Case Study on GameStop (GME) with Nobias technology

GameStop (GME) has played a starring role in the financial news cycle in recent years because of its volatility trading momentum and its leading position in the recent “meme stock” movement. In 2020, GME shares rallied from approximately $1.00/share to highs in the $75.00 range. However, GameStop has struggled throughout much of 2022, with shares down by 24.3% on a year-to-date basis.

Summary

GameStop shares rallied by nearly 12% on Friday after the company reported earnings.

GME missed consensus sales estimates during Q2. And, its earnings were negative.

However, the company announced a new crypto partnership which inspired a spike in bullish sentiment.

GameStop (GME) has played a starring role in the financial news cycle in recent years because of its volatile trading momentum and its leading position in the recent “meme stock” movement. In 2020, GME shares rallied from approximately $1.00/share to highs in the $75.00 range. However, GameStop has struggled throughout much of 2022, with shares down by 24.3% on a year-to-date basis.

The stock was up nearly 12% on Friday in response to its Q2 earnings report. However, credible authors and analysts are still extremely bearish on shares. in a recent article at Zacks, Derek Lewis, a Nobias 5-star rated author, summed up the meme-stock mania which broke down Wall Street’s expectations for GME coming into the company’s Q2 report.

The rise of "meme-stocks," Lewis noted, has been one of the market's most fascinating stories in recent years. Out of the group, GameStop was unquestionably the most well-liked, violently shaking the market with a short-squeeze of a rarely seen magnitude. No matter which side you were on, we can all agree on one thing – it was wild. " He goes on to point out that the “wild” momentum that GME shares have benefited from since 2020 has resulted in an abnormally high valuation.

GME Sep 2022

Lewis wrote, “The company’s shares appear elevated in valuation—its forward price-to-sales ratio of 1.4X is well above its five-year median of 0.2X and its Zacks Sector average.” Taking a look at GME’s bottom-line expectations coming into Q2, Lewis said, “the Zacks Consensus EPS Estimate of $0.38 reflects a year-over-year decline of a steep 100%.”

“However,” he continued, “the company’s top-line appears to be in much better shape – GameStop is forecasted to have generated $1.3 billion in revenue throughout the quarter, penciling in a solid 6% Y/Y uptick.”

When GameStop reported its Q2 results on September 7, 2022, the company beat analyst estimates on the bottom line, posting non-GAAP earnings-per-share of -$0.35/share. However, GME missed consensus estimates on the top line, posting $1.14 billion in sales.

Josh Arnold, a Nobias 4-star rated author, covered GME’s Q2 results in a Seeking Alpha article titled, “GameStop's Q2 Earnings Highlight Long-Term Issues”. Arnold began his piece by stating that the primary catalyst for GME’s 2020 bullish momentum has dissipated, leaving him with a bearish outlook on shares. He said, “I’ll be clear and state right up front that the short squeeze happened in early-2021 and is not going to reoccur." GME had short interest levels exceeding 100% of the float then, and shorts were scorched in spectacular fashion. Today’s short interest is around 20%, which is nowhere near high enough for the kind of move we saw earlier. "

Arnold continued, “What we have with GME is a retailer that, to my eye, is struggling to generate cash flow because, at the end of the day, its business is still a relic of the past.” Regarding the Q2 sales trend, Arnold said, “The Q2 report showed a year-over-year revenue contraction of 4%, to $1.14 billion. That’s obviously not the direction investors should want revenue to be moving, and it’s a departure from the past couple of years’ results."

Arnold mentioned that GME has been trying to diversify its revenue stream, moving away from physical game sales and into the collectables market. He stated, “That segment’s share of revenue was almost 20% in Q2, up from 15% a year ago.” Yet, Arnold continued, “That segment is still way too small to stem the tide of declines elsewhere, so the total continues to fall.”

Arnold transitioned from the top-line to the bottom-line, writing, “The second thing I’m concerned about, and even more so than sales, is that the company cannot get its act together from a margin perspective.” Regarding GME’s margin trend, he wrote, “This is ugly as we continue to see quarter after quarter of lower margins." Operating margins haven’t been positive on a TTM basis since 2019. Part of this is that gross margins have tanked and are showing no signs of slowing that descent. " Arnold stated, “Gross profit fell 12% while SG&A costs rose about 2%." That’s a massive deleveraging of SG&A costs and it is exactly the opposite of what GME needs to be showing investors. "

Furthermore, Arnold touched upon his earnings-per-share outlook, saying, “The share count rose by about 40 million in total, which means that if GME can ever achieve profitability again, it will be that much more difficult to move the needle on a per-share basis.”

The recent dilution came from equity sales, and Arnold noted that these moves by management can be viewed as positives. He said, “The good news is the big increase in shares has cleaned up GME’s balance sheet, and it ended Q2 with $909 million in cash, and almost no long-term debt." "That's fantastic, and it means the company should be able to operate for a long time, even if it’s unprofitable (which it is).”

Ultimately, though, Arnold concluded with a bearish opinion. He said, “It has bought itself some time (literally) with it [sic] share issuances, but it’s also burning through that cash at an alarming rate.” He continued, “This company is struggling in a variety of critical operating metrics, and I don’t see a path forward.”

Overall, traders didn’t share Arnold’s bearish outlook on the quarter. GME shares rallied by 11.96% on Friday, largely because of an announcement that management made during the quarterly report, which highlighted plans to enter into the cryptocurrency space.

Dan Berthiaume, a Nobias 4-star rated author, highlighted GME’s crypto plans in a recent article. Berthiaume wrote, “In its latest step toward becoming what GameStop CEO Matt Furlong publicly termed a “customer-obsessed technology company” in a March 2022 earnings call, the retailer has entered into a partnership with cryptocurrency exchange FTX U.S. According to GameStop, the partnership is intended to introduce more of its customers to FTX’s community and its marketplaces for digital assets.”

Berthiaume continued, “In addition to collaborating with FTX on new e-commerce and online marketing initiatives, GameStop will begin carrying FTX gift cards in select stores. During the term of the partnership, GameStop will be FTX’s preferred retail partner in the United States.”

Furthermore, Berthiaume touched upon GME’s plans to become an NFT marketplace. He said, “GameStop’s new cryptocurrency initiative follows its July 2022 launch of a beta version of an online platform where consumers and creators can buy, sell, and trade NFTs, which are unique digital assets stored on a blockchain ledger that certifies the owner.” He said that GME’s current platform is “a non-custodial, Ethereum Layer2 blockchain-based platform that enables users to own their digital assets."

Looking further down the road, Berthiaume said, “Over time, GameStop says its NFT marketplace will expand functionality to encompass additional categories such as Web3 gaming, more creators, and other Ethereum environments.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

In addition, Michael Grothaus, a Nobias 5-star rated author, touched upon these crypto/NFT plans in a post-earnings report as well. Grothhaus asked the hypothetical question, “Does the GameStop/FTX partnership make sense?” Then, he rescinded, “Sure. People who invest in meme stocks are also likely to invest in crypto. And GameStop has its fingers in various crypto products already as it seeks to remake itself for a new era. So the FTX partnership is understandable. "

Furthermore, Grothaus quoted GameStop CEO Matt Furlong, who highlighted his long-term vision in the company’s Q2 conference call, stating, “Our path to becoming a more diversified and tech-centric business is one that obviously carries risk and will take time. This said, we believe GameStop is a much stronger business than it was 18 months ago.”

The credible authors and analysts that the Nobias algorithm tracks who cover GME shares do not share Furlong’s bullish outlook. 63% of recent articles written about GME shares have expressed a “bearish” sentiment. Right now, the average price target being applied to GME shares by credible analysts is $6.63/share. Today, GME trades for $28.92. Therefore, this average price target implies downside potential of approximately 77%.

