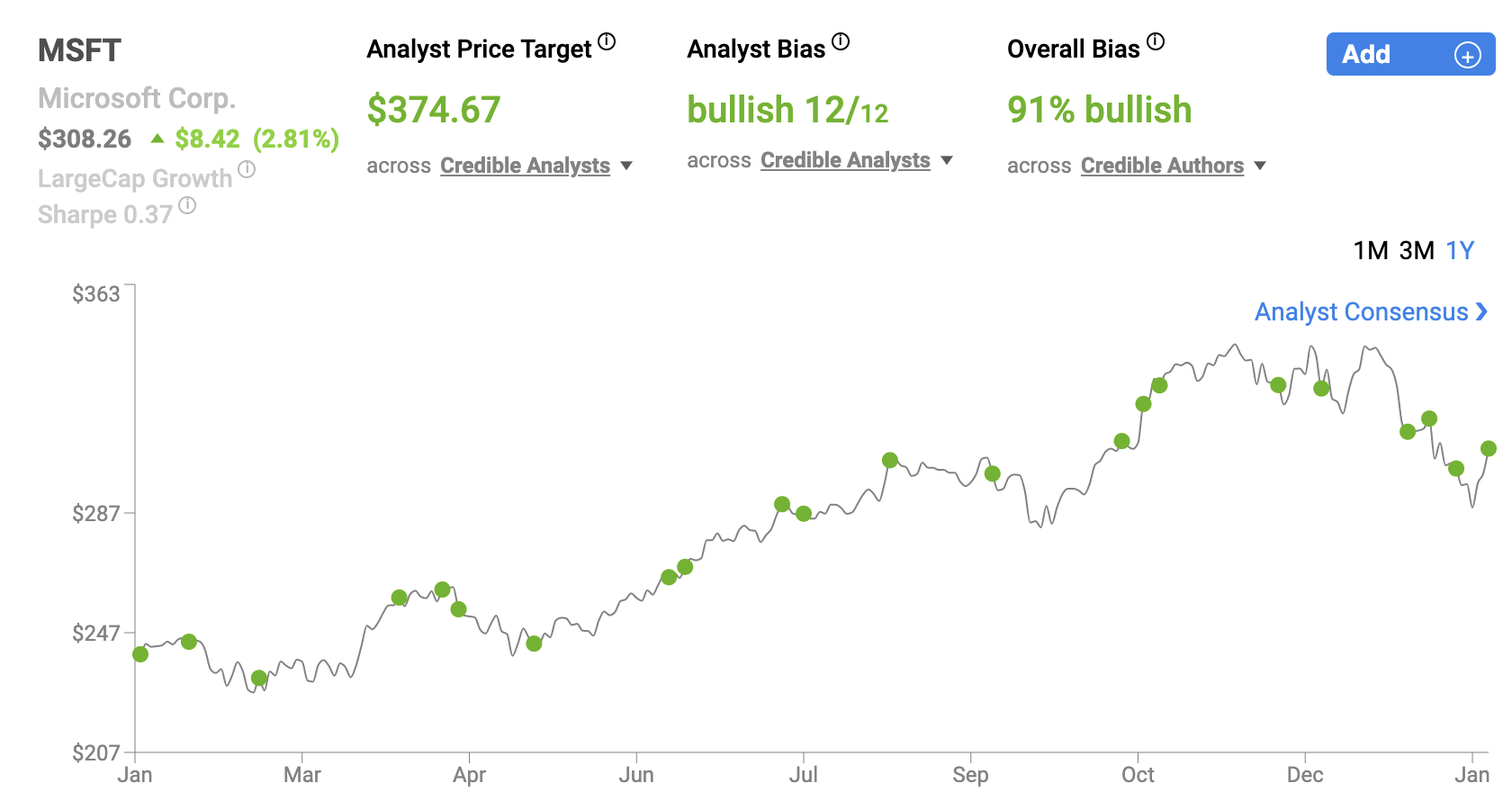

MSFT with Nobias technology: Is Microsoft’s 12% Year-To-Date Pullback A Buying Opportunity?

Microsoft is on a 20-year annual dividend growth streak. And while the company’s dividend yield is rather low, at just 0.84%, this company has been very generous with its shareholder returns. MSFT’s 5 and 10-year dividend growth rates are 9.4% and 13%, respectively.

Microsoft (MSFT) is widely considered to be one of the world’s highest quality companies. It is one of just two companies in the world with a AAA-rated balance sheet (Johnson and Johnson (JNJ) is the other). MSFT has the world’s second highest market cap, of $2.25 trillion (behind only Apple’s (AAPL) $2.72 trillion total). Microsoft is a leader in the fast growing cloud market. It has developed a strong presence in the artificial intelligence and cybersecurity spaces as well. Most recently, Microsoft made a $69 billion acquisition of Activision-Blizzard, showing strong aspirations in the gaming space as well (Microsoft owns the Xbox gaming platform and in recent years, they’ve been growing their game developer portfolio rapidly). And, not only is this a growth stock, but also a favorite pick amongst dividend growth investors. Microsoft is on a 20-year annual dividend growth streak. And while the company’s dividend yield is rather low, at just 0.84%, this company has been very generous with its shareholder returns. MSFT’s 5 and 10-year dividend growth rates are 9.4% and 13%, respectively.

Needless to say, this $2t+ company has a lot of good things going for it. However, shares have been caught up in the technology sector sell-off that we’ve seen throughout 2022. MSFT is down 12% on a year-to-date basis. And therefore, we wanted to take a look at what the credible authors and analysts that the Nobias algorithm tracks have had to say about this stock recently. Is Microsoft a buy after its recent dip? Let’s find out.

Billy Duberstein, a Nobias 4-star rated, recently posted a bullish article on Microsoft, where he highlighted the company’s primary growth catalysts as well as its present valuation. Duberstein began his piece saying, “One of the biggest winners has been Microsoft ( MSFT -1.63% ), up 374% over the past five years, nearly quadrupling the return of the S&P 500.” He continued, noting that, “Microsoft has proved itself a safe and durable grower, and perhaps the best tech stock to own for older investors and those near retirement.” Then, he posed the same question that we have in this article, “However, is it too late to get in on Microsoft's red-hot performance?” Ultimately, his conclusion was: No, it’s not too late.

MSFT March 2022

Duberstein mentioned that MSFT has reinvented itself in recent years, transforming itself from an out-of-favor old-tech stock into a market darling in the growth space under the leadership of current CEO, Satya Nadella. He wrote, “Nadella had been the head of Microsoft's young but growing cloud computing business, which would usher in a new "cloud first, mobile first" era. Microsoft's Azure cloud computing platform grew by leaps and bounds in short order, and its Office and Dynamics software suite also benefited from the more efficient cloud deployment.”

Duberstein continued, “Nadella then gave Microsoft's prospects a new twist with its "intelligent cloud" strategy, named in 2017, in which artificial intelligence would be infused into all Microsoft's offerings. Integrating AI and machine learning into its cloud and enterprise software, Microsoft made its tools even more automated, productive, and beneficial to customers.” And, regarding the company’s ongoing growth prospects and its valuation, Duberstein said: “Since Microsoft has a number of high-growth products and is currently pursuing even more value-add acquisitions, I think it can sustain 20% or so revenue growth for the next few years at least. And since the company's profit margins are expanding as it grows, earnings should grow even faster. That would bring Microsoft's PEG ratio, or the P/E ratio divided by its growth rate, to a little bit over one. That's not an expensive price at all, provided Microsoft achieves that level of earnings growth.

