Case Study: What Credible analysts are saying on Procter & Gamble (PG) stock

Procter and Gamble increased full-year 2023 guidance due to bullish data coming out of China.

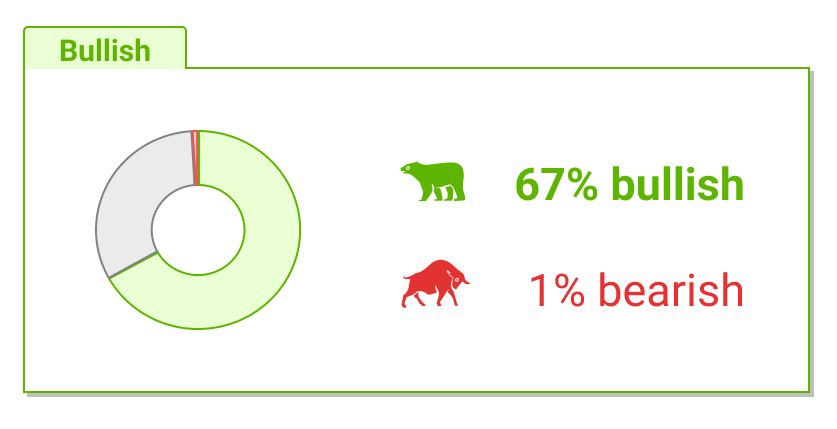

Nobias Insights: 66% of recent articles published by credible authors focused on Procter and Gamble shares offer a “bullish” bias. Two out of the three credible Wall Street analysts who cover PG offer a “bullish” outlook. The average price target being applied to PG by these credible analysts is $157.00, which implies upside potential of approximately 9.8% relative to the stock’s current share price of $142.97.

Bullish Take: Robert Abbott, a Nobias 4-star rated author, said, “Procter & Gamble has been profitable for all 10 years of the past decade. That reflects its industry-leading operating and net margins of 22.03% and 18.11% respectively.”

Bearish Take: Shawn Johnson, a Nobias 4-star rated author, said, “At a roughly 15% premium compared to the 3% discount to the average consumer defensive sector, the consumer goods company is still one of the more highly valued stocks in the sector”

Key Points

Performance

Procter & Gamble (PG) shares fell by 5.69% this week. On a year-to-date basis, PG's shares are now down by 5.67%. This compares poorly to the S&P 500, which is up by 3.88% during 2023 thus far.

Event & Impact

Procter & Gamble announced fiscal 2023 Q2 earnings results this week, beating Wall Street’s estimates on the top line and meeting expectations on the bottom-line. PG posted $20.8 billion in revenue, which was down by 0.7% on a year-over-year basis, beating estimates by $50 million. The company posted non-GAAP earnings per share of $1.59.

Noteworthy News:

Procter & Gamble increased its full-year 2023 guidance due to bullish data coming out of China.

Nobias Insights

66% of recent articles published by credible authors focused on Procter & Gamble shares offer a “bullish” bias. 2 out of the three credible Wall Street analysts who cover PG offer a “bullish” outlook. The average price target being applied to PG by these credible analysts is $157.00, which implies upside potential of approximately 9.8% relative to the stock’s current share price of $142.97.

Bullish Take Robert Abbott, a Nobias 4-star rated author, said, “Procter & Gamble has been profitable for all 10 years of the past decade. That reflects its industry-leading operating and net margins of 22.03% and 18.11% respectively.”

Bearish Take Shawn Johnson, a Nobias 4-star rated author, said, “At a roughly 15% premium compared to the 3% discount to the average consumer defensive sector, the consumer goods company is still one of the more highly valued stocks in the sector”

PG Jan 2023

Consumer staple giant, Procter and Gamble (PG), announced its fiscal 2023 second quarter earnings results this week. The $347 billion company posted sales which beat Wall Street’s expectations and earnings-per-share which was in-line with consensus estimates coming into the quarter.

Yet, even with this top-line beat in mind, PG shares slumped by 5.69% this week. The company’s shares are now down by 5.67% on a year-to-date basis, underperforming the broader market by a wide margin (the S&P 500 is up by 3.88% during 2023 thus far).

Bullish Nobias Credible Analysts Opinions:

Credible authors and analysts remain bullish on shares, however. With P&G’s 2.56% dividend yield in mind, the average price target being applied to PG right now imply double digit total returns moving forward. Robert Abbott, a Nobias 4-star rated author, examined Proctor and Gamble’s business model in a recent report that he published at GuruFocus.

Abbott said, “Founded in 1837 in Cincinnati, Ohio, where it is still headquartered, the consumer products company has a market cap of $359.17 billion and had trailing 12-month revenue of $80.461 billion.”

Regarding the company’s brand portfolio, he wrote, “The company noted in its 10-K for fiscal year 2022 (which ended on June 30) that it has a portfolio of leading brands, 20 of which generate more than $1 billion dollars a year in global sales, such as Tide, Charmin, Pantene and Pampers.” “International sales accounted for about 55% of consolidated sales in fiscal 2022,” Abbott noted.

Looking at the company’s balance sheet, Abbott said, “Its interest coverage ratio is 39.14, which tells us the company generates $39.14 in operating income for every dollar of interest expense. Its hard to imagine the firm getting into trouble because it could not pay the interest on its debt.”

Looking at the company’s profitability metrics, he stated, “Procter & Gamble has been profitable for all 10 years of the past decade. That reflects its industry-leading operating and net margins of 22.03% and 18.11% respectively.”

Abbott noted that these reliable bottom-line results have translated directly into predictable shareholder returns. He said, “At 2.35%, the Procter & Gamble dividend yield is higher than the latest average for S&P 500 companies, though that's not saying much. But, the most important characteristic of its dividend situation is its status as a Dividend King. Having raised its dividend for 66 consecutive years, it is well above the Dividend King minimum of 50 years.”

Putting this into perspective, Abbott stated, “Only 41 of the many thousands of publicly traded stocks have reached this elite level.” Furthermore, he also mentioned that PG returns cash to shareholders in the form of stock buybacks as well. He said, “It also has bought back its own shares quite consistently over the past decade, reducing the number of shares outstanding by an average of 1.66% per year.”

Bearish Nobias Credible Analysts Opinions:

Shawn Johnson, a Nobias 4-star rated author, covered P&G’s fiscal 2023 Q2 results in an article published this week titled, “Procter & Gamble Shows Resilience But the Stock Is Overvalued”. Johnson highlighted the persistent reliability of Procter and Gamble, stating, “The results were largely in line with market expectations. Revenue fell about 1% year over year to $20.77 billion, which slightly missed FactSet’s consensus estimates of $20.75 billion. Earnings per share met expectations of $1.59.”

Johnson highlighted the company’s Q2 data, writing:

Revenue: $20.77 billion versus the FactSet average estimate of $20.75 billion.

Earnings per share: $1.59 versus average estimates of $1.59.

Guidance for organic sales growth increased to 4%-5% from 3%-4% on expectations of a recovery in the Greater China market.

Headwinds from unfavorable currency exchange rates and inflation have eased slightly with the firm forecasting a 5% decline in the after-effects.

Despite PG’s ability to meet Wall Street’s expectations, Johnson notes that the company’s stock appears to be expensive. He said, “At a roughly 15% premium compared to the 3% discount to the average consumer defensive sector, the consumer goods company is still one of the more highly valued stocks in the sector”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

Overall, Johnson concluded, “Procter & Gamble’s PG fiscal second-quarter 2023 earnings showed the consumer goods giant is weathering macroeconomic and competitive headwinds well, but the stock is trading above Morningstar’s fair value estimates, meaning is [sic] that investors should keep their powder dry.”

Despite Johnson’s valuation concerns, 66% of recent articles published by credible authors that focused on PG stock expressed a “bullish” bias towards shares.

Overall bias of Nobias Credible Analysts and Bloggers:

Furthermore, 2 out of the 3 credible Wall Street analysts that Nobias tracks which have offered an opinion on Procter and Gamble believe that the company’s shares are likely to head higher.

