutting back on ads, and introducing an edit button.”

Molina said, “One of the big benefits for taking Twitter private is Musk can make changes more quickly without worrying about pleasing shareholders.” And, he quoted Wedbush Securities analyst Dan Ives, who recently said, “We think a subscription service will be key to a potential turnaround for Twitter. We view this as one of the first business model changes to the platform."

Since our last update, Twitter posted its Q1 earnings results. The company missed on the top-line, reporting revenue of $1.2 billion (which was $30 million below consensus estimates). But, this $1.2 billion sales figure did represent 15.4% year-over-year growth. TWTR’s non-GAAP EPS came in at $0.90/share, beating estimates by $0.87/share. During the quarter, Twitter’s advertising revenue increased by 23%, totaling $1.11 billion.

The company noted that, “Costs and expenses totaled $1.33 billion, an increase of 35% year-over-year. This resulted in an operating loss of $128 million and -11% operating margin, compared to an operating income of $52 million or 5% operating margin in the same period of the previous year.”

Furthermore, Twitter said, “Stock-based compensation (SBC) expense grew 60% year-over-year to $177 million and was approximately 15% of total revenue.” However, while costs were on the rise, so were users. Twitter stated, “Average monetizable daily active usage (mDAU)[2] was 229.0 million for Q1, up 15.9% compared to Q1 of the prior year.” The company noted that average U.S. mDAU’s were up 6.4% and average international mDAU’s were up 18.1%.

TWTR shares are relatively flat since posting these results. They’re down 0.39% during the last week. Therefore, it appears that the merger arbitrage game is limiting potential upside here. However, another social media platform also recently posted Q1 results and according to the credible authors and analysts that Nobias tracks, it has relatively attractive upside.

Albert Lin, a Nobias 4-star rated author, recently published an article at Seeking Alpha breaking down Snap’s earnings, which he called a “Mixed Bag”. Lin touched upon the results, saying, “Snap reported 1Q22 total revenue of $1.06 billion (+37.8% Y/Y) and non-GAAP EPS of -$0.02 which both came short of Street expectations of $1.07 billion and $0.01. Adj. EBITDA for the quarter was $64 million (vs. $22 million Street and guidance of breakeven), representing an adj. EBITDA margin of 6%.”

SNAP’s revenue totaled $1.06 billion during the quarter, up 38% y/y. Lin continued, “For 2Q22, the social media company guided revenue growth of 20-25% YoY (vs. +27% YoY Street) and adj. EBITDA of $0-50mm, short of Street estimates of $144 million.” SNAP said, “Daily Active Users increased 18% year-over-year to 332 million”. Lin touched upon this, saying, “this compares less favorably to the company's multi-quarter record of 20%+ growth.” Like TWTR, the majority of SNAP’s growth is coming from international markets.

Lin wrote, “Digging deeper into the user base, we can see growth stalling in North America where DAUs increased just 5% YoY in Q1 and 1% QoQ over the last 3 quarters.” He continued, “DAU growth in Rest of World appears to be picking up the slack in North America and Europe by contributing 10 million incremental users in Q1.”

But, Lin points out that this relative growth scenario isn’t ideal. He wrote, “However, RoW ARPU remains significantly below North America at just $0.95 vs. $7.77 in the quarter. In my view, the structurally lower revenue per user outside of Snap's core North American market poses a challenge to incremental revenue acceleration as the US market eventually slows.”

Ultimately, regarding SNAP (and the entire social media industry as a whole), Lin concluded, “Considering the company is yet to turn a profit, I believe investors are unlikely to stick with the stock through thick and thin under a hawkish Fed. That said, I would generally stay on the sidelines and recommend investors to do the same for all social media stocks including Twitter (TWTR), Pinterest (PINS) and Meta (FB).”

Irfan Ahmad, a Nobias 5-star rated author, recently published a much more bullish perspective, highlighting SNAP’s strong user growth and its leadership in the augmented reality market, saying that its Q1 results were “promising to say the least.”

Ahmad noted the higher ARPU that SNAP generates in international markets, but stated, “Keeping that point aside, Snap is still flourishing as the more users it has, the more the ads are viewed. Furthermore, this attracts more members to join in with promising aspects.” He continued, “Speaking of usage trends, Snap is doing quite well on that front, especially in regards to AR tools. Today, nearly 250 million users engage via AR elements on a routine basis. Similarly, more than 250,000 creators have used the Lens Studio to design 2.5 million Lenses, keeping creativity at an all-time high.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

Ahmad continued, “This growing interest in AR Tools is another indication of how Snap could further benefit by venturing into the realm of creativity while keeping in mind the latest trends.” He stated, “It’s no surprise that both tech giants Apple and Meta are far ahead of the race because they’ve got more resources on hand. But despite this, Snap proves that it’s far better than them when it comes to staying on top of trends.”

And, he concluded, “Remember, most AR trends of today have stemmed all thanks to Snapchat and if it continues to work its magic with more AR tools, it could very well remain a leader in the market.” Overall, the consensus amongst the credible authors that Nobias tracks leans bullish when it comes to Snap Inc. 75% of recent articles published by such authors have expressed a “Bullish” bias.

The average price target currently being applied to SNAP shares by the credible Wall Street analysts that we track also implies bullish sentiment. SNAP’s current share price is $30.16. The average analyst price target that we track is currently $50.32. This implies upside potential of approximately 66.8%. Therefore, according to the credible analysts that we track, when comparing Meta, Twitter, and Snap, there is a clear winner: SNAP, with upside of nearly 67%.

Disclosure: Of the stocks discussed in this article, Nicholas Ward is long FB. Nicholas Ward wrote this article for Nobias at their request with a view of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

TSLA With Nobias Technology: Case Study on Tesla

Throughout 2022, Tesla (TSLA) shares have posted rare underperformance. However, last week the company posted first quarter earnings results which beat analyst consensus estimates on both the top and bottom lines. Shares rallied on the heels of those results while the Nasdaq sold off and we saw several credible authors/analyst post updated opinions on the company’s shares.

Throughout 2022, Tesla (TSLA) shares have posted rare underperformance. However, last week the company posted first quarter earnings results which beat analyst consensus estimates on both the top and bottom lines. Shares rallied on the heels of those results while the Nasdaq sold off and we saw several credible authors/analyst post updated opinions on the company’s shares.

Nobias 5-star rated author, Brandon Michael, recently published an article at Nasdaq.com which highlighted Tesla’s operations.

He wrote, “Being the poster child of the electric vehicle (EV) industry, Tesla would be no stranger to most investors. Put simply, Tesla designs, develops, sells, and leases electric vehicles and energy generation and storage systems. To create an entire sustainable energy ecosystem, it manufactures a unique set of energy solutions, Powerwall, Powerpack, and Solar Roof to enable consumers to transition to a green energy future.”