Julin Lin, a Nobias 4-star rated author also recently published a bullish report on MSFT shares. Lin touched upon the stock’s recent rally (MSFT shares are up more than 30% during the trailing twelve months) and said that he expects to see the company split its stock in the near-term.

In recent years, we’ve seen stock splits from other big-tech names, such as Apple and Tesla (TSLA) inspire strong rallies. And, Lin thinks this is yet another bullish catalyst for MSFT in the near-term. He wrote, “Based on the company’s history of stock splits and the large market cap, I wouldn’t be surprised if we did see a stock split in 2022. Even without a stock split, the stock looks priced for double-digit returns over the next decade.”

Regarding the fundamental impact of a split on the company’s shares, Lin wrote: “A stock split would not create any fundamental value, but the increased liquidity often leads to a rising stock price. It is also possible that the strong performances of stocks following stock splits are not correlated at all, but merely a continuation of the strong price performance prior to the split - after all, stocks need to perform very well in order to justify a stock split.”

But, the potential for a share split isn’t the only reason Lin is bullish. He said, “Long time investors are already very familiar with the success of Azure, which delivered 46% growth. MSFT’s bread and butter services like Office and LinkedIn continued to deliver solid top and bottom line growth.” He continued, saying, “What I think investors should instead focus on is the “more personal computing” segment. This segment has arguably been the most boring of the three segments in recent years. MSFT delivered 15% revenue growth, but that growth has not always been consistent.”

And finally, he touched upon the Activision acquisition, saying: “This would be an all-cash deal meaning it would be immediately accretive, but I expect MSFT to extract considerable value over the long term. For starters, there are the typical synergy benefits, but the combination may also bring rise to a new gaming powerhouse as MSFT will be able to invest considerable cash flows above and beyond what ATVI had itself.”

Lin also touched upon the company’s valuation after its recent pullback. He wrote, “Is MSFT a buy now? Trading at 33x earnings, I could see the stock outperforming the market indices for a long time.” He continued, “Due to the constant innovation at the company, I could see the stock sustaining at least a 25x-30x earnings multiple. Yet with revenues projected to grow double-digit for many years, the stock could deliver double-digit returns from growth alone.”

Ultimately, Lin said, “I rate shares a buy, though note that there may be better buying opportunities elsewhere in the tech sector, albeit at higher risk than MSFT.” However, he noted that MSFT offers unique profitability metrics and a strong balance sheet, which makes it an easy company to accumulate. He concluded his piece saying, “Throw in the 3% earnings yield and the fact that the company has $50 billion of net cash, and one can see the increased certainty in the projected returns.”

Zvi Bar, a Nobias 4-star rated author recently posted a more conservative report, saying that he believes MSFT shares will remain rangebound in the short-term, due to several headwinds holding the stock back. Bar began his piece by highlighting the strong earnings report that MSFT posted in late-January. He wrote, “The company's results were strong, with revenue of $51.7 billion and diluted earnings per share of $2.48 within the quarter. This is an increase of about 20% to revenue, and 22% to EPS compared to the same quarter one year earlier. Further, both revenue and EPS were above most estimates.” However, he continued, “The numbers were great, and the shares appreciated in response, but have not moved much since then.” Therefore, Bar has arrived at the conclusion that, “Microsoft Corporation's (MSFT) shares appear likely to remain rangebound for the next quarter or two for multiple reasons, including the pending acquisition of Activision Blizzard Inc. (ATVI). Beyond that, it is also the case that Microsoft substantially appreciated over the last two years.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

In his mind, the stock’s recent pullback seems “reasonable” after, “Shares went through an unreal melt-up that took MSFT from around $290 at the start of October to about $345 in mid-November.” And, he noted, the Activision-Blizzard acquisition adds more downside pressure to the stock due to the potential of heightened regulatory scrutiny. Bar said, “Another downside risk is that Microsoft gets targeted in some way by a government agency. There already appears to be some level of scrutiny from the FTC, and it is possible that this will become a greater issue. Since the market reacted poorly to the proposed acquisition, the risk from the deal should only be so great from here, and it may be priced into the shares already.” Bar concluded his article saying, “I believe MSFT is likely to remain rangebound between its recent lows and the highs it set late last year. This range is reasonably wide, at nearly 20% of the market valuation, with Microsoft sitting sort of in the middle right now. This may be good reason to consider selling short-term covered calls against an existing position on any further strength.”

Looking at the broader aggregated opinion of the authors that the Nobias algorithm follows, we see that 89% of recently expressed opinions were “Bullish” on MSFT shares. And, when looking at the opinions expressed by credible Wall Street analysts (only those with a 4 or 5-star Nobias rating), we see that the average price target being applied to MSFT shares is currently $377.46. Today, MSFT trades for $291.64. Therefore, that $377.46 average price target implies upside potential of approximately 29.4%.

Disclosure: Of the stocks mentioned in this article, Nicholas Ward is long MSFT, JNJ, and AAPL. Nicholas Ward wrote this article for Nobias at their request with a view of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

CVX with Nobias technology: Is Chevron Still A Buy After Its 27% Year-to-Date rally?

investors who are fearful of ongoing inflation (especially in the energy markets) are likely looking for potential safe havens. Chevron (CVX) is one of the world’s largest integrated oil companies, it is important to see what the credible authors and analysts that we track with the Nobias algorithm have had to say about the stock recently.

Right now, one of the major headwinds that the broader market faces is rising oil prices. Inflation in the energy space hits just about everyone’s pocket books. It hurts the bottom lines of businesses that have to allocate capital towards energy resources. And, on the consumer side, it hurts bullish sentiment and has historically led to reduced discretionary spending, as higher prices at the pump result in a higher percentage of savings being directed towards energy expenses. Inflation was already a major financial theme heading into February and now we’re seeing the war in Ukraine drive energy prices even higher.

The International Energy Agency (IEA) recently published a report highlighting the potential impacts that the Russian invasion of Ukraine and the global sanctions put onto the Russian economy could have on oil prices. The report read, “An invasion into the Ukraine by Russian troops on 24 February 2022 has as of yet not resulted in a loss of oil supply to the market. Prices nevertheless surged by $8/bbl to $105/bbl following the news, on expectations that sanctions against Russia would cripple energy exports. It is currently unclear what the impact of sanctions will be on energy flows and how long any potential supply losses will last.”

The report continued, highlighting Russia’s oil production, saying, “Russia is the world’s third largest oil producer behind the United States and Saudi Arabia. In January 2022, Russia’s total oil production was 11.3 mb/d, of which 10 mb/d was crude oil, 960 kb/d condensates and 340 kb/d NGLs. By comparison, US total oil production was 17.6 mb/d while Saudi Arabia produced 12 mb/d.”

CVX March 2022

Finally, the report also touched upon Russia’s oil exports, saying, “Russia is the world’s largest exporter of oil to global markets and the second largest crude oil exporter behind Saudi Arabia.” Therefore, it shouldn’t come as a surprise to investors that oil prices have been on the rise in recent weeks. Just this morning, the price of oil hit a 52-week high.

A recent CNN article highlights the pre-market rise which read, “Brent crude futures, the global benchmark, increased nearly 6% to $110.90 per barrel at 5:30 a.m. ET. US oil futures traded with a slight discount at $109.30 per barrel. In Europe, the price of wholesale natural gas spiked 60% to a record high of €194 ($215) per megawatt hour. That's more than double where it stood last Friday.” And with this in mind, investors who are fearful of ongoing inflation (especially in the energy markets) are likely looking for potential safe havens. Chevron (CVX) is one of the world’s largest integrated oil companies, it is important to see what the credible authors and analysts that we track with the Nobias algorithm have had to say about the stock recently.

