TSLA with Nobias Technology: Case Study on Tesla

The Nasdaq just posted a strong weekly performance of +2.26%; however, Tesla (TSLA) shares posted even bigger gains, up 9.48% during the last 5 trading sessions. This was welcomed news for TSLA bulls after the roughly 38% year-to-date losses that Tesla had posted coming into its recent second quarter report.

The Nasdaq just posted a strong weekly performance of +2.26%; however, Tesla (TSLA) shares posted even bigger gains, up 9.48% during the last 5 trading sessions. This was welcomed news for TSLA bulls after the roughly 38% year-to-date losses that Tesla had posted coming into its recent second quarter report.

Tesla reported earnings on Wednesday, Jule 20th, meeting Wall Street’s expectations on the top-line, posting quarterly revenue of $16.93 billion, up 41.6% on a year-over-year basis, and exceeding expectations on the bottom-line, with non-GAAP earnings-per-share coming in at $2.27/share, $0.47/share above the consensus analyst estimate. These Q2 results inspired a late-week rally, sending shares nearly 10% higher from the $745 area up to their current share price of $816.73.

According to coverage from Kevin. P. Curran, a Seeking Alpha news editor, this rally caused investors who were short Tesla coming into the quarter to lose more than a billion dollars in total. Regarding the aggregate position of TSLA short sellers, Curran highlighted work performed by Ihor Dusaniwsky, Head of Predictive Analytics at data and predictive analytics firm S3 Partners, who noted “that while short sellers were “actively trimming” exposure into the quarter by covering over 2M shares, total short interest remained at just over $18.5B heading into the report.”

TSLA Jul 2022

Dusaniwsky continued, “We should expect its short covering trend to continue as short sellers get squeezed out of their positions due to these large and sudden losses. These buy-to-covers and the potential for hedge funds to bulk up their positions in a high beta name with a positive price trend may help reverse TSLA’s year price weakness.”

Howard Smith, a Nobias 4-star rated author, covered Tesla’s earnings results in an article at The Motley Fool. Smith wrote, “Tesla earned $1.95 per share for the quarter from sales of $16.9 billion. While that was down from first-quarter revenue of $18.8 billion, it still represented a jump of 42% year over year. And both top- and bottom-line results beat analyst expectations of $1.81 per share and $16.5 billion, respectively.” He continued, “Investors already knew the second quarter was challenging, with COVID-19 delays at its Shanghai plant and supply chain issues hampering the ramp-up of its two new plants. But Tesla's original guidance of 50% annual production growth still remains doable, which boosted investor confidence after the stock was down more than 30% year to date heading into the report.”

Smith highlighted Tesla’s improving balance sheet, writing, “The company ended the quarter with $18.9 billion in cash, cash equivalents, and marketable securities. The cash position grew thanks to more than $600 million in free cash flow.” Ultimately, he concluded, “That's the sign of a healthy business.”

With regard to the health of Tesla’s business, Shrilekha Pethe, a Nobias 5-star rated author, broke down the company’s automotive producing numbers during Q2 in a recent report. Pethe said, “In Q2, TSLA produced 258,580 cars, which increased 25% year-over-year. It delivered 254,695 cars, up 27% year-over-year.

Pethe continued, “By the top-rated analyst’s estimate, the company’s installed annual production capacity is currently at more than 1.9 million vehicles, with production likely to reach approximately 40,000 per week by the end of this year.”

Pethe acknowledged Tesla’s post-earnings rally; however, she offered a bit of caution to bullsh investors during the conclusion of her piece, stating, “While Tesla seems to be riding through the current challenging macro environment well, it remains to be seen how it measures up if the current economic slowdown continues.”

Marty Shtrubel, a Nobias 4-star rated author, also noted a potential concern coming out of Tesla’s second quarter results in a recent article at Nasdaq.com, stating, “One area of concern, however, was noted in the margin profile, which suffered at the hands of rising inflation and stiff competition for EV parts. Margins contracted to 27.9%, below the impressive 32.9% reported in Q1 and the 28.4% delivered during the same period last year. The margin drop was linked to the costs associated with the ramping of the new facilities in Austin and Berlin.”

It appears that Morgan Stanley analyst, Adam Jonas, shares these concerns. In his piece, Shtrubel wrote, “Surveying the results, Morgan Stanley’s Adam Jonas notes that demand is still outstripping supply. Although with the “new challenges” on account of the ramping of production - especially in Berlin - the analyst is readying for further “near-term margin headwinds.”’

However ultimately, Jonas remains a Tesla bull. Jonas touched upon Tesla’s valuation in his note, saying, “In the interim, we have a stock trading at approx 20x EBITDA and 35x our current FY25 forecasts… multiples that many auto investors are likely to find unacceptably high but tech investors may find attractive…” Shtrubel stated, “Jonas seems to find those multiples acceptable. The analyst reiterated an Overweight (i.e., Buy) rating along with a $1,150 price target, implying room for share appreciation of 41% over the coming year.”

Overall, on July 22, 2022 Shtrubel said that the average price target for TSLA shares on Wall Street was $886.04. Therefore, he acknowledged that the majority of Wall Street analysts agree with Jonas’ bullish take, saying, “Most are backing TSLA’s continued success, but there are voices heeding caution; the stock’s Moderate Buy consensus rating is based on 17 Buys, 5 Holds and 7 Sells. Going by the $886.04 average target, shares are expected to climb a modest 9% over the one-year timeframe.”

One such Wall Street TSLA bull is Gene Munster of Loup Funds. In the wake of TSLA’s Q2 report, Shanthi Rexaline, a Nobias 4-star rated author, highlighted analysis provided by “Noted Tesla analyst and Loup Fund co-founder Gene Munster”.

Rexaline broke down Munster’s post-earnings analysis, listing his “Key Earnings Call Takeaways”. Rexaline wrote:

Musk reaffirmed that the broader rollout of the full-self-driving feature is on track this year. Munster is of the view the recent departure of Tesla’s ex-AI executive Andrej Karpathy isn’t a measurable headwind to the timing of the FSD release, given the company has a team of 120 people in the software AI group.

The Tesla CEO also said in his prepared remarks that FSD users now number 100,000. Munster said this is ahead of his estimate of 50,000.

The company announced that AI Day 2.0 is being pushed from August to either September or October. The shift, according to the Loup analyst, is due to Karpathy leaving.

Tesla CFO Zach Kirkhorn said the delivery growth target of 50% is difficult but doable. Kirkhorn also hinted at margin pressure due to the ramp of the Giga factories in Austin and Berlin.

Musk mentioned carbon, steel, and aluminum prices are falling. Munster expects this to positively impact margins in early 2023.

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

Looking at the credible Wall Street analysts that Nobias tracks, we see that the average price target being applied to TSLA shares by the individuals with 4 and 5-star Nobias ratings is even higher than Wall Street’s consensus opinion.

Right now, the average TSLA price target amongst this cohort of credible individuals is $928. Relative to TSLA’s current price of $891, that presents an upside potential of approximately 6%. However, the credible authors that the Nobias algorithm tracks (once again, only individuals with 4 and 5-star Nobias ratings) remain largely bearish on TSLA shares. 90% of recent articles published by credible authors have expressed a “Bearish” bias towards TSLA shares.

Tesla has been a very volatile stock throughout 2022 and with this disconnect between the author and the analyst communities tracked by the Nobias algorithm in mind, it’s likely that this trend continues as the game of tug-of-war between the bulls and the bears on this $845 billion company continues to play itself out.

