Case Study: Microsoft (MSFT) stock according to high performing analysts

Coming into Q3 the market feared a major cloud slowdown from MSFT due to slowing enterprise spending; however, the company posted 16% year-over-year cloud growth, assuaging these fears.

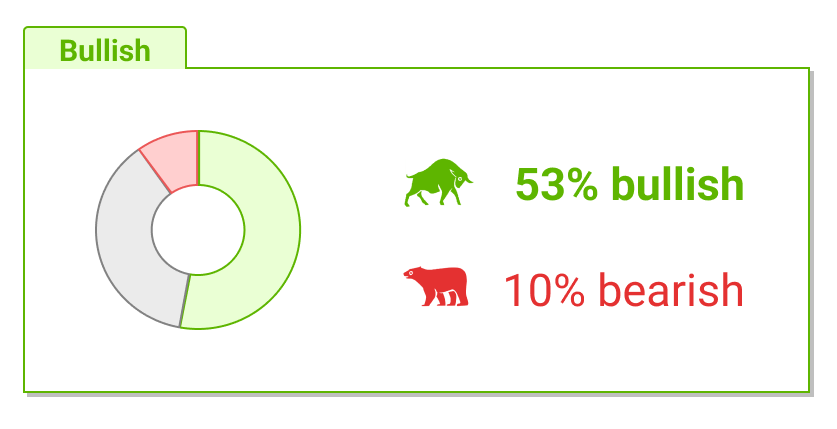

Nobias Insights: 53% of recent articles published by credible authors focused on MSFT shares offer a “bullish” bias. One of the two credible Wall Street analysts covering MSFT believes that shares are likely to rise in value. The average price target being applied to Microsoft by these credible analysts is $248.50, implying a downside of approximately 19.1% relative to the stock’s current share price of $307.26.

Bullish Take: Dividend Sensei, a Nobias 4-star rated author, said, “Cloud computing is expected to grow 21% annually through 2028 to $222 billion.”

Bearish Take: Joe Toppe, a Nobias 4-star rated author, stated, “British regulators blocked Microsoft’s $69 billion purchase of video game maker Activision Blizzard on Wednesday, saying it would hurt competition in the cloud gaming market.”

Key Points

Performance

Microsoft shares rose by 8.24% this week, pushing their year-to-date gains up to 28.25%. This compares favorably to both the S&P 500 and the Nasdaq Composite Index, which are up by 9.03% and 17.71%, respectively, on a year-to-date basis.

Event & Impact

Microsoft posted its fiscal 2023 third quarter results this week, beating consensus estimates on both the top and bottom lines. During Q3, MSFT’s revenue totaled $52.86 billion, beating Wall Street’s consensus estimate by $1.85 billion. Microsoft’s Q3 non-GAAP earnings per share came in at $2.45, which was $0.22/share above consensus estimates.

Noteworthy News:

Coming into Q3 the market feared a major cloud slowdown from MSFT due to slowing enterprise spending; however, the company posted 16% year-over-year cloud growth, assuaging these fears.

Nobias Insights

53% of recent articles published by credible authors focused on MSFT shares offer a “bullish” bias. One of the two credible Wall Street analysts covering MSFT believes that shares are likely to rise in value. The average price target being applied to Microsoft by these credible analysts is $248.50, implying a downside of approximately 19.1% relative to the stock’s current share price of $307.26.

Bullish Take Dividend Sensei, a Nobias 4-star rated author, said, “Cloud computing is expected to grow 21% annually through 2028 to $222 billion.”

Bearish Take Joe Toppe, a Nobias 4-star rated author, stated, “British regulators blocked Microsoft’s $69 billion purchase of video game maker Activision Blizzard on Wednesday, saying it would hurt competition in the cloud gaming market.”

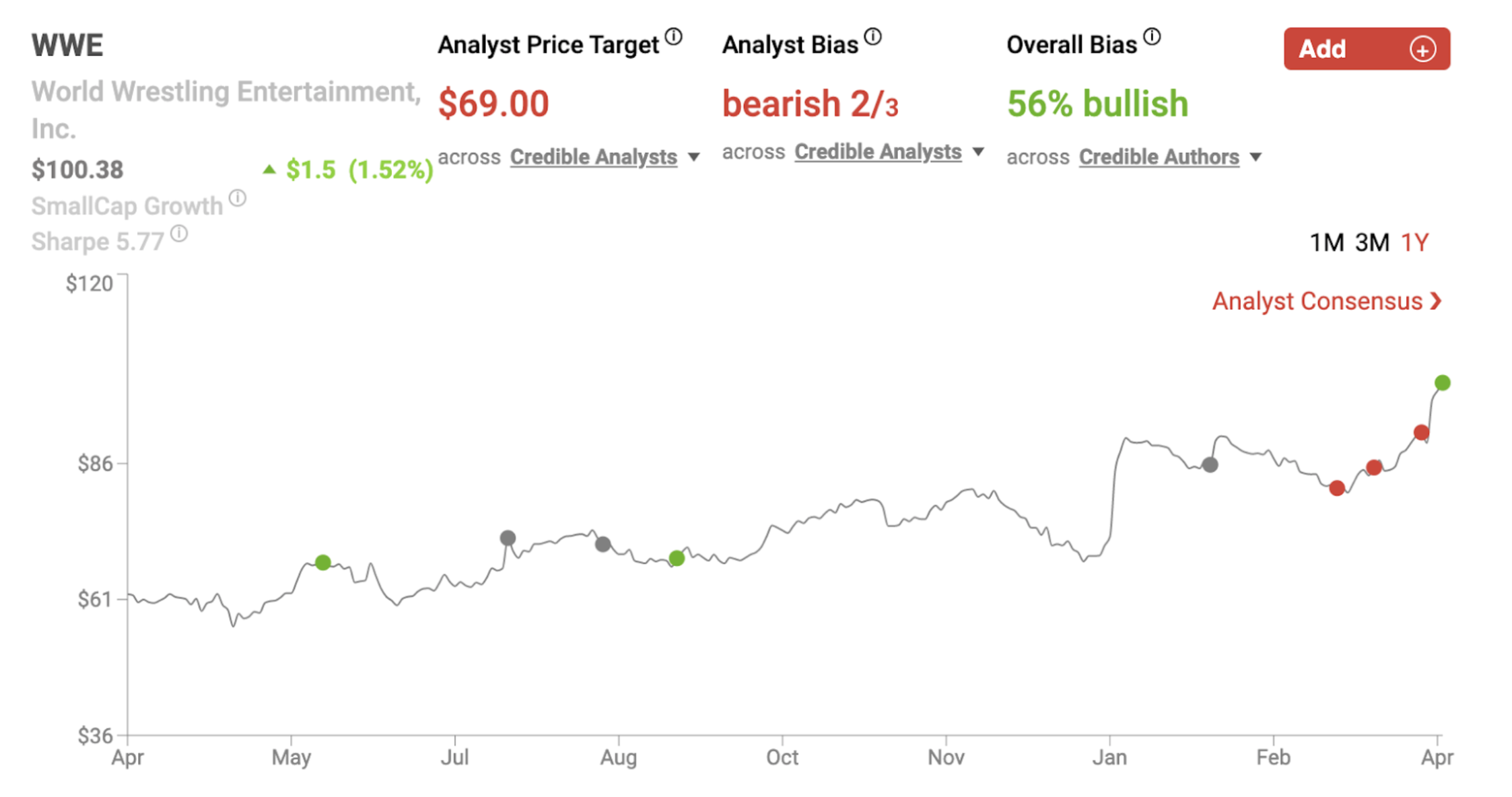

MSFT Apr 2023

Microsoft posted its fiscal 2023 third quarter results this week, beating Wall Street’s consensus estimates on both the top and bottom lines. These results inspired shares to rally; Microsoft closed the week up by 8.24%. This rally pushed Microsoft’s year-to-date gains up to 28.25%.

During the trailing twelve month period, MSFT shares are now up by 6.09% and the company’s market capitalization currently sits at $2.27 trillion.

Bullish Nobias Credible Analysts Opinions:

Harsh Chauhan, a Nobias 4-star rated author, covered Microsoft’s Q3 results this week at the Motley Fool. Regarding Microsoft’s illustrious history, Chauhan said, “A $1,000 investment made in Microsoft five years ago is now worth almost $3,300, assuming the dividends were reinvested.”

“That translates into an average annual return of nearly 27%.” Investors can expect such solid returns from Microsoft in the future as well, thanks to the fast-growing markets the company is involved in such as cloud computing and generative artificial intelligence (AI),” he continued.