Chevron shares have been on quite a run in recent days. The stock is up 11.03 during the last week alone. On a year-to-date basis, CVX is up 27.58%. However, even after this recent rally, when looking at the sentiment expressed by the credible (4 and 5-star rated) authors that we track, it’s clear that the sentiment surrounding this stock remains very bullish. Right now, 92% of the recent reports published by credible authors have expressed “Bullish” sentiment.

Several recent bullish reports were published by Daniel Foelber, a Nobias 5-star rated author who covers energy markets at The Motley Fool. In a recent article titled, “7.5% Inflation: 2 Safe Dividend Stocks to Buy Now” Foelber highlights CVX as a potential safe haven for investors looking for shelter in today’s inflationary environment.

Regarding inflation, Foelber said, “One way to invest in businesses that can perform well during inflationary times is to find the industries causing inflation and avoid the ones most vulnerable to it. Higher oil and gas prices are contributing to inflation right now.” He acknowledged that one of the primary reasons that stocks in the energy sector have underperformed for much of the prior decade was because of aggressive capital expenditures and poor cost controls. Yet, it appears that Chevron has changed its ways in recent years. The company is clearly focused, not just on ramping production, but also, on increasing its bottom line.

Regarding CVS’s fundamentals, Foelber wrote, “2021 revenue was up only 15.5% in five years, but net income was up 70%, and free cash flow increased over 200% -- a sign that Chevron is converting more sales into actual profits.” He continued, “A lean business operating in the heart of an industrywide boom should allow Chevron to have another excellent year in 2022. In its fourth-quarter 2021 conference call, management indicated it would stay disciplined and keep capital spending under control so as not to overexpand and leave the company vulnerable during a downturn.”

In a second recent report, Foelbert touched upon recent M&A activity, with CVX showing savvy awareness to pick up beaten down assets during the COVID-19 recession period in 2020, which not only reduced its energy footprint, but also reduced its cost of production. He said, “In 2020, Chevron reduced its capital expenditures to $8.9 billion as it cut costs to make ends meet. However, Chevron also played some offense by acquiring Noble Energy in an all-stock deal valued at $13 billion -- which included around $8 billion of Noble Energy's debt. Chevron announced the deal in July 2020 and closed it in October 2020.”

Foelber continues, “The deal gave Chevron 92,000 largely contiguous acres in the Permian Basin at the cost of less than $5 per barrel of oil equivalent (BOE) of proven reserves and less than $1.50 per BOE for 7 billion barrels of risked resource. In total, it added 18% to Chevron's total proven reserves as of year-end 2019.”

Regarding cost reductions, he noted, “The deal reduced Chevron's cost of production, something the company has expressed as one of its core strategic goals. Today, Chevron can achieve breakeven positive free cash flow (FCF) at around $40 per BOE, allowing it to operate successfully in good times and bad.”

Lastly, he believed that CVX’s strong balance sheet allowed the company to go shopping while sentiment was poor. He said that this value oriented approach, when it came to the Nobel Energy acquisition meant that “Chevron was able to buy the company at a steep discount to what it would be worth today.”

Foelber mentioned CVX as a top pick in a recent discussion about “ultra safe dividend stocks” to buy during the market volatility during February, saying, “for over 30 years, Chevron has consistently paid and raised its annual dividend, making it one of the few energy stocks on the coveted list of Dividend Aristocrats (members of the S&P 500 that have raised their dividend for at least 25 consecutive years).” He continued, “Chevron raised its dividend in 2020 -- a year where many of its competitors were reducing their dividends. Chevron also raised its dividend in 2021 from $1.34 per share per quarter to $1.40 per share per quarter. A couple of weeks ago, it increased the quarterly dividend yet again to $1.42 per share.” He noted that this dividend growth was more than supported by the company’s fundamentals (due, largely to management’s renewed focus on cost reduction and operational efficiency).

Foelber wrote, “In 2021, Chevron spent just $8.1 billion in capital expenditures and earned a record-high $21.1 billion in free cash flow that it can use to grow the dividend, buy back stock, and reinvest in the business.” And, while Foelber has been prolific recently with his CVX coverage, we see that he isn’t the only credible author who has recently published a bullish report on the stock.

George Budwell, a Nobias 4-star rated author, recently mentioned CVX in a bullish light in his article titled, “2 Incredibly Cheap Value Stocks to Buy in February”. This article was written on February 1st, but Budwell showed great foresight, saying, “If crude oil prices do indeed breach $100 a barrel this year as some analysts predict, for instance, Chevron's top line could jump by as much as 19.6% this year, according to Wall Street's most optimistic forecast.” He continued, “That kind of explosive top-line growth would mean that the oil and gas giant's shares are currently trading at under nine times 2022 projected earnings. To put this figure into context, the three-year average price-to-earnings ratio for oil and gas stocks at large is roughly 13.4 at the time of this writing. Therefore, Chevron's stock might be deeply undervalued right now.” And, Budwell said that not only has CVX been quite generous with its dividend recently, but with its buyback as well.

Regarding shareholder returns, he said, “The energy titan also noted during its latest quarterly update that share buybacks this year should range from $3 billion to $5 billion. Depending on how aggressive the company gets with share repurchases, Chevron's bottom-line growth could surpass even Wall Street's most bullish forecast for 2022.”

Budwell noted that all is not well with the company (all equities are risk assets and no stock is ever perfect), writing, “The one drawback with this story is that Chevron is facing some hefty production headwinds in key foreign territories right now.” However, overall Budwell made it clear that he believed shares were cheap and likely to produce “market-beating returns for shareholders this year”.

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

It’s important to note that all of these reports were published before the most recent leg of CVX’s 2022 really. Few analysts predicted a war in Ukraine coming into the year and therefore, most full-year price targets for CVX have not baked in the recent uptick in oil prices. With that in mind, we see that the credible Wall Street analysts that the Nobias algorithm tracks are relatively bearish on CVX stock, at least, when it comes to their price targets.

While we see quite a few “Buy” ratings up and down the credible analyst list when it comes to CVX, the average price target being applied to these shares by these individuals and the firms they work for is currently $133.63. CVX closed the trading session yesterday with a share price of $149.72 and right now, as I write this, shares are up in the pre-market, with futures pointing towards a $151.83 open.

In short, the stock’s current price is roughly 12% above the current average price target being applied to shares by the credible Wall Street analysts that we follow. However, we also think it’s important to note that unique circumstances in the energy space right now (related to the war in Ukraine) mean that these price targets are largely lagging indicators and we wouldn’t be surprised to see upgrades to CVX price targets in the near-term as the Wall Street community begins to calculate 2022 returns with $100+ oil in mind.

Disclosure: Nicholas Ward has no positions in any stock mentioned in this article. Nicholas Ward wrote this article for Nobias at their request with a view of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

INTC with Nobias technology: Can Intel’s Ambitious Growth Plans Reverse This Stock’s Recent Underperformance Trend?

Intel (INTC), which is widely considered to be a market darling, has fallen off of its pedestal. INTC shares are down 21% during the last year and they’ve drastically underperformed their peers over the last 5 and 10-year periods, posting gains of 30.6% and 78.69%, respectively. Intel recently experienced a management change and the company has embarked upon ambitious plans to return to growth. Therefore, we wanted to highlight the recent opinions expressed by authors/analysts which the Nobias algorithm deem to be credible, with regard to whether or not investors should consider buying into INTC’s recent dip.

The semiconductor space has been one of the most popular places to invest in recent years because of the digitalization of society and the world’s economy. Computer chips are ubiquitous in today’s world. And, as we venture further and further into the digital age (as a society and species) this trend isn’t likely to change anytime soon.

