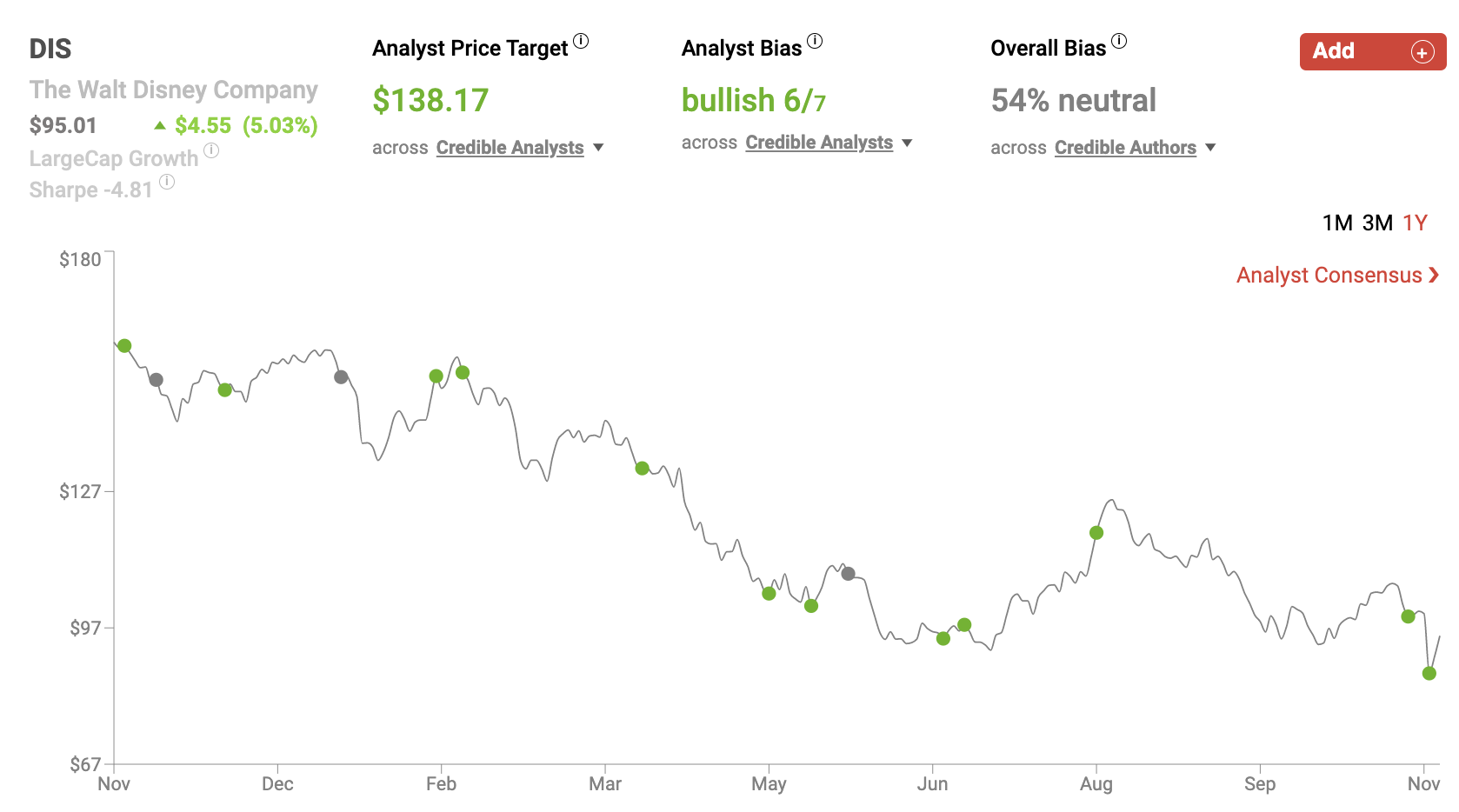

Case Study: What Credible analysts are saying on Disney (DIS) stock

Nobias Insights: 54% of credible authors offer a “Neutral” bias towards Disney shares. 6 out of the 7 credible Wall Street analysts believe that DIS shares are headed higher. The average price target being applied to Disney shares by credible analysts is $138.17 which implies upside potential of approximately 40% relative to DIS’s current share price of $96.20.

Bullish Take: Morgan Stanley analyst Benjamin Swinburne, who receives a Nobias 4-star analyst rating, said that he believes Iger's return "improves the risk/reward" surrounding Disney shares.

Bearish Take: Matthew Clark, a Nobias 4-star rated author, said, “We consider it [Disney] a “High-Risk” stock and expect it to significantly underperform the market over the next 12 months.

Key Points

The Walt Disney Company shares rallied by roughly 9% this week. DIS shares are now down nearly 33.25% on the year, drastically underperforming the S&P 500, which is down by roughly 16% during 2022 thus far.

Disney continues to invest heavily in its streaming platform and direct to consumer content; however, management doesn’t expect its Disney+ streaming service to be profitable until 2024. High capital expenditures are hurting cash flows and this makes the company’s high debt load a concern for certain investors.

Disney announced that it was replacing its CEO, Bob Chapek, with former CEO, Bob Iger this week.

54% of credible authors offer a “Neutral” bias towards Disney shares. 6 out of the 7 credible Wall Street analysts believe that DIS shares are headed higher. The average price target being applied to Disney shares by credible analysts is $138.17 which implies upside potential of approximately 40% relative to DIS’s current share price of $96.20.

Morgan Stanley analyst Benjamin Swinburne, who receives a Nobias 4-star analyst rating, said that he believes Iger's return "improves the risk/reward" surrounding Disney shares.

Matthew Clark, a Nobias 4-star rated author, said, “We consider it [Disney] a “High-Risk” stock and expect it to significantly underperform the market over the next 12 months.”

Performance

Event & Impact

Noteworthy News:

Nobias insights

Bullish Take:

Bearish Take:

Last weekend, Disney made headlines announcing that it was removing its CEO, Bob Chapek, and replacing him with his predecessor, Bob Iger. Nobias recently highlighted Disney’s recent Q3 earnings data in a report; however, this CEO news is material to sentiment surrounding shares and therefore, we wanted to provide an update to subscribers on Disney’s outlook.

DIS Nov 2022

Iger’s return was unexpected on Wall Street and the surprise caused Disney shares to rally by nearly 10%. Despite this rally, Disney shares have still underperformed the S&P 500 by a wide margin in 2022 thus far. On a year-to-date basis, Disney is now down by 33.25% compared to the S&P 500’s -16% performance. But, the credible Wall Street analysts that Nobias tracks see strong upside potential ahead for Disney shares, implying that the stock’s recent rally could spark a larger share price rebound.

Bearish Nobias credible authors:

Matthew Clark, a Nobias 4-star rated author, published a report at Money and Markets that highlighted the management transition at the Walt Disney Company. Clark began his piece stating, “One Bob is out. An old Bob is in. “Over the weekend,” he continued, “The Walt Disney Co. surprised everyone by firing CEO Bob Chapek and appointing former CEO Bob Iger to the job.”

Clark said, “It’s been less than three years since Chapek replaced Iger, who was Disney’s CEO for 15 years.” He noted that this move was so surprising because in June on 2022, Disney extended Bob Chapek’s contract through 2025. “At the time,” Clark said, “the board said Chapek’s leadership was key to helping the company through the COVID-19 pandemic.” He highlighted quarterly data showing that revenues rose coming out of the pandemic; however, in recent quarters, they “stagnated”.

Disney’s focus as of late has been on growing its streaming platforms. Streaming was the focus on many of the authors/analysts that we quoted in the recent Disney Q3 quarterly review. And, Clark made it clear that Disney’s streaming platforms remained one of Chapek’s highest priorities.

By November of 2022, Clark notes that Disney Plus had 164 million subscribers and Disney’s bundle, which includes Disney+, Hulu, and ESPN+ had 235 million subscribers overall. “However, the streaming business continues to lose Disney money … to the tune of $1.5 billion last quarter and $4 billion for the year,” Clark said.

Looking at a series of broader fundamental metrics, including, Disney’s size, volatility, growth, momentum, value, and quality, Clark notes that DIS stock’s performance was poor in all but the “Quality” rating system. “That means we consider it a “High-Risk” stock and expect it to significantly underperform the market over the next 12 months,” he said.

Ultimately, Clark wrote, “Bringing in former CEO Bob Iger to lead the business may turn around The Walt Disney Co.” But, he continued, “it’s going to take patience” and therefore, Disney “is a stock to avoid in your portfolio now.”