Disclosure: Nicholas Ward has no TSLA position. Nicholas Ward wrote this article for Nobias at their request with a view of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

NFLX with Nobias Technology: Case Study on Netflix

After hitting all-time highs of $700.99/share in late 2021, Netflix has experienced a tumultuous first half of the year thus far during 2022, posting -62.2% losses on a year-to-date basis. Netflix struggled during the first several months of the year, due in large part to the risk-off trade that hurt many of the popular growth stocks in the market; however, the pace of its 2022 sell-off accelerated after the company’s first quarter report.

After hitting all-time highs of $700.99/share in late 2021, Netflix has experienced a tumultuous first half of the year thus far during 2022, posting -62.2% losses on a year-to-date basis. Netflix struggled during the first several months of the year, due in large part to the risk-off trade that hurt many of the popular growth stocks in the market; however, the pace of its 2022 sell-off accelerated after the company’s first quarter report.

During Q1, Netflix posted its first year-over-year subscriber loss number in more than a decade. Coming into the first quarter print, the company’s guidance called for approximately 2.5 million additional subs. When the official numbers were published, Wall Street was taken aback by a net loss of 200,000 subscribers, causing NFLX shares to fall by more than 20% in the after hours.

That negative momentum remained throughout the rest of the quarter, with NFLX falling from nearly $350/share on April 19th (when the Q1 numbers were released) to 52-week lows of $162.71/share (which the stock hit on 5/12/2022).

Since hitting those lows, Netflix shares have traded in a fairly right range, in the $175-$200 range. However, in recent days the stock has rallied, up more than 15% during the last week alone, due to Q2 results which appeased investors and removed some of the negative sentiment surrounding the stock.

NFLX Jul 2022

Regarding Netflix’s recent sell-off, Nobias 4-star rated author, Stjepan Kalinic, said, “Few large companies experienced a fall from grace with a higher velocity than Netflix, Inc., as it cratered over 70% year to date. Now, the stock is showing signs of bottoming, supported by the fact that the latest results were not as bad as expected.”

In the recent post-earnings article that Kalinic posted at Simply Wall Street, he discussed ongoing headwinds for the company, due to the thesis that over-the-top content streaming has peaked, writing, “For the first time, the company lost subscribers for 2 quarters in a row. It seems that the streaming market has reached its zenith, with the average household signed up to 4.7 services.”

Looking forward, Kalinic appears to be bearish on the company’s ability to return to growth. He stated, “Considering that some of the most popular series like Stranger Things and Ozark ended, the company doesn't have standout content coming out to boost the Q3 numbers.”

Another concern that Kalinic mentioned was rising content costs. He noted that NFLX’s content costs rose by “almost 20% Y/Y” during Q2 and this is having a negative impact on the company’s balance sheet. Kalinic said, “According to the last reported balance sheet, Netflix had liabilities of US$7.74b due within 12 months and liabilities of US$20.0b due beyond 12 months. On the other hand, it had cash of US$6.01b and US$824.7m worth of receivables due within a year. So it has liabilities totaling US$21.0b more than its cash and near-term receivables combined. This deficit isn't bad because, despite the recent crash, Netflix still has a market capitalization of about US$89b. Thus, it could raise enough capital to shore up its balance sheet if needed.”

Kalinic does go on to note that, “Netflix has net debt of just 1.3 times EBITDA, indicating that it is undoubtedly not a reckless borrower.” However, he continues, “Over the last three years, Netflix recorded negative free cash flow in total. Debt is usually more expensive and almost always riskier in the hands of a company with negative free cash flow.”

Concluding his piece, Kalinic wrote, “The most recent results were not as bad as anticipated. However, they're still not great - the company lost another 1 million subscribers as it looks like the streaming wars have saturated the market.” He also cautioned investors, noting, “While we appreciate debt can enhance returns on equity, we'd suggest that shareholders keep a close watch on its debt levels lest they increase.”

Stephen Guilfoyle, a Nobias 4-star rated author, also recently wrote a post-earnings update on Netflix shares at The Street. Guilfoyle dove into the Q2 data, writing, “For the three month period ending June 30th, Netflix posted GAAP EPS of $3.20, handily beating Wall Street's expectations, on revenue of $7.97B. The sales number was good enough for year over year growth of 8.6% (13% in constant currency), but not good enough to beat consensus view. Operating income of $1.578B was down 14.6% versus the comparable year ago quarter. Operating margin dropped from 25.2% for Q2 2021 to 19.8%.”

Regarding Q2 subs, Guilfoyle said, “Global streaming paid memberships contracted by a rough 970K subscribers to 220.67M.” Netflix rallied on this ~1 million sub loss, because, in large part, Guilfoyle notes, previous guidance calling for losses of 2 million subs or more.

In other words, Netflix set a very low bar for itself to clear during the quarter. Guilfoyle noted that the stock’s “euphoric response to a number that would have been seen as tragic had the firm not provided such a low bar.”

Guilfoyle continued, breaking down Netflix’s regional performance, stating:

“UCAN (US/Canada) drove $3.538B in revenue (+9.4%), as paid memberships contracted to 73.28M (-0.1%). Average revenue per membership increased to $15.95.

EMEA (Europe, Middle East & Africa) drove $2.457B in revenue (-2.4%), as paid memberships increased to 72.97M (+6.2%). Average revenue per membership decreased to $11.17.

LATAM (Latin America) drove $1.03B in revenue (+19.6%), as paid memberships increased to 39.62M (+2.5%). Average revenue per membership increased to $8.67.

APAC (Asia Pacific) drove $908M in revenue (+13.6%), as paid memberships increased to 34.8M (+22.2%). Average revenue per membership decreased to $8.83.”

Looking ahead at Q3 expectations, Guilfoyle touched upon NFLX’s most recent guidance, stating, “For the current quarter, Netflix sees revenue of $7.838B and diluted EPS of $2.14. Wall Street had been up at revenue of $8.1B and EPS of $2.77 on these metrics.”

However, even though NFLX is guiding for a return to subscriber growth (management is now calling for 1 million+ new net subs during Q3), Guilfoyle is not bullish on the news because “operating margin is expected to sink from Q2's 19.8% to 16.0%.”

He concluded his bearish piece, stating, “I see a problem that I don't think is being spoken of. Netflix still lost a lot of paying customers. A lot of these subscriber losses were in North America. A lot of those folks pay their bills in U.S. dollars. Growth elsewhere, among subscribers paying their bills in their home currency is not a one for one exchange with a lost sub who pays in greenbacks. The outlook bothers me too. Who cares if you add a million subs if doing so crushes margin and pressures earnings?”

Since NFLX’s earnings were posted, a slew of Wall Street analysts have updated their opinions on the stock. Georg Szalai, a Nobias 4-star rated author covered several of these recent analyst notes in an article he published at The Hollywood Reporter.

Szalai highlighted a recent note from Credit Suisse analyst Douglas Mitchelson, a Nobias 4-star rated analyst, who reduced his price target on NFLX shares from $360 to 263, “due to a more conservative long-term forecast.”

Mitchelson said, “Uncertainty remains elevated for Netflix with subscriber growth stalled post-pandemic and (management) focusing on improving monetization via charging for password sharing and broadening the service’s value proposition through lower-priced ad tiers.”

Szalai noted that Mitchelson acknowledged that he “sees some promise” in NFLX’s new endeavors, ultimately, the analyst concluded that they “will take at least well into 2023 to prove out (and perhaps into 2024 to drive meaningful revenue reaccelerating).”