Currently, the average price target being applied to P&G by credible Wall Street analysts is $157.00. Relative to PG’s current share price of $142.97 that represents upside potential of approximately 9.8%.

Disclosure: As of 1/21/2023, Nicholas Ward had no PG position. Nicholas Ward wrote this article for Nobias at their request with the intention of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

Case Study: What Credible analysts are saying on Netflix (NFLX) stock

After 2022, a year in which Netflix posted net subscriber losses for the first time, the company provided strong growth guidance for 2023.

Nobias Insights: 51% of recent articles published by credible authors focused on Netflix shares offer a “bearish” bias. while 4 out of the 6 credible credible Wall Street analysts who cover NFLX offer a “bullish” outlook. Yet, the average price target being applied to NFLX by these credible analysts is $361.17 which implies upside potential of less than 10% relative to the stock’s current share price of $342.50.

Bullish Take: Nobias 4-star rated author, Patrick Seitz, said, “The streaming video leader late Thursday said it added 7.66 million new subscribers worldwide in the December quarter, ending the year with 230.75 million total subscribers.

Bearish Take: Alex Sherman, a Nobias 4-star rated author said, “For the past three years, the global media and entertainment industry has been defined by the streaming wars. Each media company created a streaming service to compete. Only the strongest would survive, the narrative went. The losers would consolidate or die.”

Key Points

Performance

Netflix (NFLX) shares rose by nearly 5.5% this week. On a year-to-date basis, NFLX shares are now up by 16.12%. This compares favorably to both the S&P 500 and the Nasdaq Composite, which have risen by 3.88% and 7.25%, respectively, during 2023 thus far.

Event & Impact

Netflix announced Q4 results this week, causing the stock to soar. However, it appears that the post-earnings rally was based upon guidance, because during Q4 NFLX posted revenue that was in-line with Wall Street consensus and GAAP earnings-per-share of $0.12/share, which missed consensus estimates by $0.38/share.

Noteworthy News:

After 2022, a year in which Netflix posted net subscriber losses for the first time, the company provided strong growth guidance for 2023.

Nobias Insights

51% of recent articles published by credible authors focused on Netflix shares offer a “bearish” bias. while 4 out of the 6 credible credible Wall Street analysts who cover NFLX offer a “bullish” outlook. Yet, the average price target being applied to NFLX by these credible analysts is $361.17 which implies upside potential of less than 10% relative to the stock’s current share price of $342.50.

Bullish Take Nobias 4-star rated author, Patrick Seitz, said, “The streaming video leader late Thursday said it added 7.66 million new subscribers worldwide in the December quarter, ending the year with 230.75 million total subscribers.

Bearish Take Alex Sherman, a Nobias 4-star rated author said, “For the past three years, the global media and entertainment industry has been defined by the streaming wars. Each media company created a streaming service to compete. Only the strongest would survive, the narrative went. The losers would consolidate or die.”

NFLX Jan 2023

Netflix (NFLX) reported Q4 earnings this week, spending the stock soaring higher. NFLX shares rose by 5.5% during the week, pushing their year-to-date gains up to 16.12%. This compares favorably to both the S&P 500 and the Nasdaq Composite, which have risen by 3.88% and 7.25%, respectively, during 2023 thus far.

Bearish Nobias Credible Analysts Opinions:

Alex Sherman, a Nobias 4-star rated author, touched upon the stock’s recent struggles in a post-earnings report that he published at CNBC this week. Sherman said, “For the past three years, the global media and entertainment industry has been defined by the streaming wars. Each media company created a streaming service to compete. Only the strongest would survive, the narrative went. The losers would consolidate or die.”

During 2022, he noted, “For the first time ever, Netflix lost subscribers. Its shares fell more than 60%.”Yet, Sherman highlighted a positive momentum shift with regard to subscriber growth trends, that occurred during Q4. He said, “Netflix added 7.7 million streaming subscribers in the fourth quarter, blowing out analyst estimates, which were closer to 5 million. Netflix’s shares rose more than 6% after hours.” Sherman added, “Netflix’s big quarter doesn’t yet include results from forcing password sharers to pay, a process that will kick into gear soon.”

And regarding future growth prospects, Sherman concluded, “Netflix said it expects subscriber growth in the first quarter to be lower than the fourth quarter for general seasonality reasons, but it expects growth in the second quarter due to more customers signing up rather than losing the service as Netflix cracks down on sharing passwords.”

Shawn Johnson, a Nobias 4-star rated author, specifically covered Netflix’s password sharing crackdown plans in an article this week. Johnson wrote,”Netflix confirmed Thursday that it will crack down on account sharing “more broadly” in the coming months.” He continued, “This change will limit a Netflix account to users in a household instead of sharing it with multiple external users. Account holders who want to share with users outside the household can pay an additional fee to keep those profiles (though exact pricing hasn’t been released yet).”

Johnson highlighted a press release from the company’s Q4 earnings report, which stated, “Today’s widespread account sharing (100M+ households) undermines our long-term ability to invest in and improve Netflix, as well as build our business. While our Terms of Use limit use of Netflix to one household, we recognize that this is a change for members who share their accounts more widely.”

Lastly, he said, “The company warned that this would likely result in some customer cancellations in the short term, with Peters noting in the interview that it would not be a “universally popular move” but would lead to more revenue going forward.”

Bullish Nobias Credible Analysts Opinions:

Nobias 4-star rated author, Patrick Seitz, also covered Netflix’s Q4 results this week. In his article at Investors.com, Seitz also highlighted NFLX’s subscriber growth rebound, writing, “The streaming video leader late Thursday said it added 7.66 million new subscribers worldwide in the December quarter, ending the year with 230.75 million total subscribers.” Analysts polled by FactSet expected Netflix to add 4.57 million new subscribers.” “However,” he continued, “the Los Gatos, Calif.-based company missed Wall Street's sales and earnings targets for the fourth quarter.”

Seitz said, “Netflix earned 12 cents a share on revenue of $7.85 billion in the period. Wall Street had predicted earnings of 55 cents a share on sales of $7.86 billion. In the year-earlier period, Netflix earned $1.33 a share on sales of $7.71 billion.”

Regarding management’s future guidance, Seitz noted, “For the first quarter, Netflix expects to earn $2.82 a share on sales of $8.17 billion.” He continued, “Analysts were looking for earnings of $2.98 a share on sales of $8.15 billion in the March quarter. In the same quarter last year, Netflix earned $3.53 a share on sales of $7.87 billion.” “Wall Street cheered Netflix's free cash flow generation,” he wrote. Setiz noted, “The company reported $1.6 billion in free cash flow in 2022 and expects at least $3 billion in 2023. Analysts had been modeling $2.4 billion in free cash flow this year.”

Lastly, Seitz says that this strong cash flow generation is likely to result in shareholder returns. He concluded, “Also, Netflix said it plans to resume share repurchases in 2023. Another significant headline that broke alongside NFLX’s earnings results centered around a management shake-up at the company.

Dawn Chmielewski and Lisa Richwine covered this news in an article published at Yahoo Finance. Chmielewski is a Nobias 4-star rated author. The writers said, “Netflix co-founder Reed Hastings is stepping down as chief executive of the streaming video pioneer but will remain at the company as executive chairman, he announced on Thursday.” They continued, “Greg Peters, who was serving as chief operating officer and chief product officer, will become co-CEO alongside Ted Sarandos, Hastings said in a blog post.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

It’s often concerning to investors when a founder-led company loses that title. Yet, calming nerves, Chmielewski and Richwine reported, “Hastings, 62, said he planned to work with Sarandos and Hastings as executive chairman for "many years to come."’.

Overall bias of Nobias Credible Analysts and Bloggers:

Contrary to the stock’s post-earnings rally, 51% of recent articles published on NFLX shares by credible Nobias authors have expressed a “bearish” sentiment towards the stock. The credible Wall Street analysts who have offered opinions on NFLX shares are also bearish.