Disclosure: Nicholas Ward has no GME position. Nicholas Ward wrote this article for Nobias at their request with a view of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

Case Study on Kroger(KR) with Nobias technology

Kroger (KR) has been a top performer throughout 2022, showing its defensive nature during today’s volatile trading environment, with shares rising approximately 13.5% since the start of the year as opposed to the S&P 500, which has fallen by nearly 15% on a year-to-date basis thus far. Kroger reported second quarter earnings this morning. The company’s beat and raise results have caused shares to rally. Today’s 5%+ move has pushed KR shares up towards the consensus fair value estimate provided by the credible analysts that Nobias tracks.

Summary

Kroger posted Q2 earnings this morning, beating on the top and bottom lines.

Management also raised its full-year EPS guidance.

Kroger is investing heavily into its digital ecosystem.

The stock's post-earnings rally has pushed shares up to credible analysts' average price target.

Kroger (KR) has been a top performer throughout 2022, showing its defensive nature during today’s volatile trading environment, with shares rising approximately 13.5% since the start of the year as opposed to the S&P 500, which has fallen by nearly 15% on a year-to-date basis thus far.

Kroger reported second quarter earnings this morning. The company’s beat and raise results have caused shares to rally. Today’s 5%+ move has pushed KR shares up towards the consensus fair value estimate provided by the credible analysts that Nobias tracks.

The Alpha Sieve, a Nobias 4-star rated author, published an earnings preview report at Seeking Alpha earlier in the week, highlighting Kroger’s past performance, consensus expectations coming into the Q2 results, and ultimately, providing an update on the author’s buy/sell/hold recommendation.

KR Sep 2022

The Alpha Sieve touched upon Kroger’s reliable operations, stating, “KR has a fairly decent track record in [sic] beating street estimates, particularly on the bottom-line front. Indeed, if you want to consider when KR last fell short of consensus EPS estimates, you need to rewind the clock by 11 quarters, back to October 2019, when it missed EPS estimates by 4%.”

Looking ahead, the author expects to see this trend continue. They stated, “with regards to the upcoming Q2 results, consensus currently expects EPS of $0.7986 on revenue of $34.19bn. Compared to Q1, this would represent some improvement at the EPS level (Q2 expected growth rate of 31%, vs 22% in Q1) but a continuation of the run rate seen in Q1 (+8% annual growth).” This opinion is in-line with management’s prior guidance.

The Alpha Sieve said, “At the end of the Q1 results, Kroger's management had scaled up their FY guidance by ~3%, lifting the EPS range from previous levels of $3.75-$3.85 to $3.85-$3.95.” However, noting caution, they continued, “Consensus EPS estimates are currently only 0.5% lower than the upper end of that range at $3.931, so the potential for upside surprises isn't a lot.” And, due to the lack of upside potential the author expressed concern about the stock’s valuation.

With regard to KR’s free-cash-flow yield, the author wrote, “Currently, KR stock only yields 6.93%, below its 5-year average of 7.67%.” But, as The Alpha Sieve points out, KR has been a defensive stock that has provided investors with strong shareholder returns throughout recent volatility.

Kroger’s dividend yield is currently 2.15%, which is well above the S&P 500’s 1.50% level. Kroger is known for increasing its dividend. The stock is on a 17-year dividend growth streak. And, as The Alpha Sieve points out, the company has been generous with its stock buyback program as well.

Touching upon Q2 shareholder returns, The Alpha Sieve said, “It would also be interesting to keep track of the level of buybacks Kroger did in Q2. Just for some perspective, in Q1 they were pretty aggressive doing around $552m of buybacks (the most for a quarter in three years), accounting for over half of the $1bn buyback program launched in late December last year.”

But, even with increasing dividends and share buybacks in mind, the stock’s valuation continues to be a concern for this author. They concluded their report writing, “whilst Kroger has some useful defensive qualities, I don't see any great incentive in entering this stock at this juncture. Would prefer to stay on the sidelines. The KR stock is a HOLD.”

Russel Redman, a Nobias 5-star rated author, also posted a pre-earnings article this week at Supermarket News; however, instead of focusing on fundamental metrics, Redman’s piece put a spotlight on Kroger’s technological innovation and long-term growth opportunities, striking a more bullish tone.

Redman’s piece highlighted Kroger’s omni-channel approach to retail, quoting Yael Cosset, senior vice president and chief information officer, who said, “Our aspiration is to be the destination for our customers for their food needs. At the heart of our vision for a seamless ecosystem is the precise understanding of our customers.” “Unsurprisingly,” Redman continued, “technology is playing a central role.”

Regarding Kroger’s operations, Redman said, “Overall, The Kroger Co. operates 2,723 supermarkets and multi-department stores under more than 20 banners. More than 2,250 stores have pharmacies, and over 1,600 have fuel centers. Eighty-two percent of Kroger’s customers within five miles of one of its stores, with most living within two miles.”

Redman noted that the company aims to leverage this market penetration to collect consumer data and become more efficient in the new digital age. He wrote, “Kroger, which serves more than 60 million households annually, is leveraging the vast stores of data from across its physical and virtual properties and brands to create more personalized experiences and value for customers.” He touched upon new logistics investments that Kroger is making into “Spoke” facilities via a four-year partnership with Ocado Group.

Regarding these facilities, Redman said, “These high-tech facilities use Ocado’s automation and artificial intelligence technology to fill online grocery delivery orders, including in markets where Kroger doesn’t have physical stores.”

At a high level, Redman said that this company hopes to use the automation and the consumer data that it collects to “hone its supply chain to improve product freshness, expedite pickup and delivery service, and introduce new, on-trend items in its Our Brands portfolio.”

Overall, he stated, “Digital represents a more than $10 billion annual business for Kroger.” He noted, “About 18.5 million households engaged online with the retailer in 2021.” And he notes that this trend is just getting started due to KR management’s focus on using technology to develop a “seamless ecosystem” for customers moving forward.

Kevin Coupe, a Nobias 4-star rated author, also recently highlighted KR’s logistical infrastructure build out in a report published at Morning News Beat, where he stated, “Kroger announced yesterday that it has opened "two new spoke facilities in Greater Nashville and the Chicago Metro Area. Serving as last-mile cross-dock locations, the new spokes will operate as a seamless extension of regional fulfillment centers, making Kroger Delivery available to more customers in Tennessee and Illinois.”

When Kroger reported earnings this morning, the company beat Wall Street estimates on both the top and bottom lines. KR produced Q2 sales of $34.64 billion, which represented 9.3% year-over-year growth, coming in $200 million ahead of consensus estimates. KR’s Q2 non-GAAP EPS totaled $0.90/share, beating consensus estimates by $0.07.

Kroger management highlighted 10.2% growth in its Our Brands category, which helped the company maintain profit levels in the face of rising inflation and raw material costs. Kroger’s gross margin came in at 20.9% for the second quarter, up by 2 basis points on a year-over-year basis.

The company said that its digital sales increased by 8% on a year-over-year basis. The company’s CEO, Rodney McMullen, said, “Our consistent performance underscores the resiliency and flexibility of our business model, which enables Kroger to thrive in many different operating environments. We are applying technology and innovation to improve freshness, grow Our Brands, and create a seamless shopping experience so our customers can get what they want, when and how they want it, with zero compromise on quality, selection and affordability.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

With regard to shareholder returns, Kroger’s earnings press release stated, “Earlier this quarter, Kroger increased its dividend by 24%, marking the 16th consecutive year of dividend increases. Additionally, during the quarter, Kroger repurchased $309 million in shares and year-to-date, has repurchased $975 million in shares. On September 9th, the Board of Directors authorized a new $1 billion share repurchase program.”

And, Kroger’s CFO, Gary Millerchip, also used the Q2 report as an opportunity to raise full-year guidance, yet again. Millerchip said, “Our consistent execution of this strategy is building momentum in our business which, combined with sustained food at home trends, gives us the confidence to raise our full-year guidance. We now expect identical sales without fuel to be in the range of 4.0% to 4.5% and adjusted net earnings per diluted share in the range of $3.95 to $4.05.”