Szalai put a spotlight on a more bullish take from Guggenheim’s Michael Morris, a Nobias 4-star rated analyst, who said, “Key opportunities in advertising and password sharing are taking shape, though still early. Notably, the company’s ambitious pursuit comes with spend discipline, with annual cash content spend of around $17 billion in ‘the right ZIP code’ for the next several years.” Morris maintained his “buy” rating no NFLX shares, with a $265 price target. Morris concluded his note stating, “We continue to see attractive value and optionality in Netflix shares.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

Chris Morris, a Nobias 4-star rated author, also provided cause for optimism for NFLX bulls, penning a piece at Yahoo Finance which highlighted merger activity that was recently announced. He wrote, “Netflix announced Tuesday it plans to acquire Animal Logic, the animation studio behind such hits as The Lego Movie and Happy Feet. It’s an extension of a previous relationship between the two companies, which had previously worked together on Klaus and The Sea Beast, which are Netflix exclusives.”

Chris Morris continued, “The move, which is expected to close later this year, would give Netflix more ownership of its catalog, something critics of the brand have called out as a weakness when compared to other streaming houses, such as Disney+ or HBO Max.”

Overall, the Nobias algorithm is still seeing a very bearish lean amongst the credible authors that we track (only those with 4 and 5-star Nobias ratings). 72% of recent articles published by such authors have included a “Bearish” bias.

The credible Wall Street analysts that we track are more bullish, however. Right now, the average price target that the credible analysts that the Nobias algorithm tracks (once again, only those with 4 and 5-star ratings) is $238.70. After its post-earnings rally, NFLX shares trade for $223.88. Therefore, that average price target implies further upside potential of approximately 6.6%.

Disclosure: Nicholas Ward is long NFLX. Nicholas Ward wrote this article for Nobias at their request with a view of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

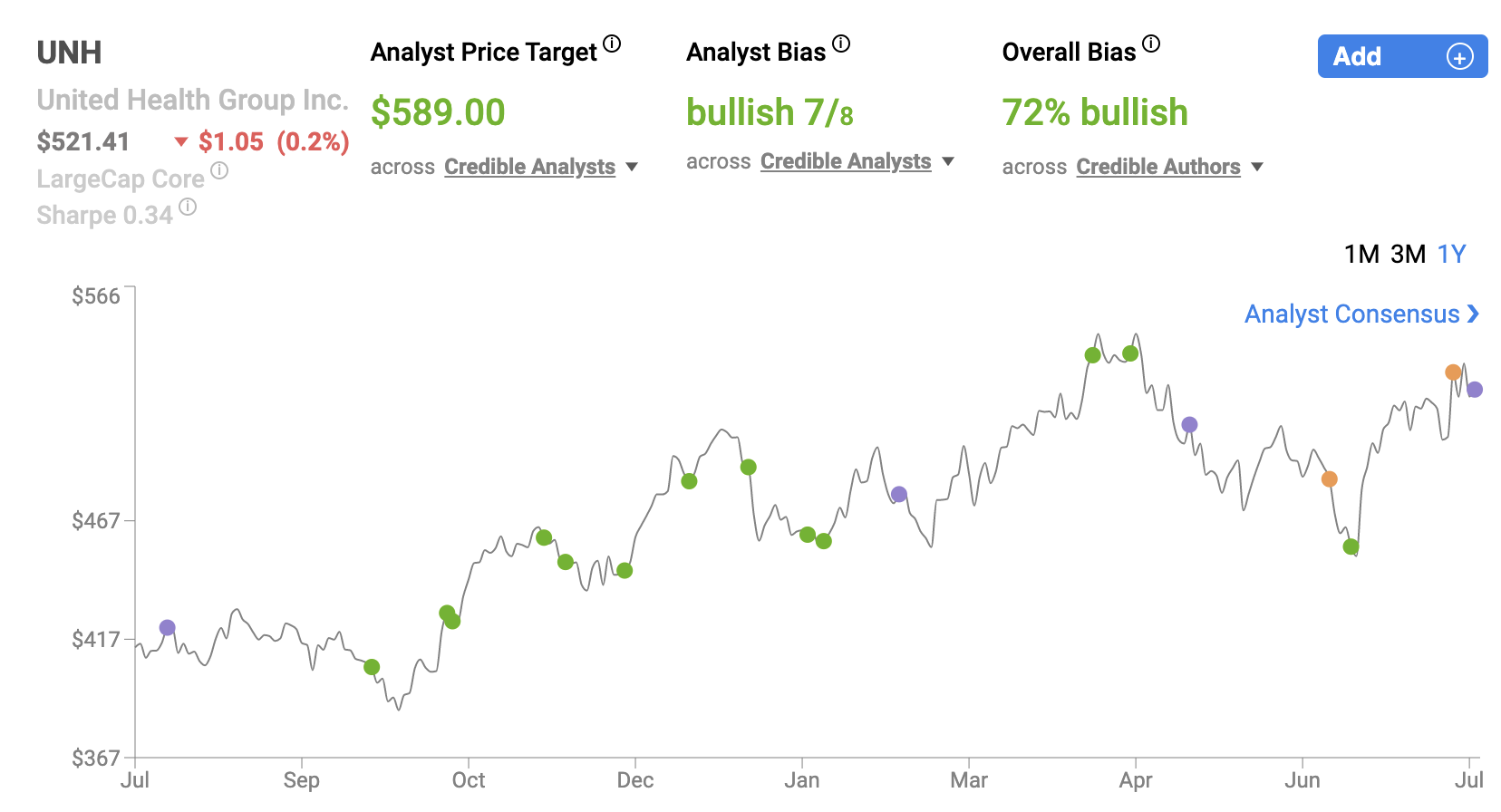

UNH with Nobias Technology: Case Study on United Healthcare

United Healthcare reported earnings on Friday of last week. It was the first major insurance company to do so. The company continued its trend of beating Wall Street estimates and rallied into the end of the week. UNH shares were up by 3.02% on the week, pushing its year-to-date gains up to 5.47%. This means that UNH is a major out-performer on a year-to-date basis (the S&P 500 is down by 19.46% during 2022 thus far). And yet, even with this relative year-to-date outperformance in mind, credible analysts are still bullish on UNH moving forward, projecting double digit upside potential.

United Healthcare reported earnings on Friday of last week. It was the first major insurance company to do so. The company continued its trend of beating Wall Street estimates and rallied into the end of the week. UNH shares were up by 3.02% on the week, pushing its year-to-date gains up to 5.47%. This means that UNH is a major out-performer on a year-to-date basis (the S&P 500 is down by 19.46% during 2022 thus far). And yet, even with this relative year-to-date outperformance in mind, credible analysts are still bullish on UNH moving forward, projecting double digit upside potential.

Jonathan Block, a Nobias 4-star rated author, recently highlighted the importance of Unitedhealth earnings in a Seeking Alpha report, writing, “UnitedHealth's results are closely looked at by investors as they are seen as a bellwether for the rest of the industry. The company is the largest health insurer based on membership.”

Block’s report stated, “UnitedHealth has a history of beating analyst estimates going back at least to Q2 2017.” Block said, “As COVID-19 continues to have less of a daily impact, one statistic in earnings releases to pay attention to is change in the medical loss ratio ("MLR").” He continued, “During the height of the pandemic, many doctor visits and procedures were put off, allowing the MLR to fall for many insurers. This helped the bottom line.”

UNH Jul 2022

However, Block stated, “There are already signs MLRs are rising. In its Q1 results, the MLR was 82%, up from 80.9% in the year-ago period.” Yet, despite these rising MLR figures, Block noted that UNH management increased its full-year guidance after a bullish Q1 report (where the company beat Wall Street’s estimates on both the top and bottom lines).

Back in mid-April, the company stated, “Based upon the first quarter performance and enterprise-wide growth outlook, the Company increased its full year net earnings outlook to $20.30 to $20.80 per share and adjusted net earnings to $21.20 to $21.70 per share.” Coming into UNH’s second quarter report, Block noted, “For Q2 2022, analysts are expecting GAAP EPS of $4.99 and revenue of $79.68B.”