He continued, “As the automotive industry evolves to become greener, electric vehicles (EVs) have been leading the charge. Therefore, as the EV transition continues to accelerate, EV stocks could be worth a look in the stock market.”

In a recent article titled, “Tesla Is Up By 8%, Here Is Why”, Nobias 4-star rated author, Vladimir Zernov, broke down the company’s recent Q1 results saying, “Shares of Tesla gained strong upside momentum after the company released its first-quarter report. The company reported revenue of $18.76 billion and adjusted earnings of $3.22 per share, easily beating analyst estimates on both earnings and revenue.”

Zernov highlighted Tesla’s margins, which were a big part of the bullish Q1 storyline, saying, “The company noted that its operating margin was 19.2%, which was a material improvement from the operating margin of 14.7% in the fourth quarter of 2021. The comparison on a year-over-year basis is even more favorable, as operating margin was just 5.7% in the first quarter of 2021.”

Looking ahead, Zervov said, “Analysts expect that Tesla will report earnings of $10.56 per share in the current year and earnings of $13.72 per share in the next year, so the stock is trading at 76 forward P/E. However, earnings estimates keep moving higher, so traders are not worried about the rich valuation of the company.” He concluded, “The major improvement in the operating margin may serve as a longer-term positive catalyst for Tesla stock as it shows that the company’s profits could grow at a fast pace.”

TSLA April 2022

Samed Olukoya, a Nobias 4-star rated author, also recently covered Tesla’s Q1 earnings result in a recent article. Regarding the company’s $18.76 billion sales figure, Olukoya wrote, “The amount represents an 81 percent year-on-year increase when compared to $10.4 billion reported in the same period of 2021.” He continued, “According to the manufacturer, $16.86 billion of the total revenue, was generated from its automotive unit, an increase of 87% from the first quarter of 2021.”

Olukoya touched upon the company’s bottom-line results as well, writing, “Tesla also announced a $3.3 billion profit for the quarter under review.” Along these lines, he continued, “The company’s automotive gross margins jumped a record 32.9% while gross profit was $5.54 billion in its main segment.”

Olukoya mentioned that emissions credits helped to bolster the company’s results writing, “On emission credit sales to other automakers, the company filed $679 million, up from $314 million reported in Q4, 2021. Emission credit sales are credit sales to other automakers who make less clean vehicles than is required in the European Union area and the United Sales.” He also touched upon the bullish production outlook that Tesla’s CEO, Elon Musk laid out during the quarterly report.

Olukoya quoted Musk who said, “It seems likely that we’ll be able to produce one and a half million cars this year.”

In his piece, Michael touched upon this production target writing, “Financials aside, Tesla also remains confident in growing its vehicle delivery figures by 50% over 2021 numbers.”

Even with this strong Q1 beat in mind, TSLA shares are down 16.23% on a year-to-date basis. However, this short period of underperformance is a relative blip on the long-term radar for this company. TSLA shares are up 1531% during the last 5 years. They’re up nearly 15,400 during the last decade.

In short, Tesla has been one of the best performing equities in the entire market since its IPO, prompting Nobias 4-star rated author, Howard Smith, to recently pen an article titled, “Is It Too Late To Buy Tesla Shares?”

Howard wrote, “Valuation has always been the knock on Tesla from those who shunned the stock. After today's jump, Tesla is being valued with a market cap of $1.1 trillion. With a net income of about $5.5 billion in 2021, that gives it a trailing price-to-earnings (P/E) ratio of 200.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

However, Howard continued, “But revenue in the first quarter of 2022 soared 81% year over year. And net income in the quarter was $3.3 billion. That elevated P/E will drop quickly if it continues to have results like it just produced. The company itself says it expects vehicle deliveries to be able to grow at a 50% rate annually for several years to come.”

Looking at the Q1 results, Howard said, “Based on the most recent quarter, that might be a conservative prediction.” Ultimately, he concluded, “Investors who buy it would need to have patience and expect volatility, however. That might mean it's not for everyone, but today's stock jump isn't a reason on its own to avoid the stock.”

Overall, the majority credible authors that the Nobias algorithm follows agrees with the bearish sentiment. 65% of recent reports that we’ve seen published by such authors have expressed a “Bearish” bias while credible analysts are bullish.

Looking at the credible Wall Street analysts that we track (only those with 4 or 5-star ratings) the average price target currently is $962. Relative to TSLA’s current share price of $870, this represents limited upside potential.

Therefore, it appears that much of the recent growth has already been priced into TSLA price estimates, though it is certainly possible that we see TSLA’s average price target rise as analysts factor in the recently reported Q1 figures into their evaluation models.

Disclosure: As of the writing of this article, Nicholas Ward has no TSLA position; however, because of TSLA’s Q1 beat, he may initiate a long position in the near future. Nicholas Ward wrote this article for Nobias at their request with a view of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

TWTR With Nobias Technology: Case Study on Twitter

With the world’s richest man, Elon Musk, making a significant investment in Twitter (TWTR) shares and then offering to take the company private with a buyout offer, TWTR shares have been on a volatile ride in recent weeks. Prior to Musk’s offer, Twitter was trading for less than $40/share. Then, they rallied up to approximately $53, before trending lower to their current share price of $48.93.

With the world’s richest man, Elon Musk, making a significant investment in Twitter (TWTR) shares and then offering to take the company private with a buyout offer, TWTR shares have been on a volatile ride in recent weeks. Prior to Musk’s offer, Twitter was trading for less than $40/share. Then, they rallied up to approximately $53, before trending lower to their current share price of $48.93.

Leo Sun covered the recent Must/Twitter saga in a recent article published at The Motley Fool. Sun said, “Twitter's stock recently went on a roller-coaster ride after Elon Musk -- who previously took a 9.2% stake in the social media company -- offered to buy all of its remaining shares for $54.20 apiece in a $43 billion deal. It's unclear if Musk is actually serious about buying Twitter, but its stock had delivered unimpressive growth for years before his abrupt bid.”

But, even with TWTR’s recent rally, Sun points out that the stock’s long-term performance has been underwhelming. He wrote, “Twitter went public on Nov. 7, 2013, at $26 per share and opened with a 74% gain at $45.10. But as of this writing, it still only trades in the high $40s.” Sun continued, “Investors who bought some IPO shares could have turned a $1,000 investment into about $1,800 today, but the same amount invested in an S&P 500 index fund during the same period would be worth roughly $2,500 now.”