Overall, this beat and raise quarter caused KR stock to pop during Friday’s trading session. At mid-day, shares were up by more than 5%. Coming into the Q2 report the average price target for KR shares amongst the credible analyst community that Nobias tracks was $51.25. That’s almost exactly where the stock trades at the moment - currently, KR shares are valued at $51.94.

Currently 68% of recent articles written by credible authors that the Nobias algorithm tracks have expressed a “Bullish” sentiment. Our algorithm hasn’t reported any new analyst updates on the stock which would reflect this updated 2022 guidance. We expect to see this occur in the coming days, which could send the average analyst price target higher.

Disclosure: Nicholas Ward has no KR position. Nicholas Ward wrote this article for Nobias at their request with a view of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

Case Study on Exxon Mobil (XOM) with Nobias technology

The energy sector has been the big winner thus far throughout 2022. Year-to-date, there are only two sectors with positive gains: energy and utilities. The utility sector has posted gains of 3.7% during 2022 thus far. However, energy has put those returns to shame, posting year-to-date gains of 43.95%. And, within the energy space, Exxon Mobil (XOM), one of the world’s largest integrated oil companies, has posted even greater outperformance. XOM shares are up by 50.44% on a year-to-date basis. Yet, credible analysts still see double digit upside ahead.

Summary

Year-to-date, there are only two sectors with positive gains: energy and utilities.

XOM shares are up by 50.44% on a year-to-date basis.

After this strong rally, credible authors and analysts remain bullish on shares; the average price target amongst credible analysts calls for 11.85% upside moving forward.

The energy sector has been the big winner thus far throughout 2022. Year-to-date, there are only two sectors with positive gains: energy and utilities. The utility sector has posted gains of 3.7% during 2022 thus far. However, energy has put those returns to shame, posting year-to-date gains of 43.95%. And, within the energy space, Exxon Mobil (XOM), one of the world’s largest integrated oil companies, has posted even greater outperformance. XOM shares are up by 50.44% on a year-to-date basis. Yet, credible analysts still see double digit upside ahead.

The Alpha Sieve, a Nobias 4-star rated author, recently published a report which highlighted XOM’s bull and bear case theses at Seeking Alpha. On the bullish side, The Alpha Sieve said, “XOM is in an admirable position at the moment as they were prescient enough to still invest $13bn in exploration and development activities in 2020 when most other competitors were laying low.” They continued, “On account of that foundation, XOM has been able to ramp up production with great alacrity and take advantage of the attractive average realizations that have been prevalent in the energy space in 2022.”

XOM Sep 2022

The author noted that “On account of the elevated price realizations this year, and the volume uptake that XOM has been witnessing, cash flow generation too is a highly attractive facet (last year XOM generated $48bn in operating cash flow and intends to generate another $40bn this year).” This profitability has resulted in very attractive free cash flow multiples.

The Alpha Sieve wrote, “The strong operating cash flow generation also enables Exxon to comfortably meet its CAPEX requirements leaving ample FCF. Incidentally, at the current share price, Exxon's FCF yield is at an impressive level of 12.6%, the highest it's been in 10 years, and exactly 3x higher than its 5-year average.”

Furthermore, Exxon’s strong profits has allowed the company to repair its balance sheet in recent years. The author stated, “It's also fair to say that Exxon has the balance sheet to withstand a prolonged down cycle (if it were to happen, which is not the base case). Last year they paid down $20bn worth of long-term debt (and this year they intend to pay down another $2bn), and currently, their debt to capital ratio is only at 20%, which is at the lower end of their target range of 20-25%.”

However, taking a look at bearish arguments, The Alpha Sieve highlighted negative growth expectations in the coming years and XOM’s troublesome forward valuation multiples. They said, “For instance, in FY23, consensus estimates point to an EPS of only $10.48 (FY24: $8.65), this would imply annual de-growth of ~17%. In effect, the declining trajectory of the EPS base makes the XOM stock an expensive proposition on a forward P/E basis.”

The author continued, “At the current share price, an FY23EPS of $10.48 translates to a forward P/E of 8.72x, which is 48% greater than the 5-year average forward P/E multiple of 5.9x.” And in conclusion, The Alpha Sieve offered a cautious take on XOM shares after the stock’s 50%+ year-to-date rally, stating, “whilst Exxon Mobil currently appears to have the wind in its sails and a lot of attractive qualities, at this relatively elevated price point, I wouldn't be too enthused to commence a long position in XOM stock. I rate Exxon Mobil stock as a HOLD.”

Daniel Thurecht, a Nobias 4-star rated author, also recently published a report focused on Exxon at Seeking Alpha. Thurecht’s work was focused on the company’s success in the gas space. He wrote, “Even though oil prices often dominate the discussion surrounding Exxon Mobil, gas still forms a sizeable portion of their production. During the first half of 2022, their total oil and gas production was a massive 3.704mboe/d of which 2.282mboe/d was oil and associated liquids, as per their second quarter of 2022 results announcement. This means their gas production was 1.422mboe/d and thus comprises a formidable circa 38% of their total production, which largely stems from their once controversial acquisition of XTO Energy back in 2010.”

Thurecht viewed this move as a hedge against technological innovation and demand destruction in the oil markets. He stated, “Since oil demand sees threats from electric vehicles, it means that a portion of demand destruction from high prices will never return as more consumers are pushed towards electric vehicles in response to crippling fuel prices.”

Regarding Exxon’s gas success, Thurecht said, “Even though gas prices were climbing during 2021, they were turbocharged during 2022 as Russian troops marched into Ukraine and set off a pivotal geopolitical shock that will shape the continent for decades to come. The ride is never smooth but despite this inherent volatility, gas in the United States prices are now consistently trading for over $9mmbtu for the first time in over a decade, helped along by the world scrambling to secure LNG supply.”

He continued, “Since gas sees very strong fundamentals following the Russia-Ukraine war, it creates very profitable prospects for Exxon Mobil whose once maligned gas production is now poised to benefit through feeding the increased demand for United States LNG to Europe.”

Ultimately, Thurecht said, “In my view, this actually represents a far greater opportunity for Exxon Mobil than what is offered by high oil prices because in the case of gas, it actually represents a structural change in the global energy market that stands to perpetually into the future for decades to come.”

However, even with the long-term growth tailwinds that gas provides in mind, like The Alpha Sieve, Thurecht concluded his piece with a neutral outlook on shares, writing, “thus with their share price near record highs, I believe that a hold rating is appropriate.”

Shareholder returns have attracted investors - especially income oriented investors - to the energy sector for decades. High dividend yields are often at the center of a bullish XOM thesis. The stock currently yields 3.68%, which is well above the S&P 500’s 1.46% yield.

And, as Alex Kimami, a Nobias 4-star rated author recently pointed out in an article published at oilprice.com, with profits soaring, these strong shareholder return trends are likely to remain in place. Kimami wrote, “According to data from Bernstein Research, the seven supermajors–including ExxonMobil (NYSE: XOM), Chevron (NYSE: CVX), BP (NYSE: BP) and Shell (NYSE: SHEL)--are poised to return $38bn to shareholders through buyback programmes this year, with investment bank RBC Capital Markets putting the total figure even higher, at $41bn.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

With specific regard to Exxon Mobil, he continued, “Exxon Mobil Corp. has been using the strength of its balance sheet to return significant capital to its shareholders via dividends and share buybacks and has announced plans to continue such distributions going forward.”

Kimami stated, “Exxon returned $7.6 billion to shareholders during the second quarter through dividends and share buybacks, with $3.9 billion for share repurchases and $3.7 billion going into dividends. Year-to-date, Exxon has repurchases amounting to $6 billion and eyes repurchasing up to $30 billion shares through 2023.”

Although The Alpha Sieve and Thurecht offered a “hold” rating on shares, 70% of recent articles published by credible authors (individuals who have received 4 or 5-star ratings by the Nobias algorithm) on XOM shares expressed a “Bullish” bias.