With that said, the VanEck Semiconductor ETF (SMH) has been a wonderful investment vehicle for people in recent years. The SMH is down 12.41% on a year-to-date basis in 2022 as the market rotates out of growth and into more defensive value plays; however, during the trailing 12 months, this fund is up 14.57%, during the last 5 years, the SMH is up 252.51%, and over the last decade, this fund is up 686.28%.

However, not all semiconductors are created equally. Intel (INTC), which was a former leader in this space and widely considered to be a market darling, has fallen off of its pedestal. INTC shares are down 21% during the last year and they’ve drastically underperformed their peers over the last 5 and 10-year periods, posting gains of 30.6% and 78.69%, respectively.

Intel recently experienced a management change and the company has embarked upon ambitious plans to return to growth. Therefore, we wanted to highlight the recent opinions expressed by authors/analysts which the Nobias algorithm deem to be credible, with regard to whether or not investors should consider buying into INTC’s recent dip.

INTC Feb 2022

The Value Portfolio, a Nobias 5-star rated author, recently published an article highlighting several catalysts that Intel has to unlock long-term value. They highlighted the investments that Intel is making into the foundry business, saying, “Intel has announced IDM 2.0 with an interest to build a foundry business. The company has announced a $20 billion investment into new Arizona factories and a $3.5 billion in New Mexico.”

The Value Portfolio continued, “There's no guarantee of success here, but especially if the company passes TSMC in 2025, it could be a massive business. Evident of this is that TSMC is twice as big as Intel and only offers foundry services. More so, another important part of this business is that there's demand for chips in all nodes, much of the current shortage is legacy nodes. That means the business could generate reliable and growing cash flow.”

However, this ambitious plan to become a leader in the global foundry business does not come without risks. They touched upon the downside potential of these multi-billion investments saying, “Intel's most substantial risk, in our view, is that the company has fallen behind its largest peers, TSMC and Samsung. The company has set its target of regaining the crown by 2025, however, it's struggled for the last several years, and this is a lofty target. Until the company actually releases 2 nm CPUs in 2024-2025, it remains to be seen whether the company will hit its targets.”

In a recent article, fellow Nobias 5-star rated author, Harsh Chauhan also touched upon the risks involved with attempting to comete with global foundry giant, Taiwan Semiconductor (TSM) saying: “TSMC has a capital expenditure (capex) budget of $40 billion to $44 billion for this year, which points toward a huge increase over its 2021 capital spending of $30 billion. What's more, TSMC's 2022 capital expenses are way higher than Intel's ( INTC 2.12% ) estimated outlay of $25 billion to $28 billion for this year. This doesn't look like good news for Intel, as there was a massive spending gap between the two companies in 2021 as well, given Chipzilla's capital spending budget of $19 billion to $20 billion last year.”

However, the foundry investments that management is making aren’t the only upside catalysts for this beaten down stock, in The Value Portfolio’s eyes. In their article, they touched upon recent news that Intel was looking to spin off potentially highly valued assets to unlock value for shareholders. In December of 2021, news broke that Intel was looking to spin off its Mobileye assets. The Value Portfolio highlighted this news saying: “Intel initially acquired Mobileye in 2017 in a $15 billion acquisition. Since then the company has become an even more dominant force in the self-driving vehicle industry. The company expects 40% more 2021 revenue versus 2020 revenue and continued growth. As a result, Intel has announced the intention to take Mobileye public in mid-2022.

The IPO details are fuzzy, however, analysts see a valuation as high as $50 billion (or 25% of Intel's valuation). Given the company's strong positioning and the significant amount of hype around self-driving valuation, we could see it fetching a higher valuation. This could represent a way for Intel to unlock significant value and earn cash.” Even though Chauhan acknowledges the risks of attempting to compete in the foundry landscape, he also recently published a bullish article on Intel which touched upon other potential growth markets that Intel could tap into, putting a spotlight on the GPU space within the broader semiconductor market. GPU chips, or Graphics Processing Units, are semiconductors that benefit from the strong secular tailwinds that exist in the gaming industry.

High growth companies NVIDIA (NVDA) and Advanced Micro Devices (AMD) dominate this space. However, Chauhan believes that Intel can compete for market and potentially generate billions in revenues with its own GPU ambitions. In his recent article, Chauhan wrote, “Intel's Arc GPUs are equipped with ray-tracing technology. They also sport artificial intelligence-powered resolution upscaling and a proprietary Deep Link technology that Intel says can accelerate many workloads if the computer also features a compatible Intel processor. These features indicate that Intel is serious about making a dent in the discrete GPU market, as its cards are packed with technology on par with rivals.”

With regard to the competitive landscape in the GPU industry, Chauhan wrote, ”According to Jon Peddie Research, Nvidia commanded 83% of this space in the third quarter of 2021, while AMD was left with the remaining 17%. Nvidia has dominated the graphics card market with an iron hand thanks to its robust supply chain and competitive RTX 30 series cards.” Cutting into this duopoly is a daunting task; however, the risks are clearly worth the rewards. Chauhan continued, “After all, Jon Peddie Research estimates that the discrete GPU market could be worth $54 billion in 2025 as compared to $23.6 billion in 2020.”

Chauhan concluded his piece saying, “In all, Intel seems to be entering the GPU market on a promising note. If the chipmaker can corner even 10% of this market in the next couple of years, it could add billions of dollars to its revenue that may act as a catalyst for the tech stock in the long run.” And, while much of the highlights surrounding this company have surrounded its future growth prospects, there are other credible authors that we follow who appear to be bullish on Intel stock because of the value it presents and the shareholder returns that it continues to provide.

The Dividend Diplomats, a Nobias 4-star rated author, recently published an article highlighting two of their favorite dividend paying stocks for the month of February; one of which was Intel. “Intel has been crushed due to supply chain issues and chip shortages. The short-term outlook for Intel isn’t looking that great; however, the company is taking steps to address this in the long run. Intel recently announced a $20 billion new chip manufacturing facility in Ohio and plans to invest significant dollars in their Arizona facility. The moves will take time to bear fruit; however, in the long run, this will help Intel avoid future shortages by reducing its exposure to the global supply chain.”

When making investments for their family, the Dividend Diplomats said they they look for companies to pass 4 primary screens: a “Price to Earnings Ratio Less than the S&P 500”, a “Dividend Payout Ratio Less than 60%”, and “History of Increasing Dividends.” Regarding these screens when it comes to Intel shares, the Dividend Diplomats say:

Price to Earnings Ratio: 13.45x. The stock is trading at less than half the valuation of the S&P 500. Check!”

“Dividend Payout Ratio: 41.24%. A very strong payout, perfect ratio. There is still plenty of room to continue increasing its dividend going forward.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

“History of Increasing Dividends: Intel just announced a 5% increase to its dividend. Despite the negative news, Intel still said “hey look at us, this isn’t gong to stop us from increasing our dividend.” After this last dividend increase, the company has increased its dividend for 8 consecutive years. The company’s 5 year average dividend growth rate is just under 6%.”

With that all in mind, they concluded their bullish report noting that they added to their personal position during INTC’s recent sell-off. Overall, when looking at the community of credible authors tracked by the Nobias algorithm (only those with 4 and 5-star ratings) we see that the sentiment lean is decidedly positive, with 90% of recent reports expressing a “Bullish” outlook on shares.

Furthermore, when looking at the credible Wall Street analysts that our algorithm tracks, we see that relative to the stock’s current share price of $47.71, the average analyst share price target attached to INTC shares of $58.38 represents upside potential of 22.36%.

In short, the communities of credible authors and analysts are both bullish on INTC shares, meaning that this is a company that investors looking for exposure to the technology sector may want to consider owning moving forward.