Trapping Value, a Nobias 4-star rated author, also covered Iger’s return in an article this week titled, “Disney: Why The Return Of The Jedi Won't Work”. Trapping Value highlighted Iger’s past success, showing why the market’s initial reaction to his return to Disney was a positive one (Disney shares are still up by roughly 9% since Iger’s return to the c-suite was announced).

The author wrote, “Iger's claim to fame comes from the tremendous performance of the stock from September 30, 2005 to February 25, 2020. During the nearly 15-year tenure of Iger, DIS stock rallied more than 500% for an annualized gain of 13.9% including dividends. Total returns demolished that of the S&P (SPY) by a huge margin and investors could not say enough good things about the old guard.” But, they also provided caution, stating, “While the numbers appear spectacular and they were, a good deal of the return came from valuation expansion. Disney's price-to-sales ratio more than doubled during Iger's tenure.”

For comparison’s sake, Trapping Value noted that the S&P 500’s price-to-sales ratio increased by only 60% during this same period of time, showing that Disney’s share price outperformance was driven largely by relative sentiment, as opposed to fundamental growth.

Trapping Value was sympathetic towards Chapek, writing, “Chapek's term was of course marked by the brutal COVID-19 induced recession, but more importantly, is a tale of excesses coming home to roost.” And, while it’s possible that the positive sentiment that Iger has been known to garner could return and surround Disney shares for years to come, Trapping Value believes that investors should focus on the company’s fundamentals. They said, “While Disney has got back to profitability quickly after COVID-19, investors are likely eyeing that cash flow statement with some concern. The company managed to generate free cash flow this year (8-K Link), but the amount trailed net income by more than $2.5 billion.”

Trapping Value continued, “Streaming costs are exploding in the current high inflation environment and there are plenty of competitors that are spending without worrying about profits. This remains the biggest concern and all hopes of significant free cash flow and we might add those big earning numbers for future years, depend upon turning this around.”

Ultimately, the author concluded, “As amazing as Iger's performance was, this comeback story has more room for disappointment than for a heroic ending.” And therefore, Trapping Value wrote, “We rate it [Disney] at Neutral for now.”

While Trapping Value provided a relatively neutral take on Iger’s return, Harold L. Vogel CFA, a Nobias 4-star rated author, provided a distinctly bearish piece this week, stating that investors should use the recent share price rally related to the Iger announcement as an opportunity to sell shares.

Like Trapping Value, Vogel highlighted Iger’s prior success, stating, “His record as CEO for 15 years has generally been good, especially on the early acquisitions of Pixar, Marvel, and Lucasfilm (Star Wars franchise).” “However,” Vogel said, “it seems that he overpaid for Twentieth Century Fox entertainment assets. Rupert Murdoch, to make a pun, “outfoxed ” him and was prescient in seeing that Fox could not gain sufficient scale in streaming or films and had a chance to become a major shareholder of a better growth vehicle in Disney shares.”

Looking at Disney’s recent performance under Chapek, Vogel acknowledged the COVID-19 pandemic headwinds that Disney faced, but went on to say, “soon after in late 2020, the company began to falter, in my opinion.” He continued, “It [Disney] became a woke-driven company that seemed to forget that its history, traditions, underlying culture, and operating structure were intended to appeal to the core base of middle-income families.” This is going to be a difficult problem for Iger to solve, in Vogel’s opinion.

Furthermore, he said, “In other areas, such as content distribution, Chapek approved a major reorganization that upset relations with creative talent. It will be a massive challenge for Iger to undo/fix this. In the process, much creative energy will be wasted as managers are reassigned and/or leave.”

“Meanwhile,” Vogel continued, “cord-cutting will continue to sap the high-margin profits of the cable networks as the transition to streaming is still largely a drain on cash flow.” “ESPN may eventually be spun off, and the linear ABC might also be headed for the same fate. Private equity companies are likely to be the buyers,” Vogel wrote.

In the end, Vogel said, “Mr. Iger has the ability and power to fix some of the current disorders but he can't perform miracles.” And therefore, he concluded, “I'd take the investors' enthusiasm rally about Mr. Iger's return as an opportunity to sell.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

Bullish Nobias credible authors:

While we saw a couple of bearish reports published by credible authors this week, Morgan Stanley analyst Benjamin Swinburne, who receives a Nobias 4-star analyst rating, said that he believes Iger's return "improves the risk/reward" surrounding Disney shares.

Swinburne said that Iger has the "experience and credibility to execute what can only be described as an operational turnaround." Swinburne maintained his “Overweight” weighting for Disney shares with a $125.00/share price target.

Overall, the schism between the more bearish authors and the more bullish Wall Street analysts that recent reports highlight is representative of the broader sentiment being expressed by these two communities of credible individuals that the Nobias algorithm tracks.

Overall bias of Nobias Credible Analysts and Bloggers:

54% of recent articles posted by credible analysts express a “Neutral” bias for Disney shares. However, 6 out of the 7 credible Wall Street analysts that Nobias tracks who have offered an opinion on Nobias shares believes that DIS is headed higher. Currently, the average price target being applied to Disney shares by credible analysts is $138.17. Relative to Disney’s current share price of $96.20, this implies upside potential of approximately 40%.

Disclosure: Nicholas Ward is long DIS. Nicholas Ward wrote this article for Nobias at their request with the intention of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

Case Study: What Credible analysts are saying on Medtronic (MDT) stock

Nobias Insights: 67% of recent articles published by credible authors focused on MDT shares offer a “Bullish” bias. 50% of credible Wall Street analysts believe shares are likely to rise in value. The average price target being applied to Medtronic shares by credible analysts is $99.33, which implies an upside potential of approximately 25% relative to Medtronic's current share price of $78.96.

Bullish Take from Gen Alpha, a 5-star rated Nobias author: “I believe Medtronic is a premium quality enterprise that trades at a significant discount to its historical valuations.”

Bearish Take: 4 credible Wall Street analysts: Wells Fargo analyst Larry Biegelsen, Stifel analyst Rick Wise, Citi analyst Joanne Wuensch, and Truist analyst Richard Newitter, all lowered their fair value estimates for MDT shares post-earnings.

Key Points

Medtronic shares fell by 4.3% this week. On a year-to-date basis, MDT is now down by 25.4%. This compares poorly to the S&P 500, which is down by approximately 16% during 2022 thus far.

Supply chain issues in the semiconductor industry are hurting sales growth and product margins for large cap companies in the medical device segment of the healthcare sector

Medtronic posted Q3 earnings this week, beating Wall Street’s expectations on the bottom line, but missing consensus estimates the top-line. MDT’s second quarter sales totaled $7.59 billion, which missed estimates by $110 million, and represented -3.3% year-over-year growth. However, Medtronic’s non-GAAP earnings-per-share came in at $1.30, which beat consensus estimates by $0.02/share, representing -2% year-over-year growth.

67% of recent articles published by credible authors focused on MDT shares offer a “Bullish” bias. 50% of credible Wall Street analysts believe shares are likely to rise in value. The average price target being applied to Medtronic shares by credible analysts is $99.33, which implies an upside potential of approximately 25% relative to Medtronic's current share price of $78.96.

From Gen Alpha, a 5-star rated Nobias author: “I believe Medtronic is a premium quality enterprise that trades at a significant discount to its historical valuations.”

Four credible Wall Street analysts: Wells Fargo analyst Larry Biegelsen, Stifel analyst Rick Wise, Citi analyst Joanne Wuensch, and Truist analyst Richard Newitter, all lowered their fair value estimates for MDT shares post-earnings.

Performance

Event & Impact

Noteworthy News:

Nobias insights

Bullish Take:

Bearish Take:

Throughout much of 2022, large cap healthcare stocks have provided investors with a safe haven from the broader market’s negative volatility. Many of the large-cap bio-pharmaceutical companies have posted positive returns on the year (during a period of time when the S&P 500 has fallen by approximately 16%).

However, the medical device segment of the healthcare sector has largely struggled due to supply chain issues associated with the semiconductors that are required to manufacture their products. Medtronic (MDT) is one such medical device name that has struggled during 2022. After falling roughly 4.3% this week, MDT shares are down by 25.4% on the year.

MDT Nov 2022

Medtronic published its fiscal second quarter results on November 22, 2022, missing Wall Street estimates on the top-line, but beating analyst expectations on the bottom-line. MDT’s second quarter sales totaled $7.59 billion, which missed estimates by $110 million, and represented -3.3% year-over-year growth. However, Medtronic’s non-GAAP earnings-per-share came in at $1.30, which beat consensus estimates by $0.02/share, representing -2% year-over-year growth.

Regarding its revenue breakdown, Medtronic’s press release stated: “Second quarter U.S. revenue of $4.069 billion represented 54% of company revenue and increased 2% as reported and 1% organic. Non-U.S. developed market revenue of $2.157 billion represented 28% of company revenue and decreased 13% as reported and increased 3% organic. Emerging Markets revenue of $1.359 billion represented 18% of company revenue and decreased 1% as reported and increased 4% organic.”