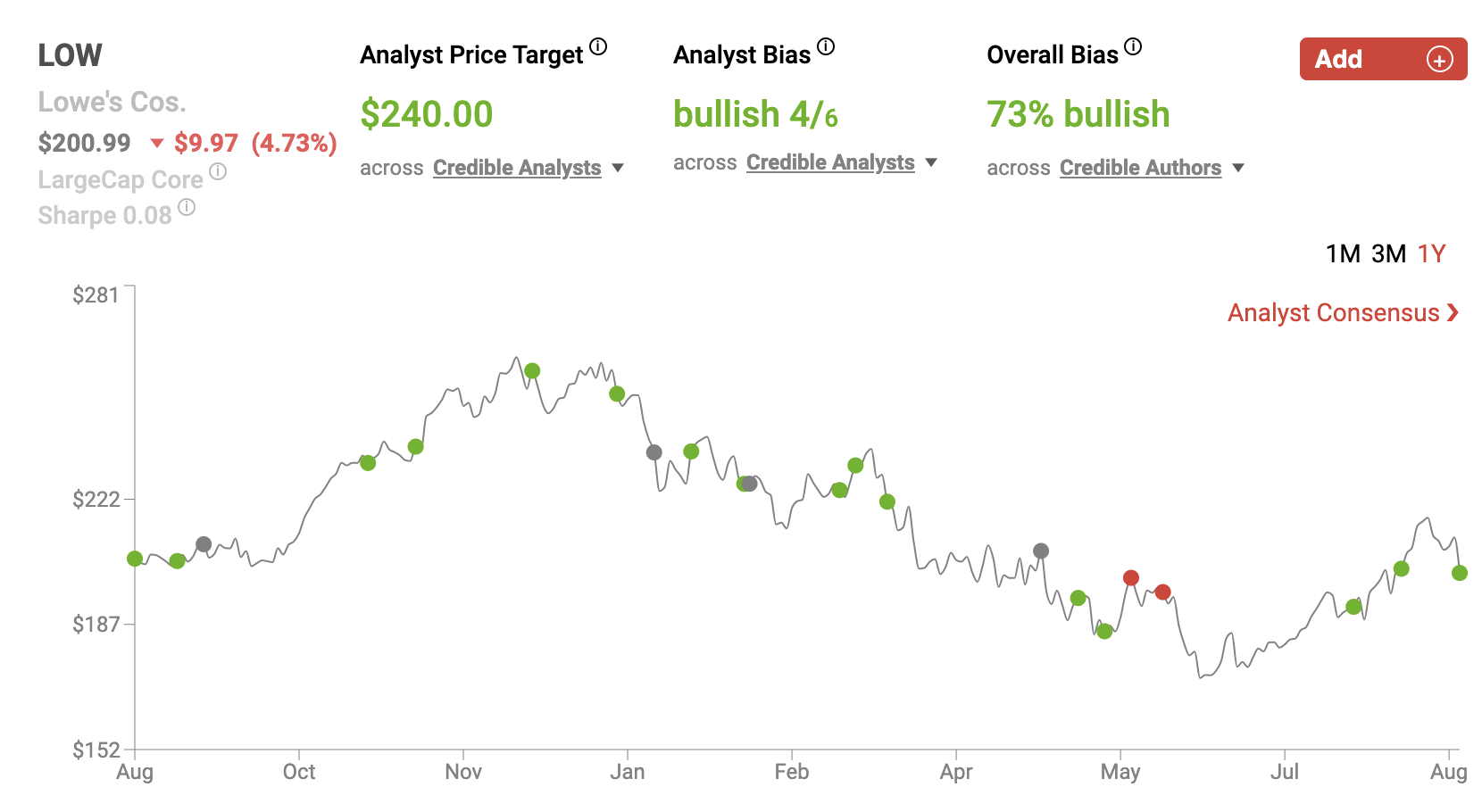

4 out of the 6 credible Wall Street analysts that Nobias tracks that have expressed an opinion on Exxon Mobil believe that the company’s shares are headed higher. Currently, the average price target being applied to XOM shares by these credible analysts is $106.5. Today, XOM trades for $96.50. Therefore, this average price target implies upside potential of approximately 11.85%.

Disclosure: Nicholas Ward has no position in any stock mentioned in this article. Nicholas Ward wrote this article for Nobias at their request with a view of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

Case Study on NVIDIA (NVDA) with Nobias technology

After establishing itself as a top Nasdaq performer in 2020 and 2021, Nvidia’s (NVDA) shares have suffered throughout 2022. On a year-to-date basis, NVDA is down by 54.69%. The stock is down 25.66% during the past month. NVDA shares fell 15.75% last week alone. And yet, even with such strong negative momentum in mind, the credible analysts that the Nobias algorithm follows continue to express very bullish opinions with regard to NVDA stock.

Summary

On a year-to-date basis, NVDA is down by 54.69%, falling by 15.75% last week alone.

The most recent leg of the sell-off was inspired by semiconductor sales restrictions between the U.S. and China.

Yet, even with such strong negative momentum in mind, the credible analysts see upside potential of approximately 50%.

After establishing itself as a top Nasdaq performer in 2020 and 2021, Nvidia’s (NVDA) shares have suffered throughout 2022. On a year-to-date basis, NVDA is down by 54.69%. The stock is down 25.66% during the past month. NVDA shares fell 15.75% last week alone. And yet, even with such strong negative momentum in mind, the credible analysts that the Nobias algorithm follows continue to express very bullish opinions with regard to NVDA stock.

Howard Smith, a Nobias 4-star rated author, touched upon NVDA’s most recent leg lower in an article published on September 2, 2022. Smith said, “Shares hit a 52-week low on Thursday when the company reported it has the potential to lose up to $400 million in data center revenue in the current quarter after the U.S. government imposed a new license requirement that restricts some semiconductor chips from being sold in China.”

Smith continues, “Panic-selling can provide a good opportunity for long-term investors to buy shares at lower prices. But Nvidia's business was already in transition prior to these new impacts. Its recently reported quarterly results showed a 19% drop in revenue compared to the previous quarter. Year-over-year revenue still grew 3%, but investors had bid Nvidia shares up to a valuation that priced in much stronger annual growth.”

NVDA Sep 2022

During NVDA’s recent quarterly results, the company began its quarterly “Highlights” segment by showing its recent Data Center success. The company’s press release stated, “Second-quarter revenue was $3.81 billion, up 61% from a year ago and up 1% from the previous quarter.”

And, as Smith noted, this is why the China sanctions news was so significant to investors. He said, “The news this week that this segment could take a hit from the new government restrictions was particularly troublesome for some shareholders.”

Smith ended his article with a fairly neutral conclusion, stating, “It may take some time for the stock to settle from this news, and some questions remain about Nvidia's growth path and valuation. But for some investors, this week's drop could be a good time to get shares of a leader in a growing sector.”

Nobias 4-star rated author, Shanthi Rexaline, also covered the semiconductor restrictions that the U.S. government put into place in an article that was published at Benzinga on 9/02/2022. “The affected chips,” Rexaline said, are the “H100 and A100 from Nvidia and Advanced Micro Devices, Inc.”

Rexaline said, “TFI Securities analyst Ming-Chi Kuo said the government’s move will ensure that the U.S. maintains its leadership position in the field of AI.” She continued, “However, the analyst noted that China was the frontrunner in terms of AI patent filings.”

Rexaline notes that there are national security implications to this type of move. She stated, “According to Kuo, AI development is one of the core competitiveness of a country, and it has applications in aerospace and the military, among other things.”

But, even though this situation creates a potential long-term growth headwind for semiconductor stocks like NVDA, Rexaline highlighted how these sanctions may bolster near-term quarterly results. She wrote, “Kuo said Chinese clients may directly or indirectly place “rush orders” to boost inventory in order to lower the risk associated with the possible expansion of sales restrictions by the U.S. government.”