Looking at Microsoft’s third quarter results, Chauhan said, “Its revenue was up 7% year over year to $52.9 billion in the third quarter of fiscal 2023 (for the three months ended March 31). “Microsoft's non-GAAP (generally accepted accounting principles) earnings increased 10% year over year to $2.45 per share,” he added.

Chauhan also wrote, “Robust growth in the company's productivity and cloud businesses was enough to offset the 9% year-over-year revenue drop in the personal computing business, which produced a quarter of the company's top line last quarter.”

Chauhan maintains a bullish outlook on MSFT shares, in large part, because of its ongoing cloud growth. He said, “Microsoft's 23% share of the cloud infrastructure services market puts it in position to make the most of this huge growth opportunity and help sustain the healthy pace at which its cloud business is growing.” He quoted a research report, stating, “Gartner estimates that $597 billion will be spent on public cloud services globally this year, up nearly 22% from last year's levels. The market research firm expects the impressive growth to continue in 2024 with another 21% increase in worldwide public cloud spending to $724.5 billion.”

Looking at another growth catalyst for Microsoft moving forward, Chauhan said, “With the generative AI market set to clock 34% annual growth through 2030, per Grand View Research, Microsoft is setting itself up to make the most out of this nascent technology. As such, it won't be surprising to see this potential AI winner continue soaring.”

Dividend Sensei, a Nobias 4-star rated author, also highlighted MSFT’s Q3 results in a report this week, once again focusing on the company’s enormous cloud growth potential. Dividend Sensei said, “Azure revenue is expected to grow 33% this year and keep growing at solid [sic] 24% to 29% rate through 2028.” He continued, “Cloud computing is expected to grow 21% annually through 2028 to $222 billion. For context, MSFT is expected to generate $210 billion in revenue for the entire company this year.”

Then, the author went on to put a spotlight on Microsoft’s cash flows and its shareholder return prospects. Dividend Sensei wrote, “Free cash flow is expected to be a record $90 billion this year and grow to $140 million by 2028.” And they expect Microsoft to use these profits to reward investors. “Buybacks are expected to be $24 billion this year and grow to $34 billion by 2028,” Dividend Sensei said. “MSFT is paying $20 billion per year dividend [sic] dividends, and that's expected to grow to $35 billion by 2028,” they continued. “Despite $350 billion in buybacks and dividends,” the author concluded, “MSFT's net cash position is expected to grow to $217 billion (including deferred subscription revenue) by 2028.”

Bearish Nobias Credible Analysts Opinions:

Although Microsoft posted the top and bottom-line beat on Tuesday, not all of the headlines associated with the company with week were bullish. On Wednesday, Joe Toppe, a Nobias 4-star rated author, highlighted bad news that Microsoft received regarding its record breaking acquisition of Activision Blizzard in an article that he published at Yahoo Finance.

Toppe wrote, “British regulators blocked Microsoft’s $69 billion purchase of video game maker Activision Blizzard on Wednesday, saying it would hurt competition in the cloud gaming market.” “Both Microsoft and Activision will appeal the decision, despite facing opposition to the all-cash deal from contemporaries like Sony and regulators in the U.S. and Europe concerned the consolidation would give Microsoft control of popular game franchises like Call of Duty, World of Warcraft and Candy Crush,” he continued.

However, Toppe noted that both parties are still trying to get this deal completed, writing, “Microsoft President Brad Smith said in a tweet Wednesday that the company remains fully committed to the acquisition and would appeal the decision.”

Dina Bass, a Nobias 4-star rated author, also touched upon the UK regulator headlines in an article that she published at BNN Bloomberg this week. Bass wrote, “Microsoft Corp. executives sought to reassure workers in the Xbox gaming unit that there’s a way forward for the approval of the company’s planned $69 billion purchase of Activision Blizzard Inc., while emphasizing that its success in gaming isn’t solely dependent on the deal.”

Bass noted that Microsoft Gaming Chief Phil Spencer “told staffers that Microsoft President Brad Smith was up at 2 a.m. Seattle time Wednesday drafting a response to the UK Competition and Markets Authority. ”Chief Financial Officer Amy Hood, who oversees acquisitions, held a senior leadership meeting the same day,” she continued.

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

According to her sources, Bass wrote, “The Xbox chief said the acquisition was intended to speed up Microsoft’s gaming plans, but doesn’t represent the entirety of the company’s gaming strategy, which would move ahead even without Activision”.

Overall bias of Nobias Credible Analysts and Bloggers:

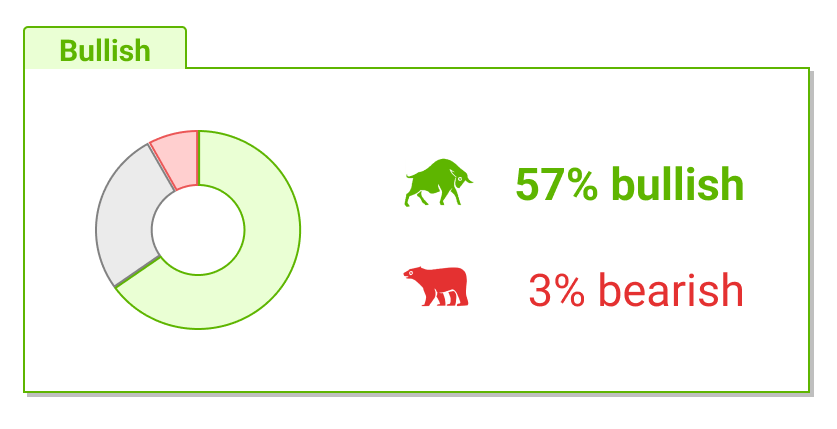

Overall, 53% of recent articles written by credible Wall Street analysts have expressed a “bullish” bias towards MSFT shares. 50% of the credible Wall Street analysts that are tracked by the Nobias algorithm who have expressed an opinion on Microsoft believe that shares are headed higher.

Since Microsoft’s earnings report this week, Nobias 5-star analyst, John DiFucci of Guggenheim, raised his price target on MSFT shares.

According to the Fly of the Wall, “Guggenheim raised the firm's price target on Microsoft to $232 from $212 and keeps a Sell rating on the shares, noting that the company exceeded fiscal Q3 estimates set by guidance "on all pertinent line items" other than free cash flow, for which it had not given guidance. Microsoft management did a good job of managing expectations for the quarter, but while Office 365 is doing well and should continue to as tailwinds compound over time, "Azure and Windows are struggling," the analyst argues. The firm does not expect Microsoft to continue the free cash flow or revenue growth it's enjoyed for years, the analyst added.”

Currently, the average price target being applied to Microsoft by Nobias credible analysts is $248.50. After its 8.24% rally this week, Microsoft is trading for $307.26. Therefore, that average price target implies downside potential of approximately 19.1%.

Disclosure: Nicholas Ward is long MSFT. Nicholas Ward wrote this article for Nobias at their request with the intention of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

Case Study: Lockheed Martin (LMT) stock according to high performing analysts

During Q1, Lockheed continued to improve upon the supply chain headwinds that the company has experienced since the COVID-19 pandemic began. The company posted low single digit sales growth and reaffirmed full-year guidance, which calls for flat top-line growth. Management highlighted the company’s $145 billion sales backlog going forward.

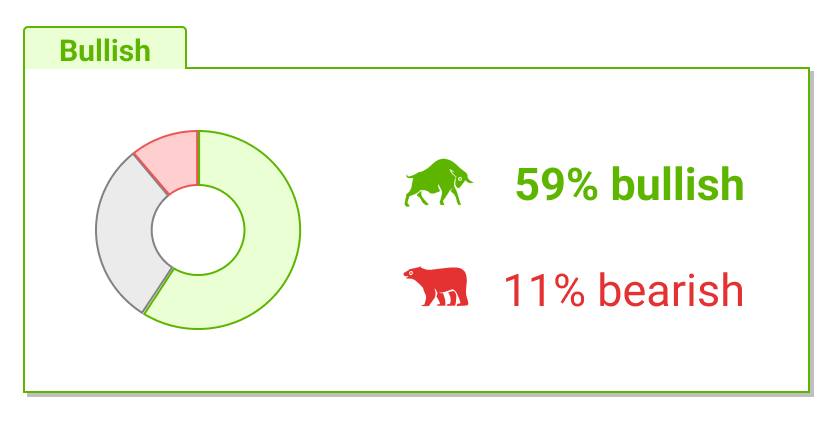

Nobias Insights: 65% of recent articles published by credible authors focused on LMT shares offer a “Bullish” bias. 3 out of the 6 credible Wall Street analysts who cover Lockheed Martin believe that shares are likely to rise in value. The average price target being applied to LMT by these credible analysts is $480.67 which is essentially in-line with the stock’s current share price of $482.55.