Currently, the average price target being attached to Netflix by these credible individuals is $361.17. NFLX closed the week trading for $342.50. Therefore, that average price target implies upside potential of less than 10%.

Disclosure: Nicholas Ward has no NFLX position. Nicholas Ward wrote this article for Nobias at their request with the intention of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

Case Study: What Credible analysts are saying on JP Morgan (JPM) stock

JPMorgan’s quarterly data showed that a consumer slowdown hasn’t occurred yet, with credit card spending up 12% and overall loans on cards up 20% on a year-over-year basis.

Nobias Insights: 55% of recent articles published by credible authors focused on JPM shares offer a “Neutral” bias. 4 out of the 7 credible credible Wall Street analysts who cover JPMorgan believe shares are likely to fall in value. Yet, the average price target being applied to JPM by these credible analysts is $139.57, which implies upside potential of approximately 3.3% relative to the stock’s current share price of $135.08.

Bullish Take: Harrison Miller, a Nobias 4-star rated author, said, “JPMorgan earnings rose 7% to $3.57 per share and reported revenue grew 18% to $34.5 billion.”

Bearish Take: AJ Fabino, a Nobias 5-star rated author, said, “As interest rates rise, banks may also experience an increase in defaults on loans — this is why most of them are increasing provisions for defaults and delinquencies.”

Key Points

Performance

JPMorgan (JPM) shares sunk by nearly 4% this week. On a year-to-date basis, JPM shares are now down by -0.03%. This compares favorably to the S&P 500, which is up by approximately 3.88% during 2023 thus far.

Event & Impact

JPMorgan announced Q4 results last Friday, beating Wall Street’s expectations on the top and bottom lines. JPM posted Q4 revenue of $34.5 billion (up by 17.9% on a year-over-year basis), beating consensus estimates by $270 million. The company’s non-GAAP earnings-per-share came in at $3.56/share, beating Wall Street’s estimate by $0.46/share.

Noteworthy News:

JPMorgan’s quarterly data showed that a consumer slowdown hasn’t occurred yet, with credit card spending up 12% and overall loans on cards up 20% on a year-over-year basis.

Nobias Insights

55% of recent articles published by credible authors focused on JPM shares offer a “neutral” bias. 4 out of the 7 credible Wall Street analysts who cover JPMorgan believe shares are likely to fall in value. Yet, the average price target being applied to JPM by these credible analysts is $139.57, which implies upside potential of approximately 3.3% relative to the stock’s current share price of $135.08.

Bullish Take Harrison Miller, a Nobias 4-star rated author, said, “JPMorgan earnings rose 7% to $3.57 per share and reported revenue grew 18% to $34.5 billion.”

Bearish Take AJ Fabino, a Nobias 5-star rated author, said, “As interest rates rise, banks may also experience an increase in defaults on loans — this is why most of them are increasing provisions for defaults and delinquencies.”

JPM Jan 2023

In mid-October, JPMorgan (JPM) shares hit 52-week lows of $101.28. Since then, shares have rallied roughly 33.3%, closing the trading session of Friday at $135.08. In recent weeks, a slew of large-cap U.S. banks have announced fourth quarter earnings, including JPMorgan. JPM beat Wall Street estimates on both the top and bottom lines when it announced its Q4 results on January 13th. However, since then, shares have fallen, trading down by 3.96% this week, alone.

As credible authors and analysts have analyzed the company’s quarterly data, positive and negative reports have come out. The majority of credible Wall Street analysts that cover JPM shares believe that the stock is likely to head lower. Yet, the average price target being applied to JPM shares by the credible analysts community implies slight upside potential. In short, JPMorgan remains a battle stock as credible individuals attempt to decipher whether or not the stock’s recent rally is likely to continue.

Bullish Nobias Credible Analysts Opinions:

In early January, Nobias 5-star rated author, Gen Alpha, highlighted J.P. Morgan in a bullish report that was published on Seeking Alpha. They wrote, “JPMorgan Chase is one of the largest and most influential financial institutions, with a history dating back over two centuries. The company is a global leader in investment banking, financial services for consumers and small businesses, commercial banking, financial transaction processing, and asset management.”

Gen Alpha continued, “What differentiates JPM from the likes of Goldman Sachs (GS) and Morgan Stanley (MS) is its multi-cylinder business approach that's not overly reliant on deal-making, transactions, and IPOs. This has worked out well for JPM, especially over the last year, as M&A and IPO activity has substantially declined due primarily to higher interest rates and economic uncertainty.”

Regarding the company’s quality metrics, they stated, “Importantly, JPM maintains an A- credit rating from S&P and carries a common equity tier 1 ratio of 12.5% as of the last reported quarter, up 30 basis points sequentially. This sits well above the 4.5% requirement by the Federal Reserve for large banks. It's worth noting that management is targeting an even stronger CET1 ratio of 13% for the first quarter of 2023.”

Regarding shareholder returns, Gen Alpha wrote, “The strong operating fundamentals and balance sheet lends support to JPM's 3% dividend yield, which is well-supported by a 34% payout ratio. The dividend also comes with 8 years of consecutive annual growth and an impressive 5-year CAGR of 14.4%.”

Lastly, they concluded, “With a well-covered dividend yield, track record of growth, and low valuation, JPM could give investors potentially strong long-term returns from present levels.” Shares of JPM are essentially flat since this report was published; however, since then, the company has posted its Q4 earnings results.

Coming into the quarter, Nobias 4-star rated author, Mircea Vasiu, touched upon Wall Street’s consensus estimates for the JPM’s Q4 results. Vasiu wrote, “JPMorgan Chase reports its quarterly earnings on Friday, January 13, during pre-market hours. The market expects EPS of $3.12, and the annual revenue estimate for the fiscal period ending December 2023 is $140.36 billion.”

Bearish Nobias Credible Analysts Opinions:

Harrison Miller, a Nobias 4-star rated author, highlighted JPM’s Q4 results in an article that he published at Investors.com shortly after the results went public. Looking at JPMorgan’s top and bottom-line results, Miller said, “JPMorgan earnings rose 7% to $3.57 per share and reported revenue grew 18% to $34.5 billion.” He continued, “Net interest income spiked 48% to $20.3 billion, exceeding forecasts of 39% growth to $19.1 billion and marking the fifth straight quarterly gain. Consumer banking revenue increased 29% to $15.8 billion and just beat estimates of $15.6 billion. Meanwhile, JPMorgan's consumer and investment banking revenue dipped 9% to $10.5 billion, coming in lower than the expected $10.8 billion.”

AJ Fabino, a Nobias 5-star rated author, also covered JPMorgan’s Q4 results in an article published at Benzinga this week. Fabino put a spotlight on management’s macro economic outlook, writing, “During a call with reporters, Dimon said, “It may be a mild recession. It may not be,” according to the Wall Street Journal.”

And with that in mind, he continued, “It’s important to understand the ambivalent relationship between the Fed’s interest rates, and its effects on banks.” Fabino wrote, “When the Fed raises interest rates, banks are able to charge higher interest rates on loans, which can lead to higher revenue for the bank.”

“Additionally,” he said, “banks often invest a portion of their assets in Treasury bonds and other fixed-income securities.” As interest rates rise, the value of these investments increases, which can also contribute to an increase in bank profits."

But, there are potential risks in play as rates rise as well. Fabino said, “As interest rates rise, banks may also experience an increase in defaults on loans — this is why most of them are increasing provisions for defaults and delinquencies.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

Thankfully, he notes, this slowdown isn’t appearing in the company’s reported data. Fabino noted, “JPMorgan said Friday that spending on credit cards rose 12% from a year ago and loans on cards were up 20%. It also said total loans rose 5% as big- and medium-size businesses borrowed more.”

Overall bias of Nobias Credible Analysts and Bloggers:

Despite JPMorgan’s sell-off this week, the majority of credible authors that the Nobias algorithm tracks offer tepid sentiment for shares. 55% of recent articles published on JPM have expressed a “neutral” sentiment. The credible Wall Street analysts that the Nobias algorithm tracks have expressed similar opinions.