Cavenagh Research, a Nobias 4-star rated author, published a bearish report on NVDA at Seeking Alpha after these restriction headlines broke. Regarding the impacts of the sales restrictions the author wrote, “Nvidia has estimated the impact of the export restriction at $400 million in potential sales for its third fiscal quarter. Accordingly, the impact could be expanded to about $1.6 billion annually. If we apply Nvidia's 26% net income margin, and further apply the stock's current x81 one-ear forward P/E multiple, the impact on valuation loss could be estimated at about $33.7 billion of equity value.”

Then Cavenagh Research touched upon NVDA’s valuation metrics, stating, “Investors should consider that Nvidia's one-year forward GAAP P/E of 81x implies a 270% premium to the U.S. technology sector. Nvidia's P/B of 15.8x and P/S of 13.9x imply a 290% and 395% premium respectively.”

They continued, “In my opinion, Nvidia stock has for a long time been overhyped and overvalued. And although NVDA stock is down approximately 60% from all time highs, I argue there is still some excess valuation premium that need[sic] to be corrected in order for investors to enjoy an attractive risk/reward.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

The author concluded their report, “No doubt, Nvidia is a great business. But the company's stock is dangerous.” Highlighting their “sell” rating, Cavenagh Research said, “Personally, I would not buy Nvidia at a valuation above 30x EV/EBIT and/or 10x EV/Sales, which are still very proud multiples. Accordingly, I see 20 - 30 percent more downside before the risk/reward for investors becomes justified (but arguably still not attractive given the regulatory risk and slowing business cycle).”

Rexaline also published a report on 9/3/2022 which showed that not all investors are quite so bearish. She noted that Ark Invest remains bullish, stating, “Ark Stands By Nvidia: Undeterred by the weakness, Cathie Wood continued to bulk up on the stock on Thursday and Friday. The fund manager’s Ark Invest bought 21,026 shares of Nvidia, valued at over $2.9 million, on Friday, a daily trade disclosure showed.”

While the majority of credible authors that the Nobias algorithm tracks are bearish on NVDA shares, the majority of Wall Street analysts that cover the stock remain bullish. 57% of recent articles published on the stock by credible authors have expressed a “Bearish” sentiment.

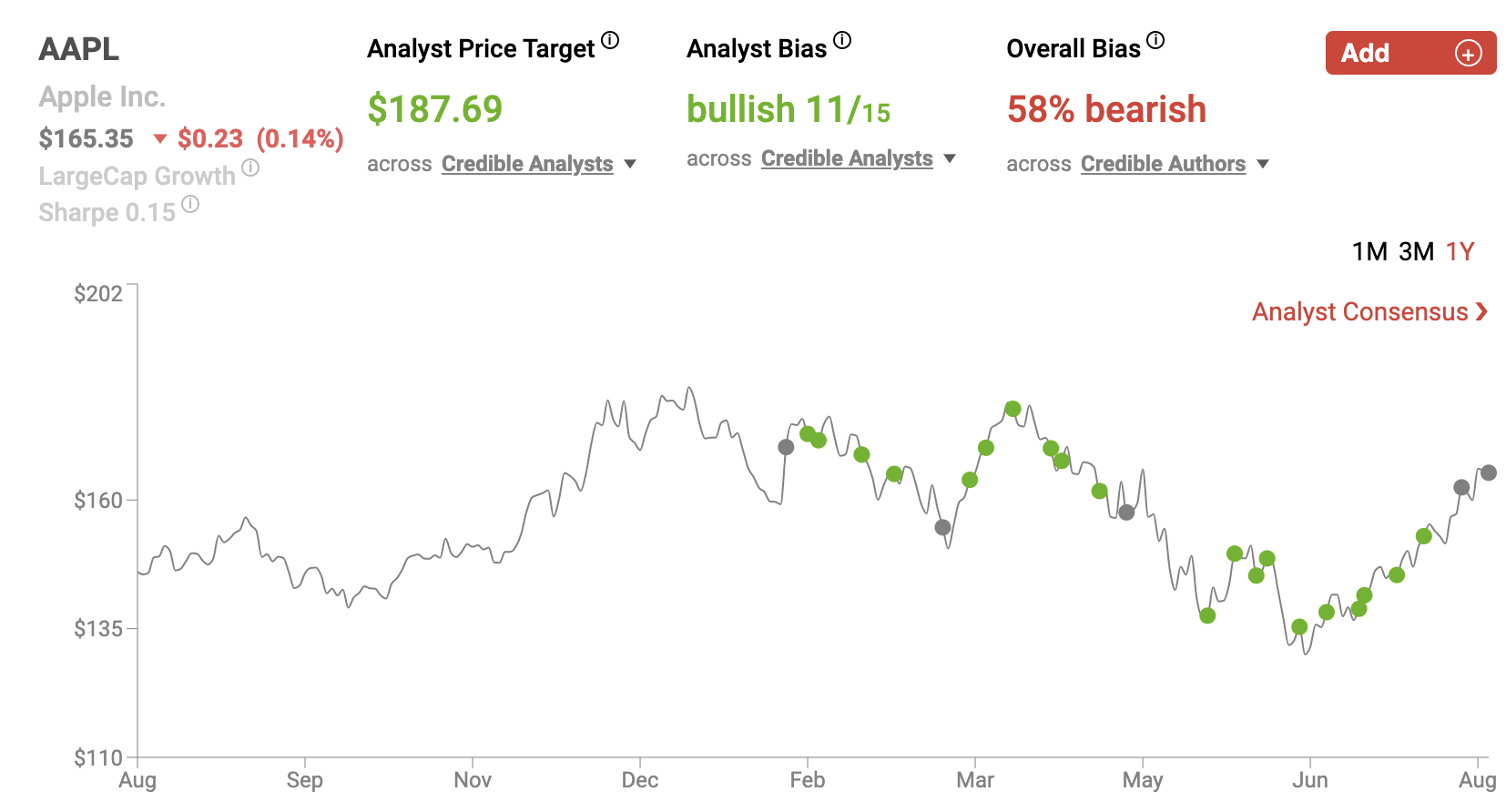

However, 11 out of the 18 credible Wall Street analysts that Nobias tracks who offer opinions on Nvidia believes that shares are headed higher. Right now, the average price target that credible Wall Street analysts are applying to NVDA shares is $197 Relative to NVDA’s closing price on Friday of $136.47 this average price target implies upside potential of approximately 50%.

Disclosure: Of the stocks discussed in this article, Nicholas Ward is long NVDA. Nicholas Ward wrote this article for Nobias at their request with a view of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

Case Study on Lululemon (LULU) with Nobias technology

Macy’s (M) is the biggest U.S. department store chain and one of the most iconic names in the American retail space. The company was founded in 1858, moved into its landmark location in Herald Square in 1902, and the company’s red star logo has been a part of popular culture in the United States for well over a century. However, in recent years, shares of this once prominent department store have struggled due to the secular headwinds created by the growing eCommerce trend. Macy’s shares are down roughly 9.9% during the last 5 years. During this same period of time, the S&P 500 is up by more than 71.5%.

1) Lululemon reported Q2 earnings this week, beating Wall Street consensus estimates on both the top and bottom lines.

2) The company also raised full-year guidance.

3) Shares initially popped more than 10% in response to this beat and raise quarter.

4)Credible analysts still see double digit upside ahead.

Lululemon (LULU) has been a top performer in the retail and apparel space over the last 5 and 10-year periods, posting capital gains of 415.2% and 310.0%, respectively. These gains represent strong outperformance relative to the broader market. The S&P 500 is up by 62.2% during the trailing 5-year period and 177.2% during the trailing 10-year period. However, LULU shares have struggled during the trailing 12 months, posting losses of 19.8%.

Apparel stocks have suffered from inflationary headwinds in recent quarters and coming into the second quarter earnings season, there were credible analysts expressing concern about Lululemon’s growth prospects.

LULU Sep 2022

Brain Sozzi, a Nobias 4-star rated author, recently published an article at Yahoo Finance which highlighted a negative analyst report on LULU shares coming into earnings season. Touching upon LULU’s recent weakness and the headwinds impacting the apparel industry, Sozzi wrote, “Shares of the premium athletic-wear maker are down 21% year to date, hammered recently amid warnings on slowing demand (and rising inventories) for workout gear from retailers Kohl's, Macy's, Under Armour and others.”