Bullish Take: Harrison Miller, a Nobias 4-star rated author, said, “Shares are holding above their 50-day and 200-day moving averages and reclaimed their 10-day line Tuesday. The current buy zone for the pattern extends to 524.”

Bearish Take: Nobias 4-star rated analyst, Noah Poponak, said, ”The U.S. defense budget has grown significantly to an all-time high level, and with a large level of cumulative government debt, focus on slowing spending growth or reducing it outright could return in 2023.”

Key Points

Performance

Lockheed Martin shares fell by 1.42% this week, pushing their year-to-date gains down to 1.05%. This compares poorly to the S&P 500’s year-to-date returns. Thus far in 2023, the S&P 500 has posted gains of 8.09%.

Event & Impact

Lockheed Martin posted its first quarter results this week, beating Wall Street’s expectations on both the top and bottom lines. During Q1, LMT’s revenue totaled $15.1 billion, missing Wall Street’s consensus estimate by $90 million. Lockheed’s Q1 non-GAAP earnings-per-share came in at $6.43, beating the consensus estimate by $0.37/share.

Noteworthy News:

During Q1 Lockheed continued to improve upon the supply chain headwinds that the company has experienced since the COVID-19 pandemic began. The company posted low single digit sales growth and reaffirmed full-year guidance, which calls for flat top-line growth. Management highlighted the company’s $145 billion sales backlog going forward.

Nobias Insights

65% of recent articles published by credible authors focused on LMT shares offer a “bullish” bias. Three out of the six credible Wall Street analysts who cover Lockheed Martin believe that shares are likely to rise in value. The average price target being applied to LMT by these credible analysts is $480.67, which is essentially in-line with the stock’s current share price of $482.55.

Bullish Take Harrison Miller, a Nobias 4-star rated author, said, “Shares are holding above their 50-day and 200-day moving averages and reclaimed their 10-day line Tuesday. The current buy zone for the pattern extends to 524.”

Bearish Take Nobias 4-star rated analyst, Noah Poponak, said, ”The U.S. defense budget has grown significantly to an all-time high level, and with a large level of cumulative government debt, focus on slowing spending growth or reducing it outright could return in 2023.”

LMT Apr 2023

Lockheed Martin, the world’s largest defense contractor, posted its first quarter earnings this week. After beating Wall Street’s estimates on the top and bottom lines, LMT shares hit new 52-week highs of $508.10 on Tuesday.

However, the market’s enthusiasm wore off throughout the remainder of the week, and LMT shares ultimately closed at $482.55. This price is in-line with the average price target that is currently being associated with shares by the credible Wall Street analysts that Nobias tracks.

Bullish Nobias Credible Analysts Opinions:

However, the credible author community is more bullish with 65% of recent reports expressing bullish sentiment. Ahmed Farhath, a Nobias 4-star rated author, posted a pre-earnings breakdown of what the market was expecting from Lockheed Martin coming into the stock’s Q1 report at Seeking Alpha this week.

Farhath wrote, “The consensus EPS Estimate is $6.06 and the consensus Revenue Estimate is $15.01B (+0.3% Y/Y).” “Over the last 1 year,” he continued, “LMT has beaten EPS estimates 75% of the time and has beaten revenue estimates 25% of the time.”

Looking at Wall Street’s sentiment gauge coming into the quarter, Farhath said, “Over the last 3 months, EPS estimates have seen four upward revisions and 1 downward. Revenue estimates have seen 1 upward revision and 4 downward.”

Harrison Miller, a Nobias 4-star rated author, covered Lockheed’s Q1 report in an article that he published at Investors.com this week. Looking at the macro-environment surrounding this defense stock, Miller highlighted the Russia/Ukraine war as a tailwind for the company.

Regarding Lockheed he said, “The maker of the F-22 and F-35 fighter jets has been a heavy supplier of missiles and other military equipment in Ukraine's fight against Russia's invasion over the past year.” “Lockheed Martin provided High Mobility Artillery Rocket Systems (HMARS) and ammunition, Javelin and Stinger missiles early in the assault,” he added.

Moving onto Lockheed’s Q1 results, Miller wrote, “Lockheed Martin reported adjusted earnings of $6.43 per share, unchanged from last year. GAAP earnings, excluding mark-to-market investment gains, rose 2.6% to $6.61 per share.” “Net sales ticked up to $15.126 billion from $14.96 billion,” he added. Both of these figures came in ahead of Wall Street consensus estimates.

Lockheed Martin beat consensus top-line estimates by $90 million and it beat consensus earnings-per-share estimates by $0.37. Focusing on LMT’s bottom-line, Miller wrote, “Cash flow from operations were $1.56 billion with free cash flow of $1.27 billion.”

During Lockheed’s Q1 report the company’s CEO Jim Taiclet reaffirmed full-year guidance. Taiclet said, “We remain on track to achieve our full year 2023 financial guidance and continue our robust approach to returning capital to shareholders, with $500 million in share repurchases and $784 million in dividends distributed in the first quarter.”

Miller touched upon these guidance figures, stating, “Lockheed guided full-year earnings between $26.60 per share and $26.90 per share on $65 billion to $66 billion in net sales.” Looking at Wall Street’s full-year estimates, Miller added, “For the year, analysts see earnings jumping 24% to $26.91 per share as revenue edges down 0.36% to $65.746 billion.” After its top and bottom-line beat, LMT shares hit new 52-week highs.

Miller touched upon the stock’s technical momentum, stating, “Shares are holding above their 50-day and 200-day moving averages and reclaimed their 10-day line Tuesday. The current buy zone for the pattern extends to 524.” However, after hitting highs of $508 on Tuesday, LMT shares trended downwards throughout the rest of the week.

Lockheed Martin closed the week trading for $482.55, meaning that they gave up their post-earnings gains and ended up falling by 1.42% during the last 5 trading sessions. Rob Williams, a Nobias 4-star rated author, also highlighted Lockheed’s Q1 results in a Seeking Alpha report this week.

Williams focused on the Lockheed’s operating segment results, stating, “The company’s aeronautics revenue slipped 2% from the prior year to $6.27 billion. The drop was mostly attributed to a decline of $335 million for the F-35 fighter jet program on lower volume. The company has a growing backlog, having received an order from Canada for 88 of the fifth-generation aircraft during Q1.”

During the company’s Q1 report, Lockheed Martin stated that its total backlog stood at $145.09 billion, down slightly from the $149.99 billion backlog that it reported during the same quarter one year ago. “Its missiles and fire control segment saw a 3% decline in net sales to $2.39 billion, including a drop of $60 million on lower output of the Guided Multiple Launch Rocket Systems (GMLRS), a long-range missile that the United States has supplied to Ukraine to defend itself against Russia’s invasion,” Williams added.

Regarding the Ukraine tailwinds, Williams stated, “Jay Malave, CFO of Lockheed Martin, said the company estimates it will see $1.5 billion in sales related to Ukraine this year, about the same as in 2022, and $6 billion by 2027, The Wall Street Journal reported Tuesday.”

Bearish Nobias Credible Analysts Opinions:

Not everyone is bullish on LMT shares, however. After the company’s full-year results were published back in January, Nobias 4-star rated analyst, Noah Poponak, downgraded LMT shares.

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

According to the Fly on the Wall: “Goldman Sachs analyst Noah Poponak downgraded Lockheed Martin to Sell from Neutral with a price target of $332, down from $388. The U.S. defense budget has grown significantly to an all-time high level, and with a large level of cumulative government debt, focus on slowing spending growth or reducing it outright could return in 2023, Poponak tells investors in a research note. The analyst says Lockheed often grows at similar rates as the budget while it also has a number of program specific headwinds in the near-to-medium term, including F-35, Blackhawk, OPIR, and tough compares in missile and missile defense. This creates an "idiosyncratic growth headwind" on top of the overall budget pressures that could materialize, contends Poponak.”

And although Lockheed beat the market’s expectations during Q1 and reaffirmed full-year guidance, the macro headwinds regarding national debt that Poponak brings up remain in place.

Overall bias of Nobias Credible Analysts and Bloggers:

Overall, 3 out of the 6 opinions expressed by the credible Wall Street analysts tracked by the Nobias algorithm who cover LMT shares imply that shares are likely to rise in value.

The average price target being applied to Lockheed Martin by these 6 credible individuals is $480.67. LMT shares closed the week trading for $482.55. Therefore, the current price is essentially in-line with the average price target, implying a neutral stance by credible analysts.

Disclosure: Nicholas Ward is long LMT. Nicholas Ward wrote this article for Nobias at their request with the intention of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

Case Study: Netflix (NFLX) stock according to high performing analysts

During Q1 Netflix saw its top-line growth slow and its margins compress. The company continues to work on its password sharing crackdown, which has the potential to drive paying subscriber growth over the long-term. During Q1, Netflix’s paid membership hit a record his of 235.5 million.