4 out of the 7 credible analysts that Nobias tracks who have published reports on JPM believe that shares are likely to continue to decrease in value from here.

Yet, the average price target being applied to JPM shares by this group of credible analysts implies a slight upside. Currently, JPM shares trade for $135.08. The average price target that the credible analyst community has attached to JPMorgan is $139.57, which implies upside potential of approximately 3.3%. Therefore, although there are more credible bears than bulls on Wall Street, the bulls’ high fair value estimates outweigh the more prevalent negative sentiment expressed by the bears. All in all, it appears that both authors and analysts believe that JPMorgan’s recent 33.3% rally off of its recent lows was justified. However, they doubt significant near-term upside from here.

Disclosure: Nicholas Ward has no JPM position. Nicholas Ward wrote this article for Nobias at their request with the intention of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

Case Study: What Credible analysts are saying on Bank of America (BAC) stock

Strong net interest income (bolstered by higher rates) and Bank of America’s more diversified loan book have helped this stock to outperform its peers over the last 6 months.

Nobias Insights: 57% of recent articles published by credible authors focused on BAC shares offer a “Bullish” bias. Furthermore, the average price target being applied to Bank of America shares by the credible analysts that the Nobias algorithm tracks is $43.50 which implies upside potential of approximately 23.5% relative to the stock’s current share price of $35.23.

Bullish Take: Growth at a Good Price, a Nobias 4-star rated author, said: “I added heavily to my Bank of America position last year, and I have no plans to stop this year. Bank of America Corporation definitely is a solid pick to consider for 2023.”

Bearish Take: Chris Lau, a Nobias 4-star rated author said, “The FOMC cut its GDP growth targets for 2023. It expects the GDP will grow by only 0.5%, as shown below. The negligible growth forecast is as good as predicting a mild recession next year, followed by a rebound from 2024 to 2025.”

Key Points

Performance

Bank of America rose by 2.2% on Friday, pushing their year-to-date performance up to 5.1%. This compares favorably to the S&P 500, which is up by approximately 4.6% during 2023 thus far.

Event & Impact

Bank of America announced Q4 results this week, beating Wall Street’s expectations on both the top and bottom lines. The bank posted Q4 sales of $24.53 billion, which was up by 11.2% on a year-over-year basis, beating Wall Street’s estimates by $360 million, and GAAP EPS of $0.85/share, which beat consensus estimates by $0.08/share.

Noteworthy News:

Strong net interest income (bolstered by higher rates) and Bank of America’s more diversified loan book have helped this stock to outperform its peers over the last 6 months.

Nobias Insights

57% of recent articles published by credible authors focused on BAC shares offer a “Bullish” bias. Furthermore, the average price target being applied to Bank of America shares by the credible analysts that the Nobias algorithm tracks is $43.50 which implies upside potential of approximately 23.5% relative to the stock’s current share price of $35.23.

Bullish Take Growth at a Good Price, a Nobias 4-star rated author, said: “I added heavily to my Bank of America position last year, and I have no plans to stop this year. Bank of America Corporation definitely is a solid pick to consider for 2023.”

Bearish Take Chris Lau, a Nobias 4-star rated author said, “The FOMC cut its GDP growth targets for 2023. It expects the GDP will grow by only 0.5%, as shown below. The negligible growth forecast is as good as predicting a mild recession next year, followed by a rebound from 2024 to 2025.”

BAC Jan 2023

A slew of “big banks” reported earnings this week, giving investors a sense of how well the economics is performing and a glance at what to expect from the financial sector as we head into the fourth quarter earnings season.

Bank of America (BAC) was one such company; BAC reported Q4 results on Friday, beating Wall Street’s consensus estimates on both the top and bottom lines. This earnings data caused BAC shares to rally by 2.20% on Friday, pushing their year-to-date returns up to 5.13% (ahead of the S&P 500’s 4.6% year-to-date gains).

Several credible authors highlighted favorable macro conditions for the bank (highlighting the benefits associated with higher interest rates, bolstering net

Bearish Nobias Credible Analysts Opinions:

In a recent article. Chris Lau, a Nobias 4-star rated author, touched upon the Federal Reserves’ recent rate hike decision and his outlook for the U.S. economy, from a macroeconomic standpoint. He noted that after the December rate hike, “The benchmark interest rate is at the highest level in 15 years.” Lau continued, “Since rates are below that of inflation, investors should model a range of 4.9% to 5.6% in 2023.”

Looking forward, he wrote, “According to its, investors should expect sustained interest rates in 2023. The “pivot” will not start until 2024 when the lowest projected rate is still above 3.0%.”

Lau then went on to highlight some of the commentary provided in the December FOMC statement. He said, “The FOMC reaffirmed its attentiveness to inflation risks. It cited elevated inflation reflects the imbalance between supply and demand. Conversely, the economy is adding jobs. Unemployment rates remain low. Most importantly, it reaffirmed the bank’s objective of maximum employment and inflation at 2% in the long run.”

Regarding the potential for a recession, he stated, “The FOMC cut its GDP growth targets for 2023. It expects the GDP will grow by only 0.5%, as shown below. The negligible growth forecast is as good as predicting a mild recession next year, followed by a rebound from 2024 to 2025.”

Bearish Nobias Credible Analysts Opinions:

Dave Kovaleski, a Nobias 4-star rated author, published an article on Bank of America this week, highlighting the quality of its business heading into its Q4 earnings report. He said, “Bank of America Corp. actually finished the year on a high note, relatively speaking. Bank of America gained 6.39% in the second half of 2022, according to S&P Global Market Intelligence.”

Kovaleski continued, “Bank of America, the second largest U.S. bank, actually outperformed the average bank stock in the second half of 2022.” He noted, “For the entire year of 2022, the index [referring to the KBW Nasdaq Bank Index] was down 21.4%, while Bank of America fell slightly more, 23.8% in calendar year 2022.”

What caused this relative outperformance? Kovaleski stated, “Rising interest rates allowed the bank to generate high levels of net-interest income on its loans, which offset losses in other portions of its business, particularly investment banking and asset management.”

He also highlighted two other bullish factors which have been serving as tailwinds for the bank. Kovaleski wrote, “One, loan activity remained robust, as average loan balances were up 11% year over year to $1.0 trillion in Q3. The second key metric is credit quality. Bank of America was able to lower its net charge-off ratio in Q3 from the previous quarter and keep it on par with Q3 2021.”

Finally, he said, “Bank of America has benefited from a decade-plus long commitment to diversifying its loan mix. In 2009, 67% of its loans were consumer loans. In 2022, 56% of loans are commercial loans, with 44% consumer loans. This has helped lower the bank's credit risk.”

Kovaleski concluded, “Bank of America is in a good position to continue its positive momentum given high interest rates, its anticipated loan growth, and its good credit quality.” “Overall,” he said, “the worst should be over for Bank of America. This year remains fraught with uncertainty, but ultimately, the stock should have a better year in 2023.”

Growth at a Good Price, a Nobias 4-star rated author, covered Bank of America’s Q4 results in a report that they published at Seeking Alpha this week. The author said, “Bank of America Corporation (NYSE:BAC) just released its fourth quarter earnings and beat expectations.”

“In the quarter,” Growth at a Good Price, continued, “we saw a big jump in net interest income, likely due to the 7.2% increase in credit card spending that was reported by credit card companies prior to the release.” The author said, “Q4 was the second quarter in a row when NII went up more than 20%”.

Furthermore, Growth at a Good price highlighted Q4 fundamental data, writing, “ In the fourth quarter, Bank of America delivered:

$24.5 billion in revenue, up 11% (a beat).

$7 billion in net income, up 1.42%.

$0.85 in diluted EPS, up 3.65% (a beat).

$9 billion in pre-tax, pre-provision earnings, up 23%.

$1.1 billion in investment banking fees.”