Damian J. Troise, a Nobias 4-star rated author, collaborated on a macro write-up published at MarketBeat on Friday, which highlighted consumer sentiment data, alongside several prominent earnings reports (including UnitedHealthcare’s), which sent the market higher into the weekend.

Troise wrote, “Stocks are broadly higher in afternoon trading on Wall Street Friday following an encouraging report on consumer sentiment and inflation expectations.” His report stated, “Wall Street has been worried that the Fed could go too far in raising rates and actually bring on a recession. Investors have been closely watching economic reports for clues as to how the central bank might react and the latest upbeat consumer sentiment report raises the chance of the Fed softening its current policy.”

Troise said, “A July survey from the University of Michigan showed that inflation expectations have held steady or improved, along with general consumer sentiment. It was a welcome update following several government reports this week that showed consumer prices remained extremely hot in June, along with wholesale prices for businesses.”

Thinking about market impact, Troise wrote, “The report also bodes well for investors looking for signs that the Federal Reserve might eventually ease off its aggressive policy to fight inflation.” And looking at the ticker specific action on Friday, he said, “Technology stocks, banks and healthcare companies made some of the biggest gains.”

With specific regard to UNH, Troise stated, “UnitedHealth Group rose 5% after raising its profit forecast for the year following a strong earnings report.” When UnitedHealthcare reported Q2 earnings on July 15th, 2022, the company once again beat Wall Street’s consensus expectations on the top and bottom lines.

UNH produced quarterly revenue of $80.3 billion during Q2, beating the consensus estimate by $620 million, and representing 12.6% year-over-year growth. UnitedHealthcare’s non-GAAP earnings-per-share came in at $5.57/share, beating estimates by $0.37/share. The company stated that “Earnings from Operations were $7.1 Billion, Growth of 19% Year-Over-Year”. UNH’s “Cash Flows from Operations were $6.9 Billion, 1.3x Net Income”.

Andrew Witty, chief executive officer of UnitedHealth Group, said, “Customers are responding as we build on our five growth pillars, enabling us to move into the second half of 2022 with strong momentum serving ever more people more deeply.”

The company highlighted the overall scope of its business, stating: “Total people served by UnitedHealthcare has grown by over 600,000 in 2022, including 280,000 in the second quarter. Growth was led by UnitedHealthcare’s community-based and senior offerings. The number of people served with domestic commercial benefit offerings has grown by over 250,000 over the past year, including 80,000 in the second quarter.”

UnitedHealthcare touched upon its medical care ratio, stating: “The second quarter 2022 medical care ratio was 81.5% compared to 82.8% last year, due to COVID effects and business mix. Favorable medical reserve development of $890 million compared to $500 million in the year ago second quarter. Days claims payable were 50.6, compared to 49.1 in the first quarter of 2022 and the second quarter of 2021.”

And, once again, UNH raised full-year bottom-line guidance, stating: “Based upon the first half performance and growth expectations, the company increased its full year net earnings outlook to $20.45 to $20.95 per share and adjusted net earnings to $21.40 to $21.90 per share. Growth in the second quarter was balanced across the company’s businesses, driven especially by continued strong expansion in people served at UnitedHealthcare and in value-based arrangements at Optum Health.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

After UNH’s Q2 results were posted, John Reese, a Nobias 5-star rated author, published an article at Nasdaq.com which put a spotlight on UNH as a company which was recently upgraded via “Validea's Patient Investor model based on the published strategy of Warren Buffett.”

Reese stated, “This strategy seeks out firms with long-term, predictable profitability and low debt that trade at reasonable valuations.” Regarding UNH and the Validea Patient Investor model, Reese said, “The rating according to our strategy based on Warren Buffett changed from 86% to 93% based on the firm’s underlying fundamentals and the stock’s valuation.”

To put this into perspective, he continued, “A score of 80% or above typically indicates that the strategy has some interest in the stock and a score above 90% typically indicates strong interest.” Looking at the data collected by the Nobias algorithm, it appears that the consensus amongst the credible authors and Wall Street analysts that we track agree with the Validea outlook.

95% of recent articles on UNH published by credible authors (only those with Nobias 4 and 5-star ratings) have expressed a “Bullish” bias on the stock. Right now, the average price target being applied to UNH shares by the credible Wall Street analysts that we track (once again, only those with 4 and 5-star Nobias ratings) is $588.63. Today, UNH shares trade for $529.75. Therefore, that average price target implies upside potential of 11.1%.

Disclosure: As of 7/17/2022, Nicholas Ward had no position in UNH. Nicholas Ward wrote this article for Nobias at their request with a view of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

JPM with Nobias Technology: Case Study on JP Morgan

J.P. Morgan (JPM) reported its second quarter earnings on Thursday, July 14th, missing Wall Street consensus estimates on both the top and bottom lines. The company posted revenues of $30.7 billion, which were $1.12 billion lower than consensus. JPM’s GAAP earnings-per-share totaled $2.76, which was $0.13/share below Wall Street’s average target.

J.P. Morgan (JPM) reported its second quarter earnings on Thursday, July 14th, missing Wall Street consensus estimates on both the top and bottom lines. The company posted revenues of $30.7 billion, which were $1.12 billion lower than consensus. JPM’s GAAP earnings-per-share totaled $2.76, which was $0.13/share below Wall Street’s average target.

Nobias 5-star rated author, AJ Fabino, covered the company’s quarterly report in an article at Benzinga, stating, “Shares of JPMorgan fell to a new 52-week low on Thursday following the release of the report, falling 4.10% to $107.31 in the morning; here are more details.”

Regarding the company’s press release, Fabino quoted JPMorgan CEO Jamie Dimon who said, “Geopolitical tension, high inflation, waning consumer confidence, the uncertainty about how high rates have to go, and the never-before-seen quantitative tightening and their effects on global liquidity, combined with the war in Ukraine and its harmful effect on global energy and food prices are very likely to have negative consequences on the global economy sometime down the road.” This bearish sentiment from management came after the company produced relatively poor bottom-line results.

JPM Jul 2022

Fabino stated, “Net income (profits) came in at $8.6 billion: Down 28% in the same period last year, predominantly driven by a net credit reserve build of $428 million.” In light of the negative profit growth, JPM management decided to reduce shareholder returns. Once again, Fabino quoted Dimon, who said, “We have temporarily suspended share buybacks which will allow us maximum flexibility to best serve our customers, clients, and community through a broad range of economic environments.”

Moving forward, Fabino noted, “The capital that would’ve been used in the share repurchase program will be shifted to help the company reach its regulatory capital requirements.” In short, because of macro concerns and ongoing global headwinds, J.P. Morgan is preparing for an even deeper economic slowdown.

Despite Dimon’s relatively cautious remarks which spooked many investors across Wall Street, after JPM’s Q2 earnings were announced, Nobias 4-star rated author, Stjepan Kalinic, published a report at Simply Wall Street which expressed bullish sentiment, largely due to the stock’s low valuation.

Kalinic highlighted some of the cautious commentary from JPM management during the quarterly release, stating, “In recent months, CEO Jamie Dimon has been rather vocal about a potential recession incoming, pointing out geopolitical and economic challenges of high inflation, supply chain issues, and geopolitical conflicts. Yet, he remains optimistic about handling the recession, noting that the consumers are in relatively good shape – spending money and having access to a strong labor market.” He continued, “While CEO Jamie Dimon remains optimistic about the bank's capabilities to navigate through a (potential) recession – the bank is already taking preventive actions, the first among them being a suspension of stock buybacks.”