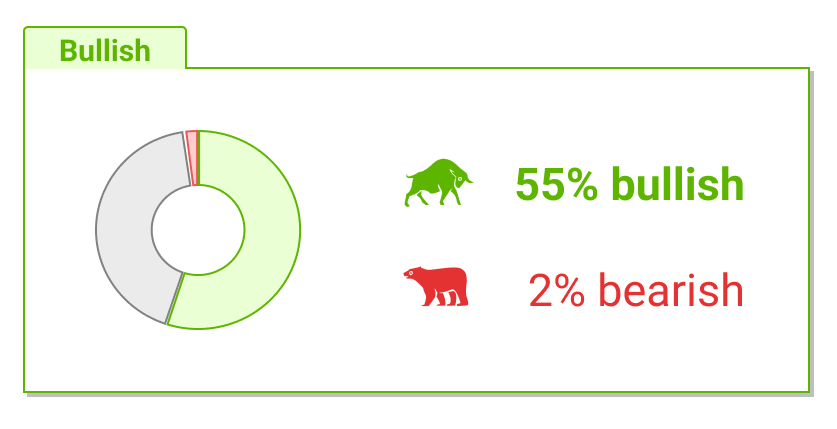

Nobias Insights: 47% of recent articles published by credible authors focused on NFLX shares offer a “Bullish” bias. 3 out of the 5 credible Wall Street analysts who cover Netflix believe that shares are likely to rise in value. The average price target being applied to NFLX by these credible analysts is $348.00, which implies upside potential of approximately 6.1% relative to the stock’s current share price of $$327.98.

Bullish Take: Royston Yang, a Nobias 4-star rated author, said, “Paid memberships continued to rise to a new record of 232.5 million, up 4.9% year on year, adding another 1.75 million members to Netflix’s database,”

Bearish Take: Nobias 5-star rated author, David Trainer, stated, “As we noted in our report Netflix: A Meme Stock Original, NFLX has historically moved more on narrative and sentiment than fundamentals. We think it's time investors wake up to the company's fundamentals and value it accordingly.”

Key Points

Performance

Netflix shares fell by 2.47% this week, pushing their year-to-date gains down to 11.20%. This means that Netflix has outperformed the S&P 500 on the year; however, its performance is lagging behind the tech-heavy Nasdaq. The S&P 500 and the Nasdaq Composite Index are up by 8.09% and 16.23%, respectively, during 2023 thus far.

Event & Impact

Netflix posted its first quarter results this week, missing top-line expectations and beating bottom-line estimates. During Q1, NFLX’s revenue totaled $8.16 billion, missing Wall Street’s consensus estimate by $20 million. Netflix’s Q1 GAAP earnings per share came in at $2.88, beating the consensus estimate by $0.01/share.

Noteworthy News:

During Q1 Netflix saw its top-line growth slow and its margins compress. The company continues to work on its password sharing crackdown, which has the potential to drive paying subscriber growth over the long-term. During Q1, Netflix’s paid membership hit a record his of 235.5 million.

Nobias Insights

47% of recent articles published by credible authors focused on NFLX shares offer a “bullish” bias. Three out of five credible Wall Street analysts who cover Netflix believe that shares are likely to rise in value. The average price target being applied to NFLX by these credible analysts is $348.00, which implies upside potential of approximately 6.1% relative to the stock’s current share price of $327.98.

Bullish Take Royston Yang, a Nobias 4-star rated author, said, “Paid memberships continued to rise to a new record of 232.5 million, up 4.9% year on year, adding another 1.75 million members to Netflix’s database,”

Bearish Take Nobias 5-star rated author, David Trainer, stated, “As we noted in our report Netflix: A Meme Stock Original, NFLX has historically moved more on narrative and sentiment than fundamentals. We think it's time investors wake up to the company's fundamentals and value it accordingly.”

NFLX Apr 2023

Netflix reported its first quarter earnings this week and posted mixed results. The company beat analyst estimates on the top-line, driven by a record number of paying subscribers. However, Netflix saw its margins compress, which caused its earnings-per-share results to lag consensus expectations.

The stock pulled back 10% on the earnings report initially, but ended up rallying on future guidance provided by management. NFLX shares ended the week down by 2.47% and after this slight dip shares offer mid-single digit upside potential relative to the average price target being applied to shares by the credible analysts that the Nobias algorithm tracks.

Bullish Nobias Credible Analysts Opinions:

Luke Lango, a Nobias 4-star rated author, published a post-earnings report on Netflix this week at InvestorPlace. Lango began his article discussing the broader market’s valuation and the potential implication of upcoming tech-stock earnings. He wrote, “At 19X forward earnings today, then, the stock market is trading at a very fair valuation.”

“P/E multiples have some, but not much, room to expand if Treasury yields fall (they are inversely related),” he continued. “Therefore,” Lango concluded, “the next leg higher in stocks will need to be driven by higher earnings – not P/E multiple expansion.”

With that in mind, he is bullish on tech stocks moving forward; not because they’ve been out of favor of the last year or so, but because of the secular growth potential that they offer investors from a fundamental metric perspective.

Transitioning to Netflix’s first quarter results, Lango wrote, “Netflix’s earnings themselves weren’t great.” “Now, the company beat most first-quarter metrics, including subscribers, revenues, profit margins, and earnings. But management offered guidance to lighter-than-expected revenues, margins, earnings, and subscriber growth in the second quarter,” he added.

Lango noted that NFLX shares fell roughly 10% right after these results were published; however, the stock fought back up to the flatline area once the market digested the reason for the poor guidance. “In short,” Lango said, “Netflix planned to expand its password-sharing crackdown efforts toward the end of the first quarter of 2023. That included a rollout of those efforts in the all-important U.S. market.”

“Instead,” he continued, “Netflix pushed back that expansion to the second quarter, which means the financial benefits of those efforts will be reflected in the third-quarter numbers, not the second-quarter numbers.” He pointed to the Canadian market as a bullish sign for investors. “Canada is a good analog for the U.S.,” he stated.

In Canada,” Lango wrote, “where these efforts have already launched, the paid membership base is now larger than it was prior to the crackdown. And revenue has accelerated to above pre-password-sharing levels.” And therefore, regarding this thesis for strong fundamental growth moving forward, Lango concluded, “Q3 Netflix earnings should reflect the big growth acceleration investors were expecting in Q2.”

Regarding secular growth potential, Royston Yang, a Nobias 4-star rated author, published an article at Yahoo Finance this week titled, “4 US Growth Stocks Whose Share Prices Can Continue Climbing” Looking at NFLX’s Q1 results, Yang wrote, “The company is off to a slow start for the first quarter of 2023 (1Q 2023), with revenue growing 3.7% year on year to US$8.2 billion.”

“Operating margin rebounded strongly to 21%, up from the previous quarter’s 7%, but was down from 1Q 2022’s operating margin of 25.7%,” he said. “Consequently,” Yang continued, “net profit fell by 18.3% year on year to US$1.3 billion.” However, he believes that these growth headwinds are short-term in nature and that Netflix’s growing subscriber base points towards more long-term growth.

“Paid memberships continued to rise to a new record of 232.5 million, up 4.9% year on year, adding another 1.75 million members to Netflix’s database,” Yang stated. Yang believes that Netflix can continue to grow rapidly in international markets. He concluded his bullish outlook by writing, “Netflix also quoted figures from Nielsen that showed it had a market share of 2% to 4% in markets such as Brazil, Mexico and Poland, suggesting that it has plenty of opportunity to capture more market share.”

Bearish Nobias Credible Analysts Opinions:

David Trainer, a Nobias 5-star rated author, expressed a clearly bearish sentiment in his post-earnings write up on Netflix that was published at Forbes and Seeking Alpha this week. Trainer wrote, “As we noted in our report Netflix: A Meme Stock Original, NFLX has historically moved more on narrative and sentiment than fundamentals. We think it's time investors wake up to the company's fundamentals and value it accordingly.”

“In 1Q23, Netflix's revenue grew just 3.7% YoY, which is well below the long-term goal to "sustain double-digit revenue growth" announced during the company's 4Q22 earnings release,” he said. Looking at bottom-line results, Trainer said, “Profitability is heading in the wrong direction as well. Netflix's reported operating margin was 21% in 1Q23, which is down from 25.1% in 1Q22.”

“Expect further margin deterioration going forward, given that management forecasts operating margins of 19% in 2Q23, which would be down from 19.8% in 2Q22,” he added. Trainer also wrote, “Netflix has generated negative free cash flow in 10 out of the past 12 years, and a cumulative -$7.6 billion in FCF over the past five years alone.”