Sozzi went on to shine a spotlight on a report published by Jefferies analyst Randal Konik, who is a Nobias 5-star rated analyst. Sozzi quoted Konik, who said, "The quarter should be strong (belt bags likely helped too) and we expect the company's fiscal year 2023 outlook to be reiterated, but that's not our concern.”

Konik’s bearish report continued, "Our downgrade thesis is based on a view that long-term projections are aggressive across total revenues, EBIT [earnings before interest, taxes] margins, men's, and international. We believe in coming quarters, Lululemon will have to walk back its long-term projections as competition rises, end markets weaken, and promos increase industry-wide." Sozzi noted that Konik believes that Lulu’s sales are likely to continue to grow.

However, the analyst concluded his report, stating, "COVID likely pulled forward demand with Lululemon one of the biggest beneficiaries. As a result, we see risks to consensus estimates ahead as competition rises and headwinds grow."

Lululemon reported second quarter earnings this week and it appears that Konik’s negative sentiment may have been misplaced. LULU beat Wall Street estimates on both the top and bottom lines during Q2. During the company’s Q2 report, Lulu’s Chief Executive Officer, Calvin McDonald, stated: "The momentum in our business continued in the second quarter, fueled by strong guest response to our product innovations, community activations, and omni experience. I would like to express my gratitude to our teams around the world for their continued dedication and enthusiasm for our brand, which enabled us to generate this elevated level of performance. As we look ahead, we're excited about our ability to successfully deliver against our Power of Three ×2 growth plan and create ongoing value for all our stakeholders."

Also, during the Q2 report, Meghan Frank, Lululemon’s Chief Financial Officer, stated: "Our teams continue to execute at a high level, which is driving our strong financial and business performance. Despite the challenges around us in the macro-environment, guest traffic in our stores and on our e-commerce sites remains robust, which speaks to the strength of our multi-dimensional operating model. I am pleased with our start to the third quarter and believe we are well positioned for the fall and holiday seasons."

Huw Hughes, a Nobias (4-star) rated author, published a piece at Fashion United which examined the company’s Q2 results. Regarding Lulu’s top-line, Hughes wrote, “The US-Canadian company reported a 29 percent increase in net revenue to 1.87 billion dollars thanks to 28 percent growth in its North American business and 35 percent growth in its international business.” He continued, “Total comparable sales increased 28 percent in the second quarter, or 29 percent on a constant dollar basis, while comparable store sales were up 24 percent.”

Moving onto the bottom-line, Hughes stated, “Net income for the quarter came in at 289.5 million dollars, up from 208 million dollars a year earlier.” What’s more, Hughes noted that LULU management raised its forward looking guidance. He said, “The company now expects annual net revenue to be in the range of 7.87 billion dollars to 7.94 billion dollars. That’s up from its previous guidance of between 7.61 billion dollars and 7.71 billion dollars.”

Furthermore, he said, “It now forecasts diluted earnings per share to be in the range of 9.82 dollars to 9.97 dollars compared to previous guidance of between 9.42 dollars and 9.57 dollars.” This beat and raise quarter caused LULU shares to spike higher on Friday morning. LULU shares were trading up by more than 11.5% shortly after the opening bell range on Friday, September 2, 2022.

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

Throughout the trading day this strength has waned a bit. It’s 12:25 pm and shares are currently up slightly less than 8%. However, it’s clear that the company’s strong guidance is overshadowing the fears that investors and analysts shared with regard to ongoing issues within the apparel space, brought on by supply chain issues, rising material costs, and inventory gluts.

Overall, the majority of the credible authors and analysts that the Nobias algorithm tracks agree with today’s upside momentum. 71% of recent articles published on LULU by credible authors (those with 4 and 5-star Nobias ratings) have expressed a “Bullish” sentiment. 5 out of the 9 credible Wall Street analysts (once again, only individuals with 4 and 5-star Nobias ratings) who cover LULU believe that shares are headed higher.

Right now, the average price target being applied to LULU from his cohort of credible analysts is $352.22. Therefore, even after today’s high single-digit pop, credible analysts still see strong upside ahead. LULU shares are currently trading for $317.50. Therefore, that average analyst price target implies upside potential of approximately 10.9%.

Disclosure: Nicholas Ward has no position in any stock mentioned in this article Nicholas Ward wrote this article for Nobias at their request with a view of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

Case Study on Macy's (M) with Nobias technology

Macy’s (M) is the biggest U.S. department store chain and one of the most iconic names in the American retail space. The company was founded in 1858, moved into its landmark location in Herald Square in 1902, and the company’s red star logo has been a part of popular culture in the United States for well over a century. However, in recent years, shares of this once prominent department store have struggled due to the secular headwinds created by the growing eCommerce trend. Macy’s shares are down roughly 9.9% during the last 5 years. During this same period of time, the S&P 500 is up by more than 71.5%.

1) Macy’s shares are down by more than 30% on a year-to-date basis.

2) The company reported earnings this week, beating Wall Street expectations on the top and bottom lines.

3) Macy’s lowered its full-year guidance during its Q2 report.

4) Yet, credible analysts believe that the stock’s valuation is too low, with an average price target that implies 52% upside potential.Title: Macy’s SEO

Macy’s (M) is the biggest U.S. department store chain and one of the most iconic names in the American retail space. The company was founded in 1858, moved into its landmark location in Herald Square in 1902, and the company’s red star logo has been a part of popular culture in the United States for well over a century. However, in recent years, shares of this once prominent department store have struggled due to the secular headwinds created by the growing eCommerce trend. Macy’s shares are down roughly 9.9% during the last 5 years. During this same period of time, the S&P 500 is up by more than 71.5%.

During the trailing twelve months, Macy’s is down by 19.2%, once again, trailing the S&P 500, which is down by only 6.55% during this period. On a year-to-date basis, M shares have fallen by 30.39%. During 2022 thus far, the S&P 500 is down by approximately 12.2%. And yet, after all of this underperformance, the credible Wall Street analysts that track Macy’s shares believe that the beaten down stock has upside potential with an average price target that implies strong double digit upside.

M Aug 2022

Macy’s reported its second quarter earnings last week, beating Wall Street consensus estimates on both the top and bottom lines during its 8/23/2022 release; however, management cut forward looking guidance. Coming into Macy’s Q2 report, The Alpha Sieve, a Nobias 4-star rated author, published an earnings preview on the stock at Seeking Alpha.

The author highlighted the difficult macro environment that retailers like Macy’s find themselves in, stating, “Elevated fuel costs too will likely leave their mark on Macy’s cost dynamics, although I do suppose it helps that they have a lower amount of digital sales versus what it was last year.”

Alpha Sieve cites another potential profit-related headwind, writing, “Also consider that Macy’s higher minimum wage of $15 (per hour) for around 100,000 US employees would have come into play by May (the average base pay will be closer to $17 an hour)”.

The Alpha Sieve also touched upon Macy’s inventory issues, stating, “they had almost $5bn of merchandise inventory on their books at the end of Q1, up by 17% on an annual basis and 13% on a quarterly basis”. The author wrote that inventories “will be needed [sic] to be wound down at lower prices, particularly in some overstocked categories such as activewear and soft home categories.”

However, despite these operational issues and touch macro headwinds, The Alpha Sieve concludes that Macy’s is an attractive value. They wrote, “Whilst Macy’s forward EV/EBITDA multiple has grown pricier by 6% (4.27x) since the May 2022 update (4.01x), its discount relative to its peers in the department stores arena has only widened; previously Macy's could be picked up at a 19% discount to the average multiple of its peers (4.94x); now it can be picked up at a 21% discount (5.39x).”