On the subject of buyback suspensions, Kalinic noted that investors should be grateful that JPM continues to provide shareholder returns in the form of a quarterly dividend. He wrote, “Given the recent stress test results, a decision to suspend the buyback isn't surprising, but the good news is that the bank won't cut the dividend.”

Looking at the quarterly results, Kalinic highlighted a slew of fundamental metrics:

Revenue: US$31.6b, +1% Y/

Net income: US$8.64b (US$2.76 per share): -28% Y/

Credit costs: US$1.1b (US$428m net reserve build, US$657m net charge-offs

Average deposits: +9

Average loans: +7%

He then stated, “The Consumer Banking arm was the biggest loser, with net income declining 45% Y/Y. On the other hand, Asset & Wealth Management arm declined "just" 13% Y/Y.”

Regarding JPM’s fundamental growth, Kalinic stated, “Recent times haven't been advantageous for JPMorgan Chase as its earnings have risen slower than most other companies. A Low P/E of 7.8x is probably low because investors think this lackluster earnings performance will not get any better.” But, he notes that these subpar earnings results haven’t always been the case for this stock.

Kalinic wrote, “Looking back, the company grew earnings per share by 7.1% last year. This was backed up by an excellent period before seeing EPS up by 48% in total in the previous three years. Therefore, it's fair to say the earnings growth recently has been superb for the company, yet - over the last 10 years, JPMorgan stock has lagged the S&P500 increase.”

Overall, after looking at all of the quarterly data and JPM’s current valuation, Kalinic concluded, “At the moment, JPM trades at an attractive valuation. Still, its attractiveness remains mainly a question of whether an investor is comfortable with high exposure to the investment banking segment, which seems to be heading for more challenging times.”

Yet, in recent days we’ve seen another credible Nobias author publish a post-earnings report which came to a different, much more bearish conclusion. In a recent article published at Seeking Alpha, Nobias 4-star rated author, Cory Cramer, highlighted the highly cyclical nature of J.P. Morgan’s earnings and established a bearish price target for JPM shares using historical data.

Cramer said, “The rough earnings growth decline threshold I use to declare a business either "deep cyclical" or "less-cyclical" is -50%. This level can actually vary quite a lot from bank to bank, depending on what kind of bank it is and their loan practices or whether they are an investment bank or a traditional bank. In the end, all I care about are their historical earnings patterns. In JPM's case, because of the -69% decline in earnings growth in 2008, combined with various other years of double-digit earnings growth declines, I would classify JPM stock as a "deep cyclical" stock.” He noted that, “Obviously, JPM has changed over the decades and it is not the same company it was in the 1970s or 1980s, but I find it's always useful to start with a big picture view first so that we have some idea of what is possible.”

Looking at past data, Cramer said, “During the big downcyles it is typical for JPM's stock price to fall about -70% off its highs. This happened during the 1987, 2000, and 2007 downcycles. I think it's reasonable, most other things being equal, to be prepared for the stock to fall that far if we have a bad recession this downcycle.”

When attempting to find connections between the past and the bear market that investors are witnessing today, Cramer stated, “Generally speaking, I think the 2000 stock market decline has the most in common with our current decline. But I think JPM was about 20% more overvalued at the 2000 peak than it was at the 2021 peak based on their peak pre-recession P/E ratios.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

However, he noted that JPM’s valuation was more attractive at the start of the recent drawdown than it was prior to the dot-com boom/bust period and therefore, he believes that the stock’s downside potential is limited towards the lower end of the historical range that he established.

Cramer said, “Based on these past declines, an expected price decline this time around is somewhere between -60% and -70%. I'm inclined to think there is more cash floating around going into this coming recession, and there are a lot of retirees who would probably be willing to come in and buy JPM stock because they know the name well, and JPM is perceived as relatively safe. So, I wouldn't count on JPM stock falling into the deeper end of that range, and I would consider buying after a -60% drawdown, rather than aiming for a deeper decline (at least initially).” With that in mind, he concluded, “JPM's price peaked at about $172.96 this cycle. If it sold off -60% from there, that would produce a buy price of $69.18 per share, and that's when I'll be a buyer.” All in all, Cramer wrote, “Currently, that would be a buy price of $69.18, which is about -35% lower than where the stock trades today.”

Overall, the vast majority of credible authors and analysts that the Nobias algorithm tracks take the bullish side of the argument when it comes to JPM shares. 91% of recent articles written about the stock by credible authors (only those with 4 and 5-star Nobias ratings) have expressed a “Bullish” bias. Right now, the average price target being applied to JPM shares by the credible Wall Street analysts that our algorithm tracks (once again, only those with 4 and 5-star Nobias ratings) is $140.88. JPM closed the trading day on Friday at $112.95. Therefore, relative to this average price target, JPM shares present upside potential of approximately 24.7%.

Disclosure: Nicholas Ward has no JPM position. Nicholas Ward wrote this article for Nobias at their request with a view of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

PEP with Nobias Technology: Case Study on Pepsi

J.P. Morgan (JPM) reported its second quarter earnings on Thursday, July 14th, missing Wall Street consensus estimates on both the top and bottom lines. The company posted revenues of $30.7 billion, which were $1.12 billion lower than consensus. JPM’s GAAP earnings-per-share totaled $2.76, which was $0.13/share below Wall Street’s average target.

The second quarter earnings season is just getting underway and with the June CPI data in hand, many investors are anxious to see what sort of impact the highest inflation that we’ve witnessed in 40 years will have on the fundamental results of stocks.

PepsiCo (PEP) reported earnings this week and shortly after the company’s results were made public, Nobias 5-star rated author, AJ Fabino, published an interview with Navellier & Associates founder and Chief Investment Officer Louis Navellier, which touched upon the current macro environment, and PEP’s results specifically, as a potential bellwether for the market as we forge further into the Q2 earnings season.

Aftering being asked, “How Do You Feel About Defensive [stocks] Coming Forward After Pepsi’s Report?” Navellier responded: “Clearly, the consumer is still spending. They want their chips and soft drinks. Pepsi’s international products are selling better than domestic products. It’s a good sign, we keep hearing that we’re in a recession — but, we keep creating jobs; we’re not in an earnings recession, earnings are still growing. Given that, year-over-year comparisons are becoming more difficult. So, Pepsi raising guidance today helped the entire market.”

PEP Jul 2022

Eric Schoeder, a Nobias 4-star rated author, published a report at Food Business News, which broke down the company’s results in great detail. Schoeder began his piece stating, “A pre-tax impairment charge related to the war in Ukraine dragged down second-quarter earnings at PepsiCo, Inc. but didn’t dampen the spirits of company executives who said business momentum continues.”

With regard to management’s upbeat tone, Schoeder quoted Ramon Laguarta, Pepsi’s chairman and chief executive officer, who highlighted the company’s growth during the recent earnings call. Laguarta said, “Our results are indicative of our highly dedicated employees, the strength and resilience of our categories, agile supply chain and go-to-market systems and strong marketplace execution. Our performance also gives us confidence that our investments to become an even Faster, even Stronger, and even Better organization by winning with pep+ are working. Given our year-to-date performance, we now expect our full-year organic revenue to increase 10% (previously 8%) and we continue to expect core constant currency earnings per share to increase 8%.”

On the top-line, PEP beat Wall Street’s expectations. During the quarter, Schoeder said that Pepsi’s net revenues “increased to $20.23 billion from $19.22 billion.” Wall Street analysts were expecting to see $19.51 billion, so PEP’s $20.23 mark not only represented 5.3% year-over-year growth, but also a $720 million beat.

With regard to PEP’s bottom-line, Schoeder wrote, “Net income in the second quarter ended June 11 totaled $1.43 billion, equal to $1.03 per share on the common stock, down 39% from $2.36 billion, or $1.70 per share, in the same period a year ago. The most recent quarter included a $1.4 billion pre-tax impairment charge related to the Russia-Ukraine conflict as well as a $13 million gain from the sale of the Tropicana, Naked and other select juice brands to PAI Partners.”