TWTR April 2022

Sun then highlighted Twitter’s historical monthly active users (MAU) growth trends, ultimately, pointing out that this social media company is much smaller than its peers. He put a spotlight on Twitter’s early success with regard to MAU growth, pointing to the strong double digit that the company generated shortly after its IPO. He said, in 2013, Twitter’s MAU growth was 30. In 2014, that figure was 20%. And, in 2015, Twitter posted year-over-year MAU growth of 11%.

With growth slowing, Sun mentioned that “Founder and early CEO Jack Dorsey returned to succeed Costolo, but Twitter still struggled to gain new users. Its MAUs dipped to 319 million in 2016, rose to 330 million in 2017, but fell to 321 million in 2018.”

Sun continued, saying, “In 2019, Twitter stopped disclosing its MAUs altogether and rolled out a new metric: monetizable daily active users (mDAUs). It claimed that mDAUs filtered out the spam, bot, and inactive accounts which made it difficult for advertisers and investors to gauge its true engagement rates.” “But,” he contiued, “that change also revealed just how tiny Twitter was. Twitter ended 2019 with 152 million mDAUs. That figure rose 27% to 192 million in 2020 and grew another 13% to 217 million in 2021, but it's still a lot smaller than Snapchat, which ended last year with 319 million DAUs.”

Sun note that in early 2021, Twitter provided medium-term guidance, calling for 315 million mDAU by the end of 2023. He said, “It also declared it could more than double its annual revenue from $3.7 billion in 2020 to over $7.5 billion in 2023.”

This was great news for bulls; however, Dorsey recently left his position as Twitter CEO to focus on running Block (SQ), another company that he founded, which, as Sun says, “cast doubts” on the company’s ability to hit these 2023 targets.

Regarding Musk’s recent investing in TWTR, Sun said, “Musk, a vocal critic of Twitter's censorship policies, was initially appointed to its board of directors upon disclosing his initial stake in early April. But he subsequently turned down the offer, publicly mocked the company in a series of now-deleted tweets, and launched a full buyout offer.”

However, Sun says that he doesn’t expect Twitter’s board to accept Musk’s “best and final”offer and he concluded, “Therefore, I predict that Musk will eventually walk away, sell his stake, and Twitter will go right back to where it was before the buyout drama started.”

In other words, Sun believes Twitter’s share price is likely headed back to the $40 area and therefore, investors buying the stock today are putting themselves at risk of significant losses (Twitter currently trades for approximately $48/share).

It appears that Sun isn’t the only credible author that the Nobias algorithm tracks who has this opinion. The Asian Investor also recently published an article at Seeking Alpha offering a bearish opinion on TWTR shares after their recent rally.

They author wrote, “In response to recent developments surrounding Elon Musk and social media company Twitter (NYSE:TWTR), I am changing my recommendation from Twitter from buy to sell. Considering that a full hostile takeover of Twitter is unlikely, I believe it is best for shareholders to sell into the current strength!”

Regarding the likelihood that Twitter will accept Musk’s $54.20/share offer to buy 100% of Twitter, The Asian Investor said, “Board members have a fiduciary duty to evaluate take-over offers and make a determination about whether or not an offer is in the best financial interests of shareholders. I don't believe, at this point, that Twitter will accept Elon Musk's takeover offer and the company might look for another potential acquirer.”

The Asian Investor also believes that it’s possible that Twitter shares will fall back down to the ~$40 area in the near-term, meaning that they offer double digit downside potential in the near-term. They wrote: “In my last work on Twitter, I recommended to buy the social media company due to a strengthening ad business, strong user growth and improving free cash flow in FY 2022. I still believe these reasons are valid reasons to consider Twitter... if there wasn't a takeover offer on the table.

The surge in Twitter's stock price from $39, before the disclosure of Elon Musk's 9.2% stake, to $54 this week gives investors the opportunity to capture a huge takeover premium. If the takeover bid for Twitter gets rejected by the firm's board and Elon Musk officially abandons his hostile takeover of the company, the share price of Twitter is likely to sink back to where it was in March.”

However, we have seen bullish articles posted by credible authors recently as well. Julian Lin published a report on Seeking Alpha recently which highlighted his opinion that TWTR shares offer strong upside potential.

Lin stated, “From a valuation perspective, TWTR trades at only 6x sales. It trades at 55x earnings which does not look cheap, but this is the kind of company where operating leverage can cause the bottom line to grow at a rapid pace once the company decides to slow down investments in growth.” He continued, “Prior to Musk’s involvement, this stock has been a “show me” story, unable to achieve rich multiples in spite of what feels like an inevitable inflection point in monetization. Yet after Musk’s large buy-in, I could see the stock trading up to a 2x price to earnings growth ratio (‘PEG ratio’). TWTR has always seemed to trade based on the promise of future innovation - the presence of Musk makes such a possibility seem ever more likely, and that should be reflected in the valuation.”

Ultimately, Lin said, “Based on the 20% projected revenue growth rate, TWTR might trade at 12x sales, representing 100% upside over the next 12 months.” Regarding near-term risks, Lin says, “There still remains the risk that Musk eventually liquidates his position without any real impact, but the company has a solid balance sheet and is generating cash.” Finally, he states, “I nonetheless am optimistic that Musk can inspire some innovative changes in the company and the stock offers substantial upside in either case.”

Looking at the aggregate opinions of the credible authors and Wall Street analysts that the Nobias algorithm tracks, it’s clear that Twitter remains a battleground stock after the Musk news. Right now, 55% of recent reports published on the stock by credible authors have included a “Bearish” bias. And, looking at the $44.20 average price target being applied to TWTR shares by credible Wall Street analysts, we see that TWTR offers downside potential of approximately 9.6%.

We have seen analysts come out with price targets in the $50 area in recent weeks as the Musk news sinks in, but at this point in time, there is no clear consensus on the direction that credible authors/analysts expect the stock to trend.

UPDATE:

On 4/25/2022 news broke that - contrary to the opinions of the credible authors we originally cited - Twitter’s Board of Directors agreed to be acquired.

A press release published by the PRNewswire stated, “Twitter, Inc. (NYSE: TWTR) today announced that it has entered into a definitive agreement to be acquired by an entity wholly owned by Elon Musk, for $54.20 per share in cash in a transaction valued at approximately $44 billion. Upon completion of the transaction, Twitter will become a privately held company.”

The press release continued, “Under the terms of the agreement, Twitter stockholders will receive $54.20 in cash for each share of Twitter common stock that they own upon closing of the proposed transaction. The purchase price represents a 38% premium to Twitter's closing stock price on April 1, 2022, which was the last trading day before Mr. Musk disclosed his approximately 9% stake in Twitter.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

Elon Musk was quoted saying: "Free speech is the bedrock of a functioning democracy, and Twitter is the digital town square where matters vital to the future of humanity are debated. I also want to make Twitter better than ever by enhancing the product with new features, making the algorithms open source to increase trust, defeating the spam bots, and authenticating all humans. Twitter has tremendous potential – I look forward to working with the company and the community of users to unlock it."