After analyzing the company’s low growth during Q1 and management’s tepid Q2 guidance, Trainer said, “Warren Buffett believes "streaming isn't a very good business", and with Netflix, we agree.” Trainer called Netflix “just another streamer” and said, “ While Netflix was once the dominant player in the streaming industry, its recent actions prove that its first-mover advantages are gone.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

After analyzing Netflx’s current fundamentals and adding in his own growth estimates, Trainer concluded that Netflix shares are worth $175.00/share. That implies nearly 50% downside, which is why he remains bearish on this stock.

Overall bias of Nobias Credible Analysts and Bloggers:

Overall, looking at recent reports published by the credible authors that Nobias tracks, Trainer is in the majority when it comes to his bearish outlook on NFLX. Only 47% of recent articles have expressed a “Bullish” bias towards Netflix shares.

However, the credible Wall Street analysts that the Nobias algorithm tracks lean the other way. Three out of five credible analysts that Nobias tracks who have expressed an opinion on NFLX shares believe that they’re likely to increase in value.

We haven’t seen any credible analysts update their price targets for Netflix since the company published its Q1 results; however, after NFLX’s Q4 results, all 5 of them increased their price targets for shares.

After Q4:

Michael Morris of Guggenheim raised his price target from $305 to $375.

Mark Mahaney of Evercore ISI raised his price target from $340 to $400.

Peter Supino of Wolfe Research raised his price target from $366 to $417.

William Power of Robert Baird raised his price target from $275 to $325.

Mathew Harrigan of Benchmark raised his price target from $225 to $250.

Morris is a 5-star rated Nobias analyst and the rest of these men receive 4-star Nobias ratings.

Currently, the average price target being applied to NFLX by the credible analyst community is $348.00. Today Netflix trades for $327.98. Therefore, the average credible analyst price target implies upside potential of approximately 6.1%.

Disclosure: Nicholas Ward has no NFLX position Nicholas Ward wrote this article for Nobias at their request with the intention of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

Case Study: Tesla (TSLA) stock according to high performing analysts

Tesla’s margins fell during Q1 on the heels of recent price cuts. While it’s true that this company continues to produce margins that are much higher than its legacy automotive peers; analysts fear that rising competition across the electronic vehicle space is going to cause ongoing bottom-line struggles for Tesla.

Nobias Insights: 92% of recent articles published by credible authors focused on TSLA shares offer a “Bearish” bias. 2 out of the 4 credible Wall Street analysts who cover TSLA believe that shares are likely to rise in value. The average price target being applied to Tesla by these credible analysts is $175.50, which implies upside potential of approximately 6.3% relative to the stock’s current share price of $165.08.

Bullish Take: Kit Norton, a Nobias 4-star rated author, said, “Wood's Ark Invest also predicted Thursday night Tesla will reach a $2,000 per share price in 2027. Wood's firm sees Tesla's autonomous "robotaxi business" as a "key driver" for this estimated valuation.”

Bearish Take: Nobias 5-star rated author, David Trainer, stated, “Tesla faces an increasingly uphill battle to secure its competitive position, which makes its current valuation look even more unrealistic.”

Key Points

Performance

Tesla shares fell by 12.06% this week, pushing their year-to-date gains down to 52.71%. Despite recent weakness, TSLA has still outperformed the S&P 500 and the Nasdaq Composite Index, which are up by 8.09% and 16.23%, respectively, on a year-to-date basis.

Event & Impact

Tesla posted its first quarter results this week, missing top-line expectations and meeting bottom-line estimates. During Q1, TSLA’s revenue totaled $23.3 billion, missing Wall Street’s consensus estimate by $60 million. Tesla’s Q1 non-GAAP earnings-per-share came in at $0.85, which was in-line with consensus estimates.

Noteworthy News:

Tesla’s margins fell during Q1 on the heels of recent price cuts. While it’s true that this company continues to produce margins that are much higher than its legacy automotive peers; analysts fear that rising competition across the electronic vehicle space is going to cause ongoing bottom-line struggles for Tesla.

Nobias Insights

92% of recent articles published by credible authors focused on TSLA shares offer a “Bearish” bias. 2 out of the 4 credible Wall Street analysts who cover TSLA believe that shares are likely to rise in value. The average price target being applied to Tesla by these credible analysts is $175.50, which implies upside potential of approximately 6.3% relative to the stock’s current share price of $165.08.

Bullish Take Kit Norton, a Nobias 4-star rated author, said, “Wood's Ark Invest also predicted Thursday night Tesla will reach a $2,000 per share price in 2027. Wood's firm sees Tesla's autonomous "robotaxi business" as a "key driver" for this estimated valuation.”

Bearish Take Nobias 5-star rated author, David Trainer, stated, “Tesla faces an increasingly uphill battle to secure its competitive position, which makes its current valuation look even more unrealistic.”

TSLA Apr 2023

Tesla reported its first quarter earnings this week, missing Wall Street’s revenue expectations and posting non-GAAP earnings per share that were in line with consensus estimates. This report caused TSLA shares to fall by 12.06% during the week. However, even after this double digit sell-off, TSLA shares are up by 52.71% on a year-to-date basis.

2023 has been a great year for TSLA shareholders; however, these strong gains come after a tumultuous 2022 and on a trailing 12-month basis, Tesla shares are down by 50.91%. In other words, Tesla shares continue to trade with extremely high volatility, making it clear that this is a battleground stock.

Bearish Nobias Credible Analysts Opinions:

Shanthi Rexaline, a Nobias 4-star rated author, put a spotlight on the negative impact that Tesla’s recent sell-off has had on its founder and CEO, Elon Musk’s, net worth in a recent article that she published at Benzina. She said, “Musk, the world's second richest person, saw his net worth drop sharply on Thursday. At the end of the day, his net worth stood at $164 billion, down $12.6 billion from Wednesday, according to Bloomberg's Billionaires Index.”

Regarding Musk’s resume, Rexaline added, “The billionaire now owns four companies, including his flagship electric vehicle business, Tesla. He is also at the helm of SpaceX, Boring Company, Neuralink and Twitter. Looking at Tesla’s most recent quarter, Rexaline stated, “The negative reaction reflected investor worries over a further contraction in margins after auto gross margin, excluding regulatory credits, fell below the 20% threshold in the first quarter.” “To make matters worse,” she added, “Musk brought up the issue of Tesla's ability to sell at zero profit and make up for it long-term with the high-margin autonomy software.”

The Value Portfolio, a Nobias 5-star rated author, touched upon Tesla’s bottom-line struggles and attached a “Sell” rating to TSLA shares in their post-earnings report. The Value Portfolio mentioned ongoing price cuts and apparent demand issues for Tesla products, stating, “Tesla cut prices on its Model 3 and Model Y vehicles in the United States on Wednesday, the 6th time YTD. Soon after, the company announced its earnings, showing a collapse in margins across the board, a trend that we expect to get markedly worst going into the rest of the year.”

The author continued, “It's worth noting that the company's prices have dropped by towards early-2021 levels, but they are still above starting launch prices. That means the company has seen demand drop substantially versus supply to prior levels that no longer enable the COVID-19 induced price raising.

“Additionally,” The Value Portfolio said, “it's worth noting that the company's production has increased much faster than deliveries, with lease accounting increasing the fastest, and the company now having a record 15 days of vehicle inventory.” “In our view, that's another sign of decreasing demand, and a particularly worrying number for the company's margins,” they continued.

With regard to rising competition in the EV market, The Value Portfolio wrote, “In some markets, where the competition is more robust, Tesla is no longer the largest EV manufacturer. Consistent price cuts show its struggles.” They also broke down struggles in other areas of Tesla’s business.

The Value Portfolio wrote, “We will once again state the company's solar business is irrelevant. Residential solar is ~$2k / kWh, meaning the company's most recent quarter of deployments earned roughly $130 million in revenue. We see the business as a non-starter to the company's long-term earnings where it has a minuscule market share and no competitive advantages.”

The Value Portfolio called Tesla’s energy storage segment a “bright spot” during the quarter. “However,” the continued, “the company's margins are roughly 10% and it costs roughly $475 / KWh / megapack. Even at 100 GWh, which is years away, that's $50 billion in revenue or $5 billion in profit, nowhere near enough to justify the company's valuation.”

Overall, The Value Portfolio said, “The company saw gross profit decline 17% YoY and GAAP gross margins declined by almost 10% YoY.” “The company's GAAP net income dropped 24% YoY to $10 billion annualized, giving the company a P/E ratio of almost 60x, in an expensive and competitive business with minimum growth,” they added.