During the company’s second quarter report, MDT’s CEO,-Geoff Martha, said, "We're taking decisive actions to improve the performance of the company." Martha continued: "Slower than predicted procedure and supply recovery drove revenue below our expectations this quarter. We continue to take decisive actions to improve the overall performance of the company, including streamlining our organizational structure, strengthening our supply chain, driving a performance culture, and strategically allocating capital to support our best growth opportunities with the investments they deserve. We're seeing the benefit of these changes – along with new incentives and strong execution – in certain businesses, and we're focused on ensuring these efforts translate into improved performance across the company. Looking ahead, we're confident we have a clear path to delivering durable growth and increased shareholder value."

Medtronic also updated investors with new full-year fiscal 2023 guidance, stating: “The company expects fiscal year 2023 second half revenue growth of 3.5% to 4.0% on an organic basis, an acceleration over the first half. If foreign currency exchange rates as of the beginning of November hold, revenue growth in fiscal year 2023 would be negatively affected by approximately $1.740 billion to $1.840 billion versus the previously stated $1.4 billion to $1.5 billion impact.”

The company continued, “The company now expects fiscal year 2023 diluted non-GAAP EPS in the range of $5.25 to $5.30. EPS guidance includes an estimated 18 cent negative impact from foreign currency at rates as of the beginning November.”

Regarding these new guidance figures, Medtronic’s chief financial officer, Karen Parkhill, said: "We continue to expect organic revenue growth acceleration, with the second half growing faster than the first. However, given a slower pace of market and supply recovery, we're reducing our revenue expectations for the remainder of the year. On the bottom line, we are driving expense reductions throughout the company to help offset the lower revenue and the effects of cost inflation. We are also committed to investing appropriately for the long-term, allocating capital to our most promising growth drivers and executing tuck-in acquisitions, all designed to reach more patients and create greater value for our shareholders."

Bearish Nobias credible authors:

Since posting these results and providing the market with new forward guidance, MDT shares have fallen by approximately 4%. In response to Medtronic’s earnings report, several credible Wall Street analysts that the Nobias algorithm tracks lowered their fair value estimates for MDT shares.

Truist analyst Richard Newitter, who receives a Nobias 4-star rating, lowered his price target from $89 to $84 and maintained a “Hold” rating on shares.

Citi analyst Joanne Wuensch, who receives a Nobias 4-star rating, lowered her price target from $108 to $85 and reduced her “Buy” rating on MDT shares to “Neutral”.

Wells Fargo analyst Larry Biegelsen, who receives a Nobias 4-star rating, lowered his price target from $96 to $82 and maintained an “Equal Weight” rating on MDT shares.

And lastly, Stifel analyst Rick Wise, who receives a Nobias 4-star rating, lowered his price target on MDT shares from $105 to $90, keeping a “Buy” rating on shares.

Bullish Nobias credible authors:

Poor guidance provided during the last quarter inspired several credible Wall Street analysts to lower their price targets for MDT shares. Yet, despite these recent downgrades, the average price target being applied to MDT by credible Wall Street analysts implies upside potential that is greater than 25%.

With this strong upside potential in mind, Jonathan Block, a Seeking Alpha News Editor who is also a Nobias 4-star rated author, recently published a report which focused on the macro growth tailwinds that medical device companies are expected to benefit from during the coming decades.

Block wrote, “The global medical devices market was ~$489B in 2021, and is projected to increase to ~$496B in 2022.” “However,” he continued, “it is expected to expand to ~$719B by 2029, according to Fortune Business Insights, meaning several companies are set to benefit handsomely.”

Regarding the data from the Fortune Business Insight report, Block said, “The consulting firm sees a CAGR for the industry of 5.5% between 2022 and 2029.” Block said that increasing “prevalence of chronic disease around the world” is driving this growth trend. For instance, Block noted that the International Diabetes Foundation says that there were 537 million people with the disease in 2021 and the Foundation expects to see that figure rise to 643 million by 2030 and 783 million by 2045.

“Based on these insights,” Block wrote, “there are several companies set to benefit from an increase in demand for medical devices.” He continued, “These include the top three medical device companies based on 2021 revenue: Medtronic (NYSE:MDT), Abbott (NYSE:ABT), and Johnson & Johnson (NYSE:JNJ).”

With specific regard to Medtronic, Block said, “Although Medtronic (MDT) operates several segments, it is perhaps known for its cardiovascular portfolio. But its products in medical surgical, neuroscience, and diabetes show that the company is well-positioned to benefit in multiple device areas.”

Gen Alpha, a Nobias 5-star rated author, also highlighted a bullish outlook for Medtronic shares in a recent article titled, “Medtronic: Buy This 'A' Quality Gem On The Cheap”. Gen Alpha said, “Medtronic is a medical device giant with a presence in over 150 countries. Its broad array of products includes pacemakers, stents and insulin pumps, treating 70 various health conditions.” They continued, “MDT employs over 90K employees around the world, and in the trailing 12 months, generated $31 billion in total revenue.”

Gen Alpha touched upon Medtronic’s recent struggles, writing, “It's fair to say that the past 9 months have been challenging, as MDT has had to contend due to chip shortages that have caused disruptions on the supply side.” But, they went on to say that the extent of MDT’s sell-off in response to supply chain issues has been irrational.

Gen Alpha wrote, “I believe the market has not fully awakened to the fact that the chip shortage has greatly eased in recent months.” While MDT investors wait for a share price rebound, Gen Alpha points out that Medtronic continues to provide generous shareholder returns. They said, “Importantly, for dividend investors, MDT carries a strong A rated balance sheet. At the current price of $84.65, MDT yields a respectable 3.2%. The dividend is also well-protected by a 48% payout ratio, and comes with a 5-year CAGR of 8%.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

Looking at Medtronic’s valuation, Gen Alpha concluded, “Given the quality of the enterprise, long-term growth attributes, and the turnaround in the chip supply chain, I believe the shares are too cheaply valued at present.”

When Gen Alpha wrote this, Medtronic shares were trading for $84.65. Today, they’re even cheaper, trading for $79.12/share. Ultimately, the author stated, “I believe Medtronic is a premium quality enterprise that trades at a significant discount to its historical valuations.” “As such,” they continued, “I view MDT as being a high quality buy for income and potentially strong total returns.”

Overall bias of Nobias Credible Analysts and Bloggers:

Yet, despite this slew of downgrades from the credible Wall Street community that Nobias tracks, the majority of credible authors that have published reports on MDT shares recently continue to be bullish on shares. 67% of recent reports published by credible authors have expressed a “Bullish” bias. While we saw 4 of the credible analysts that cover MDT lower their price targets on shares, the average price target amongst the credible individuals that the Nobias algorithm tracks for Medtronic is currently $99.33. Therefore, compared to Medtronic’s current share price of $79.19, that average credible analyst price target implies upside potential of approximately 25.4%.

Disclosure: Nicholas Ward is long MDT. Nicholas Ward wrote this article for Nobias at their request with the intention of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