They continued, “In the quarter, we saw Bank of America profit off of rising interest rates yet again, despite the yield curve inversion observed in the period.” “Generally speaking,” the author noted, “inverted yield curves are thought to be bad for banks, because they borrow on the short end and lend on the long end.”

Also, they said, “Bank of America itself expects the macroeconomic picture to be troubling. It raised PCLs (reserves set aside for underperforming loans) by $403 million and used the phrase "dampened macroeconomic outlook" five times in its press release. It appears that investors are betting on tough times for the big banks in 2023.”

However, Growth at a Good Price believes that this stock continues to benefit from long-term tailwinds. They wrote, “Looking ahead past 2023, we can see that Bank of America has several long-term advantages” Breaking down these bullish aspects, the author said, “It has strong brand recognition. It has a more than adequate 11.2% CET1 ratio. Finally, with a large investment banking division, it could benefit if the Fed finally pivots in 2024.”

Ultimately, they said that their “favorite aspect of Bank of America” is “the valuation.” Growth at a Good price said, “According to Seeking Alpha Quant, it trades at:

10.9 times earnings.

3 times sales.

2.92 times sales.

1.15 times book value.

37 times operating cash flow.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

They concluded, “The bottom line on Bank of America Corporation is that it is a highly profitable bank whose earnings just easily surpassed expectations.”

Growth at a Good price finished the report stating, “I added heavily to my Bank of America position last year, and I have no plans to stop this year. Bank of America Corporation definitely is a solid pick to consider for 2023.”

Overall bias of Nobias Credible Analysts and Bloggers:

Overall, 57% of recent articles published by the credible authors that the Nobias algorithm tracks (only those individuals with 4 and 5-star Nobias ratings) expressed a “Bullish” bias towards Bank of America stock.

Furthermore, the average credible analyst price target being attached to BAC shares implies bullish price action as well.

Presently, the average price target being applied to BAC is $43.50 which implies upside potential of approximately 23.5% relative to the current stock’s share price of $35.23.

Disclosure: Nicholas Ward has no BAC position. Nicholas Ward wrote this article for Nobias at their request with the intention of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

Case Study: What Credible analysts are saying on Wells Fargo (WFC) stock

Wells Fargo continues to deal with the fallout from its scandalous past, with 5-star Nobias author, John Foley, noting that “the total notional cost of Wells Fargo’s misconduct” has not exceeded $100 billion.

Nobias Insights: 55% of recent articles published by credible authors focused on WFC shares offer a “bullish” bias. Furthermore, all three credible Wall Street analysts who recently covered Wells Fargo believe the share price is likely to rise. The average price target applied to WFC by credible analysts is $51.33, implying upside potential of approximately 16.1% relative to the stock’s current share price of $44.22.

Bullish Take: John Reosti, a Nobias 4-star rated author, said: “The firm pulled in a record $13.4 billion in net interest income in the quarter, surpassing analyst expectations. The 45% rise from a year earlier shows the dramatic impact of the Federal Reserve's interest rate hikes on Wells Fargo's bottom line.”

Bearish Take: Giles Gwinnett, a Nobias 4-star rated author, said, “In the three months to end-December, the US's fourth largest lender posted a profit of US$0.67 per share, compared to US$1.38 per share in the fourth quarter of 2021.”

Key Points

Performance

Wells Fargo (WFC) rose by 3.3% this week, pushing their year-to-date performance up to 5.81%. This compares favorably to the S&P 500, which is up by approximately 4.6% during 2023 thus far.

Event & Impact

Wells Fargo announced Q4 results this week, beating Wall Street’s expectations on the bottom-line, posting GAAP EPS of $0.67/share, which was $0.06/share above consensus estimates. However, the company’s Q4 revenue came in at $19.66 billion, which was $380 million below expectations.

Noteworthy News:

Wells Fargo continues to deal with the fallout from its scandalous past, with 5-star Nobias author, John Foley, noting that “the total notional cost of Wells Fargo’s misconduct” has not exceeded $100 billion.

Nobias Insights

55% of recent articles published by credible authors focused on WFC shares offer a “bullish” bias. Furthermore, all three credible Wall Street analysts who recently covered Wells Fargo believe the share price is likely to rise. The average price target applied to WFC by credible analysts is $51.33, implying upside potential of approximately 16.1% relative to the stock’s current share price of $44.22.

Bullish Take John Reosti, a Nobias 4-star rated author, said: “The firm pulled in a record $13.4 billion in net interest income in the quarter, surpassing analyst expectations. The 45% rise from a year earlier shows the dramatic impact of the Federal Reserve's interest rate hikes on Wells Fargo's bottom line.”

Bearish Take Giles Gwinnett, a Nobias 4-star rated author, said, “In the three months to end-December, the US's fourth largest lender posted a profit of US$0.67 per share, compared to US$1.38 per share in the fourth quarter of 2021.”

WFC Jan 2023

With big-banks beginning to post earnings this week, sentiment wise, there’s a tug-of-war going on between rising interest rates (which are generally bullish for bank earnings as net interest income rises) and the ongoing threat of an economic slowdown and recession on the horizon.

Harrison Miller, a Nobias 4-star rated author, recently touched upon analyst sentiment surrounding the banks in an article published at Investors.com, writing, “Barclays analyst Jason Goldberg thinks bank stocks are likely to show resilience, despite the recession concerns as loan growth slows and loan losses increase.”

Miller also wrote, “Oppenheimer analyst Chris Kotowski believes banks will remain "steadier than most think" in the fourth quarter and 2023, even as his models predict loan losses will nearly double as credit trends normalize.”

Wells Fargo (WFC) was one of the banks that reported earnings this week, and despite an initial sell-off following its results, WFC shares rallied into the end of the week, closing the week up 3.3%, pushing their year-to-date returns to up 5.8%. Wells Fargo is a bit of a battleground stock itself, as investors weigh its scandalous history and its poor relative performance over the past 5 years or so against its former glory as a potential contrarian bet.

With specific regard to Wells Fargo, Miller highlighted recent headwinds that the stock has overcome throughout 2023 thus far. He said, “In late December, the Consumer Financial Protection Bureau fined Wells Fargo $3.7 billion for engaging in numerous banking violations that harmed customers dating back to 2011.”

Also, Miller highlighted surprising news that WFC was planning to significantly alter its mortgage business. He noted, “Wells Fargo is the largest mortgage servicer in the U.S. with nearly $1 trillion in loans, or 7.3% of the market, as of Q3, CNBC reported.”

However, he said, “On Tuesday, Wells Fargo announced plans to dramatically shrink its mortgage business.” Harrison continued, “It will now only offer home loans to existing bank and wealth management customers, as well as borrowers in minority communities. The bank is also closing its correspondence business, which sells mortgages through third parties, and "significantly" reducing its mortgage servicing portfolio through asset sales.”

Reducing its exposure to mortgage lending, the company’s former cash cow business, caused some to question the bank’s growth potential. However, WFC’s 5.8% year-to-date gains are better than the broader market (the S&P 500 is up by 4.6% thus far throughout 2023), and it appears that many investors are looking past regulatory headwinds and towards the company’s strong net interest income results supported by the Federal Reserve's hawkish policies.

Bearish Nobias Credible Analysts Opinions:

Giles Gwinnett, a Nobias 4-star rated author, wrote an article focused on Wells Fargo’s earnings this week, stating, “The weaker numbers come as revenue fails to meet the bank's expectations and it has had to deal with 'one-off' costs related to litigation and regulatory and customer remediation as the company continues to deal with a six year old scandal over sales practices.”

Looking at WFC’s Q4 results, Gwinnett said, “In the three months to end-December, the US's fourth largest lender posted a profit of US$0.67 per share, compared to US$1.38 per share in the fourth quarter of 2021.” In other words, WFC’s bottom-line was slashed by approximately 50%. Gwinnett also said, “The bank's total revenue dropped in the quarter to US$19.7 billion versus US$20.9 billion in Q4, 2021.”