In conclusion, The Value Portfolio stated, “We expect the company's profits to continue to drop, pushing up its lofty valuation of 60x P/E and 1% FCF yield. The company exists in a difficult industry and it's clear that the industry expects a downturn from recent white-hot markets. As a result, at this time we recommend selling / shorting the stock.”

In a recent article that he published a Forbes, Nobias 5-star rated author, David Trainer, also highlighted his bearish outlook for Tesla shares. fter 1Q23 earnings and another missed growth goal, I continue to see Tesla as one of the most overvalued stocks in the market. Even in an optimistic future cash flow scenario, shares could trade as low as $28/share.

Tesla’s latest earnings definitively show that it is not immune to competitive challenges and will likely see lower profitability in the future. Any investor doing due diligence needs to be aware of the disconnect between Tesla’s fundamentals and the future growth implied by its stock price, which I will quantify below.

Tesla has grown deliveries at less than the 50% year-over-year (YoY) “goal” in four straight quarters as well as for the full year 2022. Tesla’s price cuts more likely point to its lack of pricing power in the increasingly competitive affordable EV market.

Going forward, I would expect Tesla’s ASP to fall as further price cuts are needed as incumbent manufacturers scale up EVs at much lower entry prices. Such price cuts will directly undermine Tesla’s ability to grow profits at anywhere close to the rate implied by its valuation.

Over the past five years, Tesla has burned a cumulative $4.2 billion in free cash flow (FCF) and generated negative FCF in all but one year (2019) of its existence as a public company. New entrants into the EV space, as well as ongoing competition from legacy automakers who want to ensure their long-term survival by taking market share in the electronic vehicle market. “Tesla faces an increasingly uphill battle to secure its competitive position, which makes its current valuation look even more unrealistic.”

Bullish Nobias Credible Analysts Opinions:

Not everyone came away from Tesla’s recent results with bearish sentiment, however. In an article published at Investors.com, Kit Norton, a Nobias 4-star rated author, noted that famed technology investor and long-term Tesla bull, Cathie Wood of Ark Invest, made bullish statements about Tesla and added to her fund’s position in the stock this week.

Norton said, “Wood's Ark Investment Management spent an estimated more than $40 million on 256,000 TSLA shares Thursday, after Tesla sank nearly 10% following the EV company's first 2023 financial announcement.”

“Along with the TSLA share purchases, Wood's Ark Invest also predicted Thursday night Tesla will reach a $2,000 per share price in 2027. Wood's firm see Tesla's autonomous "robotaxi business" as a "key driver" for this estimated valuation,” he wrote.

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

Lastly, Norton added, “Cathie Wood's Ark sees Tesla sales in 2027 between 10.3 million and 20.7 million, with massive revenue from autonomous driving. Ark has long made sky-high predictions about Tesla sales and robotaxis that haven't come to pass.”

Overall bias of Nobias Credible Analysts and Bloggers:

Overall, 92% of recent articles written by credible authors which focused on Tesla stock expressed a “Bearish” sentiment towards shares. However, the credible Wall Street analyst community that the Nobias algorithm tracks is more positive on the stock. Two out of the four credible analysts that have offered opinions on Tesla shares believe that they’re likely to increase in value.

The average price target being applied to TSLA shares by these credible individuals is $175.50. After TSLA’s -12.06% performance this week, shares trade for $165.08. Therefore, that average analyst price target implies upside potential of approximately 6.3%.

Disclosure: Nicholas Ward has no TSLA position. Nicholas Ward wrote this article for Nobias at their request with the intention of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

Case Study: Boeing (BA) stock according to high performing analysts

In early April, reports broke that Boeing had plans to increase 737 Max production up to levels that were well above what investors saw prior to the COVID-19 pandemic and the 737 Max crashes in Asia and Africa. This bolstered the bullish sentiment surrounding shares. But Friday, shares sold off by 5.56% with near-term growth in jeopardy.

Nobias Insights: 48% of recent articles published by credible authors focused on Boeing shares offer a “neutral” bias. However, 3 out of the 4 credible Wall Street analysts who cover Boeing believe shares are likely to rise in value. The average price target being applied to BA shares by these credible analysts is $236.25, which implies upside potential of approximately 17.1% relative to the stock’s current share price of $201.71.

Bullish Take: Noah Poponak, a Nobias 4-star rated analyst, stated, “Goldman Sachs raised the firm's price target on Boeing to $270 from $261 and keeps a Conviction Buy rating on the shares after the company reported its total delivery numbers for Q1.”

Bearish Take: Nobias 4-star author, Rob Williams stated, “Boeing on Thursday declined 4.2% in after-hours trading after the plane maker warned that deliveries of its best-selling 737 Max jet might be delayed because of issues with a part supplied by Spirit AeroSystems.”

Key Points

Performance

Boeing shares fell by 4.83% this week. On a year-to-date basis, Boeing shares are now up by 3.23%. This compares poorly to the S&P 500 which is up by 8.20% on a year-to-date basis thus far.

Event & Impact

After a strong Q1, in terms of 737 Max deliveries and production guidance, this week Boeing announced that it was having supply chain issues which would disrupt its growth outlook.

Noteworthy News:

In early April, reports broke that Boeing had plans to increase 737 Max production up to levels that were well above what investors saw prior to the COVID-19 pandemic and the 737 Max crashes in Asia and Africa. This bolstered the bullish sentiment surrounding shares. But Friday, shares sold off by 5.56% with near-term growth in jeopardy.

Nobias Insights

48% of recent articles published by credible authors focused on Boeing shares offer a “neutral” bias. However, three out of the four credible Wall Street analysts who cover Boeing believe shares are likely to rise in value. The average price target applied to BA shares by these credible analysts is $236.25, implying upside potential of 17.1% relative to the stock’s current share price of $201.71.

Bullish Take Noah Poponak, a Nobias 4-star rated analyst, stated, “Goldman Sachs raised the firm's price target on Boeing to $270 from $261 and keeps a Conviction Buy rating on the shares after the company reported its total delivery numbers for Q1.”

Bearish Take Nobias 4-star author, Rob Williams stated, “Boeing on Thursday declined 4.2% in after-hours trading after the plane maker warned that deliveries of its best-selling 737 Max jet might be delayed because of issues with a part supplied by Spirit AeroSystems.”

BA Apr 2023

Boeing shares have been on a nice run over the last year, rising by double digits, as the stock continues to bounce back from its post-pandemic sell-off inspired by the 737 Max catastrophes in Asia and Africa. However, this week Boeing experienced a setback. Its shares fell by 4.83% this week, underperforming the S&P 500 which was up by 1.51% this week.

On a year-to-date basis, BA shares are now up by 3.23%. Once again, this means that they’ve underperformed the broader market. The S&P 500 is up by 8.20% during 2023 thus far. However, despite Boeing’s recent setback, the credible analyst community that Nobias tracks believes that the stock offers double digit upside potential.

Bearish Nobias Credible Analysts Opinions:

Nobias 4-star author, Rob Williams, covers the Boeing beat at Seeking Alpha and in several recent reports he has highlighted the company’s success throughout 2023 thus far. In an April 11th report, Williams said, “Boeing in March delivered 64 planes, the most since December, as the aircraft maker seeks to ramp up production.” “The deliveries included seven 787 Dreamliners and 52 of its best-selling 737 Max narrowbody planes,” he added.

Overall, looking at the company’s Q1 results, Williams said, “First-quarter deliveries of commercial jets rose 37% from a year earlier to 130 in total, beating the Wall Street consensus estimate of 120.” Looking at Boeing’s press release regarding Q1 deliveries, we see that 113 of these 130 deliveries during Q1 were 737 models.

Boeing’s 787 planes accounted for 11 Q1 sales, 777 planes represented 4 sales, and the company delivered 1 of each of the 747 and 767 models. Williams also recently noted that Boeing planned to increase production of its 737 model - a move that analysts predicted would increase the company’s cash flows. He wrote, “Boeing rose as much as 1.1% after the report from Bloomberg News said the company's goal is to deliver 38 of its 737s a month starting in the middle of the year. The delivery goal is earlier than analysts expected.”’

A recent report published by Valerie Insinna at Reuters noted that Boeing’s production increases are likely to continue for years to come. Insinna wrote, “Boeing Co intends to restore production of its bestselling 737 MAX jet to its 2019 rate of 52 a month by January 2025 as it seeks to fully recover from two deadly crashes and the COVID-19 pandemic that curtailed output, two people familiar with the matter said.”

Joe Toppe, a Nobias 4-star rated author, recently highlighted a bullish catalyst for Boeing: the acceptance of its 737 narrow body planes in the Chinese market. He wrote, ”The Boeing Company announced Tuesday that 11 Chinese airlines have returned the company’s maligned 737 MAX to service as of April 10.”