Schoeder broke down the food & beverage giant’s operational segment results, stating, “Operating profit at Frito-Lay North America (FLNA) totaled $1.45 billion, up 4.8% from $1.38 billion in the second quarter of fiscal 2021. Net revenue in the unit also increased, climbing nearly 14% to $5.18 billion from $4.55 billion.” He continued, noting, “Within the Quaker Foods North America (QFNA) unit operating income was $135 million, up 5.5% from $128 million in the same period a year ago. Net revenue was $675 million, up 17% from $575 million.”

Then, Schoeder said, “Operating profit in the PepsiCo Beverages North America (PBNA) unit totaled $651 million, down 20% from $809 million in the same period a year ago. Net revenue totaled $6.12 billion, down from $6.16 billion.”

Petar Mirkovic, a Nobias 4-star rated author, recently published an article at Seeking Alpha which also highlighted the strength of PEP’s recent quarter. He stated, “In the almost ever-increasingly difficult stock market situation we find ourselves in today, as market liquidity is being sucked out by high-interest rates, 40-year high record inflation numbers, and ongoing geopolitical crises caused by the Ukraine conflict, there are only a few companies that seem truly resilient to the ongoing crisis, and leading the way is none other than PepsiCo itself.”

Mirkovic continued, “The food and snack giant has solidified its position as a rock-solid inflation hedge and a top-class defensive stock in the eyes of many as it once again comes out swinging for its second quarter results showcasing its immense moat and pricing power that allowed it to push nearly all of the negative impacts down to the end customer.”

Mirkovic highlighted the top and bottom-line results, then stated, “More importantly, the company has shown strong resilience to the ongoing macroeconomic situation and once more solidified its position as an inflation hedge and a top-class defensive stock.” He went on to say, “A key metric in the staples space, organic sales have risen 13% in the quarter as well.”

Mirkovic clarified the importance of this data, stating, “An interesting way to look at the data is that "organic revenues" growth was set at 13%, while "organic volume" grew by only 1% this quarter, effectively meaning that demand stayed the same on aggregate, while prices were raised by roughly 12%. By itself, this can be viewed as a testament to the pricing power that PepsiCo commands.”

Mirkovic pointed out that PepsiCo’s ability to increase prices (via strong pricing power) shows the strength of its brands and the company’s ability to produce strong cash flows, even during volatile environments. He touched upon the ongoing issues that the company faces, especially in Europe, where circumstances outside of management’s control (the loss of sales in the Ukrainian and Russian markets due to the war) resulted in lower than expected volumes. But, Mirkovic said that this issue doesn’t point towards a global trend for Pepsi. He wrote, “Developing and emerging markets, on the other hand, remained resilient and managed to deliver double-digit organic revenue growth in the quarter.”

Regarding pricing power, Mirkovic concluded, “At the end of the day, the macroeconomic situation as bad as it is still hasn't gotten to a point at which it would chip away at the demand for PepsiCo's food and beverage family of products. Management felt that and was comfortable raising prices and pushing all the negative effects toward the end customer, which at least as far as the data tells us, has largely stayed loyal to the brands.”

Because of pricing power and the relatively strong cash flows that it allows PepsiCo to generate, Mirkovic noted that PEP has been able to be very generous to its shareholders with shareholder returns. He celebrated the company’s dividend, stating, “One of the strongest arguments for the food and beverage giant is its attractive dividend or more precisely, its commendable dividend growth story. PepsiCo is a company that has been successful in raising its dividend each year for the past 50 years, ultimately earning it the title of a "Dividend King" this year. This is an achievement so rare that only 31 companies held the status as of last year.”

In his conclusion, Mirkovic put a spotlight on the high quality metrics that PEP offers investors, writing, “As a result, PepsiCo was successful in solidifying its position as a great inflation hedge and a top-class defensive stock, which no doubt helped the company outperform the market for the first time in years, with the maker of Lays, Pepsi, and Mountain Dew generating a market alpha of 18.43% year-to-date and a 23.02% one-year alpha. In fact, with almost the entire rest of the market selling at significant discounts even as compared to pre-pandemic prices, the valuation situation has arguably gotten even more complicated.”However, after generating such strong alpha, Mirkovic could not offer a “Buy” rating on shares, due to relative valuation concerns.

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

After its strong year-to-date performance, PEP shares trade with a 26.3x blended price-to-earnings ratio. This multiple is above the stock’s historical 5, 10, and 20-year price-to-earnings rate averages of 24.8x, 22.1x, and 21.1x, respectively.

With this outsized premium in mind, Mirkovic finished off his report stating, “With fully recognizing PepsiCo as a brilliant business that we would love to own, we simply cannot escape the conclusion that the current market premium assigned to the company is significantly limiting its prospect of being a great investment opportunity.”

Looking at the overall data collected by the Nobias algorithm when looking at the bullish/bearish bias expressed by the credible authors and Wall Street analysts that we track, we see an aggregate opinion that is somewhat in-line with Mirkovic’s. 90% of recent articles written by credible analysts focused on PEP shares have highlighted the company’s strong quality and expressed a “Bullish” bias.

However, when looking at the average price target currently being attached to the stock by the community of Wall Street analysts that Nobias tracks, we see limited upside potential from here. PEP currently trades for $170.98/share. Right now, the average price target that credible analysts have for PEP is $188.00. This implies upside potential of approximately 10% and results in a “neutral” overall sentiment from the credible analyst community.

Disclosure: Nicholas Ward is long PEP. Nicholas Ward wrote this article for Nobias at their request with a view of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

TWTR with Nobias Technology: Case Study on Twitter

On Friday news broke that Elon Musk was abandoning his plans to acquire Twitter. These headlines occurred after the stock market closed on Friday, yet during the after-market trading session, shares of Twitter (TWTR) fell by nearly 5% and shares of Tesla (TSLA) rose by nearly 2.5%.

Nobias has covered the Musk/Twitter saga with several articles/updates thus far and therefore, we wanted to see what credible authors have had to say about Musk’s new plans over the weekend. Furthermore, we wanted to take a look at the sentiment being expressed by credible authors and Wall Street analysts alike, regarding shares of Twitter and Tesla, both of which have been caught up in this M&A whirlwind for months.

On Friday news broke that Elon Musk was abandoning his plans to acquire Twitter. These headlines occurred after the stock market closed on Friday, yet during the after-market trading session, shares of Twitter (TWTR) fell by nearly 5% and shares of Tesla (TSLA) rose by nearly 2.5%.

Nobias has covered the Musk/Twitter saga with several articles/updates thus far and therefore, we wanted to see what credible authors have had to say about Musk’s new plans over the weekend. Furthermore, we wanted to take a look at the sentiment being expressed by credible authors and Wall Street analysts alike, regarding shares of Twitter and Tesla, both of which have been caught up in this M&A whirlwind for months.

On Friday evening, shortly after the Musk/Twitter break-up news broke, Joshua Summers, a Nobias 4-star rated author, published a report at the Latin Post which highlighted the recent happenings. Summers wrote, “Elon Musk terminated his billion-dollar deal with Twitter on Friday, prompting the social media company to threaten the Tesla mogul with legal action.” He continued, “According to DW, Musk terminated his $44 billion bid with Twitter through a letter addressed to the company's board.”

Finally, Summers said, “In the letter, Elon Musk accused Twitter of lying about the number of bots and spam accounts on the social media platform, according to CBS News.” Regarding the alleged bot issue at Twitter, Summers said, “The letter claimed that the advisors of the Tesla mogul analyzed the number of bots on the platform, and they found a number "wildly higher than 5%". Twitter has previously claimed that fewer than 5% of its users are spam or fake accounts.”