Disclosure: Of the stocks mentioned in this article, Nicholas Ward is long INTC and NVDA. Nicholas Ward wrote this article for Nobias at their request with a view of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

UBER with Nobias technology: On The Verge Of Profitability, Is It Finally Time To Buy UBER?

Uber (UBER) is a highly followed name in the growth space because of the secular tailwinds that many analysts believe exist in the ride sharing industry. Uber’s IPO made headlines in 2019 due to the immense size of the company’s initial market cap. As you can see in this article, Uber’s $8.1 billion IPO price was one of the largest of all-time. And yet, the stock has been on a relatively bumpy road since then.

Uber (UBER) is a highly followed name in the growth space because of the secular tailwinds that many analysts believe exist in the ride sharing industry. Uber’s IPO made headlines in 2019 due to the immense size of the company’s initial market cap. As you can see in this article, Uber’s $8.1 billion IPO price was one of the largest of all-time. And yet, the stock has been on a relatively bumpy road since then.

UBER’s IPO price was $45/share. Today, shares trade for $34.68. This means that since its IPO date, UBER has produced negative returns for shareholders. During the COVID-19 pandemic this company struggled in a major way as social distancing trends and regulation hurt the travel sector and led to secular movements like “work from home” and the “urban exodus”, both of which have created headwinds for Uber’s growth.

In March of 2020, Uber’s share price was essentially cut in half, with shares falling from the $40 area to less than $20/share, because of fears associated with COVID-19. And yet, during its recent Investor Day presentation, Uber management highlighted the fact that its company has continued to grow nicely throughout the pandemic period, with Gross Bookings posting a 27% compounded annual growth rate (CAGR) throughout the 2017-2021 period.

The market remains content to largely ignore this growth, however. UBER shares are down 17.29% on a year-to- date basis. They’ve fallen 41.22% during the trailing 12-months. And, even in more recent times, the stock’s struggles have continued (during the last month, UBER shares are down 9.71%).

UBER Feb 2022

In short, this stock has been a perennial under-performer when compared to the major averages. And yet, reading through analyst reports, it’s clear that many individuals and Wall Street firms believe that UBER continues to offer strong long-term growth potential. The stock reported Q4 2021 earnings this week. And therefore, we wanted to take a look at what the credible authors/analysts that the Nobias Algorithm tracks have had to say about the stock recently.

Is this -41% trailing twelve month sell-off a buying opportunity? Many people think of Uber when they think of ride hailing; however, this company has expanded its operations quickly in recent years and is now much more than a ride hailing service.

Danassa Lincoln, a Nobias 5-star rated author, highlighted Uber’s diverse operations in a recent article saying, “Uber Technologies, Inc operates as a technology platform for people and things mobility. The firm offers multi-modal people transportation, restaurant food delivery, and connecting freight carriers and shippers. It operates through the following segments: Rides, Eats, Freight, Other Bets and ATG and Other Technology Programs.”

During the company’s recent quarter, its continued efforts to diversify its operations appears to have paid off nicely. Within UBER’s Q4 earnings report, its CEO, Dara Khosrowshahi, said: “Our results demonstrate just how far we’ve come since the beginning of the pandemic. In Q4, more consumers were active on our platform than ever before, Delivery reached Adjusted EBITDA profitability, and Mobility Gross Bookings approached pre-pandemic levels. While the Omicron variant began to impact our business in late December, Mobility is already starting to bounce back, with Gross Bookings up 25% month-on-month in the most recent week.”

Nobias 4-star rated author, The Value Pendulum, recently published a bullish article on Uber, bucking the year-to-date sentiment trend. The Value Pendulum began their piece with an “elevator pitch” for their bullish outlook, saying, “Uber's Q4 2021 financial performance was good, but its management guidance relating to 2024 EBITDA and Q1 2022 gross bookings disappointed investors. But I remain bullish on Uber and reiterate my Buy rating, on the basis that Uber's valuations are undemanding and the company's multiproduct platform has lots of untapped potential with respect to growing cross-platform users.”

The Value Pendulum noted that Uber recently beat analyst estimates during its fourth quarter earnings results, writing: “Uber reversed from an operating loss of -$454 million at the non-GAAP adjusted EBITDA level in Q4 2020 to generate a positive adjusted EBITDA of +$86 million in Q4 2021, as disclosed in the company's recent quarterly media release. In November 2021, Uber had guided for the company to deliver an adjusted EBITDA in the $25-$75 million range for the fourth quarter of last year, so its actual operating earnings exceeded the higher end of management guidance by +15%. Moreover, Uber's Q4 2021 adjusted EBITDA was +28% higher than the sell-side analysts' consensus forecast of $67 million as per S&P Capital IQ data.”

When discussing Uber’s bottom-line beat, The Value Pendulum attributed the company’s success to two primary catalysts. They said, “Firstly, Uber has managed to scale up its mobility (ride sharing) and delivery businesses to a level that we are able to see the positive effects of operating leverage kick in.” They continued, “Secondly, competition naturally becomes less intense in specific markets which have gone past the initial growth phase, and the focus of Uber and its rivals then shifts from gaining market share to expanding profit margins in these markets. “

The Value Pendulum also highlighted the fact that after their recent sell-off, Uber trades at a relative discount to its peers. Therefore, they believe that mean reversion back up towards the industry standard could be yet another catalyst for upside share price moment. They wrote, “According to S&P Capital IQ, the market currently values Uber at a consensus forward next twelve months' Enterprise Value-to-Revenue multiple of 2.9 times. In contrast, Uber's peers Lyft and DoorDash trade at consensus forward next twelve months' Enterprise Value-to-Revenue multiples of 3.2 times and 5.0 times, respectively.” Concluding their article, The Value Pendulum touched upon this relatively attractive valuation status again, saying, “I still rate Uber as a Buy. The company's shares have significant upside potential, taking into account the valuation discount on a historical and peer comparison basis.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

After years of unprofitable operations, it appears that Uber is on the verge of posting consistently positive bottom-line results. During the Q4 report, the company announced first quarter guidance for EBITDA of $100 million to $130 million. And, while the analyst consensus estimate across all of Wall Street currently points towards negative earnings-per-share once again in 2022 (right now, the forward consensus estimate is -$0.80/share), that trend is changing as well.

The consensus estimate for Uber’s earnings-per-share in 2023 is currently $0.03/share (which would mark the company’s first profitable year - from an EPS perspective - since its IPO). And, in 2024, analysts expect bottom-line growth to accelerate, rising to $0.76/share. This rapid growth potential is what has the bulls excited. However it’s important to note that at Uber’s current share price, shares are still trading with a very speculative forward price-to-earnings ratio (relative to the broader market’s forward multiple of approximately 21x) of 47x when looking at those 2024 estimates. That’s a hefty price to pay for earnings potential nearly 3 years down the road. But, bullish analysts aren’t necessarily thinking about what type of cash flows Uber can generate during the next several years, but instead, its potential a decade or more down the road.

Looking at the sentiment expressed by credible authors, it appears that the vast majority of individuals that our algorithm tracks remain incredibly bullish on this long-term potential. 95% of recent articles written by 4 and 5-star authors have included a “Bullish” leaning opinion. And, when we look at the credible Wall Street analysts that cover UBER stock, we see a similar trend. The average price target that credible (once again, Nobias 4 and 5-star rated) analysts place on UBER shares is currently $67.80. Today, UBER’s share price sits at $34.68. Therefore, this price target represents upside potential of approximately 95.5%.

Disclosure: Nicholas Ward has no position in UBER. Nicholas Ward wrote this article for Nobias at their request with a view of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

CSCO with Nobias technology: Cisco Shares Are Up 6% Since Their Q2 Earnings Report. Is It Too Late To Buy?