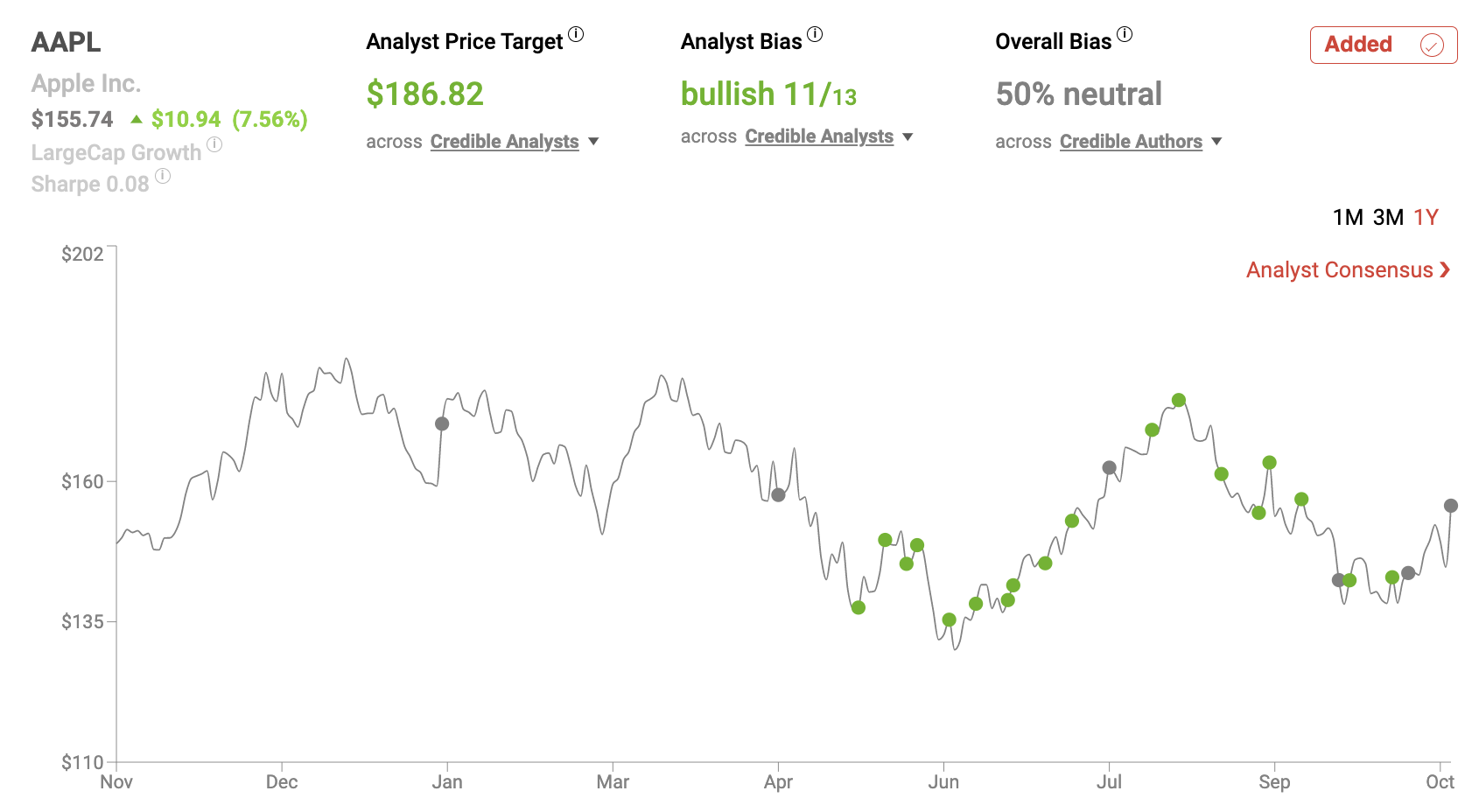

Case Study: What Credible analysts are saying on Amazon (AMZN) stock

Performance: Amazon shares rallied by 10.9% this week, yet they’re still down by 40.85% on the year; this compares poorly to the S&P 500 which is down by 16.75% on the year and the Nasdaq Composite Index which has fallen by 28.48% during 2022 thus far.

Event and Impact: Amazon faces macroeconomic headwinds which have caused its major growth engines to slow. Poor fundamental results have led to the stock’s price-to-earnings ratio increasing, even as its share price falls.

Noteworthy News: AMZN posted Q3 earnings recently, missing Wall Street’s expectations with $127.1 billion in sales (which was $370 million below consensus), but beat estimates on the bottom-line, posting non-GAAP earnings-per-share of $0.28.

Nobias Insights: 59% of recent articles published by credible authors focused on AMZN shares were “Bullish”. Only 14 out of 15 credible Wall Street analysts believe shares are headed higher. The average price target being applied to Amazon shares by credible analysts is $177.21, which implies upside potential of approximately 69.9% relative to AMZN’s current share price of $100.77.

Key Points

Amazon shares rallied by 10.9% this week, yet they’re still down by 40.85% on the year; this compares poorly to the S&P 500 which is down by 16.75% on the year and the Nasdaq Composite Index which has fallen by 28.48% during 2022 thus far.

Amazon faces macroeconomic headwinds which have caused its major growth engines to slow. Poor fundamental results have led to the stock’s price-to-earnings ratio increasing, even as its share price falls.

AMZN posted Q3 earnings recently, missing Wall Street’s expectations with $127.1 billion in sales (which was $370 million below consensus), but beat estimates on the bottom-line, posting non-GAAP earnings-per-share of $0.28.

59% of recent articles published by credible authors focused on AMZN shares were “Bullish”. Only 14 out of 15 credible Wall Street analysts believe shares are headed higher. The average price target being applied to Amazon shares by credible analysts is $177.21, which implies upside potential of approximately 69.9% relative to AMZN’s current share price of $100.77.

Performance

Event & Impact

Noteworthy News:

Nobias insights

Amazon is the poster child of tech companies that have generated fantastic long-term wealth for their shareholders. Since its IPO in May 1997, AMZN shares have generated total returns north of 134,000%. During the last decade, AMZN shares have risen by 795%.

And yet, during 2022 this stock has been a major underperformer, falling by 40.85% on a year-to-date basis, compared to the S&P 500 which is down by 16.75% on the year and the Nasdaq Composite Index which has fallen by 28.48% during 2022 thus far.

Amazon recently reported third quarter earnings which disappointed Wall Street, inspiring the latest leg of the company’s sell-off. And yet, despite serious weakness during 2022, the credible authors and analyst that Nobais tracks largely maintain their “Bullish” outlook for shares.

AMZN Nov 2022

Bearish Nobias credible authors:

Huileng Tan, a Nobias 4-star rated author, recently published an article at Business Insider that put the extent of Amazon’s recent sell-off into historical perspective. Tan said, “Amazon has become the first public company ever to lose $1 trillion in market value amid the tech stock rout, according to Bloomberg.”

Breaking down the sell-off, Tan wrote, “The world's largest online retailer's share price closed 4.3% lower at $86.14 on Wednesday, taking its market capitalization to about $879 billion.” She continued, “The stock has lost around 48% of its value this year alone, and is a far cry from July 2021 when the company's market cap almost touched $1.9 trillion, per Bloomberg.”

Tan highlighted a quote provided by Amazon’s CFO, Brian Olsavsky, during the company’s recent Q3 earnings call. Olsavsky said, "We are seeing signs all around that, again, people's budgets are tight, inflation is still high, energy costs are an additional layer on top of that caused by other issues. We are preparing for what could be a slower growth period, like most companies."

During the third quarter, Amazon missed Wall Street’s expectations with $127.1 billion in sales (which was $370 million below consensus), but beat estimates on the bottom-line, posting non-GAAP earnings-per-share of $0.28..

Although Amazon missed sales expectations, the company is still growing revenues at a double digit rate. In its Q3 report, the company stated, “Net sales increased 15% to $127.1 billion in the third quarter, compared with $110.8 billion in third quarter of 2021. “Excluding the $5.0 billion unfavorable impact from year-over-year changes in foreign exchange rates throughout the quarter, net sales increased 19% compared with third quarter of 2021.”

Dani Cook, a Nobias 4-star rated author, put a spotlight on Amazon’s recent earnings data in a recent report that she published at the Motley Fool. Cook mentioned the company’s top and bottom-line results and then said, “Meanwhile, Amazon Web Services brought in $20.5 billion versus the expected $21.1 billion.” She continued, “AWS was responsible for 100% of Amazon’s operating income in Q3, underscoring how crucial the cloud computing business has become.” And, she said, “AWS lost some steam in the company's latest quarter, with its year-over-year rise of 27.4% lower than Q2 2022's increase of 33% and Q3 2021's 39%.” Amazon CFO Brian Olsavsky attributed the slowed growth primarily to consumers and businesses reining in spending.”

Cook believes that the slowdown in Amazon’s cloud business was a primary catalyst for its recent sell-off. Also, she points out, the company’s forward guidance left investors wanting more. Cook wrote, “The company's fourth-quarter forecasts have also fallen short. Amazon is expecting revenue of $140 billion to $148 billion, amounting to a year-over-year rise of 2% to 8%. Analysts at Refinitiv had previously projected that the company would earn $155.15 billion for the quarter.”

In response to rising costs applied to the company’s retail business by high inflation, she says that the company is cutting costs. Cook wrote, “So far, CEO Andy Jassy has responded by cutting costs in multiple divisions, such as reducing its warehouse footprint, axing some experimental tech projects, shutting down its telehealth service, Amazon Care, and pausing hiring in its executive positions.”

The macroeconomic conditions that Amazon faces concern her. Cook continued, “Amazon is likely to continue suffering declines in the short term as geopolitical and macroeconomic factors keep operating costs high but consumer spending low.”