Although TWTR’s Board unanimously approved the takeover, the deal is also subject to shareholder approval. However, the press release stated that the deal is expected to close in 2022 now that Musk has funding lined up.

To finance this $44 billion deal, the release stated, “Mr. Musk has secured $25.5 billion of fully committed debt and margin loan financing and is providing an approximately $21.0 billion equity commitment. There are no financing conditions to the closing of the transaction.”

News that Musk used his personal Tesla (TSLA) stake as a part of a margin loan to secure funding caused Telsa shares to fall by 12.18% on 4/26/2022. Twitter closed the trading day on 4/26/2022 at $49.68. The proposed buyout price of $54.20 represents upside of approximately 9.1%.

As of 4/27/2022, the average price target being applied to TSLA shares by the credible Wall Street analysts that the Nobias algorithm tracks is $1010.00. After yesterday’s 12% sell-off, TSLA shares closed the trading day at $876.42. Relative to this closing price, the average price target discussed above represented upside potential of approximately 15.2%.

Disclosure: Of the stocks mentioned in this article, Nicholas Ward is long SQ. Nicholas Ward wrote this article for Nobias at their request with a view of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

JPM With Nobias Technology: Case Study on J.P.Morgan

J.P. Morgan (JPM) shares are down 18.91% on a year-to-date basis. During the last 30 days, JPM shares are down 6.16%. Although JPM has been surrounded by negative sentiment (from traders) throughout 2022, the credible authors and analysts tracked by the Nobias algorithm maintain a bullish bias on shares. The company reported Q1 earnings last week.

J.P. Morgan (JPM) shares are down 18.91% on a year-to-date basis. During the last 30 days, JPM shares are down 6.16%. Although JPM has been surrounded by negative sentiment (from traders) throughout 2022, the credible authors and analysts tracked by the Nobias algorithm maintain a bullish bias on shares. The company reported Q1 earnings last week. Richard Saintvilus, a Nobias 4-star rated author, published an earnings preview piece at Nasdaq.com.

Saintvilus wrote, “Offering a nice mix of earnings growth, income and value, JPMorgan Chase (JPM) has enjoyed a well-deserved reputation as being the best-executing bank among its peer group. However, its business is intricately tied to the U.S. and to some extent, the global, economy, given its status as the country’s largest bank.”

Regarding the bank’s near-term prospects, he noted, “inflationary pressures on consumers presents a potential headwind, though consumer balance sheets are currently strong and bookended by wage increases.” He also said, “the Federal Reserve has begun to raise interest rates, which bodes well for JPMorgan’s top and bottom forecasts and its net interest margins.”

JPM April 2022

Saintvilus touched upon some of the rationale spurring the negative sentiment that has recently surrounded JPM shares saying, “During its Q4 conference call, JPMorgan management spooked investors by forecasting operation expenditures that were significantly higher than analysts expected. The management team has a solid reputation for capital deployment, and thus I believe the spending should be viewed more as “investments” that are intended to help the bank maintain its leadership position and its ability to outperform its peer group.”

However, he wrote, “High double-digit returns from banks is not out of the question as the Fed being [sic] to raise rates and unwind asset purchases. Combined with its 2.50% dividend yield, which has grown at an average of almost 8% over the last five years, JPMorgan looks like a solid opportunity ahead of earnings.”

Speaking about JPM’s Q1 earnings potential, he said, “For the three months that ended March, analysts expect the New York-based bank to earn $2.69 per share on revenue of $31.08 billion. This compares to the year-ago quarter when earnings came to $4.50 per share on revenue of $30.52 billion.”

BOOX Research, a Nobias 4-star rated author, also touched upon Wall Street’s estimates for Q1 in a recent article, but also highlighted another piece of data: J.P. Morgan’s historical outperformance. BOOX Research wrote, “One of the curiosities about JPM is that the company has a strong record of beating the earnings estimates. Over the past 5 years, quarterly EPS has come in above the consensus in 17 of the last 20 quarters. On the revenue side, the history has been more variable but the point here is to say that it's a good bet that JPM can beat what we view as a low bar of expectations, or at least that the headline results won't have too many surprises.”

Ultimately, however, BOOX maintained a neutral stance on the stock, concluding, “We rate JPM as a hold with a price target for the year ahead at $150.00 per share representing a 13.5x multiple on the current 2022 consensus EPS. While our price target is about 12% higher than the current share price, it's not enough upside in our view to take an aggressively bullish position.”

When JPM reported Q1 results on April 13th, 2022, the company missed Wall Street’s expectations on the bottom-line, but the company managed to beat them on the top-line. JPM reported Q1 revenue of $30.7 billion, beating the consensus estimate by $170 million. This $30.7 billion sales result represented -5.0% year-over-year growth. JPM reported non-GAAP earnings-per-share of $2.63, which missed Wall Street’s expectation by $0.07.

Librarian Capital, a Nobias 4-star rated author, covered the JPM results in a recent article published at Seeking Alpha. They wrote, “JPM's Q1 2022 EPS was 41.4% lower year-on-year and 21.0% lower sequentially, but the underlying trends were actually positive”. They continued, breaking down JPM’s primary metrics. Librarian Capital said that the following metrics were “Normalizing” during Q1.

“Non-Interest Revenues were down 12.4% year-on-year (though up 5.9% from Q4 2021), including double-digit declines in Investment Banking Fees, Principal Transactions, Investment Securities Gains, Mortgage Fees & Related Income and Card Income. The first four can be attributed to an exceptional prior year, while Card Income fell due to higher new account acquisition costs as JPM invests to grow its Card business:”

”Net Interest Revenues grew 7.5% year-on-year and 1.9% from Q4 2021, with improvements in both loan balances and Net Yields (more below).”

“Non-Interest Expense grew 2.5% year-on-year, with structural growth and investments in the cost base offset by lower revenue-related costs.”“Pre-Provision Pre-Tax Profit, which excludes one-off reserve builds/releases, was 13.9% lower than the prior year, but slightly higher than both the preceding quarter than the (mostly) pre-COVID Q1 2020”.

“Provision for Credit Losses was positive $1.46bn, compared to negative figures of $4.16bn in Q1 2021 and $1.29bn in Q4 2021. This consisted of $0.6bn of Net Charge-Offs, no worse than prior quarters, and a reserve build of $0.9bn, compared to large releases before”

“The number of shares was down 3.3% year-on-year but flat sequentially, due to Q1 being the quarter when share incentives are recorded. JPM spent $2.5bn to repurchase 18.1m shares in Q1, but this was offset by 11.0m shares issued for employee compensation.”