Cisco (CSCO), which has transitioned from a speculative high flier several decades ago into a equintessential cash cow of an “old tech” stock in today’s market, has regained its market darling status recently. Over the past year, the S&P 500 is up 11.11%. During this same period of time, CSCO shares are up 23.46%. Throughout 2022, both the S&P 500 and CSCO shares have experienced high single digit weakness; however, Cisco posted fiscal Q2 results last week which caused the stock to rally. Cisco shares rose 6.14% during the past week.

Cisco (CSCO), which has transitioned from a speculative high flier several decades ago into a equintessential cash cow of an “old tech” stock in today’s market, has regained its market darling status recently. Over the past year, the S&P 500 is up 11.11%. During this same period of time, CSCO shares are up 23.46%.

Throughout 2022, both the S&P 500 and CSCO shares have experienced high single digit weakness; however, Cisco posted fiscal Q2 results last week which caused the stock to rally. Cisco shares rose 6.14% during the past week. The broader markets were down roughly 1.5% during this period of time. We’re seeing geopolitical headlines (regarding the potential Russia/Ukraine crisis) drive markets lower. However, investors appear to be seeking shelter in the relatively defensive CSCO shares. Can this trend continue? Let’s take a look at what the credible analysts that the Nobias algorithm tracks have recently had to say.

Prior to Cisco’s earnings report Nobias 4-star rated author, Stephen Simpson, published a bullish article on Cisco shares. Regarding the company’s attempt to accelerate its fundamental growth after struggling for a couple of years during the pandemic period (during its fiscal 2020 and fiscal 2021 years, Cisco’s earnings-per-share total came in at just 4% and 0%, respectively), Simpson said: “Opportunity has never been the issue for Cisco, and it isn’t today – Cisco is targeting attractive growth markets that can easily support revenue growth. That’s particularly true over the next 12-24 months, as spending from enterprise, webscale, and service provider customers on 5G, 400GE, Wi-Fi, security, and other areas of interest to Cisco should be quite strong. The question is whether Cisco can get its large array of ducks in a row and execute on that opportunity.”

CSCO Feb 2022

Simpson highlighted Cisco’s relatively conservative valuation (unlike many of the speculatively valued technology stocks that we’ve witnessed experiencing precipitous sell-offs in recent months) and noted that this provides relative upside potential to the stock. He wrote, “Low-to-mid single-digit revenue and modest improvement in FCF margins (around 100bp or so from recent trends) can support a high single-digit long-term annualized return, and the markets Cisco serves should be able to support an even higher growth.” He concluded his piece saying, “I’m guardedly bullish here. The expectations embedded in the share price today suggest decent upside even if Cisco doesn’t significantly improve itself, but significant upside if execution were to materially improve.”

Anthony Miller, a Nobias 5-star rated author, recently published a report focused on Cisco’s Q2 results. He highlighted Cisco’s “Company Profile” saying: “Cisco Systems, Inc engages in the design, manufacture, and sale of Internet Protocol-based networking products and services related to the communications and information technology industry. The firm operates through the following geographical segments: the Americas, EMEA, and APJC. Its products include the following categories: Switches, Routers, Wireless, Network Management Interfaces and Modules, Optical Networking, Access Points, Outdoor and Industrial Access Points, Next-Generation Firewalls, Advanced Malware Protection, VPN Security Clients, Email, and Web Security.”

Regarding the company’s top and bottom-line numbers, Miller wrote: “The network equipment provider reported $0.84 earnings per share (EPS) for the quarter, topping the Zacks’ consensus estimate of $0.81 by $0.03, MarketWatch Earnings reports. The business had revenue of $12.72 billion during the quarter, compared to the consensus estimate of $12.67 billion.“ He continued, “Cisco Systems had a return on equity of 30.59% and a net margin of 22.44%.”

With regard to valuation and recent share price movement, Miller said, “The company has a market cap of $239.14 billion, a PE ratio of 20.17, a P/E/G ratio of 2.76 and a beta of 1.00. Cisco Systems has a 12 month low of $44.15 and a 12 month high of $64.29. The company has a current ratio of 1.62, a quick ratio of 1.54 and a debt-to-equity ratio of 0.21. The firm’s 50-day moving average is $58.87 and its 200-day moving average is $57.30.”

During the Q2 report, the company also provided full-year fiscal 2022 guidance. Management believes that Cisco will generate sales growth of 5.5%-6.5% on the year. Management is also calling for non-GAAP earnings-per-share to arrive in a range between $3.41-$3.46, which, at the mid-point, would represent roughly 6.5% growth compared to fiscal 2021’s full-year earning-per-share figure of $3.22.

Cisco management touched upon shareholder returns during the quarter as well. The company raised its dividend by approximately 3%. In a separate article, Miller touched upon this dividend raise saying, “The newly announced dividend which will be paid on Wednesday, April 27th. Investors of record on Wednesday, April 6th will be issued a dividend of $0.38 per share. This is a boost from Cisco Systems’s previous quarterly dividend of $0.37. This represents a $1.52 annualized dividend and a yield of 2.69%. Cisco Systems’s dividend payout ratio is currently 55.02%.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

The company said, “Cisco's board of directors has also approved a $15 billion increase to the authorization of the stock repurchase program. There is no fixed termination date for the repurchase program. The remaining authorized amount for stock repurchases including the additional authorization is approximately $18 billion.”

Within the company’s earnings report Cisco’s CFO, Scott Herren, touched upon these plans saying: "We delivered healthy margins while continuing to make good progress in our business model shift, with software product revenue growing 9% year over year and the product portions of ARR and RPO growing in double digits. The combination of our dividend increase and additional share repurchase authorization demonstrates our commitment to returning excess capital to our shareholders and confidence in our ongoing cash flows."

Cisco ended Q2 with $21.1 billion of cash on its balance sheet, which helps to support these generous returns. Overall, when looking at the sentiment expressed by the credible authors that the Nobias algorithm tracks (only those with Nobias 4 and 5-star ratings), we see that 95% of recent reports published on the stock have been “Bullish”. Right now, the average price target associated with CSCO shares provided by the credible (once again, 4 and 5-star rated only) Wall Street analysts that our algorithm tracks is $66.50. Today, CSCO shares trade for $57.21. Therefore, the aforementioned price target represents upside potential of approximately 16.2%.

Disclosure: Nicholas Ward is long CSCO. Nicholas Ward wrote this article for Nobias at their request with a view of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

DDOG with Nobias technology: DDOG Shares Are Up 20% During The Last Month. Is It Too Late To Buy?

2022 has been a tough year for markets thus far. The S&P 500 is down 8.76% on a year-to-date basis. The Nasdaq has suffered even worse, down 13.4% on the year. However, that doesn’t mean that all tech stocks have been down and out during recent weeks. For instance, Datadog, Inc (DDOG) has rallied roughly 20% during the trailing 30 days. This move came on the heels of the company’s recent Q4 earnings report. We take a look at this stock to see what the credible analysts that cover it have had to say.

2022 has been a tough year for markets thus far. The S&P 500 is down 8.76% on a year-to-date basis. The Nasdaq has suffered even worse, down 13.4% on the year. However, that doesn’t mean that all tech stocks have been down and out during recent weeks. For instance, Datadog, Inc (DDOG) has rallied roughly 20% during the trailing 30 days. This move came on the heels of the company’s recent Q4 earnings report. We take a look at this stock to see what the credible analysts that cover it have had to say.