However, she noted, “the future is still bright for the e-commerce titan.” “Regardless of temporary market declines in the next year,” Cook stated, “Amazon is well-positioned to see significant gains once it bounces back.” But, she states, “With a price-to-earnings ratio that is about 21% higher than a year ago -- despite the steep drop in the stock price -- Amazon's shares are not the cheapest around despite a sell-off.” And therefore, Cook concluded, “Amazon is likely to come back strong over the long term, but it might be best to first watch its AWS business and wait until it begins seeing improving quarterly growth again before committing to Amazon.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

Kevin Coupe, a Nobias 4-star rated author, published a recent article that put a spotlight on the company’s cost cutting measures. Coupe said, “Amazon said yesterday that it is freezing corporate hiring "for the next few months," a move that it said "is due to the economy and 'in light of how many people we have hired in the last few years'," the Seattle Times reports.” He continued, “The story notes that "Amazon already has paused hiring in its corporate retail division, which includes online and physical stores, its marketplace for third-party sellers, and its Prime subscription service. The company also reportedly stopped hiring for its advertising business and at Amazon Web Services, its cloud computing arm and one of the most profitable parts of the company.”

Tristan Bove, a Nobias 5-star rated author, also touched upon macroeconomic issues facing Amazon in a recent report that he published at Yahoo Finance, stating, “A week before the earnings report, Amazon founder and former CEO Jeff Bezos advised people to “batten down the hatches” in anticipation of a clouding economic environment.”

There is no shortage of macro concerns surrounding this mega-cap company; however, looking at the overall opinions expressed by the credible authors and analysts tracked by the Nobias algorithm, a clear bullish trend has emerged after the stock’s recent sell-off.

Overall bias of Nobias Credible Analysts and Bloggers:

59% of recent articles published by credible authors have expressed a “Bullish” bias towards AMZN shares. 14 out of the 15 credible Wall Street analysts that Nobias tracks which have offered an opinion on Amazon stock believe that the company’s shares will increase in value. Right now the average price target being applied to AMZN shares by credible analysts is $171.21. Compared to Amazon’s current share price of $100.77, this represents upside potential of approximately 69.9%.

Disclosure: Nicholas Ward is long AMZN. Nicholas Ward wrote this article for Nobias at their request with the intention of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

Case Study: What Credible analysts are saying on Occidental Petroleum (OXY) stock

Performance: Occidental Petroleum (OXY) shares were flat this week; however, they’re up by nearly 17% during the last month. On a year-to-date basis, Occidental shares are up by 139.31%, making the stock a major out-performer during a year when the S&P 500 is down nearly 17%.

Event and Impact: Warren Buffett’s Berkshire Hathaway continues to accumulate OXY shares, driving up its valuation.

Noteworthy News: OXY posted Q3 results this week, beating Wall Street’s consensus on the top-line, but missing on the bottom-line by $0.01/share.

Nobias Insights: 73% of recent articles published by credible authors were “Bullish”. Only 4 out of 8 credible Wall Street analysts believe shares are headed higher. The average price target being applied to Occidental shares by credible analysts is $77.35, which implies upside potential of approximately 3.9% relative to OXY’s current share price of $74.33.

Key Points

Occidental Petroleum (OXY) shares were flat this week; however, they’re up by nearly 17% during the last month. On a year-to-date basis, Occidental shares are up by 139.31%, making the stock a major out-performer during a year when the S&P 500 is down nearly 17%.

Warren Buffett’s Berkshire Hathaway continues to accumulate OXY shares, driving up its valuation.

OXY posted Q3 results this week, beating Wall Street’s consensus on the top-line, but missing on the bottom-line by $0.01/share.

73% of recent articles published by credible authors were “Bullish”. Only 4 out of 8 credible Wall Street analysts believe shares are headed higher. The average price target being applied to Occidental shares by credible analysts is $77.35, which implies upside potential of approximately 3.9% relative to OXY’s current share price of $74.33.

Performance

Event & Impact

Noteworthy News:

Nobias insights

The energy sector continues to be the major out-performer during 2022. Although the S&P 500 rallied more than 5% this week, the major index is still down nearly 17% on the year and the energy sector is the only sector showing positive performance.

Energy stocks are up by 69.38% on the year, outpacing all other areas of the market by a wide margin. And within the energy space, Occidental Petroleum (OXY) has been one of the biggest winners for investors this year, up 139.31% on a year-to-date basis.

OXY shares were flat this week; however, over the last month they’ve risen by 16.8%. The company posted third quarter earnings this week and with those results in mind, we’re seeing a mixed bag when it comes to future expectations between the credible author and analyst communities.

OCY Nov 2022

Bearish Nobias credible authors:

Fun Trading, a Nobias 4-star rated author, published an article at Seeking Alpha this week titled, “Occidental Petroleum: Strong Quarter But Not Strong Enough”. The author put a spotlight on OXY’s strong trailing twelve month performance, writing, “Occidental Petroleum is up 122% on a one-year basis.” They continued, “The excellent recovery was led by higher commodity prices reaching over $94 per barrel and Buffett's renewed interest in Berkshire Hathaway (BRK.A, BRK.B), increasing its stake in the company to 20.7% after buying nearly 6 million shares in September.”

Looking at the company’s quarterly results, Fun Trading said, “Occidental Petroleum reported third-quarter 2022 adjusted earnings of $2.44 per share, falling short of analysts' expectations but well over the $0.87 per share made last year.” They stated, “The increase can be attributed to operating efficiencies and significantly higher commodity prices.”

Looking at the company’s top-line, Fun Trading said, “Total revenues were $9.501 billion, which was better than expectations.” The author continued, highlighting Occidental’s segment revenue, stating:

Oil and Gas revenues were $7,098 million, up 43.3% from 3Q21.

Chemical revenues were $1,691 million, up 21.1% from 3Q21.

Midstream & Marketing revenues were $1,005 million, up 43.2% from last year.

Fun Trading also highlighted a quote from Occidental’s CEO, CEO Vicki Hollub, from the quarterly in the conference call: “We delivered another strong quarter operationally and financially, enabling us to further advance our shareholder return framework as we made meaningful progress toward completing our $3 billion share repurchase program. We achieved our goal of reducing the face value of our debt to the high-teens and plan to continue repaying debt through the remainder of this year before allocating a higher percentage of cash flow to shareholder returns next year.”

And yet, even with OXY’s fundamental growth and management’s increased shareholder return program in mind, Fun Trading remains concerned about the stock’s relative value. They wrote, “Buffett's buying spree has propelled the stock price artificially to new highs, pushing the stock to a much higher valuation than is fair if we compare it to a few other strong companies in this industry.”

“Still,” Fun Trading concluded, “I see it as an inflated level that could be a substantial negative if the world economy falters due to over-reasonable commodity prices, weakening world stability where emerging countries bear the brunt of the pain.”

Two things that could justify a premium valuation are an improving balance sheet and unique long-term growth prospects. In a recent article that he published at the Motley Fool on Occidental, Tyler Crowe, a Nobias 4-star rated author, highlighted both of these aspects.

Crowe began his piece off on a bullish note, writing, “Occidental's oil and gas business is looking better by the day.” He continued, “ After taking a risky bet in 2019 to acquire Anadarko Petroleum, which required a lot of debt and special financing from Berkshire Hathaway, the recent period of high oil prices has helped to improve its financials drastically. According to management, its current operations can support its current dividend as long as domestic oil prices remain above $40, and it has been putting much of its excess cash toward debt reduction.”

Regarding Occidental’s balance sheet, Crowe said, “Its debt load peaked in the second quarter of 2020 at $37.4 billion, and has since been reduced to $20.2 billion for a debt-to-capital ratio of 43%.” But, echoing the Vicki Hollub statement highlighted by Fun Trading, Crowe wrote, “Management believes it no longer needs to pay down debt immediately and will pay down debt as it matures. In the interim, it plans to buy back stock. In the most recent quarter, it repurchased about $1.1 billion worth of shares.”

With regard to long-term growth prospects, Crowe mentioned that, “The company's investor presentations highlight a plan to use its current oil and gas operations as a cash-generating engine to incubate its carbon capture and sequestration plans.” He continued, “Occidental is uniquely positioned in this business because it has extensive assets and expertise in what is known as Enhanced Oil Recovery (EOR). EOR is a type of oil production that involves injecting CO2 into older oil and gas wells to repressurize the reservoir and extract more oil.”

Crowe said, “Management believes that it can use these assets as a way to capture and transport CO2 to injection sites or to facilities that can create products from the captured carbon.” But, he notes that there is a potential issue for investors here.

Crowe says, “The challenge to this whole plan is that it is based largely on a carbon market that does not yet exist.” He continued, “Much of the rationale for these facilities is based on Article 6 of the Paris Climate accords, which outlines a plan to develop a global market such that we can assign a dollar value to carbon emissions.”

With this uncertainty in mind, Crowe concluded, “Even though Occidental has the Buffett stamp of approval, I would be more comfortable knowing that a carbon trading market is established before buying this stock.”