“Return on Tangible Common Equity was 16%, lower than prior periods but in line with our (long-term average) assumption.”

“The Common Equity Tier-1 ("CET1") ratio was 11.9%, down from 13.0% in Q4, but near the top of management’s 11-12% target range. It was kept high in the preceding quarter to absorb anticipated charges.”

The author continued, saying that the follow metrics were “Stable, Excluding COVID Boost”:

“Consumer & Community Banking revenues were down 2.3% year-on-year, as higher revenues in Consumer & Business Banking (from higher deposits and client assets) were offset by lower revenues in Home Lending (mortgage activity was high last year due to low rates) and in Card & Auto (higher Card account acquisition costs, lower Auto volumes due to vehicle shortages).”

“Corporate & Investment Banking revenues were down 7.4% year-on-year, primarily due to much lower Investment Banking ("IB") fees for both Debt (down 20%) and Equity (down 76%) underwriting. IB Advisory fees were up, and Markets revenues were only 3% lower year-on-year. There was also a $524m loss in Credit Adjustments & Other, due to spreads widening and credit valuation adjustments (including on Russia-related exposure).”

“Commercial Banking revenues were up 0.2% year-on-year, with lower IB revenues being offset by higher payments revenue and deposits.”

“Asset & Wealth Management revenues were up 5.8% year-on-year, due to growth in deposits and loans, higher management and performance fees, and the absence of valuation gains in the prior year.”

Ultimately, the author concluded, “We upgrade our rating on JPMorgan Chase & Co. stock to Buy.” Librarian Capital laid our their bullish thesis saying: “Q1 results support the 16% Return on Tangible Common Equity we assume. With shares trading at 1.8x Tangible Book Value, this implies a 11.3x P/E. With shares at $126.12, we expect an exit price of $198 and a total return of 73% (16.8% annualized) by 2025 year-end.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

Bram Berkowitz, a Nobias 4-star rated author, also recently published a bullish article on J.P. Morgan highlighting a specific area of the company that he expects to outperform. Berkowitz touched upon a series of headwinds impacting major financial institutions like JPM, but ultimately arrived at an attractive catalyst for shares, saying, “A lot of conflicting factors, such as rising interest rates, the normalization of credit, inflation, and Russia's ongoing invasion of Ukraine, could continue to make earnings unpredictable this year. However, one division at JPMorgan Chase that looks like it may perform better than initially expected this year is the corporate and investment bank (CIB).” He continued, “JPMorgan's CIB generated roughly $13.5 billion of revenue in the first quarter of this year, down about $1.1 billion from the remarkable first quarter of 2021 but up nearly $2 billion from the previous quarter.”

Berkowitz points out that there are headwinds for JPM’s CIB operations, writing, “One area of CIB that struggled a lot, however, is investment banking, which includes M&A Advisory and equity and debt underwriting. The struggles are not a surprise, as the volatile markets and war in Ukraine have brought M&A and initial public offerings (IPOs) to a screeching halt.” It’s unclear as to when M&A activity is going to pick back up (largely due to macro uncertainty and shaky management confidence sentiment); however, Berkowitz said, “Ultimately, equity and fixed-income trading is looking better than anticipated, while investment banking is struggling but perhaps will pick up later this year if conditions improve. On a net-net basis, I expect CIB revenue to come in better than initially thought this year.”

Overall, the vast majority of credible authors that we track with the Nobias algorithm share this bullish outlook while analysts are neutral. 92% of recent articles published by credible authors have included a “Bullish” bias. Of the credible Wall Street analysts that we track (only those with 4 and 5-star Nobias ratings) the average price target being applied to JPM shares right now is $154.33. Today, JPM shares trade for $131.12/share, meaning that this average price target implies 17.7% upside potential.

Disclosure: Nicholas Ward has no JPM position. Nicholas Ward wrote this article for Nobias at their request with a view of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

BLK With Nobias Technology: Case Study on BlackRock

BlackRock (BLK) posted its Q1 earnings last week. The company missed Wall Street’s consensus estimate on the top-line when it reported Q1 earnings last week; however, the company’s $4.7 billion revenue result still represented 6.8% year-over-year growth. BLK beat estimates on the bottom-line, posting non-GAAP earnings-per-share of $9.52, which came in $0.65/share ahead of the consensus analyst target.

BlackRock (BLK) posted its Q1 earnings last week. The company missed Wall Street’s consensus estimate on the top-line when it reported Q1 earnings last week; however, the company’s $4.7 billion revenue result still represented 6.8% year-over-year growth. BLK beat estimates on the bottom-line, posting non-GAAP earnings-per-share of $9.52, which came in $0.65/share ahead of the consensus analyst target.

During Q1, BLK’s EPS was up 20% on a diluted basis and 18% on an adjusted basis. At the end of Q1, BlackRock’s assets under management totaled $9.56 trillion. This was down from the $10.01 trillion that the company reported at the end of the fourth quarter. However, it was up on a year-over-year basis, compared to Q1 2021’s AUM total of $9.37 trillion. During Q1, BlackRock saw $86.3 billion of total net inflows. The company also highlighted $114 billion of “quarterly long-term net inflows”, which it said, “reflect[s] strength of broad-based platform with positive flows across all product types, investment styles and regions”.

With regard to BLK’s ~7% revenue growth, the company highlighted, “strong organic growth and 11% growth in technology services revenue, partially offset by lower performance fees”. During the Q1 earnings conference call, BlackRock’s CEO, Larry Fink, touched upon the ongoing strength that the company is seeing with its flagship iShares ETF brand, saying, “In the first quarter, we once again saw investors using ETFs to quickly allocate capital and the managed risk during periods of volatility. In the US, iShares’ secondary trading volumes were up nearly 40% compared to 2021 levels providing clients worldwide with the liquidity they needed in volatile markets.”

BLK April 2022

Fink noted that BLK’s ETF segment saw $56 billion in net inflows during the quarter, “with growth coming from each of our major product categories, including core strategic and precision ETFs.” During the conference call, BLK’s CFO, Gary Shedlin, highlighted the company’s strong operational results and then put a spotlight on shareholder returns saying, “Our capital management strategy remains, first, to invest in our business and then to return excess cash to shareholders through a combination of dividends and share repurchases.”

Shedlin continued, “We previously announced an 18% increase in our quarterly dividend to $4.88 per share of common stock and repurchased $500 million worth of common shares in the first quarter. At present, based on our capital spending plans for the year and subject to market conditions, including the relative valuation of our stock price, we still anticipate repurchasing at least $375 million of shares per quarter for the balance of the year consistent with our previous guidance in January.”