Nicole Kennedy, a Nobias 5-star rated analyst recently published an article on the stock which highlighted some of the company’s fundamental data coming into its recent earnings report. When describing DDOG’s operations, Kennedy said, “Datadog, Inc provides monitoring and analytics platform for developers, information technology operations teams, and business users in the cloud in North America and internationally. The company's SaaS platform integrates and automates infrastructure monitoring, application performance monitoring, log management, and security monitoring to provide real-time observability of customers technology stack.”

Kennedy wrote her piece on February 9th, a day before the February 10th earnings release. At the time, she noted that DDOG was trading for $151.73. Then, she went on to say: “The company has a debt-to-equity ratio of 0.77, a quick ratio of 3.94 and a current ratio of 3.94. The business’s 50-day simple moving average is $155.94 and its two-hundred day simple moving average is $151.69. The company has a market cap of $47.34 billion, a PE ratio of -1,083.71 and a beta of 1.17. Datadog has a fifty-two week low of $69.73 and a fifty-two week high of $199.68.”

DDOG Feb 2022

Let's start with a quick summary of Q4. Revenue was $326 million, an increase of 84% year over year and above the high end of our guidance range. We had about 18,800 customers, up from about 14,200 at the end of last year. We ended the quarter with about 2,010 customers with ARR of $100,000 or more, up from 1,228 at the end of last year.

When Datadog reported, it beat those estimates, posting revenue of $326.2 million, which was $34.78 million above Wall Street estimates, representing 83.7% year-over-year growth. The company’s non-GAAP earnings-per-share totaled $0.20 during the quarter, beating analyst consensus estimates by $0.09/share.

During the quarterly report, DDOG management provided Q1 fiscal year 2022 guidance, calling for revenue to come in a range of $334-$339 million, non-GAAP operating income to come in a range of $36-$39 million, and non-GAAP earnings-per-share to arrive in the range of $0.10-$0.12, which was essentially in-line with Wall Street’s $0.12/share consensus estimate.

The company also provided full-year 2022 estimates for sales, calling for them to arrive in the range of $1.51-$1.53 billion (above the $1.4 billion consensus), non-GAAP operating income to come in a range of $160-$180 million, and non-GAAP earnings-per-share to arrive in the range of $0.45-$0.51 (which was below analyst consensus of $0.58/share). Even though this earnings-per-share guide was below consensus, DDOG shares rallied on the Q4 results, popping more than 20% in the after hours.

During the company’s earnings report conference call, Olivier Pomel, DDOG’d CEO, was quite bullish on his company’s results saying: “Let's start with a quick summary of Q4. Revenue was $326 million, an increase of 84% year over year and above the high end of our guidance range. We had about 18,800 customers, up from about 14,200 at the end of last year. We ended the quarter with about 2,010 customers with ARR of $100,000 or more, up from 1,228 at the end of last year.” He continued: “These customers generated about 83% of our ARR. We had 216 customers with ARR of $1 million or more, which is more than double the 101 we had at the end of last year. The leverage and efficiency of our business model is coming through with free cash flow of $107 million. And our dollar-based net retention rate continued to be over 130% as customers increase their usage and adopted our newer product.”

Analysts seemed quite bullish on DDOG’s retention and growth amongst its higher paying clients; the market was pleased to see the adoption of its services amongst the larger corporations which should continue to have large CAPEX to dedicate towards products/services like DDOG offers over the long-term.

Pomel also announced a partnership with Amazon.com (AMZN) and its Amazon Web Services cloud operations which has the potential to increase the size and scale of DDOG’s services in a significant way. He said: “We also announced a global strategic partnership with AWS. This is a recognition of our success and growth with AWS and our commitment to further invest to accelerate our joint opportunities. Among the areas of further partnership, we have already integrated Datadog more tightly into the AWS marketplace. We are also working with AWS to build deeper integrations not only for observability, but also for security use cases, and we are also planning to extend our joint go-to-market activities.”

We see that it’s not just DDOG’s management team who’ve been bullish on the stock’s prospects lately. Tristan Rich, a Nobias 5-star rated author, recently published a piece which highlighted a handful of analyst updates on DDOG shares. Rich said:

Monness Crespi & Hardt raised their price target on shares of Datadog from $160.00 to $220.00 and gave the company a buy rating in a report on Friday, November 5th.

Morgan Stanley raised their price target on shares of Datadog from $164.00 to $200.00 and gave the company an overweight rating in a report on Sunday, November 7th.

Rosenblatt Securities upgraded shares of Datadog from a neutral rating to a buy rating and set a $175.00 price target on the stock in a report on Wednesday, February 2nd.

Needham & Company LLC lowered their price target on shares of Datadog from $236.00 to $190.00 and set a buy rating on the stock in a report on Tuesday.

Finally, Citigroup lifted their target price on shares of Datadog from $188.00 to $225.00 and gave the stock a buy rating in a research note on Friday, November 5th.

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

Furthermore, Hans Christensen, a Nobias 5-star rated author, published a similar piece, highlighting several more analyst pre-earnings updates. Christensen wrote:

Royal Bank of Canada raised Datadog from a “sector perform” rating to an “outperform” rating and increased their price target for the company from $191.00 to $235.00 in a research note on Friday, November 19th.

JPMorgan Chase & Co. cut shares of Datadog from an “overweight” rating to a “neutral” rating and lowered their price objective for the company from $212.00 to $195.00 in a research report on Tuesday, December 14th.

Mizuho lowered their price objective on shares of Datadog from $225.00 to $200.00 in a research report on Tuesday, January 18th.

Finally, Barclays lowered their price objective on shares of Datadog from $225.00 to $190.00 and set an “overweight” rating for the company in a research report on Wednesday, January 12th.

As you can see, coming into the 2/10/2022 earnings report, many of the large Wall Street firms were bullish on DDOG shares and it appears that this positive sentiment flowed into the earnings report reaction by the market.

Looking at the credible authors and Wall Street analysts that we track with the Nobias algorithm, this positive sentiment remains in place. 75% of the recent reports published by credible authors (those with 4 and 5-star ratings) have expressed a “Bullish” sentiment. And, looking at the credible (once again, only individuals with 4 or 5-star ratings) Wall Street analysts that we follow, we see that the average price target being applied to DDOG shares by this cohort is $210.50. Today, DDOG shares trade for $159.02. Therefore, this average price target implies upside potential of approximately 32.3%.

Disclosure: Of the stocks discussed in this article, Nicholas Ward is long AMZN. Nicholas Ward wrote this article for Nobias at their request with a view of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

NET with Nobias technology: Down 50%+ From Its 52-Week Highs, Is It Time To Buy Cloudflare?

Cloudflare is a very interesting company to follow. The stock exists in an industry (edge computing)) that is expected to benefit from strong secular tailwinds for years (if not decades) to come. However, because of these growth expectations the company came into 2022 trading with a very speculative valuation and therefore, NET shares have been caught up in the selling pressure that we’re seeing surrounding speculative growth stocks throughout 2022 (largely driven by an increasingly hawkish Federal Reserve). After posting roughly 200% capital gains in 2021, NET shares are down 20.21% year-to-date thus far in 2022. But, their sell-off actually began in late 2021. NET shares are down a whopping 52.6% from their current 52-week highs of $221.64. 50%+ sell-offs aren’t uncommon to see in the tech sector right now.

Cloudflare is a very interesting company to follow. The stock exists in an industry (edge computing)) that is expected to benefit from strong secular tailwinds for years (if not decades) to come. However, because of these growth expectations the company came into 2022 trading with a very speculative valuation and therefore, NET shares have been caught up in the selling pressure that we’re seeing surrounding speculative growth stocks throughout 2022 (largely driven by an increasingly hawkish Federal Reserve). After posting roughly 200% capital gains in 2021, NET shares are down 20.21% year-to-date thus far in 2022. But, their sell-off actually began in late 2021. NET shares are down a whopping 52.6% from their current 52-week highs of $221.64.