Bullish Nobias credible authors:

While these two credible authors published cautious Occidental reports recently, Growth at a Good Price, a Nobias 4-star rated author, published a bullish post-earnings report at Seeking Alpha this week. Growth at a Good Price also highlighted OXY’s valuation, stating: “Before today’s earnings release came out, OXY traded at:

9.96 times adjusted earnings.

2 times sales.

3.9 times book value.

4.8 times operating cash flow.”

However, unlike Fun Trading, Growth at a Good Price likes the stock’s price, stating, “The bottom line on Occidental Petroleum is that it’s a thriving oil company that just put out solid earnings. It’s cheap, it’s growing fast, and it’s paying off its debt.”

Regarding earnings-per-share growth, the author said, “As I wrote previously, OXY is in a great position to grow its earnings and cash flows from here. Due to the ongoing debt reduction, it can increase its earnings even without rising oil prices. So, it’s safe to assume that there will be some year-over-year growth going forward. However, for the sake of conservatism, I will assume it’s only 10% per year.”

“Now,” the author said, “if we assume 0% growth, we can come up with a terminal value estimate for OXY. Using an 10% discount rate, the last 12 months’ cash flows are worth $130.09.” They continued, “If we assume 10% CAGR growth over 5 years and no growth after that, we get a $196 price target.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

“That’s a truly enormous amount of upside to today’s prices,” Growth at a Good Price wrote. “But of course,” they continued, “this estimate involves a future growth projection that may not correspond to what unfolds.” “Nevertheless,” they concluded, “even with 0% growth, OXY has upside. So, despite all of the gains it has already made, the stock looks appealing.”

Summing up their bullish report, Growth at a Good Price stated, “This stock has been among the S&P 500’s best performers this year for a reason. Few companies have turned their fortunes around quite like OXY has since 2020. Yes, the company is subject to certain risk factors. But on the whole, the risks inherent in buying OXY are risks I’m comfortable taking. If you’re a risk-averse investor who is uncomfortable with volatility, then oil stocks might not be for you. For those willing to bet on the future of a very strong company, Occidental Petroleum Corporation is a worthy pick.”

Overall bias of Nobias Credible Analysts and Bloggers:

Overall, it appears that most of the credible authors covering OXY shares agree with Growth at a Good Price’s assessment; 73% of recent articles published by credible analysts have expressed a “Bullish” bias. However, credible Wall Street analysts aren’t quite as enamored with OXY shares. Only 4 out of the 8 credible analysts that Nobias tracks believe that OXY shares should increase in value. Right now, the average price target being applied to OXY by credible analysts is $77.25 which implies a 3.9% upside potential from today’s $74.33 share price.

Disclosure: Nicholas Ward has no OXY position. Nicholas Ward wrote this article for Nobias at their request with the intention of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

Case Study: What Credible analysts are saying on Disney (DIS) stock

Performance: The Walt Disney Company shares sold off more than 5.5% this week. DIS shares are now down nearly 39.4% on the year, drastically underperforming the S&P 500, which is down by 16.75% during 2022 thus far.

Event and Impact: Disney continues to invest heavily in its streaming platform and direct to consumer content; however, management doesn’t expect its Disney+ streaming service to be profitable until 2024.

Noteworthy News: Disney reported Q4 earnings this week, missing Wall Street’s estimates on both the top and bottom lines.

Nobias Insights: 54% of credible authors offer a “Neutral” bias towards Disney shares. 6 out of the 7 credible Wall Street analysts believe that DIS shares are headed higher. The average price target being applied to Disney shares by credible analysts is $138.17 which implies upside potential of approximately 45.4% relative to DIS’s current share price of $95.01.

Key Points

The Walt Disney Company shares sold off more than 5.5% this week. DIS shares are now down nearly 39.4% on the year, drastically underperforming the S&P 500, which is down by 16.75% during 2022 thus far.

Disney continues to invest heavily in its streaming platform and direct to consumer content; however, management doesn’t expect its Disney+ streaming service to be profitable until 2024.

Disney reported Q4 earnings this week, missing Wall Street’s estimates on both the top and bottom lines.

54% of credible authors offer a “Neutral” bias towards Disney shares. 6 out of the 7 credible Wall Street analysts believe that DIS shares are headed higher. The average price target being applied to Disney shares by credible analysts is $138.17 which implies upside potential of approximately 45.4% relative to DIS’s current share price of $95.01.

Performance

Event & Impact

Noteworthy News:

Nobias insights

Shares of the Walt Disney Company (DIS) fell by 5.54% this week, bucking the bullish trend that the broader indexes experienced. The S&P 500 rose by 5.82% this week, pushing its year-to-date performance up to -16.75%. Disney, on the other hand, is now down by 39.39% on the year, making it a drastic underperformer on the year.

Disney released its fourth quarter/full year earnings report this week. Disney missed Wall Street’s estimates on both the top and bottom lines, posting quarterly revenue of $20.15 billion, $1.29 billion below consensus, and non-GAAP earnings-per-share of $0.30, missing Wall Street’s target by $0.26.

The company highlighted its fundamental results, stating:

Revenues for the quarter and year grew 9% and 23%, respectively.

Diluted earnings per share (EPS) from continuing operations for the quarter was comparable to the prior-year quarter at $0.09. Excluding certain items(1), diluted EPS for the quarter decreased to $0.30 from $0.37 in the prior-year quarter.

Diluted EPS from continuing operations for the fiscal year ended October 1, 2022 increased to $1.75 from $1.11 in the prior year. Excluding certain items(1), diluted EPS for the year increased to $3.53 from $2.29 in the prior year.

Disney’s CEO, Bob Chapek, led off the press release with a statement: “2022 was a strong year for Disney, with some of our best storytelling yet, record results at our Parks, Experiences and Products segment, and outstanding subscriber growth at our direct-to-consumer services, which added nearly 57 million subscriptions this year for a total of more than 235 million. Our fourth quarter saw strong subscription growth with the addition of 14.6 million total subscriptions, including 12.1 million Disney+ subscribers. The rapid growth of Disney+ in just three years since launch is a direct result of our strategic decision to invest heavily in creating incredible content and rolling out the service internationally, and we expect our DTC operating losses to narrow going forward and that Disney+ will still achieve profitability in fiscal 2024, assuming we do not see a meaningful shift in the economic climate. By realigning our costs and realizing the benefits of price increases and our Disney+ ad-supported tier coming December 8, we believe we will be on the path to achieve a profitable streaming business that will drive continued growth and generate shareholder value long into the future. And as we embark on Disney’s second century in 2023, I am filled with optimism that this iconic company’s best days still lie ahead.”(2)

Looking at Disney’s operating segment performance, the company’s press release highlighted -3% revenue growth from the Disney Media and Entertainment Distribution segment and 36% revenue growth from the Disney Parks, Experiences and Products segment.

DIS Nov 2022

Disney’s media segment posted $12.75 billion of sales and Disney’s Parks segment posted $7.4 billion of sales. Disney highlighted 39% growth of Disney+ subscribers; however, the company’s average monthly revenue per subscriber fell by 10% in the U.S. and Canada market. Disney+ Core’s average monthly revenue per subscriber fell by 4% and Global Disney+ saw this same metric fall by 5%. So, while management has succeeded in growing its subscriber base, it appears to be sacrificing near-term profits for subscriber gains.

During Q4, Disney’s cash from operations fell by 4% and its free cash flow fell by 10%. Falling margins, net income, and free cash flow fueled the bear’s negativity, leading to a 10%+ sell-off following this Q4 earnings release. Yet, as Chapek said, the company still believes that Disney+ will be a profitable operation by 2024, providing optimism for bulls.

Bullish Nobias credible authors:

Dani Cook, a Nobias 4-star rated author, wrote about Disney’s recent earnings report in a bullish article at the Motley Fool this week. Cook said, “The company's fourth-quarter earnings release on Nov. 8 was a bit of a mixed bag, as its parks revenue soared, but its media segment took some concerning hits.”

Cook mentioned the threat of recession moving forward and the potential negative impact of this on Disney’s consumer-centric business model; however, she also stated, “While Disney's short-term prospects may be uncertain, the company has proven the staying power of its content and is home to some of the world's most in-demand franchises.”

Because of the experiential aspect of Disney’s business (live sports, theme parks, and cruise ships) the company experienced a lot of volatility during the pandemic. Cook highlighted this stating, “Its parks business experienced massive losses due to closures, while its streaming service Disney+ seemed to launch at the perfect time in 2019. The streaming service received a significant boost to its growth as home-bound people flocked to online entertainment platforms.”

But ultimately, she is bullish on the company because of the strength of its steaming platform. Cook said, “In three years, Disney+ has reached 164.2 million members, pushing the company's total streaming subscribers to 235.7 million, and beating Netflix's (NASDAQ: NFLX) 223.09 million.”