The 737 Max planes were grounded in response to the deadly crashes in Indonesia and Ethiopia; however, in recent years, the plane has re-entered service for most airlines across the world. But, Toppe notes, “China is the last major market to resume flying the MAX amid ongoing trade tensions with the United States.”

Due to the potential size of China’s aerospace market, regaining traction there has been a top priority for Boeing management. Toppe addressed this, stating, “To support the MAX's return to commercial service in China, Boeing is offering enhanced 737 MAX training following the company’s upgrade to a training device at the Shanghai Flight Training Campus.” All of this positive 737 news helped to bolster Boeing’s share price throughout the start of 2023.

Bullish Nobias Credible Analysts Opinions:

From January 1st to April 13th, Boeing shares were beating the market, up by 9.3%. Several credible Wall Street analysts that are tracked by the Nobias algorithm came out with bullish notes on BA shares after the Q1 delivery figures were updated.

According to the Fly on the Wall, “Goldman Sachs raised the firm's price target on Boeing to $270 from $261 and keeps a Conviction Buy rating on the shares after the company reported its total delivery numbers for Q1. The official reported orders for March were solid, and demand remains strong, with the ongoing recovery in air traffic and desire for more fuel efficient aircraft driving continued strength in new order demand moving ahead, the analyst tells investors in a research note.” The Goldman analyst, Noah Poponak, is a Nobias 4-star rated analyst.

Furthermore, the Fly on the Wall also recently reported that, “Susquehanna analyst Charles Minervino noted Boeing announced March 2023 aircraft deliveries of 64, led by 53 737's. Aircraft deliveries came in 21 above our estimate and significantly improved from 34 in March 2022. With demand picking up broadly across multiple international regions and Chinese demand still to turn the corner, we think there is still a multi-year runway for Boeing to grow its order book as well as deliveries. Susquehanna maintans [sic] its Positive rating and $260 price target on Boeing shares.” Minervino is a Nobias 4-star rated analyst. However, that changed late in the week when a report broke that cited supply chain issues for the 737 Max planes which would hurt Boeing’s production schedule moving forward.

In an April 13th report, Williams wrote, “Boeing on Thursday declined 4.2% in after-hours trading after the plane maker warned that deliveries of its best-selling 737 Max jet might be delayed because of issues with a part supplied by Spirit AeroSystems.”

Williams said: “This is not an immediate safety of flight issue and the in-service fleet can continue operating safely,” Boeing said in a statement. “However, the issue will likely affect a significant number of undelivered 737 MAX airplanes, both in production and in storage.”

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

Williams wrote that Spirit Aerosystems (SPR), the supplier of jet fuselages issued its own statement, which read: “Spirit is working to develop an inspection and repair for the affected fuselages. We continue to coordinate closely with our customer to resolve this matter and minimize impacts while maintaining our focus on safety.”

Williams also said that Boeing stated, “We expect lower near-term 737 Max deliveries while this required work is completed." This has dampened the company’s growth outlook, causing shares to fall by 5.56% on Friday.

Overall bias of Nobias Credible Analysts and Bloggers:

Still, 3 out of the 4 credible Wall Street analysts that the Nobias algorithm tracks who have offered an opinion on BA shares maintain their bullish outlook. Currently, the average price target being applied to Boeing by these credible individuals is $236.25.

Today Boeing trades for $201.71, meaning that the credible analyst average price target implies upside potential of approximately 17.1%.

Disclosure: Nicholas Ward has no BA position. Nicholas Ward wrote this article for Nobias at their request with the intention of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

Case Study: Amazon (AMZN) stock according to high performing analysts

Jassy’s focus on profits provided peace of mind to investors who are worried about poor macroeconomic conditions. Jassy’s 2022 compensation was also highlighted, which came in much lower than previous years, and much lower than other big-tech CEOs, which highlighted AMZN’s determination to cut costs.

Nobias Insights: 52% of recent articles published by credible authors focused on AMZN shares offer a “neutral” bias. However, 6 out of the 6 credible Wall Street analysts who cover Amazon believe shares are likely to rise in value. The average price target being applied to AMZN shares by these credible analysts is $148.17, which implies upside potential of approximately 44.5% relative to the stock’s current share price of $102.54.

Bullish Take: Nobias 4-star rated analyst, Mark Mahaney, stated, “The Amazon long thesis is "very much intact," with Amazon having a leading position in online retail, cloud computing and online advertising”.

Bearish Take: Harsh Chauhan, a Nobias 4-star rated author, stated, “Amazon had a forgettable 2022 thanks to a tepid e-commerce market and a slowdown in the cloud computing business, which eventually led the tech giant to slash jobs from lucrative areas of its business.”

Key Points

Performance

Amazon shares rose by 2.65% this week. On a year-to-date basis, Amazon shares are now up by 19.45%. This compares poorly to the S&P 500 which is up by 8.20% on a year-to-date basis thus far.

Event & Impact

Amazon’s CEO, Andy Jassy, published a letter to shareholders this week which focused on cost cutting, a return to strong profitability, and highlighted new growth plans in the artificial intelligence space.

Noteworthy News:

Jassy’s focus on profits provided peace of mind to investors who are worried about poor macroeconomic conditions. Jassy’s 2022 compensation was also highlighted, which came in much lower than previous years, and much lower than other big-tech CEOs, which highlighted AMZN’s determination to cut costs.

Nobias Insights

52% of recent articles published by credible authors focused on AMZN shares offer a “neutral” bias. However, six out of the six credible Wall Street analysts who cover Amazon believe shares are likely to rise in value. The average price target applied to AMZN shares by credible analysts is $148.17, implying upside potential of approximately 44.5% relative to the current share price of $102.54.

Bullish Take Nobias 4-star rated analyst, Mark Mahaney, stated, “The Amazon long thesis is "very much intact," with Amazon having a leading position in online retail, cloud computing and online advertising”.

Bearish Take Harsh Chauhan, a Nobias 4-star rated author, stated, “Amazon had a forgettable 2022 thanks to a tepid e-commerce market and a slowdown in the cloud computing business, which eventually led the tech giant to slash jobs from lucrative areas of its business.”

AMZN Apr 2023

For years, Amazon.com (AMZN) has been synonymous with successful big-tech growth. AMZN shares have risen by 687.95% during the last decade. This beats the broader performance posted by the S&P 500 and the tech-heavy Nasdaq Composite Index by a wide margin. In comparison, over the last 10-year period, these two indexes are up by 166.13% and 279.01%, respectively. And yet, the trailing 12-month period has been a tough one for Amazon.

Shares are down by 32.42% during the last year. Amazon’s growth slowed during 2022 and the company struggled to generate profits. However, the company’s CEO, Andy Jassy, published a letter to shareholders this week which addressed his plans to right the ship, which largely centered on cost cutting and profit generation.

Bearish Nobias Credible Analysts Opinions:

Nobias 4-star rated author, AJ Fabino, published an article at Benzinga this week which highlighted Jassy’s major talking points in his letter to shareholders. Fabino wrote, “Amazon.com, Inc AMZN CEO Andy Jassy addressed the company's short-term headwinds, continued investment in growth areas, cost control measures and generative AI in his annual shareholder letter Thursday.”

Fabino stated, “Jassy reaffirmed Amazon's commitment to investing in growth areas including AI, chip development and advertising, despite the cost-cutting measures — including layoffs — the company has undertaken.” “He confirmed that Amazon would shutter businesses lacking long-term potential, while allocating resources to promising enterprises,” Fabino continued.

Jassy focused on Amazon’s logistics segment, which continues to be a costly part of its retail business (as it turns out, it’s difficult to make money offering free 2-day shipping). In an effort to cut costs, Fabino said, “The company is transitioning from a national fulfillment network in the U.S. to a regional model to address rising costs and extended delivery times.”

Also, like so many other tech companies these days, Fabino noted that Jassy was bullish on artificial intelligence. Jassy made it clear that Amazon was competing in the AI market and it appears that shareholders were pleased.

Fabino said, “Jassy emphasized the transformative potential of large language models (LLMs) and generative AI in improving customer experiences across various applications.” “One of Amazon's LLMs, Titan, is already generating text for blog posts, emails and delivering search results on the company's website,” he added.

Overall, AMZN shares rose 2.65% this week, largely on the back of Jassy’s profit-centric letter. Huileng Tan, a Nobias 4-star rated author, also published an article this week that focused on Jassy’s letter to shareholders and made it clear that Jassy was putting his money where his mouth is, so to speak, when it comes to cost cutting.