However, all of this talk of ongoing growth and strong shareholder returns wasn’t enough to buoy the stock. BlackRock shares fell 7.45% last week. This negative performance pushed the stock’s year-to-date performance down to -24.52%. However, even after this short-term weakness, the credible authors and analysts that the Nobias algorithm tracks continue to remain overwhelmingly bullish on BLK shares.

On March 31st, Nobias 4-star author, Cash Builders Opportunities, published an article at Seeking Alpha titled, “JPMorgan And BlackRock: 2 Financial Stocks Worth A Look”. The author touched upon BLK’s year-to-date weakness saying, “As the stock hit an all-time high and the overall uncertainty of the market in general, it makes sense that shares have fallen quite precipitously as of late. I believe that is opening up an excellent opportunity to pick up shares at a much lower price than where we were just a few months ago.”

Cash Builders Opportunities highlighted the company’s fundamental growth saying, “The higher earnings for BLK haven't only been asset appreciation. They have been receiving some massive inflows as well. For 2021, they noted that they had total net inflows of $540 billion. That helped translate into 20% higher revenue for the year and a 20% increase in diluted EPS. EPS from 2020 was $33.82, and in 2021, it came in at $39.18. Analysts are expecting for 2022 that BLK will see $41.40 in EPS.”

With regard to peace of mind during the current inflationary environment that we’re witnessing from a macro perspective at the moment, the author stated, “The growing dividends that beat out inflation are a huge selling point for a longer-term income investor.” With regard to BLK’s dividend growth history, they said, “They are going on 12 years of dividend growth. They did freeze their dividend for several quarters between 2008 and 2009. That resulted in a lack of annual increases, but they also didn't cut their dividend through that period.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

This bullish sentiment is consistent with the aggregate outlook expressed by the 4 and 5-star authors that we track. Of the recent articles focused on BLK shares that have been published by credible authors tracked by the Nobias algorithm, 95% have included a “Bullish” bias.

Nobias 5-star rated Wall Street analyst, James Fotheringtham of BMO Capital, lowered his price target for BLK shares after the company’s earnings report; however, his updated $734 price target still represents ~7% upside from the stock’s current $668.17 share price.

The BMO Capital report stated, “The analyst is cutting his FY22 EPS view by 99c to $40.21 after the company's "low quality" Q1 earnings beat, though he still sees BlackRock as "well positioned for growth" across a broad array of products and themes. Fotheringham adds that the company will continue to steal share from its traditional asset management peers, but its multiple has "limited upside".

Overall, the average price target being applied to BLK shares by the credible analysts (only those with 4 or 5-star Nobias ratings) right now is $918.40. This average price target represents upside potential of approximately 33.5% compared to the stock’s current price.

Disclosure: Nicholas Ward is long BLK. Nicholas Ward wrote this article for Nobias at their request with a view of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

GME With Nobias Technology: Case Study on GameStop the first Meme stock

GameStop (GME) shares have been at the center of the recent “meme stock” craze that we’ve seen develop during recent years. GME shares have experienced massive volatility as traders buy and sell the stock using thesis that are largely based upon sentiment as opposed to the company’s underlying fundamentals. Today, GME shares trade for $146.19, which means that they are down roughly 57.5% from their 52-week high of $344.66. However, during the last month, GME shares have rallied more than 40%, showing that the volatility that they’ve become known for since 2020 remains in place.

GameStop (GME) shares have been at the center of the recent “meme stock” craze that we’ve seen develop during recent years. GME shares have experienced massive volatility as traders buy and sell the stock using thesis that are largely based upon sentiment as opposed to the company’s underlying fundamentals. Today, GME shares trade for $146.19, which means that they are down roughly 57.5% from their 52-week high of $344.66. However, during the last month, GME shares have rallied more than 40%, showing that the volatility that they’ve become known for since 2020 remains in place.

One of the strongest aspects of the bullish thesis for GME shares is the strength of its new leadership. Ryan Cohen is the chairman of GameStop’s Board of Directors and his involvement with the company fuels the bulls’ hopes.

Kevin Dowd, a Nobias 4-star rated author, recently published an article at Forbes which put a spotlight on Cohen and his very successful career. Dowd highlighted Cohen’s history, which began when he co-founded Chewy, a pet-oriented eCommerce site, in 2011, and eventually oversaw that company’s sale to PetSmart in 2017 for $3.35 billion. Later, Chewy IPOed as a stand alone company and during the pandemic period where eCommerce/stay-at-home stocks were all the rage, the company’s market cap soared to more than $50 billion.

GME April 2022

At this point in time, Cohen was minted as a market darling - creating a sense amongst investors that anything he touches, turns to gold. Dowd touched upon Cohen’s plans to take advantage of this sentiment, by investing his billions into other broken down retail plays. One such investment was GameStop. Cohen’s involvement with that company stoked the meme-stock mania that we’ve seen attached to GME shares.

Regarding Cohen’s GME sage, Dowd wrote: “A few months later, Cohen divulged a roughly 10% stake in GameStop, a development the company’s backers greeted with enthusiasm—enthusiasm that helped launch one of the strangest sagas in finance history. The company’s stock soared after Cohen revealed his stake, and it continued to soar to in the months to come, as an informal armada of day-traders and other opportunists attempted a short squeeze that drove the share price up to gob-smacking levels and prompted a cascade of think-pieces pondering whether Wall Street would ever be the same. In April, Cohen was named GameStop’s chairman.

The short squeeze hasn’t quite worked—not yet, at least, not in the way the true believers expected. But the whole affair has been transformative for GameStop. The company’s stock spent most of 2020 trading for less than $10 per share. Today’s it’s above $100, giving GameStop a $7.7 billion market cap and providing the financial firepower required for Cohen & Co. to attempt an ambitious digital transformation.”

The fact that Cohen, and other high level insiders, continue to accumulate GME shares bolsters the bull thesis surrounding this stock. Ed Lin, a Nobias 4-star rated author, recently published an article at Barron’s highlighting recent insider purchases at GameStop. He said, “GameStop (ticker: GME) just saw its third insider stock purchase in as many days, and shares of the videogame retailer soared last week on news of the big buys.”

Lin continued, “GameStop director Alan Attal paid $195,000 on March 24 for 1,500 shares, an average price of $129.91 each, according to a form he filed with the Securities and Exchange Commission that day. Attal, a GameStop director since January 2021, now owns 130,423 GameStop shares.”

Finally, he added, “The other insider GameStop stock buys in recent days—bigger than Attal’s purchase—have been made by Cohen, and director Larry Cheng. Those stock purchases were disclosed on March 22 and 23, respectively. These insider purchases have likely factored into the recent 40% rally that GME shares have experienced.