TWTR Jul 2022

Also, Summer noted, “Musk's buyout also claimed that Twitter failed to provide Musk with the materials he asked for, including the company's methodology for calculating its user numbers and backup materials detailing its financial valuation.”

Looking at the situation from Twitter’s standpoint, Summers said, “Twitter will resort to legal actions if Musk does not push through with his deal with the social media company.” He highlighted a Tweet that went out from Twitter Chairman, Brett Taylor, who said, “The Twitter Board is committed to closing the transaction on the price and terms agreed upon with Mr. Musk and plans to pursue legal action to enforce the merger agreement. We are confident we will prevail in the Delaware Court of Chancery.” According to Summers, “Musk will have to pay a $1 billion termination fee if the deal falls out.”

Kari Paul, a Nobias 4-star rated author touched upon this exit fee in an article published on Saturday, July 9th, saying, “Musk may also face a fine of $1bn to walk away, a penalty he is seeking to evade by accusing Twitter of a “breach of multiple provisions” of the agreement, according to a letter filed with the Securities and Exchange Commission announcing the dissolution of the offer.”

Paul quoted Anat Beck, a professor and business law expert at Case Western Reserve University, who said, “What Musk and his team are doing is trying to come up with an excuse so that he doesn’t have to pay the penalty fees to walk away.”

Paul noted, “In addition to the fine for the failed deal, Musk could face serious consequences from the SEC for his antics, which have had major impacts on the several public companies he manages as well as Twitter itself.”

Paul continued, “Fines against Musk, who with a $224bn net worth is now the richest man in the world, have had negligible impacts, said Beck, but the executive could face further action from the SEC – including being removed as CEO from one or more of the companies he helms.”

Furthermore, Paul wrote, “Musk’s waffling on the Twitter decision has led many to call for legislation that prevents such market chaos in the future, or enforcement from bodies outside the SEC. Meanwhile, Musk and Twitter could be battling in court for some time, and Musk will face additional class action lawsuits, Beck said.”

With that in mind, it appears that this issue is likely to be an overhang for Musk, Twitter, and the companies that Musk manages, for quite some time.

And yet, according to Liana Baker, a Nobias 5-star rated author, who recently published a piece at Bloomberg highlighting Elon Musk’s recent Twitter drama, it doesn’t appear as if Musks twitter issue is going to hurt his relationship with bankers and/or the potential of other large-scale M&A from occurring in the near-term.

Baker’s piece highlighted the fact that many bankers (via named and unnamed sources) would be happy to continue to work with much, even though, as the author said, “It isn’t the first time billionaire Tesla Inc. founder Elon Musk burned his investment bankers on deals and it may not be the last.”

She noted, “It was the second time in five years that Musk fielded an ambitious acquisition idea that got Wall Street’s hopes up, only to change his mind. In that 2018 episode, Musk tweeted about taking Tesla private with the claim “funding secured.”’

Paul touched upon this episode in her piece as well, writing, “The market-moving 2018 tweet resulted in a $40m fine from the SEC, as well as an agreement that Musk would step down as chairman of the Tesla board.”

However, as volatile and unpredictable as Musk may be, Baker highlighted the ongoing demand for business relationships with him from members of the financial industry, stating, “One banker said it’s hard to ignore the mercurial Musk, the world’s richest person, even if he shoots from the hip on mega deals. Musk’s personal wealth totals almost $227 billion, according to data compiled by Bloomberg.”

Baker quoted Mark Boidman, head of media and entertainment at Solomon Partners, who touched upon Musk’s alluring nature, saying, “He’s a once in a lifetime client. He’s created some of the most iconic companies, of course everybody wants to be his banker.”

Baker highlighted the size and scale of Musk’s business empire, writing, “Tesla, which has a market value of almost $780 billion, could also pursue transactions, whether it’s M&A or debt financing. Musk’s futuristic brain-computer interface startup Neuralink has also been in fundraising mode and has attracted more money than other companies in the field. Meanwhile, his tunneling startup, Boring Co., was valued at $6 billion in April.”

Looking at the sentiment expressed by credible authors and analysts that Nobias tracks, there is a trend developing with regard to both sides of this dispute (meaning, Twitter and Tesla). The credible authors that we follow (only individuals with 4 and 5-star Nobias ratings) are expressing bearish sentiment for both companies. 75% of recent reports published by credible authors on TWTR and 69% of reports published by credible authors on TSLA have expressed a “Bearish” bias.

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

However, while the author community remains bearish on both stocks, the credible Wall Street analysts that we track appear to be much more bullish. Right now, the average price target being applied to TWTR shares by the credible analysts that Nobias tracks (once again, only those with 4 and 5-star Nobias ratings) is $50.40. The average price target that credible analysts are currently applying to TSLA is $937.50.

Today, TWTR shares trade for $36.81 (however, it’s important to note that they fell by 4.94% in the after-hours trading period of Friday and therefore, could end up trading for much lower than their closing price on Friday once markets open up next week). Therefore, the average analyst price target for TWTR implies upside potential of approximately 36.9%. TSLA shares closed the trading session on Friday at $752.29. Therefore, the average analyst price target for TSLA implies upside potential of approximately 24.6%.

While several bearish articles were posted on Twitter over the weekend by credible authors, Nobias has not seen any credible analyst update their price target for TWTR over the weekend. We expect to see that occur next week and the Musk/Twitter news could certainly have a notable impact on the consensus price target. But, for the time being, credible individuals on Wall Street remain bullish on both TWTR and TSLA.

Disclosure: Disclosure: Nicholas Ward has no position in either TWTR or TSLA. Nicholas Ward wrote this article for Nobias at their request with a view of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

NOC with Nobias Technology: Case Study on Northrop Grumman

Throughout 2022, defense contractors have been one of the few rays of sunshine for investors in the stock market. For months, positive sentiment has surrounded the defense stocks with talk of the U.S. and its NATO allies increasing the size of their defense budgets to combat the Russian threat. Many of the large U.S. defense players have posted strong positive total returns on a year-to-date basis, overcoming the inflationary headwinds, in large part, due to bullish momentum created by the war in Ukraine. However, in recent days, that tide has turned a bit, with large cap defense stocks posting negative returns over the last month.

Throughout 2022, defense contractors have been one of the few rays of sunshine for investors in the stock market. For months, positive sentiment has surrounded the defense stocks with talk of the U.S. and its NATO allies increasing the size of their defense budgets to combat the Russian threat. Many of the large U.S. defense players have posted strong positive total returns on a year-to-date basis, overcoming the inflationary headwinds, in large part, due to bullish momentum created by the war in Ukraine. However, in recent days, that tide has turned a bit, with large cap defense stocks posting negative returns over the last month.

During the last 30 days, shares of Lockheed Martin (LMT) are down 3.90%, shares of General Dynamics (GD) are down 5.28%, shares of Raytheon Technologies (RTX) are down 2.88%, shares of L3Harris Technologies (LHX) are down 1.23%, and shares of Northrop Grumman (NOC) are up 0.85%. Now, all of these results are still relatively higher than the -7.43% returns that the S&P 500 index has posted during the last month. Furthermore, on a year-to-date basis, each of these stocks has also posted total returns that represent relative outperformance when compared to the S&P 500.