Therefore, she continued, “Disney+ has risen faster than any streaming service in history.” Adding color to the Disney+ and Netflix comparison, Cook wrote, “Industry founder Netflix didn't reach Disney+'s current subscriber count until 2019, 12 years after its streaming service launched in 2007. Disney has accomplished its swift streaming expansion with the draw of its incredibly potent content brands such as Marvel, Star Wars, Pixar, 20th Century Studios, and all of its franchises from Walt Disney Studios.”

But, she says, this growth hasn’t come without headaches. Cook said that Disney’s Media segment posted -91% year-over-year growth in terms of its operating income, writing, “The slump in earnings from Disney's Media and Entertainment segment was primarily driven by the company's $30 billion content spend in 2022 as it worked to grow Disney+.”

Despite the rising costs associated with building out its streaming service, Cook likes the over-the-top media space, stating that this is currently a $327 billion industry. Regarding the forward growth prospects of streaming services, Cook said, “Fortune Business Insights expects it to see a 19.9% compound annual growth rate and reach a value of $1.6 trillion by 2029.”

Cook points out that Disney has taken steps to diversify the content on Disney+ in recent years as it attempts to expand its subscriber base. And, she said, “Disney isn't done yet”. Cook said that Disney’s plans for an ad-supported version of Disney+ “still has yet to launch, which could open the door for a revenue boost in the second half of fiscal 2023.”

Ultimately, she concluded, “Disney has embarked on an expensive but promising transition to diversify its business, maximize efficiency, and grow revenue over the long term. And with a price-to-earnings ratio at 69% below what it was a year ago, Disney stock is a bargain and worth buying on the dip to hold long-term.”

Long Player, a Nobias 5-star rated author, also published a post-earnings article this week, focusing largely on the “culture wars” that Disney has been fighting in recent years. The author began their piece stating, “Disney (NYSE:DIS) long ago made a statement about inclusion and diversity that earned the ire of the state of Florida. That ire meant that a very inadequate law was passed that meant for Florida to dissolve the self-governing unit that Disney has for its business unit, the theme park. But the law never stated how to unwind decades of business deals, nor did it state how bondholders would be paid off. Paying off the bondholders is part of the bond covenants.”

Long Player noted that the strong rhetoric surrounding Disney’s culture issues had quieted in recent quarters, with investors focused instead on its post-COVID-19 rebound. “But, “ the author stated, recently “the CEO made a statement about "woke" which the news promptly carried and may well start the whole thing up again if management is not careful.”

Long Player said, “Disney got itself caught in an unfortunate situation about diversity. Right now, that discussion appears to be largely out of favor in Florida. Despite the law being passed, there's unlikely to be a material change in the situation because bondholders have a change of control as part of the bond covenant.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

Long Player states that these political issues add uncertainty to Disney’s outlook moving forward, yet looking at the company’s recent results, they aren’t hurting the company’s growth. Long Player wrote, “For all the talk about characters being appropriate for families and children, the company seems to have had no problems attracting streaming customers.” They continued, “This business, however, now needs to turn from the showing loss to a profit. That may or may not be possible, given that the streaming "wars" are just getting started.”

Long Player distinguishes Disney from its media peers, stating, “Disney does have an advantage in that the other parts of the integrated company may derive enough benefits from the streaming segment so that the company does not have to report a profit. Not all competitors appear to be in the same position.”

Regarding ongoing growth prospects for Disney, Long Player said, “The acquisition of 21st Century Fox has yet to be fully exploited.” They continued, “That will likely happen in the post-pandemic period. But it could take a year or two for investors to see the results.

Acknowledging the “woke” headwinds, the author concluded, “The recovery potential far outweighs any adverse possibilities in Florida, if they even happen.”

Overall bias of Nobias Credible Analysts and Bloggers:

Looking at the opinions expressed by the credible authors and credible analysts that the Nobias algorithm tracks, there is a schism between the two communities. 54% of recent articles released by credible authors have expressed a “neutral” bias for Disney shares. However, 6 of the 7 credible Wall Street analysts that Nobias tracks believe that DIS shares are likely to rise in value.

Right now, the average price target being applied to DIS shares by credible analysts is $138.17. Relative to the stock’s current share price of $95.01, that average price target represents upside potential of approximately 45.4%.

Disclosure: Nicholas Ward is long DIS shares. Nicholas Ward wrote this article for Nobias at their request with the intention of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

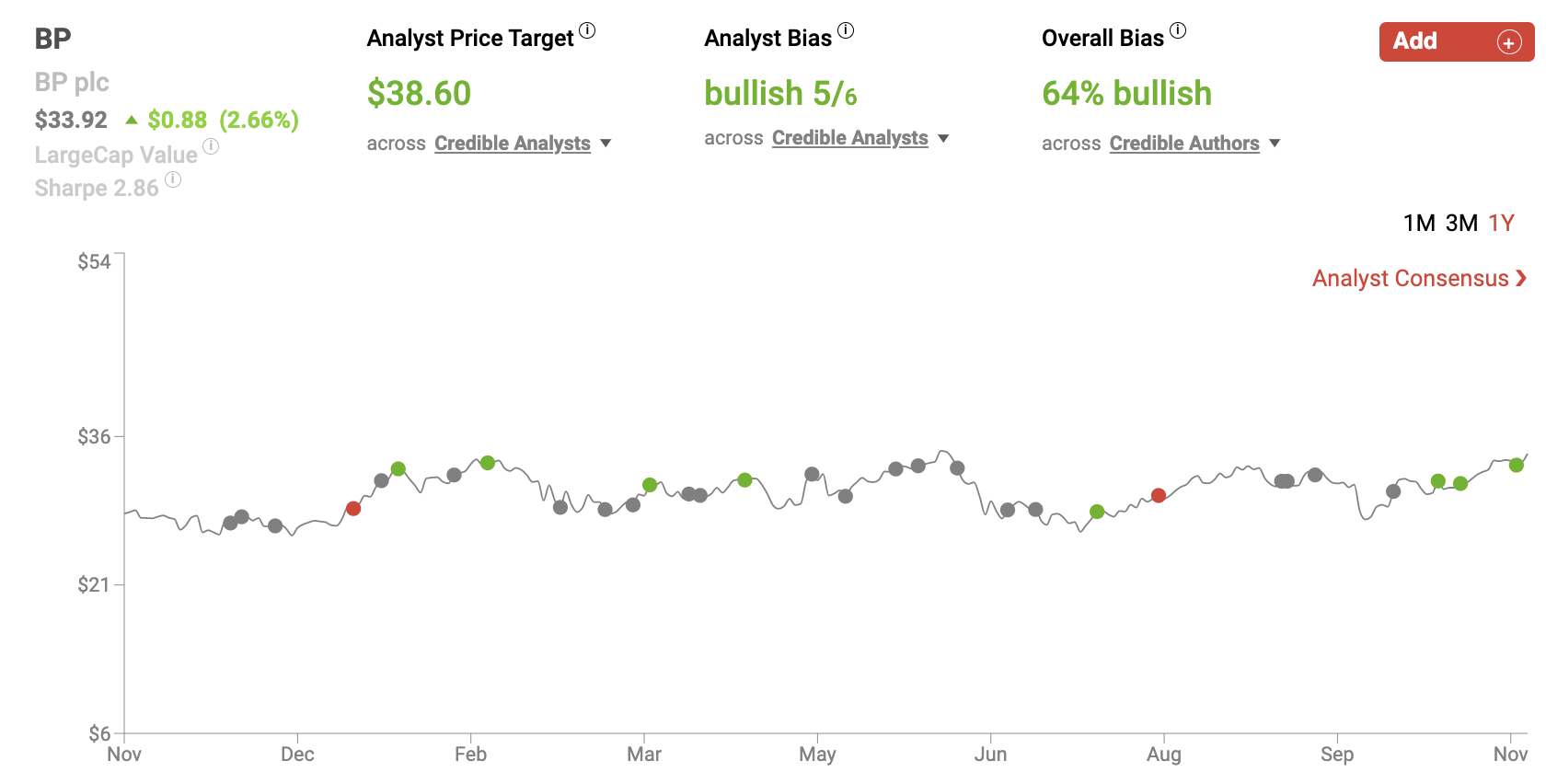

Credible Wall Street analysts and bloggers on British Petroleum (BP) stock

Performance: British Petroleum (BP) shares rose more than this week. BP shares are now up by 23.98% on the year, meaning that they’ve drastically outperformed the broader market this year (the S&P 500 is down by 20.89% during 2022 thus far).

Event and Impact: BP posted earnings that included $8.6 billion in profits, allowing the company to increase its dividend and announce significant buyback plans moving forward.