Bullish Nobias Credible Analysts Opinions:

John Reosti, a Nobias 4-star rated author, also covered Wells Fargo’s recent earnings report this week. He published an article which stated, “Wells Fargo posted higher-than-expected fourth-quarter expenses, even after the firm warned of a hefty loss tied to a regulatory sanction last month.”

Reosti continued, “The firm spent $16.2 billion in the last three months of the year [on regulatory sanctions], according to a statement Friday, exceeding analyst estimates. That included $3.3 billion in operating losses after Wells Fargo said last month it would book costs for a settlement with the Consumer Financial Protection Bureau and other legal issues.”

However, he also pointed out that without the regulatory headwinds, WFC’s quarter would have been quite impressive from an income perspective. Reosti said, “The firm pulled in a record $13.4 billion in net interest income in the quarter, surpassing analyst expectations. The 45% rise from a year earlier shows the dramatic impact of the Federal Reserve's interest rate hikes on Wells Fargo's bottom line.”

John Foley, a Nobias 5-star rated author, published an article at Reuters this week which put a spotlight on the long-term damage that Wells Fargo’s scandals have caused the bank, and more importantly, its shareholders. He wrote, “Serial mischief has cost Wells Fargo investors in three ways.”

“First,” Foley said, “there are penalties that show up in what the bank calls “operating losses.” It will have booked $25 billion of them since the beginning of 2017, the first full year after widespread fraudulent habits were uncovered in its consumer bank. Of that sum, it has paid $11.5 billion in fines, according to the Good Jobs First Violation Tracker. That is money diverted from stock buybacks and dividends, or which deprives the bank of earnings to fuel future lending.”

“Second,” he continued, “there are the expenses Wells Fargo has incurred from its internal deep clean. Those range from “professional services” to extra hires in its compliance and administrative teams. Before the fake-accounts scandal, Wells Fargo used to spend around $50 billion annually on expenses, excluding operating losses. Since then, it has laid out around $16 billion above that baseline. Together with the operating losses, it suggests over $40 billion of pre-tax earnings have been thrown on the bonfire.”

Lastly, he said, “Shareholders have suffered the biggest cost, however, in a less straightforward way: the balance sheet restrictions.”

Foley continued, “America’s top six banks as a group, over the past five years, have expanded their balance sheets by one-third. Had Wells Fargo been permitted to keep pace, it might have amassed an additional $650 billion in assets.” With that in mind, he noted, “Wells Fargo consistently generates earnings of about 1% from its assets. At that rate, it suggests $6.5 billion of forgone profit.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

And therefore, he said, “Since investors have tended to value Wells Fargo at 11 times its forecast year-ahead profit over the last decade, according to Refinitiv, it equates to some $70 billion of market capitalization that the Fed’s financial handcuffs have put out of reach, and takes the total notional cost of Wells Fargo’s misconduct to more than $100 billion.”

Overall bias of Nobias Credible Analysts and Bloggers:

55% of recent articles published by credible authors on Wells Fargo have expressed a “bullish” bias. Furthermore,, the credible analysts that the Nobias algorithm tracks are more bullish on WFC.

Their average price target for WFC shares is $51.33, which implies that the recent rally is likely to continue. Wells Fargo shares currently trade for $44.22, meaning that the credible analysts that Nobias tracks see upside potential of approximately 16.1%.

Disclosure: Nicholas Ward has no WFC position. Nicholas Ward wrote this article for Nobias at their request with the intention of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

Case Study: What Credible analysts are saying on Taiwan Semiconductor (TSM) stock

Taiwan Semiconductor continues to outperform its peers in the semiconductor industry and the company’s recent announcement for plans to produce 3nm chips points towards continued technological superiority.

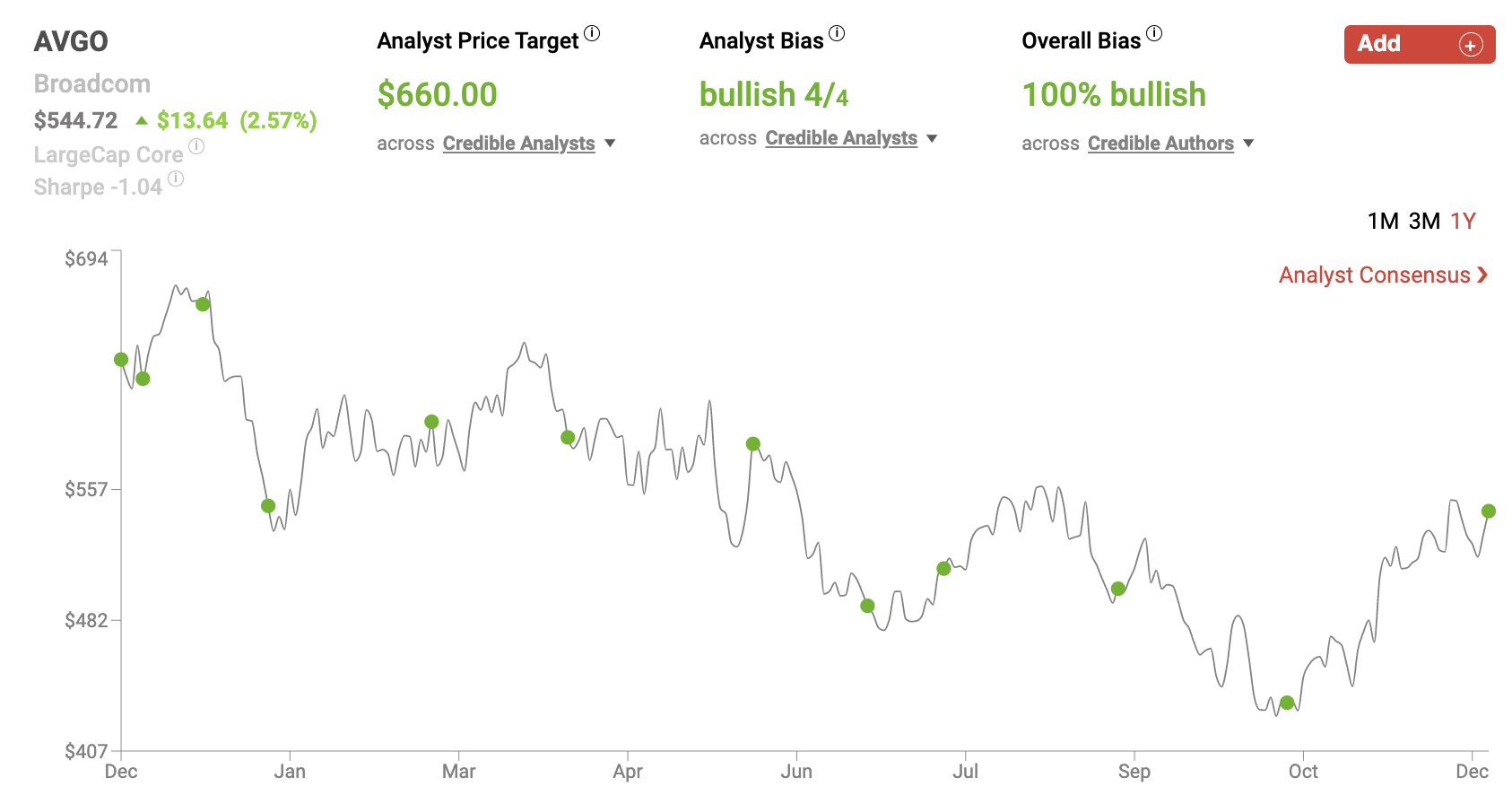

Nobias Insights: 67% of recent articles published by credible authors focused on TSM shares offer a “Bullish” bias. Three out of the four credible Wall Street analysts who cover Taiwan Semiconductor believe shares are likely to rise in value. The average price target applied to TSM by credible analysts is $88.50, which implies a small upside potential of 3.0% relative to the current share price of $86.80.

Bullish Take: Patrick Seitz, a Nobias 4-star rated author, said: “TSMC is leading the race to make chips with ever smaller circuits.”