LMT’s year-to-date gains are 20.19%, GD’s year-to-date gains are 5.83%, RTX’s year-to-date gains are 7.99%, LHX’s year-to-date gains are 13.25%, and NOC’s year-to-gate gains are 24.99%. For comparison’s sake, the S&P 500 is down 19.84% on a year-to-date basis. But, even with all of this bullishness in mind, earlier this week we saw a day where most of these names were down in the 4-6% range, with little to no significant news coming out of Ukraine. Since then, there has been a slight rebound, but that near-term weakness posed the question, are these outperformers starting to show cracks in their armor? And, with that in mind, we wanted to take a look at reports published by credible authors and analysts which have focused on Northrop Grumman (the best year-to-date performer of this space) to see whether or not this is a company that investors should still have on their watch lists.

NOC Jul 2022

After NOC’s most recent earnings report (which was posted in late April), Sejuti Banerjea, a Nobias 4-star rated author, covered the company’s operational results in an article published at zacks.com. Banerjea wrote, “Northrop Grumman’s March quarter was a bit of a mixed bag. While revenue missed estimates by less than a percent and grew from the year-ago quarter by a mere 3.6%, its earnings were a bit more encouraging, growing 8.6% to beat the Zacks Consensus Estimate by 2.5%.”

Looking at operating segment data, Banerjea said, “Aeronautics Systems revenue of $2.703 billion beat estimates by 1.3%; Defense Systems revenue of $1.283 billion missed by 10.9%; Mission Systems revenue of $2.497 billion missed by 3.7% and Space Systems revenue of $2.855 billion beat by 4.9%. Net intersegment eliminations of -$541 million missed by 5%.”

In conclusion, Banerjea wrote, “Northrop Grumman’s overall performance was more or less in line with what analysts expected with the aeronautics segment being the main outperformer, both in terms of revenue and profitability.”

Dhierin Bechai, a Nobias 4-star rated author, more recently touched upon NOC’s first quarter results in an article at Seeking Alpha titled, “Northrop Grumman: A Defense Winner With Growth And A Dividend”. In that piece, Bechai provided relatively bearish commentary on the Q1 results, touching upon the poor revenue growth as well as issues with margins (overall), stating, “While Aeronautics and Defense Systems revenues dropped, their margins improved, which led to stable operating income for Aeronautics Systems while the profit for Defense Systems declined by 12% on a 18% reduction in revenues. Mission systems margins remained more or less stable producing a 3% decline in profits. The strong surge in Space Systems revenues did not translate into higher profits as a 180 points reduction in margin more than offset the topline performance. Overall, income was 5% lower on 4% lower revenues.”

He continued, “As an investor, you would like to see top- and bottom-line growth but Northrop Grumman did not produce a year-over-year growth on either metric and when listening to the call and going through the call I found that the company provided extremely little color to what caused the declines.”

Ultimately, Bechai said that on page 75 of its recent 10-Q, NOC noted that “COVID-19, employee leave and supply chain challenges” were the primary contributors to the margin issues. But, as concerning as the Q1 report was, Bechai maintained a bullish stance on the company moving forward, writing, “While I would like to have seen Northrop Grumman provide more color on the margin and revenue pressures, I was pleased with the detail the Defense company provided for 2022 and the upcoming years.”

Looking at full-year 2022 guidance, Bechai wrote, “For 2022, Northrop Grumman maintained its guidance with $36.2 billion to $36.6 billion in sales and 11.7%-11.9% operating margin resulting in a $24.50-$25.10 adjusted earnings per share.”

Bechai said, “Overall, Northrop Grumman is guiding for 1.4% to 2.5% increase in revenues and $4.2 billion to $4.36 billion in profits. That provides a 3% uptick in profits unadjusted for inflation.” He continued, “I would say that the outlook for 2022 is not spectacular and neither is the 24% to 25% of full-year revenues that's expected in the second quarter. More useful is the color provided beyond 2022.”

Regarding longer-term growth prospects, he stated, “the company expects acceleration of revenue growth in the second half of the year as reflected in the guidance and that momentum to carry into 2023. In 2023, the aeronautics revenues will be more or less flat with growth returning in 2024 supported by the B-21 strategic bomber. In 2023-2024, Northrop Grumman sees the earliest opportunities for meaningful impact on contracts awards as international customers increase defense budgets while margins will tick up to 12%.”

Concluding his piece, Bechai said, “Northrop Grumman increased its dividend by 10% earlier this year and I believe that while its yields is not the most attractive, the combination of revenue growth, share repurchases and dividend hikes provide a solid investment opportunity in a market that is currently plagued by inflation but has seen demand for defense equipment rising.”

Jed Graham, a Nobias 4-star rated author, also recently highlighted his bullish outlook on NOC in an article published at investors.com. Graham highlighted a new $800 million round of military aid that the U.S. is providing Ukraine as a bullish catalyst for the stock. He continued, stating, “A potentially bigger deal for Northrop was the June 24 news it reached the next stage of the competition for a multibillion-dollar contract for missiles to intercept hypersonic weapons. That puts it head-to-head against Raytheon Technologies, while Lockheed Martin was eliminated.”

Graham also noted, “Northrop has been one of the big winners as the strategic implications of Russia's invasion boosts defense budgets, with Biden requesting $773 billion for fiscal 2023. That includes funds for initial production of Northrop's B-21 Raider stealth bomber and an increase in funds for developing an intercontinental ballistic missile known as the Ground Based Strategic Deterrent.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

Regarding the large contracts the NOC has garnered in recent years, Graham stated, “The Air Force plans to spend $20 billion for B-21 production over five years. In 2020, Northrop received a $13.3-billion contract to develop the new ICBM.”

Like Bechai, Graham acknowledged poor fundamental growth in recent quarters from NOC; however, he said that several major projects underway have the potential “to fuel growth in 2023 and beyond.”

Overall, the vast majority of credible authors (those that have earned 4 and 5-star ratings by the Nobias algorithm) share this bullish sentiment. 90% of recent articles published on NOC by credible authors have expressed a “Bullish” sentiment.

However, the credible Wall Street analysts that the Nobias algorithm tracks are less bullish. Right now, the average price target being applied to NOC shares by credible analysts is $477.33. Right now, NOC trades for $481.87. Therefore, the average price target supplied by credible analysts implies downside of approximately 0.94%. With that in mind, it appears that NOC shares are hovering right around fair value at the moment and bullish investors are going to have to look out further into the future to find the catalysts that could push Northrop Grumman to new highs.

Disclosure: Of the stocks discussed in this article, Nicholas Ward is long NOC, LMT, RTX, and LHX. Nicholas Ward wrote this article for Nobias at their request with a view of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

COIN with Nobias Technology: Case Study on Coinbase

Coinbase (COIN) was one of the hottest new stocks to begin public trading in 2021. The stock came public via a direct listing in April of 2021. At the time, market markers expected the stock to open trading in the $250 range; however, COIN shares opened trading in the $381 area. They quickly rose to $429.54 before trading down to $328.28, where they closed after their first day trading on the Nasdaq.

Coinbase (COIN) was one of the hottest new stocks to begin public trading in 2021. The stock came public via a direct listing in April of 2021. At the time, market markers expected the stock to open trading in the $250 range; however, COIN shares opened trading in the $381 area. They quickly rose to $429.54 before trading down to $328.28, where they closed after their first day trading on the Nasdaq.

This move equated to an $85.8 billion market cap on a fully diluted basis. With the benefit of hindsight, the violent trading that COIN shares experienced on their first day of trading was a precursor of things to come. Since April of 2021, COIN shares have sold off down to the $220 area, risen back up to the $368 range, and then most recently plunged down to all-time lows of $40.88.

Today, Coinbase shares trade for $49.04, down roughly 86.7% from their 52-week highs. And, while there is no sign that volatility is about to abandon these shares, the credible authors and analysts that we track with the Nobias algorithm remain overwhelmingly bullish on COIN shares.

COIN Jun 2022