Tan wrote, “Jassy was paid $1.3 million in 2022, including a $317,500 base salary plus another $981,000 in 401(k) plan contributions and security costs, according to the company's annual-proxy statement filed on Thursday.” She continued, “It's a massive drop from the $212.7 million he received in 2021 when he got promoted to CEO. Jassy's total compensation was $35.8 million in 2020.”

“In comparison,” Tan added, “Apple CEO Tim Cook received $84 million in total compensation in 2022, including bonuses and a $3 million base salary — although this may fall to $49 million in 2023. Microsoft CEO Satya Nadella was paid a total compensation of $55 million in 2022.”

Tan noted that in his letter to shareholders, Jassy mentioned that 2022 was "one of the harder macroeconomic years in recent memory."“Like many other tech companies, Amazon has been dealing with a downturn in the industry after business boomed during the pandemic. However, earnings are weakening amid fears of an impending recession,” she said.

It appears that lower CEO compensation resonated well with shareholders who understand that Amazon needs to cut costs and focus on generating profits during times like this. Harsh Chauhan, a Nobias 4-star rated author, mentioned Amazon is his bullish article titled, “2 Bargain Stocks on a Hot Rally to Buy Hand Over Fist Before They Soar Higher” that was published at the Motley Fool this week.

Chauhan said, “Amazon had a forgettable 2022 thanks to a tepid e-commerce market and a slowdown in the cloud computing business, which eventually led the tech giant to slash jobs from lucrative areas of its business.” He mentioned, “Revenue increased just 9% last year to $514 billion.” The company posted an adjusted loss of $0.27 per share as compared to a profit of $3.24 per share in the prior year,” he added.

“However,” Chauhan wrote, “2023 is expected to be a turnaround year for Amazon as far as its bottom line is concerned.” “The company's top-line growth is also expected to gather momentum, growing in the high single digits in 2023 and then in the double-digits from next year,” he said.

“For instance,” Chauhan added, “Amazon should benefit from easier comps in the e-commerce business in 2023.” “Meanwhile,” he continued, “global cloud infrastructure spending is anticipated to jump an impressive 23% this year, according to Canalys.”

Looking at the strength of Amazon’s cloud business, Chauhan said, “Amazon's 32% share of this market makes it the leader in the cloud infrastructure services space and puts the company on track to make the most of the solid growth opportunity available there.”

Furthermore, he noted that the company’s ongoing investments in the AI space have the potential to generate strong long-term growth for the company. “Mordor Intelligence estimates that the cloud AI market could grow at 22% a year through 2027, and Amazon's share of this market means that it could become a big beneficiary of this terrific growth,” Chauhan noted. Overall, he highlighted the stock’s relatively cheap valuation as a reason to buy shares on the recent dip.

Chauhan concluded his report by stating, “The stock is trading at just 2 times sales, a discount to the S&P 500's price-to-sales ratio of 2.4. So, investors are getting a bargain on this tech stock right now, especially considering the potential acceleration in its top and bottom lines.”

Bullish Nobias Credible Analysts Opinions:

Looking at the credible analysts coverage of Amazon, we see that it’s not just the credible authors who are bullish on AMZN shares. The most recent update that a Nobias credible analyst has provided on AMZN called for significant upside.

According to The Fly on the Wall, “Evercore ISI analyst Mark Mahaney lowered the firm's price target on Amazon.com to $155 from $160 based on a more conservative approach to the AWS segment and keeps an Outperform rating on the shares. The Amazon long thesis is "very much intact," with Amazon having a leading position in online retail, cloud computing and online advertising, but the firm's recent channel checks and forensic financial analysis suggest that AWS growth and margin stabilization "are not likely first half developments," the analyst tells investors.” Mahaney is a Nobias 4-star rated analyst.

Nicholas Ward is a Senior Investment Analyst at Wide Moat Research. He has spent the last 8 years writing about the stock market at various publications, including Seeking Alpha, The Street, Forbes Real Estate Investor, Sure Dividend, The Dividend Kings, iREIT, Safe High Yield, and The Intelligent Dividend Investor.

According to The Fly on the Wall, “Evercore ISI analyst Mark Mahaney lowered the firm's price target on Amazon.com to $155 from $160 based on a more conservative approach to the AWS segment and keeps an Outperform rating on the shares. The Amazon long thesis is "very much intact," with Amazon having a leading position in online retail, cloud computing and online advertising, but the firm's recent channel checks and forensic financial analysis suggest that AWS growth and margin stabilization "are not likely first half developments," the analyst tells investors.” Mahaney is a Nobias 4-star rated analyst.

Overall bias of Nobias Credible Analysts and Bloggers:

Overall, 52% of recent articles published by credible authors on Amazon have predicted that the stock will rise in value. This relatively neutral outlook differs significantly from the credible analyst outlook.

Currently 6 out of 6 credible Wall Street analysts that Nobias tracks who have offered an opinion on AMZN shares believe that they’re likely to rise in value.

Currently the average price target being applied to AMZN by these credible individuals is $148.17. Amazon shares currently trade for $102.54. Therefore, that credible analyst average price target implies upside potential of approximately 44.5%.

Disclosure: Nicholas Ward is long AMZN. Nicholas Ward wrote this article for Nobias at their request with the intention of giving investors a balanced perspective based on the writings of Nobias highly rated analysts and bloggers. Nobias has no business relationship with any company whose stock is mentioned in this article and does not have a position in this stock.

Additional disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

Disclaimer: The Nobias star rating is based on past performance results and is not an indicator of future results. These past performance returns do not represent returns that any investor actually earned. Assumptions made include the ability to purchase the stocks recommended by the author under liquid markets where the transaction would be at the market price for the day. In reality, loss in liquidity may have a material impact on the returns that actually may have been earned. Further, returns are calculated without any including transaction costs, management fees, performance fees or expenses, or reinvestment of dividends and other income. This information is provided for illustrative purposes only.

Case Study: JPMorgan (JPM) stock according to high performing analysts

JPMorgan appears to have performed well throughout the banking crisis period. The company’s CEO, Jamie Dimon, recently said that the crisis isn’t over and will have long-term ramifications for banks; however, the company continues to show financial strength as its deposits and net interest income continue to climb.

Nobias Insights: 59% of recent articles published by credible authors focused on JPM shares offer a “Bullish” bias. 4 out of the 6 credible Wall Street analysts who cover JPM believe that shares are likely to rise in value. The average price target being applied to JPMorgan by these credible analysts is $148.00, which implies upside potential of approximately 6.7% relative to the stock’s current share price of $138.73.

Bullish Take: Harrison Miller, a Nobias 4-star rated author, said, “Deposits were slightly higher at the end of the quarter compared to the end of 2022, up 2% to $2.37 trillion, as depositors poured into the well-capitalized giant,”

Bearish Take: Rob Starks Jr., a Nobias 4-star rated author,stated, “Although JPMorgan Chase is by far the largest bank in the U.S., even it wasn't immune from the fallout that resulted from last month's collapses of Silicon Valley Bank and Signature Bank, the second- and third-largest bank failures in U.S. history, respectively.”

Key Points

Performance

JPMorgan shares rose by 9.35% this week, pushing their year-to-date gains up to 2.67%. Despite this week’s strong gains, JPM has underperformed the S&P 500, which is up 8.20% on a year-to-date basis thus far.

Event & Impact

JPM posted its first quarter results this week, beating Wall Street estimates on both the top and bottom lines. During Q1, JPM’s revenue totaled $38.3 billion, beating Wall Street’s consensus estimate by $2.53 billion. JPMorgan’s Q1 GAAP earnings-per-share came in at $4.10, beating Wall Street’s consensus estimate by $0.69/share.

Noteworthy News:

JPMorgan appears to have performed well throughout the banking crisis period. The company’s CEO, Jamie Dimon, recently said that the crisis isn’t over and will have long-term ramifications for banks; however, the company continues to show financial strength as its deposits and net interest income continue to climb.

Nobias Insights

59% of recent articles published by credible authors focused on JPM shares offer a “bullish” bias. Four out of the six credible Wall Street analysts who cover JPM believe that shares are likely to rise in value. The average price target applied to JPMorgan is $148.00, which implies upside potential of approximately 6.7% relative to the stock’s current share price of $138.73.

Bullish Take Harrison Miller, a Nobias 4-star rated author, said, “Deposits were slightly higher at the end of the quarter compared to the end of 2022, up 2% to $2.37 trillion, as depositors poured into the well-capitalized giant,

Bearish Take Rob Starks Jr., a Nobias 4-star rated author, stated, “Although JPMorgan Chase is by far the largest bank in the U.S., even it wasn't immune from the fallout that resulted from last month's collapses of Silicon Valley Bank and Signature Bank, the second- and third-largest bank failures in U.S. history, respectively.”

JPM Apr 2023