The company’s recent Q4 report could also be factoring into the rally. When GME reported earnings on March 17th, 2022, the company beat Wall Street estimates on the top-line but missed consensus estimates on the bottom-line. GME posted sales of $2.25 billion, which were up by 6.1% on a year-over-year basis. GME’s non-GAAP earnings-per-share totaled -$1.86, missing estimates by $2.70/share. In other words, Wall Street was expecting a profit during Q4, but GME published a loss.

John Miller, a Nobias 5-star rated author published an article on GameStop, highlighting its recent quarterly results, on Seeking Alpha on March 22, 2022. In his piece, Miller touched upon GameStop’s strong holiday gaming sales, noting a quote by the company’s CEO, Matt Furlong from the Q4 report. Furlong said, “We have learned from the mistakes of the past decade when GameStop failed to adapt to the future of gaming... We've also had to change the way we assess revenue opportunities by starting to embrace, rather than run from, the new frontiers of gaming.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

As great as the growth in gaming was, Miller was quick to point out that GameStop’s valuation remains very speculative. He highlighted the company’s recent fundamentals saying:

Revenue growth in 2021 was about 18% and one could legitimately argue a large part of the growth came from the reversal of Covid effects felt in 2020. Setting this aside, assume revenue growth of 35% to $8.1 billion.

The gross profit percentage in 2021 was 22%, though the trend in the second half of the year was down, primarily on added shipping costs assumed by the company.

SG&A for 2021 was up 13% to $1.7 billion.

Looking forward, Miller used these 2021 figures to formulate a theoretical valuation scenario for the shares, using a 35% revenue growth rate, 22% gross profit margin, and $1.7 billion in SG&A for 2022. He concluded, “The result of these assumptions is $100 million of hypothetical earnings. So, even if the $1.27 billion cash balance were backed out of the $6.9 billion market cap, the price to EBIT multiple would remain above 50. GameStop is substantially overpriced even under the most optimistic of near-term outlooks.”

When looking at the aggregate opinion expressed by the credible authors and Wall Street analysts (only those with 4 or 5-star Nobais ratings) that our algorithm tracks, it appears that the valuation issues surrounding GME shares result in stark pessimism regarding the stock’s prospects. 66% of recent articles published about the stock by credible authors have expressed “Bearish” sentiment. And, the average price target being applied to GME shares by credible analysts that we track is currently $30.00/share. Right now, GME shares trade for $146.19. Therefore, this average price target implies downside potential of nearly 80%.

Disclosure: Nicholas Ward has no GME position. Nicholas Ward wrote this article for Nobias at their request with a view of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

UPS With Nobias Technology: Case Study on UPS, a dividend paying company with growth opportunities

Shares of United Parcel Service, Inc (UPS) fell 6.47% this week. UPS shares are now down 10.55% on a year-to-date basis, underperforming the S&P 500, which has seen its value fall by 6.43% during 2022 thus far. However, even with this underperformance in mind, the credible authors and analysts tracked by the Nobias algorithm remain largely “Bullish” on UPS shares.

Shares of United Parcel Service, Inc (UPS) fell 6.47% this week. UPS shares are now down 10.55% on a year-to-date basis, underperforming the S&P 500, which has seen its value fall by 6.43% during 2022 thus far. However, even with this underperformance in mind, the credible authors and analysts tracked by the Nobias algorithm remain largely “Bullish” on UPS shares.

Sirisha Bhogaraju, A Nobias 5-star rated author recently published an article highlighting her bullish opinion on UPS shares. Bhogaraju began her piece saying, “United Parcel is a leading provider of package delivery services and global supply chain management solutions with an extensive presence in over 220 countries.” She also highlighted the strong performance that UPS shares have generated recently, writing, “UPS shares touched a new all-time high of $233.72 on February 1, as the company beat Q4 expectations, issued a robust outlook and raised its quarterly dividend by 49% to $1.52 per share. This dividend hike marked the largest increase in the company’s history.”

Regarding UPS’s fundamentals, Bhogaraju wrote, “UPS reported Q4 revenue of $27.8 billion, up 11.5% from the prior-year quarter and ahead of analysts’ estimates of $27 billion.” Bhogaraju continued, saying, “Adjusted EPS grew 35% to $3.59, beating analysts’ forecasts of $3.09.”

UPS April 2022

Looking ahead, Bhogaraju notes that UPS management expects to see growth continue. Bhogaraju wrote, “UPS expects revenue of about $102 billion in 2022, compared to $97.3 billion in 2021, and adjusted operating margin of about 13.7%, up from 13.5% in 2021.”

Regarding Wall Street’s outlook on the stock, Bhogaraju said, “Overall, the Street is cautiously optimistic on the stock, with a Moderate Buy consensus rating based on 11 Buys, eight Holds and one Sell. The average United Parcel price target of $241.35 suggests 12.42% upside potential from current levels.”

Bhogaraju also covered the upside potential of UPS’s largest rivals, FedEx (FDX) and XPO Logistics (XPO). She said, “The average FedEx price target of $295.75 implies 31% upside potential from current levels.” She also said, “The average XPO Logistics price target of $99.27 implies 30.2% upside potential from current levels. Therefore, as great as UPS’s recent performance has been, it’s clear that the company continues to face strong competition in its industry which could pose a threat to growth moving forward.

Although competition in the logistics space remains fierce, UPS continues to use innovation and forward thinking partnerships to attempt to solve problems, especially with regard to carbon emissions and the “last mile” conundrum that has vexed so many delivery companies (regarding difficulties with the last several miles of deliveries, from large logistics facilities to consumers’ doorsteps in a profitable manner).

In a recent Yahoo Finance article, Nobias 4-star rated author, Nick Carey, highlighted some of UPS’s recent attempts to solve such issues. Carey noted that Luke Wake, UPS vice president of fleet maintenance and engineering, recently told Reuters that the company is trailing roughly 100 electronic bikes, built by the British firm Fernhay, as a means to make last mile deliveries.

Carey wrote, “As well as making public commitments to cut their carbon footprints, package-delivery companies are seeking new ways to cut the cost of last-mile deliveries amid soaring e-commerce orders.” Touching upon one of the benefits of the eBike program, Carey said, “The vehicle is only 36 inches (91 cm) wide, so can legally use bike lanes and enter pedestrian zones that UPS' vans and trucks cannot access. Under normal circumstances, drivers would have to get out of their vehicles, load packages on carts and haul them to customers.”