Rachel Fox, a Nobias 4-star rated author, covered Macy’s Q2 results in a recent article published at investors.com. Regarding Macy’s earnings results, Fox wrote, “Analysts expected Macy's earnings for the quarter to fall 33% year over year to 86 cents per share. But the retailer's earnings per share fell 22% to $1. Analysts also saw a 2.9% decline sales [sic], to $5.49 billion, down from $5.65 billion in 2021. But revenue only fell slightly to $5.6 billion.” She said, “Retail stocks have generally reported mixed results over the past week as inflation pressures cut into consumer spending.”

Fox noted that Macy’s is showing technical strength, stating, “The stock remains above its conjoined 50-day and 21-day lines.” However, she concluded, “But Macy's still has a lot of repair work to do before it becomes a legitimate candidate for investors. Shares maintain a low 26 RS Rating at this time.”

SGB Media also covered Macy’s Q2 earnings in an article titled, “Macy’s Cuts Outlook Despite Q2 Beat”. SGB media covered a slew of quarterly highlights; its report read:

Macy’s comparable sales were down 2.9 percent on an owned basis and down 2.8 percent, on an owned-plus-licensed basis.

43.9 million active customers shopped the Macy’s brand, on a trailing twelve-month basis, a 7 percent increase compared to the prior year.

Star Rewards program members made up approximately 70 percent of the total Macy’s brand-owned plus licensed sales on a trailing twelve-month basis, up approximately 5 percentage points versus the prior year.

The company continued to see strength in occasion-based categories, including career and tailored sportswear, fragrances, shoes, dresses, and luggage.

Bloomingdale’s comparable sales on an owned basis were up 8.8 percent and on an owned-plus-licensed basis were up 5.8 percent. 4.0 million active customers shopped the Bloomingdale’s brand, on a trailing twelve-month basis, a 14 percent increase over the prior year. Results were driven by strength across women’s, men’s and kid’s contemporary and dressy apparel as well as luggage.

Bluemercury comparable sales were up 7.6 percent on an owned and owned-plus-licensed basis. Approximately 700,000 active customers shopped the Bluemercury brand, on a trailing twelve-month basis, a 9 percent increase over the prior year.

SGB touched upon inventory trends, stating, “Inventory was up 7 percent year-over-year and down 8 percent versus 2019, reflecting disciplined inventory management in an environment of continued supply chain volatility. Where it had flexibility, the company cut receipts to manage inventory levels in line with consumer demand. However, in certain categories inventory levels remain elevated due to reduced year-over-year sell-throughs since Father’s Day driven by the industry-wide levels of excess inventory and a slowdown in consumer discretionary spend.”

The analyst continued, “The company is targeting appropriate inventory levels by the end of the year and will continue to flow fresh product in those categories in which customers are signaling demand. Simultaneously, the company is taking the required markdowns to clear aged inventory, in seasonal goods, private brand merchandise and pandemic-related categories, such as active, casual sportswear, sleepwear, and soft home.”

The SGB report also put a spotlight on Macy’s disappointing guidance. The firm stated, “The updated guidance calls for:

“Sales in the range of $24,340 million to $24,580 million, down from guidance in the range of $24,460 million to $24,700 million previously;

Adjusted EBITDA as a percent of sales to be approximately 10.5 percent, down from 11.2 percent to 11.7 percent previously; and

Adjusted diluted earnings per share in the range of $4.00 to $4.20, down from $4.53 to $4.95 previously.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

Since Macy’s Q2 results were reported, Paul Lejuez of Citi, a Nobias 5-star rated analyst, lowered his price target for M shares from $23.00 to $21.00.

Theflyonthewall.com highlighted Lejuez’s analyst note, stating, “The company's Q2 earnings were above expectations, despite a slowdown toward the end of the quarter and the annual guidance reduction was inline with what many were expecting, Lejuez tells investors in a research note. As a mall-based player selling discretionary products, Macy's "may continue to feel the pinch if consumers concentrate shopping around occasions," says the analyst.”

51% of recent articles published by credible authors (individuals with 4 or 5-star ratings by the Nobias algorithm) have expressed a “Bullish” bias, implying a neutral stance. However, the credible analyst community’s consensus implies upside ahead. Right now, the average price target being applied to M shares by the credible analysts that the Nobias algorithm tracks is $29.00/share. Today, M trades for $17.06/share; therefore, that average price target implies upside potential of approximately 55%.

Disclosure: Nicholas Ward has no M position. Nicholas Ward wrote this article for Nobias at their request with a view of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

Case Study on Affirm (AFRM) with Nobias technology

During the second half of 2021, Affirm (AFRM) shares rose from approximately $50.00/share to its current 52-week high of $172.65. However, throughout 2022 the sentiment has turned bearish for AFRM shares, which are now down by more than 74% on a year-to-date basis. AFRM posted fiscal Q4 earnings this week and although the company beat Wall Street’s expectations for Q4 sales, poor forward looking guidance spooked investors, causing shares to crater. Affirm shares fell by 19.47% this week.

During the second half of 2021, Affirm (AFRM) shares rose from approximately $50.00/share to its current 52-week high of $172.65. However, throughout 2022 the sentiment has turned bearish for AFRM shares, which are now down by more than 74% on a year-to-date basis.

AFRM posted fiscal Q4 earnings this week and although the company beat Wall Street’s expectations for Q4 sales, poor forward looking guidance spooked investors, causing shares to crater. Affirm shares fell by 19.47% this week.

However, after this precipitous sell-off, the credible analysts that Nobias tracks remain bullish on shares, with an average price target that points towards strong double digit upside potential. Dave Kovaleski, a Nobias 4-star rated author, published an article at the Motley Fool on Monday this week, highlighting some of Affirm’s recent share price weakness.

AFRM Aug 2022

Kovaleski pointed towards a shift in the macro environment, especially regarding the Federal Reserve’s hawkish stance, as an ongoing headwind for growth stocks like AFRM. He wrote, “The overall decline likely stems from renewed concerns about inflation. While the inflation rate dropped in July, sparking some hope that the Federal Reserve might ease up on its aggressive posture on interest rate hikes, the minutes of the July Fed meeting, released last week, indicated that the Fed would not pull back on rate hikes until inflation came down substantially. That, in turn, stoked fears of an economic slowdown, which would not be good for payment companies like Affirm.”

Rising rates have been a headwind throughout 2022 and Nobias 5-star rated author, Shrilekha Pethe, touched upon this in a report that she published at Nasdaq.com after AFRM’s Q3 report back in July. Regarding headwinds created by a tough macro environment for Affirm, Pethe said, “Another major concern among investors has been that as cash becomes tight, BNPL borrowers could default on their payments.” “However,” she continued, “Affirm believes it is well-placed to weather the potential storm.”

Pethe stated, “Affirm’s management pointed out that, unlike many of its competitors, the company does not charge a late payment fee, which it says would appeal to consumers during a downturn. The company also stated that it does not expect rising interest rates to immediately ramp up its borrowing costs.”

Despite management’s confidence, it appears that AFRM is struggling to execute. Chris Lau, a Nobias 4-star rated author, published a post-earnings report on AFRM stock at Seeking Alpha, where he stated, “In after-hours trade after the Q4 report, Affirm issued guidance for Q1/2023 and the full year of 2023. This disappointed investors.”

Regarding AFRM’s Q4 results Lau wrote, “In the last quarter, Affirm posted revenue growing by 39.1% Y/Y to $365.13 million. It lost 65 cents a share on a GAAP EPS basis.” He continued, “Active consumers and gross merchandise volume both soared by 96% and 77% year-on-year, respectively.”

Highlighting losses, Lau wrote, “The net loss increased from $123.4 million last year to $186.4 million. This weak result will deter investors. The bearish short interest is 20.23%. Short-sellers are ahead by 57% (before the post-market selling).”

Touching upon the disappointing forward guidance figures, Lau said, “For the first quarter, the revenue of $345 million to $365 million is below the consensus of $390.87 million.” He also stated, “More worrisome is the adjusted operating margin forecast of negative 12% to negative 10%.”