Noteworthy News: In response to rising profits and shareholder returns from the oil/gas space, politicians are discussing “windfall” taxes which could hurt profitability in the industry in the coming quarters.

Nobias Insights: 64% of recent articles published by credible authors were “Bullish”. 5 out of 6 credible Wall Street analysts believe shares are headed higher. The average price target being applied to BP shares by credible analysts is $38.60 which implies upside potential of approximately 13.8% relative to BP’s current share price of $33.92.

Key Points

British Petroleum (BP) shares rose more than this week. BP shares are now up by 23.98% on the year, meaning that they’ve drastically outperformed the broader market this year (the S&P 500 is down by 20.89% during 2022 thus far).

BP posted earnings that included $8.6 billion in profits, allowing the company to increase its dividend and announce significant buyback plans moving forward

In response to rising profits and shareholder returns from the oil/gas space, politicians are discussing “windfall” taxes which could hurt profitability in the industry in the coming quarters.

64% of recent articles published by credible authors were “Bullish”. 5 out of 6 credible Wall Street analysts believe shares are headed higher. The average price target being applied to BP shares by credible analysts is $38.60 which implies upside potential of approximately 13.8% relative to BP’s current share price of $33.92.

Performance

Event & Impact

Noteworthy News:

Nobias insights

The S&P 500 is down by 20.89% on a year-to-date basis. Throughout 2022, there is only one sector that has posted positive results: energy. The supply/demand imbalance created by removing Russian energy exports from the global markets alongside recent OPEC production cuts has caused the price of oil to soar. This has resulted in robust profits for oil/gas companies, one of which reported earnings this week.

British Petroleum (BP) posted Q3 results, missing Wall Street’s estimates on the top-line, but beating the Street’s consensus on the bottom-line. Because of these results, BP shares rose by 3.18% this week. This positive weekly performance pushed BP’s year-to-date gains up to 23.93%. And yet, even after this nearly 45% relative outperformance (compared to the S&P 500) the credible authors and analysts that the Nobias algorithm tracks remain largely bullish on BP’s prospects moving forward.

BP Nov 2022

Bullish Nobias credible authors:

Sam Meredith, a Nobias 4-star rated author, published a report at NBC Philadelphia which highlighted British Petroleum’s recent earnings report this week. Meredith wrote, “The British energy major posted underlying replacement cost profit, used as a proxy for net profit, of $8.2 billion for the three months through to the end of September.” That compared with $8.5 billion in the previous quarter and marked a significant increase from a year earlier, when net profit came in at $3.3 billion.” The author points out that “Analysts polled by Refinitiv had expected a third-quarter net profit of $6 billion.”

Alex Kimani, a Nobias 4-star rated author, also published a report which focused on BP’s recent earnings last week at oilprice.com. Kimani provided more detail on BP’s recent results, stating, “BP has high energy volatility to thank for the impressive earnings, which helped boost the earnings contribution from the oil giant’s big trading unit. Indeed, adjusted Q3 profit for the gas and low carbon energy unit totaled $6.24B, more than double the $3B profit the business made in Q2.”

Meredith touched upon shareholder returns, stating, “BP announced another $2.5 billion in share repurchases and said net debt had been reduced to $22 billion, down from $22.8 billion in the second quarter.” Kimani quoted an analyst report from Jeffreys which provided an even more aggressive outlook for the company’s buyback plan. He wrote, ‘“We believe BP will be able to set buyback at US$11bn over the next four quarters, setting BP's shareholder remuneration yield at the highest level in the sector (12%),” Jeffries analysts have said.”

Kimani says that these share buybacks are coming because capital expenditures across the oil space have been “mostly flat” in recent years. He wrote, “Data from the U.S. Energy Information Administration (EIA) shows that Big Oil companies have mostly downshifted both capital spending and production for the second-quarter. An EIA review of 53 public U.S. gas and oil companies, responsible for about 34% of domestic production, showed a 5% decline in capital expenditures in the second-quarter vs. Q1 this year.”

With regard to low capex and higher prices, Meredith wrote, “The world's largest oil and gas majors have reported bumper earnings in recent months, benefiting from surging commodity prices following Russia's invasion of Ukraine.” Meredith continued, “Combined with BP, oil majors Shell, TotalEnergies, Exxon and Chevron have posted third-quarter profits totaling nearly $50 billion.”

While these rising profits are great for the companies and their shareholders, the large buybacks and growing dividends that oil/gas companies have announced in recent months are creating problems for them in the political spectrum. The United Kingdom has already announced a “windfall tax” on energy profits.

An article published by the British Broadcasting Corporation this week broke down how the British tax works: “Rishi Sunak introduced the tax when he was chancellor, describing it as a 25% Energy Profits Levy. It applies to profits made from extracting UK oil and gas, but not from other activities such as refining oil and selling petrol and diesel on forecourts.

The tax also allows the firms to apply for tax savings worth 91p of every £1 invested in fossil fuel extraction in the UK. When the BBC asked the government how much the tax break would cost it received no reply.” The BBC article said, “The Treasury says it expects the tax to raise £5bn in its first year, but that may be optimistic if Shell is not contributing until 2023.”

Meredith points out that a similar tax proposal could arise in the United States as well, writing, “U.S. President Joe Biden on Monday called on oil majors to stop "war profiteering" and threatened to pursue higher taxes if industry giants did not work to cut gas prices.” This would put further pressure on oil/gas company profits and potentially slow shareholder returns.

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

Michael Hewson, a Nobias 5-star rated author, published a report this week which provided more details on the UK’s Energy Profits Levy and its impact on BP. Hewson said, “The “energy profits levy” as it is known, has been set at 25% until 2025 and puts BP and Shell effective UK tax rate at 65%.” He continued, “BP has already set aside an $800m adjustment in this quarter’s numbers in respect of the latest UK windfall tax, pushing the tax take from the North Sea to $2.5bn for this year. BP is also continuing to pay over $1.2bn a year in respect of the Gulf of Mexico oil spill.”

In Meredith’s piece, he highlighted recent commentary provided by BP’s CEO, Bernard Looney, who spoke at the ADIPEC conference in the United Arab Emirates on Monday. With regard to the political pressure and BP’s current operating environment, Looney said, "Our job is to pay our taxes; our job is to invest.” We just announced a $4 billion acquisition in the United States just last week in renewable natural gas so that's what our job is to do. We will continue to do that and do the very best that we can.”

Overall bias of Nobias Credible Analysts and Bloggers:

Despite rising political pressure against the oil and gas industry, the majority of the credible authors appear to be focused on rising profits as 64% of recent articles published on BP shares have expressed a “Bullish” bias. 5 out of the 6 credible analysts that the Nobias algorithm tracks who have expressed an opinion on BP shares are bullish as well. With the company’s recent Q3 earnings results factored into recent analyst reports, the average price target that is currently being applied to BP shares by credible analysts is $38.60. Today, BP shares trade for $33.92. Therefore, even after BP’s year-to-date price gains of nearly 24%, the average credible analyst price target implies upside potential of approximately 13.80%.

Disclosure: Nicholas Ward has no position in any company discussed in this article. Nicholas Ward wrote this article for Nobias at their request with the intention of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

Credible Wall Street analysts and bloggers on Meta (FB) stock

Performance: Meta Platforms shares sold off more than 21% this week. META shares are now down nearly 72% from their 52-week highs and they’ve drastically underperformed the broader market this year (META shares are down by 70.70% on a year-to-date basis while the S&P 500 is down by 18.7%.

Event and Impact: META continues to invest heavily into its virtual reality platform; however, investors question whether or not these investments will ever pan out.

Noteworthy News: Meta Platforms missed analyst consensus estimates on both the top and bottom lines during Q3.

Nobias Insights: 64% of recent articles published by credible authors were “Bullish”. 12 out of 15 credible Wall Street analysts believe shares are headed higher. The average price target being applied to Apple shares by credible analysts is $215.57 which implies upside potential of approximately 117% relative to META’s current share price of $99.20.

Key Points

Meta Platforms shares sold off more than 21% this week. META shares are now down nearly 72% from their 52-week highs and they’ve drastically underperformed the broader market this year (META shares are down by 70.70% on a year-to-date basis while the S&P 500 is down by 18.7%.

META continues to invest heavily into its virtual reality platform; however, investors question whether or not these investments will ever pan out.

Meta Platforms missed analyst consensus estimates on both the top and bottom lines during Q3.

64% of recent articles published by credible authors were “Bullish”. 12 out of 15 credible Wall Street analysts believe shares are headed higher. The average price target being applied to Apple shares by credible analysts is $215.57 which implies upside potential of approximately 117% relative to META’s current share price of $99.20.

Performance

Event & Impact

Noteworthy News:

Nobias insights