Carey quoted Wake, who said, "There are more and more opportunities for zero-emission solutions like this that can alleviate inner-city congestion.” Carey also notes that UPS is also working with electric van makers like UK startups Arrival and Tevva, plus U.S. truck maker Xos. It’s this forward-thinking management style which has allowed UPS to generate reliable growth throughout its history.

Khen Elazar, a Nobias 5-star rated author, recently published an article at Seeking Alpha titled, “UPS Is A Decent Addition To Your Dividend Growth Portfolio” which put a spotlight on UPS’s historical results. Regarding UPS’s top-line, Elazar said, “Revenues have shown decent mid-single-digits annual growth over the last decade. It amounted to an 81% increase in sales over the last ten years. The company's growth rate is mainly organic and is derived by a higher volume of shipments and the addition of value-added services to clients. Going forward, the consensus of analysts, as seen on Seeking Alpha, expects UPS to keep growing sales at an annual rate of ~4% in the medium term.”

Moving to the bottom-line results, Elazar continued, “The EPS (earnings per share) has increased at a much faster rate than the company's sales. The company's EPS has almost quadrupled, with a significant almost 50% EPS increase in 2021. The reason for such a fast growth rate was the margin expansion over the past decade and particularly in 2021. It has happened due to the company's additional services, and the price increases we see across the board in logistics. Going forward, the consensus of analysts,, expects UPS to keep growing EPS at an annual rate of ~5% in the medium term.” And, he notes, this operational success has trickled down into the pockets of shareholders via a reliable increasing dividend.

Elazar said, “The dividend is another bright point for UPS investors. The company has been increasing dividends for twelve years, and the reason the streak isn't longer is that it froze its dividend for one year during the financial crisis. The company hasn't reduced the dividend for over twenty years. In 2021, the dividend was raised by 49% in line with the EPS growth to maintain a 50% payout in the coming twelve months. Investors should expect mid-single digits dividend growth rate in line with the company's EPS growth.” He also noted that UPS has used shareholder buybacks to retire approximately 10% of its outstanding shares over the prior decade.

Elazar concluded his article with a bullish outlook, saying, “UPS is a great company across the board. The company shows strong fundamentals that lead to an ever-growing ability to return capital to shareholders in the form of buybacks and dividends. In addition, it has several significant growth opportunities and high barriers to entry. Therefore, I believe that due to the limited risks, UPS is poised to keep performing.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

BOOX Research, a Nobias 4-star rated author, also recently posted a bullish article on UPS at Seeking Alpha. In their article, BOOX noted that UPS shares are trading with a 16.0x forward price-to-earnings ratio, which, in their opinion, represents an attractive entry. BOOX Research wrote: “As it relates to valuation, we note that UPS's current forward P/E ratio and 1-year forward P/E based on the 2023 consensus EPS is below the 5-year average for the multiple closer to 22x. The dynamic can also be observed in UPS's EV to EBITDA multiple at 9.6x and 11.4x on a forward basis, which are both below the 5-year average closer to 13.5x. While the valuation multiples are slightly skewed by depressed earnings during the height of the pandemic in 2020, a more normalized range between 2015 and 2019 closer to 21x still suggests UPS is simply undervalued.”

BOOX’s research highlighted their bullish stance in the conclusion to their note as well, saying: “We rate UPS as a buy with a year ahead price target of $260 representing a forward P/E of 20x on the current 2022 consensus earnings. We like UPS as a unique "blue chip" defined by its leadership position, steady growth, solid fundamentals, and positive long-term outlook. These factors should allow shares to continue commanding a premium to the market with upside to its current valuation. The dividend increase with a yield near 3% adds to the allure of the stock for diversified portfolios.”

Looking at the opinions expressed by the credible authors and Wall Street analysts (only those with Nobias 4 and 5-star ratings) that our algorithm tracks, this bullish sentiment appears to be widely held. 92% of the recent articles published by credible authors have expressed “Bullish” bias. And, looking at the credible analysts that we track, the average price target being applied to UPS shares is $271.67. Relative to UPS’s current share price of $190.97, this consensus price target represents upside potential of approximately 42.25%.

Disclosure: Nicholas Ward has no position in any stock mentioned in this article. Nicholas Ward wrote this article for Nobias at their request with a view of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

UBER With Nobias Technology: Case Study on Uber's Deal with NYC Taxi

Uber (UBER) shares have experienced a significant rally in recent weeks. During the past month, UBER shares are up 17.97%. It appears that much of this bullish sentiment is centered around recent news related to a deal struck between this ride sharing company and taxi companies in New York City. However, even after this recent run-up in share price, UBER shares are still down 18.13% on a year-to-date basis. UBER is down approximately 41.5% from their 52-week highs of $61.50. In the company’s most recent quarter, Uber shifted towards profitability. Since then, we’ve seen a series of analyst upgrades. The credible author and analysts that Nobias tracks with our algorithm continue to express strong bullish sentiment for shares, with an average price target being applied to Uber that represents upside potential of nearly 76%.

Uber (UBER) shares have experienced a significant rally in recent weeks. During the past month, UBER shares are up 17.97%. It appears that much of this bullish sentiment is centered around recent news related to a deal struck between this ride sharing company and taxi companies in New York City. However, even after this recent run-up in share price, UBER shares are still down 18.13% on a year-to-date basis. UBER is down approximately 41.5% from their 52-week highs of $61.50. In the company’s most recent quarter, Uber shifted towards profitability. Since then, we’ve seen a series of analyst upgrades. The credible author and analysts that Nobias tracks with our algorithm continue to express strong bullish sentiment for shares, with an average price target being applied to Uber that represents upside potential of nearly 76%.

In mid-February, Uber posted its Q4/Full-year earnings results, beating analyst consensus estimates on both the top and bottom lines. UBER posted revenue of $5.78 billion, beating Wall Street’s estimate by $420 million, representing 82.3% year-over-year growth. Uber’s non-GAAP earnings-per-share came in at $0.44, beating analyst estimates by $0.77/share.

The company highlighted this profit immediately within the earnings report saying: “Gross Bookings of $25.9 billion, up 51% year-over-year and at the high end of the guidance range. Net income of $892 million, including a $1.4 billion net benefit relating to Uber’s equity investments. Adjusted EBITDA of $86 million was above the guidance range, with Delivery reaching Adjusted EBITDA profitability for Q4”

UBER April 2022

During the Q4 report, Uber’s CEO, Dara Khosrowshahi, said: “Our results demonstrate just how far we’ve come since the beginning of the pandemic. In Q4, more consumers were active on our platform than ever before, Delivery reached Adjusted EBITDA profitability, and Mobility Gross Bookings approached pre-pandemic levels. While the Omicron variant began to impact our business in late December, Mobility is already starting to bounce back, with Gross Bookings up 25% month-on-month in the most recent week.”