50%+ sell-offs aren’t uncommon to see in the tech sector right now. And while we’ve seen a stark rotation out of growth and into value throughout 2022 thus far, the fact is, this trade won’t last forward (the market always ebbs and flows). Therefore, investors who’re interested in secular growth are currently picking through the recent wreckage to find growth stocks that have experienced irrational sell-offs due to overly bearish sentiment. Is NET one of them? Let’s see what the credible authors/analysts that the Nobias algorithm tracks have had to say about the stock recently.

In mid-November, Nobias 4-star rated author, Nicholas Rossolillo, published a report on shares which offered a cautious take in the short-term, but an overall bullish long-term outlook. With the benefit of hindsight, we see that this article was essentially published at NET’s recent highs. NET’s share price has been cut in half since Rossolillo published this piece. However, in the short-term, the market isn’t always rational and therefore, we still consider Rossolillo’s opinion on the stock valuable to consider when performing due diligence on Cloudflare shares in the present.

NET Feb 2022

Rossolillio began his piece by highlighting NET’s strong 2021 performance - and noting that the stock was speculatively valued (and therefore, carried a high degree of risk). He said, “Shares of edge computing internet and security company Cloudflare (NYSE:NET) are on an absolute roll this year. As of this writing, the stock is up 220% over the last 12-month period alone -- valuing the young company at a whopping 100 times expected full-year 2021 revenue to enterprise value.” He continued, saying, “Given such a valuation, suffice to say any investor that makes a purchase right now should be expecting incredibly great things from Cloudflare for many years to come. The third-quarter 2021 update underpins the massive potential the firm still has -- although I'd advise against trying to chase returns at this point.”

In his piece, Rossolillio highlighted the strong growth that NET posted during its Q3 ER. He said, “Cloudflare posted revenue of $172 million in the third quarter, up 51% year over year and the fifth straight quarter of at least 50% sales growth. In fact, since Cloudflare started reporting as a public company in the autumn of 2019, it's only dipped below the 50% year-over-year sales growth mark a handful of times -- but never reported a quarterly sales rate lower than 48%.”

“But what about profit margins -- or lack thereof,” Rossolillio asked, rhetorically. He continued to break down the company’s results and the risky nature of the stock, saying, “Free cash flow sank to negative $39.7 million in Q3, down from negative $9.8 million posted in Q2 just a few months prior. Clearly, between a lofty stock premium and persistent losses, investing in Cloudflare isn't for everyone. Shares have been going up in a nearly straight line for months now, but that won't last forever.”

Regarding its speculative valuation, Rossolillio did say that, “If Cloudflare can keep it up, it will earn that sky-high valuation (currently an enterprise value of $66 billion) sooner or later. “As for the fourth quarter of 2021,” he continued “CEO Matthew Prince and the company anticipate revenue to be $184 million to $185 million, up "only" 47% from last year.”

Well, since this piece was published, NET has posted its Q4 results (on February 10th). And, during this report, the company continued along its 50%+ top-line growth trend, posting quarterly sales of $193.6 million, which were up 53.8% on a year-over-year basis (outperforming Prince's prior estimates).

Speculative valuation aside, Rossolillo noted that he maintains a long-term bullish stance on the company. He concluded his piece saying, “Granted, it's far too soon to declare Cloudflare "the next Amazon," or even the next tech giant. But given its stellar performance even during the pandemic where some of its peers have faltered, I certainly wouldn't bet against Cloudflare.”

On January 18th, Manali Bhade, a Nobias 5-star rated author, published an article titled, “2 Unstoppable Metaverse Stocks to Buy in 2022” in which he highlighted Cloudflare as a strong growth pick. Bhade wrote, “Edge computing -- in which data and applications are stored and processed at locations nearer to the end-users rather than at centralized server farms -- improves data reliability, efficiency, security, and speed. Those network characteristics will be vital for metaverse platforms and applications. Consequently, we can expect that edge-based content delivery network operator Cloudflare will play a major role in supporting the metaverse.”

Regarding the company’s operations, he said, “Cloudflare's broad network already extends to 250 cities in more than 100 countries. Approximately 95% of the world's population can connect to that network within 50 milliseconds.” “Additionally,” Bhade said, “Cloudflare also offers Zero Trust security solutions: Every user inside or outside the network is validated multiple times before being given access to resources. Such protocols will be essential for protecting the metaverse and those who use it from unscrupulous agents and hackers.”

Cyber security is another industry that is likely to benefit from strong long-term tailwinds, which means that Cloudflare is well situated to benefit from multiple bullish trends. While Cloudflare is a relatively volatile stock, the company’s growth trajectory has been very reliable. Bhade echoed similar sentiment to Rossolillo regarding the company’s long-term growth saying, “From 2016 to 2020, Cloudflare's top line grew at a compound average rate of 50% annually.” He also touched upon the expected reliability of these sales moving forward throughout a wide variety of economic conditions, saying, “Currently, 1,260 of Cloudflare's customers are large organizations that spend $100,000 or more on its services annually. Since these large customers account for more than half of its top line, its business model is relatively resilient in the face of changing macroeconomic conditions.”

This is the benefit of strong secular growth - companies like NET that benefit from it are well positioned to continue to take market share and post strong sales growth even during periods (like the 2020 COVID-19 recession) where broader economic growth contracts. Bhade concluded his article saying, “Cloudflare is technically not a metaverse stock. However, it will have a significant role to play in providing the underlying networking and data services required to make the metaverse a reality. This, coupled with its formidable position in the enterprise market, makes it an attractive pick for retail investors.”

During the full-year in 2021, Cloudflare generated revenue of $656.4 million. Even after its 50%+ correction, this still means that the company is trading with a very lofty price-to-sales multiple (NET’s current market cap is $37.5 billion). However, looking ahead to 2022, it appears that NET is primed to continue along its strong growth trajectory, which, as Rossolillo said, could eventually justify the stock’s valuation. During its recent Q4 report, NET provided investors with 2022 sales, GAAP income from operations, and income per share guidance.

The company is currently calling for total revenue in 2022 of $927-$931 million. Compared to 2021’s full-year result, this would represent year-over-year growth of 41.5%. This does represent a slowdown from the 50%+ growth that Rossolillio and Bhade highlighted, but 40%+ growth in today’s economic environment is certainly not shabby.

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

The company says that it expects to generate income from operations in the $10 million to $14 million range. Net income per share is expected to arrive in the $0.03-$0.04 range. Therefore, management doesn’t expect to see strong profits anytime soon - meaning that this is a hyper growth company which will have to be evaluated based upon sales growth prospects.

With that in mind, NET is certainly not a company that all investors will feel comfortable owning. Even after its massive pullback, it remains a speculative, long-term bet. But, when looking at the recent opinions expressed by the credible authors and analysts that we track with the Nobias algorithm, it appears that the vast majority of individuals who cover this stock remain bullish on the risk/reward prospects that shares present.

Right now, 93% of the opinions that we’ve seen expressed by credible authors carry a “Bullish” sentiment rating. And, looking at the credible Wall Street analysts that we track (those with Nobias 4 and 5-star ratings), we see that the average price target applied to NET shares is currently $118.57.

Today, NET shares trade for $104.92. Therefore, the average price target represents upside potential of 13%. This 13% upside pales in comparison to NET’s 2021 rally; however, in today’s market (remember, the S&P 500 is down 7.26% on a year-to-date basis) many investors are likely to continue to be attracted towards secular growth plays that offer double digit upside potential.