Bearish Take: Growth at a Good Price, a Nobias 4-star rated author, said, “If you choose to invest in Taiwan Semiconductor Manufacturing, there is one risk you'll want to watch out for: Geopolitical risk.”

Key Points

Performance

Taiwan Semiconductor (TSM) rose by 7.7% this week, pushing their year-to-date performance up to 17.5%. This compares favorably to the S&P 500, which is up by approximately 4.6% during 2023 thus far.

Event & Impact

Taiwan Semiconductor announced its Q4 earnings results this week, beating Wall Street’s estimates on the bottom line.

Noteworthy News:

Taiwan Semiconductor continues to outperform its peers in the semiconductor industry and the company’s recent announcement for plans to produce 3nm chips points towards continued technological superiority.

Nobias Insights

67% of recent articles published by credible authors focused on TSM shares offer a “Bullish” bias. Three out of the four credible Wall Street analysts who cover Taiwan Semiconductor believe shares are likely to rise in value. The average price target applied to TSM by credible analysts is $88.50, which implies a small upside potential of 3.0% relative to the current share price of $86.80.

Bullish Take Patrick Seitz, a Nobias 4-star rated author, said: “TSMC is leading the race to make chips with ever smaller circuits.”

Bearish Take Growth at a Good Price, a Nobias 4-star rated author, said, “If you choose to invest in Taiwan Semiconductor Manufacturing, there is one risk you'll want to watch out for: Geopolitical risk.”

TSM Jan 2023

One of the largest semiconductor companies in the world, Taiwan Semiconductor (TSM), reported earnings this week. Taiwan Semiconductor’s Q4 results have sparked a significant rally, with shares up by 17.50% on a year-to-date basis. This makes TSM one of the best performing stocks in the market throughout 2023 thus far and according to the credible authors and Wall Street analysts that the Nobias algorithm tracks, there is upside ahead.

Bullish Nobias Credible Analysts Opinions:

Patrick Seitz,a Nobias 4-star rated author, recently touched upon Taiwan Semiconductor’s innovative technology in an article published at Investors.com. He stated, “TSMC is leading the race to make chips with ever smaller circuits.”

Currently, Seitz notes, the company’s “state-of-the-art chips use 5-nanometer process technology”; however, Taiwan Semiconductor recently announced a ceremony “to celebrate the start of mass production using its 3-nanometer process technology.”

Regarding the importance of this advancement, Seitz wrote, “Circuit widths on chips are measured in nanometers, which are one-billionth of a meter. Smaller circuits translate to faster and more power-efficient semiconductors.” And, he states, there is significant demand for chips with the smaller nodes. Seitz said, “TSMC's customers include Apple (AAPL), Advanced Micro Devices (AMD), Nvidia (NVDA), and more.”

Shanthi Rexaline, a Nobias 4-star rated author, covered Taiwan Semiconductor’s recent earnings report in an article that she published at Benzinga. She said, “The Hsinchu, Taiwan-based company reported fourth-quarter earnings that beat expectations despite a revenue miss.”

During the fourth quarter, Taiwan Semiconductor generated $19.93 billion in sales, which missed Wall Street estimates by $990 million. However, despite the miss, this sales figure still represented 26.6% year-over-year growth. During Q4, TSMC’s GAAP earnings-per-share totaled $1.82, beating analyst estimates by $0.05/share.

During the company’s Q4 report, TSMC reported, “Gross margin for the quarter was 62.2%, operating margin was 52.0%, and net profit margin was 47.3%.The company also said, “In the fourth quarter, shipments of 5-nanometer accounted for 32% of total wafer revenue; 7- nanometer accounted for 22%. Advanced technologies, defined as 7-nanometer and more advanced technologies, accounted for 54% of total wafer revenue.”

Rexaline continued, “More importantly, the company guided to below-consensus first-quarter revenue, citing continued end-market weakness and inventory correction.” She went on to quote a Wall Street analyst, stating, “Needham analyst Charles Shi noted that TSMC expects low-single-digit earnings growth for 2023, implying a revenue bottom in the second quarter.”

Rexaline wrote, “The company also reduced its 2023 Capex guidance to $32 billion-$36 billion and called for a narrowing of margins amid a rise in R&D expenses, the analyst said.” Lower capex implies stronger cash flows, even in the face of disappointing sales guidance.

Bearish Nobias Credible Analysts Opinions:

Nobias 4-star rated author, Growth at a Good Price, also covered TSMC’s Q4 results in an article that they published at Seeking Alpha this week. Regarding the quarter, Growth at a Good Price said, “It was a very strong release from a company that fell 40% in the 2022 tech crash, thanks mainly to the weakness of other semi names in the same period.” They too covered TSMC’s top and bottom-line results, before transitioning to the company’s cash flows. The author wrote, “Free cash flow was another standout metric in the quarter. At $4.93 billion, it improved by $110 million from the prior quarter. Total free cash flow for the year was $17.33 billion, a significant improvement over the previous year.”

Furthermore, Growth at a Good Price mentioned Taiwan Semiconductor’s strong relative performance compared to its industry peers. They said, “It's impressive that TSMC is still guiding for modest full year growth in this environment, as many similar companies are already seeing revenue decline in 2022.” The author continued, “In its most recent quarter, Micron's (MU) revenue declined 47% year over year. NVIDIA (NVDA), for its part, reported a 17% decline.”

“To know whether TSM's good results can continue,” Growth at a Good Price mentioned, “we need to understand why it is performing so much better than its competitors.” “First,” they continued, “its dominant market position gives it pricing power.” “Second,” the author said, “it is not a commodity vendor.” And lastly, Growth at a Good Price stated that TSMC “doesn't specialize in just one market segment.”

Overall, they were bullish on the stock; however, they did put a spotlight on a major risk that investors need to be aware of. Growth at a Good price said, “If you choose to invest in Taiwan Semiconductor Manufacturing, there is one risk you'll want to watch out for: Geopolitical risk.” Along these lines they continued, “Many people believe that China will someday invade Taiwan.”

“China's President Xi Jinping has indicated that he could use force as a "last resort" should foreign nations interfere with his planned unification with Taiwan. He has never said what his "red lines" are for determining that an invasion is necessary, which makes the China/Taiwan situation fairly ambiguous,” said the author. Regarding the potential fallout from a Chinese invasion, Growth at a Good Price said, “the effects of an invasion on Taiwan Semiconductor are not known.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

But, they did conclude, “Chinese companies would almost certainly be sanctioned, but Taiwan is aligned with the West, so as long as China doesn't directly attack semiconductor facilities then a war would not be fatal to TSM as a business. The stock market volatility in such a scenario would likely be extreme, though, so know your risk tolerance before buying Taiwan Semiconductor stock.” Overall, the author says that for investors who can stomach the geopolitical situation, “Taiwan semiconductor stock appears to be a good bet.”

Overall bias of Nobias Credible Analysts and Bloggers:

This bullish sentiment is shared by the majority of credible authors and Wall Street analysts who cover TSMC. 65% of recent articles published by credible Nobias authors have expressed a “Bullish” bias towards Taiwan Semiconductor shares.

Furthermore, 3 out of the 4 credible analysts who have offered an opinion on TSMC have an average price target of $88.50 attached to shares. Taiwan Semiconductor has rallied 17.5% since the start of 2023 alone; however, even after this rally, that average price target implies upside potential of 3% relative to TSMC’s current share price of $86.80.

Disclosure: Nicholas Ward has no TSM position. Nicholas Ward wrote this article for Nobias at their request with the intention of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

Case Study: What Credible analysts are saying on Intel (INTC) stock

Intel plans to open up the world's largest chip making facility in Ohio in the coming years, bringing back much needed domestic production of high-end semiconductors.