Looking out over the coming year, Lau also put a spotlight on disappointing top-line expectations writing, “Affirm's 2023 revenue growth outlook is not enough to satisfy shareholders. The company's revenue forecast of $1.625 billion to $1.725 billion is below the consensus estimate of $1.9 billion.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

But, looking further out into the future, Lau sees strong growth tailwinds for a name like Affirm which is a major player in the buy now, pay later (BNPL) industry. He said, “Stretched for disposable income, BNPL (buy now, pay later) will become a critical driver to stimulating spending online. Affirm could potentially double its revenue. BNPL will more than double from 3.8% of e-commerce spending in 2021 to 8.5% by 2025.”

Yet, even with this in mind, Lau provided a neutral stance in his conclusion. He wrote, “Affirm's post-earnings sell-off is warranted. Markets will adjust for the weaker revenue outlook. The high cash burn rate increases the risk of the company raising cash.”

All in all, Lau stated, “In reflecting the opportunities against its near-term risks, I rate Affirm stock between a hold and a buy. The credible author community that the Nobias algorithm tracks appears to share this tepid outlook. 57% of recent articles published on AFRM shares have expressed a “Bearish” sentiment.

However, the credible Wall Street analysts that Nobias tracks are much more bullish. After AFRM posted its Q4 earnings, Andrew Jeffrey of Truist, a Nobias 5-star rated analyst, lowered his price target for AFRM shares from $55.00 to $45.00. This reduced the average price target amongst the credible analysts that Nobias follows to $35.00 for Affirm shares. AFRM ended the week with a $24.57 share price. Therefore, that $35.00/share credible analyst average price target represents upside potential of approximately 42.5%.

Disclosure: Nicholas Ward has no AFRM position. Nicholas Ward wrote this article for Nobias at their request with a view of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

Case Study on Home Depot (HD) with Nobias technology

Home Depot reported second quarter earnings this week, beating analyst estimates on both the top and bottom-lines, bucking some of the negative trends that have plagued big-box retailers in recent months.

Home Depot reported second quarter earnings this week, beating analyst estimates on both the top and bottom-lines, bucking some of the negative trends that have plagued big-box retailers in recent months.

Richard Saintvilus, a Nobias 4-star rated author, provided investors with an earnings preview piece that he published at Nasdaq.com prior to HD’s Q2 report. Saintvilus highlighted Home Depot’s recent strength, noting that it “has been a strong Dow performer over the past two years.” He continued, “Home Depot management noted in their recent earnings call that home equity values over the last two years had increased by 40% or over $7 billion. Because of home price appreciation, the homeowner had more money to spend on home improvement projects, which is the main driver of Home Depot’s revenue.”

However, the recent changes in the domestic housing market have caused investors’ sentiment to sour on HD shares. Saintvilus wrote, “But so far in 2022 the company has been adversely impacted by soaring interest rates which have helped to slow the housing market. If that weren't bad enough, the company's gross margins have been shrinking because of higher inflation rates. Higher input costs and weakening consumer demand has caused margin erosion within this business.”

HD Aug 2022

Coming into the Q2 report, Saintvilus stated, “In the three months that ended July, the Atlanta, GA.-based company is expected to earn $4.95 per share on revenue of $43.37 billion.” He also noted, “For the full year, ending in December, earnings of $16.46 per share would rise 6% year over year from $15.53 per share, while full-year revenue of the $156.23 billion would rise 3.4% year over year.”

Saintvilus concluded his piece writing, “On Tuesday investors will want to see whether Home Depot can continue to navigate through inflationary headwinds as well has [sic] it has in the past two quarters.”

And, as it happens, the company beat Wall Street’s consensus estimates on both the top and bottom lines, posting Q2 revenue of $43.79 billion, which was up 6.5% on a year-over-year basis, and non-GAAP earnings-per-share of $5.05, beating estimates by $0.10/share.

Regarding HD’s Q2 sales trends, Michelle Chapman, a Nobias 4-star rated author, stated, “Sales at stores open at least a year, a key indicator of a retailer's health, climbed 5.8%, and 5.4% in the U.S.”

In her recent article published at Newsmax, Chapman continued, “While the number of customer transactions fell 3%, the amount shoppers spent per transaction rose 9.1%.”

Michael E. Kanell, a Nobias 4-star rated author, published a post-earnings breakdown of Home Depot this week in the Atlanta Journal-Constitution, putting a spotlight on the company’s strong results.

Kanell wrote, “Home Depot officials had worried about consumer staying power, but the robust increase in home prices meant a surge of trillions of dollars in the amount of equity held by millions of people, and that has fueled spending on repairs and renovations.” He quoted Richard McPhail, the company’s chief financial officer, who told the AJC, “In the first quarter, we were somewhat surprised by the resilience of our customers and that resilience has continued.”

Regarding HD’s recent operational strength throughout recent home price inflation, Kanell wrote, “One of the reasons home prices have climbed is the shortage of homes for sale. That shortage, made exacerbated by the pandemic, has meant fewer people moving. And when people stay put, they are much more likely to spend money on renovations and repairs — the heart of Home Depot’s business.”

Point towards a potential risk moving forward, Kanell wrote, “If there is a downturn, homeowners may do less expensive projects, and Home Depot might see tighter profit margins, said Shoggi Ezeizat, a sector analyst at Third Bridge, a global research firm.”

However, Kanell continued, “Still, unless a downturn really rattles homeowners, Home Depot should fare relatively well, he [regarding Ezeizat] said.” Kanell quoted Ezeizat who said, “The home improvement sector tends to perform well during recessions. Home Depot was built in a recession in the early ‘90s.”

In a separate article published in the Atlanta Journal-Constitution this week, Kanell touched upon Home Depot’s recent announcements regarding shareholder returns. He said, “The board of Home Depot, flush with sales and profit amid the pandemic, has approved a $15 billion buyback of its stock as a way to use “excess cash,” company officials said.”

Kanell put a spotlight on HD’s strong balance sheet, stating, “A company filing said Home Depot finished the quarter with $1.3 billion in cash on hand.” He said that Margaret Smith, a spokeswoman for the company, stated, “Our overall capital allocation principles have remained consistent for over a decade,” she said. “We invest in the business, pay our dividend and return excess cash to shareholder in the form of share repurchases.”

Gary Gambino, a Nobias 5-star rated author, covered Home Depot’s recent earnings results and provided his readers with an in-depth breakdown of the company’s current valuation in a recent article at Seeking Alpha. Gambino offered a more cautious tone on the company, writing, “Home Depot delivered average EPS growth of 19.5% in the 7 years ending in February 2020. Since then, the company enjoyed 2 years of strong growth from the pandemic stay-at-home trade. This growth has slowed considerably in the current fiscal year although current quarterly results show that the consumer is more resilient to macroeconomic concerns than expected. Still, Home Depot is maintaining its guidance of "mid-single digit" EPS growth this year. While this guidance may be conservative, future year growth looks more likely to be around 10%.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

Gambino concluded his piece, stating, “With this lower growth rate, the historical P/E range of 20 - 25 is probably too high going forward. Home Depot remains a great company but at $327 it is still worth about 20 times this year's estimated earnings. The stock traded around $270 in June which is a more reasonable 16.5 times earnings for a stalwart 10% grower. I would not tell anyone to sell here, but those looking to start a new position should consider waiting for a pullback to that level.”

Overall, however, the credible authors and analysts that Nobias tracks express a bullish sentiment for HD shares. 65% of recent articles published by credible authors about HD have included a “Bullish” bias. Right now, 7 out of the 8 credible Wall Street analysts that Nobias tracks who offer an opinion about HD shares believe that the stock is primed to head higher.

The average price target from these 8 individuals for HD is currently $350. Today, HD trades for $300. At this price point, HD shares are down by more than 25% on a year-to-date basis. And, looking at the credible analyst average price target, which implies upside potential of approximately 12%, it appears that the stock has more upside ahead.

Disclosure: Nicholas Ward is long HD. Nicholas Ward wrote this article for Nobias at their request with a view of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.