Nobias Insights: 47% of recent articles published by credible authors focused on INTC shares express a “Bearish” bias. 7 out of the 13 credible credible Wall Street analysts who cover Intel believe shares are likely to fall in value. However, amongst these 13 credible individuals, the average price target being applied to INTC is $37.25, which implies upside potential of approximately 29.7% relative to INTC’s current share price of $28.76.

Bullish Take: Lee Jackson, a Nobias 4-star rated author, said: “This legacy leader in semiconductors has been hammered, and while some feel it is a value trap, it is hard to count out the company that defined the semiconductor revolution.”

Bearish Take: Rob Starks Jr., a Nobias 5-star rated author, said, “Because Intel's management fumbled the ball the last several years, Advanced Micro Devices (AMD) caught up; AMD is now eating Intel's lunch in the data center space, and gaining market share.”

Key Points

Performance

Intel shares rallied by 7.48% this week, significantly outperforming the broader markets. However, on a trailing twelve month basis, Intel shares are still down by 46.81%, underperforming the S&P 500, which is down by just 17.06% during this same period of time.

Event & Impact

After several years of underperformance where Intel lost notable market share to peers such as Advanced Micro Devices, Taiwan Semiconductor, and Samsung, the company hopes that its new CEO’s restructuring plan will allow for it to make up lost ground by 2025.

Noteworthy News:

Intel plans to open up the world's largest chip making facility in Ohio in the coming years, bringing back much needed domestic production of high-end semiconductors.

Nobias Insights

47% of recent articles published by credible authors focused on INTC shares express a “Bearish” bias. 7 out of the 13 credible credible Wall Street analysts who cover Intel believe shares are likely to fall in value. However, amongst these 13 credible individuals, the average price target being applied to INTC is $37.25, which implies upside potential of approximately 29.7% relative to INTC’s current share price of $28.76.

Bullish Take Lee Jackson, a Nobias 4-star rated author, said: “This legacy leader in semiconductors has been hammered, and while some feel it is a value trap, it is hard to count out the company that defined the semiconductor revolution.”

Bearish Take Rob Starks Jr., a Nobias 5-star rated author, said, “Because Intel's management fumbled the ball the last several years, Advanced Micro Devices (AMD) caught up; AMD is now eating Intel's lunch in the data center space, and gaining market share.”

INTC Jan 2023

After a tumultuous 2022, where Intel (INTC) shares declined by approximately 48.1%, they’re off to the races thus far during 2023. On a year-to-date basis, Intel has rallied by 7.48%. Investors who subscribe to the Dogs of the Dow strategy aren’t surprised by this.

According to Investopedia, the, ‘"Dogs of the Dow" is an investment strategy that attempts to beat the Dow Jones Industrial Average (DJIA) each year by leaning portfolios toward high-yield investments. The general concept is to allocate money to the 10 highest dividend-yielding, blue-chip stocks among the 30 components of the DJIA. This strategy requires rebalancing at the beginning of each calendar year

Beginning the year with a 5.5% dividend yield, Intel was one of the highest yielding Dow stocks at the end of 2022. And, it appears that the credible analysts tracked by the Nobias algorithm agree with Intel’s rebound potential. Currently, their average price target for INTC shares implies potential of nearly 30%.

Bearish Nobias Credible Analysts Opinions:

Rob Starks Jr., a Nobias 5-star rated author, recently published a bullish article at the Motley Fool titled, “With Its Stock Near a 52-Week Low, Is Intel a Buy?” He began his report, highlighting Intel’s recent struggles, especially when it came to losing market share to its largest peers in the semiconductor industry.

Starks said , “Between the chip industry sinking into a cyclical downturn and competitors eating away at its market share, Intel had a disastrous 2022.” He continued, “Investors have soured on the stock, as Intel's two most significant revenue-generating segments, the client computing group (CCG) and datacenter and AI group (DCAI), have deteriorated significantly in 2022.”

Regarding Intel’s most recent quarterly data, Starks wrote, “In the third-quarter earnings report, CCG declined 17% from the previous year's comparable period to $8.1 billion, and DCAI dropped 27% to $4.2 billion.”

“Additionally,” he continued, “consolidated gross margin has shrunk from 56% in the third quarter of 2021 to only 42.6% in the third quarter of 2022. Worse, operating margin showed a loss of 1.1% -- a terrible result.”

Regarding competition, Starks said, “Because Intel's management fumbled the ball the last several years, Advanced Micro Devices (AMD) caught up; AMD is now eating Intel's lunch in the data center space, and gaining market share.” He also stated that Intel lost ground to Taiwan Semiconductor (TSM) when it comes to manufacturing high-end chips.

Yet, Starks says, there could be sunnier skies on the horizon. He stated, “Gelsinger [referring to Patrick Gelsinger Intel’s new CEO] said on the Q3 earnings call that he believes the company is now on track to regain transistor performance leadership by 2025.”

He also mentioned that Gelsinger turnaround plan included goals to take back lost leadership. “Intel's goal is to become the No. 2 contract chipmaker worldwide by the end of the decade -- an ambitious goal since it only started its contract operation in 2021,” he said.

The recently passed CHIPS act is expected to play a major role in Intel’s turnaround. Starks wrote, “This legislation provides $39 billion in manufacturing subsidies to construct semiconductor fabrication plants (fabs) and an additional $24 billion in tax credits for companies engaged in domestic chip production.”

Despite his expectations that the semiconductor space is likely to continue to experience growth headwinds throughout 2023, Starks concluded his piece stating, “Considering Intel's low valuation, now is a great time to buy the stock for the long term.”

Bullish Nobias Credible Analysts Opinions:

Lee Jackson, a Nobias 4-star rated author, also recently highlighted Intel in an bullish light as one of his picks in an article titled, “5 Dow Stocks With the Biggest Dividends Could Be Huge 2023 Winners”.

Currently, Intel shares trade for $28.74 and therefore, the stock’s $1.46/share annual dividend equates to a dividend yield of 5.30%. This is well above the 1.67% dividend yield that the S&P 500 SPDR Trust ETF (SPY) offers investors. It’s also multiple times larger than the 1.26% yield that the iShares Semiconductor ETF (SOXX) offers.

Regarding Intel, Jackson said, “This legacy leader in semiconductors has been hammered, and while some feel it is a value trap, it is hard to count out the company that defined the semiconductor revolution.”

He touched upon Intel’s operations, stating that its chip platforms “are used in various computing applications, comprising notebooks, two-in-one systems, desktops, servers, tablets, smartphones, wireless and wired connectivity products, wearables, retail devices and manufacturing devices, as well as for retail, transportation, industrial, buildings, home use and other market segments.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

Like Starks, Jackson mentioned the CHIPS Act and Intel’s U.S. infrastructure buildout plans stating: “Intel announced almost a year ago that it would invest significantly to build potentially the world’s largest chip-making complex in Ohio, looking to boost capacity as a global shortage of semiconductors affects everything from smartphones to automobiles. Intel says the 1,000-acre “mega-site” northeast of Columbus has room for as many as eight plants, known as “fabs.” The company estimates it would require a $100-billion investment to fully build and equip those plants.” Jackson mentioned that Wall Street’s consensus price target for Intel shares is $31.13, and therefore, relative to the stock’s current share price, the stock has double digit upside potential.

Overall bias of Nobias Credible Analysts and Bloggers:

The analysts deemed credible by the Nobias algorithm are even more bullish on Intel shares. These analysts are mixed, with 7 out of the 13 reports regarding Intel containing “Bearish” sentiment; however, the average credible analyst price target for Intel currently sits at $37.25. Relative to Intel’s closing share price today of $28.73, that $37.25 average price target implies upside potential of approximately 29.7%.

It’s worth noting that 47% of recent articles published by credible authors (individuals with 4 and 5-star ratings by the Nobias algorithm) have expressed a “Bearish” sentiment. Therefore, it’s clear that not everyone believes that Intel is a great value as opposed to a value trap; yet, the average credible analyst price target implies an attractive risk/reward proposition.

Disclosure: Nicholas Ward has no INTC position. Nicholas Ward wrote this article for Nobias at their request with the intention of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.